- The New High Newsletter

- Posts

- Riding the Volatility Rollercoaster: Are We Screaming or Coasting?

Riding the Volatility Rollercoaster: Are We Screaming or Coasting?

Looking ahead, it’s all about inflation, rates, and potential consumer slowdown in 2025. Macro themes like tech regulation and trade will keep things interesting. Resilience remains the name of the game, but don’t count out surprises.

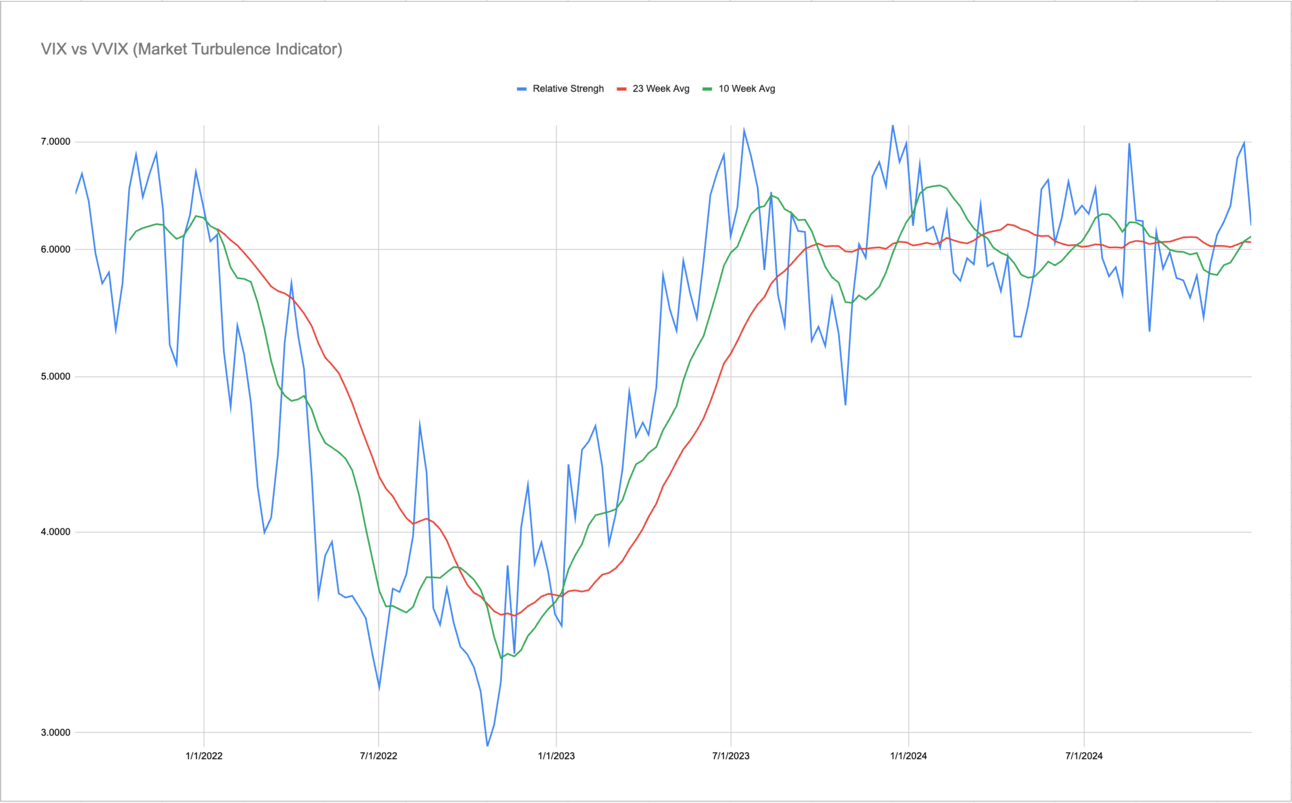

Market Overview: Biggest volatility spike in 2024, the VIX was up 74% from 12/17 to 12/18! 74% in 1 day! That should tell you everything you need to know about this week in markets. It was mind bending, drawdown inducing and absolutely predictable! I called it out in last weeks’ edition because the Turbulence indicator as I said, “It’s higher than it’s been but we can be very BULLISH since we are in a BULL MARKET. But we all know Trees Can’t Grow to the SKY! And this indicator knows it.”

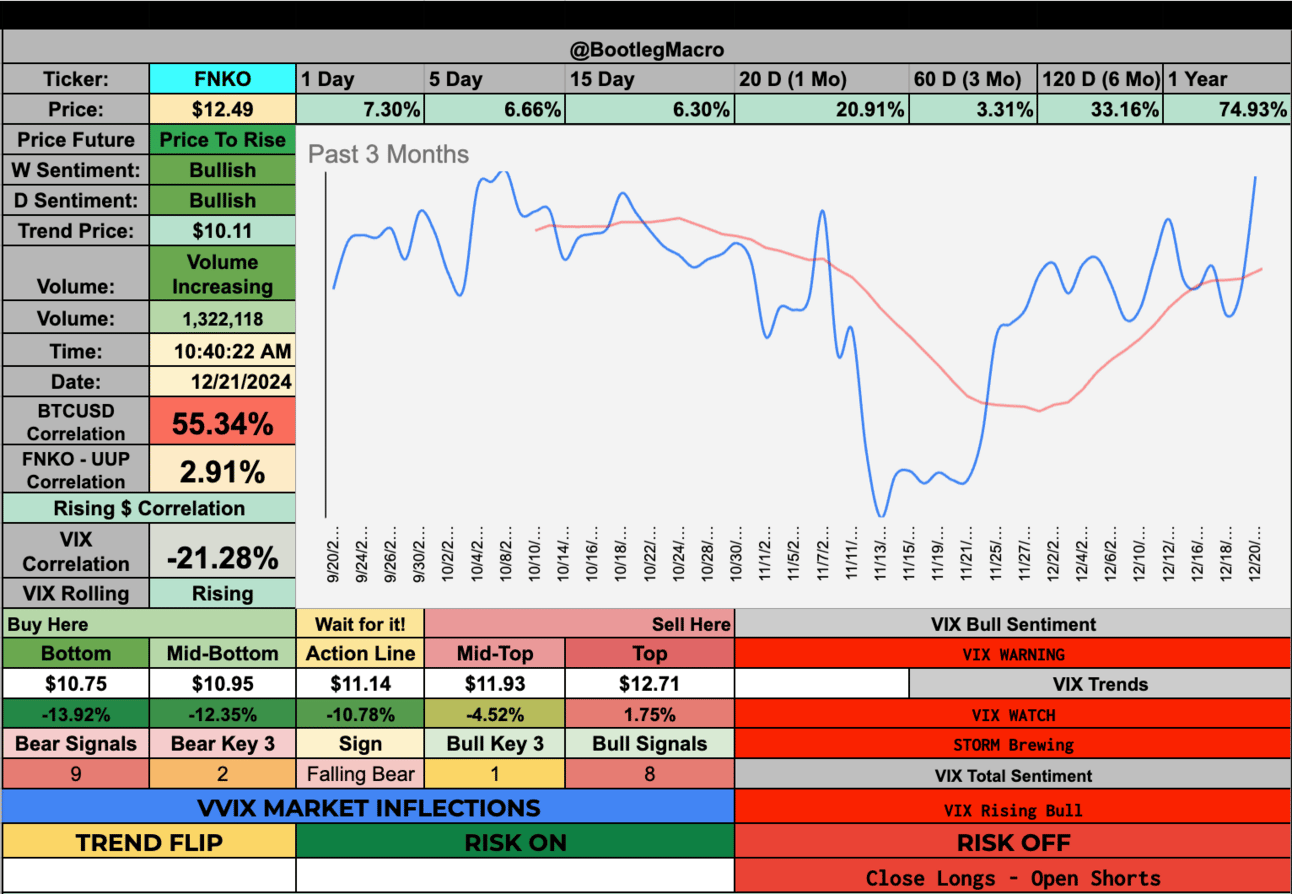

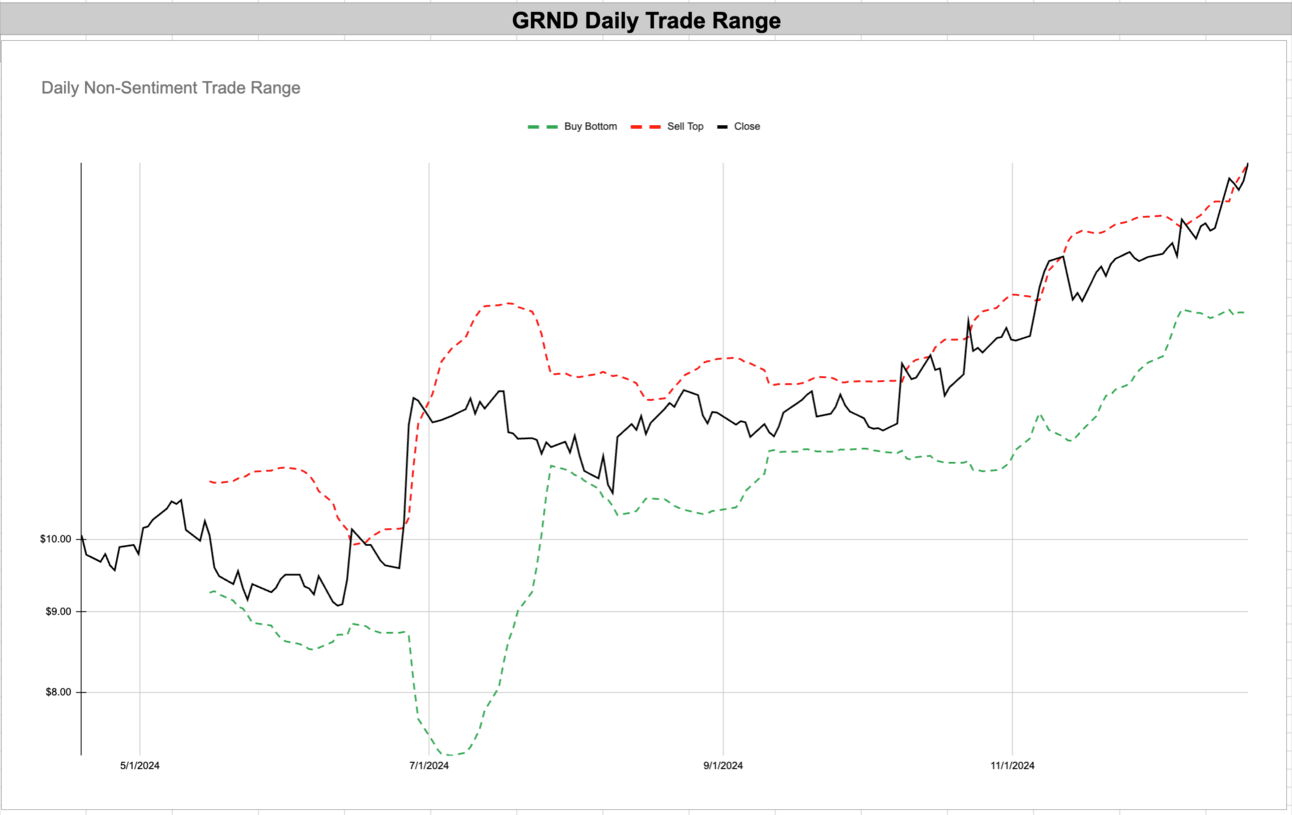

New Highs $5-$20: Grindr is back! So is Apple! Why? Because the high-beta, growers rule the market. A old name from the era of 2022 is FNKO…if you love characters, dolls and secular growth, you’ll love FUNKO. They are all breaking out.

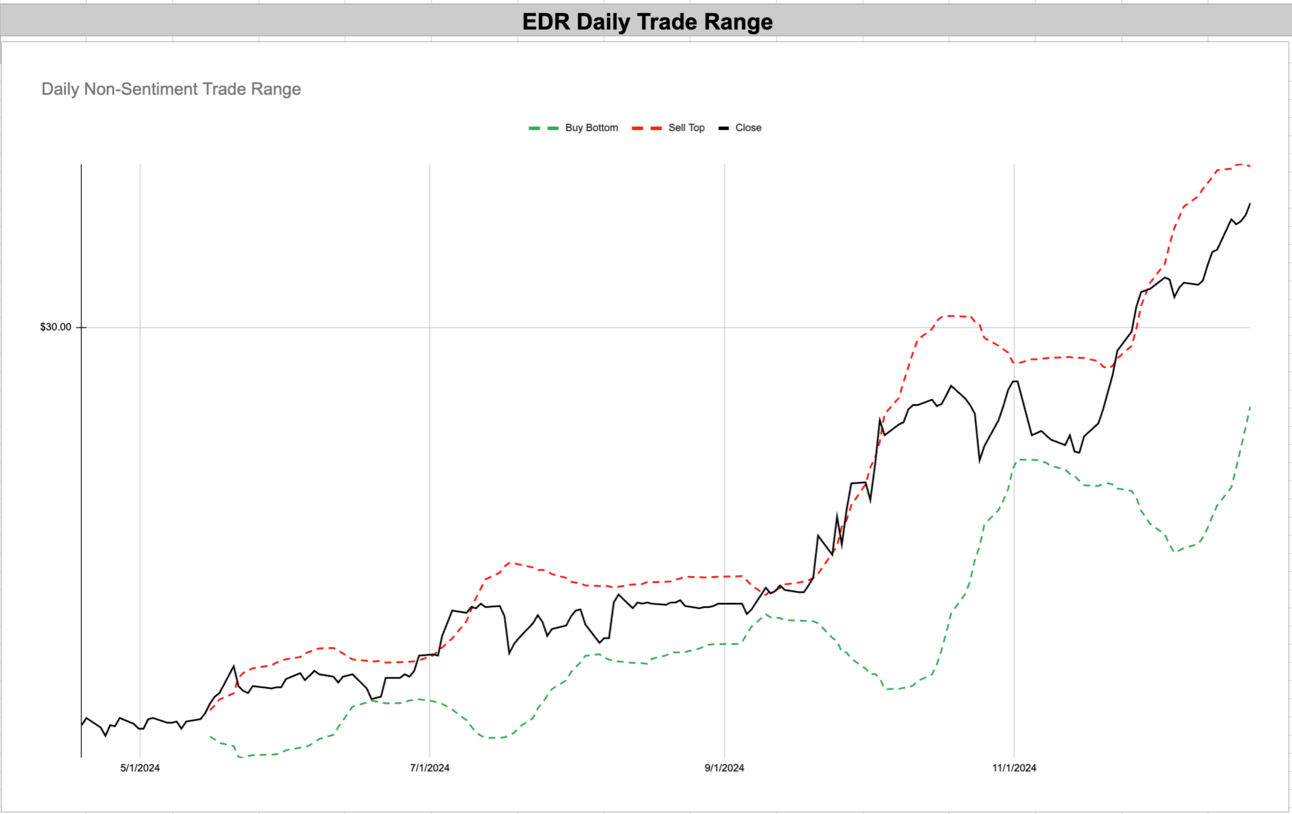

New Highs $20+: EDR, RELY, DECK all different reasons but all fit for the season. In the words of Bruce Banner, “It’s Time!”. It’s time for stocks to rise and fly. Especially because the VIX went on a

Turbulence Indicator: Market volatility spiked, which is obvious if you read the first sentence. But what do we expect from here? Because below you’ll see the VIX/VVIX relative strength look is significantly more BULLISH than it was a week ago. But we could have another holiday week of selling which sets up for 2-4 weeks of very BULLISH behavior going into the inauguration of Donald Trump.

Looking Ahead: It’s Christmas in the Western World and a shortened trading week. Expect low volume, squeezes and drops. Anything ready to run will setup. Also, anything ready to drop has the perfect low volume period to help it play out.

Market Performance Framework

Market Overview:

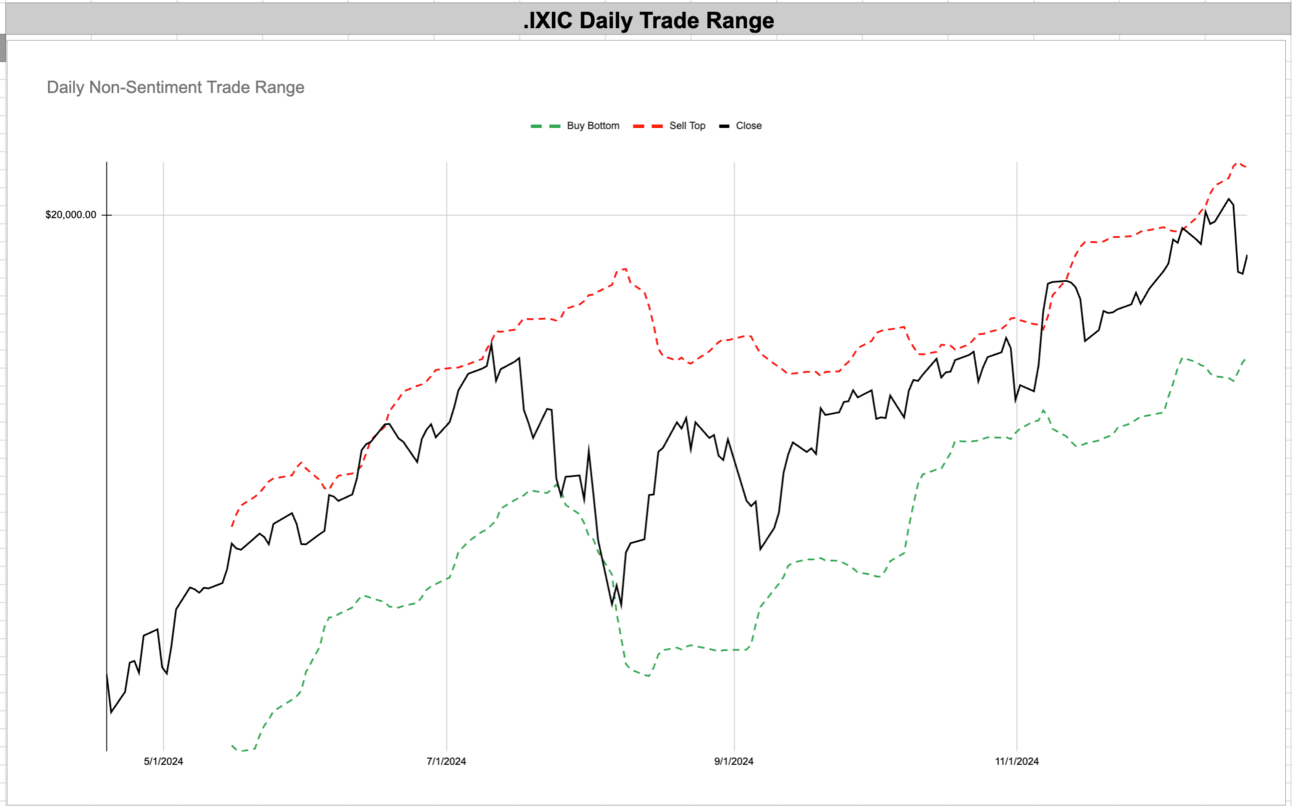

The markets are dancing into year-end, but the VIX is keeping us on our toes with a recent spike (up 32.95% over 5 days!). The Dow’s holding steady at $42,840, while the S&P 500 and Nasdaq are cautiously navigating macro jitters. It’s the classic mix of holiday optimism and year-end volatility.

Key Focus Area:

The VIX at $18.36 is bullish but cooling, suggesting traders might be winding down for the holidays—or bracing for surprises. Tech-heavy Nasdaq shows a tight trade range, hinting at opportunity if you can time it right. The volume drop? Probably a sign of traders hitting the eggnog early.

Current Outlook:

Volatility is rising, with a strong VIX-UUP correlation (81.14%), signaling dollar strength is playing a big role. The VVIX moving averages are saying, “Stay sharp—turbulence isn’t done yet.” For now, the market feels like it’s holding its breath for the next big catalyst.

Long-Term View:

Looking ahead, it’s all about inflation, rates, and potential consumer slowdown in 2025. Macro themes like tech regulation and trade will keep things interesting. Resilience remains the name of the game, but don’t count out surprises.

Closing Speculation:

Will 2025 start with a bang or a whimper? The data is sending mixed signals, so stay nimble. The markets love to surprise—are you ready for the next move?

Volatility Corner Framework

Indicator Update:

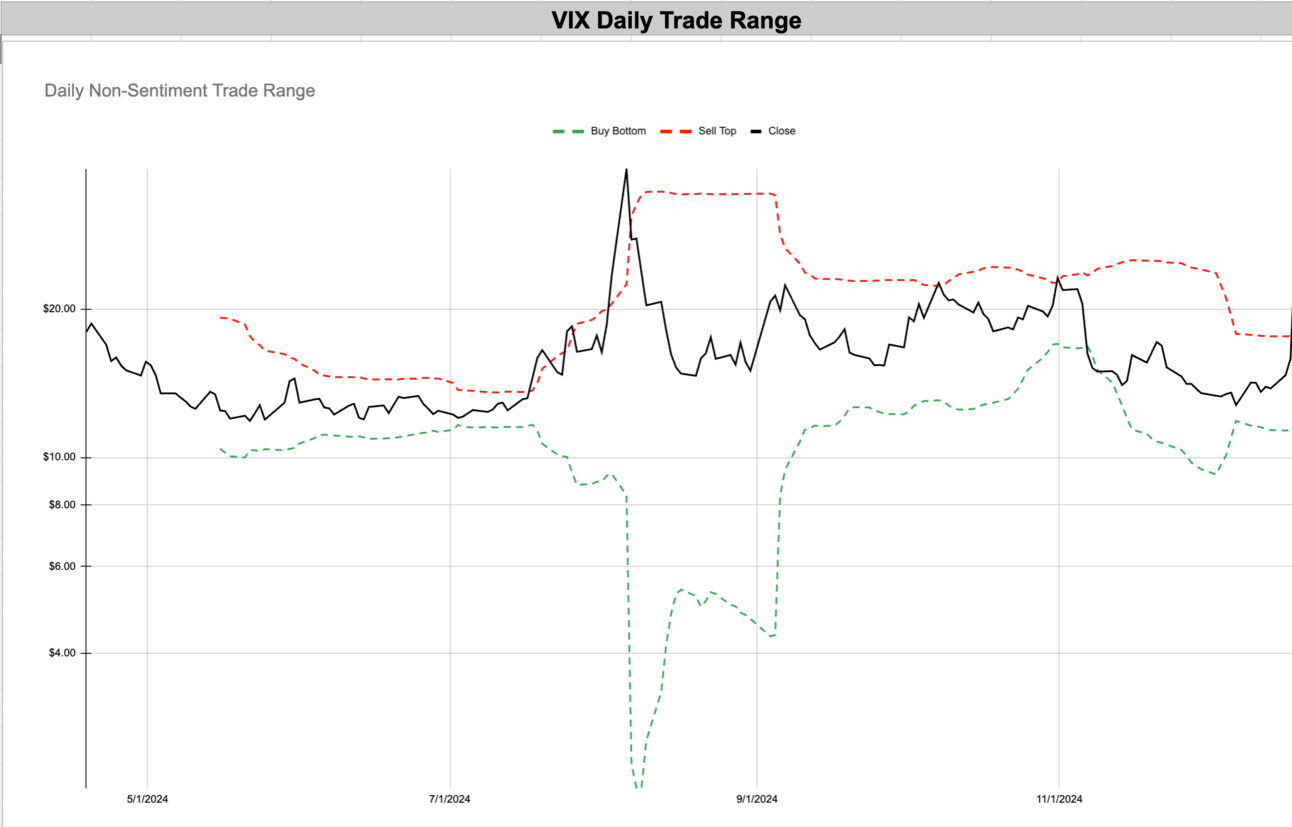

The VIX Daily Trade Range is showing signs of life after a recent spike, but it’s settling into a more stable pattern. The current level of $18.36, while bullish, suggests traders are cautious but not panicked. For perspective, falling volatility here could pave the way for a steady market, but the turbulence indicator hints we’re not out of the woods just yet.

Technical Context:

The VIX’s recent spike above $20 briefly shook up the market but has since retreated below critical resistance levels. The red “Sell Top” line suggests a ceiling around $24.65, while the green “Buy Bottom” is holding near $9.89. These levels act as guardrails, signaling the market’s potential range. A fall below $12.84 (action line) could indicate a return to calmer waters, while a breach above $18.75 signals renewed market fear.

Risk Assessment:

With the VIX-UUP correlation at 81.14%, dollar strength is a key driver of current sentiment. Rising volatility combined with a strong dollar could dampen risk appetite. Add in the VVIX’s elevated levels, and we’ve got a recipe for some continued uncertainty. The biggest risk? An unexpected macro shock that reignites fear—think inflation surprises or geopolitical tensions.

Historical Parallels:

The turbulence seen here mirrors late-2022, where the VIX spiked briefly before moderating. Back then, markets absorbed the volatility and pushed higher once the dust settled. If history repeats, we could see a similar pattern with a few weeks of consolidation before the next directional move.

Actionable Insight:

Stay vigilant but don’t overreact. The market’s fear gauge is flashing caution but not screaming panic. For traders, this is a “watch the levels” moment—pay attention to the VIX’s next move around $18.75. For investors, it’s a time to remain disciplined and prepared for turbulence while keeping an eye on long-term opportunities. Patience will pay off here!

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 8/24/24🟢

MICRO WEATHER: BEARISH Since 12/19/24🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

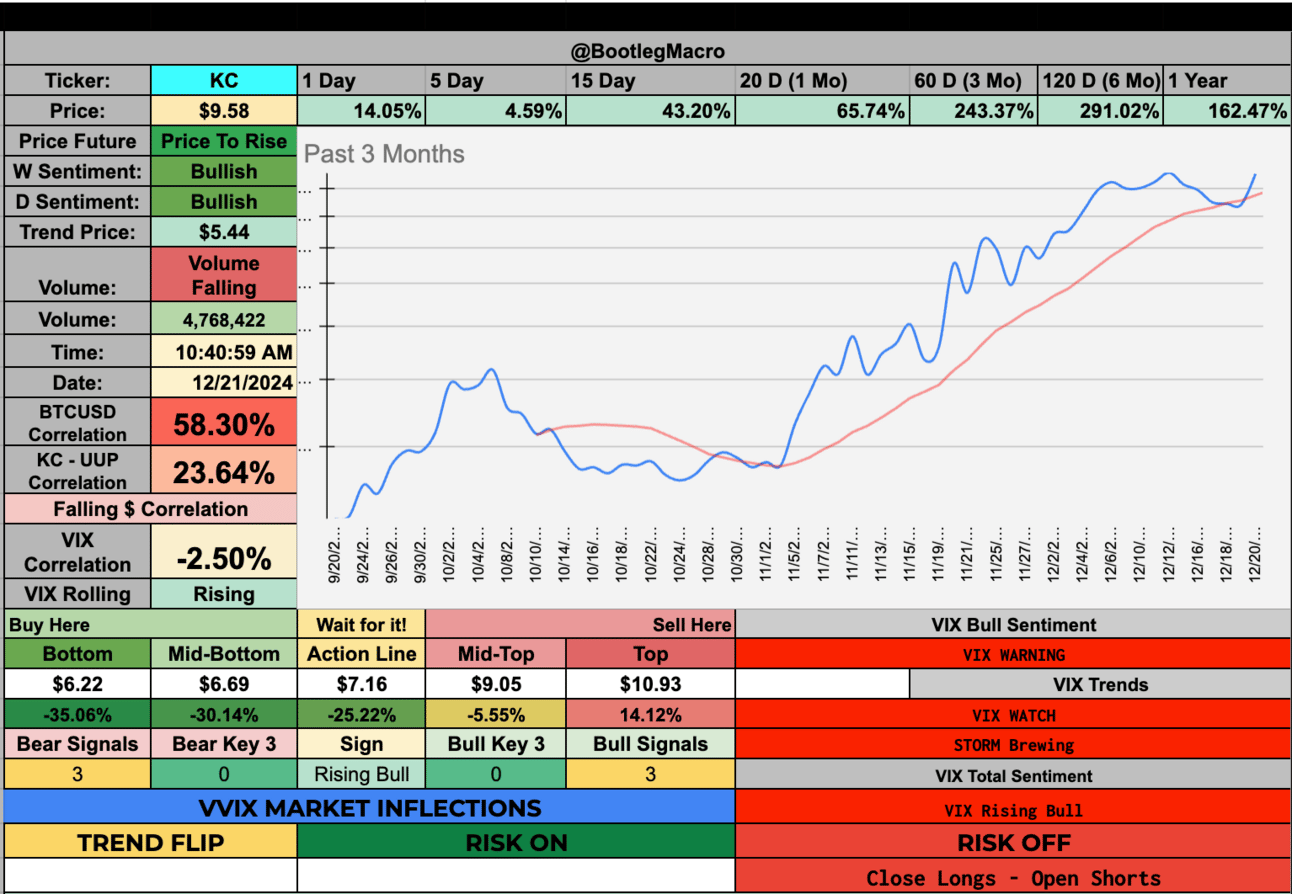

KC - Kingsoft Cloud Holdings Ltd ADR - Technology - China - 🇨🇳

FNKO - Funko Inc - Consumer Cyclical - United States - 🇺🇸

GRRR - Gorilla Technology Group Inc - Technology - United Kingdom - 🇬🇧

ARQT - Arcutis Biotherapeutics Inc - Healthcare - United States - 🇺🇸

GRND - Grindr Inc - Technology - United States - 🇺🇸

GDYN - Grid Dynamics Holdings Inc - Technology - United States - 🇺🇸

KC - Kingsoft Cloud Holdings Ltd ADR - Technology - China - 🇨🇳

FNKO - Funko Inc - Consumer Cyclical - United States - 🇺🇸

GRRR - Gorilla Technology Group Inc - Technology - United Kingdom - 🇬🇧

ARQT - Arcutis Biotherapeutics Inc - Healthcare - United States - 🇺🇸

GRND - Grindr Inc - Technology - United States - 🇺🇸

GDYN - Grid Dynamics Holdings Inc - Technology - United States - 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

EDR - Endeavor Group Holdings Inc - Communication Services - USA - 🇺🇸

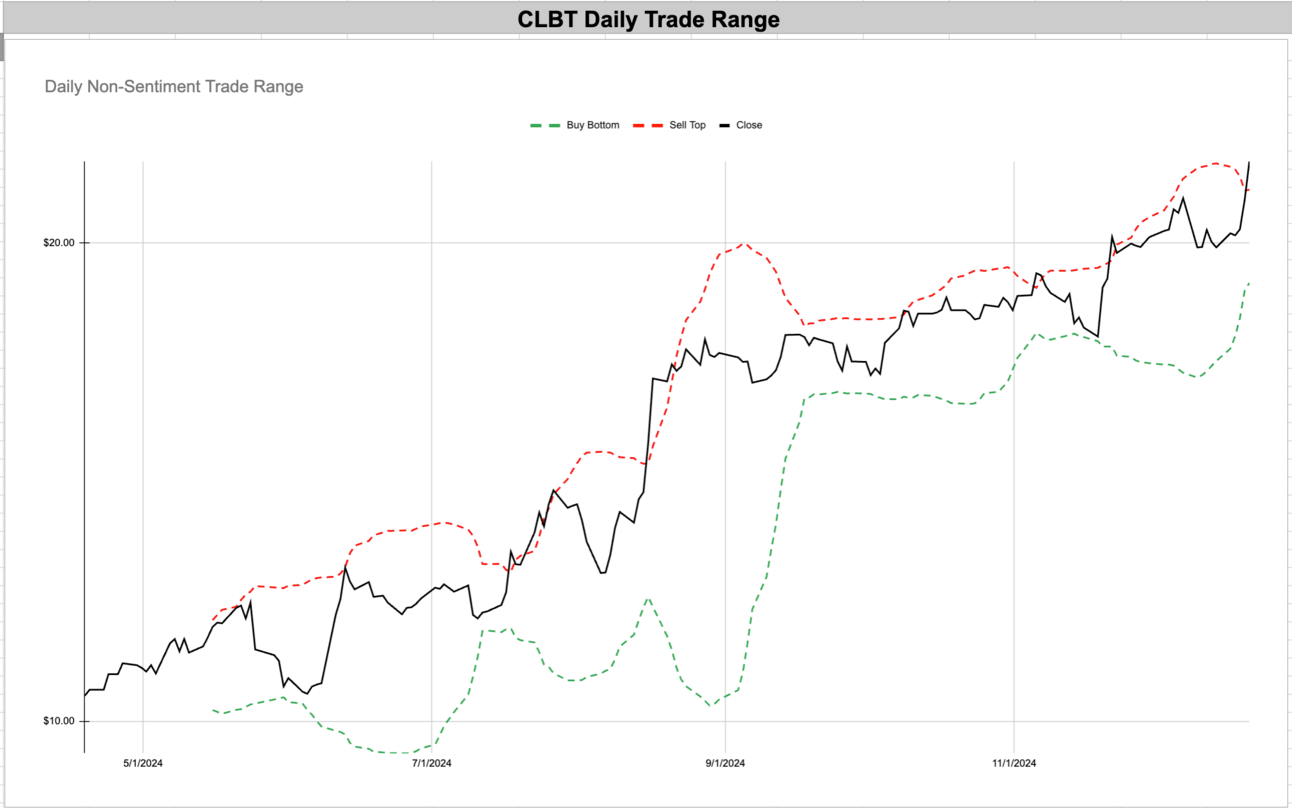

CLBT - Cellebrite DI Ltd - Technology - Israel - 🇮🇱

RELY - Remitly Global Inc - Technology - USA - 🇺🇸

SLM - SLM Corp - Financial - USA - 🇺🇸

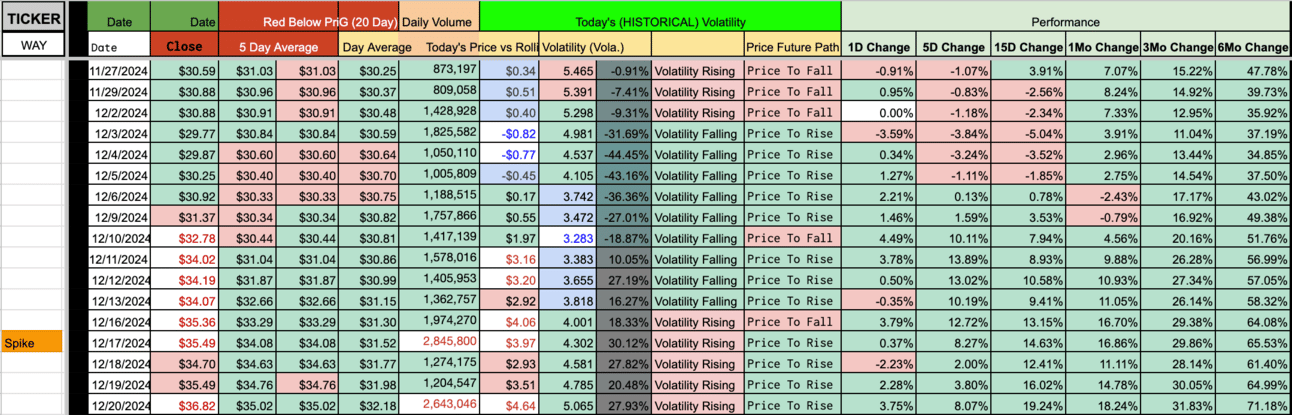

WAY - Waystar Holding Corp - Healthcare - USA - 🇺🇸

KVYO - Klaviyo Inc - Technology - USA - 🇺🇸

IONQ - IonQ Inc - Technology - USA - 🇺🇸

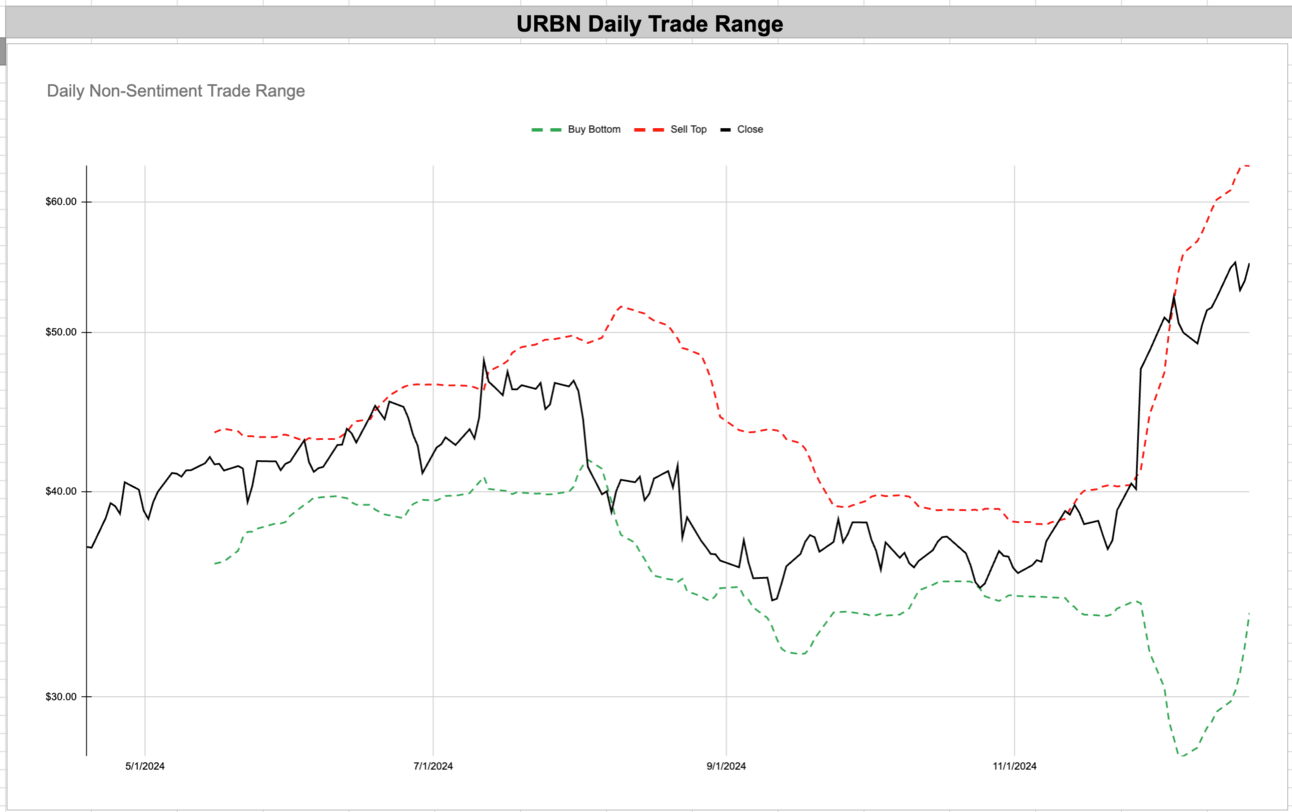

URBN - Urban Outfitters Inc - Consumer Cyclical - USA - 🇺🇸

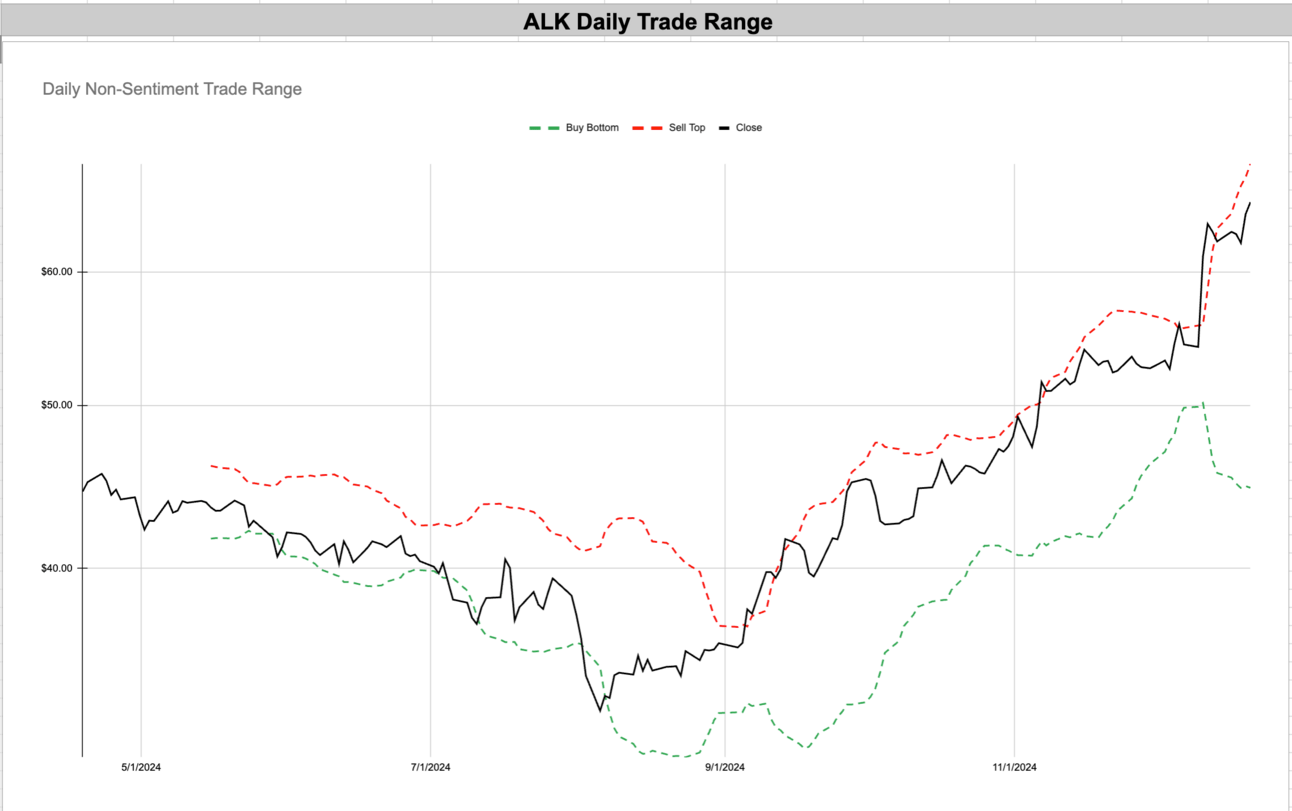

ALK - Alaska Air Group Inc - Industrials - USA - 🇺🇸

DECK - Deckers Outdoor Corp - Consumer Cyclical - USA - 🇺🇸

AAPL - Apple Inc - Technology - USA - 🇺🇸

EDR - Endeavor Group Holdings Inc - Communication Services - USA - 🇺🇸

CLBT - Cellebrite DI Ltd - Technology - Israel - 🇮🇱

RELY - Remitly Global Inc - Technology - USA - 🇺🇸

SLM - SLM Corp - Financial - USA - 🇺🇸

WAY - Waystar Holding Corp - Healthcare - USA - 🇺🇸

KVYO - Klaviyo Inc - Technology - USA - 🇺🇸

IONQ - IonQ Inc - Technology - USA - 🇺🇸

URBN - Urban Outfitters Inc - Consumer Cyclical - USA - 🇺🇸

ALK - Alaska Air Group Inc - Industrials - USA - 🇺🇸

DECK - Deckers Outdoor Corp - Consumer Cyclical - USA - 🇺🇸

AAPL - Apple Inc - Technology - USA - 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

Imagine the world 12-18 months from now...what do you see?

I tell you what I see in it all here:

$GRND $AAPL $WMT

— BootlegMacro (@bootlegmacro)

7:07 PM • Dec 7, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro