- The New High Newsletter

- Posts

- We Lost Jim Simons and Gained 20+ Breakouts from Across The Globe: Banks, Energy and Healthcare

We Lost Jim Simons and Gained 20+ Breakouts from Across The Globe: Banks, Energy and Healthcare

Jim Simons left keys to success. He did what we should all do and that's develop a true edge, what is yours?

If you have any hope of making money in markets, you need math. What’s incredible is that Jim Simons did the math before he hoped to make any money in markets.

If you followed his life or listened to his talks, you’ll take away what I took aways. Build a superpower then use that superpower as an edge in markets to generate alpha.

Boy oh boy, Jim Simon’s generated alpha already. What’s circulating on social media is that he generated a 66% return CAGR for 30 years. Absolutely stunning performance. Because he had a superpower and used it in markets.

We bid farewell to a true super hero and great man of math, markets and philanthropy. Here is a good article about Jim. If you can access the article at the bottom of this I have a tweet with a private talk he gave years ago.

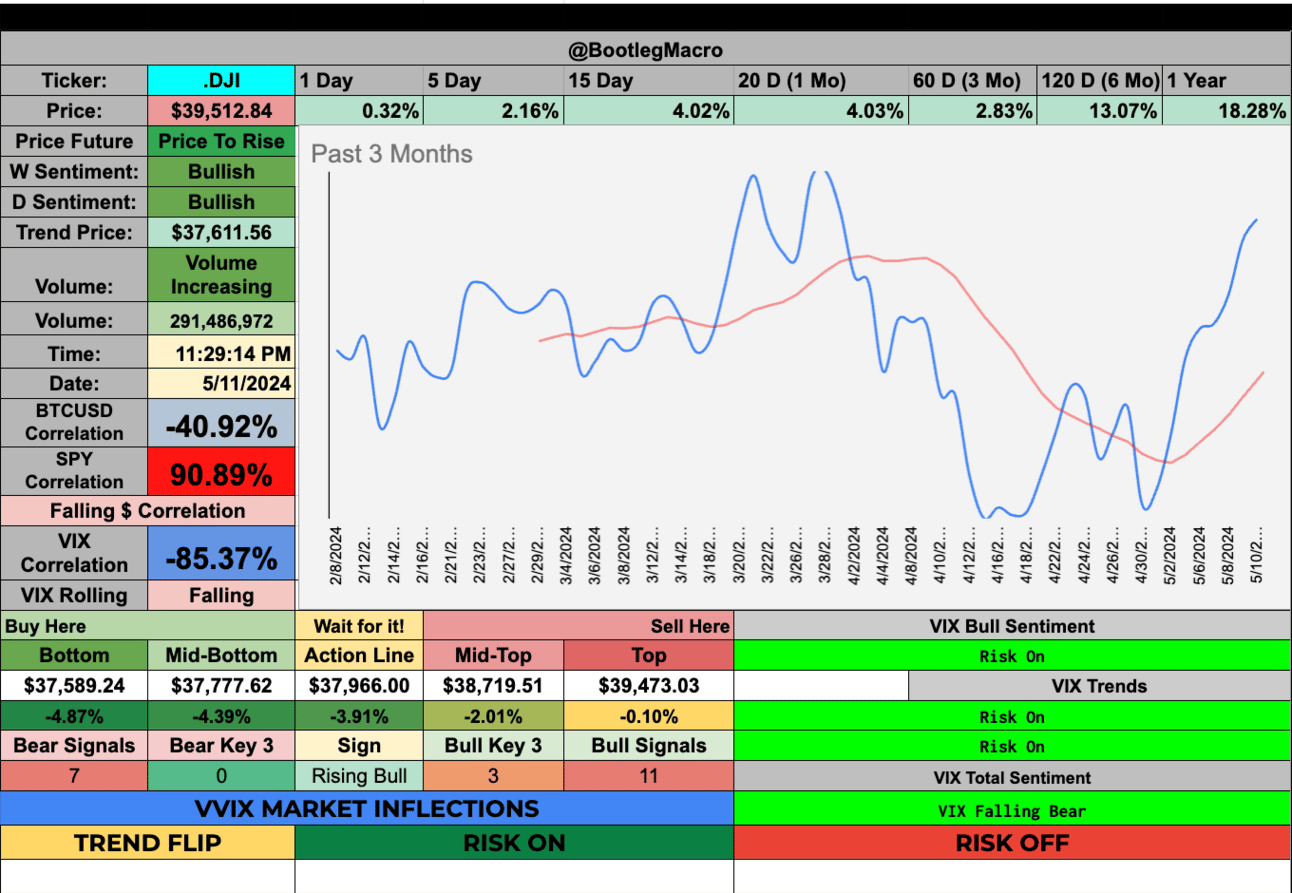

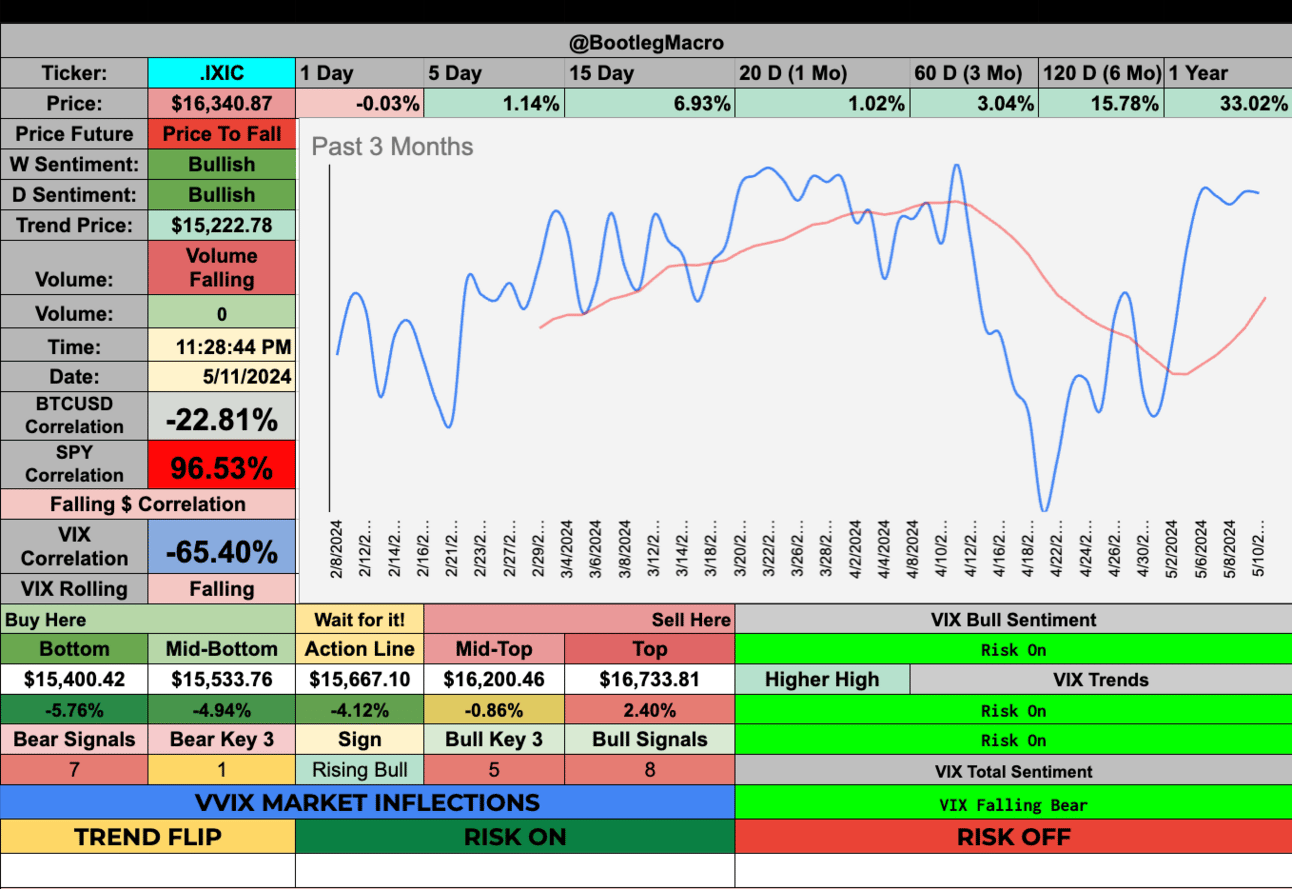

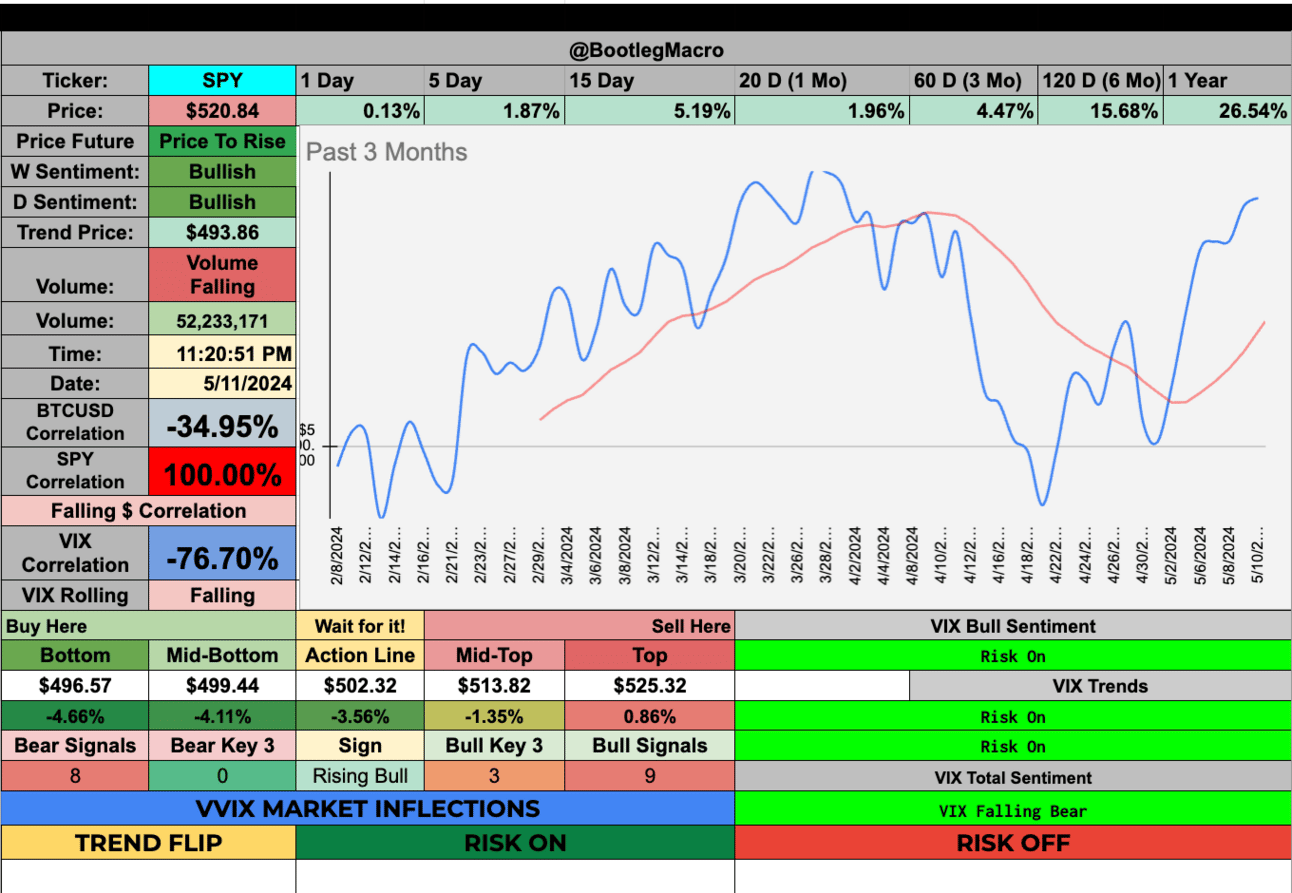

Market Performance

Markets rebounded incredibly this week. The S&P500 was up 1.85% for the week. The Dow Jones was up 2.16% (amazing!) for the week. The Nasdaq was up 1.14%.

We’re seeing a complete rotation into the industrials, energy and commodities space. People are starting to finally believe in higher for longer. After a discussion over the worst Walleye sandwich of my life this weekend, I realized people actually think we are getting a rate cut before the election. Um…that’s insane to think!

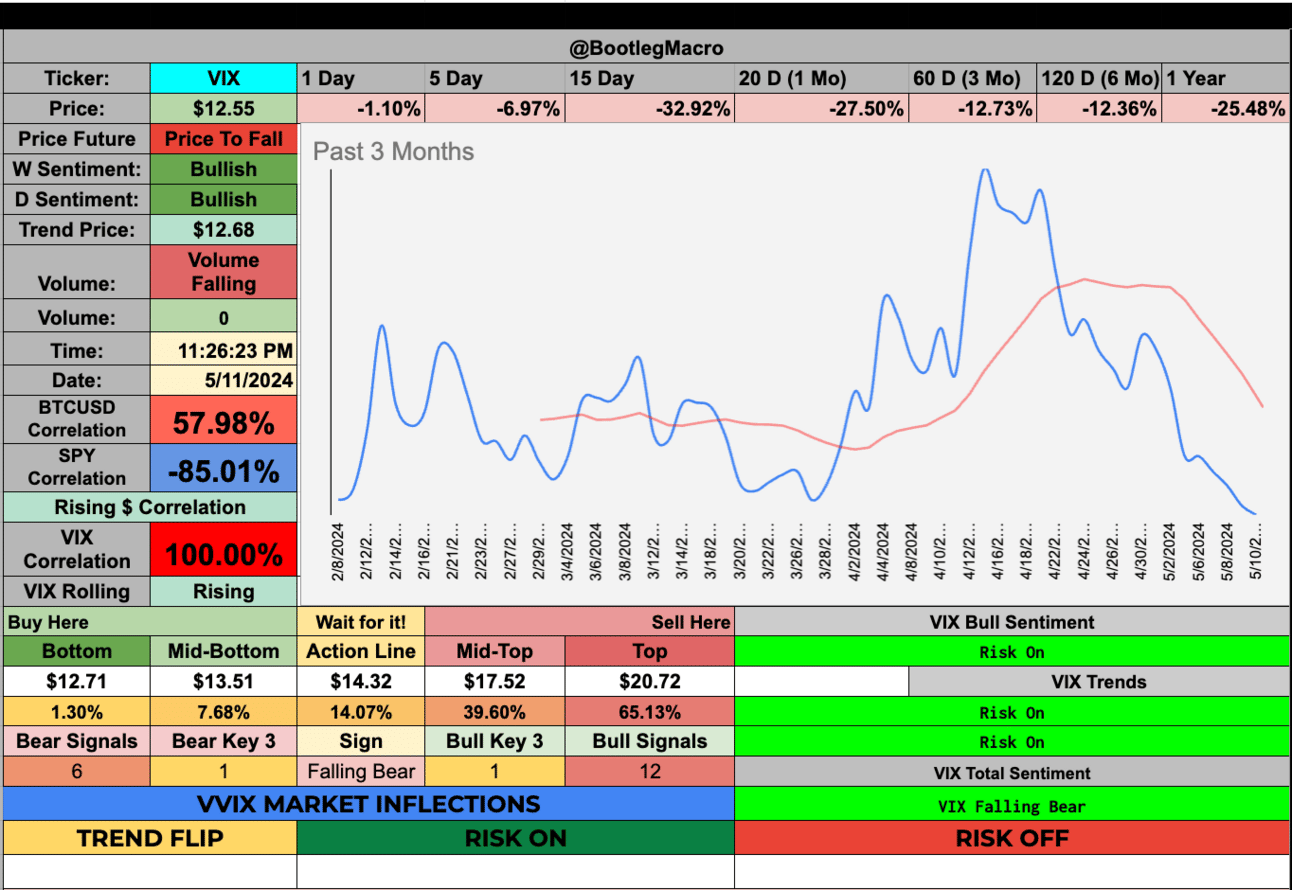

Volatility Corner:

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. This volatility in the turbulence indicator lets me think we are about to start a massive rally into the middle of summer.

I wrote my famous last words in early April / late may, “In Q2, we will officially enter into the broadening season.” and nothing has changed. It seems we are only rotating into the specific broad sectors. The chop gives entry opportunities into many tickers. Which one do you want to join?

MACRO INDICATOR:

MACRO SEASON: BEARISH Since 5/3/24🛑

MICRO WEATHER: BEARISH Since 2/15/24🛑

US Index ETF Review:

SPY

Bullish Trend Since 5/6/24🟢

Go LONG Since 5/6/24🟢

Price to RISE Since 5/6/24🟢

DIA

BULLISH Trends Since 5/6/24🟢

Go Long Since 5/6/24🟢

Price to RISE Since 5/6/24🟢

QQQ

BULLISH Trend Since 5/6/24🟢***

Go LONG Since 5/6/24🟢***

Price to Fall Since 5/6/24🟢

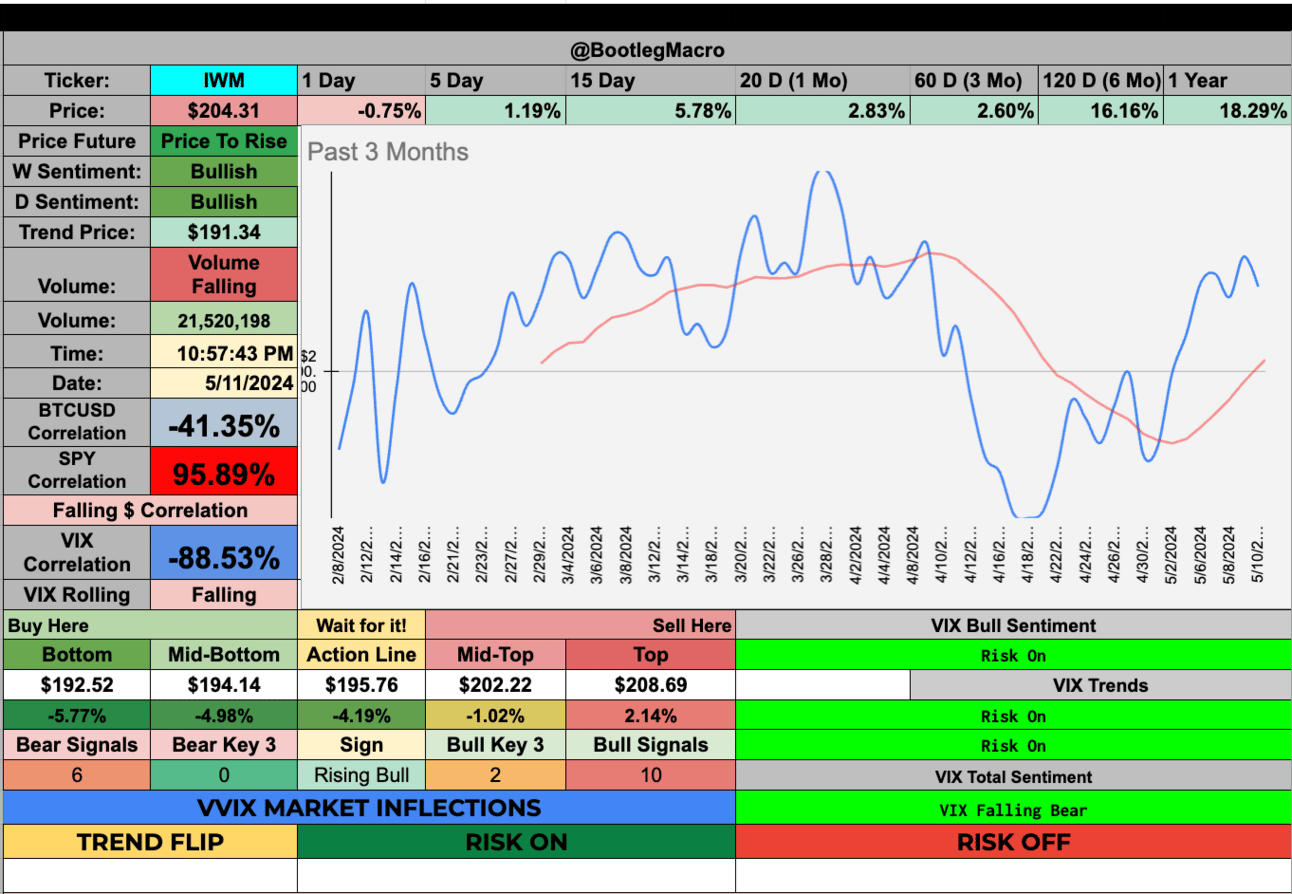

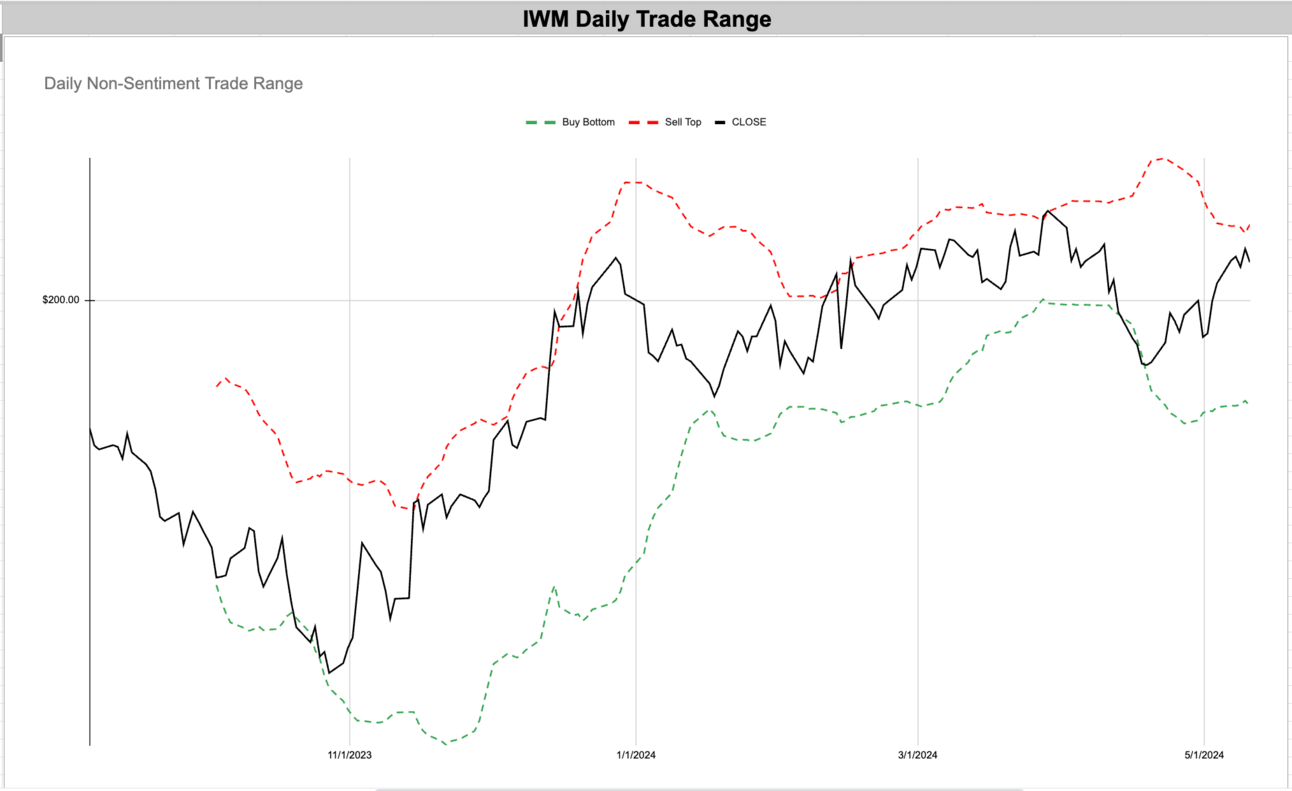

IWM

BULLISH Since 5/6/24🟢

Go LONG Since 8/10/24🟢

Price to RISE Since 8/14/24🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

FSM - Fortuna Silver Mines Inc. - Basic Materials - Canada 🇨🇦

SB - Safe Bulkers, Inc. - Industrials - Monaco 🇲🇨

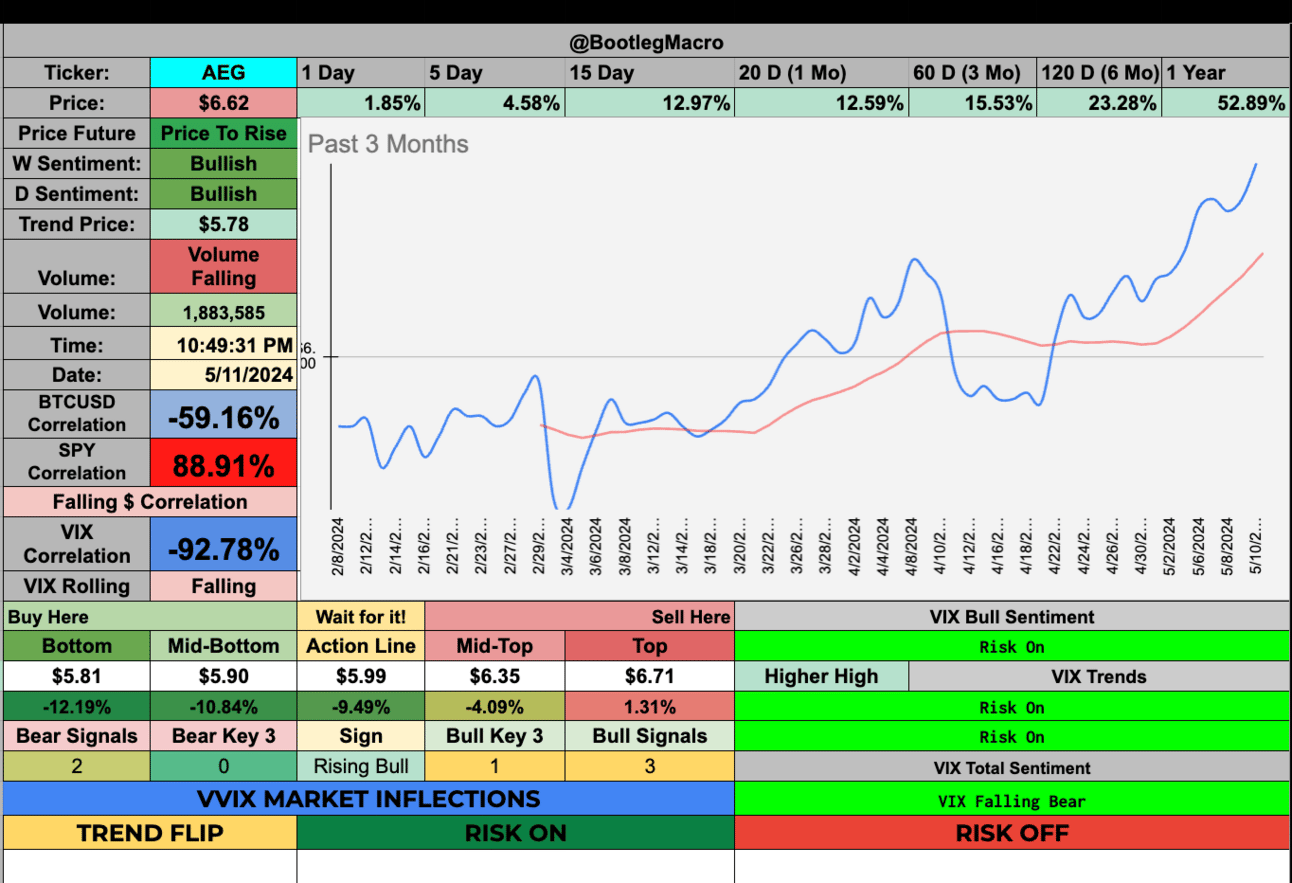

AEG - Aegon Ltd. - Financial - Netherlands 🇳🇱

FIP - FTAI Infrastructure Inc. - Industrials - USA 🇺🇸

NWG - NatWest Group Plc ADR - Financial - United Kingdom 🇬🇧

RSI - Rush Street Interactive Inc. - Consumer Cyclical - USA 🇺🇸

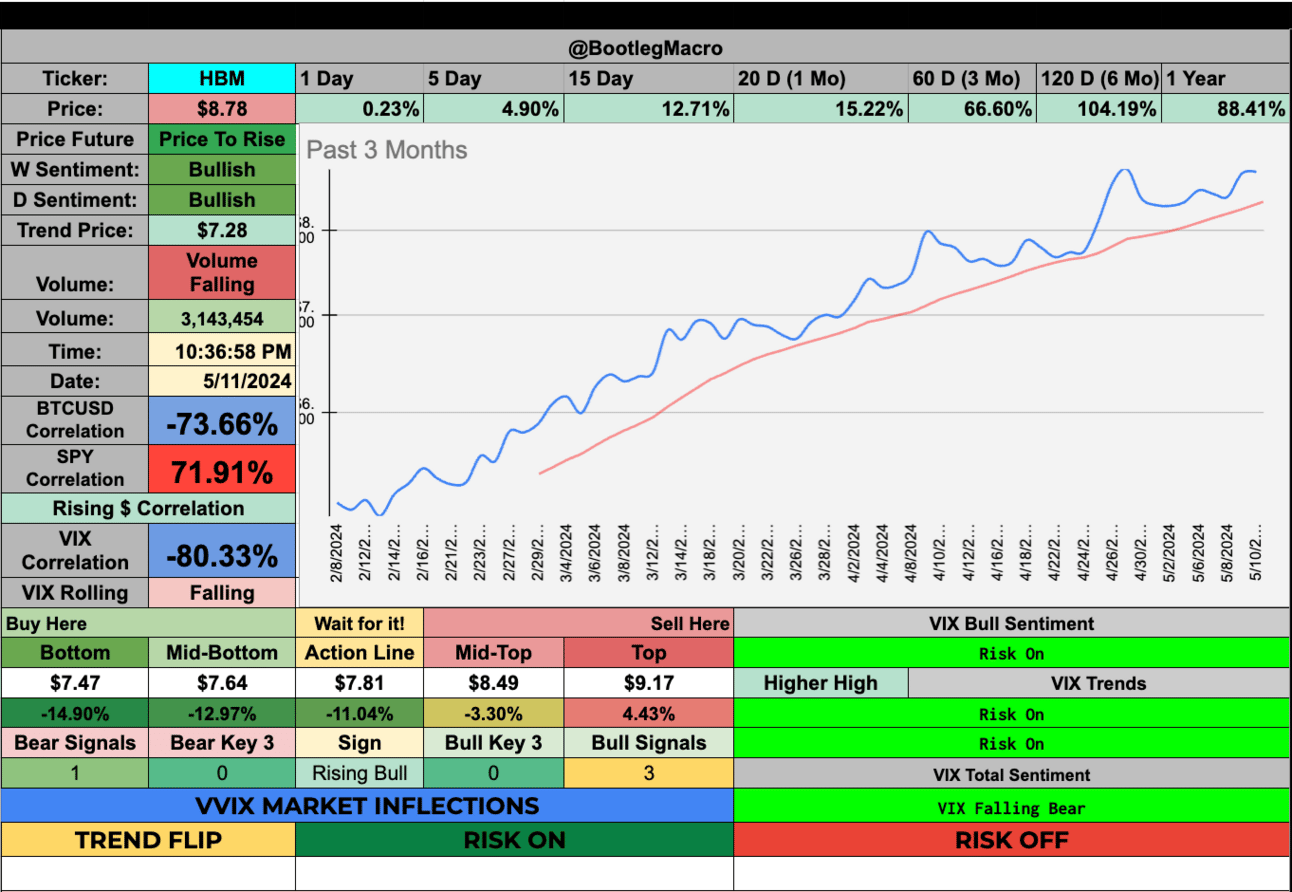

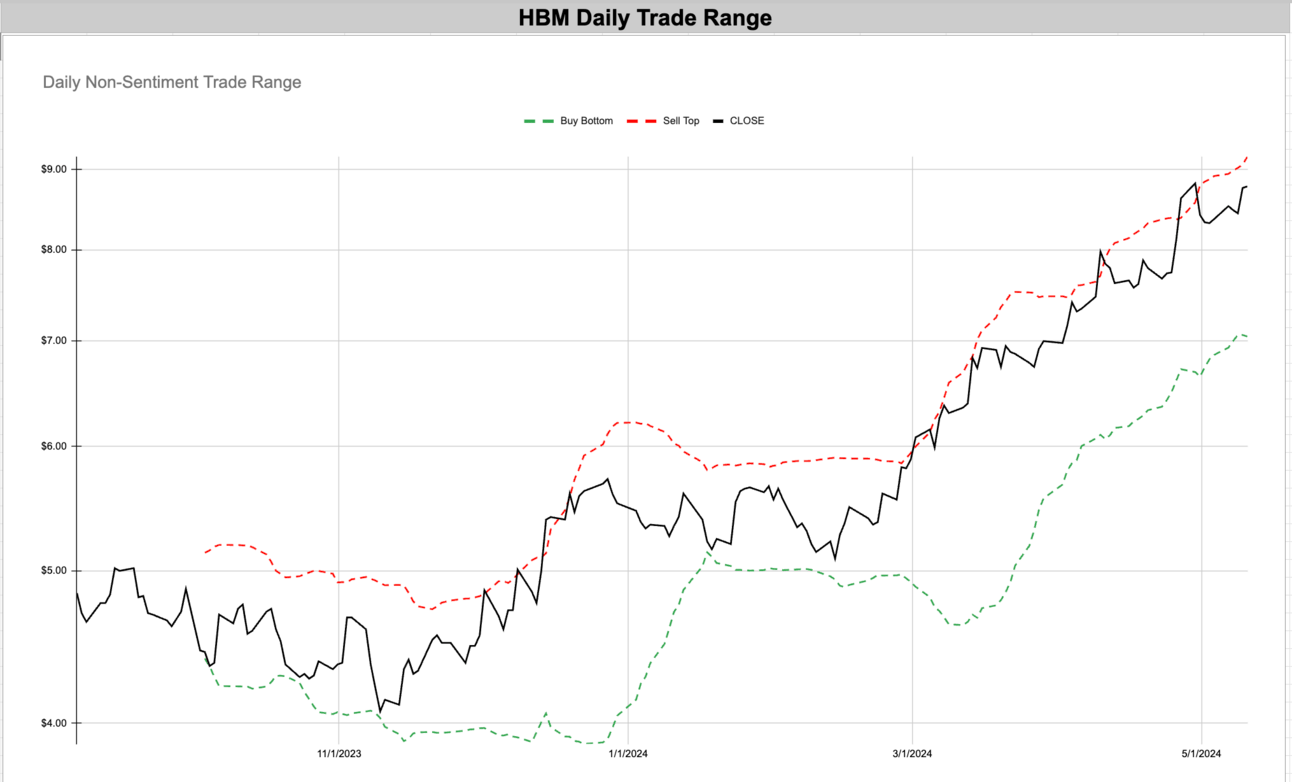

HBM - Hudbay Minerals Inc. - Basic Materials - Canada 🇨🇦

DHT - DHT Holdings Inc. - Energy - Bermuda 🇧🇲

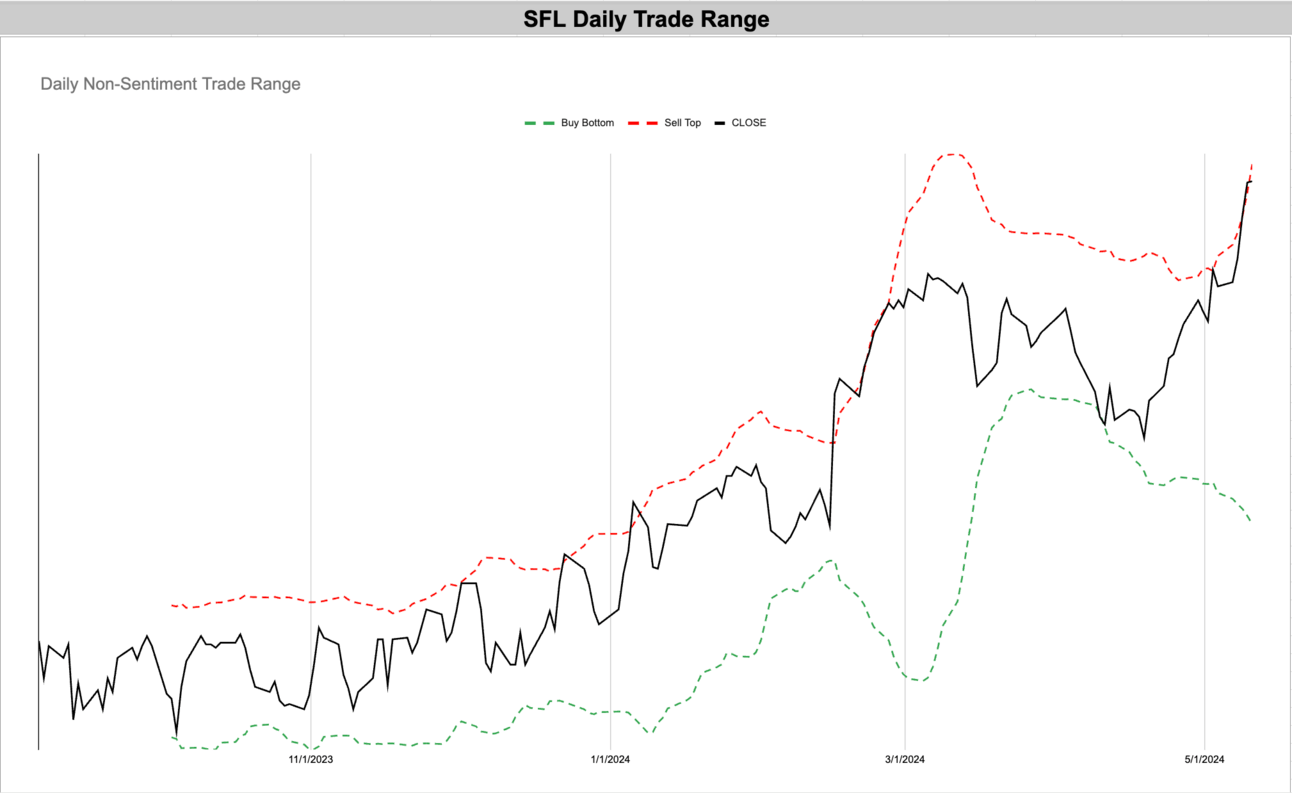

SFL - SFL Corporation Ltd. - Industrials - Bermuda 🇧🇲

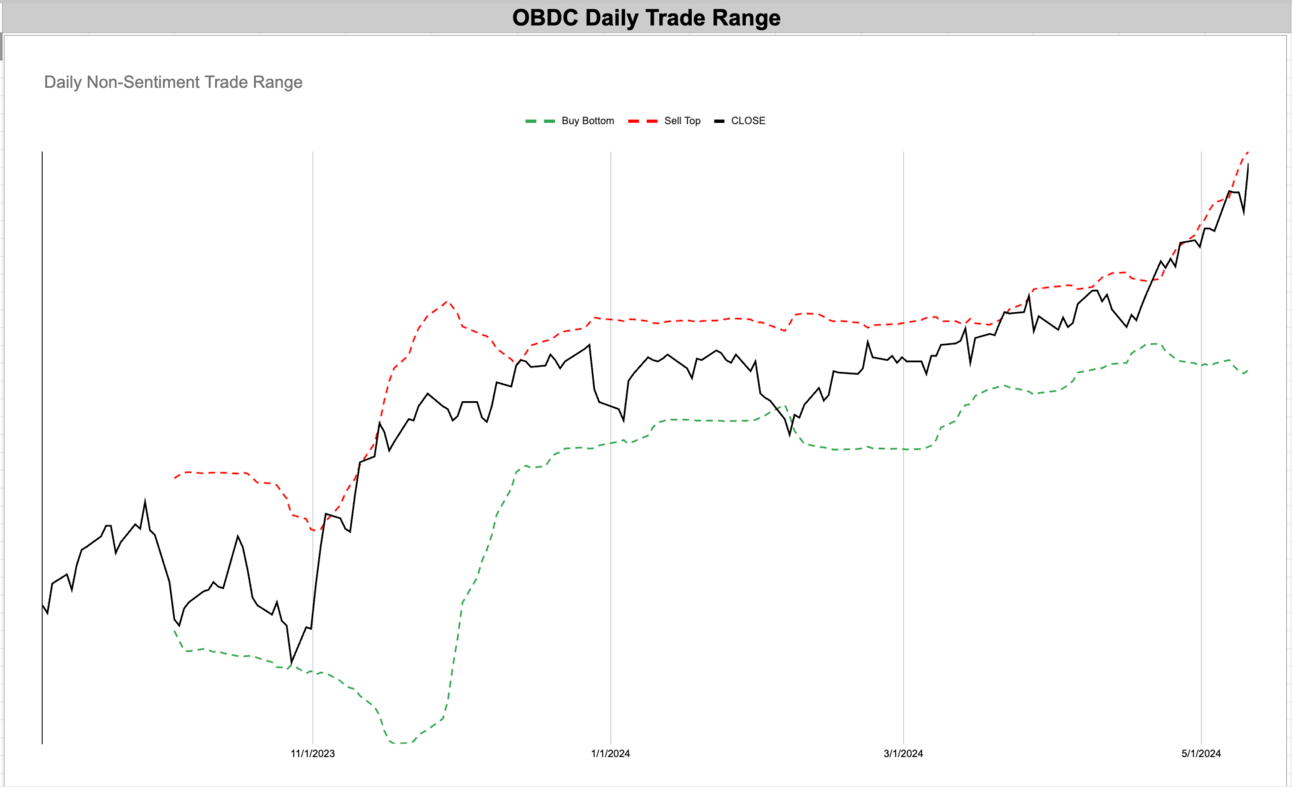

OBDC - Blue Owl Capital Corp. - Financial - USA 🇺🇸

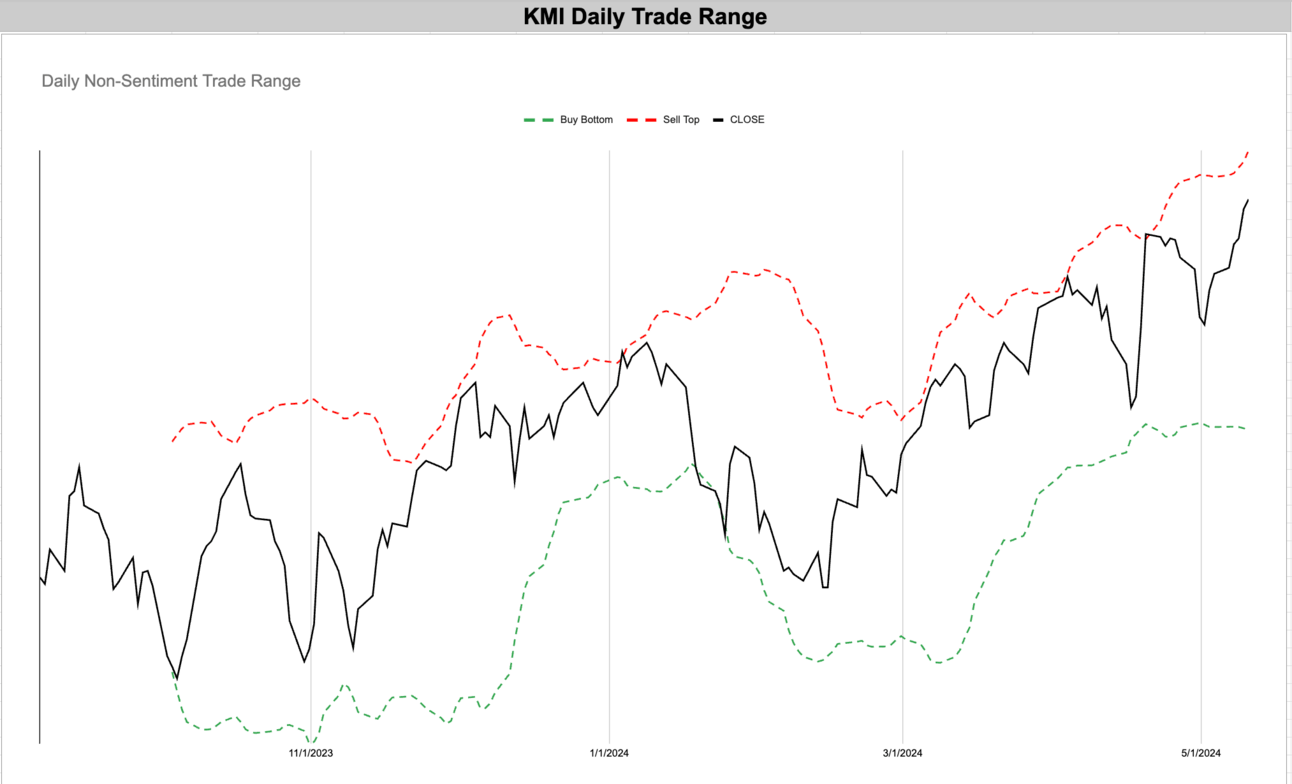

KMI - Kinder Morgan Inc. - Energy - USA 🇺🇸

FSM - Fortuna Silver Mines Inc. - Basic Materials - Canada 🇨🇦

Volatility has fallen but Silver continues to rip.

This is an ugly chart but it’s up over 40% for the past rolling year.

SB - Safe Bulkers, Inc. - Industrials - Monaco 🇲🇨

Shipping continues to show strength post the mid-april.

Shipping is hot right now.

AEG - Aegon Ltd. - Financial - Netherlands 🇳🇱

Financials across the world continue to show how good things are becoming.

A nice run for this stock.

FIP - FTAI Infrastructure Inc. - Industrials - USA 🇺🇸

It’s been very smooth recently even though it’s up 78% in 3 months.

Up over 114% in 6 months! Ok, might have a pullback.

NWG - NatWest Group Plc ADR - Financial - United Kingdom 🇬🇧

Give this time to find it’s way to the mean.

A bit more volatility than I prefer in a stock but very bullish.

RSI - Rush Street Interactive Inc. - Consumer Cyclical - USA 🇺🇸

Nice breakout but give it time.

Bullish but very volatile.

HBM - Hudbay Minerals Inc. - Basic Materials - Canada 🇨🇦

Commodities, industrials and energy are breaking out. This is no different.

This is a nice trend to ride.

DHT - DHT Holdings Inc. - Energy - Bermuda 🇧🇲

High volatility but it’s still bullish.

High volatility but it’s bullish.

SFL - SFL Corporation Ltd. - Industrials - Bermuda 🇧🇲

A slow yet continued trend.

This is a high volatility trend but it has a high dividend.

OBDC - Blue Owl Capital Corp. - Financial - USA 🇺🇸

Have you seen a more low volatility bullish trend?

A beautiful low volatility trend.

KMI - Kinder Morgan Inc. - Energy - USA 🇺🇸

Great moves from the Kinder Morgan stock.

This is a high volatility stock but it’s tied to oil and energy. Commodities are hot again!

Enjoying this?

& Invite a friend.

New Highs $20+:

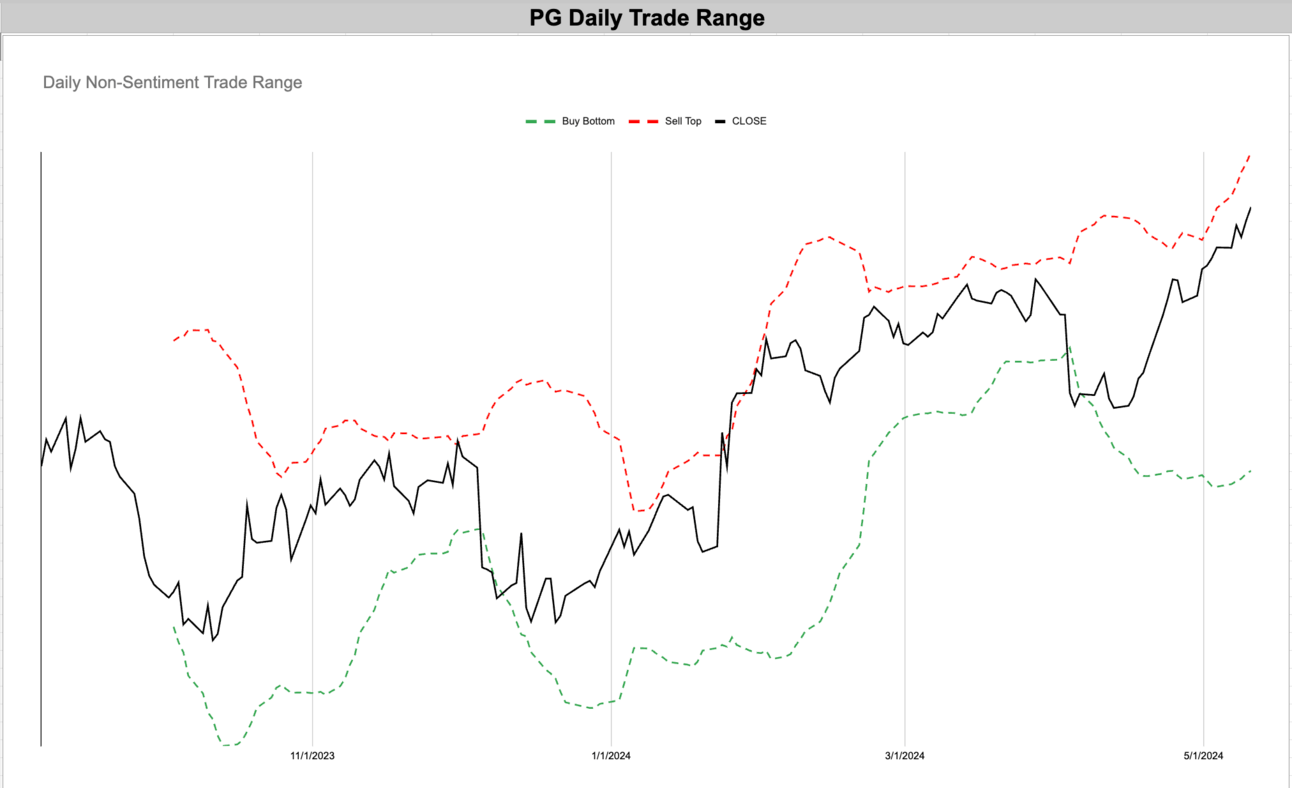

PG - Procter & Gamble Co. - Consumer Defensive - USA 🇺🇸

COST - Costco Wholesale Corp - Consumer Defensive - USA 🇺🇸

BAC - Bank Of America Corp. - Financial - USA 🇺🇸

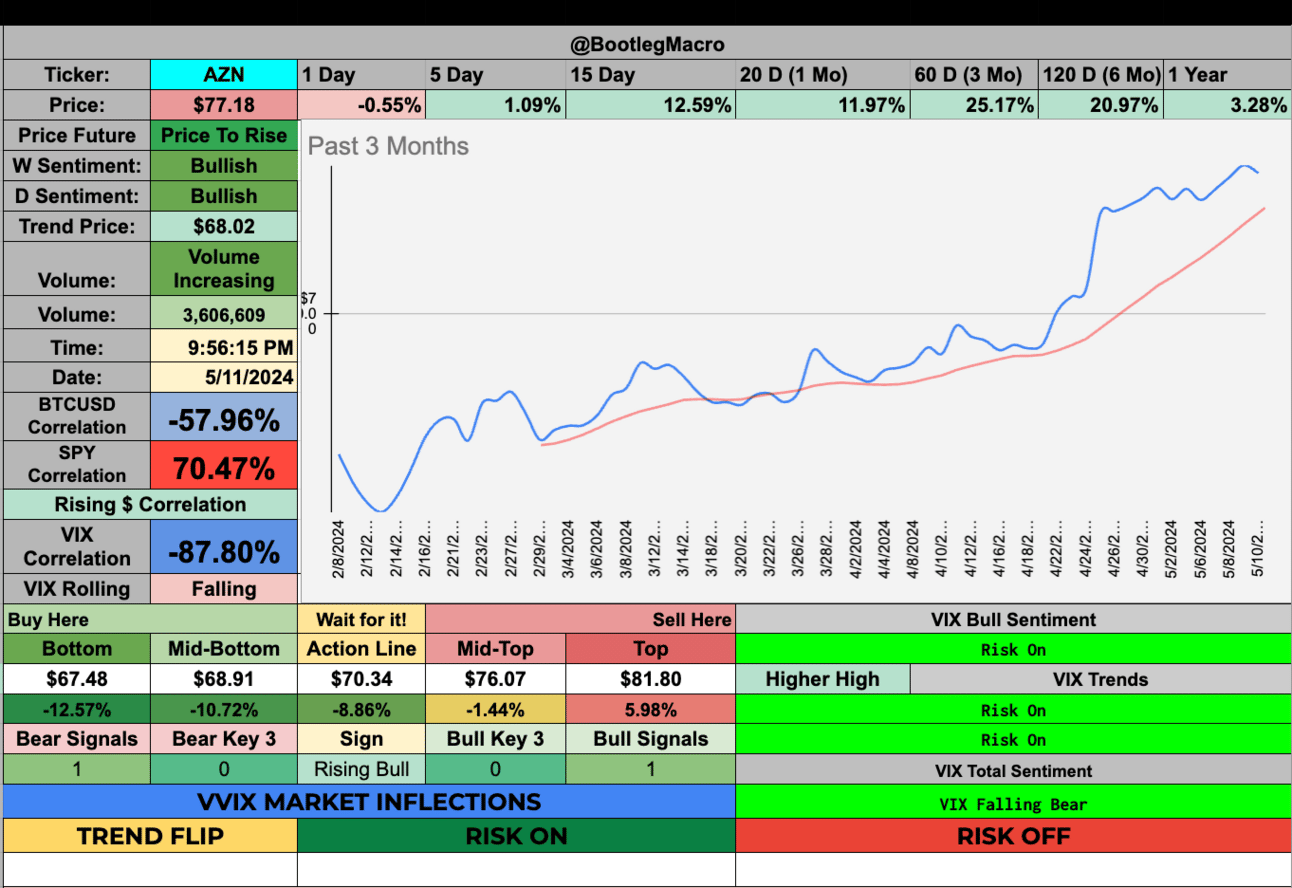

AZN - Astrazeneca plc ADR - Healthcare - United Kingdom 🇬🇧

SHEL - Shell Plc ADR - Energy - United Kingdom 🇬🇧

WFC - Wells Fargo & Co. - Financial - USA 🇺🇸

AXP - American Express Co. - Financial - USA 🇺🇸

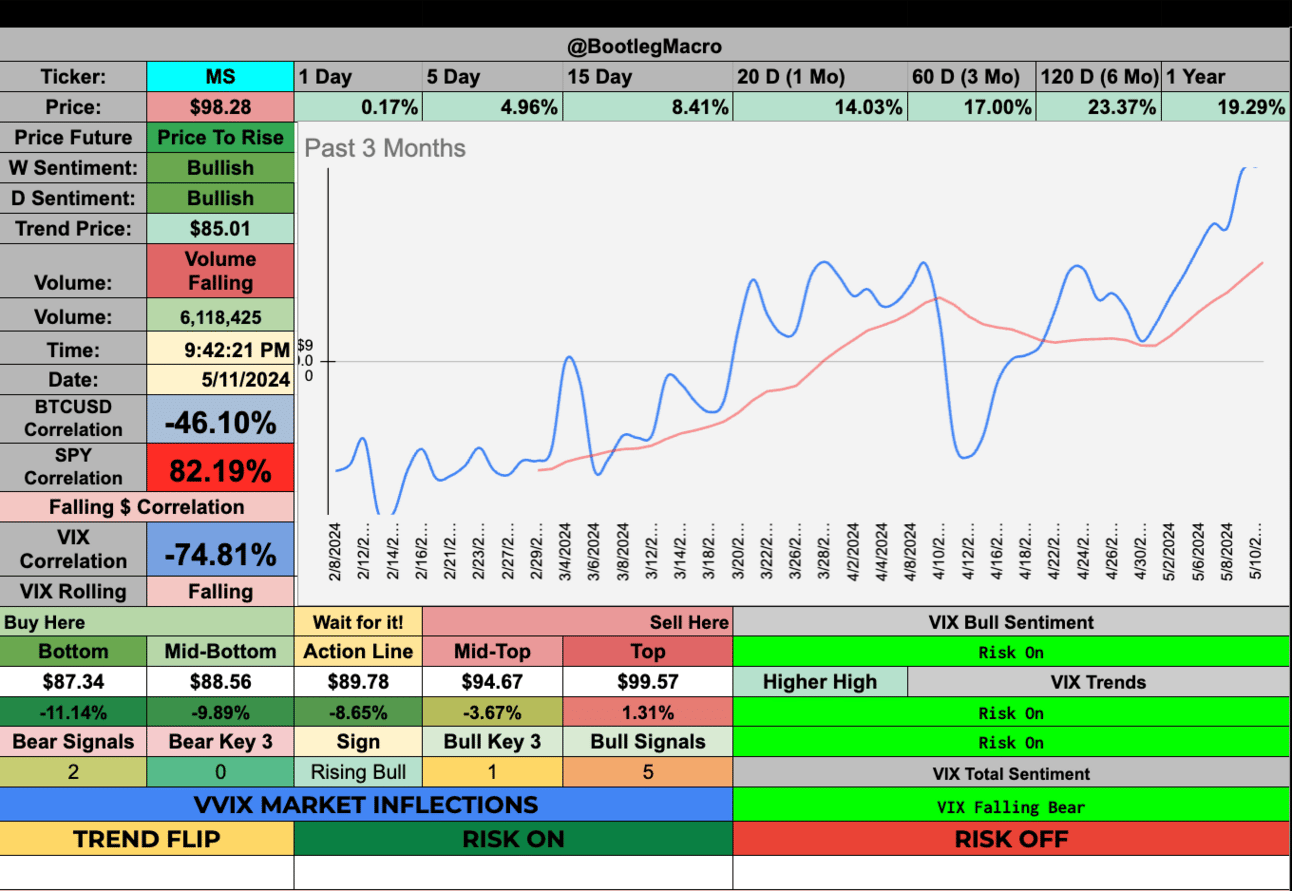

MS - Morgan Stanley - Financial - USA 🇺🇸

GS - Goldman Sachs Group, Inc. - Financial - USA 🇺🇸

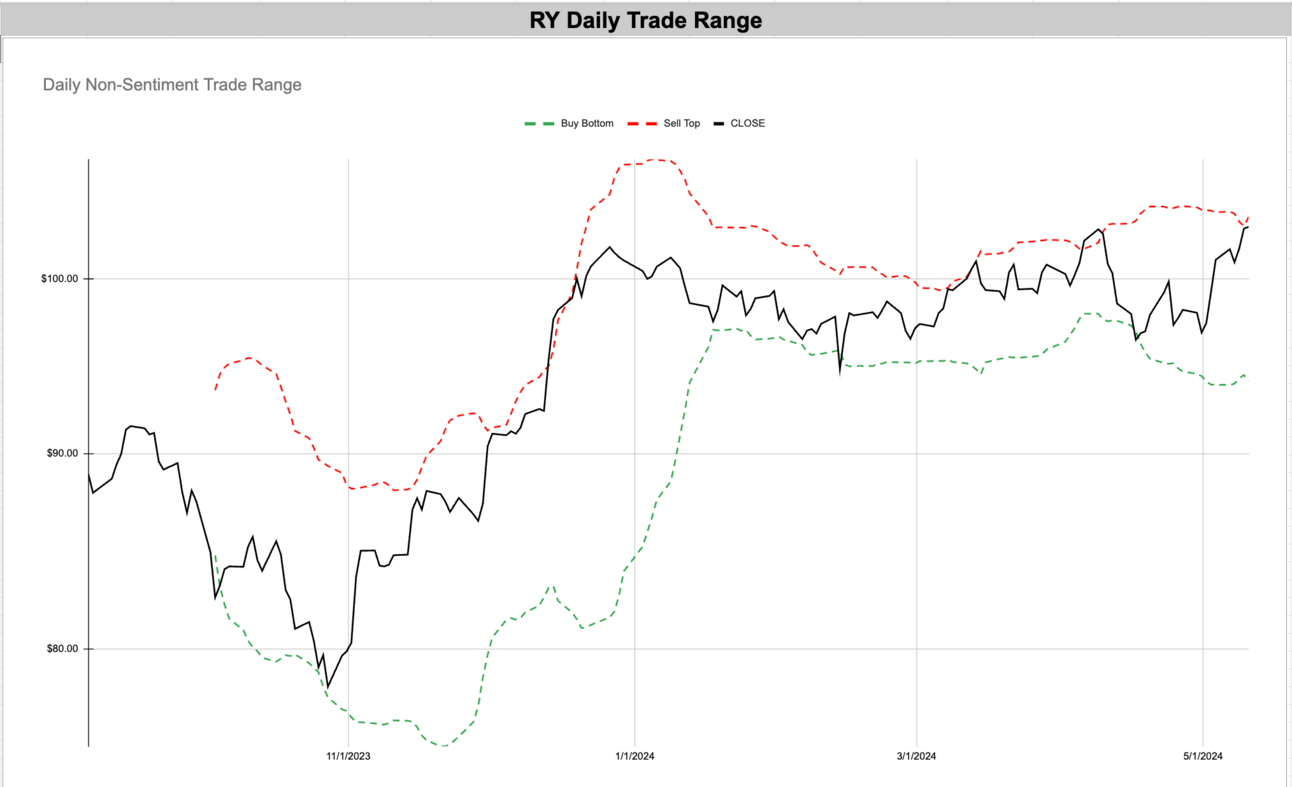

RY - Royal Bank Of Canada - Financial - Canada 🇨🇦

RTX - RTX Corp - Industrials - USA 🇺🇸

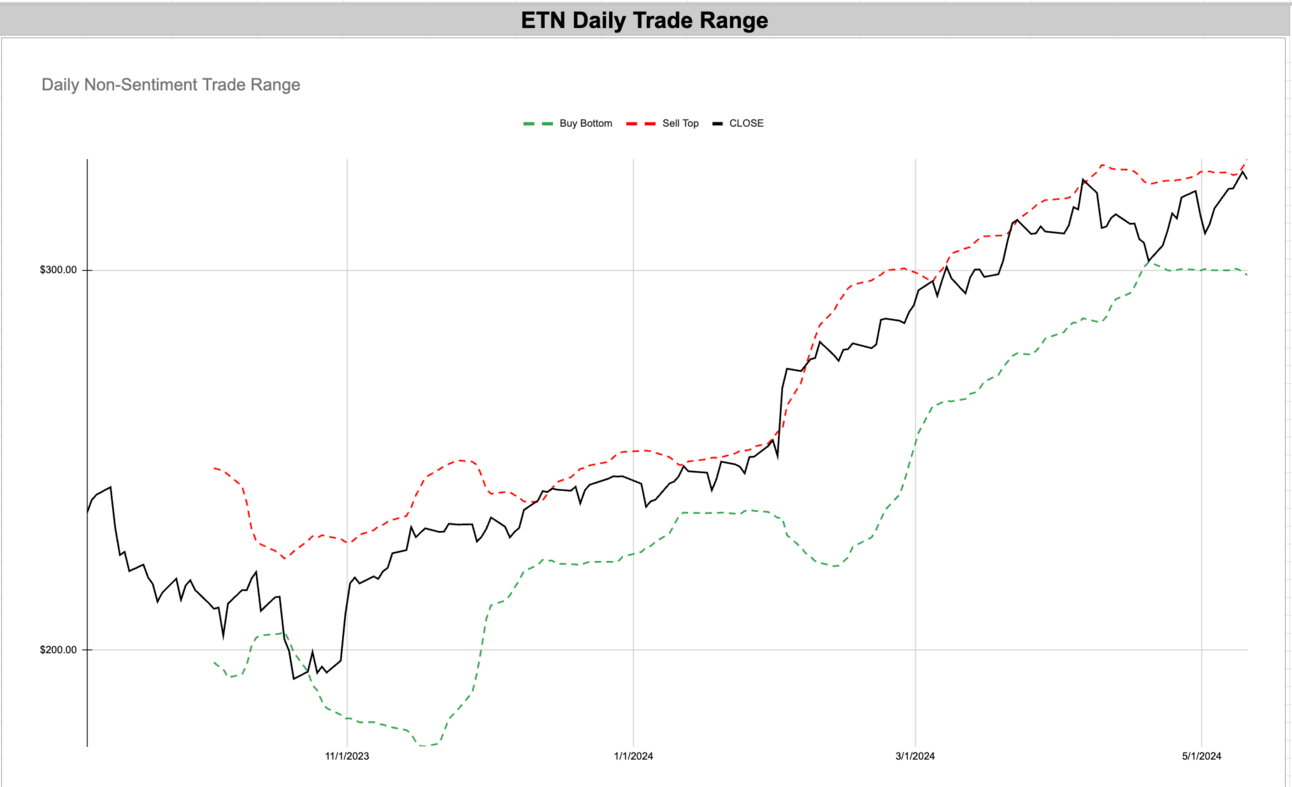

ETN - Eaton Corporation plc - Industrials - Ireland 🇮🇪

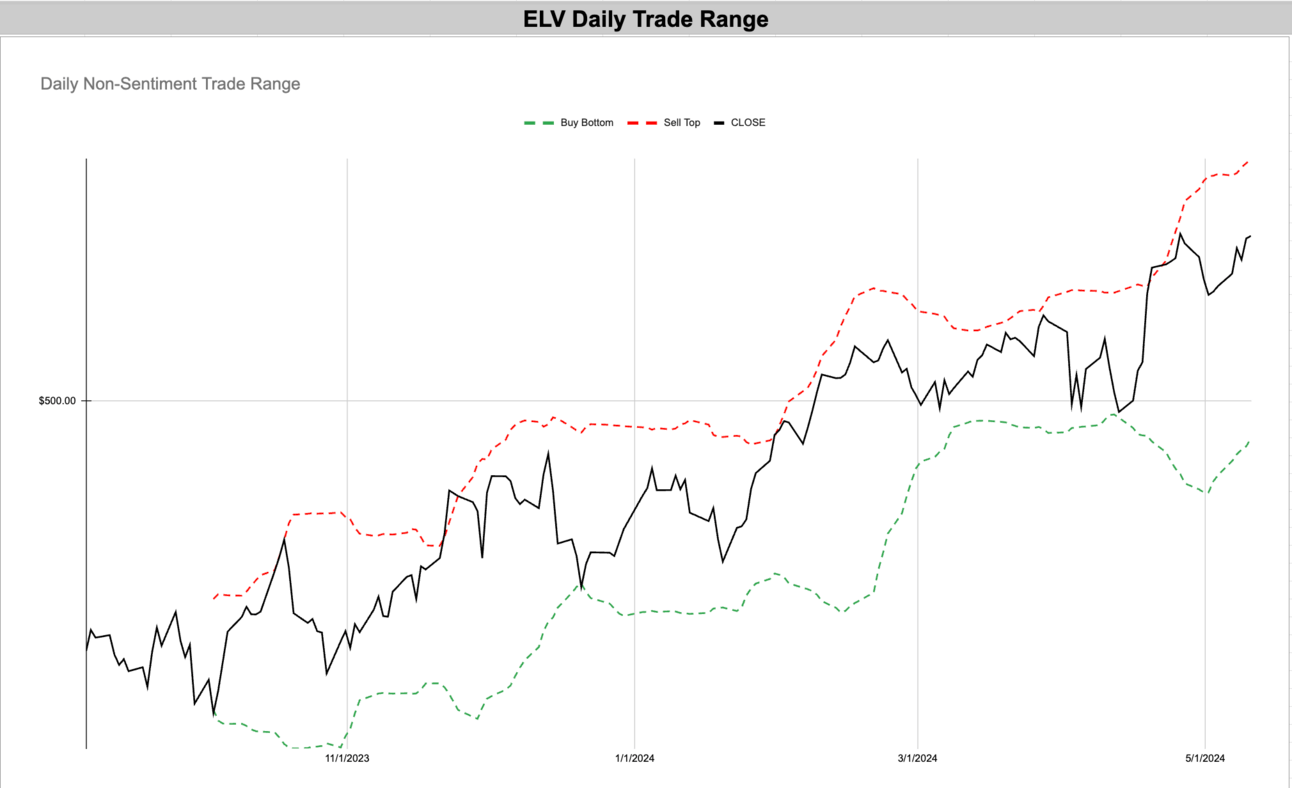

ELV - Elevance Health Inc - Healthcare - USA 🇺🇸

C - Citigroup Inc - Financial - USA 🇺🇸

ADI - Analog Devices Inc. - Technology - USA 🇺🇸

PG - Procter & Gamble Co. - Consumer Defensive - USA 🇺🇸

A massive breakout for a company with a long history and not much growth expecations.

This massive company is breaking out…that’s a massive signal in the overall market.

COST - Costco Wholesale Corp - Consumer Defensive - USA 🇺🇸

There is high volatility but it’s still very bullish.

Costco continues to be a growth stock for the ages. It rises and rages.

BAC - Bank Of America Corp. - Financial - USA 🇺🇸

A highly volatile bank trend.

A highly volatile bull trend.

AZN - Astrazeneca plc ADR - Healthcare - United Kingdom 🇬🇧

The volatility recently has fallen.

A massive breakout after sideways consolidation for over 9 months. This is strength.

SHEL - Shell Plc ADR - Energy - United Kingdom 🇬🇧

Who would think an old commodity company like Shell would be having a massive 22% rolling 1 year return. Incredible to see the producer breaking out.

A nice breakout in this major energy producer. And it’s in the UK which is a great signal of the global expansion which is starting.

WFC - Wells Fargo & Co. - Financial - USA 🇺🇸

Wells Fargo has a low volatility bullish breakout - that’s a beautiful looking breakout.

Wells Fargo continues to show it’s bullish momentum and strengh.

AXP - American Express Co. - Financial - USA 🇺🇸

A massive rally in American Express shows the upward momentum of the top tier spending in the economy.

American express continues to show a beautiful breakout and bullish trend. You want to bet against this economy?

MS - Morgan Stanley - Financial - USA 🇺🇸

A nice breakout here.

We continue to see sideways consolidation and a base for a potential breakout in Morgan Stanely.

GS - Goldman Sachs Group, Inc. - Financial - USA 🇺🇸

Goldman Sachs is showing huge strength. This continues to prove an expansion in the business cycle.

A massive breakout to higher-highs. You can see the top of the range really ripped higher which is INCREDIBLY BULLISH. Now I expect a pullback for mean reversion but this is a good sign.

RY - Royal Bank Of Canada - Financial - Canada 🇨🇦

This is high volatility which is good if you can buy low and sell high. This is hard money to make unless you have a stomach for high volatility.

This type of sideways action is very useful to setting a base before a breakout.

RTX - RTX Corp - Industrials - USA 🇺🇸

Strong upward trend with low volatility and a breakout. This is beautiful

One of the best signals is when volatility falls, the range gets tight and the price breakouts out.

ETN - Eaton Corporation plc - Industrials - Ireland 🇮🇪

We continue to see industrials starting to show a strong trend across the market. This fits with the shit to inflation, energy and commodities in mid-april.

It would be fantastic to see a higher-high in the range and a breakout in price.

ELV - Elevance Health Inc - Healthcare - USA 🇺🇸

We continue to see the price rising. The pullback was fantastic and the breakout is very strong.

Seeing a higher-high in the range. This is very bullish.

C - Citigroup Inc - Financial - USA 🇺🇸

We continue to see banks breaking out across the market.

I’d like to see the higher-high on the trade range.

ADI - Analog Devices Inc. - Technology - USA 🇺🇸

A fantastic breakout.

I love to see the higher-highs in the top of the range.

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

The most interesting tweet I saw this week - A private talk of Jim Simons at a university.

Five years ago, Jim Simons held a "fireside chat" at some bank. I was there and even talked to him afterwards. I recorded his talk (not great audio quality). It's full of factoids. I seems an appropriate way to remember him today.

— Giuseppe Paleologo (aka gappy) (@__paleologo)

6:41 PM • May 10, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro