- The New High Newsletter

- Posts

- We're Not in Kansas Anymore - Duh! Follow the Gold Road to The Emerald City!

We're Not in Kansas Anymore - Duh! Follow the Gold Road to The Emerald City!

Gold is breaking out! The dollar is collapsing! Tariffs are in whipsaw mode. And VIX is living above $30! An interesting moment...the New Highs List this week tells the story of the overall market.

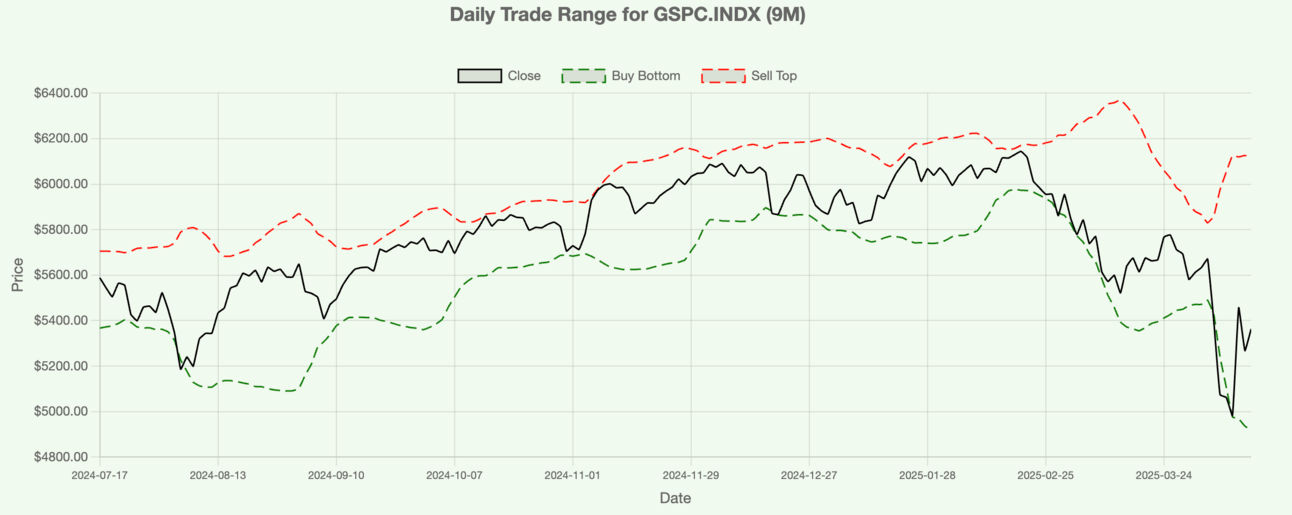

Market Overview: We’ve undergone a complete vibe shift in 5 weeks. How good am I supposed to feel after this week? Nasdaq up 7%, SPY up almost 6% — I don’t know what to think about markets and that’s a major risk: Uncertainty.

We don’t know what to expect so up 5%, down 5% — we know it can all happen. That will drive people to save haven money market funds if the volatility continues.

The only part of the market in a true BULL MARKET is metals. Both New Highs Lists below are littered with GOLD companies. We need a BULL MARKET narrative to dominate the tariff narrative or else the volatility will continue until morale improves.

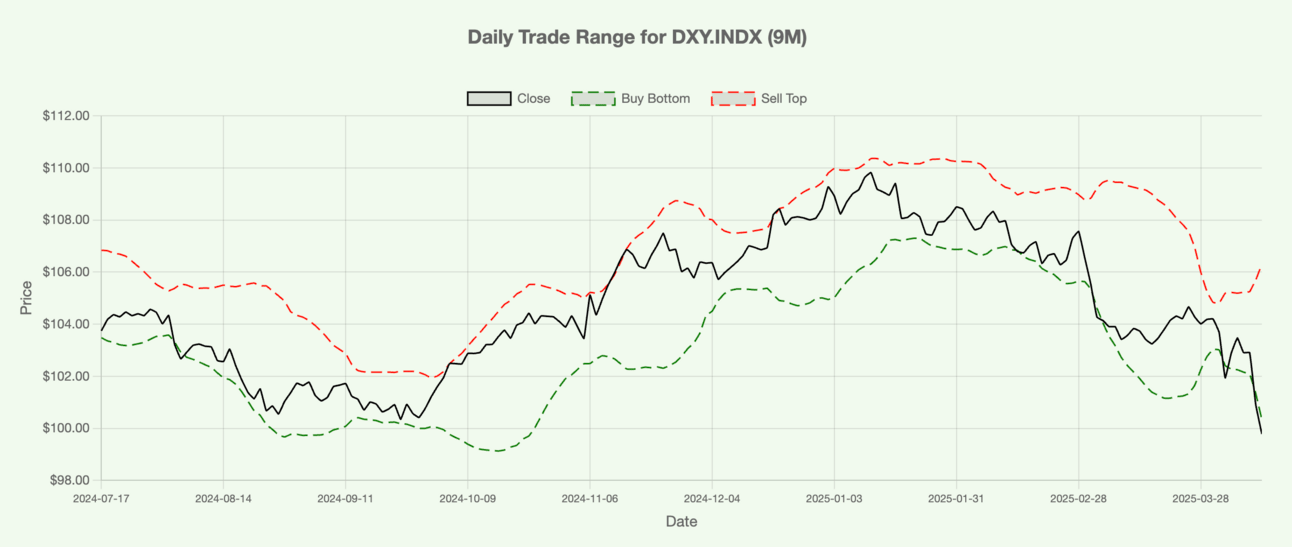

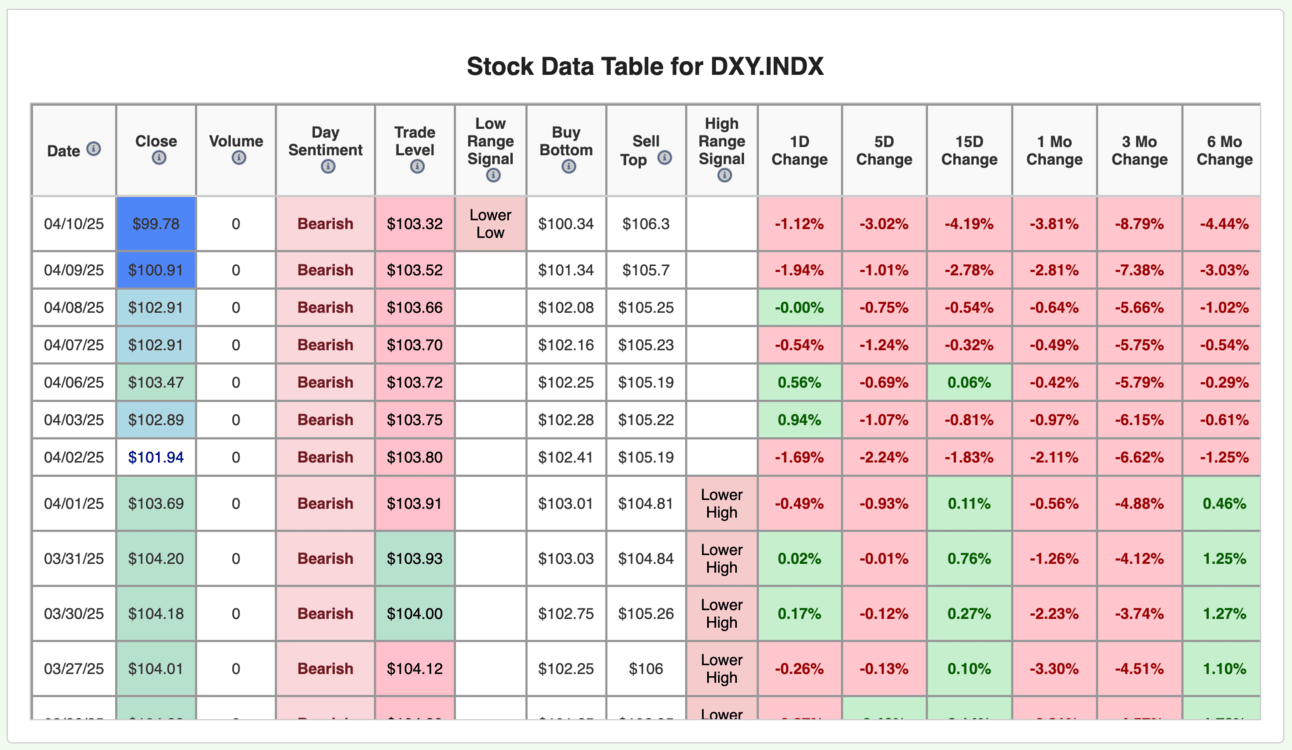

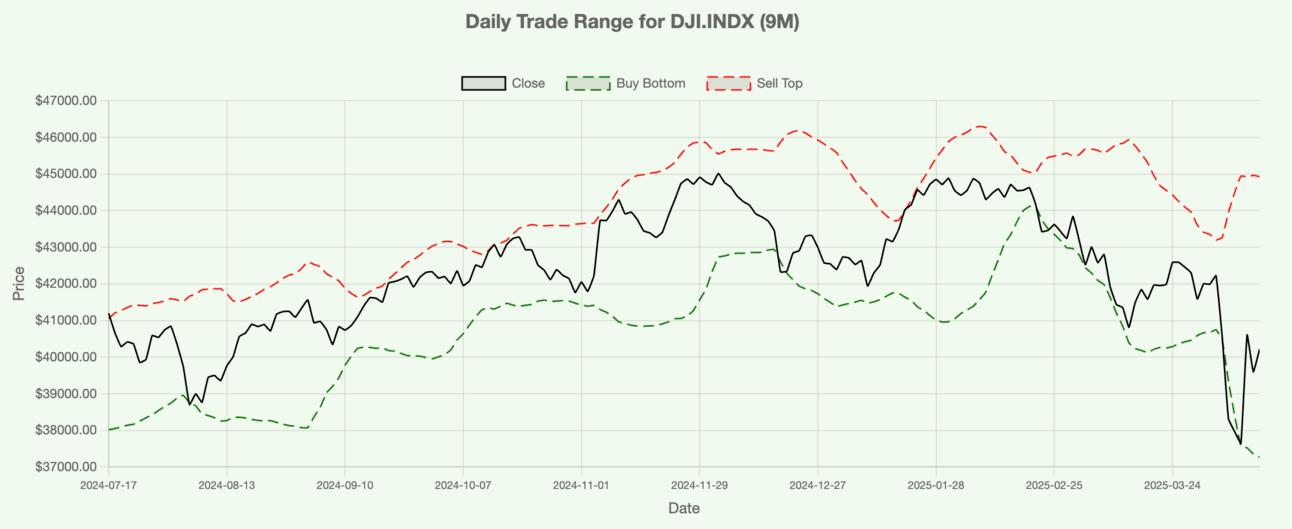

Down wind of the toxic pollution of uncertainty in this current market, the dollar is collapsing! It’s clear as day in the range below. That makes me think back to 2017 and 2012 when $EEM ( ▼ 0.21% ) was a the best macro market ETF for the entire year!

Maybe it’s ex-USA for the rest of 2025. The dollar is getting crush. International equities should get a boost from down dollar. Which will make imports for American’s more expensive with or without tariffs.

New Highs $5-$20: It’s all GOLD here, so maybe it’s time to just buy regular $GLD ( ▲ 1.31% ) - You’ll see a lot of this in the list: Basic Materials – 🇨🇦 Canada. If you want to find an American company, you can buy $GRPN ( ▼ 1.79% ) . Coupons are back in vogue…yippee!

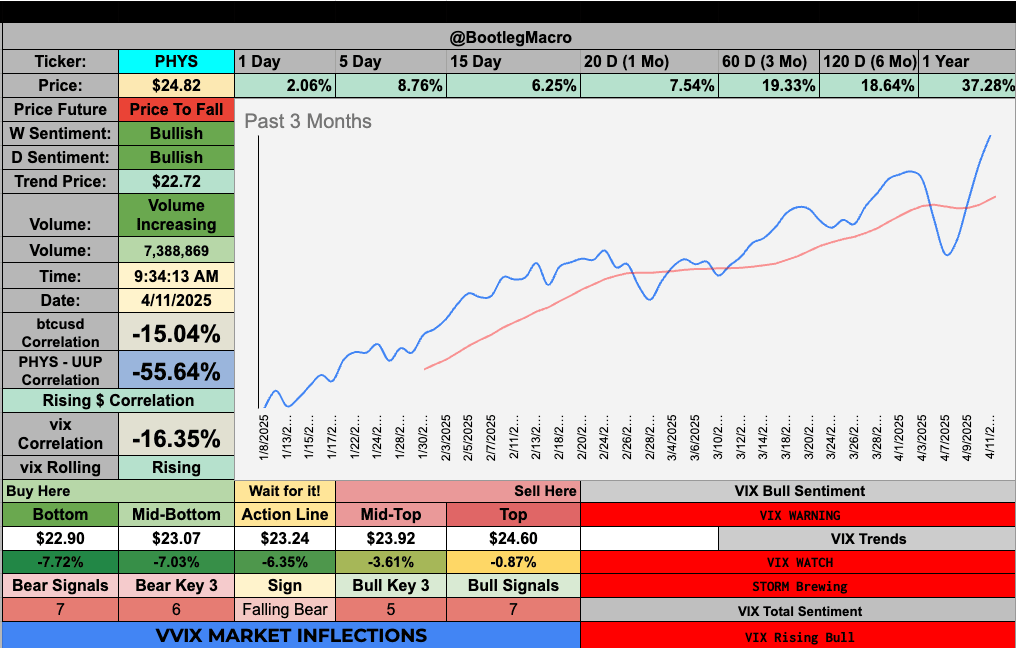

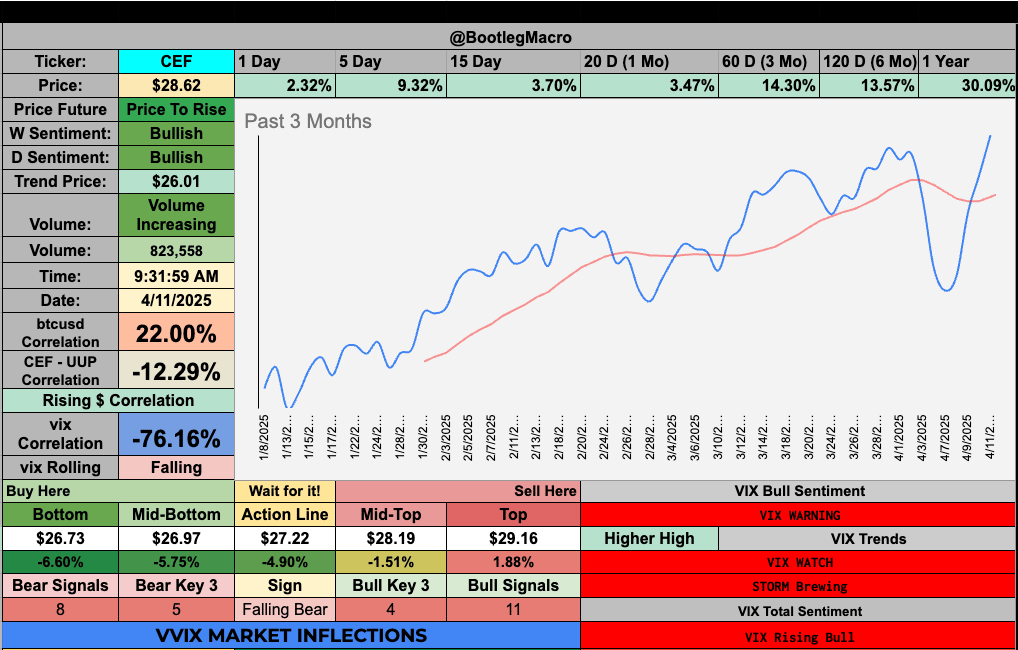

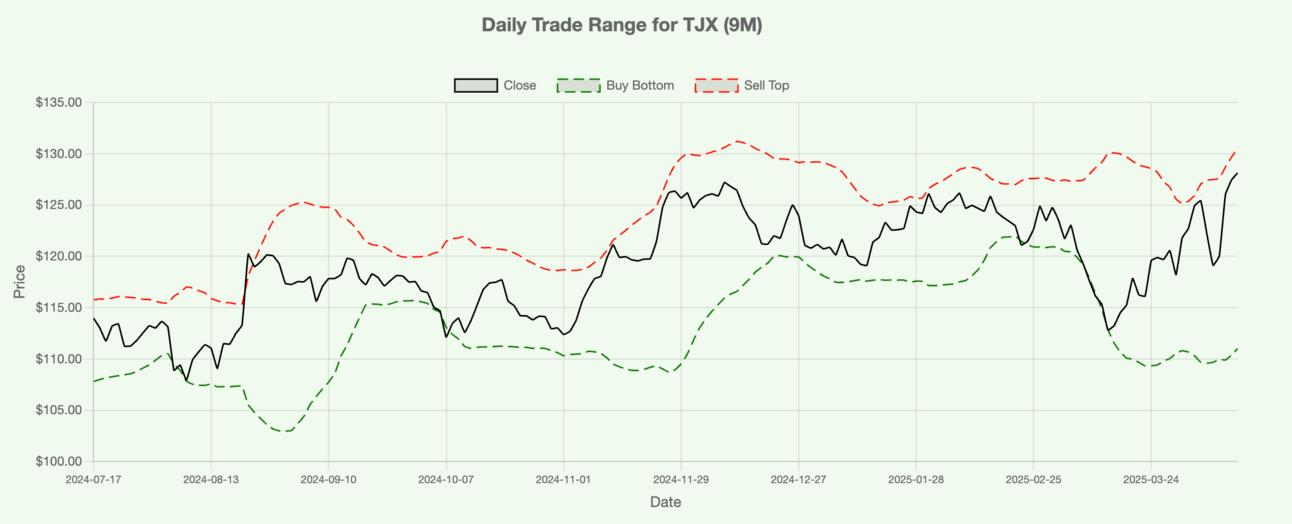

New Highs $20+: More Basic Materials – 🇨🇦 Canada on the higher priced tickers. $PHYS ( ▲ 1.21% ) $GFI ( ▲ 0.55% ) $WPM ( ▲ 1.63% ) these 3 glitter on the list. The discount names are $TJX ( ▲ 1.87% ) and $CASY ( ▲ 0.48% ) . We have signals in the New Highs List which is why I like to do it each week.

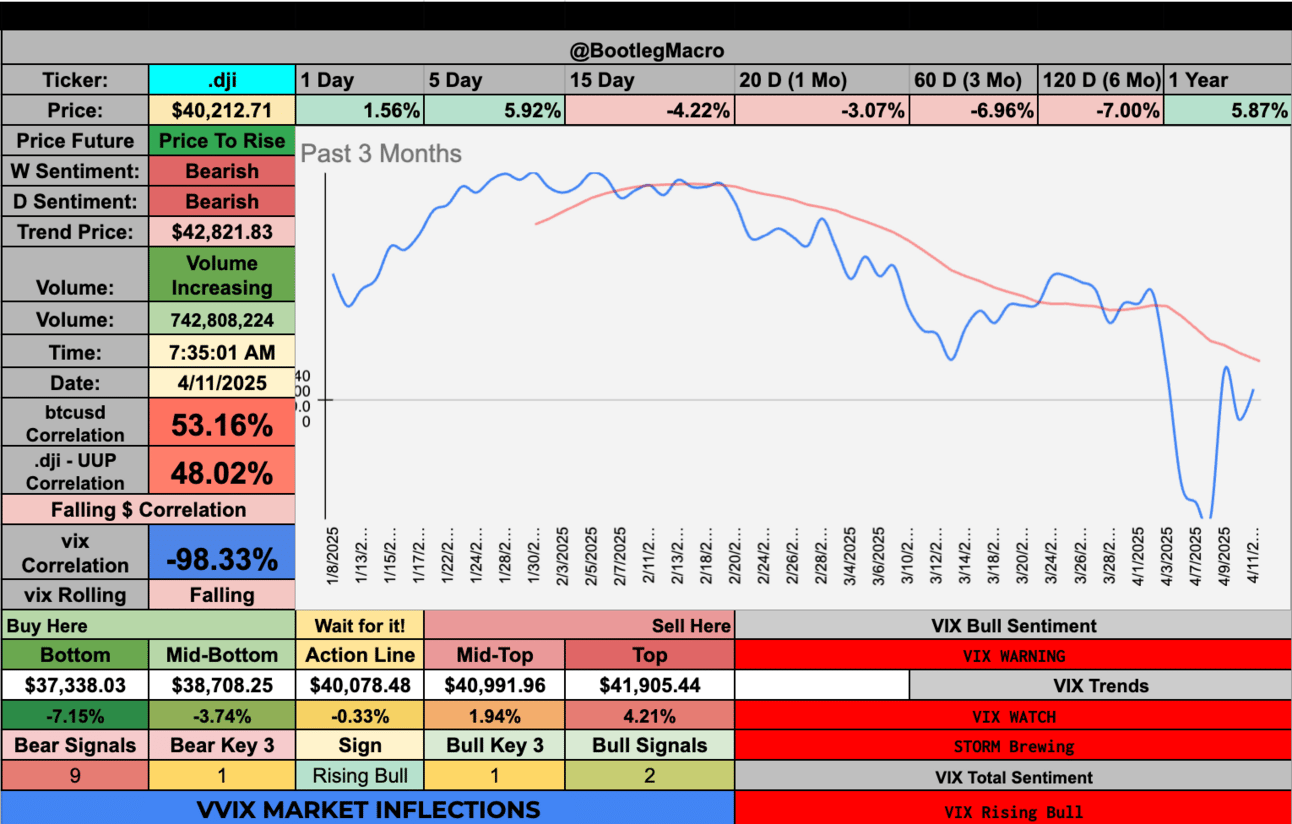

Turbulence Indicator: Sometimes prices lead, sometimes volatility leads…right now it’s volatility. Be wary. Volatility is high yet stable at these levels. — Much more below.

Looking Ahead: It’s impossible with VIX resting above $30 for days and weeks now.

Market Performance Framework

Market Overview:

The $VIX ( ▲ 6.6% ) hasn’t had a weekly close below $18 since 2/21/25 — We are entering our 8th week in a row.

Key Focus Area:

Indexes are not the area for me. Commodities, specifically GOLD. It’s important to follow BULL MARKETS if you’re long-only like me. Metals or cash can sustain me for at least another week while I wait to see where positive performance will start to shine.

Current Outlook and Indicators:

Indexes have another shot at rebounding this week. Asian markets on Sunday will tell us a lot because I’m expecting world markets to bottom first. Because the USA is decoupling from the world and adding friction to trade, those with less friction will grow more easily and faster. Uncertainty will delay progress in trade for the USA unfortunately.

Long-Term View:

The long-term view here is hazy. Eventually we will bottom and the comparisons to this period will be easy. 2026 has an opportunity to look very BULLISH. Again, I’ll be patient.

Closing Speculation or Questions:

The question for April and this week is, was that a dead cat bounce or a new base level? In another way, have we seen the highs in the VIX or do we have more surprises to come this spring?

Volatility Corner Framework

Indicator Update:

The Turbulence Indicator snapped back at the end of the week. As expected any up move will be massive. The indicator itself rallied up 20%+ this week which shows the strength of counter-trend bounces in this environment.

Be wary. Volatility is high yet stable at these levels. We need massive breaks (Sub $20) in VIX for weeks to see the Turbulence indicator even change character from the past 5 weeks.

Technical Context:

We are back at levels not seen since the early part of 2023. We have an opportunity for a BULLISH trend change. But the speed of this transition to BEARISH needs to be respected. As Jamie Dimon said, “We’re not in Kansas anymore: economy, inflation, interest rates, asset prices, trade wars, oh my!”

Risk Assessment:

Risks are very high. Retaliation from other countries, the response from Trump or simply market conditions changing due to some blow up in Japan. We’re in a place where the ranges are wide due to volatility and the prices are jumping.

Historical Parallels:

The only recent similar parallel to this moment in US volatility is March 2020 and Covid. Before this there was Q4, 2018 and the fed but nothing this dramatic which isn’t purely based on economic factors.

Actionable Insight:

I’m primarily in Gold and short-term bonds. I’ll keep position sizes small and watch to see if any specific sector gets the bid. Patience is most important for the next month or more. The question for today is, is this a dead cat bounce or a new normal level. Have we seen the highs in the VIX or do we have more surprises to come this spring?

The VIX hasn’t close below $18 since 2/21/25 - We are going into our 8th week in a row.

MACRO INDICATOR:

The end of the week certainly showed a different side of volatility but it’s still pinned in high-30s.

MACRO SEASON: BEARISH Since 3/7/25🛑

MICRO WEATHER: BEARISH Since 2/21/25🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

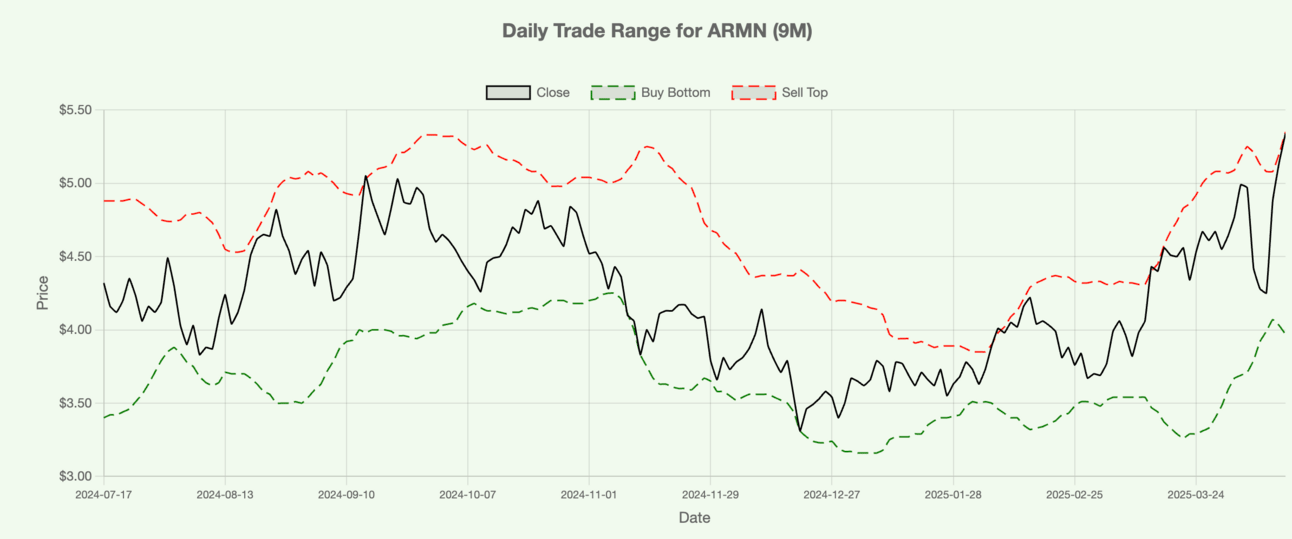

ARMN – Aris Mining Corp – Basic Materials – 🇨🇦 Canada

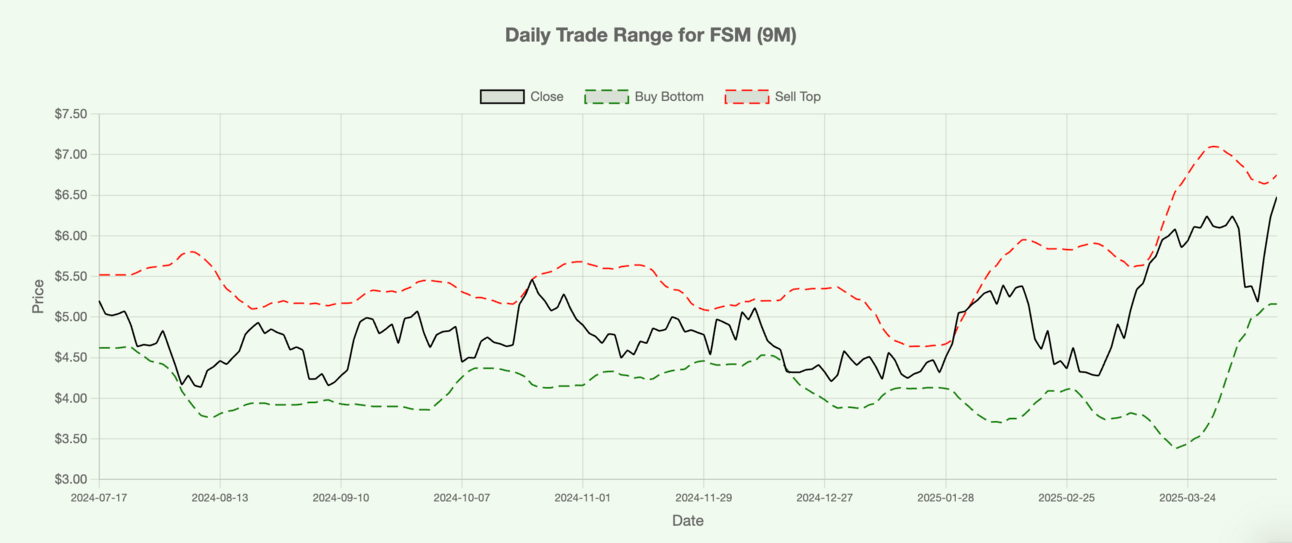

FSM – Fortuna Mining Corp – Basic Materials – 🇨🇦 Canada

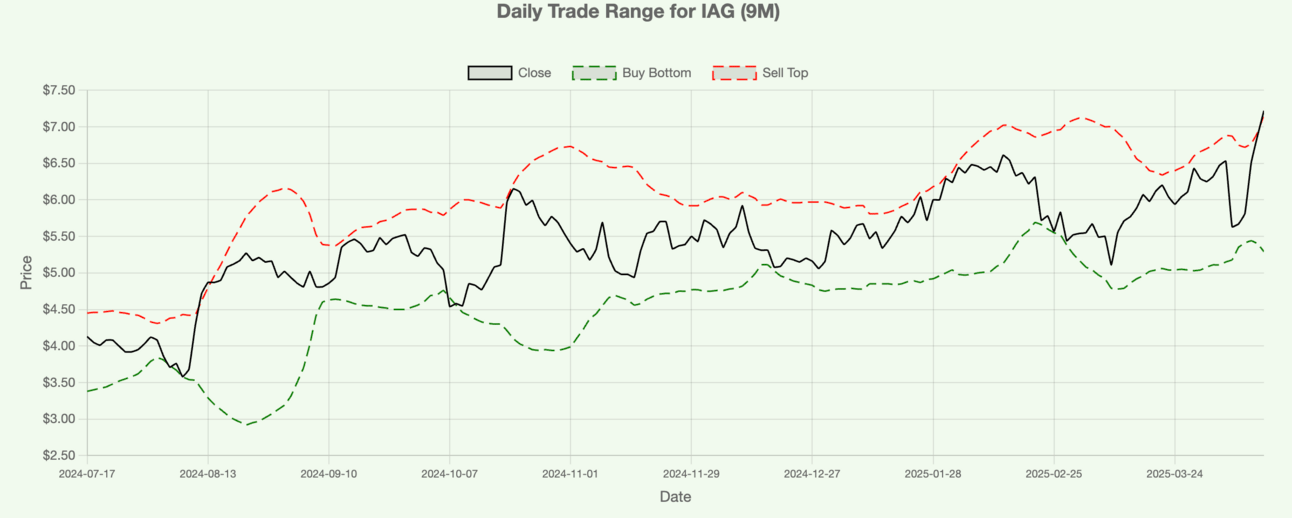

IAG – Iamgold Corp – Basic Materials – 🇨🇦 Canada

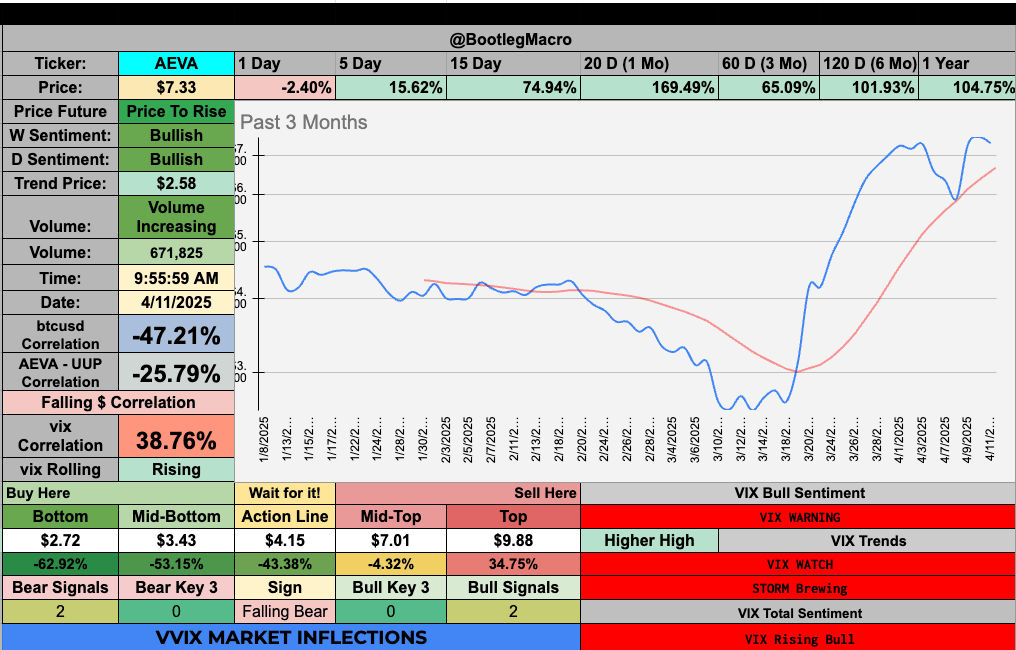

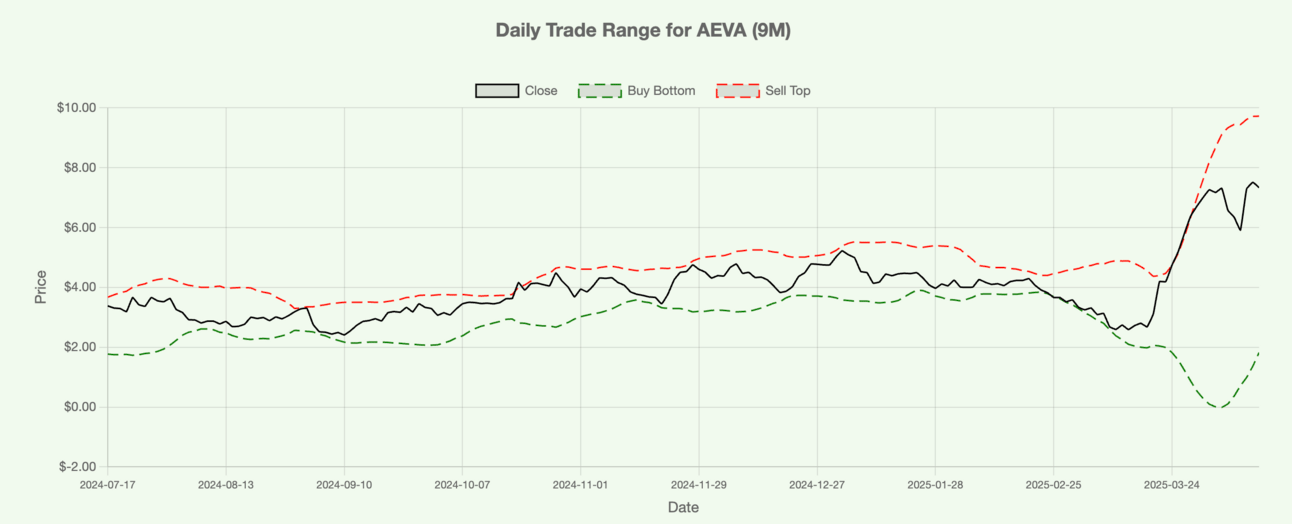

AEVA – Aeva Technologies Inc – Technology – 🇺🇸 USA

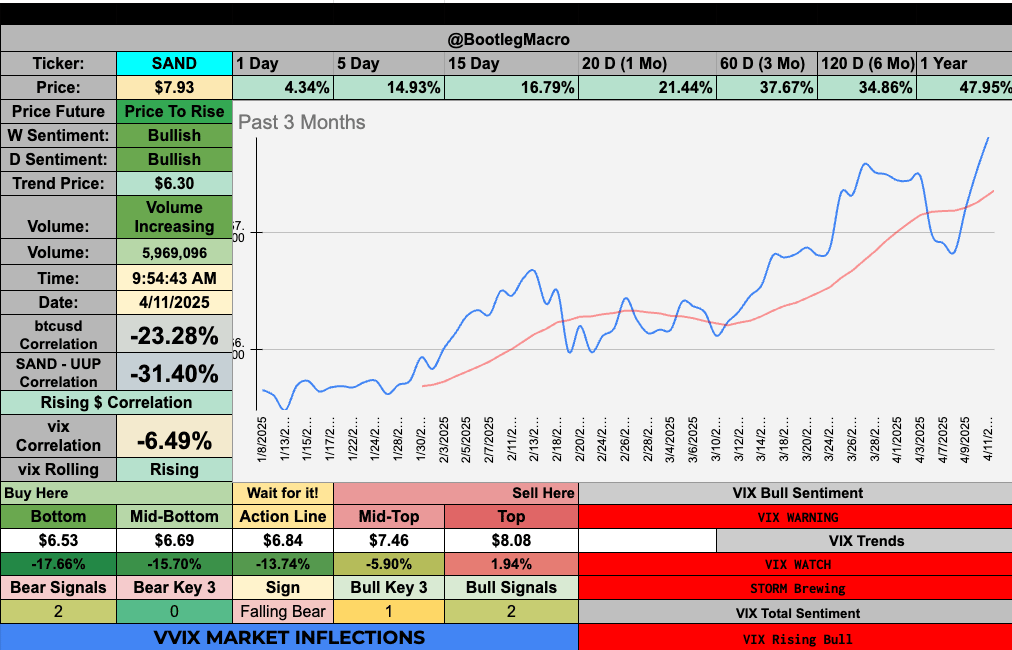

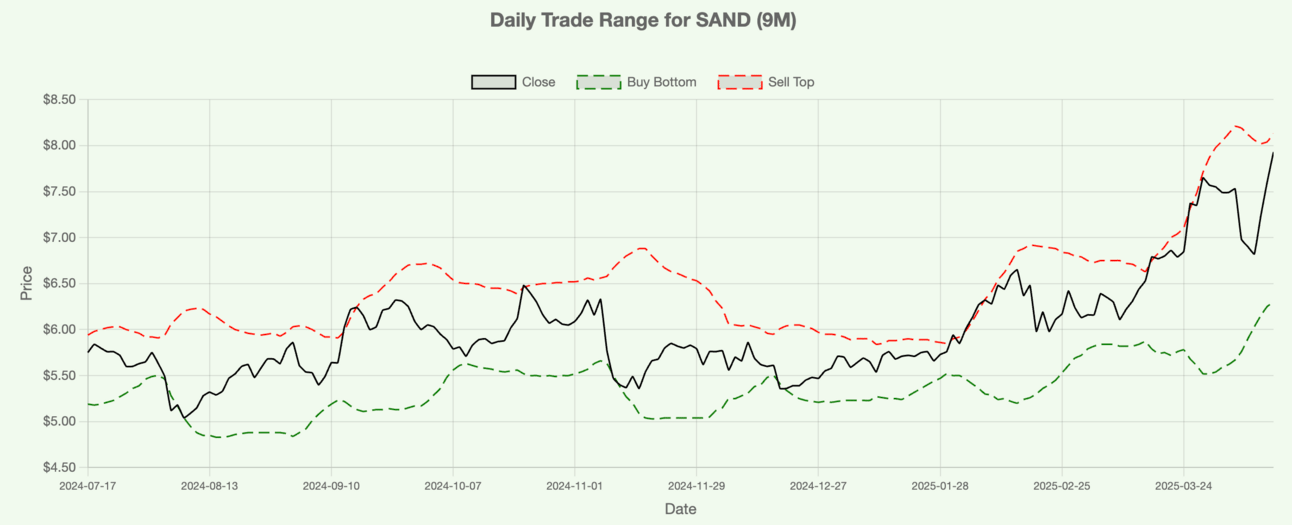

SAND – Sandstorm Gold Ltd – Basic Materials – 🇨🇦 Canada

ORLA – Orla Mining Ltd – Basic Materials – 🇨🇦 Canada

KGC – Kinross Gold Corp – Basic Materials – 🇨🇦 Canada

HMY – Harmony Gold Mining Co Ltd ADR – Basic Materials – 🇿🇦 South Africa

GRPN – Groupon Inc – Communication Services – 🇺🇸 USA

EGO – Eldorado Gold Corp – Basic Materials – 🇨🇦 Canada

OR – Osisko Gold Royalties Ltd – Basic Materials – 🇨🇦 Canada

ARMN – Aris Mining Corp – Basic Materials – 🇨🇦 Canada

FSM – Fortuna Mining Corp – Basic Materials – 🇨🇦 Canada

IAG – Iamgold Corp – Basic Materials – 🇨🇦 Canada

AEVA – Aeva Technologies Inc – Technology – 🇺🇸 USA

SAND – Sandstorm Gold Ltd – Basic Materials – 🇨🇦 Canada

ORLA – Orla Mining Ltd – Basic Materials – 🇨🇦 Canada

KGC – Kinross Gold Corp – Basic Materials – 🇨🇦 Canada

HMY – Harmony Gold Mining Co Ltd ADR – Basic Materials – 🇿🇦 South Africa

GRPN – Groupon Inc – Communication Services – 🇺🇸 USA

EGO – Eldorado Gold Corp – Basic Materials – 🇨🇦 Canada

OR – Osisko Gold Royalties Ltd – Basic Materials – 🇨🇦 Canada

Enjoying this?

& Invite a friend.

New Highs $20+:

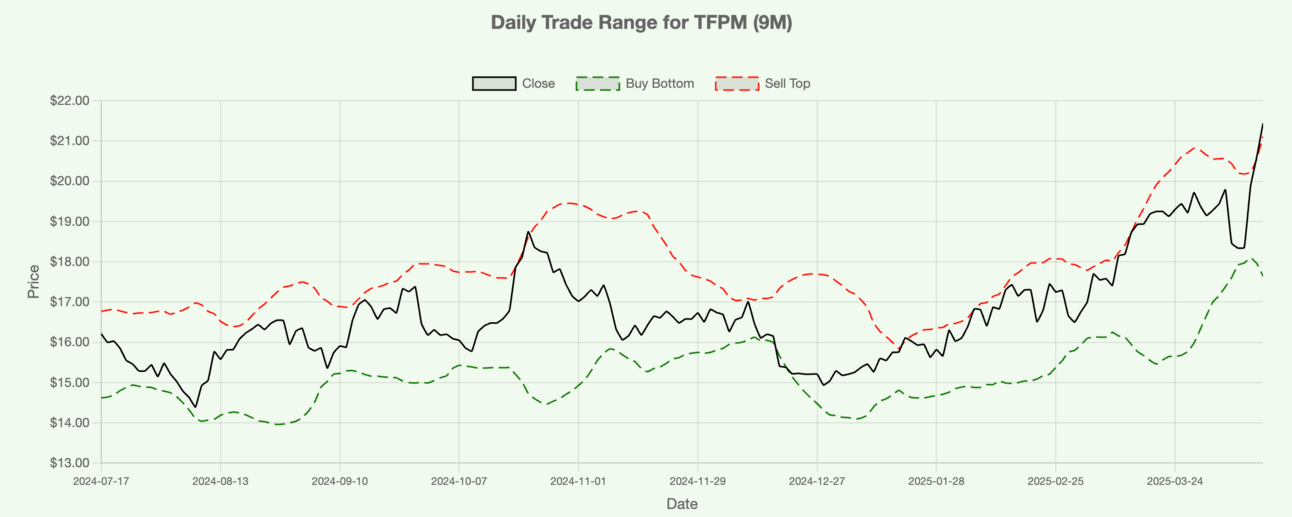

TFPM – Triple Flag Precious Metals Corp – Basic Materials – 🇨🇦 Canada

GFI – Gold Fields Ltd ADR – Basic Materials – 🇿🇦 South Africa

PHYS – Sprott Physical Gold Trust – Financial – 🇨🇦 Canada

CEF – Sprott Physical Gold and Silver Trust – Financial – 🇨🇦 Canada

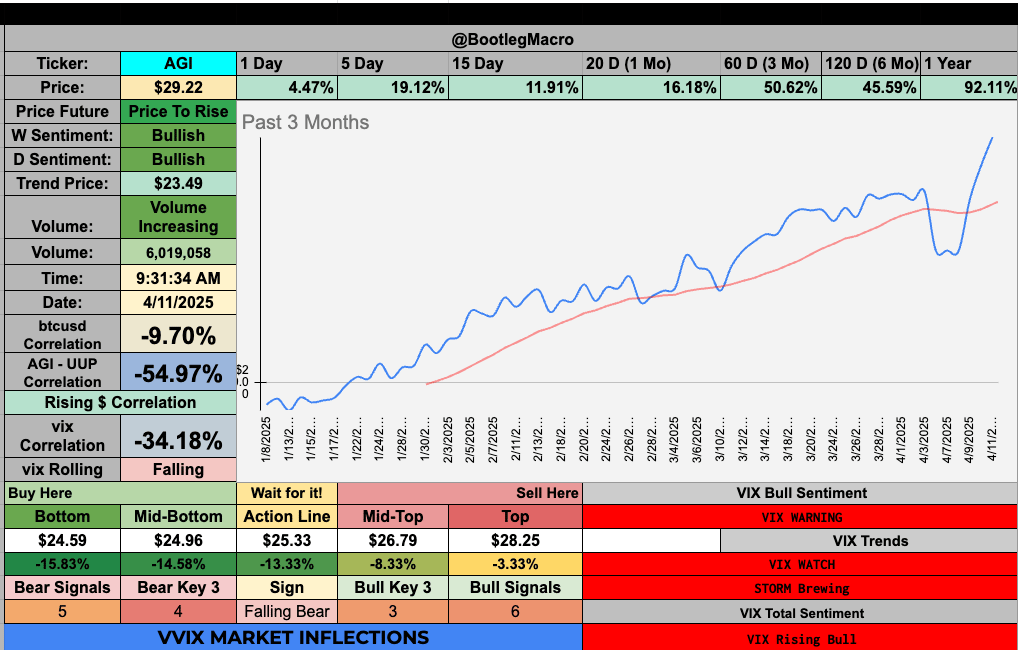

AGI – Alamos Gold Inc – Basic Materials – 🇨🇦 Canada

AU – AngloGold Ashanti Plc – Basic Materials – 🇬🇧 United Kingdom

SNRE – Sunrise Communications AG ADR – Communication Services – 🇨🇭 Switzerland

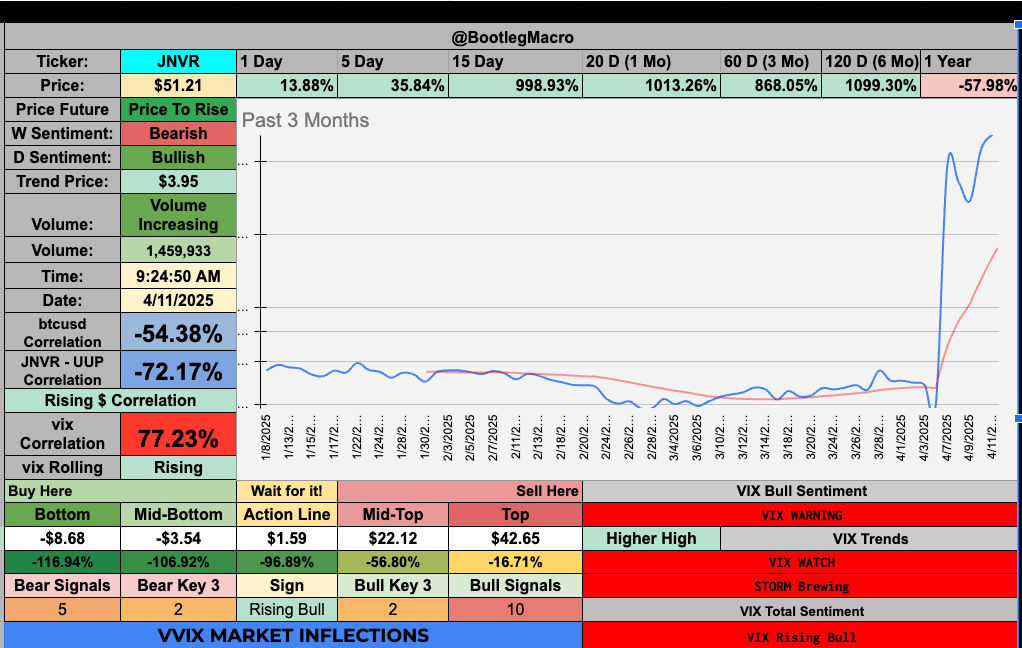

JNVR – Janover Inc – Technology – 🇺🇸 USA

PPC – Pilgrim's Pride Corp – Consumer Defensive – 🇺🇸 USA

WPM – Wheaton Precious Metals Corp – Basic Materials – 🇨🇦 Canada

TJX – TJX Companies, Inc. – Consumer Cyclical – 🇺🇸 USA

CASY – Casey's General Stores, Inc. – Consumer Cyclical – 🇺🇸 USA

TFPM – Triple Flag Precious Metals Corp – Basic Materials – 🇨🇦 Canada

GFI – Gold Fields Ltd ADR – Basic Materials – 🇿🇦 South Africa

PHYS – Sprott Physical Gold Trust – Financial – 🇨🇦 Canada

CEF – Sprott Physical Gold and Silver Trust – Financial – 🇨🇦 Canada

AGI – Alamos Gold Inc – Basic Materials – 🇨🇦 Canada

AU – AngloGold Ashanti Plc – Basic Materials – 🇬🇧 United Kingdom

JNVR – Janover Inc – Technology – 🇺🇸 USA

PPC – Pilgrim's Pride Corp – Consumer Defensive – 🇺🇸 USA

WPM – Wheaton Precious Metals Corp – Basic Materials – 🇨🇦 Canada

TJX – TJX Companies, Inc. – Consumer Cyclical – 🇺🇸 USA

CASY – Casey's General Stores, Inc. – Consumer Cyclical – 🇺🇸 USA

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro

🚀 Unveiling the Swift Trader Spotlight: The Pioneer Newsletter 📈

🚀 Unveiling the Swift Trader Spotlight: The Pioneer Newsletter 📈

Hey Bootleg Macro enthusiasts! We're ecstatic to introduce the Swift Trader Spotlight: The Pioneer Newsletter. Delve into daily briefings that take you far beyond mere trend tracking. Experience rich insights, paired with compelling visuals directly from the Swift Trader Chrome Extension. Additionally, stay updated with our 5-minute video briefings four times a week and nightly dispatches detailing trend flips for SPY & QQQ.

Special Offer: To celebrate, all "New High Newsletter" subscribers get their first week of The Pioneer Newsletter for FREE!

🔗 Discover More & Subscribe Here: [Your Link Here]

Elevate your trading acumen with curated insights and in-depth market coverage. Navigate the stock market's ever-changing trends like never before. #PioneerInsights #TradeSmarterWithSwift #SwiftTraderSpotLight

Enjoying this?

& Invite a friend.

Disclaimer:

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

Enjoying this? Probably not, it’s the disclaimer.

& Invite a friend.

🚀 Unveiling the Swift Trader Spotlight: The Pioneer Newsletter 📈

Hey Bootleg Macro enthusiasts! We're ecstatic to introduce the Swift Trader Spotlight: The Pioneer Newsletter. Delve into daily briefings that take you far beyond mere trend tracking. Experience rich insights, paired with compelling visuals directly from the Swift Trader Chrome Extension. Additionally, stay updated with our 5-minute video briefings four times a week and nightly dispatches detailing trend flips for SPY & QQQ.

Special Offer: To celebrate, all "New High Newsletter" subscribers get their first week of The Pioneer Newsletter for FREE!

🔗 Discover More & Subscribe Here: [Your Link Here]

Elevate your trading acumen with curated insights and in-depth market coverage. Navigate the stock market's ever-changing trends like never before. #PioneerInsights #TradeSmarterWithSwift #SwiftTraderSpotLight