- The New High Newsletter

- Posts

- Small Caps Hold The Keys to 2024.

Small Caps Hold The Keys to 2024.

This is the week! Small Caps show us their intention. Recession or not in 2024? We show the level to watch, click to see.

Hindsight is 20/20 👓. It’s obvious 🤓 we flipped BEARISH 🐻 on 7/28/23 (check the Volatility Corner 📈 below). We’re living in a new reality.

This week, Small Caps $IWM has to make a big choice for the market. Does Bearishness 🐻 reigns supreme 👑? Must we Pay 🪙 homage to Bearishness? There are no promises any of us make it to the other side 🪦.

But if you want to get buck 🦌-wild on a few penny 🪙 stocks…skip down below. It’s a small list for low priced stocks 🈹 (Discount Sign in Japanese). It’s not bull market harvest 🍂 season anymore. No, no, no, no, nooo…it’s season for preservation ❤️🩹and protection 🫂.

Personally, I find comfort in knowing the market trend 📉. It lets me know what kind of ride I can expect. Hopefully you enjoy it too. Watch the chop and watch for a drop.

Lets get started. 💥

Market Performance

Indexes were essentially flat for the week. S&P500 (.INX) was up ☝️0.45%. Dow Jones (.DJI) was up ☝️ 0.79% for the week. The Nasdaq (.IXIC) was down 👇 (-0.18%).

Thursday afternoon into Friday’s close was brutal 🤢😳. Hocus Pocus 🎃 vibes in the market. After the Thursday bond auction issue raising yields 🚀. It’s clear we are being driven 🏎️ by the bond market 👮 if the Fed won’t hike. The bond market is teaching our federal reserve how to manage inflation.

Friday’s index action.

Index Review

S&P500 Index: $INX

The VIX closed near $20 which offers a potential upward drift to the index. This index wants to go up.

Dow Jones Index: $DJI

The recent bottom is the same level at May 2023. Which means, Dow Jones gave up the whole summer worth of gains. It’s like June, July and August 2023, never happened.

Nasdaq Index: $IXIC

The strongest of all siren songs in the final quarter of 2023 is tech. Once a leader, always a leader. Watch the VIX correlation.

Volatility Corner:

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. You see the small blue line up this week. It’s small. Not down.☁️ That’s the goal these days. Not down. ☁️

For now, we see small signs of bullish 🐂 sentiment on shorter-term ⏩ indicators.

The recent action has been downward. The market reflected it. Now we expect the a small rally🎢 into early next week.

Don’t get it twisted 🪢🪢, this is a bad ☠️ and dangerous 🪦 setup. When we say bullish 🐂, this is picking up pennies 🪙 in front of a steam roller 🚂. This is an opportunity to position for the next great market move.

I’d expect an early rally next week. The $19.50s is a special place on the VIX. We can chop down to $15 and rip again.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑

US Index ETF Review:

SPY

I’d rather short this if I get an opportunity. But the flip in the signal and the future price path has me being patient.

Trend: BEARISH Since 9/27/23🛑

Trade Signal: Go LONG Since 10/10/23🟢***

Future Price Path: Price to RISE Since 10/11/23🟢***

The volatility is rolling over and correlation is rising…not a great setup. But the trade range makes it a mixed signal for now.

We could easily hit the bottom of the range like before. I hate executing from the middle of the range.

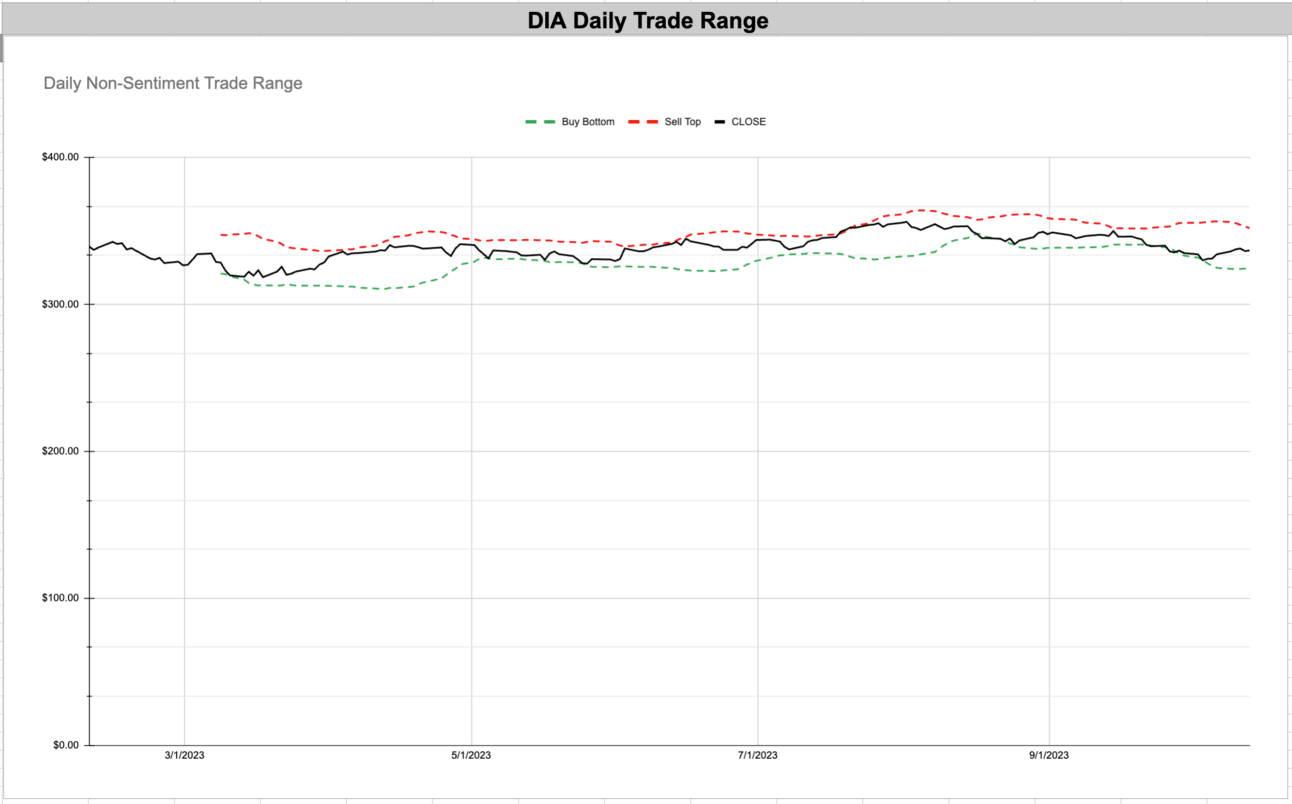

DIA

There are small slivers of hope in the signals but not enough to go long. This maintains a short setup for me.

Trend: BULLISH Since 9/1/23🟢

Trade Signal: Go Short Since 9/21/23🔴

Future Price Path: FALL Since 9/21/23🔴

QQQ

We continue to see strength in the strong areas. $META, $NVDA and $GOOG are carrying tech at this point.

Trend BEARISH Since 9/29/23🔴

Trade Signal: Go LONG Since 10/9/23🟢***

Future Price Path: RISE Since 10/09/23🟢***

Falling volatility with rising correlation shouldn’t be BULLISH. But price demands movement in QQQ.

IWM

Things continue to get worse for Small Caps. Down (-1.58%) for the week. 😳

Trend: BEARISH Since 9/29/23🔴

Trade Signal: Go Short Since 9/21/23🔴

Future Price Path: FALL Since 9/26/23🔴

Volatility is positive and flat-lining yet price correlation is negative. Price is following suit by falling.

IWM lives at the bottom of it’s trade range. We could see a bounce since we are near major weekly trade range support.

We are at an inflection point in Small Caps. Long-term. Do we bounce higher or break lower?

$168ish should be support.

Enjoying this?

& Invite a friend.

New Highs $5-$20:

SUZ - Paper and Paper Products (Brazil 🇧🇷)

LFMD - Health Information Systems

AM - Oil & Gas Midstream

LBRT - Oil & Gas Equipment & Services

DRS - Aerospace & Defense

FRO - Oil & Gas Midstream (Cyprus 🇨🇾)

SUZ - Paper and Paper Products (Brazil 🇧🇷)

This is the best setup because it’s re-breaking a recent high. If it does continue…there should be support to go higher. And if the dollar falls at all…this should help a non-USA company.

Top of range but a re-breakout, which I like to see.

LFMD - Health Information Systems

How could you not be excited about LFMD? It’s continually breaking out. High-volatility of course at this price.

Wide range. These type of stocks require ultimate patience for me.

AM - Oil & Gas Midstream

AM is a patient breakout. It’s been tempting the top of the range for months.

Slow and steady still wins.

LBRT - Oil & Gas Equipment & Services

There are so many mixed signals here. I’m inclined to go long and trust this rebound. Below you see the trade range…the price snapped of the bottom.

Very strong bounce off the bottom of the range.

DRS - Aerospace & Defense

Big break out for a new stock. It’s been probing the level for a while.

War is good for business it seems. You decide but it’s a very clear and well setup breakout.

FRO - Oil & Gas Midstream (Cyprus 🇨🇾)

Oil has been hot across the market. FRO continues to show the capital pouring into the sector.

Breaking the top of the range is bullish long-term but not short-term.

Enjoying this?

& Invite a friend.

New Highs $20+:

PGR - Insurance - Property & Casualty

BRBR - Packaged Foods

CNX - Oil & Gas E&P

VIST - Oil & Gas E&P (Mexico)

RRC - Oil & Gas E&P

NTNX - Software

IONS - Biotechnology

SHEL - Oil & Gas Integrated (United Kingdom)

AFL - Insurance - Life

NVO - Biotechnology (Denmark)

BAH - Consulting Services

WSM - Speciality Retail

CME - Financial Data & Stock Exchanges

EG - Aerospace and Defense (China)

KNSL - Insurance - Property & Casualty

MCK - Medical Distribution

LLY - Drug Manufacturers

PGR - Insurance - Property & Casualty

The best setup. But it will take a bit of time to digest this recent move.

On a closer look, this isn’t a fantastic setup but it’s not overbought which is a key component in breakouts with near-term momentum.

BRBR - Packaged Foods

The best is when you see a play up 100% in a trailing year. And across the board the rolling returns are positive. We can even see the weekly still turn BULLISH.

I prefer this trade range over PGR, honestly. This subtle breakout is an indication of a small but important change in the market of BRBR.

CNX - Oil & Gas E&P

This has been range bound for a while. We need to see it break above the $24-$25 level. If we can see $25, this is a golden breakout potentially. But for now, it’s a stock to watch.

If you’ve been patient, you deserve to get closure here. Are we headed higher or we falling?

VIST - Oil & Gas E&P (Mexico)

Oil and gas names have high volatility. The moves we’ve seen so far make us believe we haven’t seen the highs for this cycle. Even being up 151% for 1 year.

Being closer to the top of the range, I’d like to see a pullback for myself.

RRC - Oil & Gas E&P

Small gains compound too. Up 21% for the 1 year. Big move butat the top of the range.

See if this settles above the previous high and holds.

NTNX - Software Infastructure

A small software name up 65% on the trailing 1 year…that’s pretty rare these days.

This has a style, it’s a jerky, fade then slowly build until breakouts. This style is nice to hold it’s bought with patience.

IONS - Biotechnology

SHEL - Oil & Gas Integrated (United Kingdom)

AFL - Insurance - Life

NVO - Biotechnology (Denmark)

BAH - Consulting Services

WSM - Speciality Retail

CME - Financial Data & Stock Exchanges

EG - Aerospace and Defense (China)

KNSL - Insurance - Property & Casualty

MCK - Medical Distribution

LLY - Drug Manufacturers

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

$AMD - AMD Stock ($AMD): Bearish Trend Continues, But is a Bottom Near?

#stockstobuy#stockstowatch#stockmarket#BMdailyactive

— Bootleg Macro (@bootlegmacro)

11:32 PM • Sep 28, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro