- The New High Newsletter

- Posts

- Market Pulse: Is This the Greatest January Setup Ever?

Market Pulse: Is This the Greatest January Setup Ever?

This week in the New High Newsletter, we got the pullback expected last week. How can I tell? Well we only have 5 or so stocks making new highs below $20! In a BULL MARKET! Which means, we either see a bigger pullback between now and the inauguration or we had a dip buying opportunity this week. What do you think?

This week in the New High Newsletter, we got the pullback expected last week. How can I tell? Well we only have 5 or so stocks making new highs below $20! In a BULL MARKET! Which means, we either see a bigger pullback between now and the inauguration or we had a dip buying opportunity this week. What do you think?

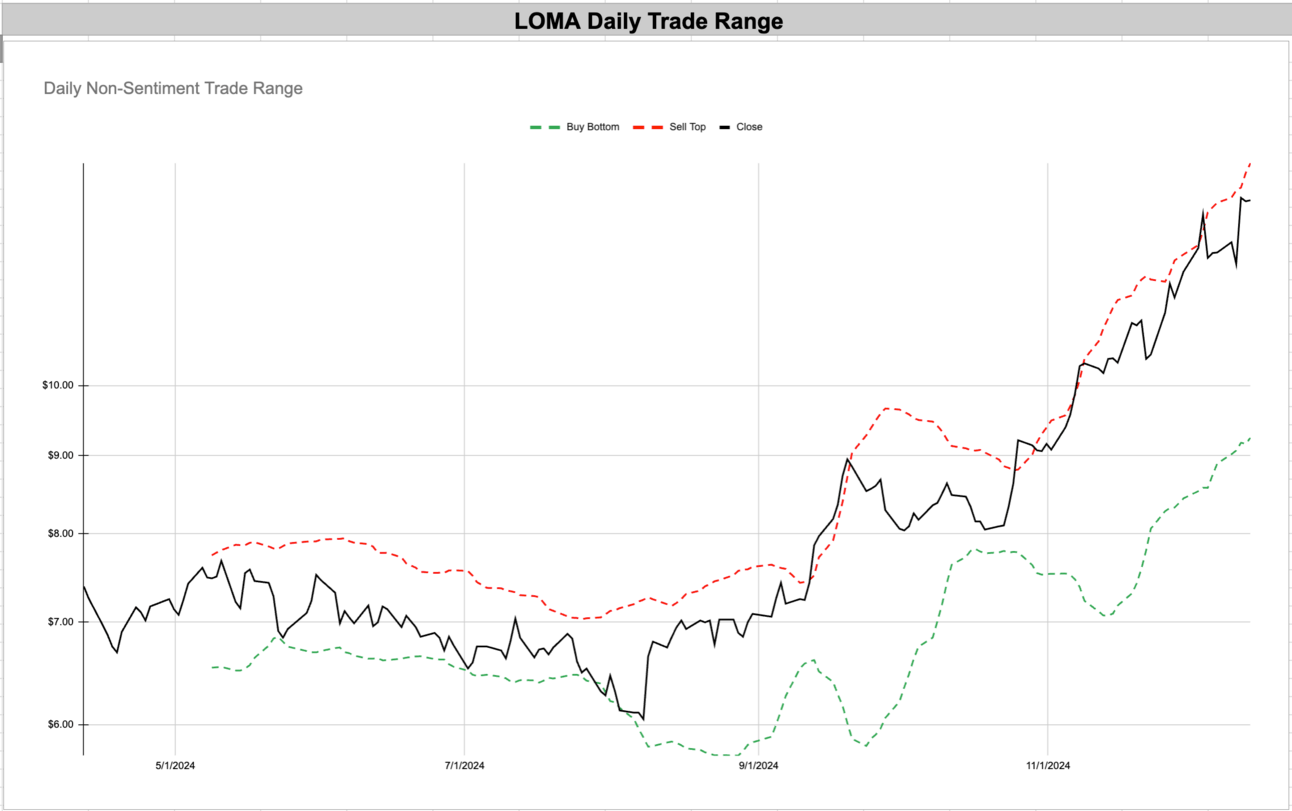

New Highs $5-$20: This week I’m excited to see $SOUN $LOMA and I even put a couple stocks below $5 because it’s a slow week. You’ll see more below.

New Highs $20+: This week is a brand-name bonanza as we have $TSLA $VSCO $WRBY and the best one $RH on the list. We’ve seen large cap stocks and higher-priced stocks breaking out. The list is great this week.

Turbulence Indicator: We are still concerned about the indicator. It’s higher than it’s been but we can be very BULLISH since we are in a BULL MARKET. But we all know Trees Can’t Grow to the SKY! And this indicator knows it.

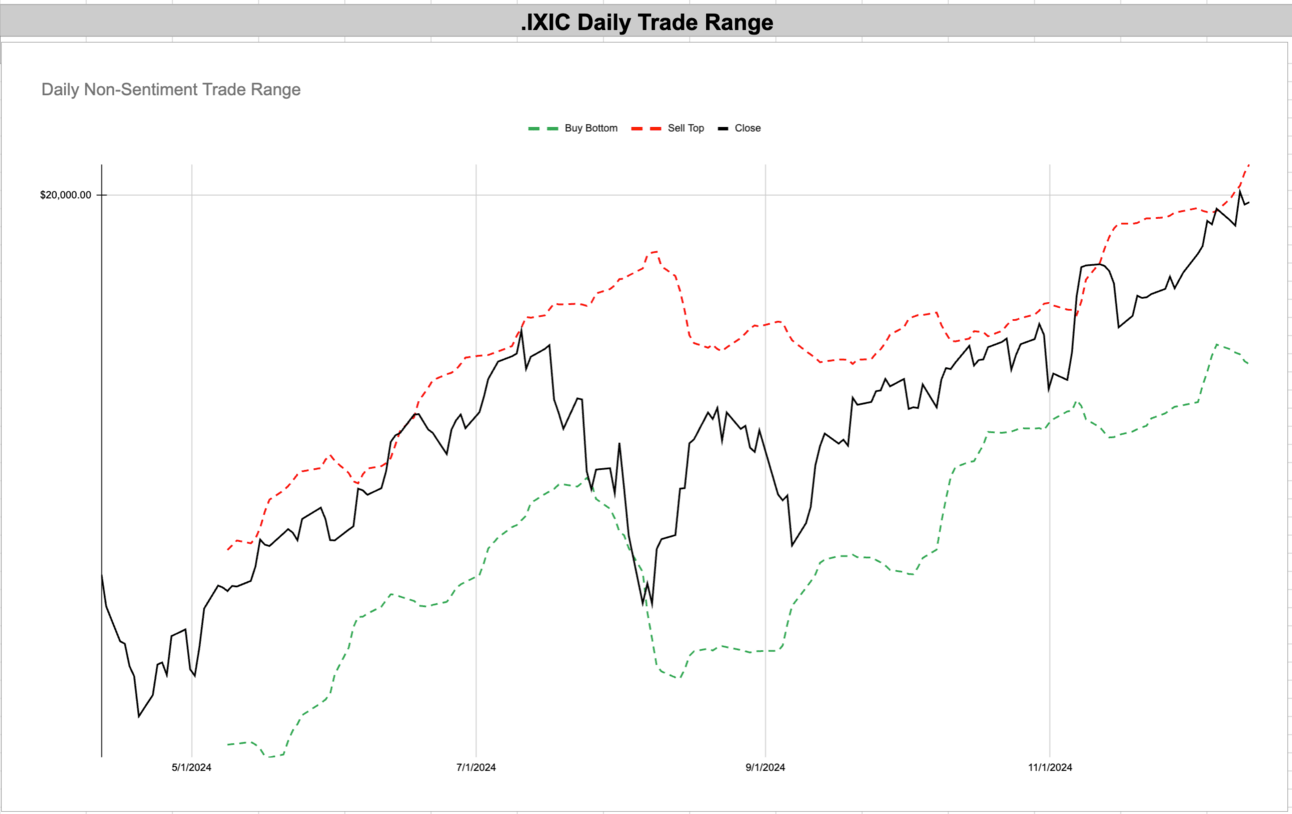

Looking Ahead: The week ahead should be relatively quiet, it’s the last full week before Christmas. But if anyone is smart they will be positioning for the greatest January potentially in American history as we prepare for the return of DJT to the WhiteHouse later next month. Honestly, I’ve gotten many long-term call options on small, mid and large cap names with high beta. Why? Well because Bitcoin is the highest beta (in my opinion) and it’s running. Which means…small caps, tech, growth and momentum are now leading the way. Why wouldn’t I be buy call option into September and December of 2025?

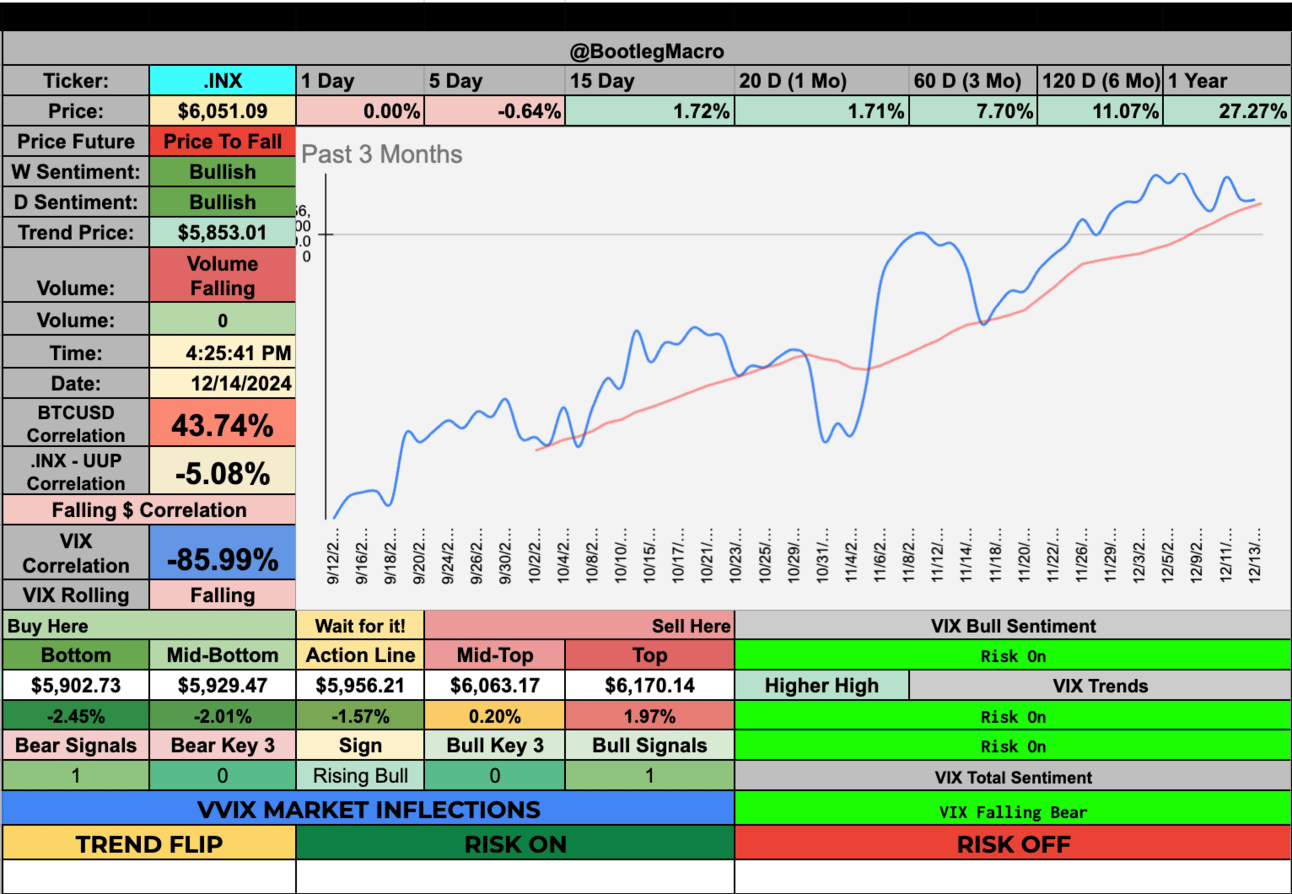

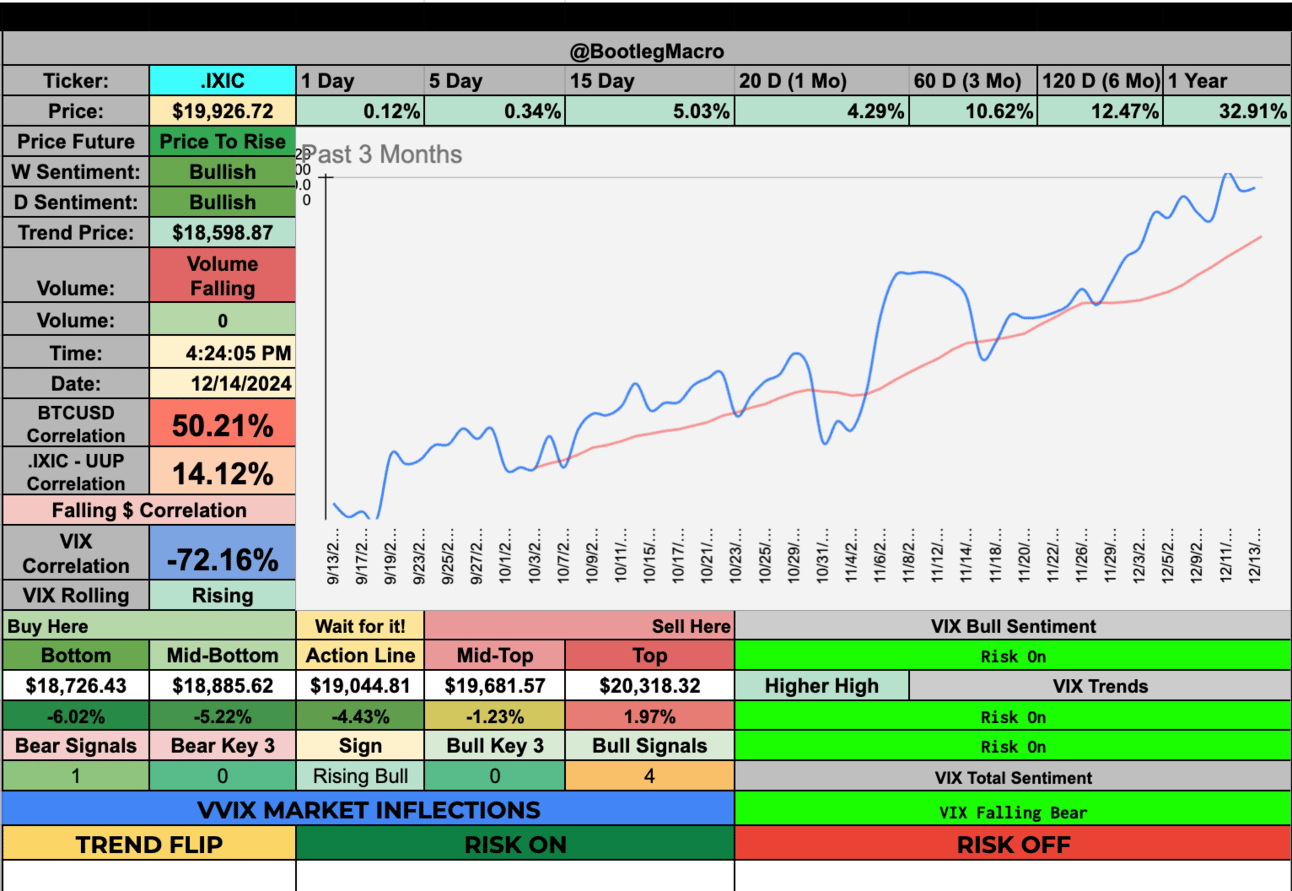

Market Performance

Market Overview: The VIX had a suddenly nice week of new highs. The VIX was up 2.81% for the week. Big change to recent history and indexes reflected it. Only 1 index was up this week and I was wrong last week, it wasn’t the DIA. This week was led by the Nasdaq.

Key Focus Area: I’ll still be looking at the Dow Jones in the coming weeks. But if I’m being honest, I’m trying to get call options on companies which cater to the richest people in the world. Why? Because I expect US Tax cuts by June of 2025, huge spending bills and stimulus coming from the US Congress by December of 2025. It’s a pretty basic playbook but no matter what, money will be flowing for the next 12-18 months! Why not be long?

Current Outlook and Indicators: The Turbulence Indicator is in a wonderful spot but it really can only go down from here. That’s my short-term fear. In the long-term any weakness is my opportunity. This week I was very active in buying 6-9+ month call options on high momentum, high beta stocks in the US market.

Long-Term View: Looking out 12-18 months, my theory is we’ll see a market and economy shaped by tax cuts, deficit reduction, increased defense spending, tariffs, and deportations. It’s an outlook that’s generally inflationary and growth-stimulating, but things could evolve.

Closing Speculation or Questions: For now, the question is: what happens next? Does the market stay steady, or will a surprise flip this picture upside down? Let’s watch and wait.

Volatility Corner:

Indicator Update:

We saw no major drop in the Turbulence Indicator this week. It’s still high and rising. But it’s can’t rise forever, or can it? The higher it goes, the better markets perform.

Technical Context:

Indexes were choppy which reflected the VIX getting smashed lower and eventually having the regular chop.

Actionable Insight:

I’ll be patient and wait for more weakness (if it comes).

MACRO INDICATOR:

MACRO SEASON: BULLISH Since 8/24/24🟢

MICRO WEATHER: BULLISH Since 11/8/24🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

SOUN - SoundHound AI Inc - Technology - United States - 🇺🇸

CRK - Comstock Resources, Inc - Energy - United States - 🇺🇸

LOMA - Loma Negra Compania Industrial Argentina Sociedad Anonima ADR - Basic Materials - Argentina - 🇦🇷

VIAV - Viavi Solutions Inc - Technology - United States - 🇺🇸

VUZI - Vuzix Corp - Technology - United States - 🇺🇸 (Sub $5)

MTTR - Matterport Inc - Technology - United States - 🇺🇸

SOUN - SoundHound AI Inc - Technology - United States - 🇺🇸

CRK - Comstock Resources, Inc - Energy - United States - 🇺🇸

LOMA - Loma Negra Compania Industrial Argentina Sociedad Anonima ADR - Basic Materials - Argentina - 🇦🇷

Nice move in Argentina stocks.

VIAV - Viavi Solutions Inc - Technology - United States - 🇺🇸

VUZI - Vuzix Corp - Technology - United States - 🇺🇸

MTTR - Matterport Inc - Technology - United States - 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

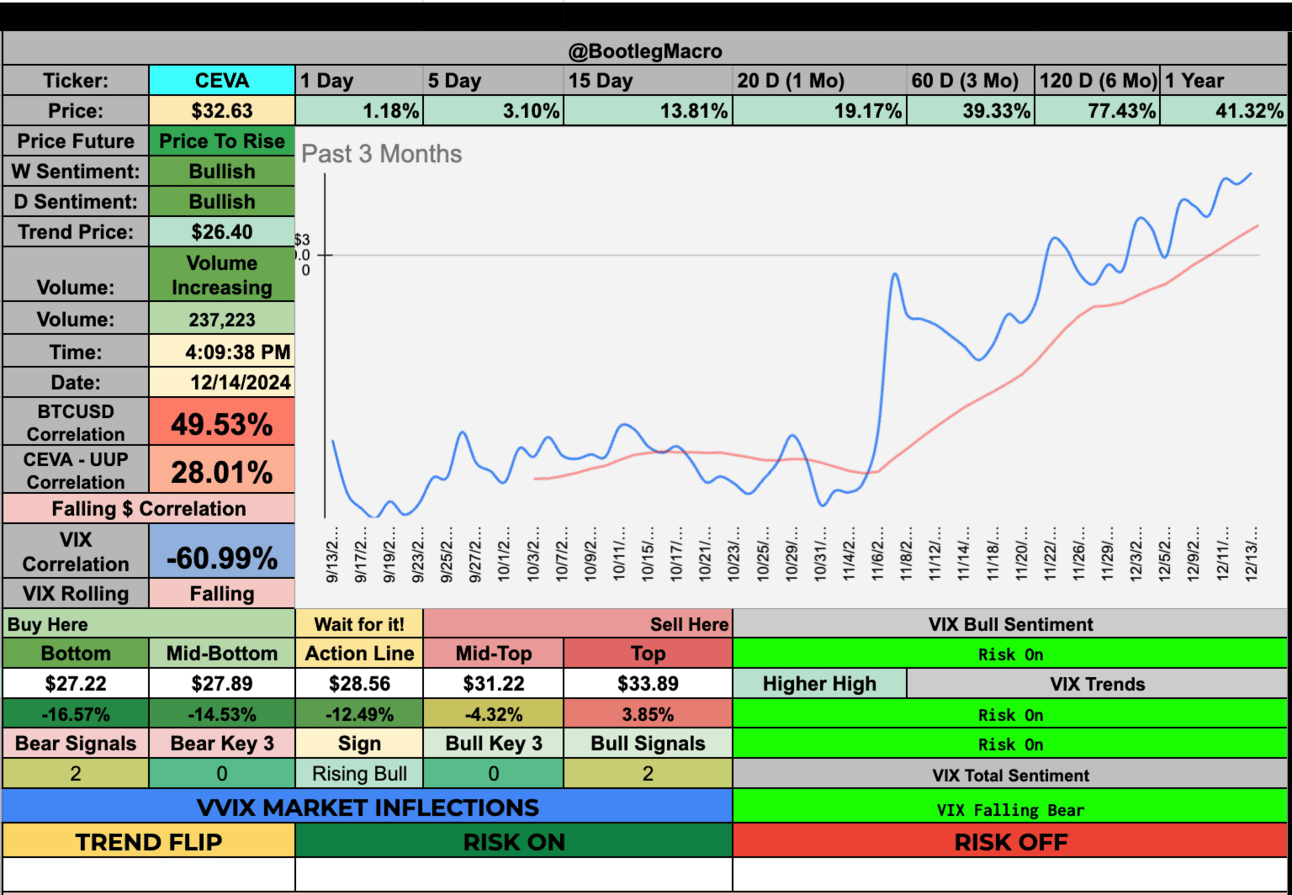

CEVA - CEVA Inc - Technology - United States - 🇺🇸

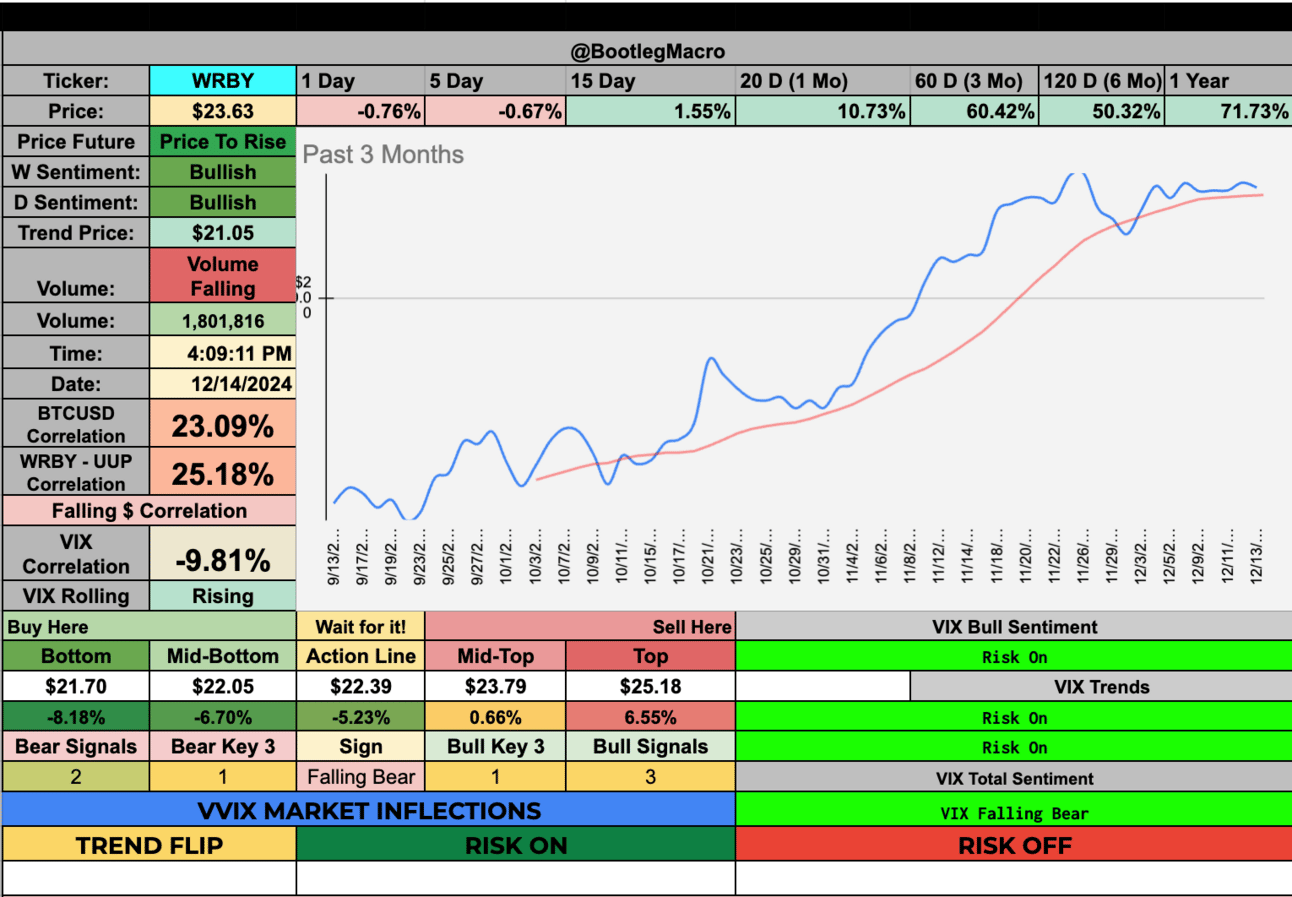

WRBY - Warby Parker Inc - Healthcare - United States - 🇺🇸

VSCO - Victoria's Secret & Co - Consumer Cyclical - United States - 🇺🇸

URBN - Urban Outfitters Inc - Consumer Cyclical - United States - 🇺🇸

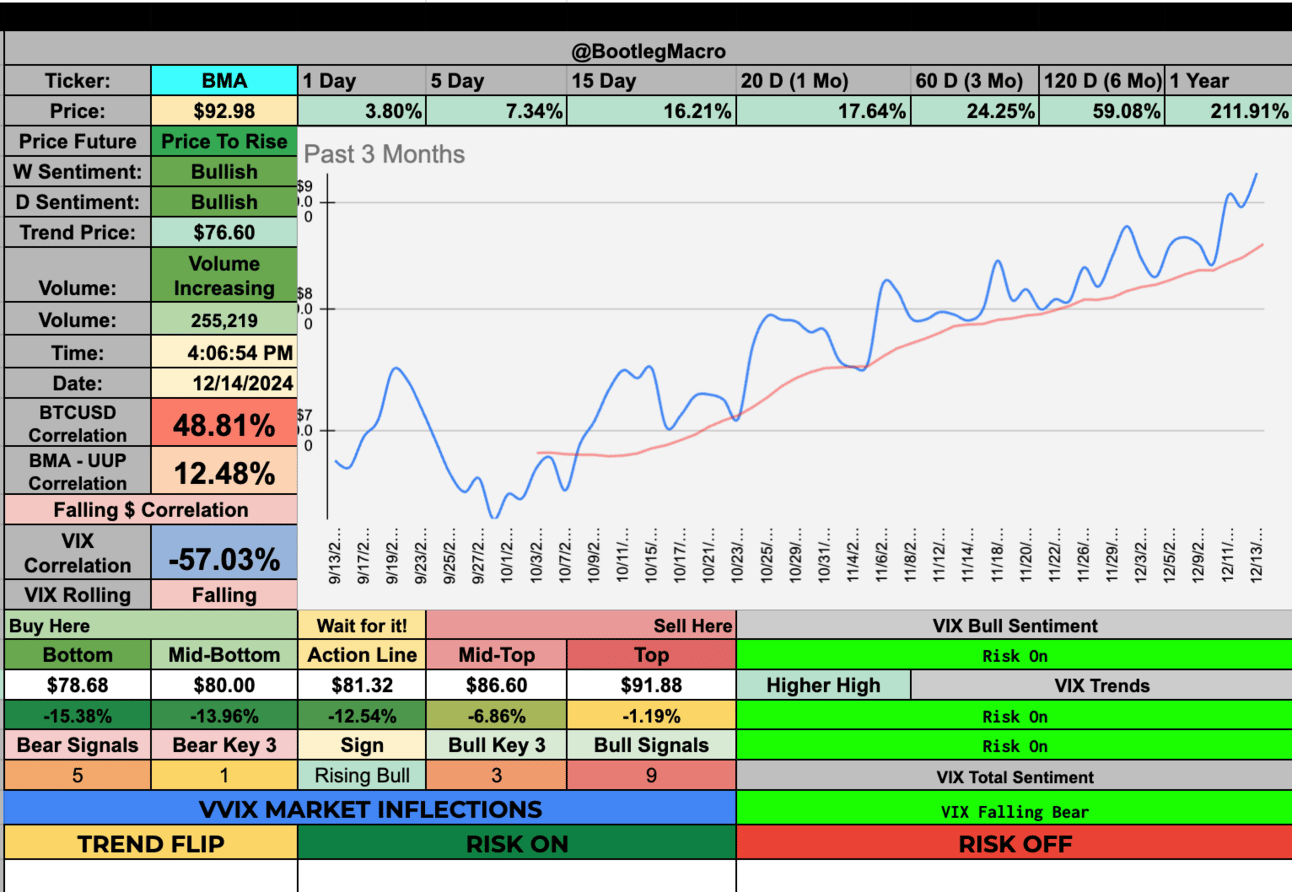

BMA - Banco Macro S.A. ADR - Financial - Argentina - 🇦🇷

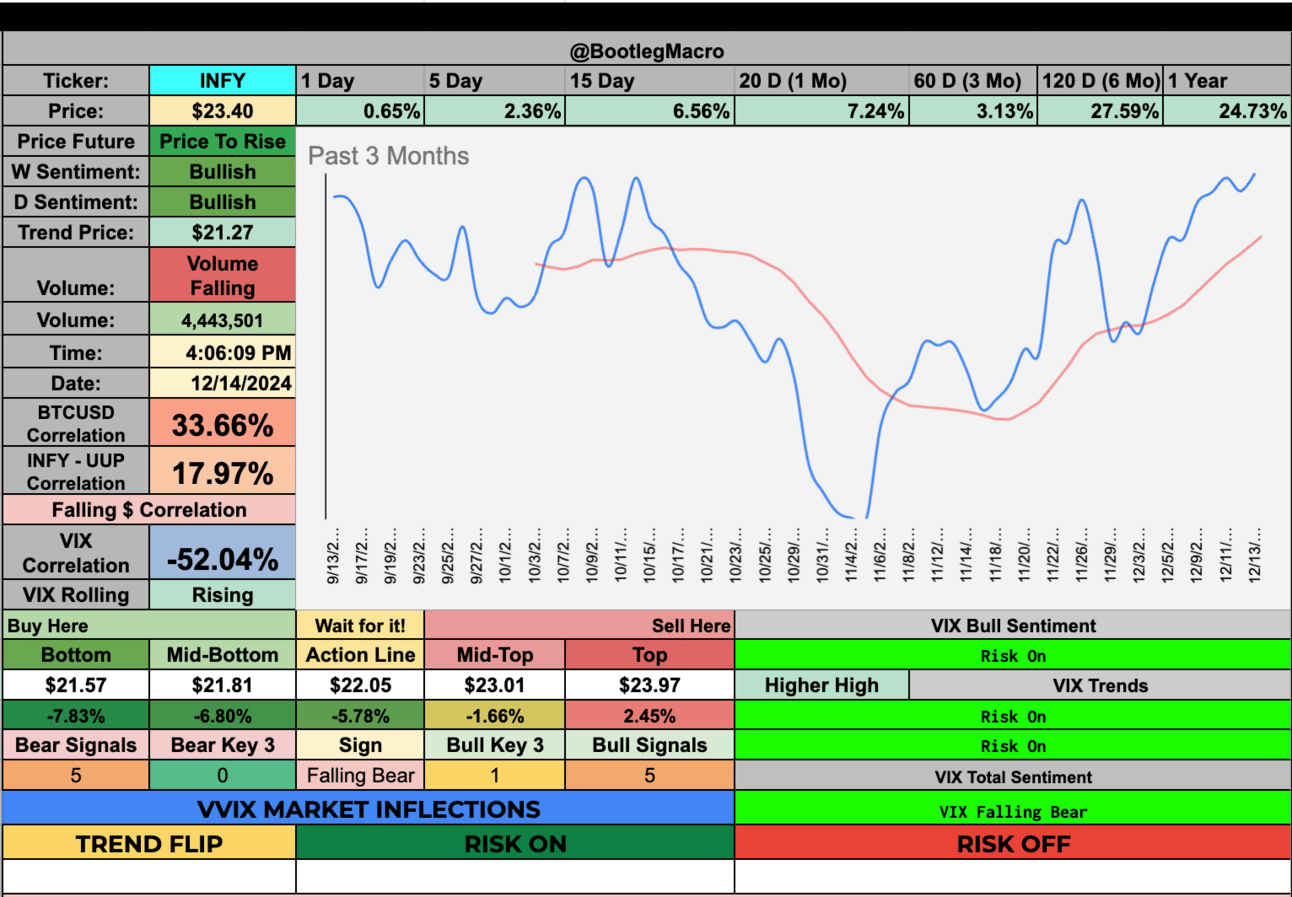

INFY - Infosys Ltd ADR - Technology - India - 🇮🇳

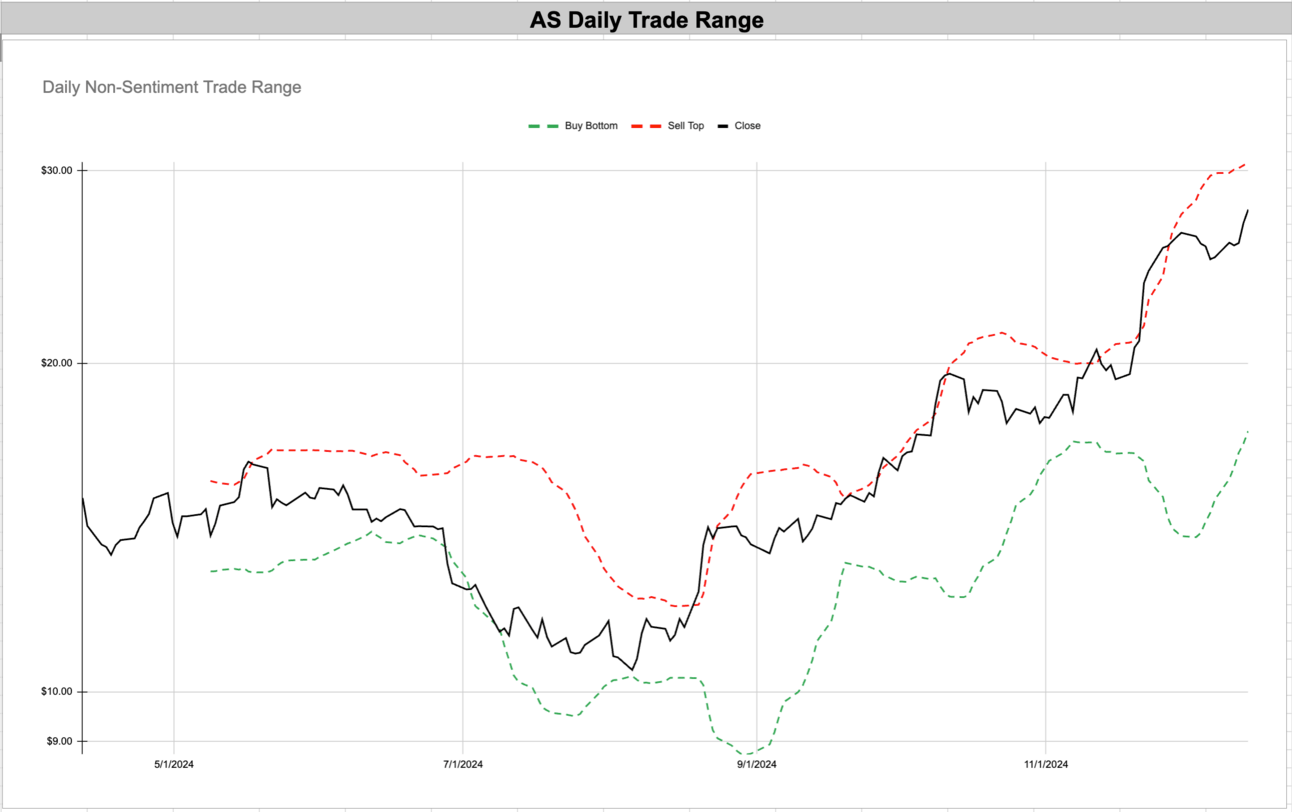

AS - Amer Sports Inc - Consumer Cyclical - Finland - 🇫🇮

TWLO - Twilio Inc - Technology - United States - 🇺🇸

RH - RH (Restoration Hardware) - Consumer Cyclical - United States - 🇺🇸

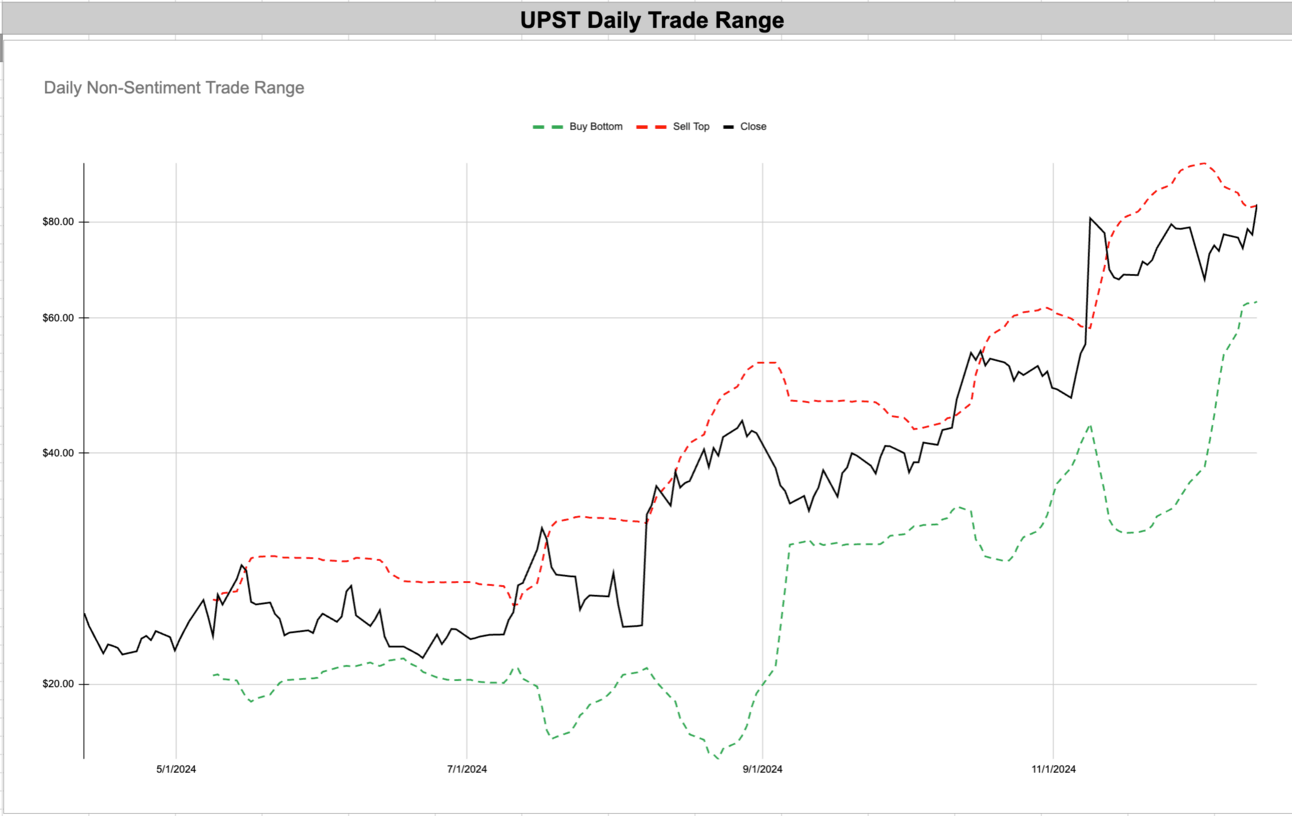

UPST - Upstart Holdings Inc - Technology - United States - 🇺🇸

CEVA - CEVA Inc - Technology - United States - 🇺🇸

This type of semiconductor play with a small market cap is perfect for the type of environment we are about to enter.

WRBY - Warby Parker Inc - Healthcare - United States - 🇺🇸

The price here is a ripe for a breakout higher. We need to see some resolution above $25 soon.

VSCO - Victoria's Secret & Co - Consumer Cyclical - United States - 🇺🇸

URBN - Urban Outfitters Inc - Consumer Cyclical - United States - 🇺🇸

We see breakouts in consumer cyclicals supporting the economic expansion narrative.

BMA - Banco Macro S.A. ADR - Financial - Argentina - 🇦🇷

This is a great breakout in Argentina.

INFY - Infosys Ltd ADR - Technology - India - 🇮🇳

AS - Amer Sports Inc - Consumer Cyclical - Finland - 🇫🇮

TWLO - Twilio Inc - Technology - United States - 🇺🇸

RH - RH (Restoration Hardware) - Consumer Cyclical - United States - 🇺🇸

Great breakout in RH. Wait for a pullback.

UPST - Upstart Holdings Inc - Technology - United States - 🇺🇸

This is in a great spot for a breakout next week - low vol, compressed range and ready to blow!

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

Imagine the world 12-18 months from now...what do you see?

I tell you what I see in it all here:

$GRND $AAPL $WMT

— BootlegMacro (@bootlegmacro)

7:07 PM • Dec 7, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro