- The New High Newsletter

- Posts

- Memorial Day 2024 - Are You Bullish Enough?

Memorial Day 2024 - Are You Bullish Enough?

Ask yourself, “When is a leader supposed to lead?” The answer is always. If the leader isn’t BULLISH, what do you expect in the market? It’s a simple methodology but when $NVDA is up 114% YTD and it’s in the SPX which is up 11.21% - What other information do you need right now?

Memorial Day 2025 - You’ll ask yourself, “Were you bullish enough on Memorial Day 2024?” You’ll wish you said yes. I know am as BULLISH as I can be right now.

Indexes are giving decent returns for the year, which means the underlying must be somewhat contributing. Now the question remains after the previous 3 years we’ve witnessed. Are the generals leading or the masses?

Great question - It’s still the generals. The leaders of the market are the leaders. This is a sign of strength to come across the whole market.

Ask yourself, “When is a leader supposed to lead?” The answer is always. If the leader isn’t BULLISH, what do you expect in the market? It’s a simple methodology but when $NVDA is up 114% YTD and it’s in the SPX which is up 11.21% - What other information do you need right now?

We can simply invert the mindset to think about how the leaders will impact the market when they are BEARISH. Actually, you can simply look back at charts in 2022 — things changed. We’re actively in the middle of a US BULL MARKET and broadening global growth.

If I’ve convinced you, then remember this with the remaining 6+ months of the bull market. Consistency requires consistent effort.

This trading period will feel effortless with the wind at our back. Yet, we must not become complacent. Risk lurks.

Market Performance

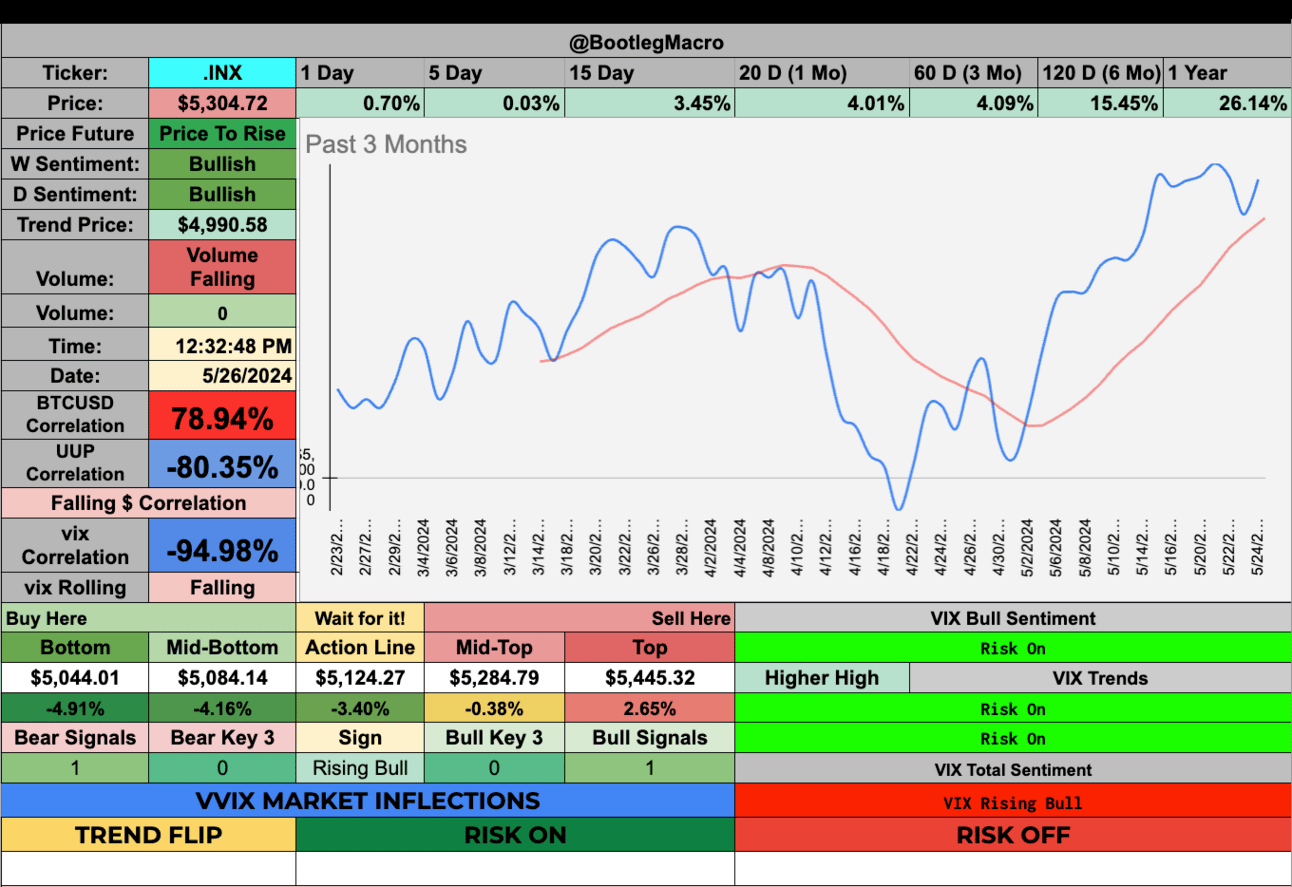

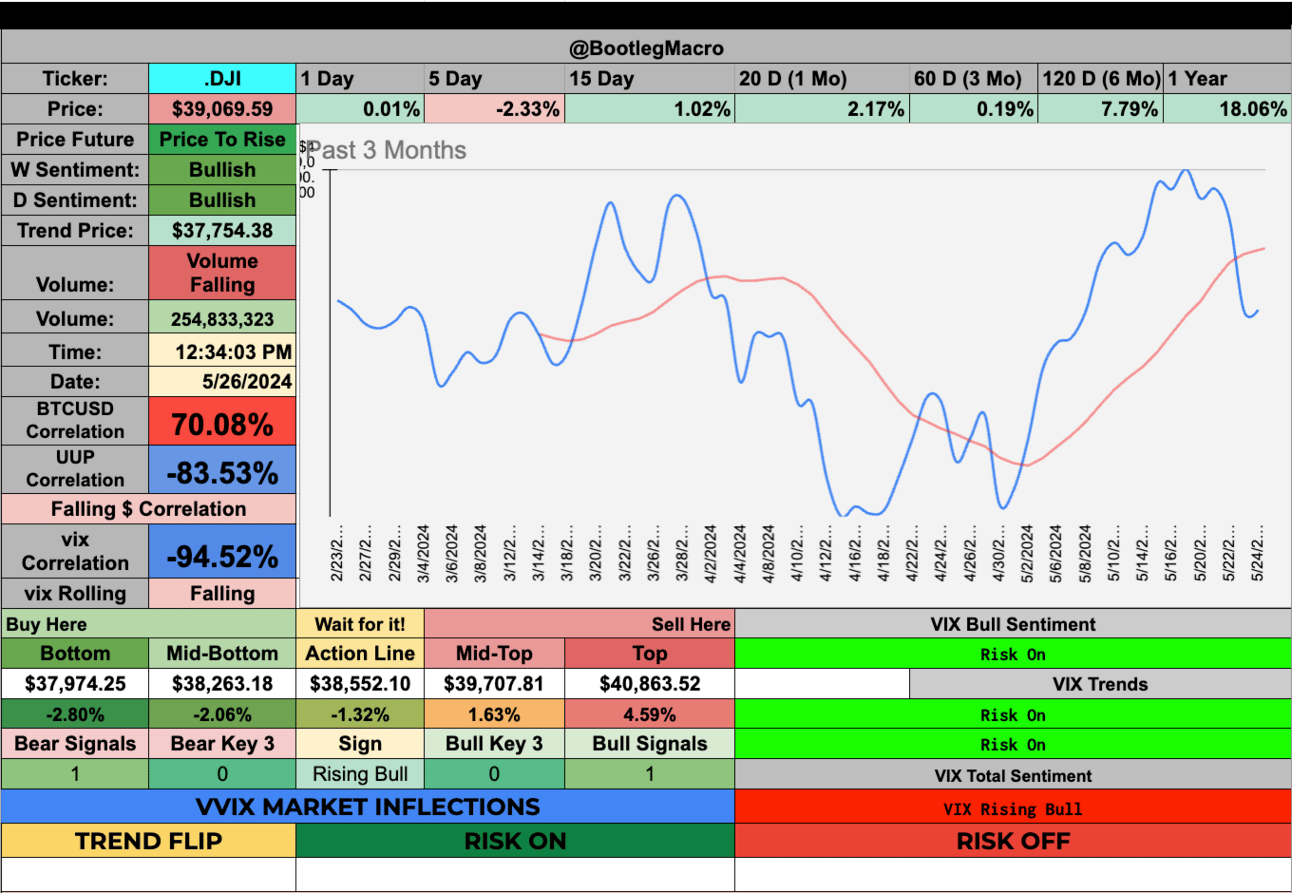

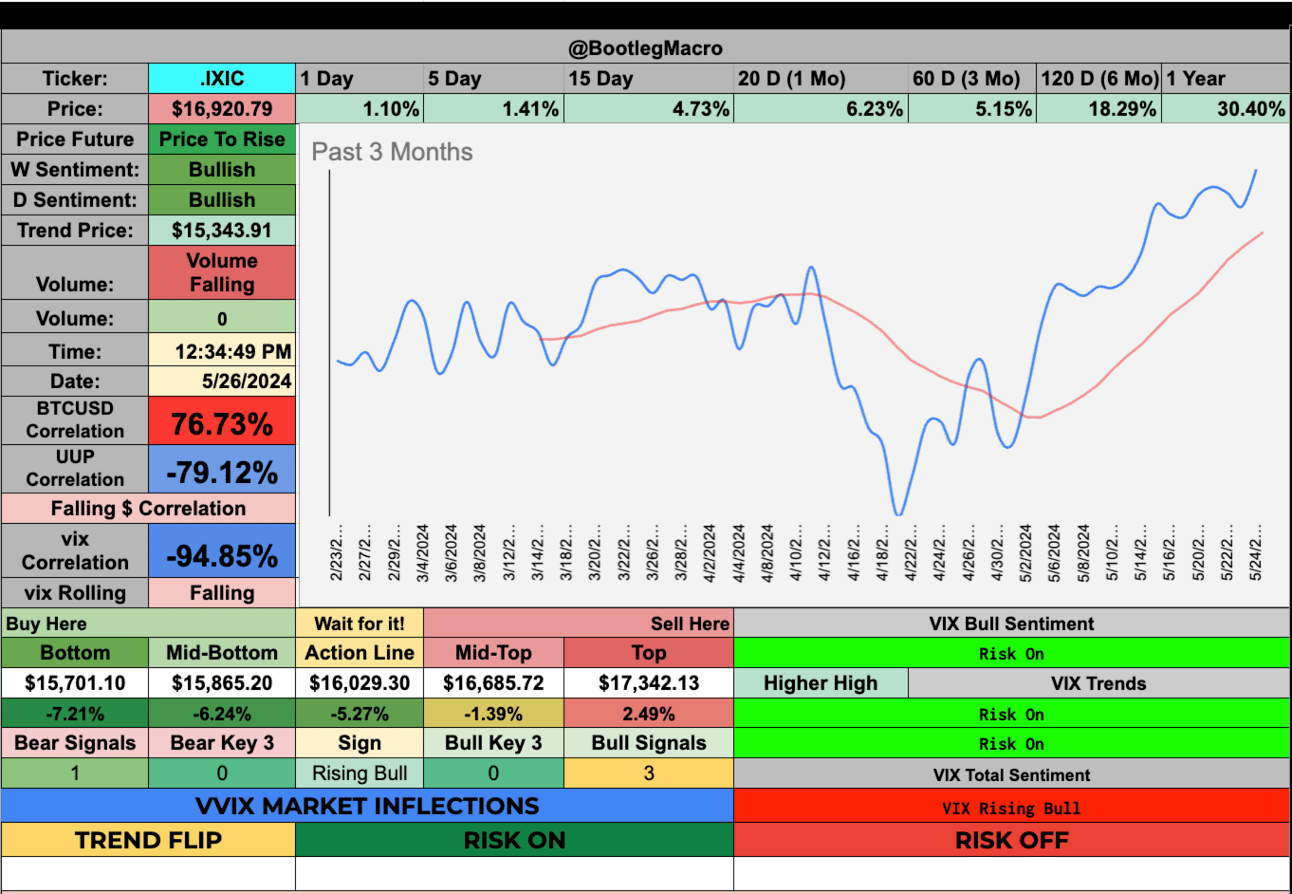

S&P500 lead by tech is pulling the whole market higher. A essentially a break-even week for the SP500. DJI was down over 2% for the week. There is a setup in the DOW Jones for this week. IXIC was up over 1.41% for the week, leading all indexes.

The new highs are a smattering of sectors, factors and home countries. The world is now giving up opportunities in many different locations. It again is time to be a “stock-picker” only so long as you admit, this is a easy environment.

If you try to do hard and time consuming deep-dives on companies right now — you’ll find entry points filled and forgotten.

Underperforming HF manager: "I must know everything about a company! Down to where the CEO sleeps, what type of mattress he sleeps on, and what his friends think of him."

Stanley Druckenmiller: Searches "five most liquid Argentina ADRs" & sends it

That's why he's the 🐐 x.com/i/web/status/1…

— Brandon Beylo (@marketplunger1)

12:23 PM • May 15, 2024

Stanley Druckenmiller highlights the importance of speed when it comes to entries on new ideas. You can always get out. Be on the look out for new ideas and never marry them.

Volatility Corner:

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. As expected, we rallied off the bottom in the turbulence indicator - giving us a fresh series of all-time highs.

As I wrote in the middle of April, “My belief is that we still have lower volatility in the future. I can see this turbulence indicator is in perfect position to give us fresh all-time-highs this summer.” That as the bottom recently and we’ve bounced off it like a ball on a backboard.

MACRO INDICATOR:

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 5/10/24🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

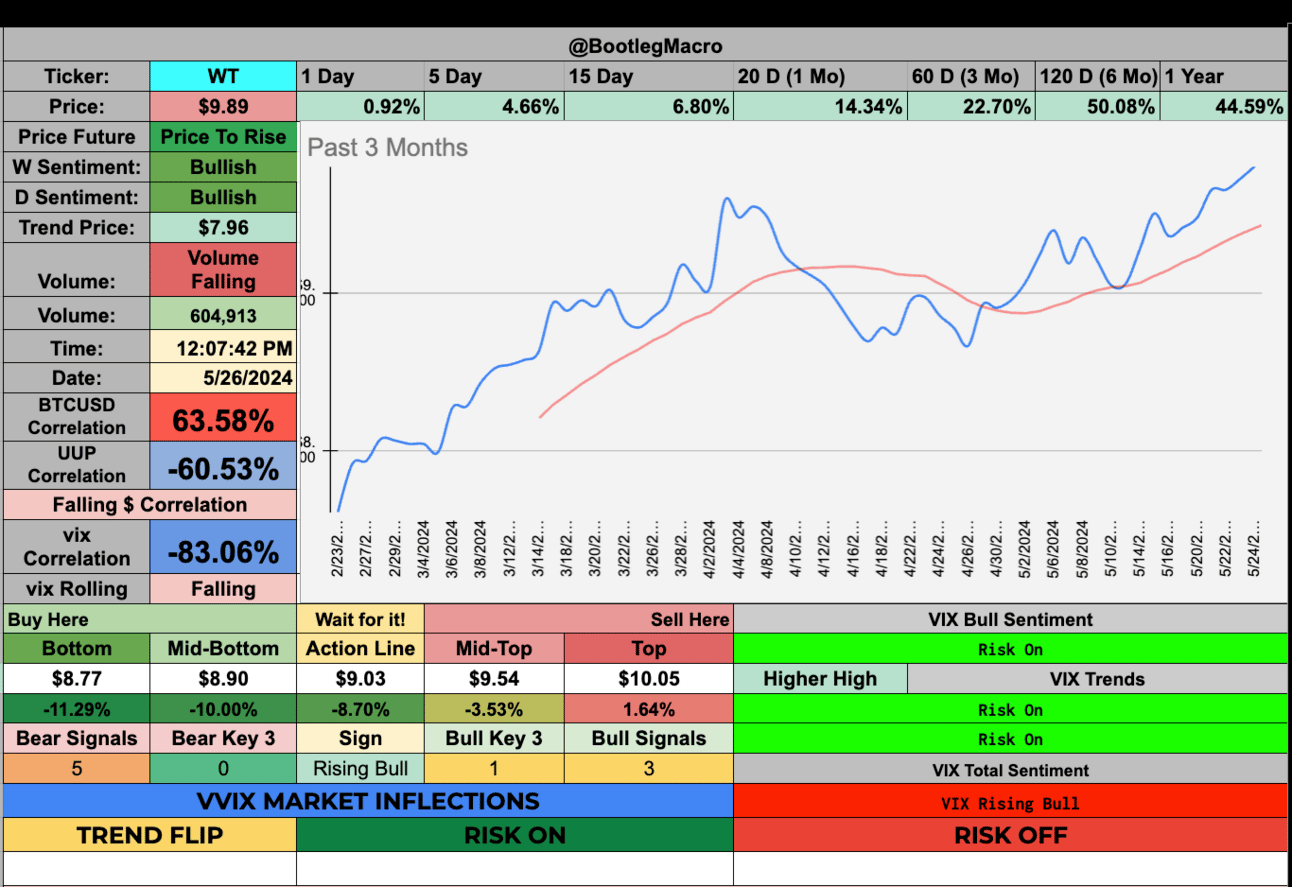

WT: Wisdom Tree - Asset Management - USA 🇺🇸

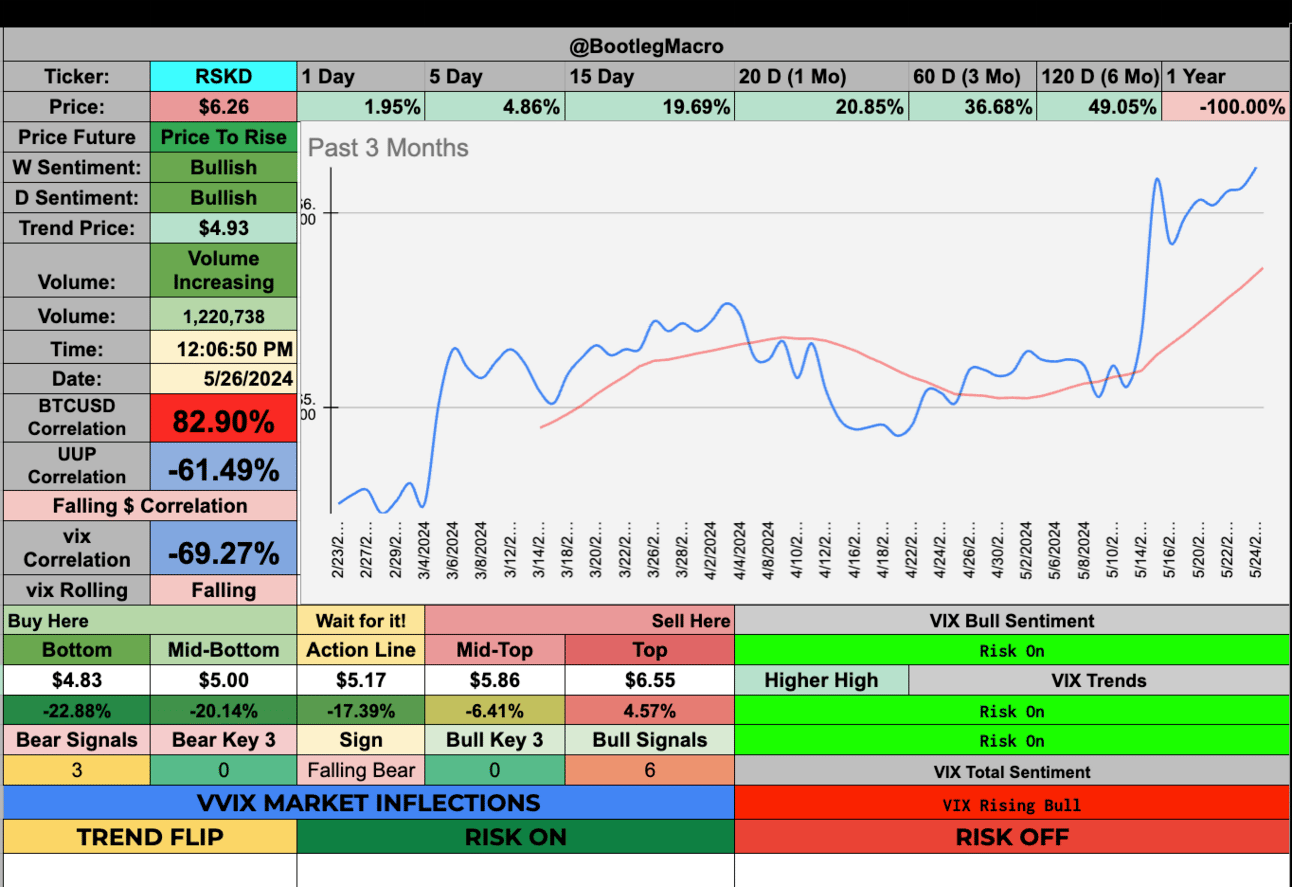

RSKD: Riskified Ltd. - Software - Infrastructure - Israel 🇮🇱

UEIC: Universal Electronics Inc. - Consumer Electronics - USA 🇺🇸

VRCA: Verrica Pharmaceuticals Inc. - Biotechnology - USA 🇺🇸

TK: Teekay Corporation - Oil & Gas Midstream - Canada 🇨🇦

MATV: Mativ Holdings Inc. - Specialty Chemicals - USA 🇺🇸

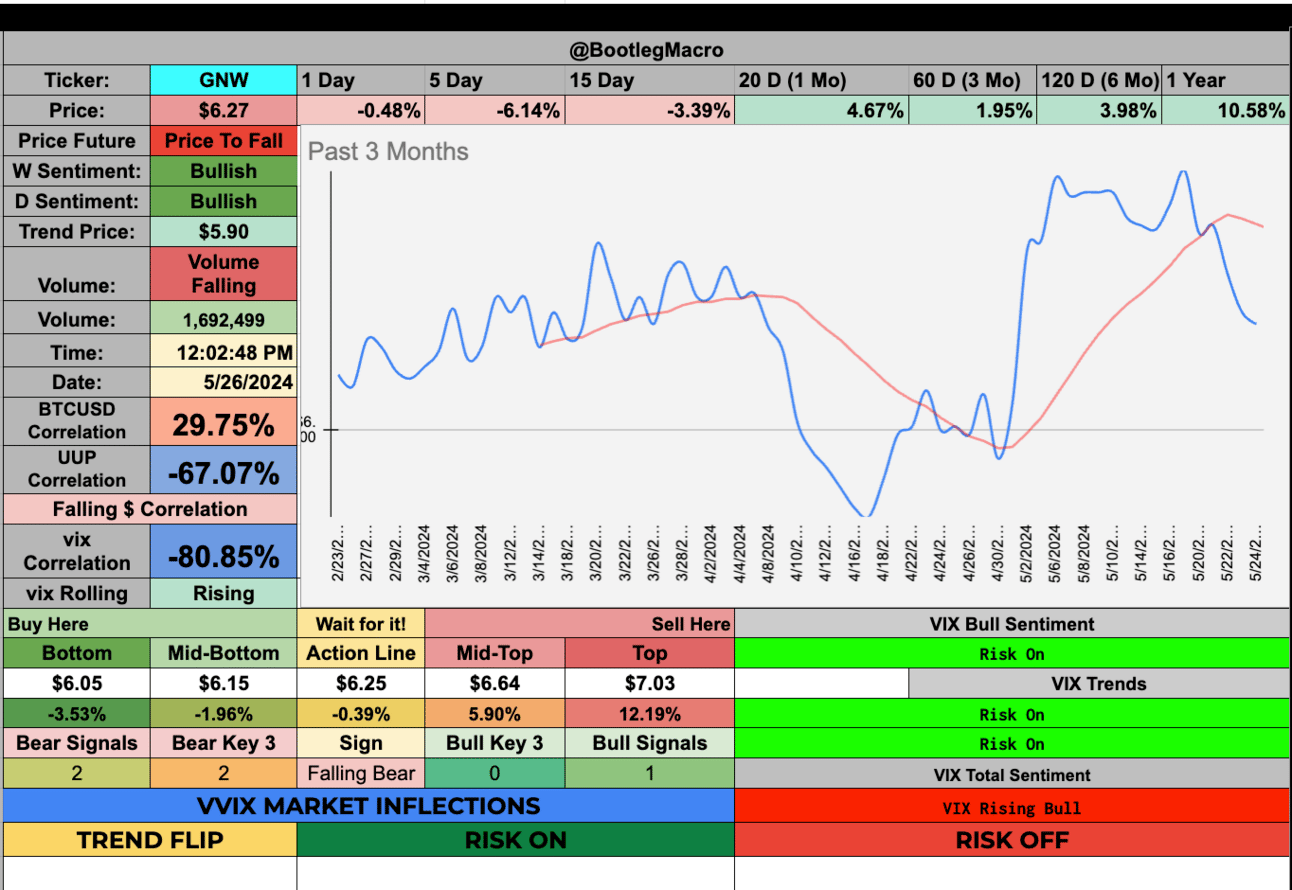

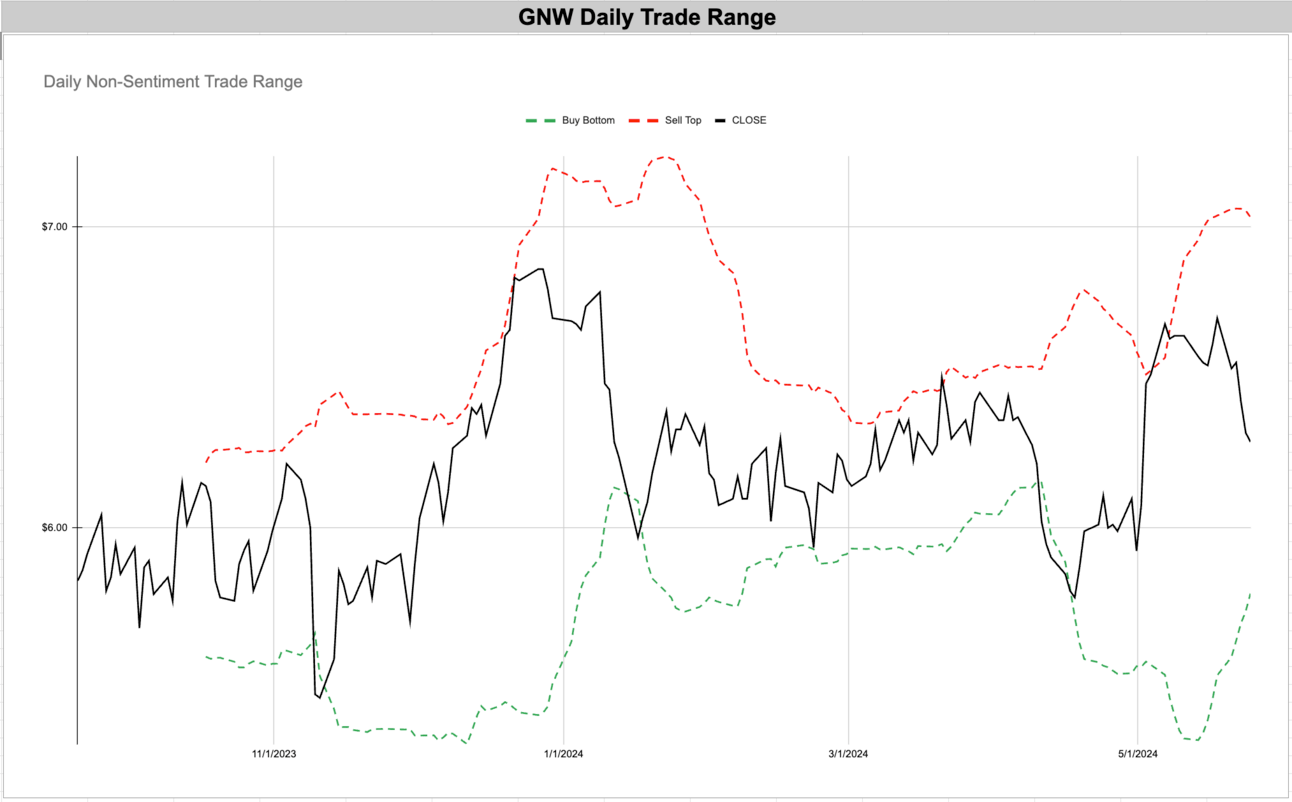

GNW: Genworth Financial Inc. - Insurance - Life - USA 🇺🇸

AIP: Arteris, Inc. - Semiconductors - USA 🇺🇸

ALOT: AstroNova Inc. - Computer Hardware - USA 🇺🇸

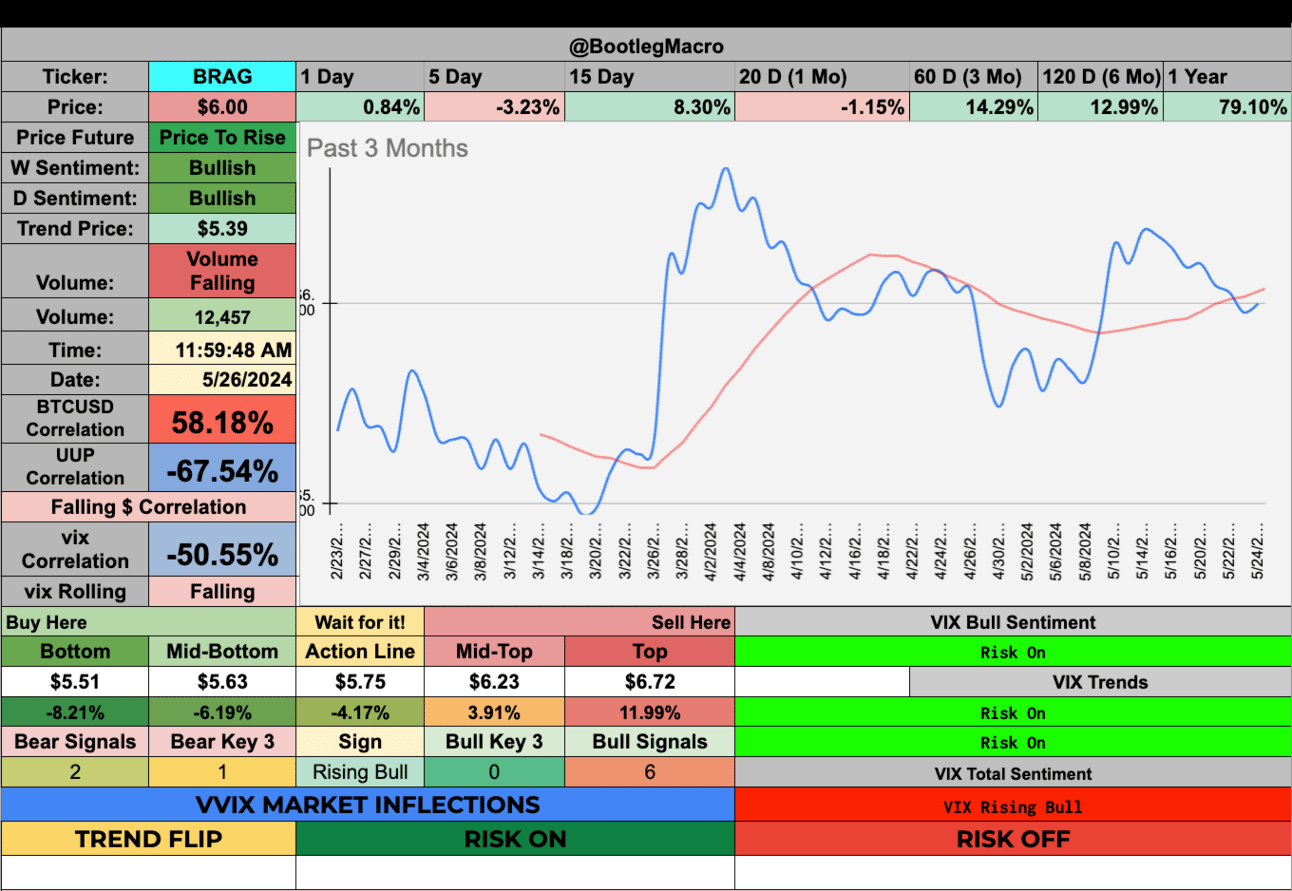

BRAG: Bragg Gaming Group Inc. - Gambling - Canada 🇨🇦

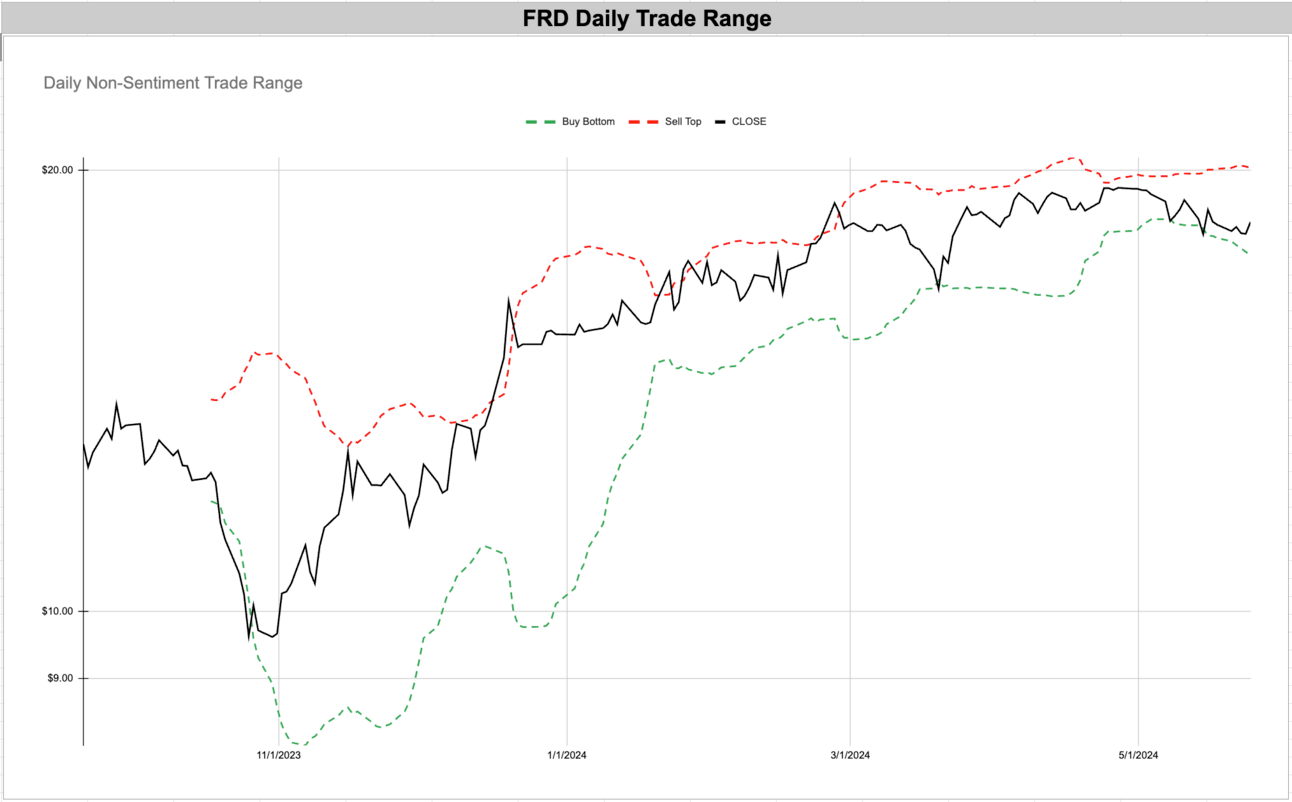

FRD: Friedman Industries, Incorporated - Steel - USA 🇺🇸

AGI: Alamos Gold Inc. - Gold - Canada 🇨🇦

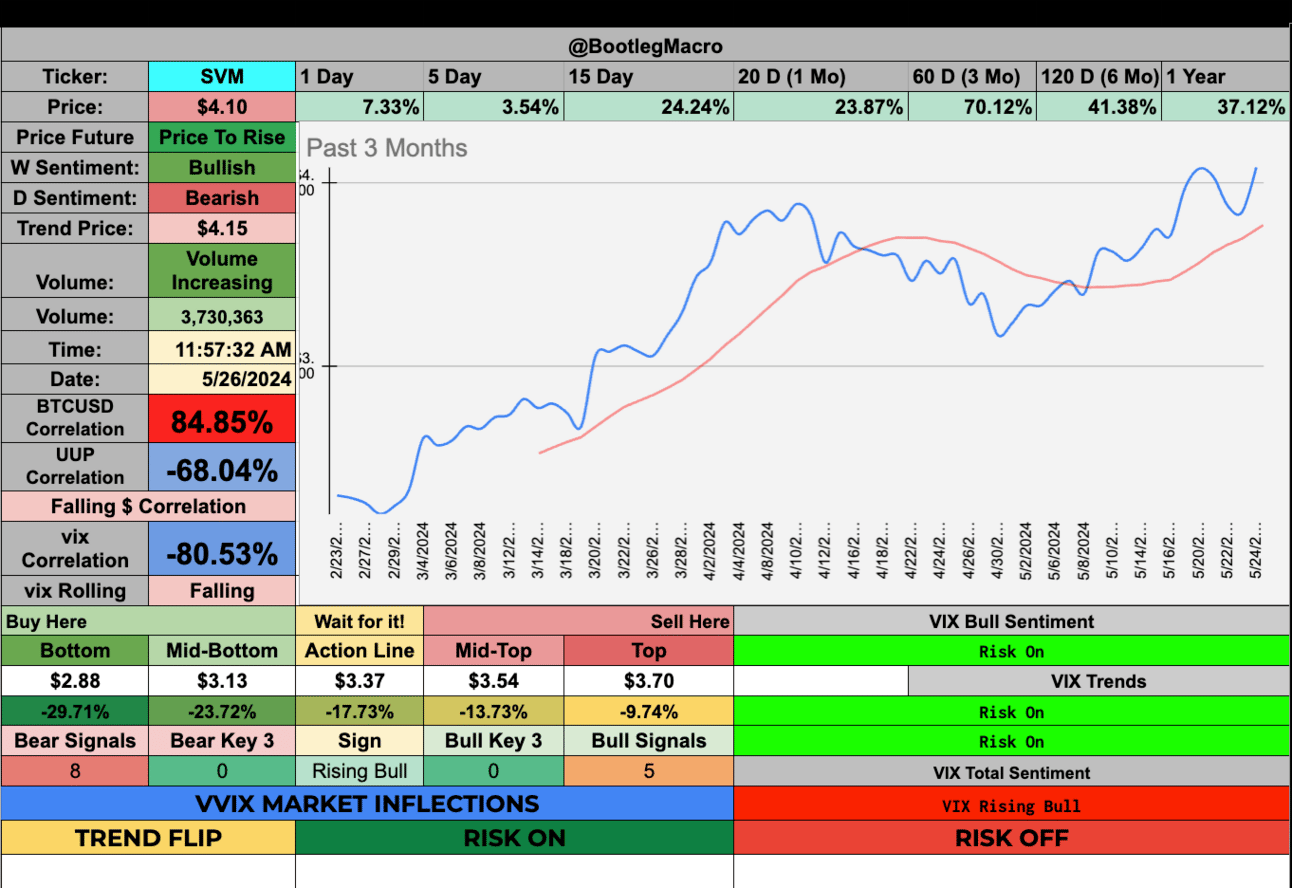

SVM: Silvercorp Metals Inc. - Silver - Canada 🇨🇦

ASPI: ASP Isotopes, Inc. - Industrial Metals & Minerals - USA 🇺🇸

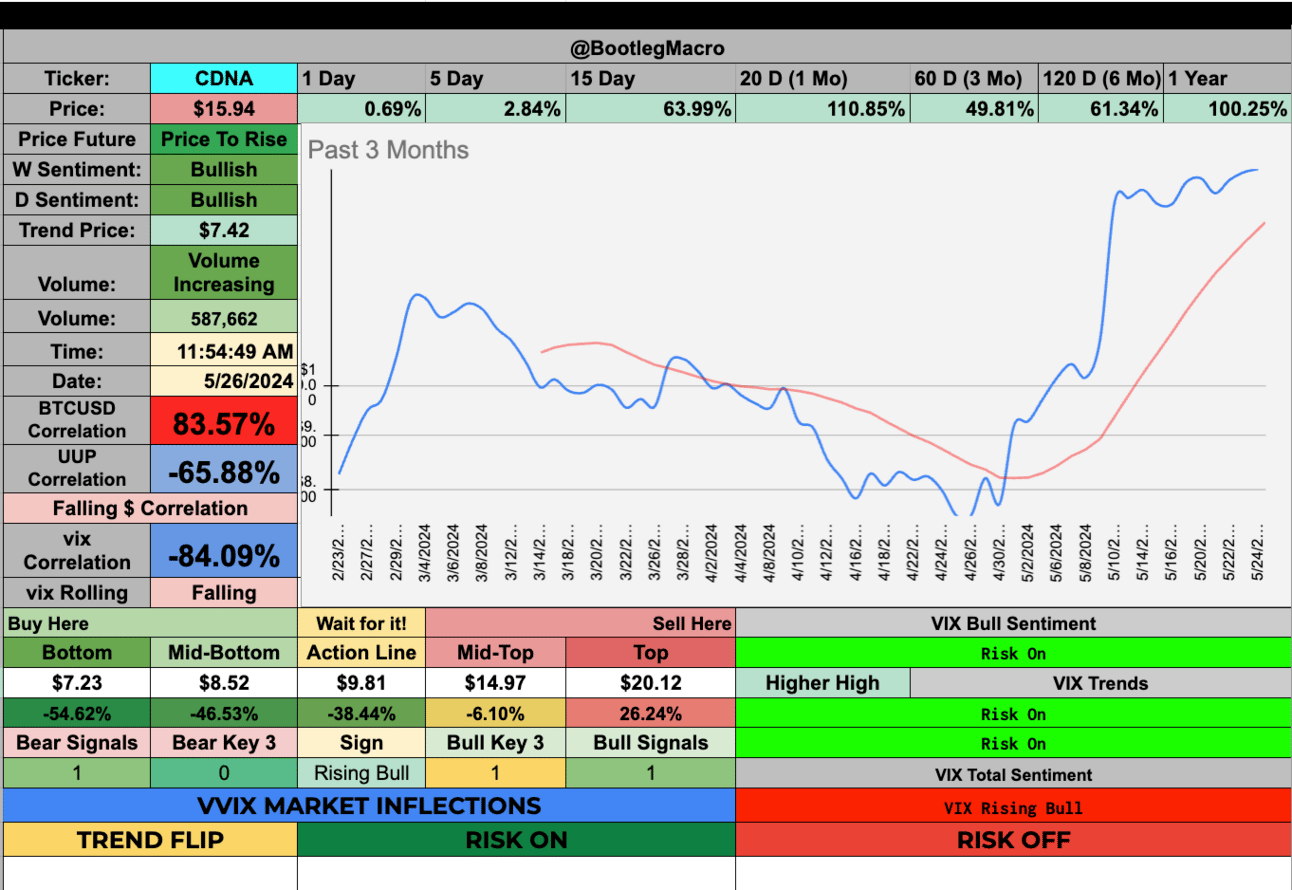

CDNA: CareDx, Inc. - Diagnostics & Research - USA 🇺🇸

WT: Wisdom Tree - Asset Management - USA 🇺🇸

RSKD: Riskified Ltd. - Software - Infrastructure - Israel 🇮🇱

UEIC: Universal Electronics Inc. - Consumer Electronics - USA 🇺🇸

VRCA: Verrica Pharmaceuticals Inc. - Biotechnology - USA 🇺🇸

TK: Teekay Corporation - Oil & Gas Midstream - Canada 🇨🇦

MATV: Mativ Holdings Inc. - Specialty Chemicals - USA 🇺🇸

GNW: Genworth Financial Inc. - Insurance - Life - USA 🇺🇸

AIP: Arteris, Inc. - Semiconductors - USA 🇺🇸

ALOT: AstroNova Inc. - Computer Hardware - USA 🇺🇸

Not enough data for the trade card. But the base setting up here is impressive.

BRAG: Bragg Gaming Group Inc. - Gambling - Canada 🇨🇦

FRD: Friedman Industries, Incorporated - Steel - USA 🇺🇸

AGI: Alamos Gold Inc. - Gold - Canada 🇨🇦

SVM: Silvercorp Metals Inc. - Silver - Canada 🇨🇦

ASPI: ASP Isotopes, Inc. - Industrial Metals & Minerals - USA 🇺🇸

CDNA: CareDx, Inc. - Diagnostics & Research - USA 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

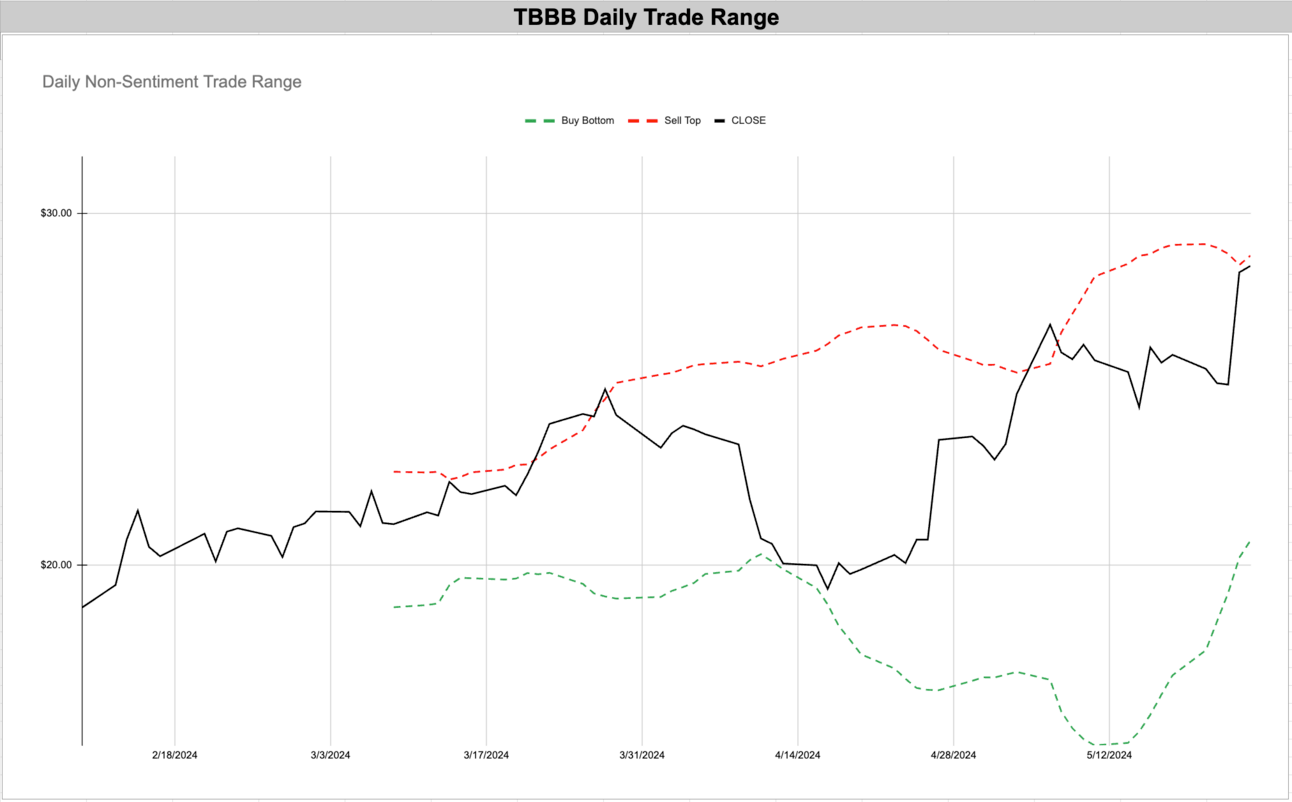

TBBB - TBBB Inc. - Consumer Defensive (Supermarkets) - Mexico 🇲🇽

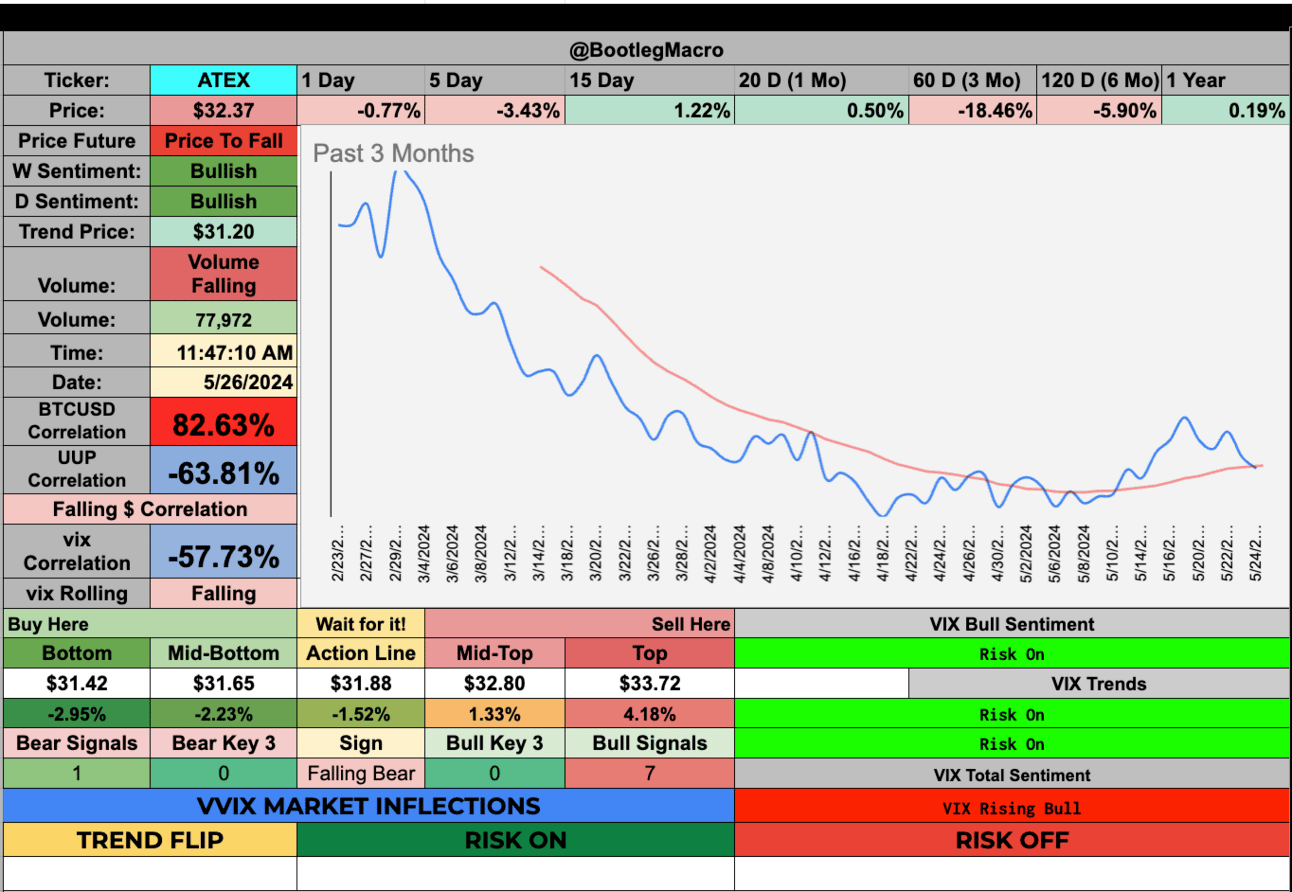

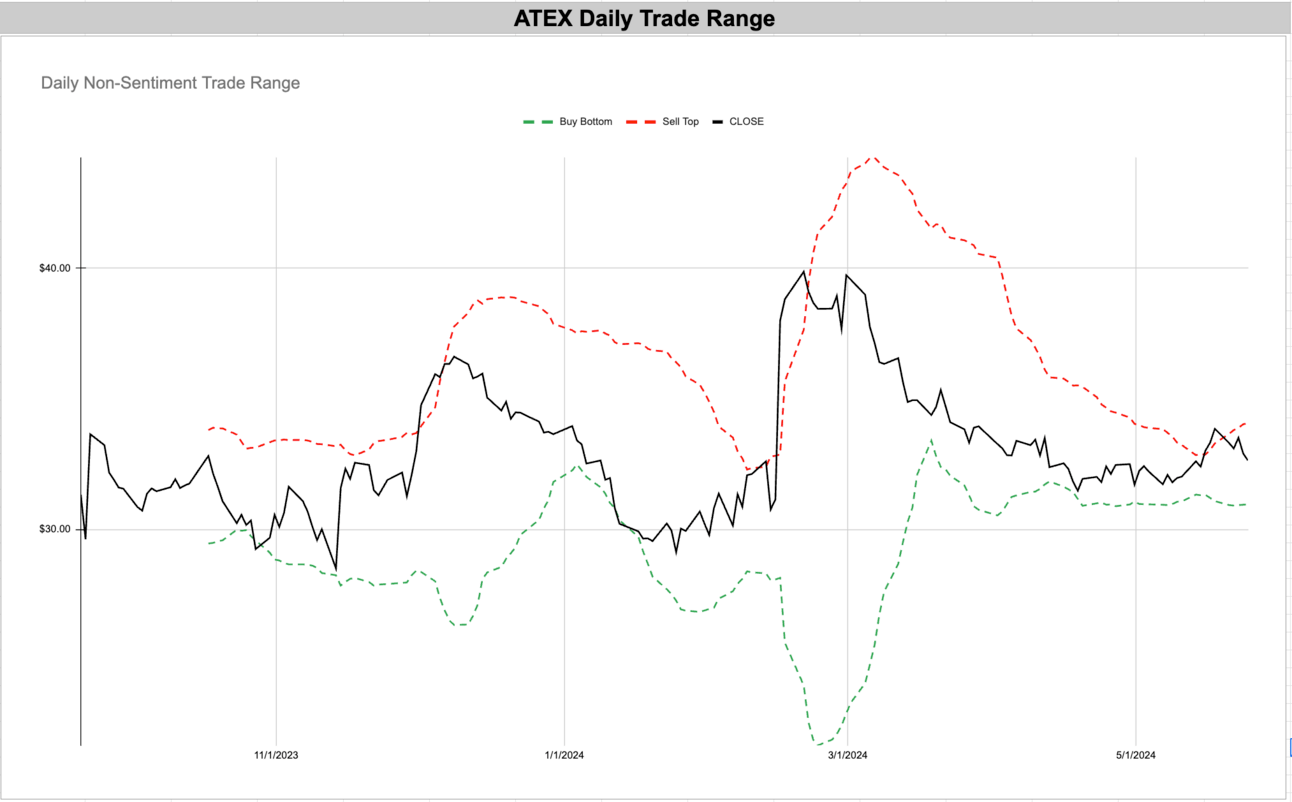

ATEX - Anterix Inc. - Communication Services - USA 🇺🇸

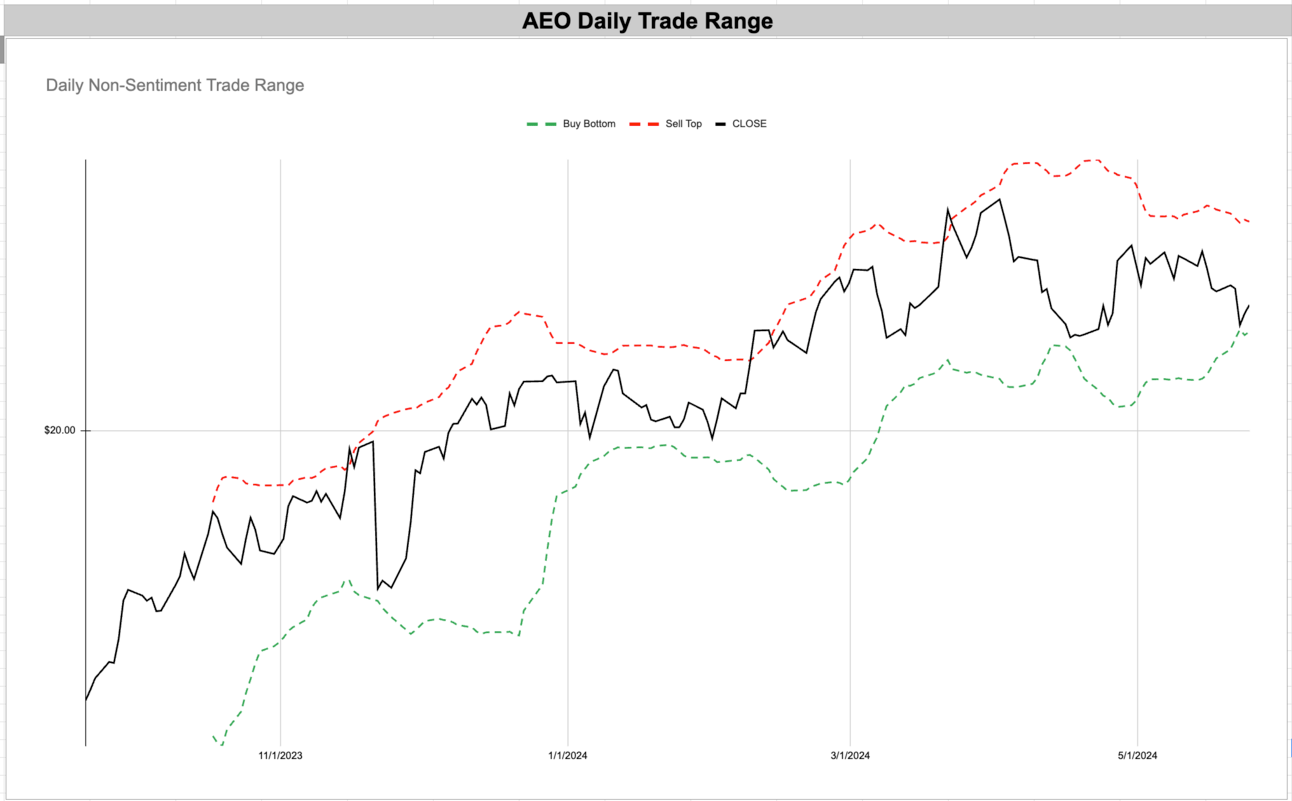

AEO - American Eagle Outfitters - Consumer Cyclical - USA 🇺🇸

COTY - Coty Inc. - Consumer Defensive - USA 🇺🇸

REVG - REV Group Inc. - Industrials - USA 🇺🇸

VECO - Veeco Instruments Inc. - Technology - USA 🇺🇸

LPG - Dorian LPG Ltd. - Energy - USA 🇺🇸

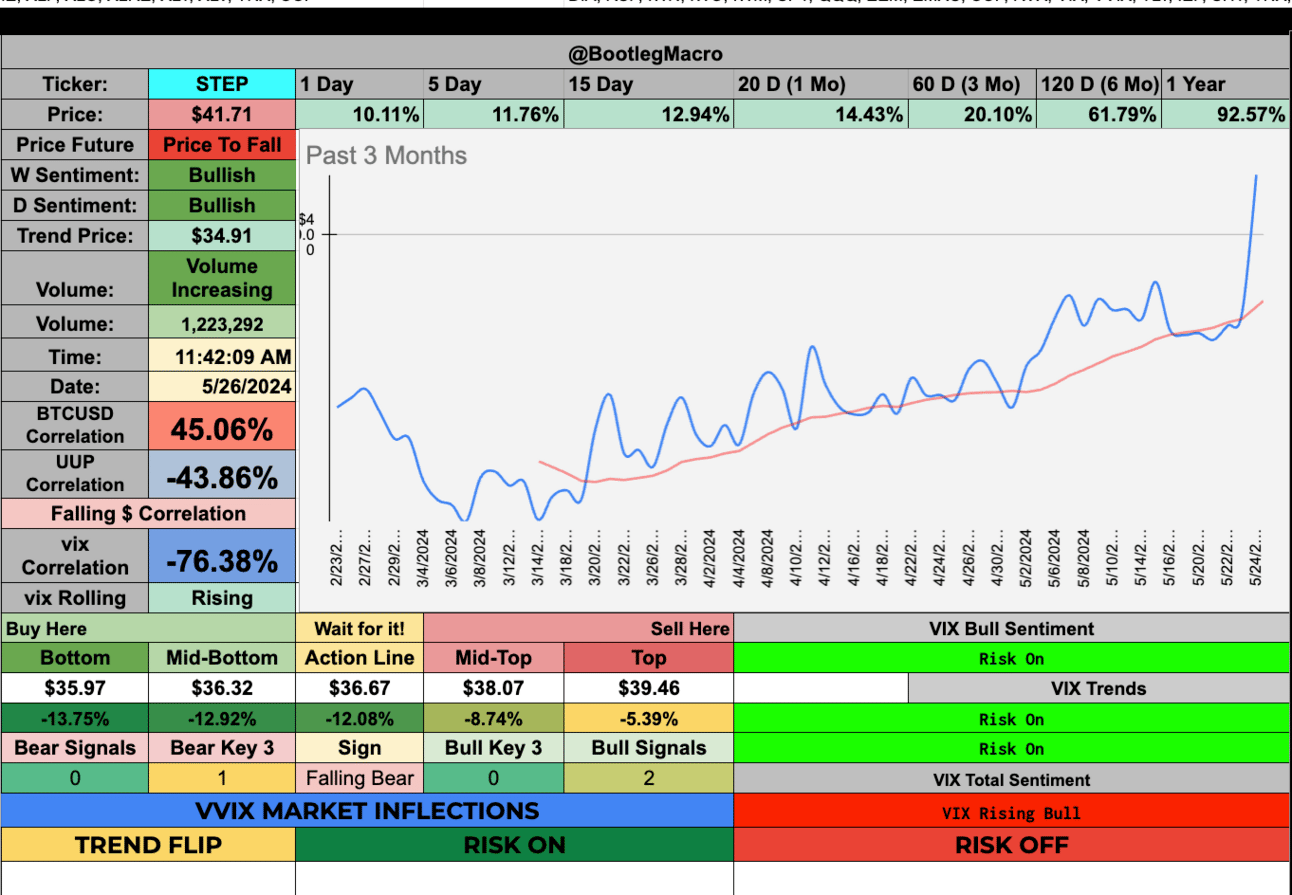

STEP - StepStone Group Inc. - Financial - USA 🇺🇸

ROAD - Construction Partners Inc. - Industrials - USA 🇺🇸

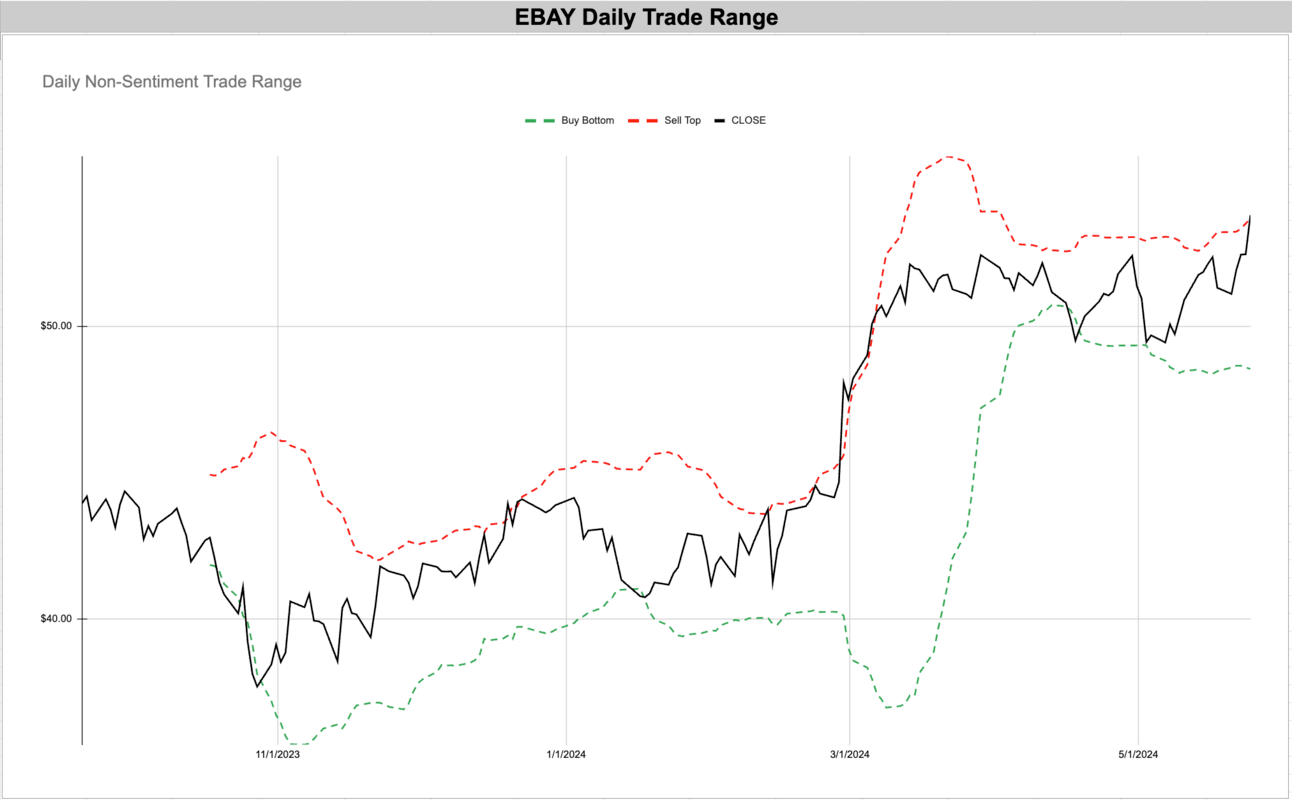

EBAY - eBay Inc. - Consumer Cyclical - USA 🇺🇸

TBBB - TBBB Inc. - Consumer Defensive (Supermarkets) - Mexico 🇲🇽

There isn’t enough data to support buying this but I love IPOs going into Q1, 2025

ATEX - Anterix Inc. - Communication Services - USA 🇺🇸

AEO - American Eagle Outfitters - Consumer Cyclical - USA 🇺🇸

COTY - Coty Inc. - Consumer Defensive - USA 🇺🇸

REVG - REV Group Inc. - Industrials - USA 🇺🇸

VECO - Veeco Instruments Inc. - Technology - USA 🇺🇸

LPG - Dorian LPG Ltd. - Energy - USA 🇺🇸

STEP - StepStone Group Inc. - Financial - USA 🇺🇸

ROAD - Construction Partners Inc. - Industrials - USA 🇺🇸

EBAY - eBay Inc. - Consumer Cyclical - USA 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro