- The New High Newsletter

- Posts

- Pullbacks Are Normal and The Pullout Method Doesn't Work

Pullbacks Are Normal and The Pullout Method Doesn't Work

Every week things change. It’s why I review the market each weekend. If you don’t pay attention to the little changes, the big stuff will surprise you.

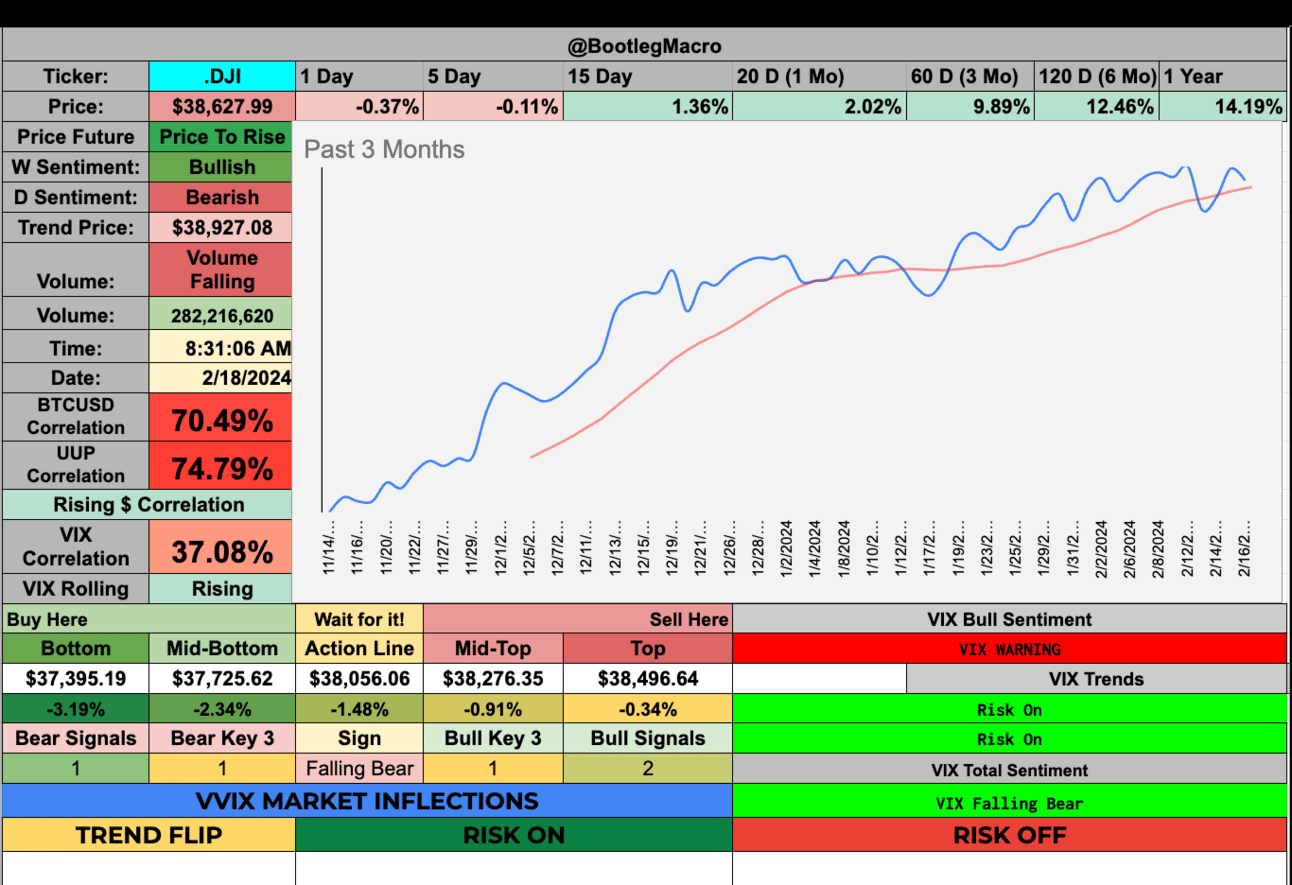

This week all indexes were down for the week. S&P500 (.INX) down -0.42%, Dow Jones (.DJI) down -0.11% and Nasdaq (.IXIC) down -1.34%.

It’s all fractals. When small things change, they can be the beginning of big things changing. But today all we can say is OIL looks much better. Volatility looks agitated too. Yet maybe it’s still blue skies for stocks?

This is the expectation of today. Higher for longer. Rates chop, inflation chops, we see a true market of stocks. The type described before the world became infatuated with quantitative easing and forward guidance.

You’ll see over 20 new highs in the list below from all sectors. The breadth is widening, as I’ve suggested will happen. Small caps have our attention for the rest of the quarter.

Bond yields look like they will go higher. The dollar looks strong and so do emerging markets! I’m watching it all.

The question you’ll need to ask, what as your attention for the last 2 weeks of our leap year February?

Market Performance

There isn’t much to mention in a week of small movement in major indexes. Any down moves are bought by me. These are opportunities to get into a broadening bull market at lower prices than all-time highs. Those are true deals.

The strongest market is still the Nasdaq but any broadening of breadth will reward less market cap weighted instruments more equal weighted.

Anything under 5000 is a deal to me. If we got 4800, I’d consider it s blessed opportunity.

This index isn’t even really bearish on the daily, we will lose that signal by next week’s open. So I trust this bull market momentum even if it does have sideways action for 1-2 months.

Nasdaq continues to be the strongest of all indexes. I like anything under 16k for the rest of the year. I’ll buy the Nasdaq on red everyday until conditions change.

Volatility Corner:

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. I have to admit, this isn’t pretty and is a cause for concern. But…I don’t see price action reflecting this bearish picture in the volatility index.

Longer-term, I do expect a proper resolution of this indicator to the upside. In the short-term, for the rest of Q1, 2024, I expect to see choppy markets with massive upside.

The VIX on the short-term does look to have upside to the mid-$15s which is a great opportunity to buy stocks for me. On the longer-term the VIX has an upside to $22 which we should hit for at least 1 day by the end of March 2024.

Spring volatility surprises during a presidential election shouldn’t really be a surprise. But markets get focused on the wrong areas all the time. Why can’t it happen again?

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

SMMT - Summit Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

ADCT - ADC Therapeutics SA - Healthcare - Biotechnology - 🇨🇭

UGP - Ultrapar Participacoes S.A. ADR - Energy - Oil & Gas Refining & Marketing - 🇧🇷

WIT - Wipro Ltd. ADR - Technology - Information Technology Services - 🇮🇳

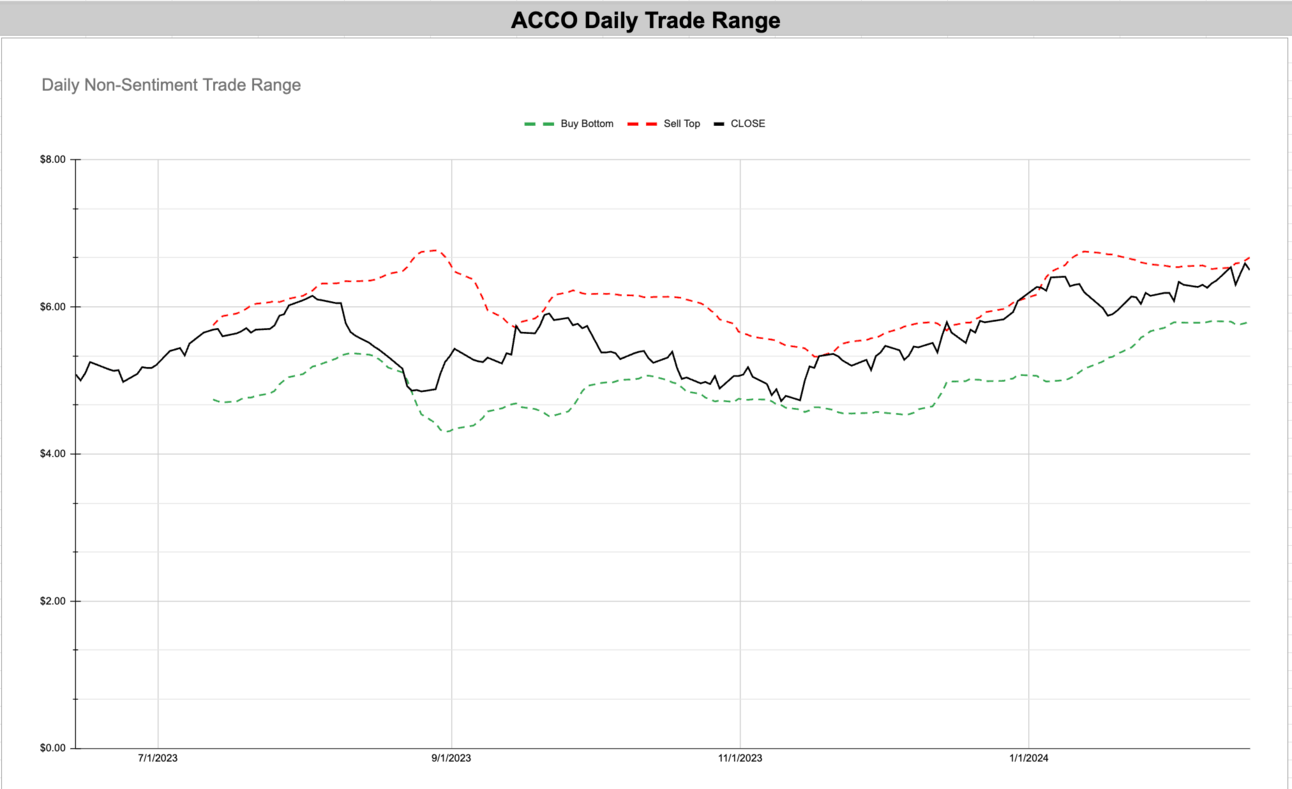

ACCO - Acco Brands Corporation - Industrials - Business Equipment & Supplies - 🇺🇸

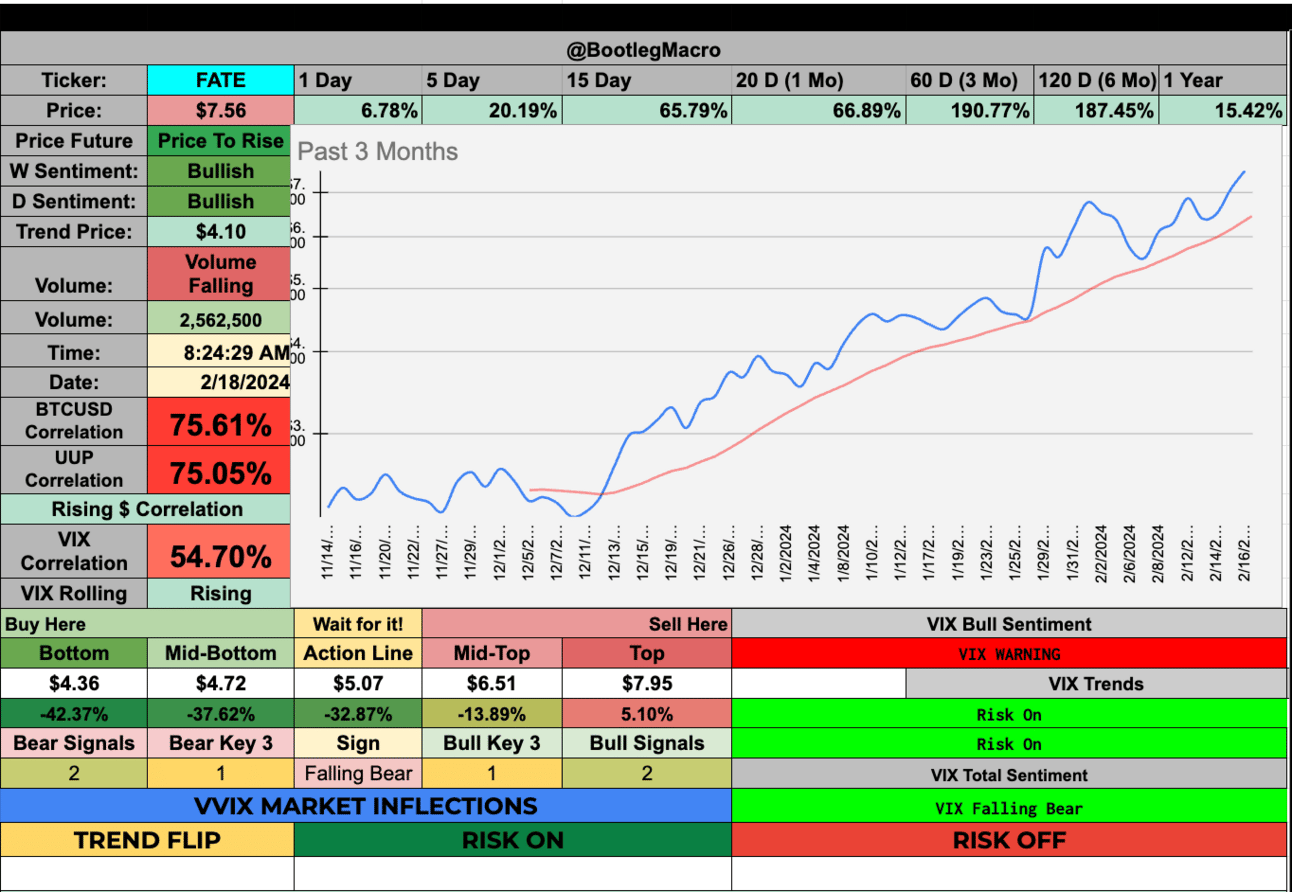

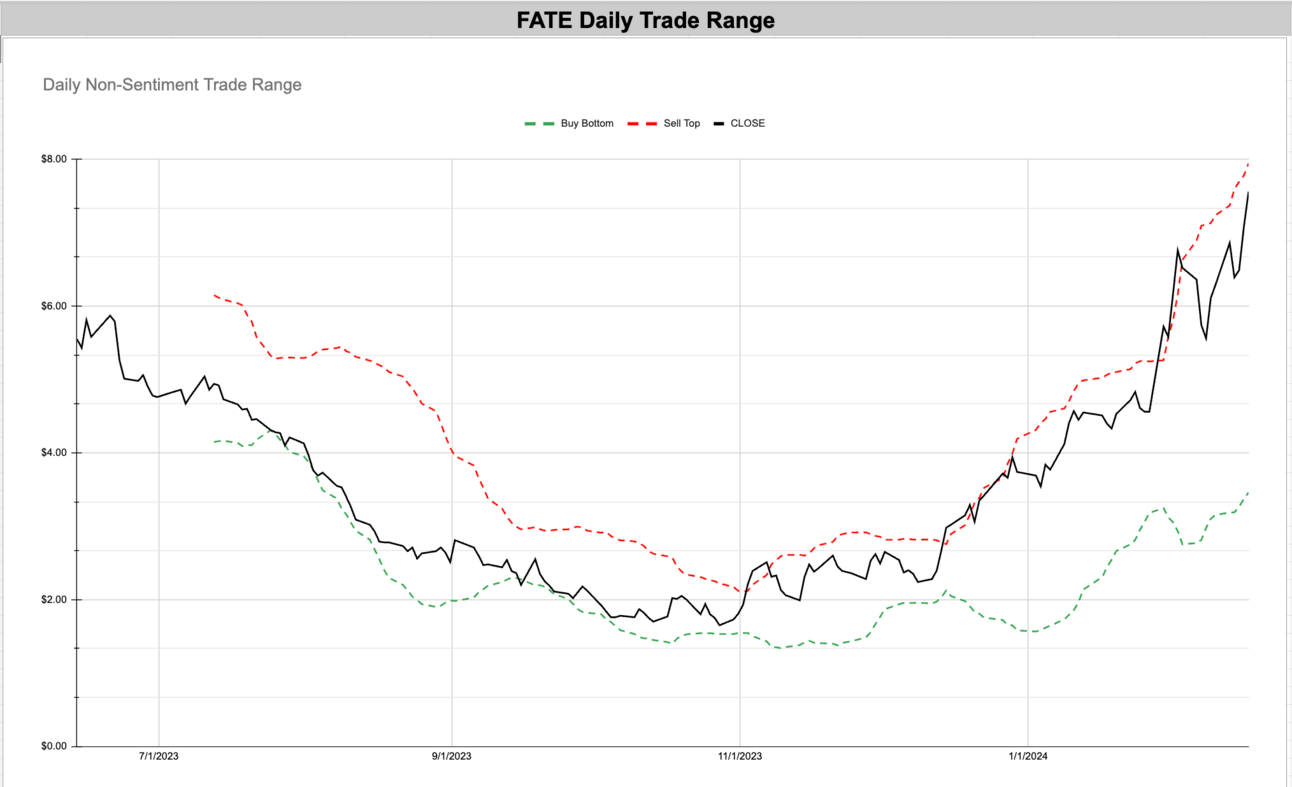

FATE - Fate Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

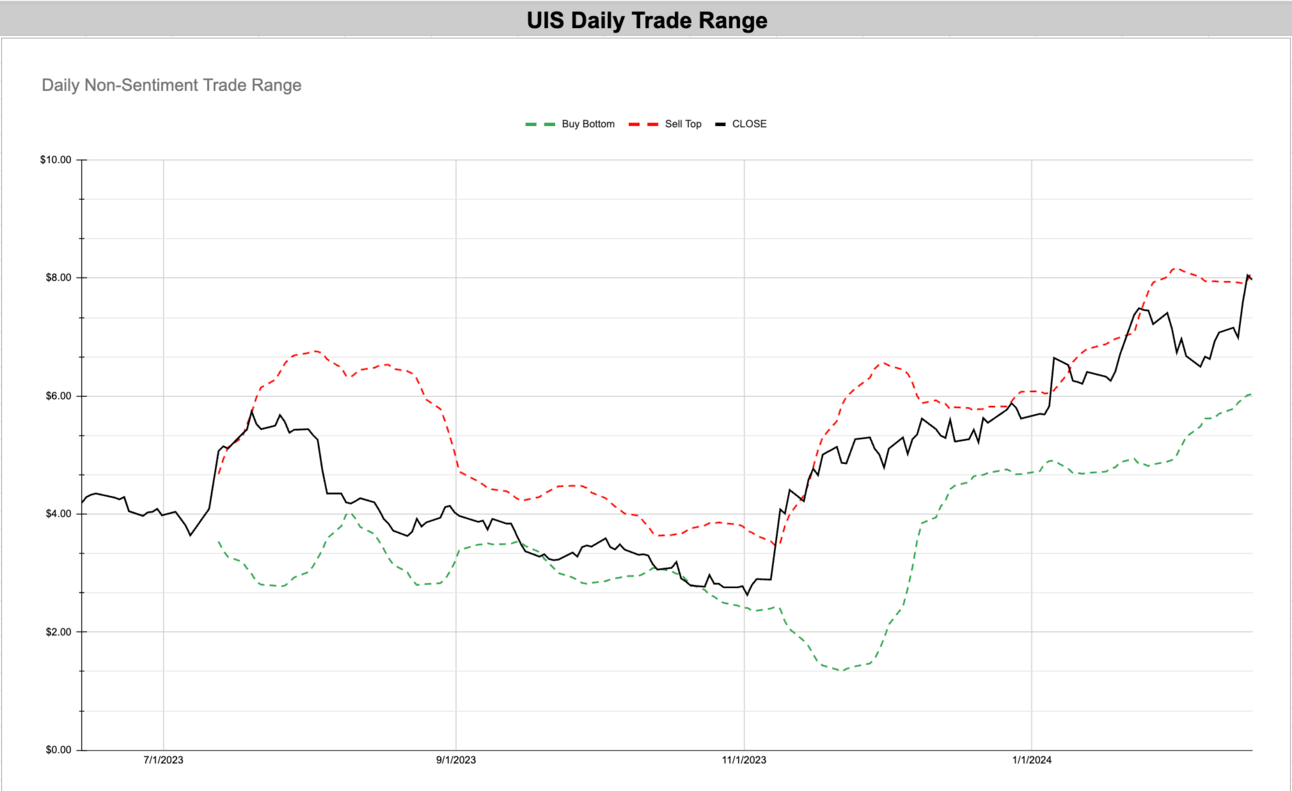

UIS - Unisys Corp. - Technology - Information Technology Services - 🇺🇸

SERA - Sera Prognostics Inc - Healthcare - Diagnostics & Research - 🇺🇸

SFL - SFL Corporation Ltd - Industrials - Marine Shipping - 🇧🇲

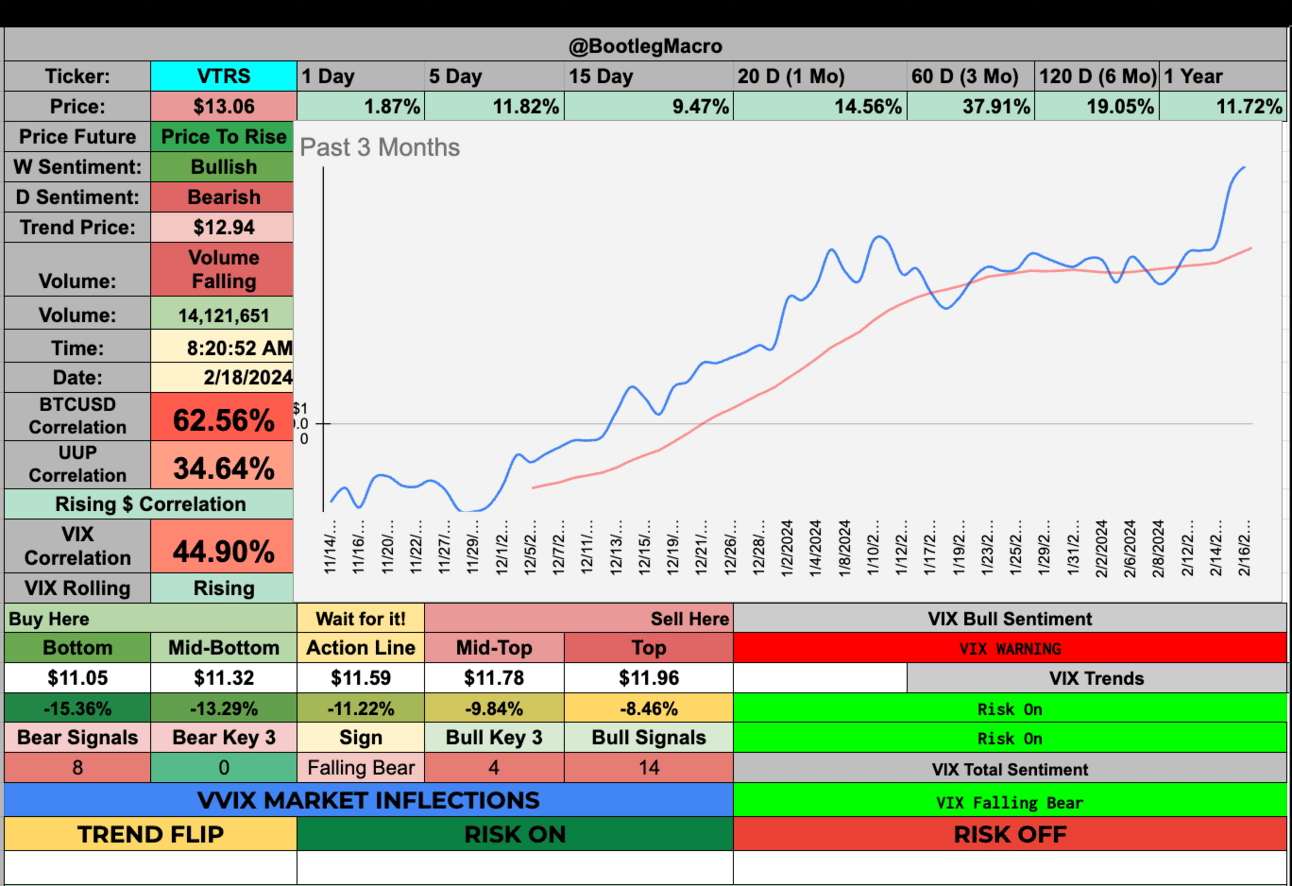

VTRS - Viatris Inc - Healthcare - Drug Manufacturers - Specialty & Generic - 🇺🇸

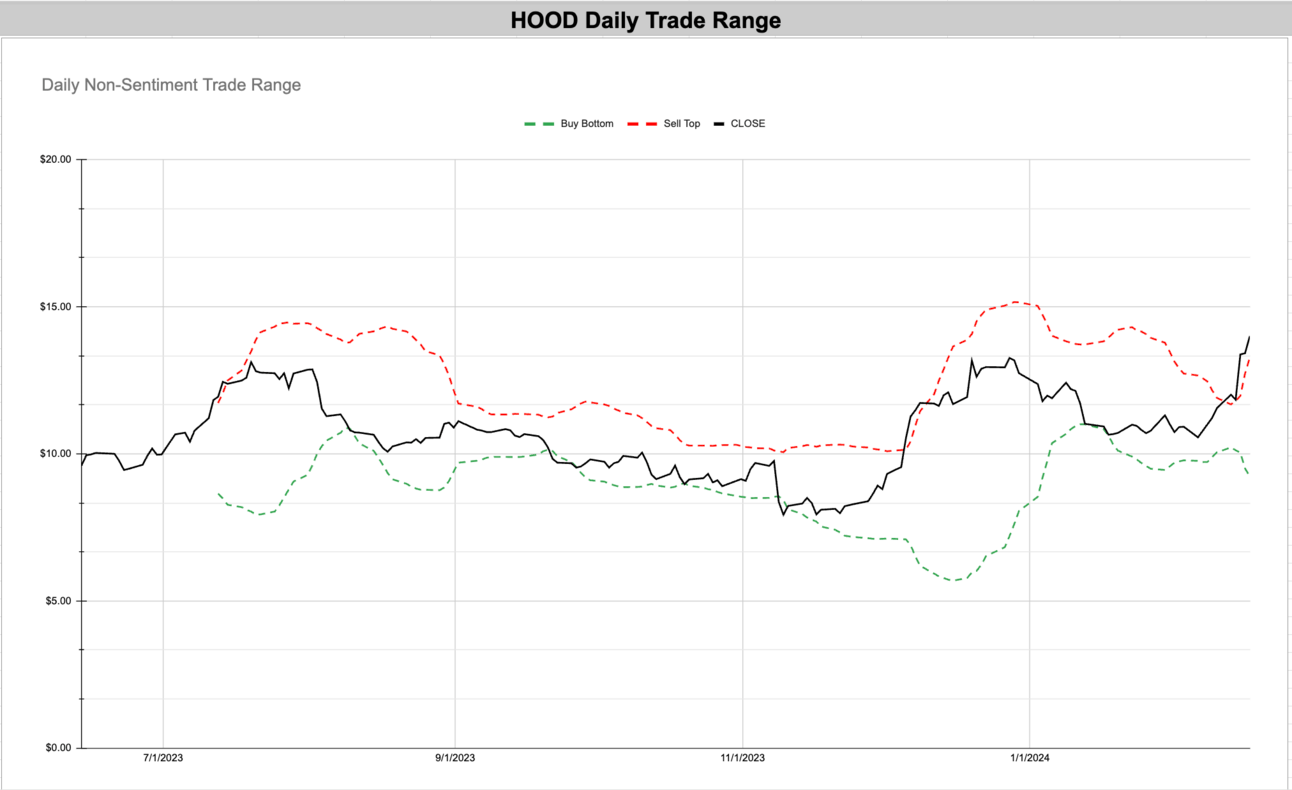

HOOD - Robinhood Markets Inc - Financial - Capital Markets - 🇺🇸

SMMT - Summit Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

ADCT - ADC Therapeutics SA - Healthcare - Biotechnology - 🇨🇭

UGP - Ultrapar Participacoes S.A. ADR - Energy - Oil & Gas Refining & Marketing - 🇧🇷

WIT - Wipro Ltd. ADR - Technology - Information Technology Services - 🇮🇳

ACCO - Acco Brands Corporation - Industrials - Business Equipment & Supplies - 🇺🇸

FATE - Fate Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

UIS - Unisys Corp. - Technology - Information Technology Services - 🇺🇸

SERA - Sera Prognostics Inc - Healthcare - Diagnostics & Research - 🇺🇸

SFL - SFL Corporation Ltd - Industrials - Marine Shipping - 🇧🇲

VTRS - Viatris Inc - Healthcare - Drug Manufacturers - Specialty & Generic - 🇺🇸

HOOD - Robinhood Markets Inc - Financial - Capital Markets - 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

NS - Nustar Energy L P - Energy - Oil & Gas Midstream - 🇺🇸

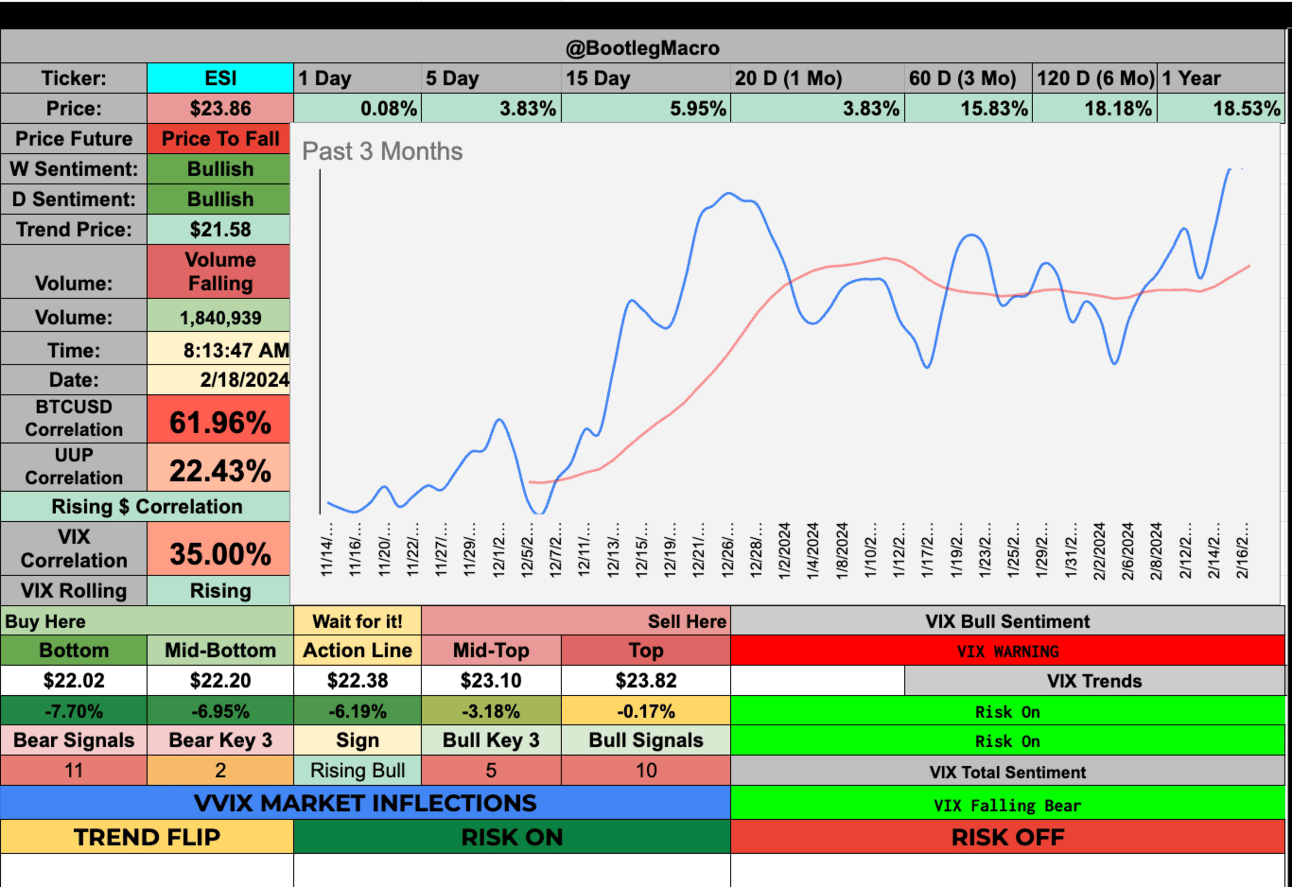

ESI - Element Solutions Inc - Basic Materials - Specialty Chemicals - 🇺🇸

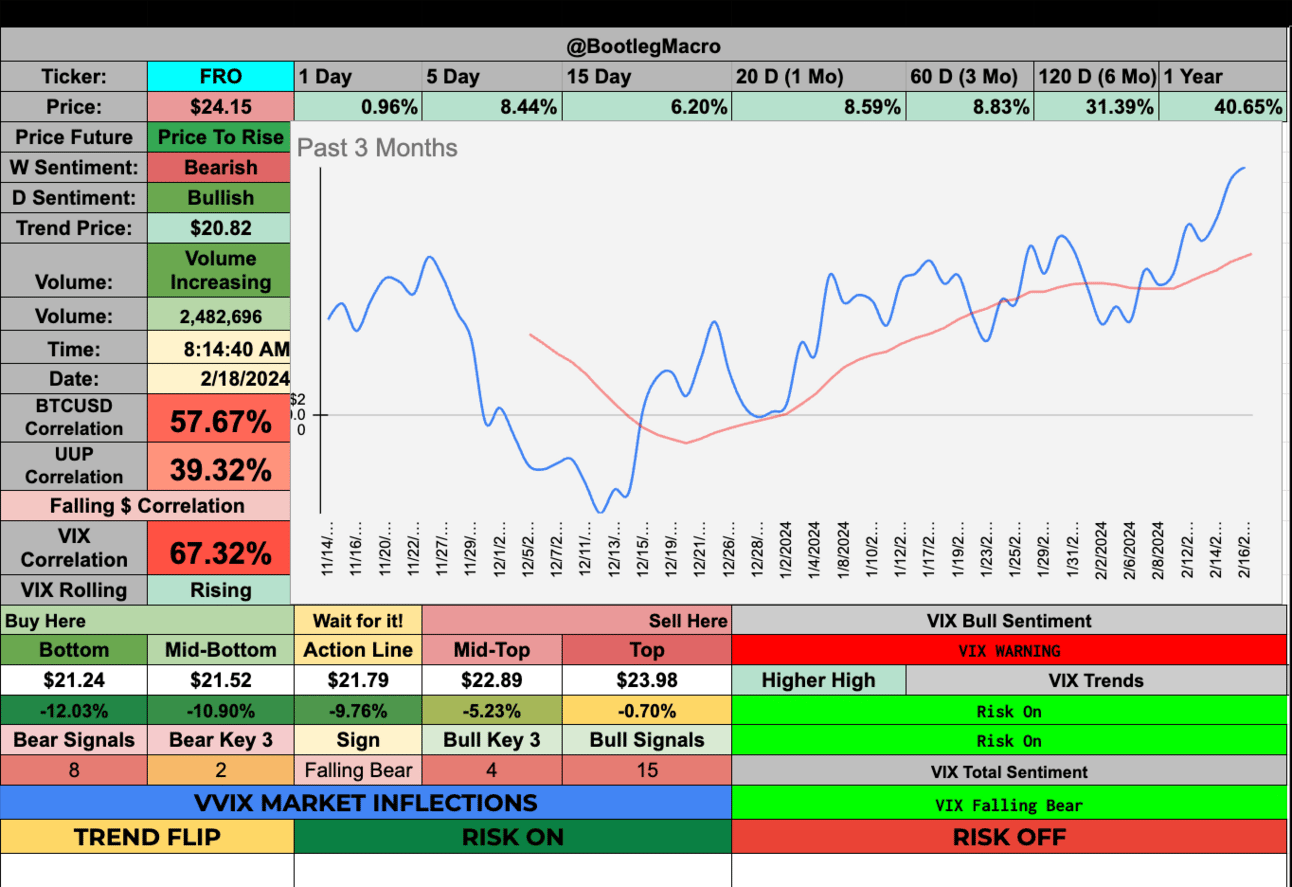

FRO - Frontline Plc - Energy - Oil & Gas Midstream - 🇨🇾

GES - Guess Inc. - Consumer Cyclical - Apparel Retail - 🇺🇸

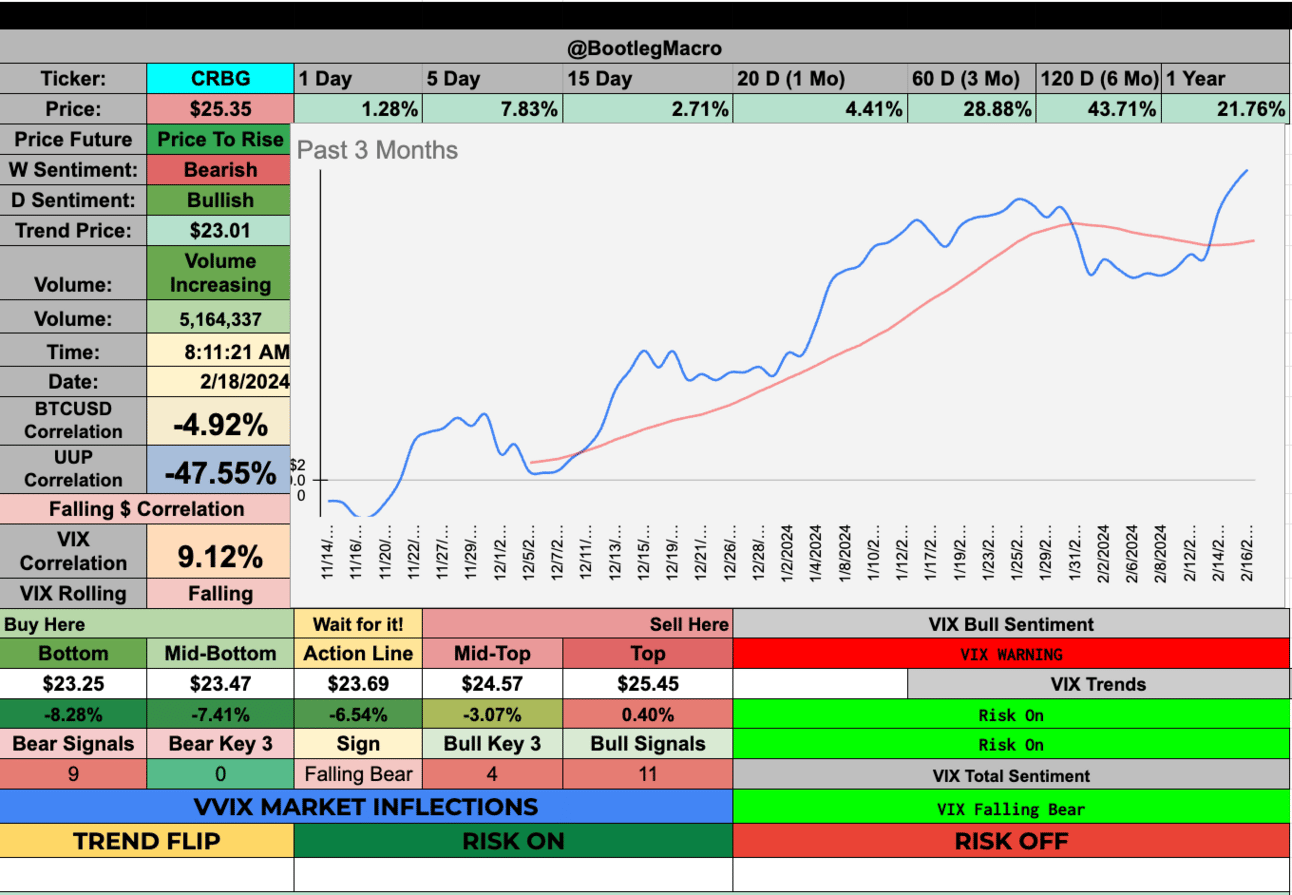

CRBG - Corebridge Financial Inc. - Financial - Asset Management - 🇺🇸

ZIMV - ZimVie Inc - Healthcare - Medical Devices - 🇺🇸

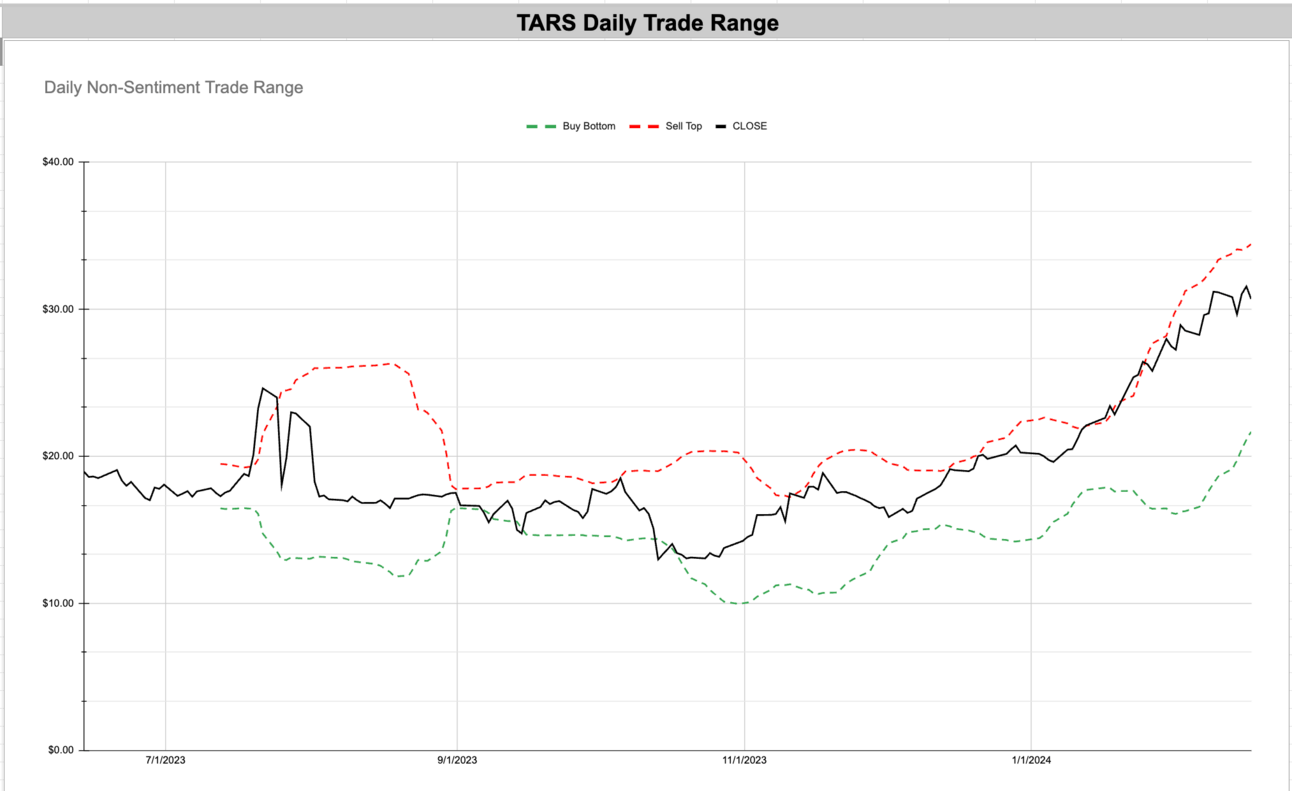

TARS - Tarsus Pharmaceuticals Inc - Healthcare - Biotechnology - 🇺🇸

TRML - Tourmaline Bio Inc - Healthcare - Biotechnology - 🇺🇸

CAL - Caleres Inc - Consumer Cyclical - Apparel Retail - 🇺🇸

GCT - GigaCloud Technology Inc - Technology - Software - Infrastructure - 🇺🇸

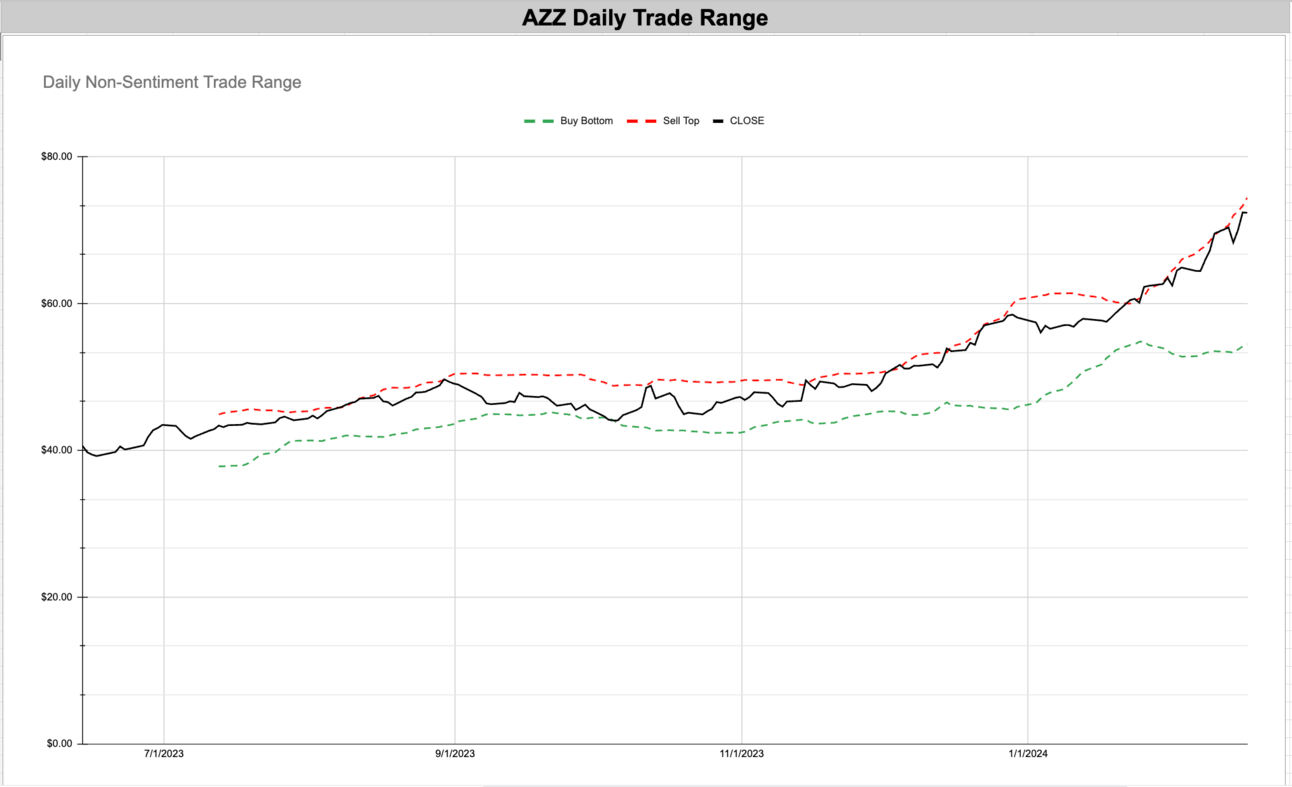

AZZ - AZZ Inc - Industrials - Specialty Business Services - 🇺🇸

POWL - Powell Industries, Inc. - Industrials - Electrical Equipment & Parts - 🇺🇸

NS - Nustar Energy L P - Energy - Oil & Gas Midstream - 🇺🇸

ESI - Element Solutions Inc - Basic Materials - Specialty Chemicals - 🇺🇸

FRO - Frontline Plc - Energy - Oil & Gas Midstream - 🇨🇾

GES - Guess Inc. - Consumer Cyclical - Apparel Retail - 🇺🇸

CRBG - Corebridge Financial Inc. - Financial - Asset Management - 🇺🇸

ZIMV - ZimVie Inc - Healthcare - Medical Devices - 🇺🇸

TARS - Tarsus Pharmaceuticals Inc - Healthcare - Biotechnology - 🇺🇸

TRML - Tourmaline Bio Inc - Healthcare - Biotechnology - 🇺🇸

CAL - Caleres Inc - Consumer Cyclical - Apparel Retail - 🇺🇸

GCT - GigaCloud Technology Inc - Technology - Software - Infrastructure - 🇺🇸

AZZ - AZZ Inc - Industrials - Specialty Business Services - 🇺🇸

POWL - Powell Industries, Inc. - Industrials - Electrical Equipment & Parts - 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro