- The New High Newsletter

- Posts

- The Other Side of Choppy Markets

The Other Side of Choppy Markets

We're never the first to experience market conditions. What can you learn from 2014-2015? We can show you the chart inside. Click and see what happened.

Hey there! So, here's the scoop: We're riding the bullish wave again 🐂, which is definitely a booster.

We're surfing the bullish waves. 🐂🌊 Sure, the breadth in index ETFs might not be super impressive, but let's not forget the silver lining - our heavy hitters are still cap weighted.- Stay with the biggest movers and it’s fine🚀🎯

And you know what? I'm embracing the role of the optimist in the room - somebody's got to spread those positive vibes, right? 😄🌈

Here's the deal: We've been enjoying a bullish market since December 3rd, 2023, and believe it or not, this trend started way back on December 5th, 2022.

For 2024, we're planning to ride the wave by following individual signals. Our mantra? Learn the trend, trade the range. It sounds simple, and that's because it is. And I'm all for keeping things simple. 📊👀

When I check out the indexes, I'm seeing lots of bullish behavior.

As for volatility, it's looking bullish too, though there might be some choppy waters 🌊📉 ahead.

But bearishness for the next 12 - 18 months? Nope, not seeing that on my radar. 🚫🐻

The market has got some exciting A.I. products on the horizon, but they're not full-blown companies just yet. 🌐🔭

Despite being near ALL-TIME-HIGHS, bearishness seems unwavering. 📈

But I'm waiting for that euphoria to hit before I start worrying about a massive drop. For now, I see risks, but also opportunities. 💡🏄♂️💼

I'm eyeing these next 6 months, leading up to Memorial Day week, as our prime time for scoring lower prices. 🗓️🛍️

I'm betting that summer will kick off a nice run. 🌞🌻 If you didn't get a chance to trade in 2016, 🎢🔮 it might be a good idea to revisit those charts.

After tough years in 2014-2015, people were pretty spooked at the start of 2016. Let's make the most of it and ride those market waves together! 🌊📊

Remember, the stock market's always full of surprises, so let's stay sharp.

You never know what is on the other side of choppy markets but it’s usually not more chop.

Market Performance

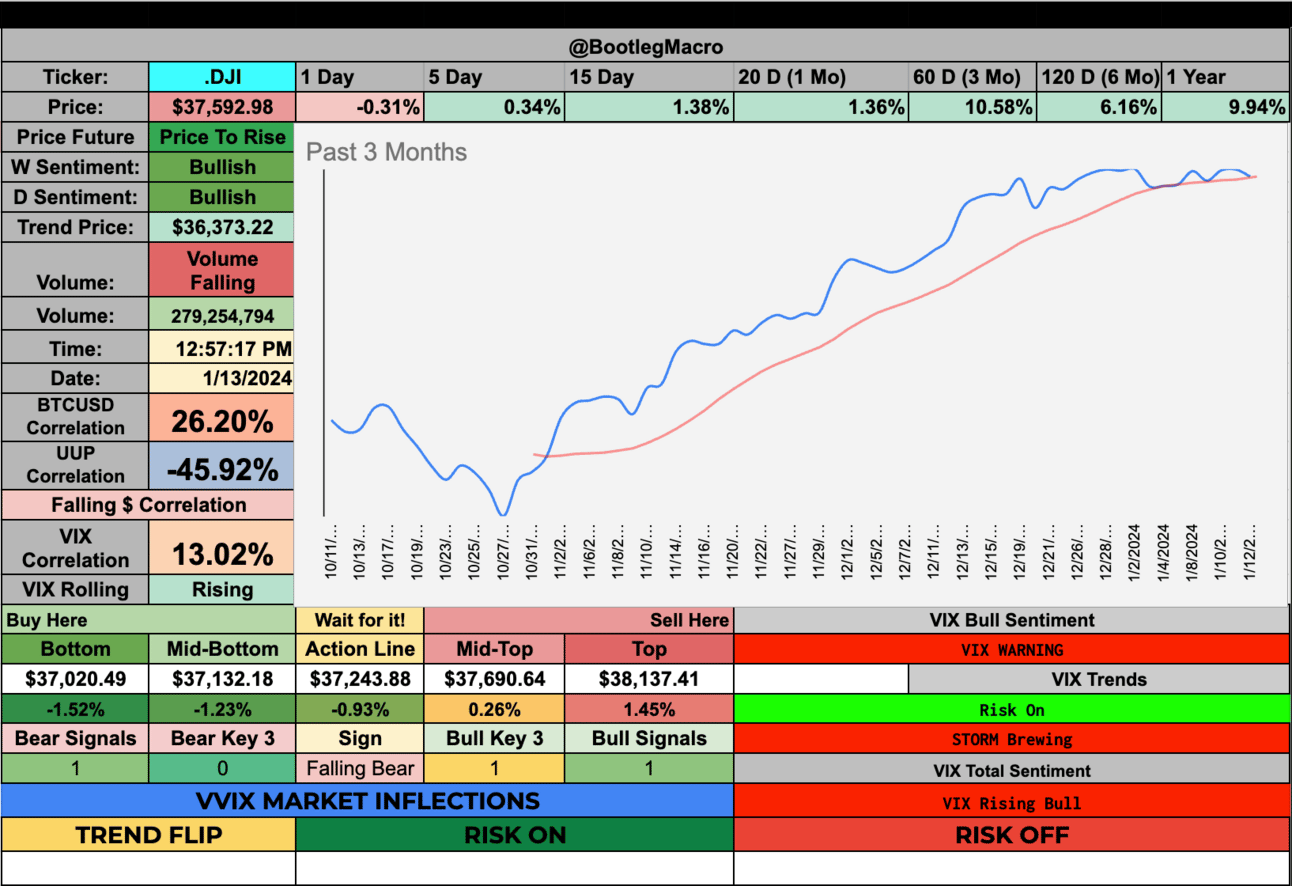

Before we jump into the new highs, which are fantastic this week (I’m very impressed by Brazilian companies below), we must start top down. What are US indexes doing?

Friday was flat action. We saw each index with a return positive for the week. The .INX and .IXIC all had well above 1% weekly returns. DJI lagged the two other indexes. Are you BULLISH yet?

Credit: Finviz - https://finviz.com/map.ashx?t=sec

Wonderful week to start the year.

Dow Jones has seen consolidation.

Nasdaq continues it’s strength.

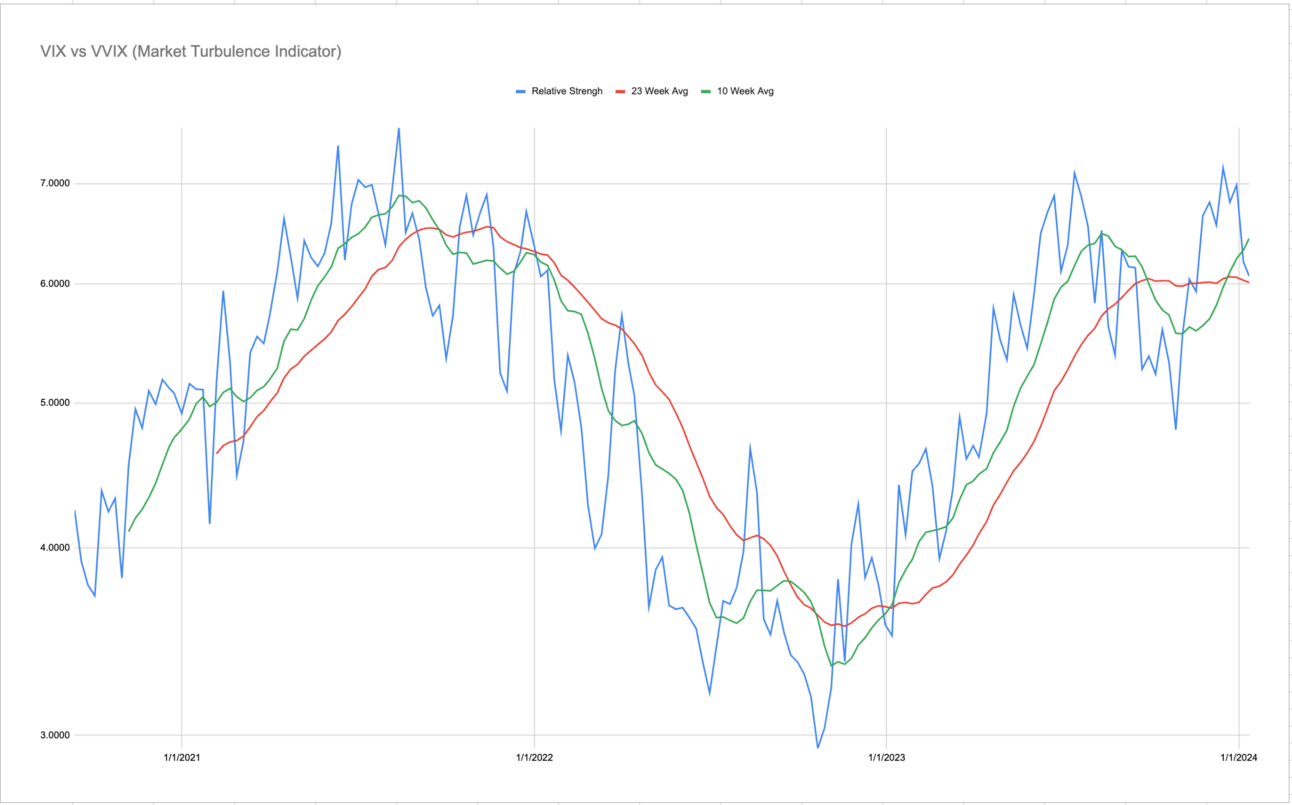

Volatility Corner:

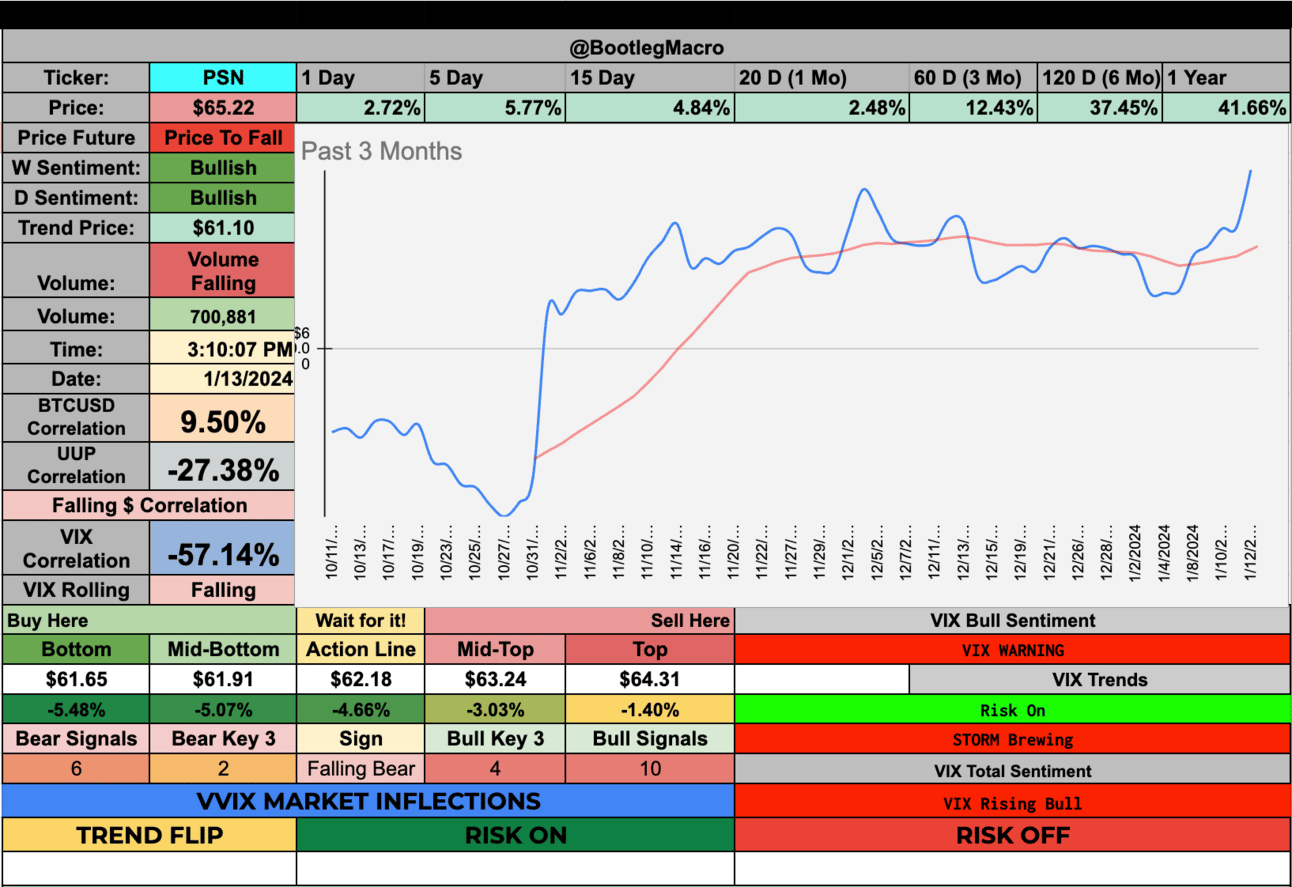

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. You see the up and down…things can get very choppy quickly in this market. The recent bottom we see in the blue line is 10/31/23. It appears we may be going for a new bottom very soon.

I suspect this falls, chops and then goes higher. But I’ll be data dependent watching.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

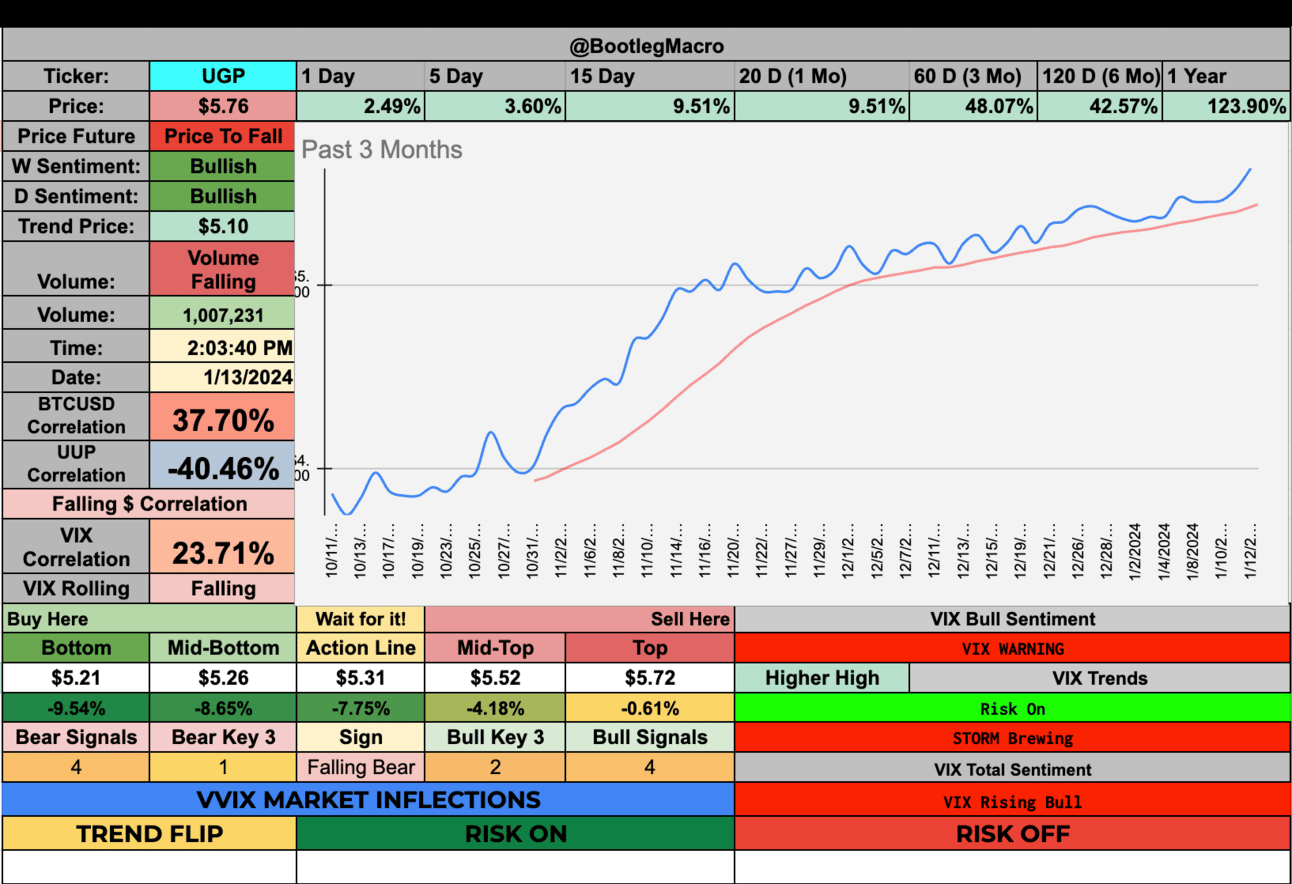

UGP - Ultrapar Participações S.A. - Energy - 🇧🇷

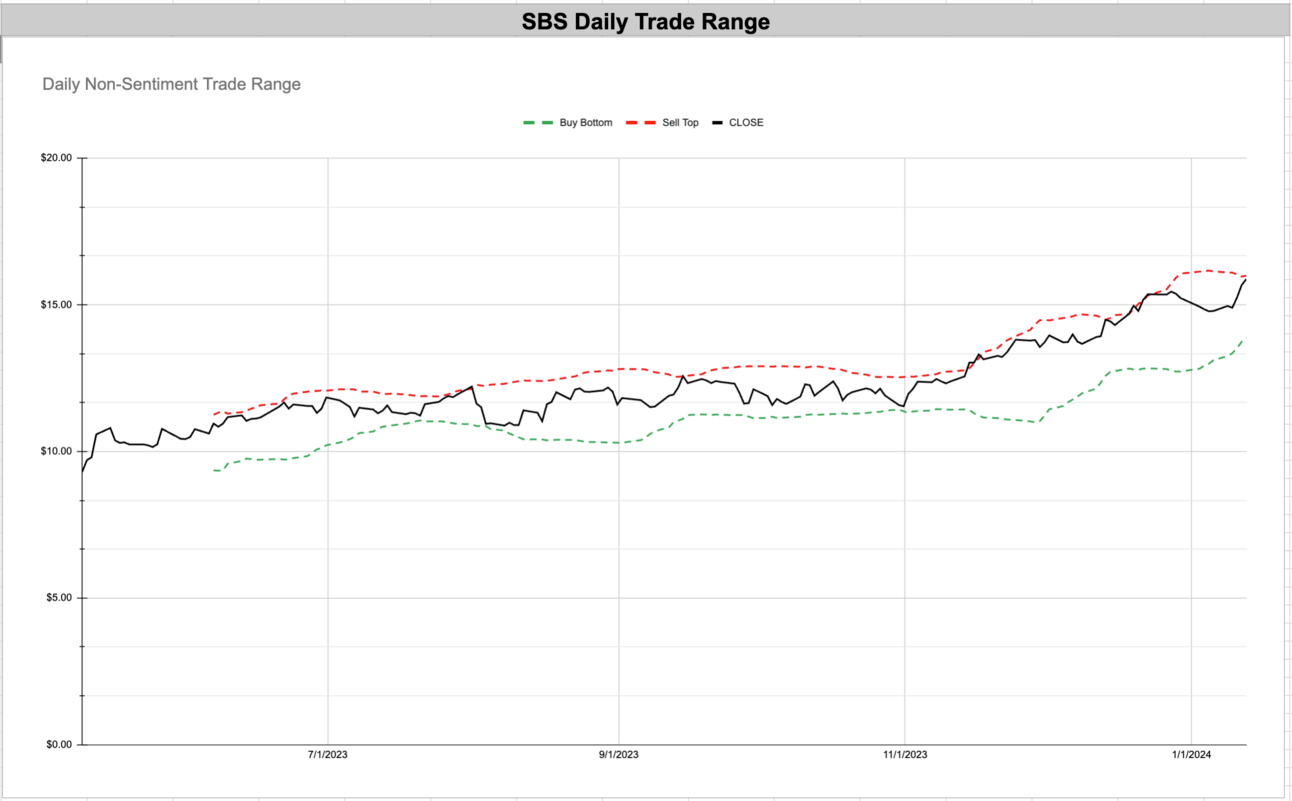

SBS - Companhia de Saneamento Básico do Estado de São Paulo - Utilities - Regulated Water - 🇧🇷

EBR - Centrais Elétricas Brasileiras S.A. - Eletrobrás - Utilities - Regulated Electric - 🇧🇷

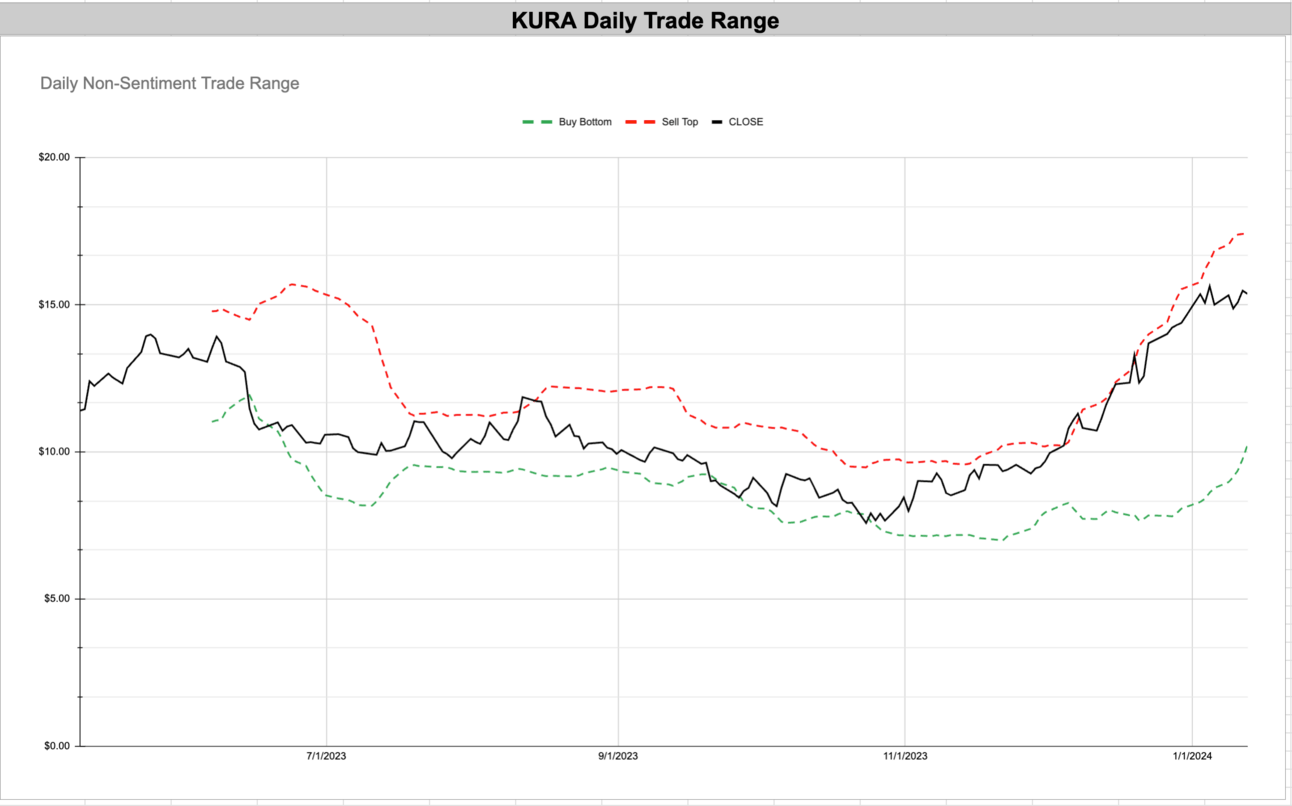

KURA - Kura Oncology, Inc. - Healthcare - Biotechnology - 🇺🇸

AKR - Acadia Realty Trust - Real Estate - 🇺🇸

KD - Kyndryl Holdings, Inc. - Technology - Information Technology Services - 🇺🇸

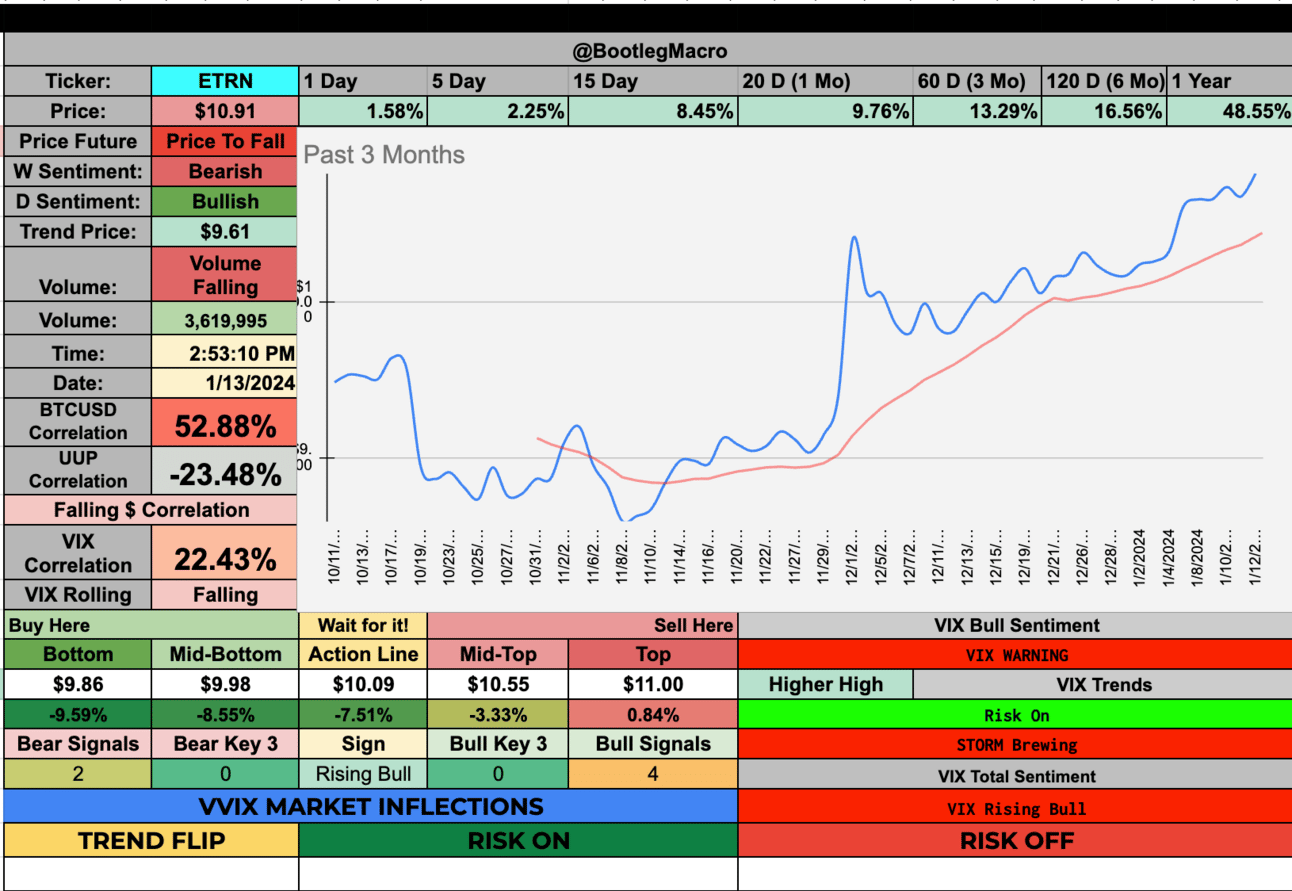

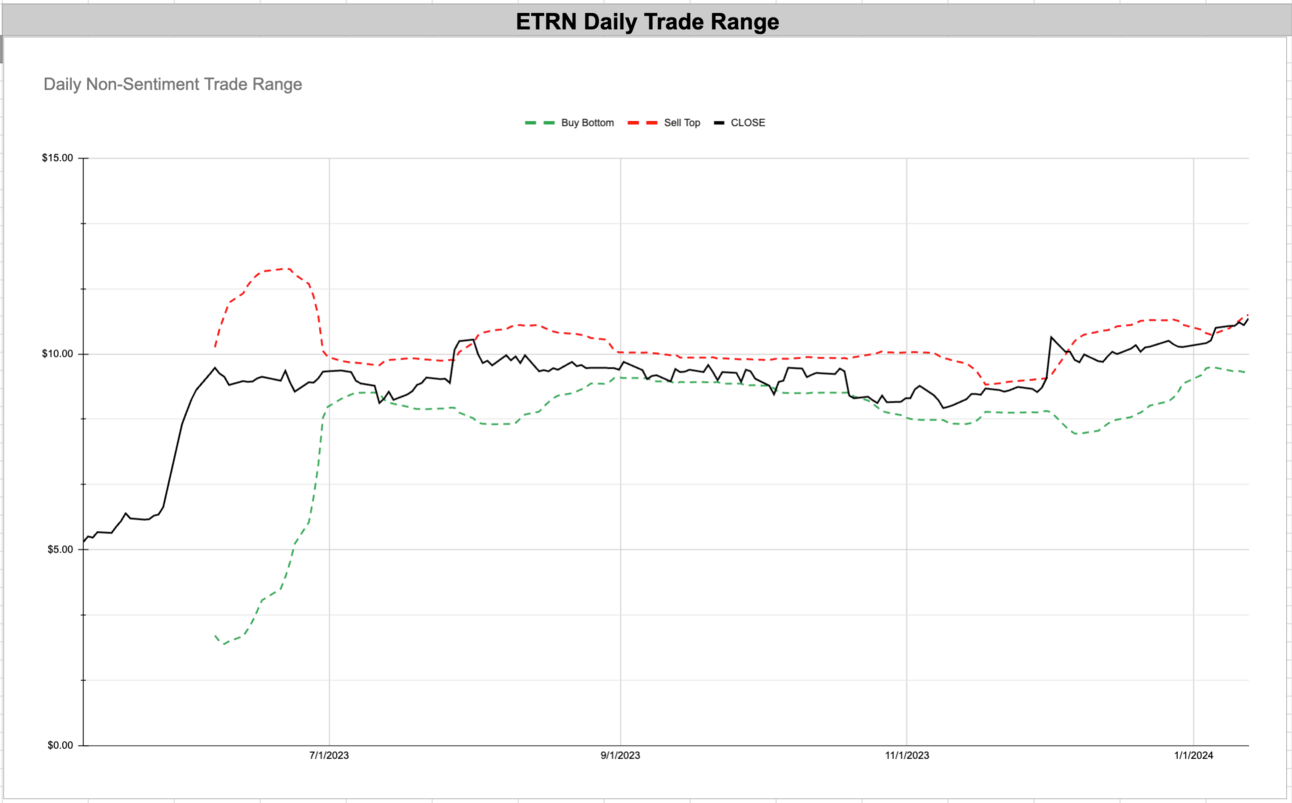

ETRN - Equitrans Midstream Corporation - Energy - Oil & Gas Midstream - 🇺🇸

TME - Tencent Music Entertainment Group - Communication Services - Internet Content & Information - 🇨🇳

CRBG - Corebridge Financial, Inc. - Financials - Asset Management - 🇺🇸

UGP - Ultrapar Participações S.A. - Energy - 🇧🇷

SBS - Companhia de Saneamento Básico do Estado de São Paulo - Utilities - Regulated Water - 🇧🇷

EBR - Centrais Elétricas Brasileiras S.A. - Eletrobrás - Utilities - Regulated Electric - 🇧🇷

KURA - Kura Oncology, Inc. - Healthcare - Biotechnology - 🇺🇸

AKR - Acadia Realty Trust - Real Estate - 🇺🇸

KD - Kyndryl Holdings, Inc. - Technology - Information Technology Services - 🇺🇸

ETRN - Equitrans Midstream Corporation - Energy - Oil & Gas Midstream - 🇺🇸

TME - Tencent Music Entertainment Group - Communication Services - Internet Content & Information - 🇨🇳

CRBG - Corebridge Financial, Inc. - Financials - Asset Management - 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

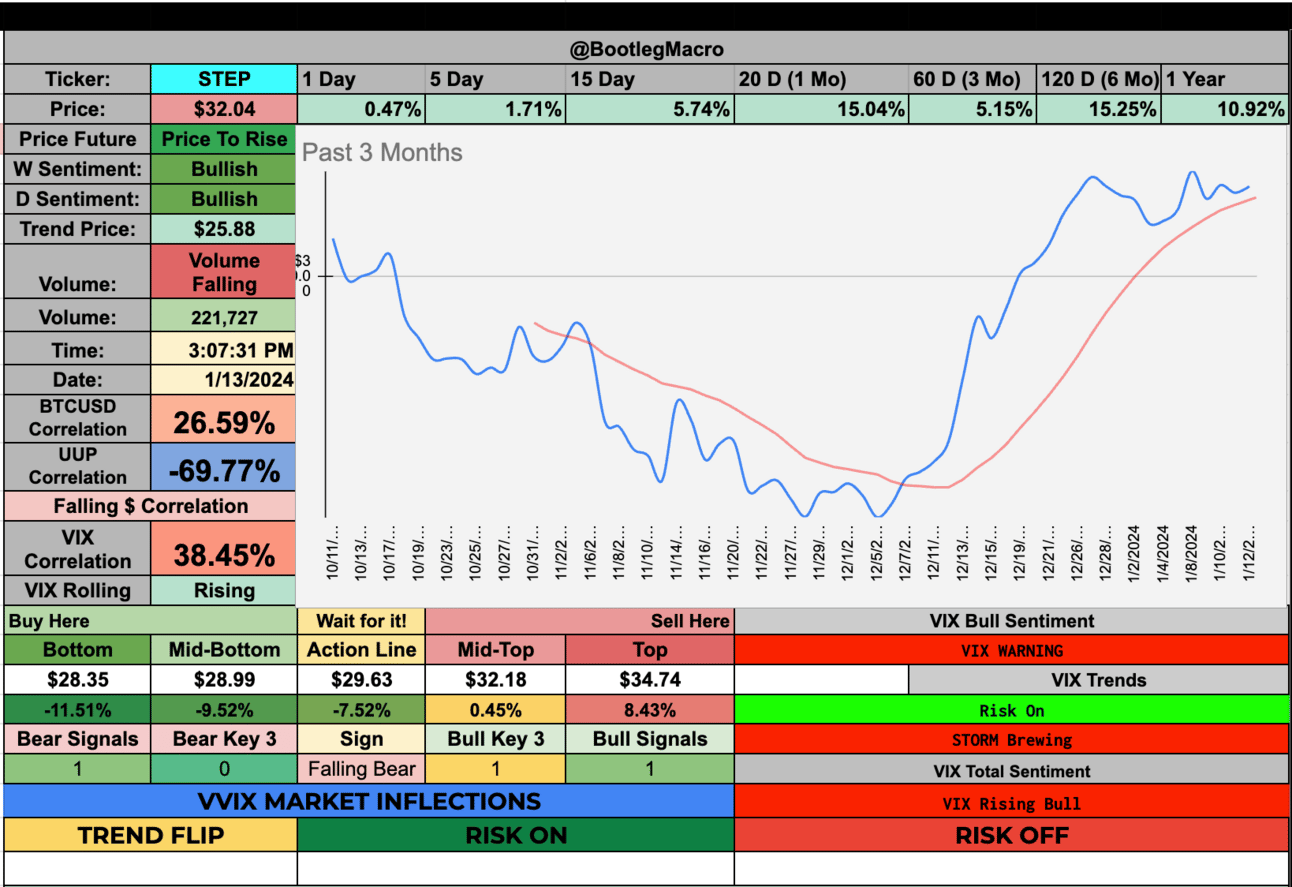

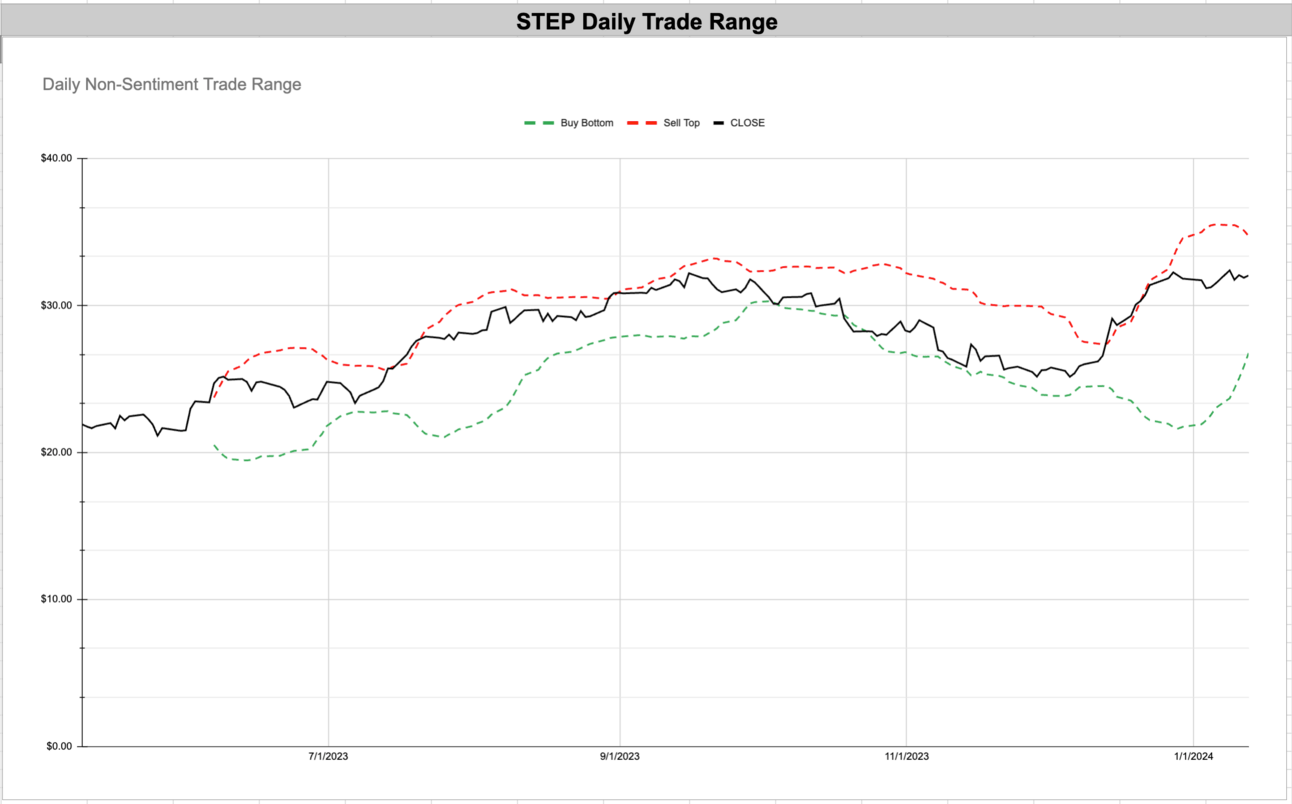

STEP - StepStone Group LP - Financials - Asset Management - 🇺🇸

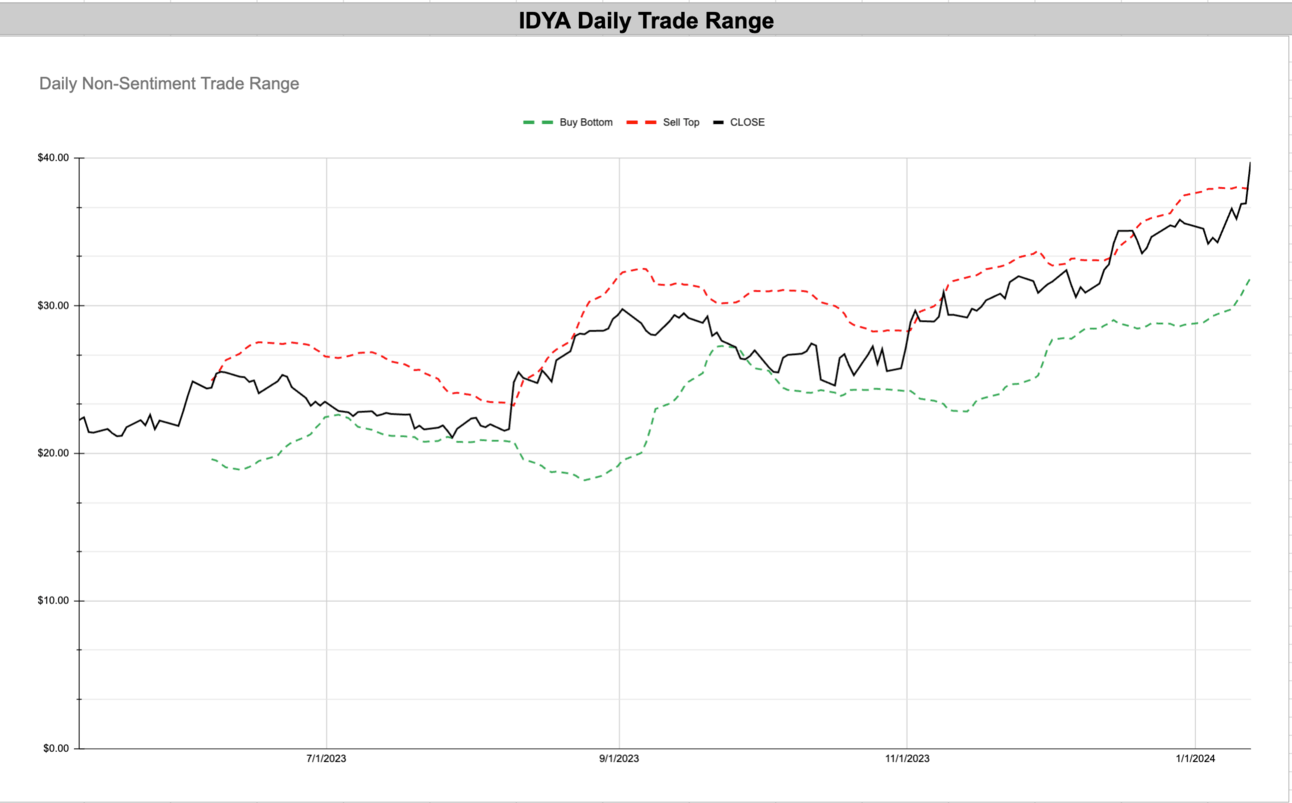

IDYA - Ideya Biosciences Inc - Healthcare - 🇺🇸

GOLF - Acushnet Holdings Corp - Consumer Cyclical - Leisure - 🇺🇸

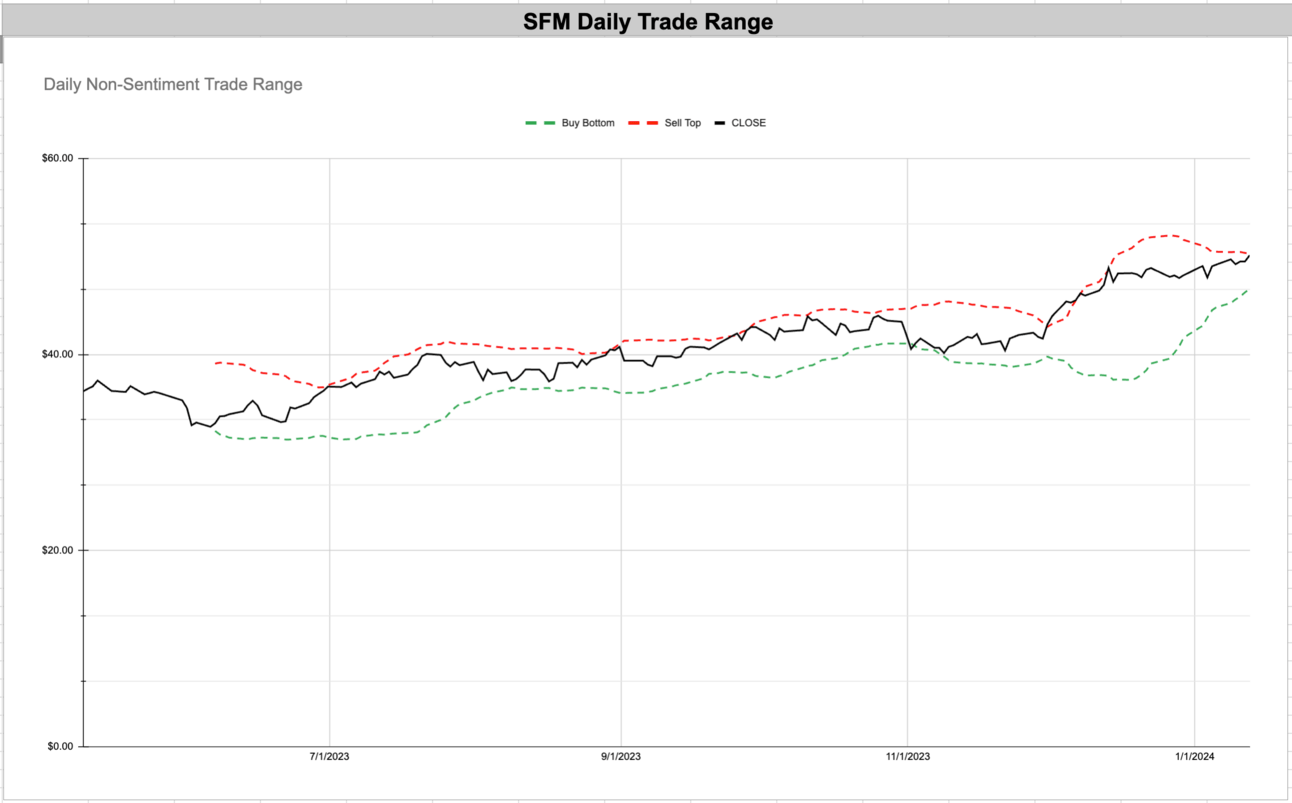

SFM - Sprouts Farmers Market Inc - Consumer Defensive - Grocery Stores - 🇺🇸

PSN - Parsons Corp - Technology - Information Technology Services - 🇺🇸

WM - Waste Management, Inc - Industrials - Waste Management - 🇺🇸

WDAY - Workday Inc - Technology - Software Application - 🇺🇸

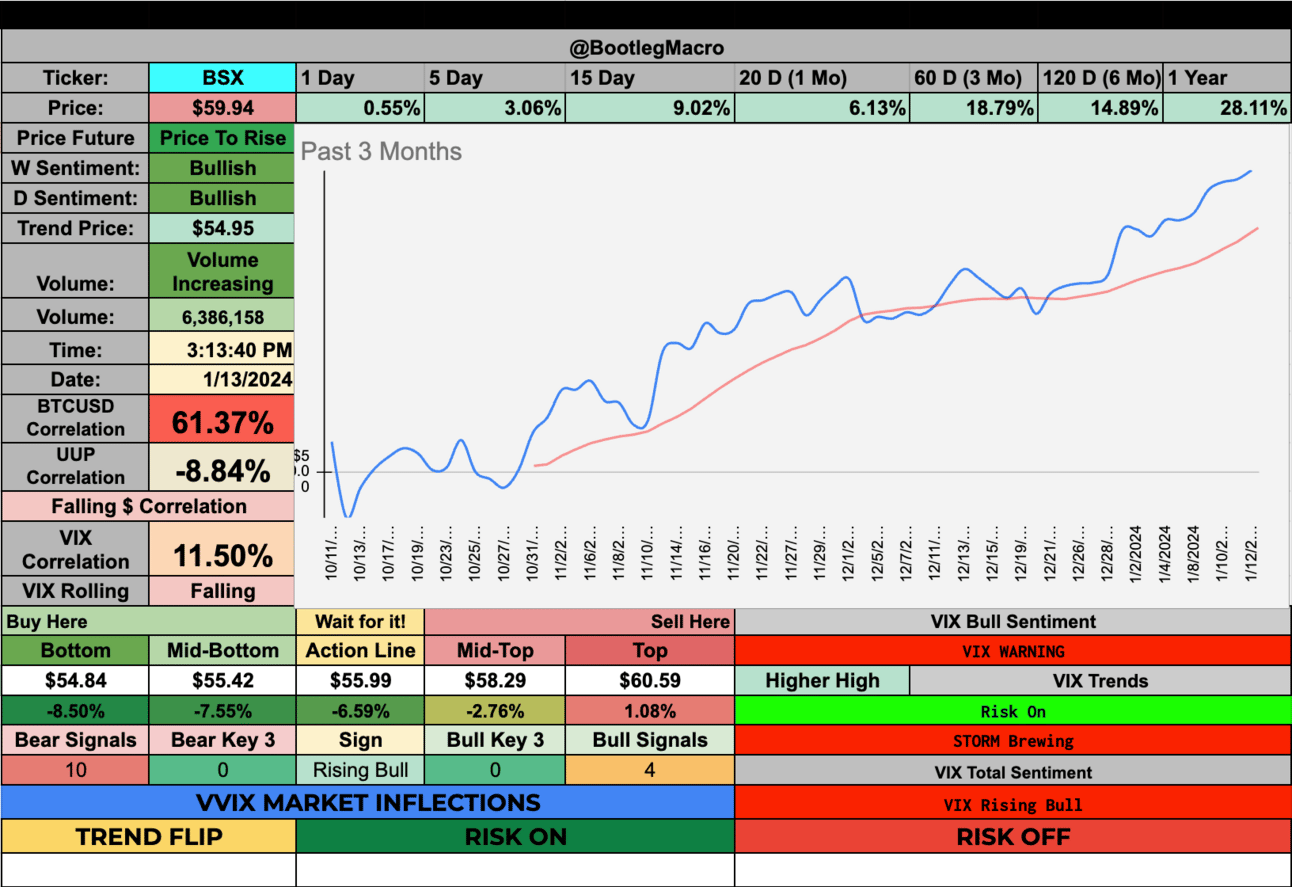

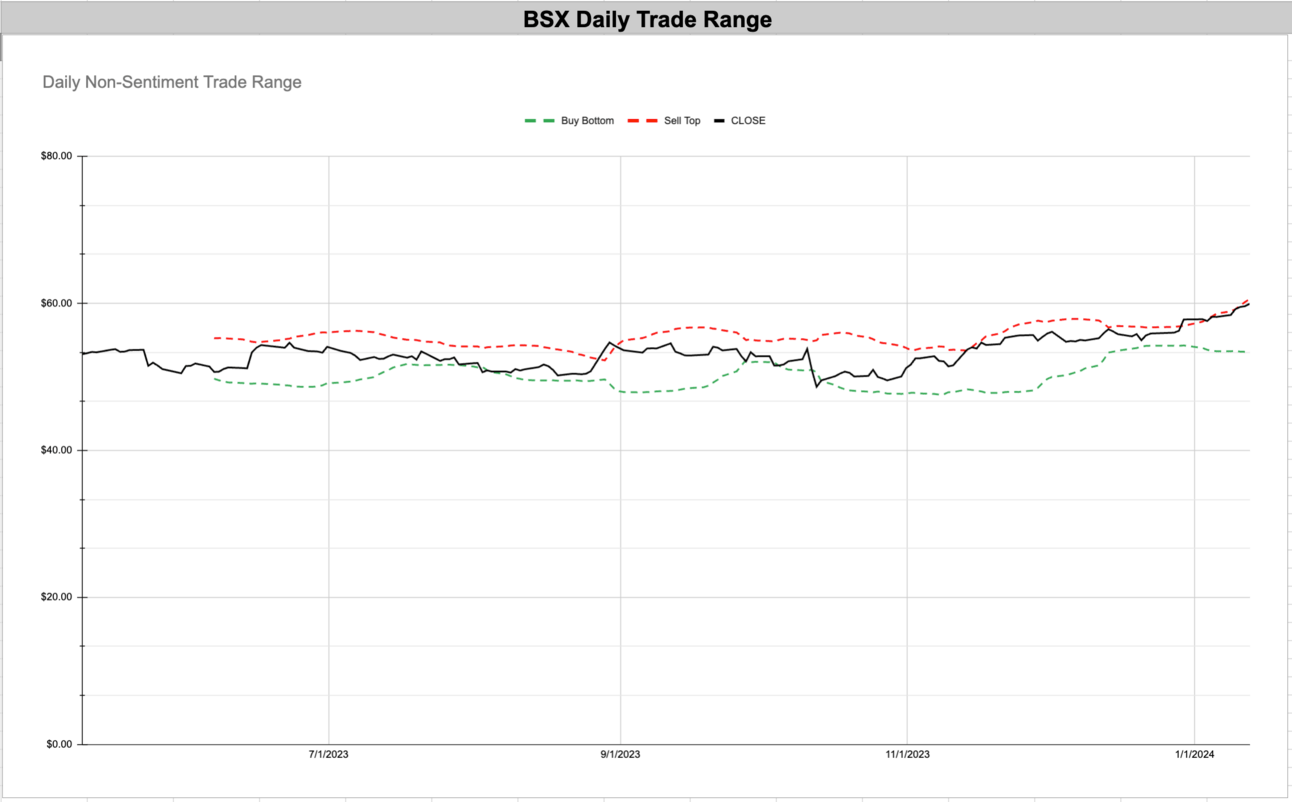

BSX - Boston Scientific Corp - Healthcare - Medical Devices - 🇺🇸

ACN - Accenture - Technology - Information Technology - 🇮🇪

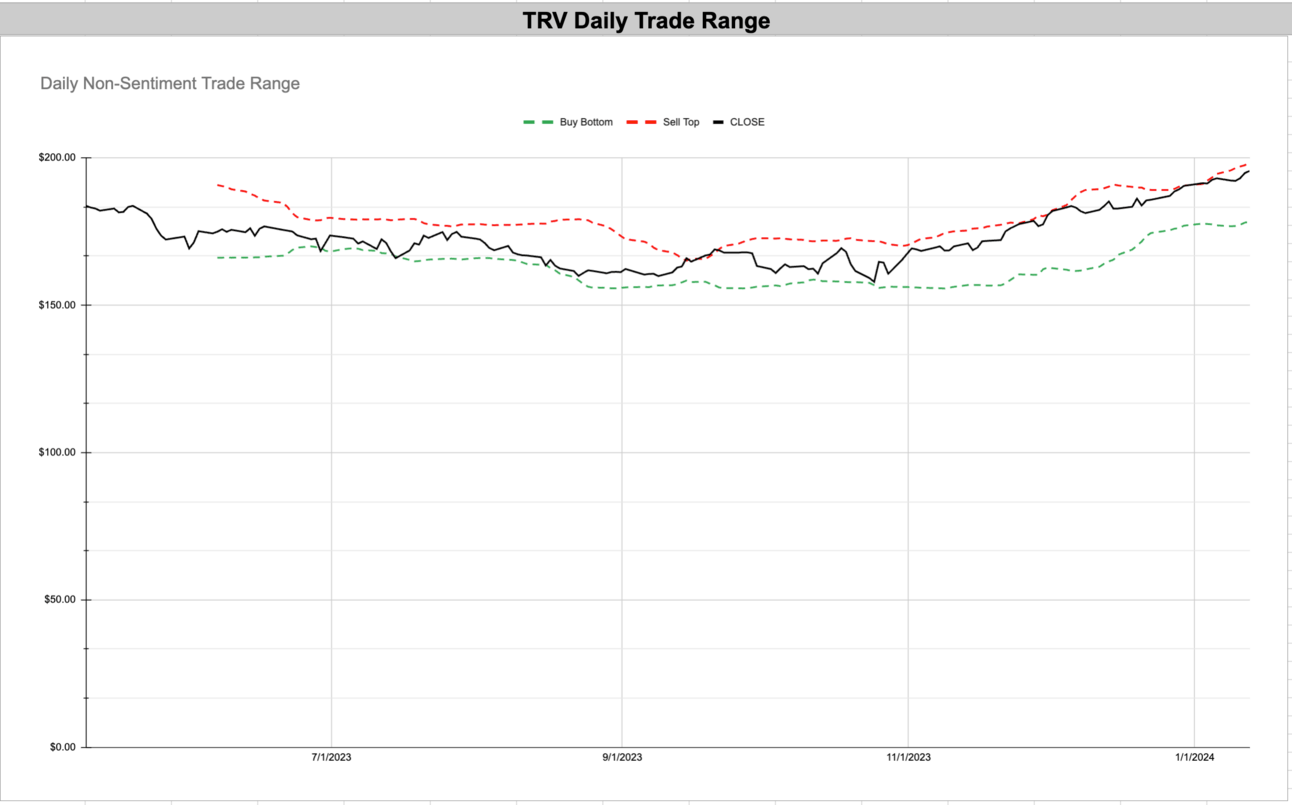

TRV - Travelers Companies Inc - Financial - Insurance - Property & Casualty - 🇺🇸

STEP - StepStone Group LP - Financials - Asset Management - 🇺🇸

IDYA - Ideya Biosciences Inc - Healthcare - 🇺🇸

GOLF - Acushnet Holdings Corp - Consumer Cyclical - Leisure - 🇺🇸

SFM - Sprouts Farmers Market Inc - Consumer Defensive - Grocery Stores - 🇺🇸

PSN - Parsons Corp - Technology - Information Technology Services - 🇺🇸

WM - Waste Management, Inc - Industrials - Waste Management - 🇺🇸

WDAY - Workday Inc - Technology - Software Application - 🇺🇸

BSX - Boston Scientific Corp - Healthcare - Medical Devices - 🇺🇸

ACN - Accenture - Technology - Information Technology - 🇮🇪

TRV - Travelers Companies Inc - Financial - Insurance - Property & Casualty - 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro