- The New High Newsletter

- Posts

- 20 Stocks Breaking Out - It's Time For Your HomeRun Trade

20 Stocks Breaking Out - It's Time For Your HomeRun Trade

My normal process requires massive diversification, which is a hedge against massive downside and massive upside. This is a time to swing for the fences. Not to try and hit a single or double, within reason. The wind is at your back and the pitches are more often ripe for a grip and rip home run. Swing away.

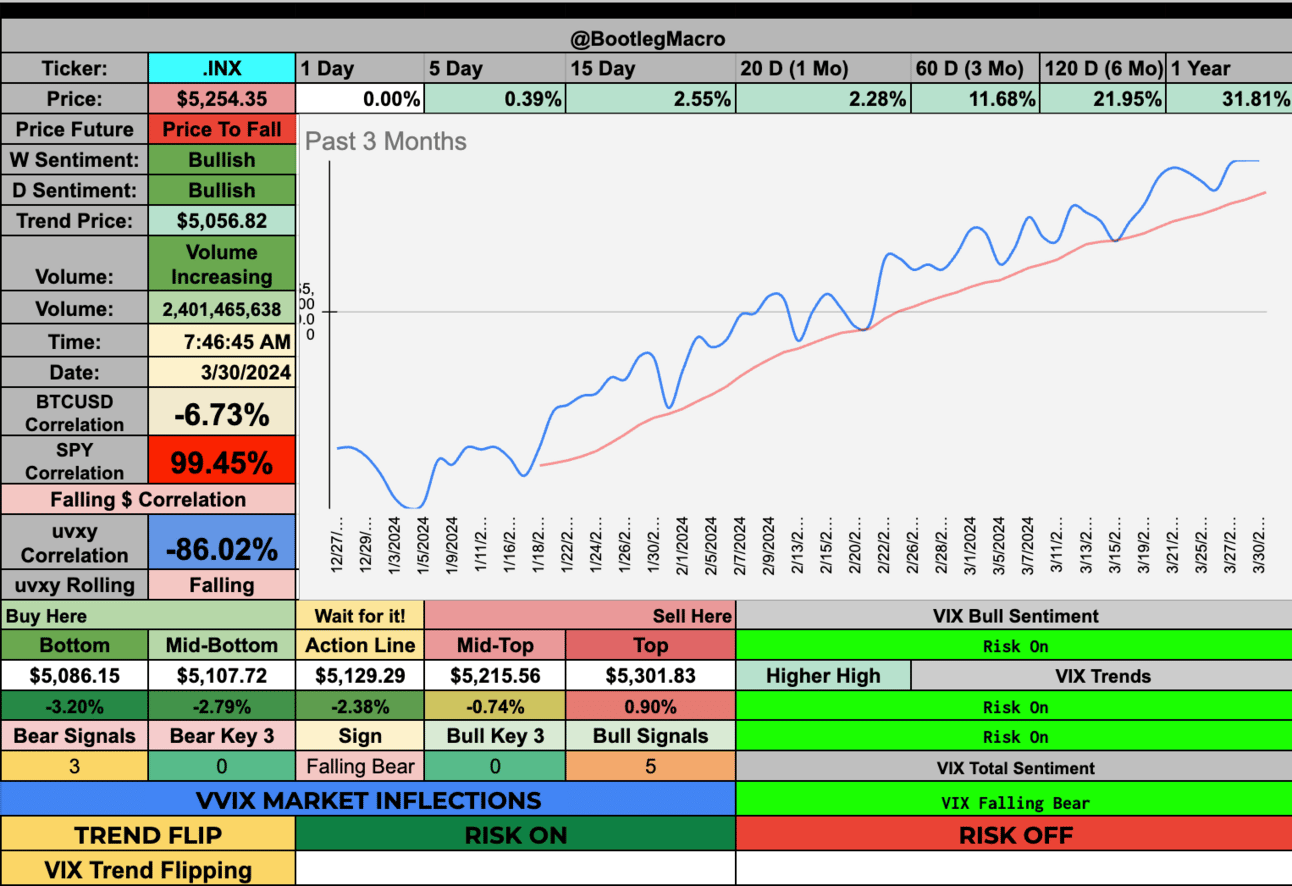

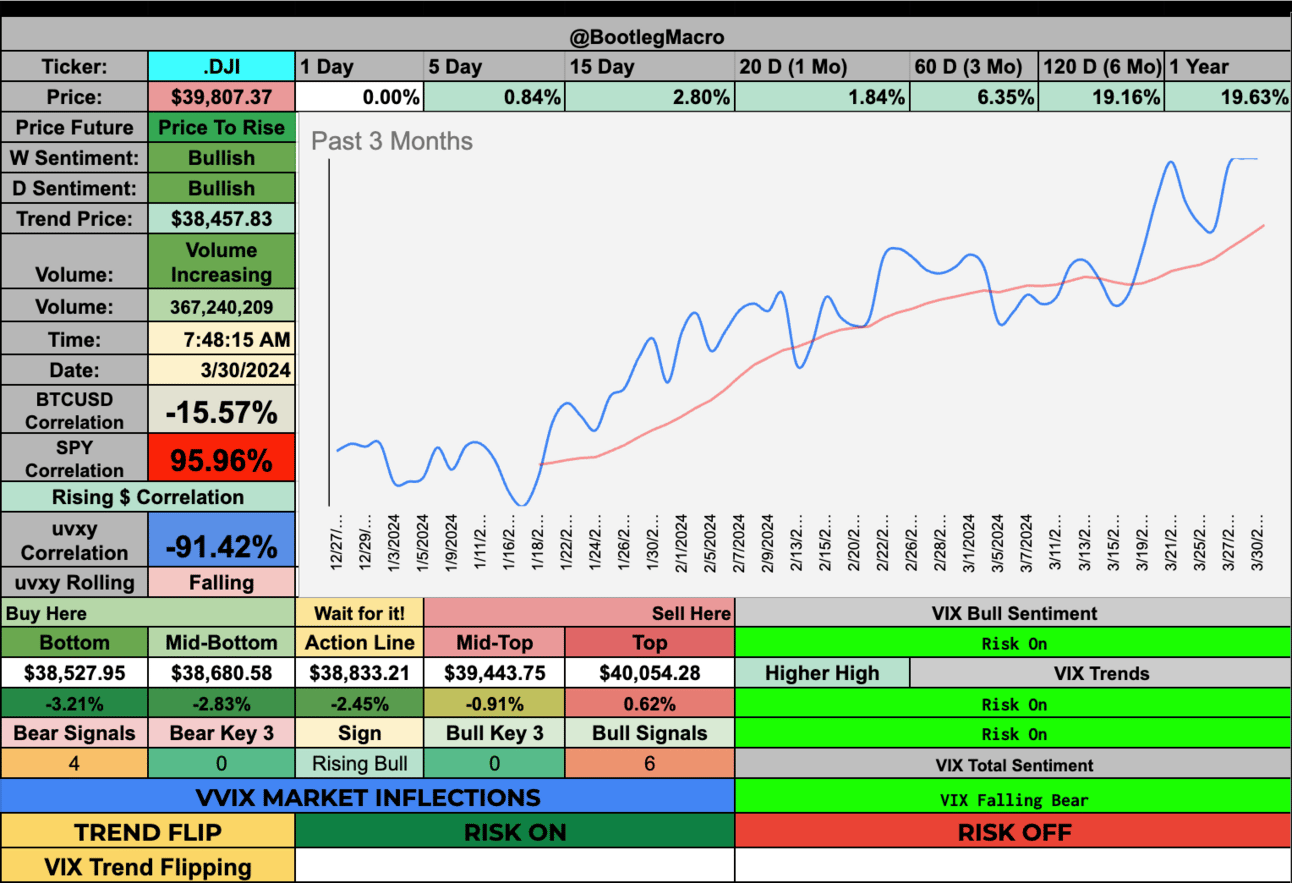

The quarter ends on a high. Q1, 2024 has confirmed a bull market in the USA. S&P500 and Nasdaq are both up over 11% in Q1, 2024 alone! Do you think that’s a sign?

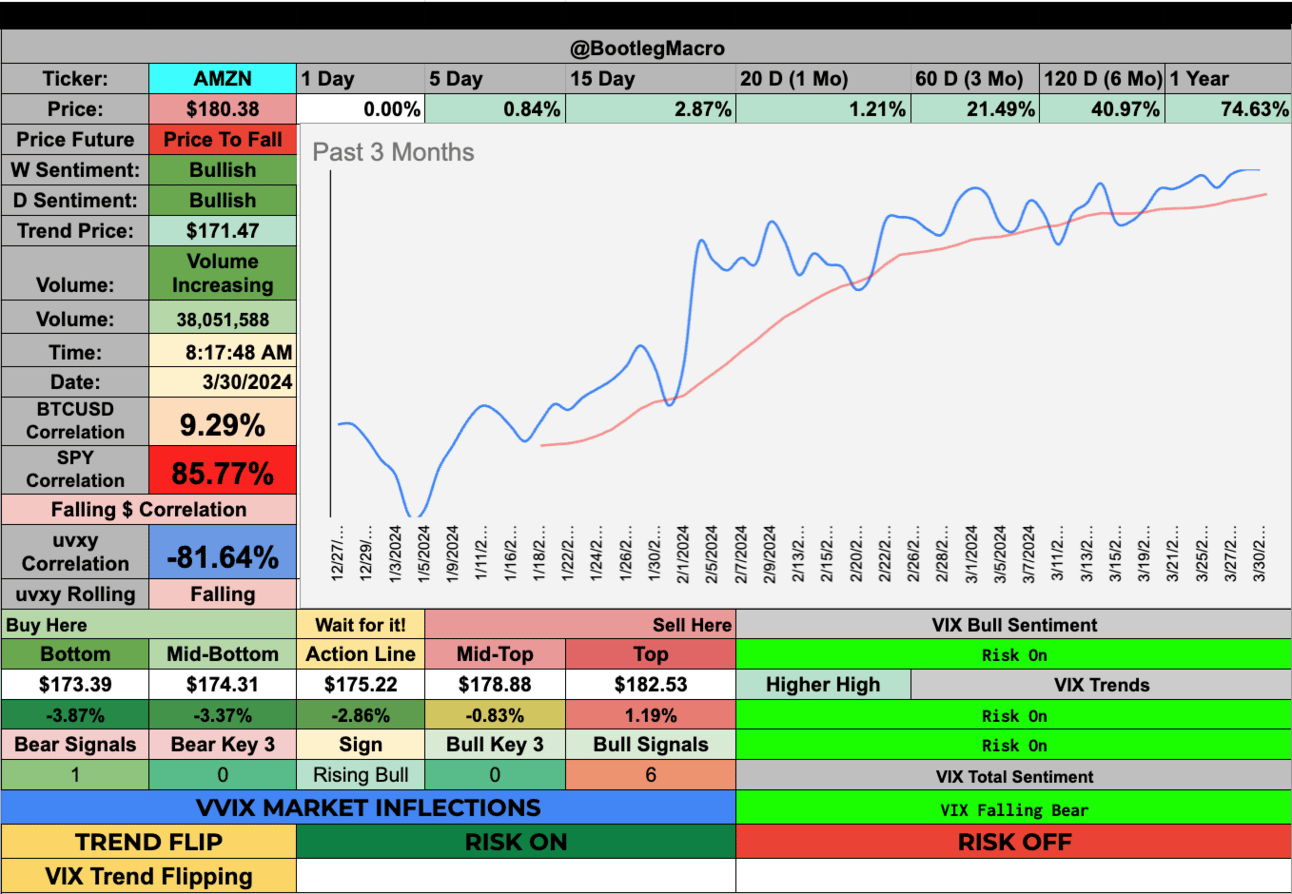

Maybe Amazon being up 21.5% for Q1 is a sign...just maybe.

The broadening bull market is coming. More stocks hitting highs, more rallies breaking out; it’s time to enjoy the ride.

This market requires patience to the point where doing nothing hurts. This is when you’re trading well or managing positions like a real serious trader.

Patience is one of the most important qualities for success.

Be quick to take losses, reluctant to take profits.

These lessons are as golden in 2024 as when they were written by Philip Carret in 1927 in the Art of Speculation.

As we enter into this new bull market era, don’t get swept into folly. Charlatans come alive in bull markets and the gains seem the same until the end. Good times do not last forever, even if they are promised with a 100% money back guaruntee.

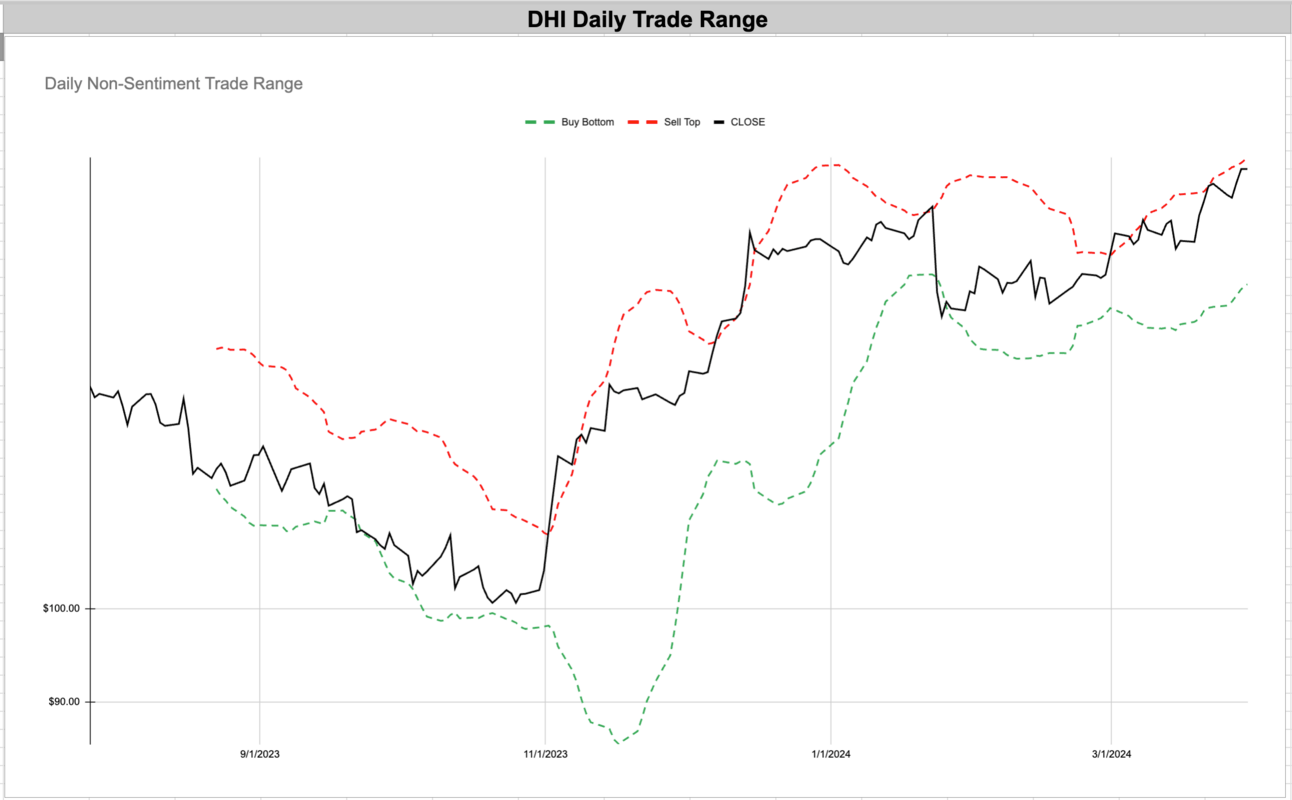

And for those looking for a bear market, I ask you, “You want to bet against a market where Target, Boston Scientific, D.R. Horton and Caterpillar are doing well?” Oh boy that sounds dumb.

On the horizon, I do see emerging markets (Argentina), oil companies and shipping companies joining my portfolio.

In Q2, we will officially enter into the broadening season. It’s time to buy small caps. Maybe not the index or sector specific ETFs but we need some small cap companies in the portfolio. See you next quarter.

Market Performance

If you’re not long, what are you doing in the market? All indexes are up YTD. I’m happy to be fully invested. Now is the time to get aggressive.

This is a reminder for myself. Go into the size required for a substantially return on a few very select bets. My past is filled with diversified bold calls, good buys and modest gains. These are true wins and yet one of the most idolized market wizards, Druckenmiller advises directly against such high diversification.

My normal process requires massive diversification, which is a hedge against massive downside and massive upside. This is a time to swing for the fences. Not to try and hit a single or double, within reason. The wind is at your back and the pitches are more often ripe for a grip and rip home run. Swing away.

This is a reminder for myself, not for anyone else. Because this will be a reminder in 1 year when I look back to ask, “Did you bet bigger when you had your edge?”

Wait for a volatility breakout and buy the dips in your favorites. This is a stalking era for stocks. Follow along and see opportunities.

Volatility Corner:

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets.

Above I write about the “wind at your back” and to “swing away”, here is why:

Market volatility measured by the VIX is falling to the lowest levels in months. The VIX closed at 13.01 for the quarter. The 3rd lowest weekly reading of the entire year.

The trend in volatility has been lower for weeks now. Adding fuel to the fire of lower for longer in volatility.

Nice to see the red line going higher.

This week in the vix was like 2017 all over again. The price is so low, vol is compressed.

MACRO INDICATOR:

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 3/5/24🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

FIP - FTAI Infrastructure Inc - Industrials - USA 🇺🇸

ADMA - Adma Biologics Inc - Healthcare - USA 🇺🇸

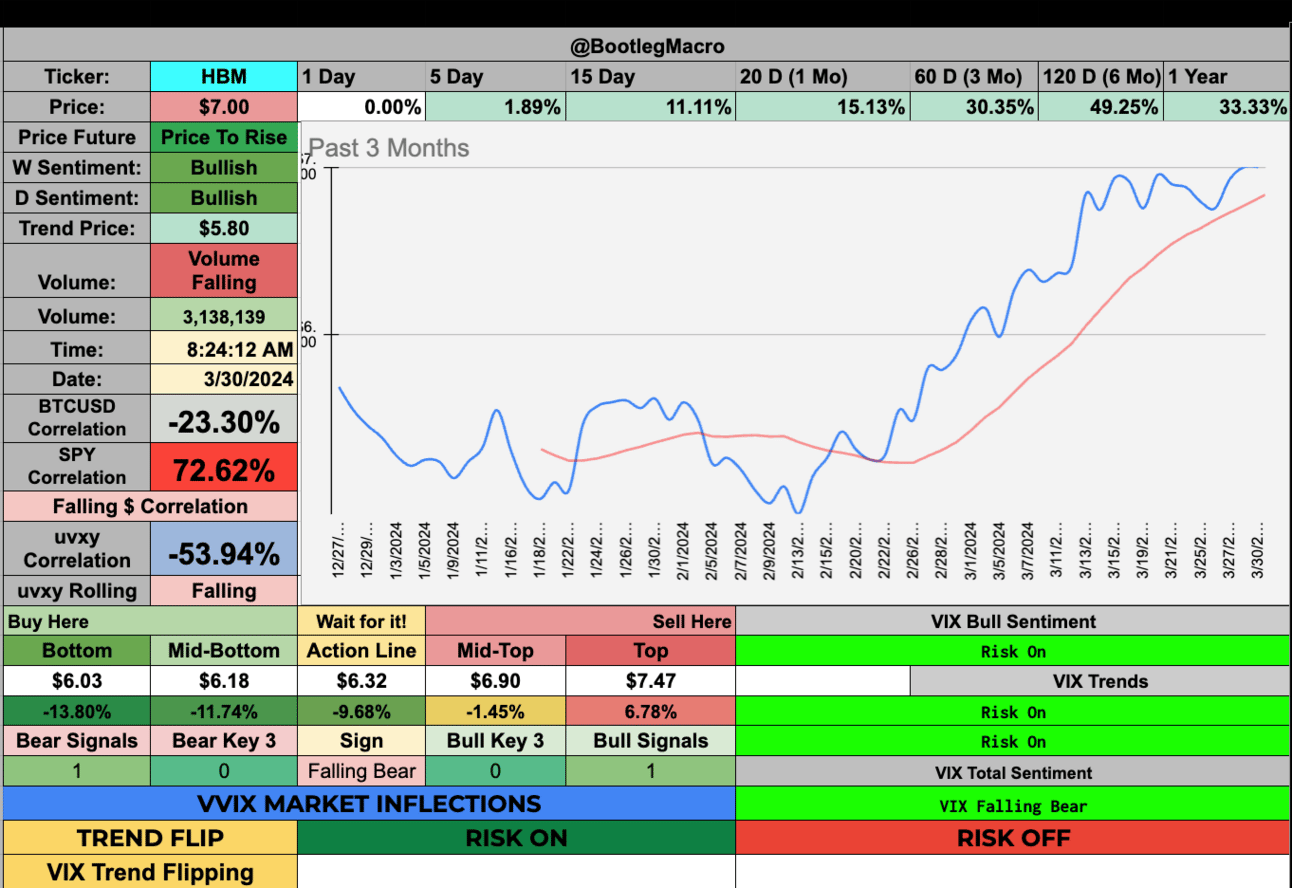

HBM - Hudbay Minerals Inc. - Basic Materials - Canada 🇨🇦

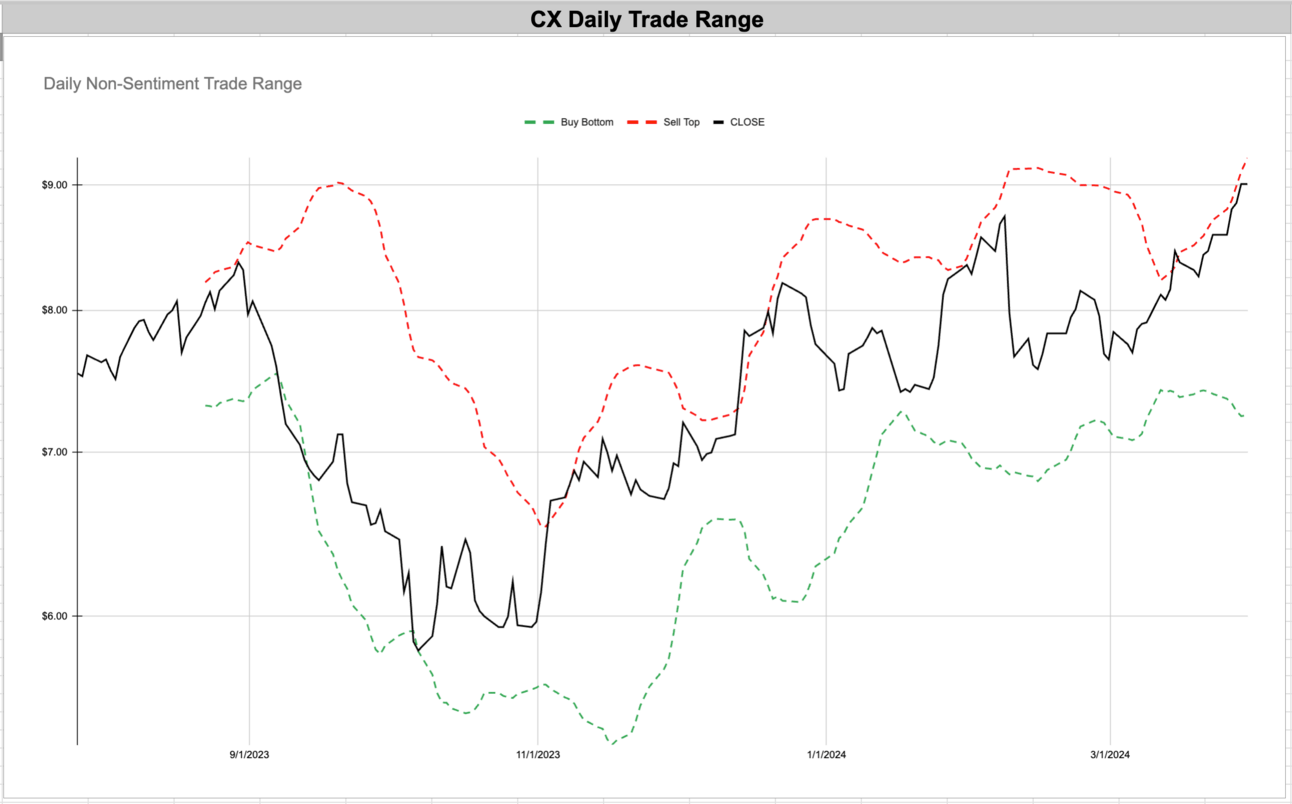

CX - Cemex S.A.B. De C.V. ADR - Basic Materials - Mexico 🇲🇽

PLYA - Playa Hotels & Resorts N.V. - Consumer Cyclical - Netherlands 🇳🇱

HLMN - Hillman Solutions Corp - Industrials - USA 🇺🇸

AM - Antero Midstream Corp - Energy - USA 🇺🇸

ARHS - Arhaus Inc - Consumer Cyclical - USA 🇺🇸

OWL - Blue Owl Capital Inc - Financial - USA 🇺🇸

LEVI - Levi Strauss & Co. - Consumer Cyclical - USA 🇺🇸

FIP - FTAI Infrastructure Inc - Industrials - USA 🇺🇸

ADMA - Adma Biologics Inc - Healthcare - USA 🇺🇸

HBM - Hudbay Minerals Inc. - Basic Materials - Canada 🇨🇦

CX - Cemex S.A.B. De C.V. ADR - Basic Materials - Mexico 🇲🇽

PLYA - Playa Hotels & Resorts N.V. - Consumer Cyclical - Netherlands 🇳🇱

HLMN - Hillman Solutions Corp - Industrials - USA 🇺🇸

AM - Antero Midstream Corp - Energy - USA 🇺🇸

ARHS - Arhaus Inc - Consumer Cyclical - USA 🇺🇸

OWL - Blue Owl Capital Inc - Financial - USA 🇺🇸

LEVI - Levi Strauss & Co. - Consumer Cyclical - USA 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

AMZN - Amazon.com Inc. - Consumer Cyclical - USA 🇺🇸

JPM - JPMorgan Chase & Co. - Financial - USA 🇺🇸

DIS - Walt Disney Co - Communication Services - USA 🇺🇸

CAT - Caterpillar Inc. - Industrials - USA 🇺🇸

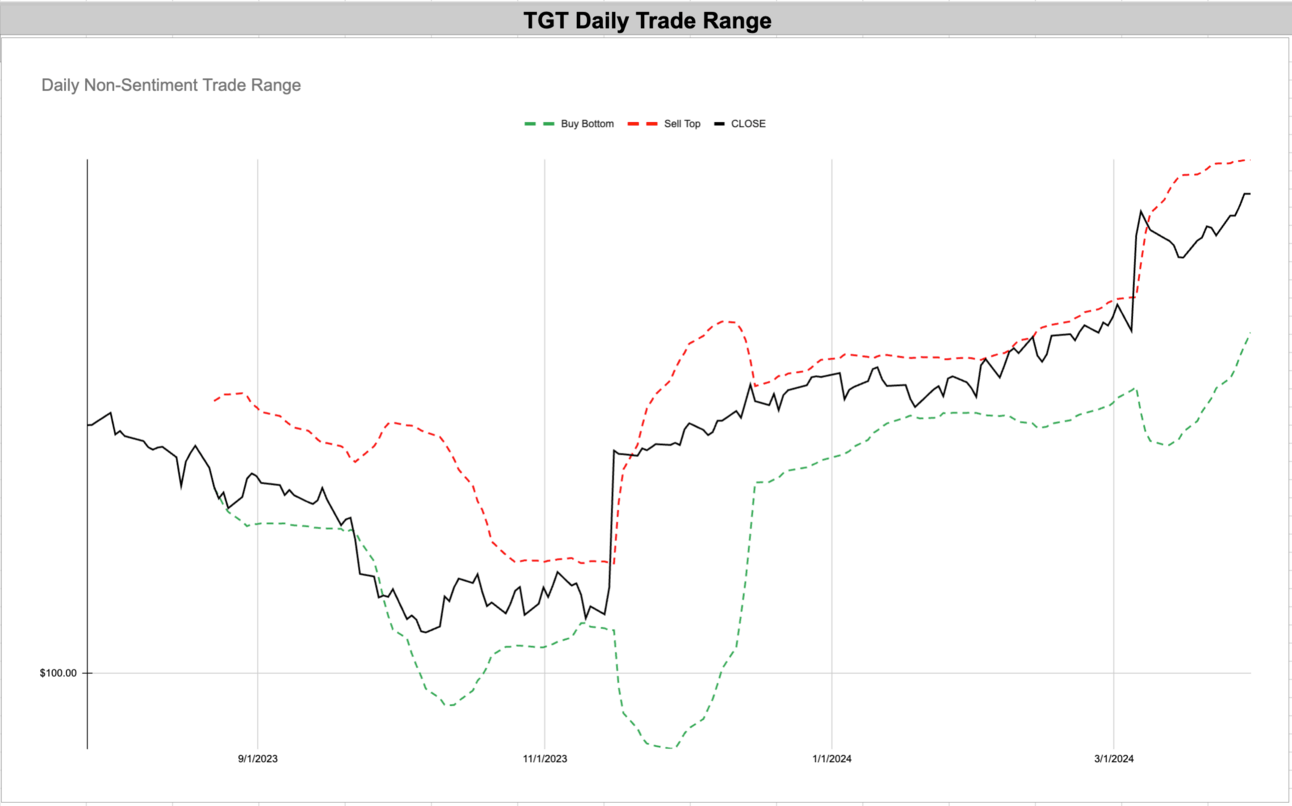

TGT - Target Corp - Consumer Defensive - USA 🇺🇸

BSX - Boston Scientific Corp. - Healthcare - USA 🇺🇸

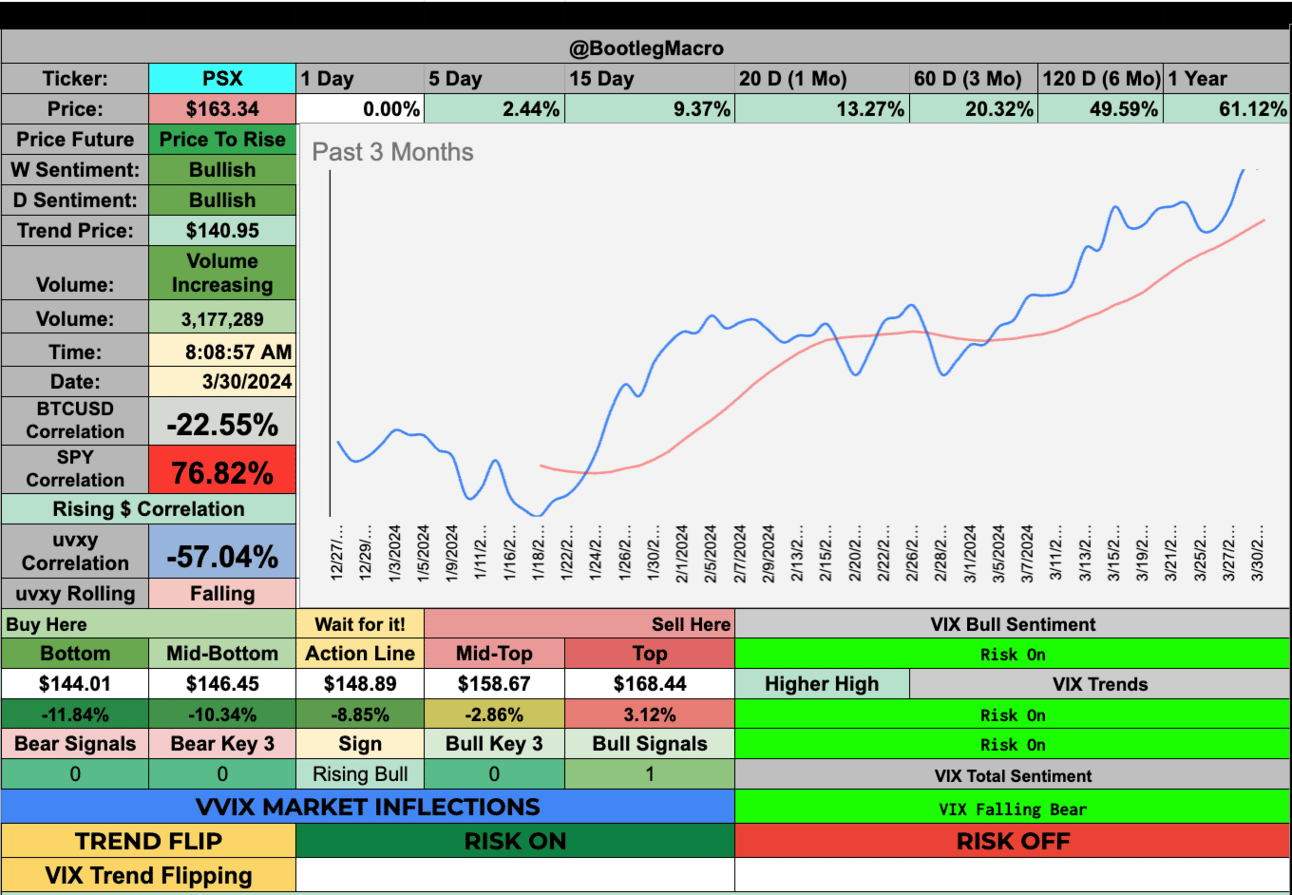

PSX - Phillips 66 - Energy - USA 🇺🇸

MSI - Motorola Solutions Inc - Technology - USA 🇺🇸

DHI - D.R. Horton Inc. - Consumer Cyclical - USA 🇺🇸

WES - Western Midstream Partners LP - Energy - USA 🇺🇸

AMZN - Amazon.com Inc. - Consumer Cyclical - USA 🇺🇸

JPM - JPMorgan Chase & Co. - Financial - USA 🇺🇸

DIS - Walt Disney Co - Communication Services - USA 🇺🇸

CAT - Caterpillar Inc. - Industrials - USA 🇺🇸

TGT - Target Corp - Consumer Defensive - USA 🇺🇸

BSX - Boston Scientific Corp. - Healthcare - USA 🇺🇸

This is a massive run for a medical device company with very low volatility. Up over 18% in Q1, 2024 alone!

PSX - Phillips 66 - Energy - USA 🇺🇸

There is a lot of volatility here but there is a consistent trend. Up and to the right.

MSI - Motorola Solutions Inc - Technology - USA 🇺🇸

Who would expect Motorola to be hitting 52 week highs in 2024? A prime example of the broadening of the bull market in the USA.

DHI - D.R. Horton Inc. - Consumer Cyclical - USA 🇺🇸

Housing stocks are hitting massive breakout levels. Across the entire sector.

WES - Western Midstream Partners LP - Energy - USA 🇺🇸

Recent consolidation helps with the price breaking out above the top of the range.

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

Back in January, I wrote about how the Q1 chop would resolve itself and we would see the other side...I even referred to the 2015-2016 period which led us to a bull market unimaginable in 2015, here is the image and the little blurb from January 2024. $spy $qqq $iwm

— BootlegMacro (@bootlegmacro)

1:30 PM • Mar 30, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro