- The New High Newsletter

- Posts

- Let 1000 Flowers Bloom! What Grows Flowers Better Than Composte?

Let 1000 Flowers Bloom! What Grows Flowers Better Than Composte?

Nothing grows flowers better than literal shit. What else do you consider this market? The bull markets are in metals and currencies...This is not a positive business cycle environment.

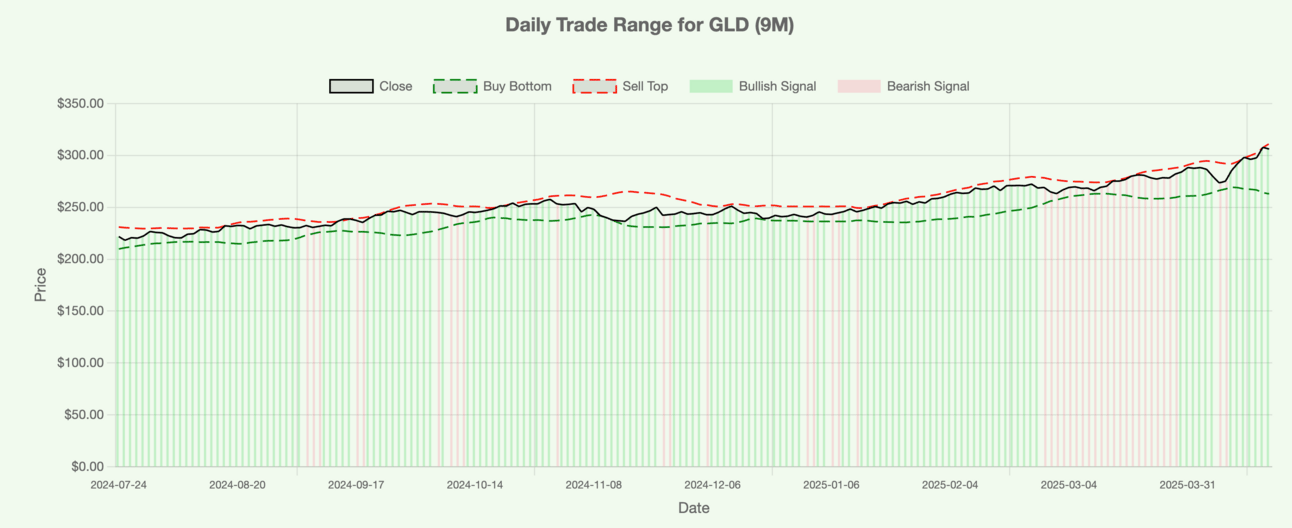

Market Overview: It can’t be said enough, even though I mentioned it in last week’s edition: ⚱️Gold is in a bull 🐂 market. Gold is having a resurgence 🚀 it’s up 9% in 1 month and 20% 🔥 in 3 month. With fewer and fewer BULL MARKETS these days, we have to hold onto the little shimmer of hope coming from metals.

Now you can ask:

Why is GOLD⚱️RIPPING?

The answer is simple:

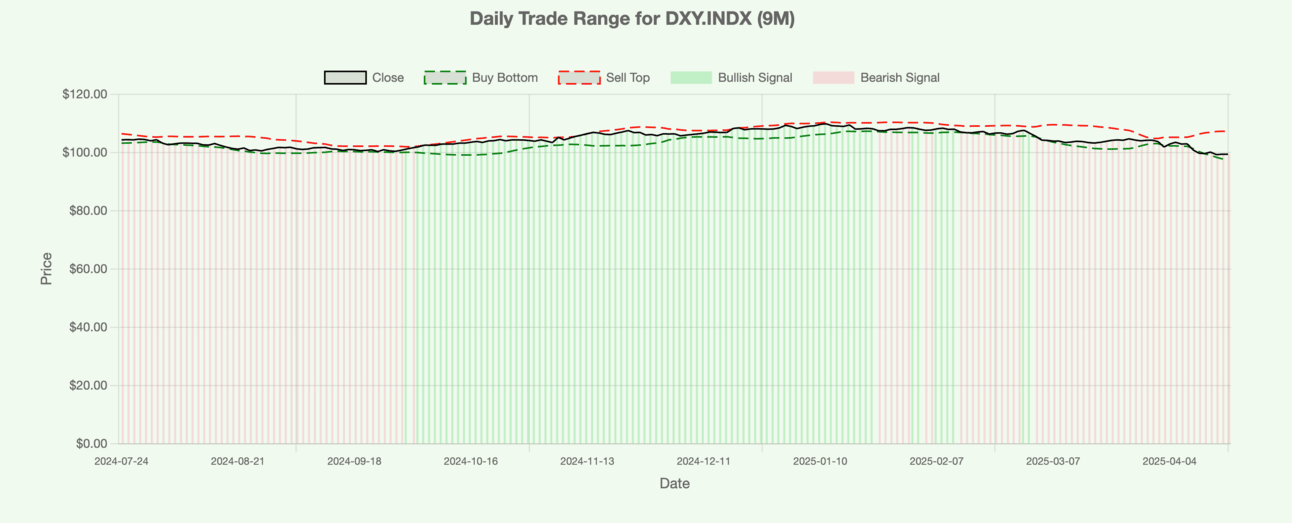

Because the dollar 💵 is VERY BEARISH 🐻.

The dollar has been BEARISH since 3/4/25

Again, last week I covered it, the dollar 💵 is breaking down. Massively and it’s the biggest trend resulting from tariffs implantation. Pause or no pause, the dollar is BEARISH and falling ☄️!

The down dollar trend we need to be tracking. The inverse is worthy of attention. Keep it on your radar for the next week. I’ll be tracking the $UUP ( ▲ 0.63% ) …stay alert this week.

New Highs $5-$20: The small cap sizzle is really a fizzle. We have 4 names ranging from data and coal mines. It’s bleak in the low priced ticker or small cap space. You can go from $GRND ( ▲ 2.88% ) to $YALA ( ▲ 0.84% ) with not much in between.

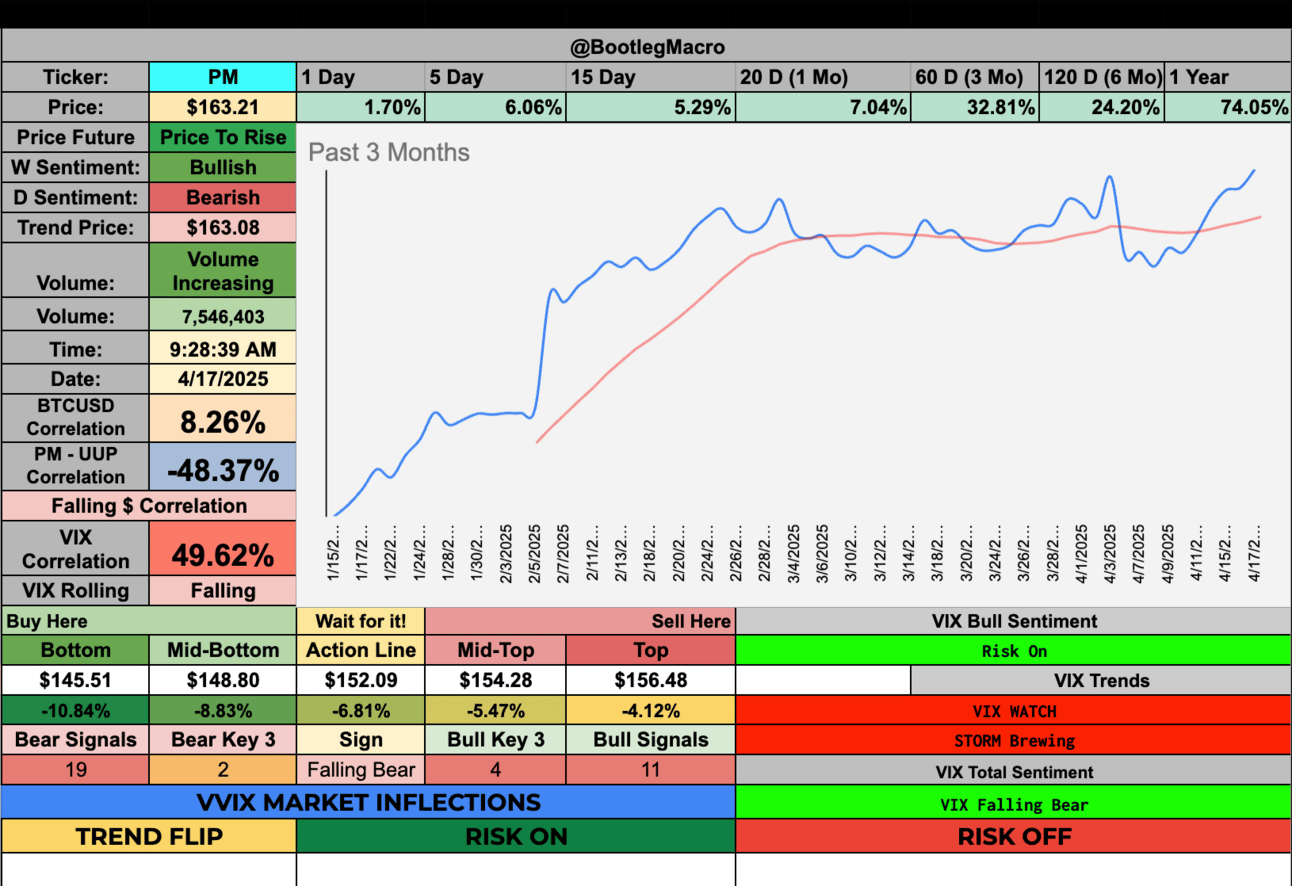

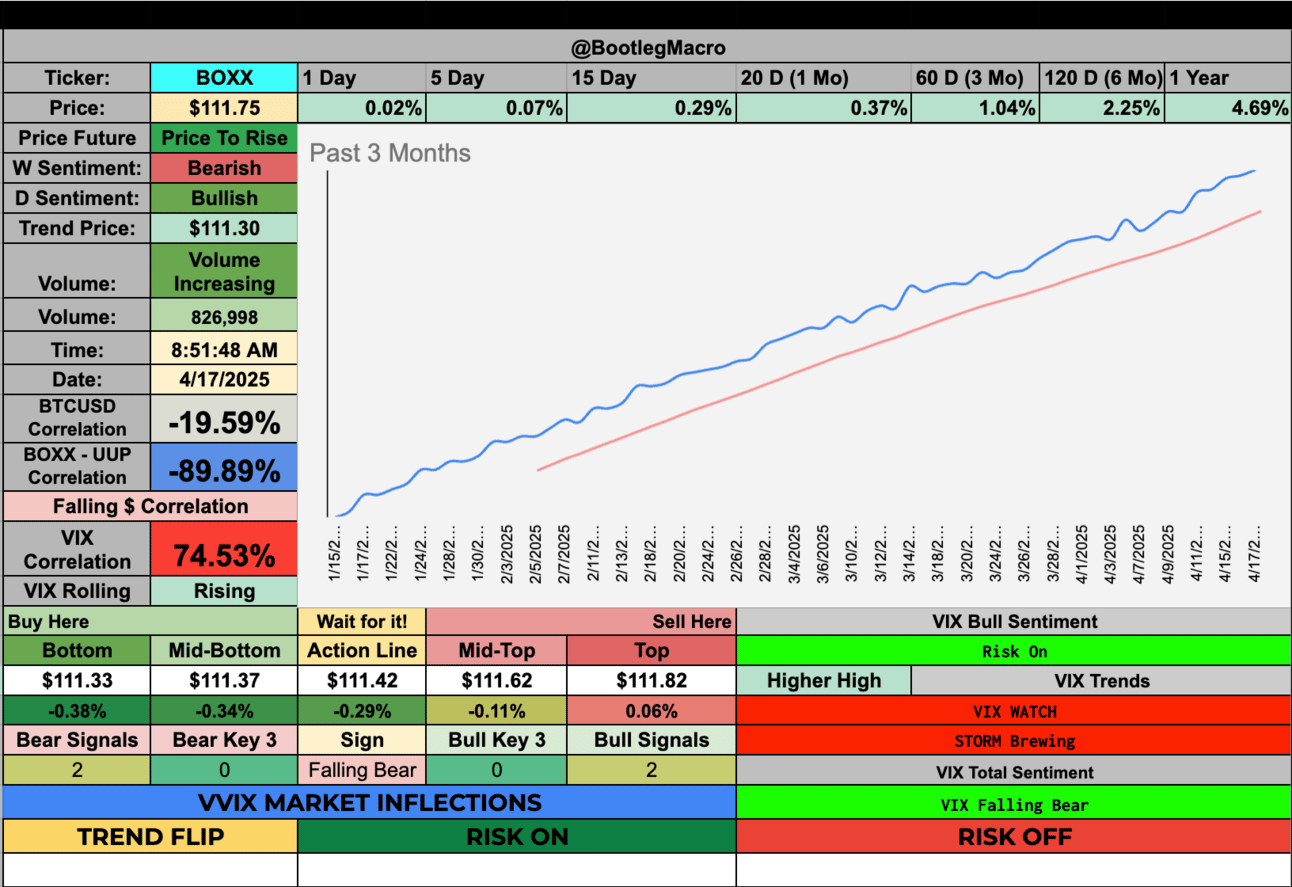

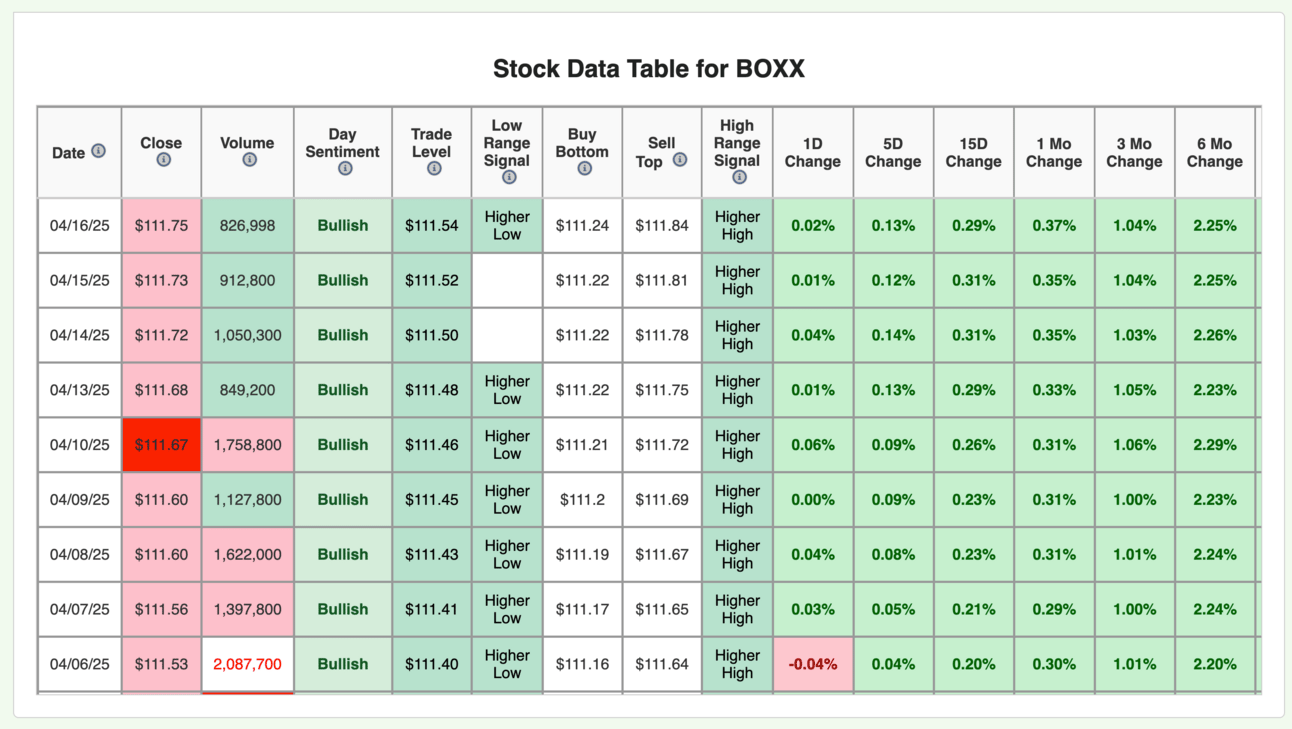

New Highs $20+: $PM ( ▼ 0.53% ) continues to razzle-dazzle investors in a challenging environment. But when Tobacco, Guns and Gold are hitting new highs…cash isn’t a bad option. Which is why I can see $BOXX ( 0.0% ) being on the list too! Hitting new highs…the 4%+ return of t-bill is too safe to ignore.

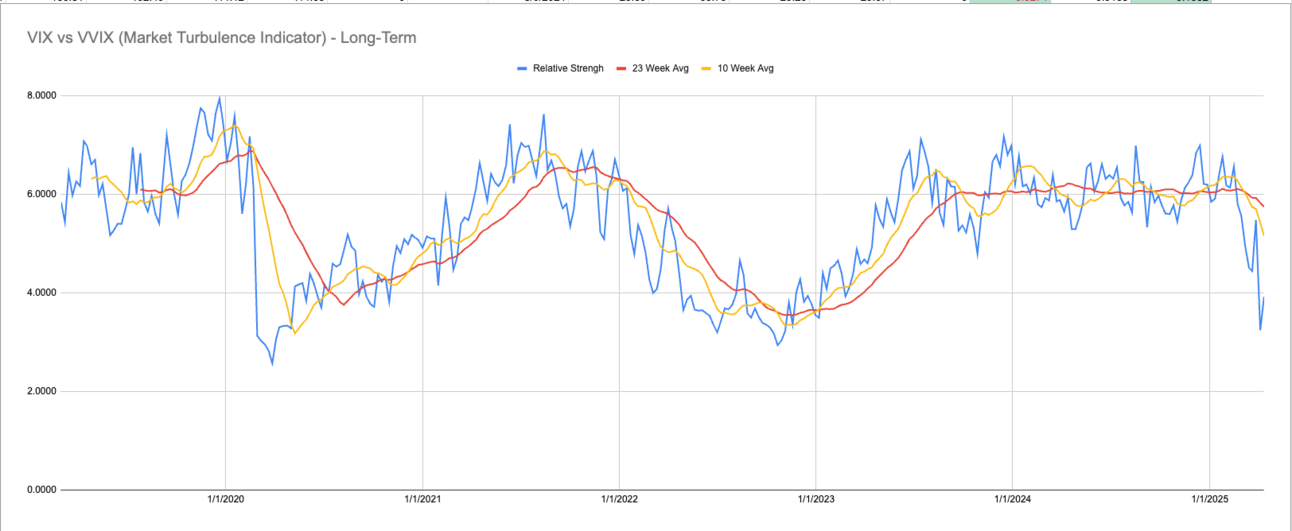

Turbulence Indicator: No major change, we are still very turbulent. This moment isn’t for the weak, it’s for the nimble aggressive traders. Be cautious, I am in mostly cash and gold. I do see a chance the $VIX ( ▼ 3.3% ) is starting to fade…might be an opp.

Looking Ahead: I’ll need another 2-4 weeks to let my turbulence indicator catch up to this moment. I’d love to see a bit of BULLISHNESS perking up around the edges of the market. So far, nothing has changed since BEARISHNESS took over sentiment in early-March.

Market Performance Framework

Market Overview:

A short week markets 📉might have been what markets needed. Over the weekend, we haven’t seen much messaging around tariffs, economy or International relations. Silence from the White House is golden 🏆. But we still have the new chirping of ole Jerome which can rattle markets too. Fingers crossed 🤞 we have light messaging from the US 🇺🇸 for the next couple weeks. If things can play out organically, the business cycle will still continue to offer counter-trends opportunities.

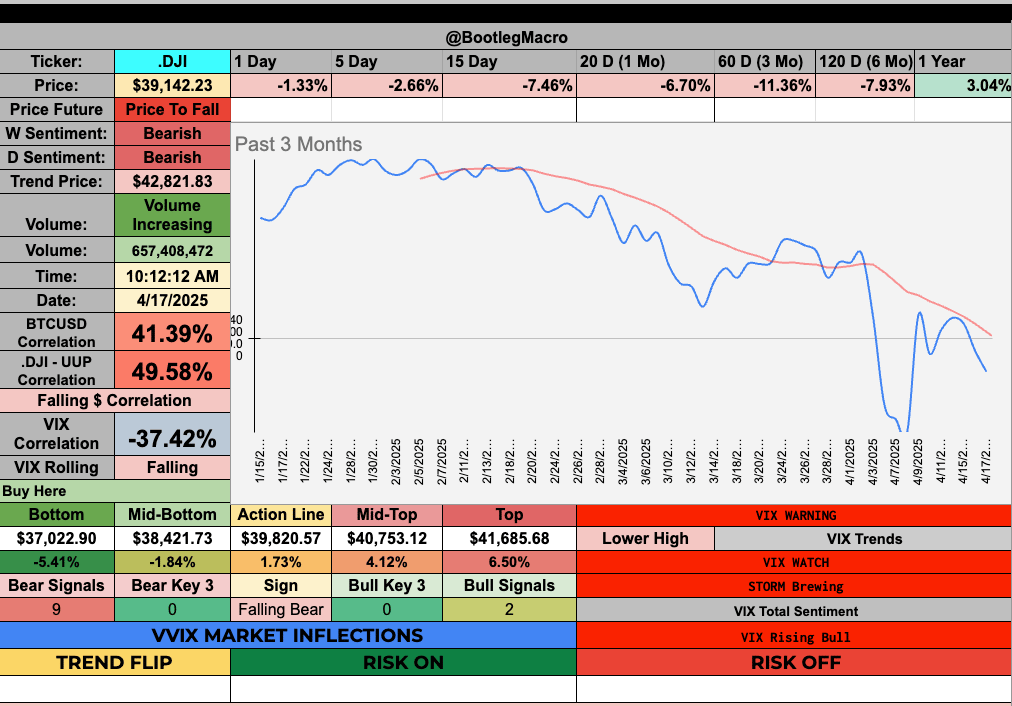

I don’t like how coiled the markets look here.

I’ll watch the price against the trade level. We could bounce off $5,400 much lower.

This move doesn’t look great…the top of the range is well below the trend price.

We are so low in the trade range. I’ll be concerned about this week in DJI.

The little BULLISH markers on 4/15 and 4/14 are non-signals.

Yikes…the trade level is so low in the range. I have concerns if we stay below $17,000.

Volatility Corner Framework

Indicator Update:

We’re in stable condition but far worse than it was 6-7 weeks ago. There is nothing like a massive drop in the market to wake up the passive index crowd. It’s about now folks are noticing their 401k isn’t funded as much as expected. So I don’t know if more volatility is on the horizon but I think we have more people bracing for pain. Which sometimes can become self-fulling.

Technical Context:

The $VIX ( ▼ 3.3% ) range is wide — but I think mid-30s to high-teens are now likely for the next week or 2. There could be a fall back into the low 10s but it should take us until mid-summer to forget this pain.

Risk Assessment:

Risks are too high still. You can see on the turbulence indicator, we are still way down in the depths of pail. Anything under 4 or 5 has to be considered choppy-to-risky market conditions.

Historical Parallels:

The move we experienced in 2025 is only similar to the COVID crash.

Actionable Insight:

I’ll trade small or buy long-calls into 2027. I’d like nothing more than to forget about his market and use it for the eventual BULL MARKET.

Turbulence indicator - up close.

I’ll use the $19.93 - $36.51 range. This volatility is too high for my model.

Range is too wide for anything useful for now. I’ll trade based on the trade level and 1 month rolling return.

VIX is at least down on the 5D rolling return!

MACRO INDICATOR:

I’d like to see the micro weather turn BULL MARKET.

MACRO SEASON: BEARISH Since 3/7/25🛑

MICRO WEATHER: BEARISH Since 2/21/25🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

GRND – Grindr Inc – Technology – 🇺🇸 United States

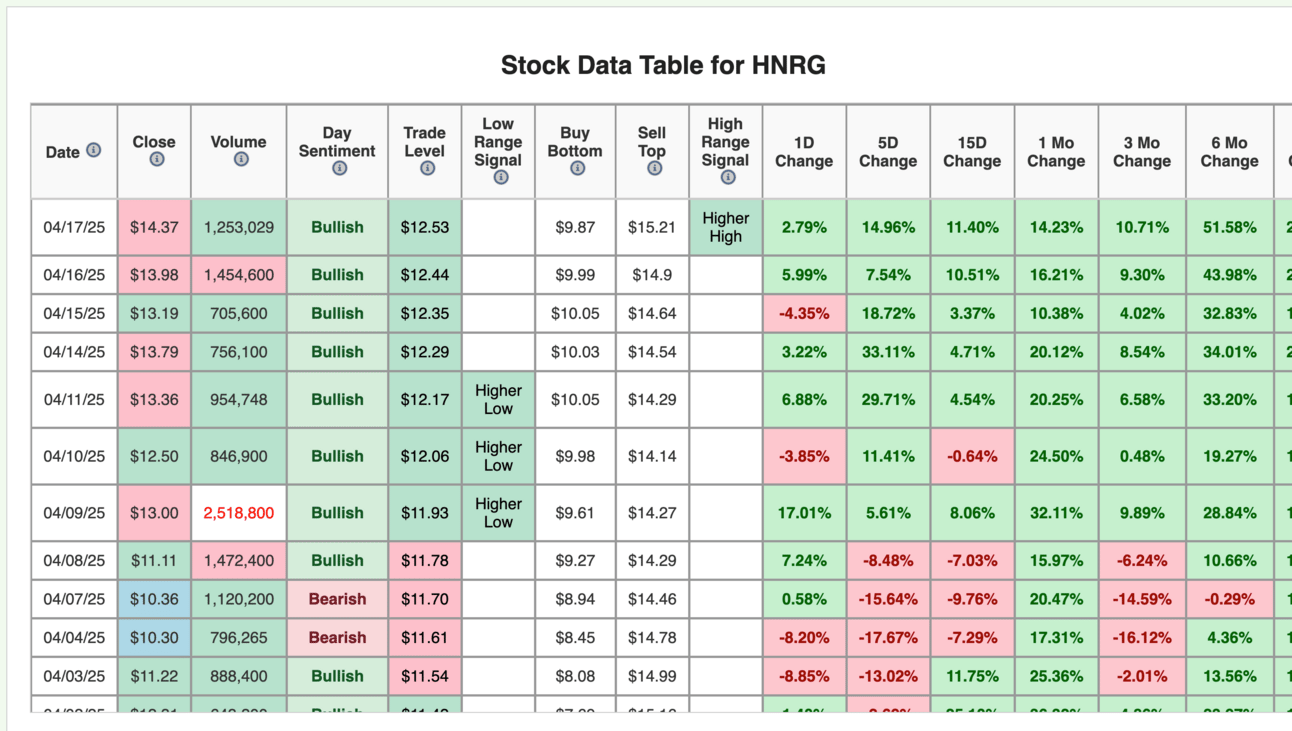

HNRG – Hallador Energy Co – Energy – 🇺🇸 United States

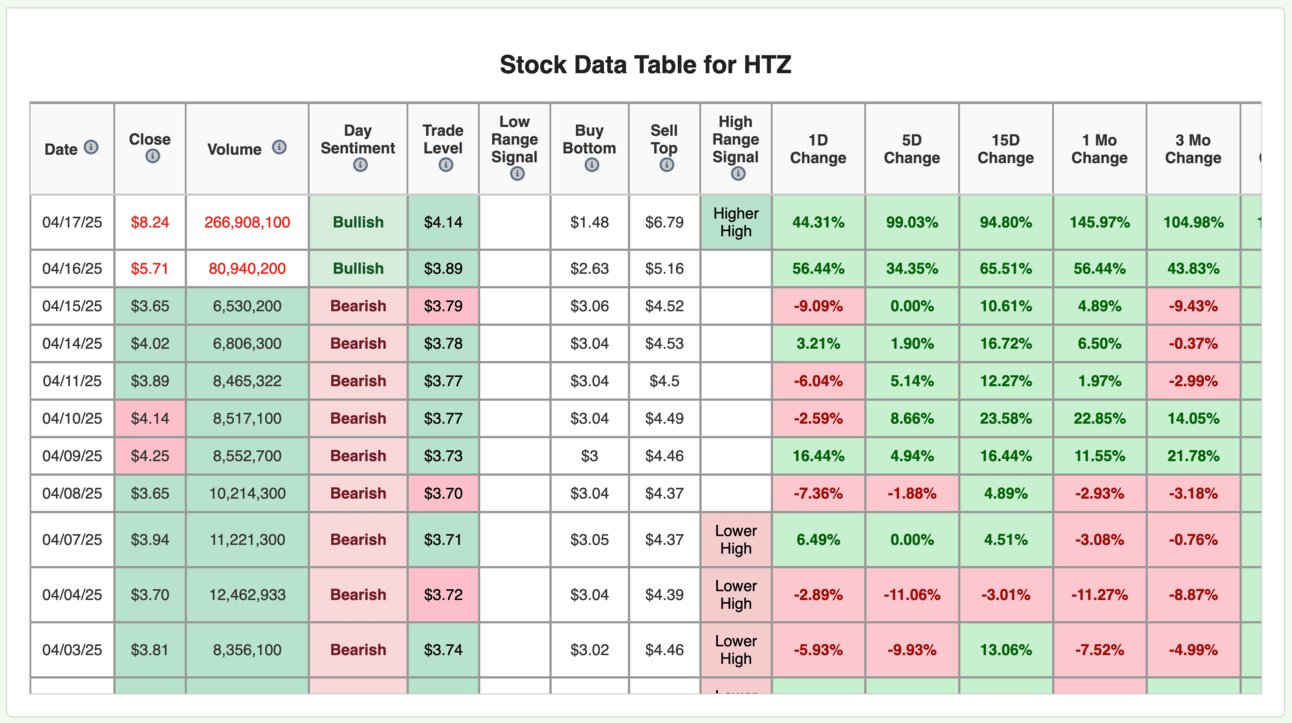

HTZ – Hertz Global Holdings Inc – Industrials – 🇺🇸 United States

YALA – Yalla Group Limited ADR – Technology – 🇦🇪 United Arab Emirates

GRND – Grindr Inc – Technology – 🇺🇸 United States

HNRG – Hallador Energy Co – Energy – 🇺🇸 United States

HTZ – Hertz Global Holdings Inc – Industrials – 🇺🇸 United States

YALA – Yalla Group Limited ADR – Technology – 🇦🇪 United Arab Emirates

Enjoying this?

& Invite a friend.

New Highs $20+:

PM – Philip Morris International Inc – Consumer Defensive – 🇺🇸 United States

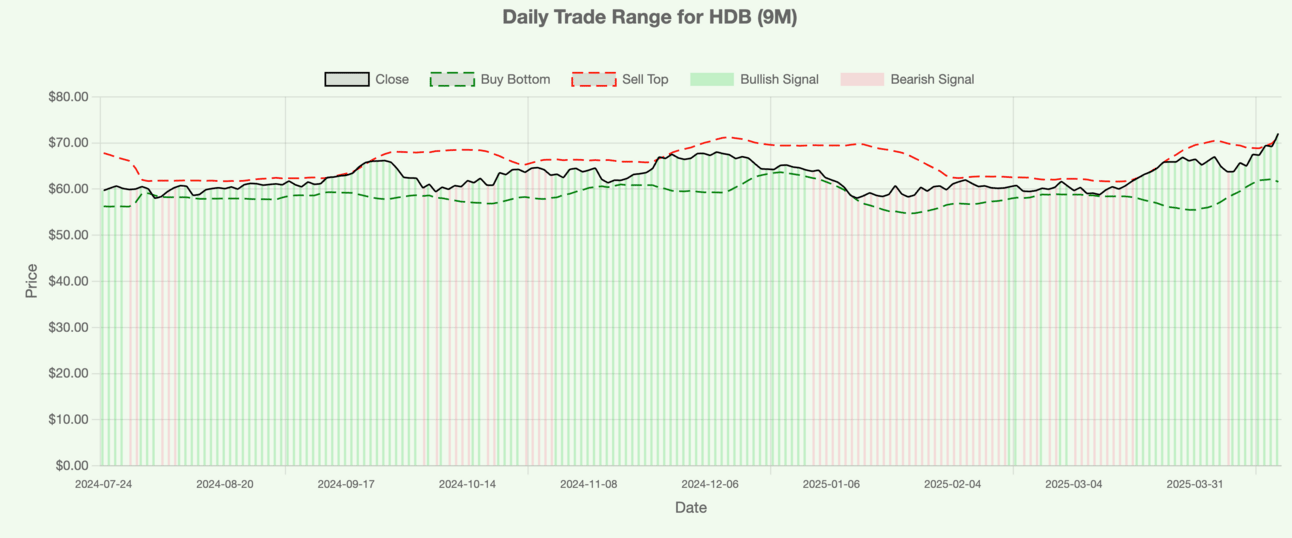

HDB – HDFC Bank Ltd. ADR – Financial – 🇮🇳 India

EWP – iShares MSCI Spain ETF – Financial – 🇺🇸 United States

EFAV – iShares MSCI EAFE Min Vol Factor ETF – Financial – 🇺🇸 United States

CPK – Chesapeake Utilities Corp – Utilities – 🇺🇸 United States

BOXX – Alpha Architect 1–3 Month Box ETF – Financial – 🇺🇸 United States

PM – Philip Morris International Inc – Consumer Defensive – 🇺🇸 United States

HDB – HDFC Bank Ltd. ADR – Financial – 🇮🇳 India

EWP – iShares MSCI Spain ETF – Financial – 🇺🇸 United States

EFAV – iShares MSCI EAFE Min Vol Factor ETF – Financial – 🇺🇸 United States

CPK – Chesapeake Utilities Corp – Utilities – 🇺🇸 United States

BOXX – Alpha Architect 1–3 Month Box ETF – Financial – 🇺🇸 United States

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

$NVDA - Analyzing NVIDIA's Market Trends 📈

— BootlegMacro (@bootlegmacro)

12:58 AM • Apr 15, 2025

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro