- The New High Newsletter

- Posts

- The Dow Jones Better Not F*ck Up Next Week!

The Dow Jones Better Not F*ck Up Next Week!

Can the DOW stay above this price?

Welcome back to the New Highs Newsletter. Hope you enjoyed your long July 4th weekend. 🎆🎆

This is the real recovery weekend but oh boy, the memories are amazing!

Savor your favorite memory.

Now let’s get back to work.

Week Review:

Happy Sunday. Who do you trust? ADP or BLS?

ADP said 497k new jobs were created in June. The BLS said 209k jobs were created in June. I dunno but the unemployment rate didn’t change. 3.6%🤷♂️🤷♂️🤷♂️

Credit BLS

Credit BLS

The Yuan Is Diving like OceanGate’s Submersible.

We follow US stocks here but a big change happened in China. They replaced the People Bank of China’s (PBOC) leader. Any change in leadership in China is a big deal and done directly by Chairman Xi.

When you look at the China Yuan vs the US Dollar, you can see it’s near a 15 year low. Not good.

fr

The last thing you want in a country without voting is economic pain and 20% unemployment for your youth. China has both right now.

Market Performance:

An ugly Friday close still kept a positive week. The S&P500🟢 was up 0.06% for the week. The Dow 30🩸 was down -1.14% and the Nasdaq 🟢(as is tradition) led the way up 0.51% for the week.

Dow 30 is at risk of going negative 🩸 on a rolling 1 month return. Watch that next week. We need to close above $33,833 next week to keep positive. That’s only 100 pts higher than we closed…so there is hope.

It’s a bull market in the S&P 500 (.INX), Dow 30 (.DJI) and Nasdaq (.IXIC) on the long-term but in the short term, it’s BEARISH. 🐻🐻🐻

In proper form we have numerous stocks breaking to new highs.

US Index Review:

I’d be less concerned about the indexes if this VIX/VVIX indicator didn’t turn down 📉so aggressively. Notice anything about when the BLUE line is down?📉 Bad things happen. 😱😱😱

Good things happen when the blue line is above the yellow and red lines.

Be cautious with the VIX in the coming weeks. But I’ll highlight the VIX correlation to the indexes in this section. Things are changing.🌦️🌦️🌦️

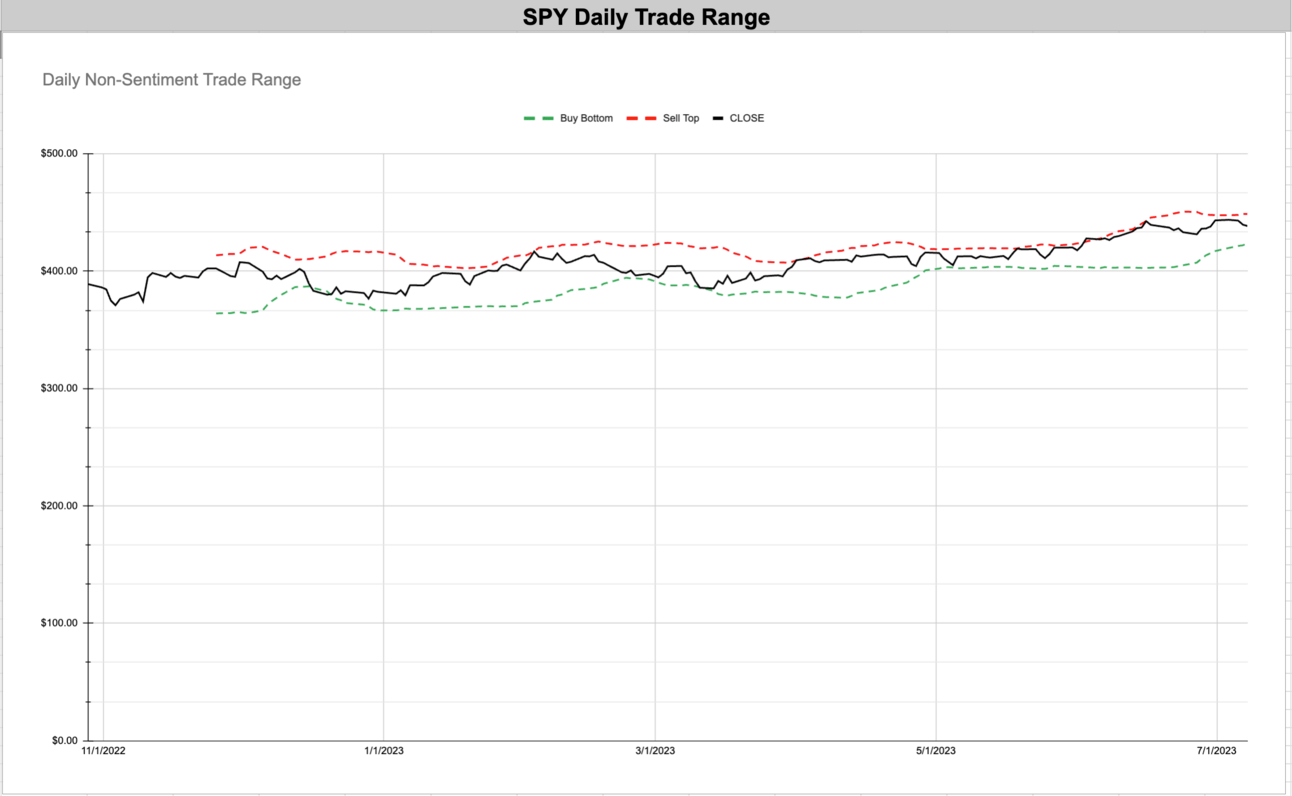

SPY is near the middle of it’s range. Falling to $430 would be a good place to rest. Notice the VIX correlation at 6.17%. That’s odd.

Bullish Trend Since 5/31/23🟢

Go Long Since 5/18/23🟢

Price to Rise Since 6/29/23🟢

SPY-VIX Correlation Graph. If this reverses and the VIX continues to spike. Watch out.

Near the middle of the range.

SPY Weekly Range. Very over bought. But in 2021, that was a good sign.

Interesting week in the $DIA.

Bullish Trend Since 6/30/23🟢

No Signal (Long or Short)**🆘

Price to Rise Since 7/7/23**🟢

DIA-VIX correlation graph. It’s clearly positively correlated right now.

DIA daily trade range. Near the bottom of the range.

DIA Weekly Trade Range. It’s been sideways and volatility has falling over the past few months.

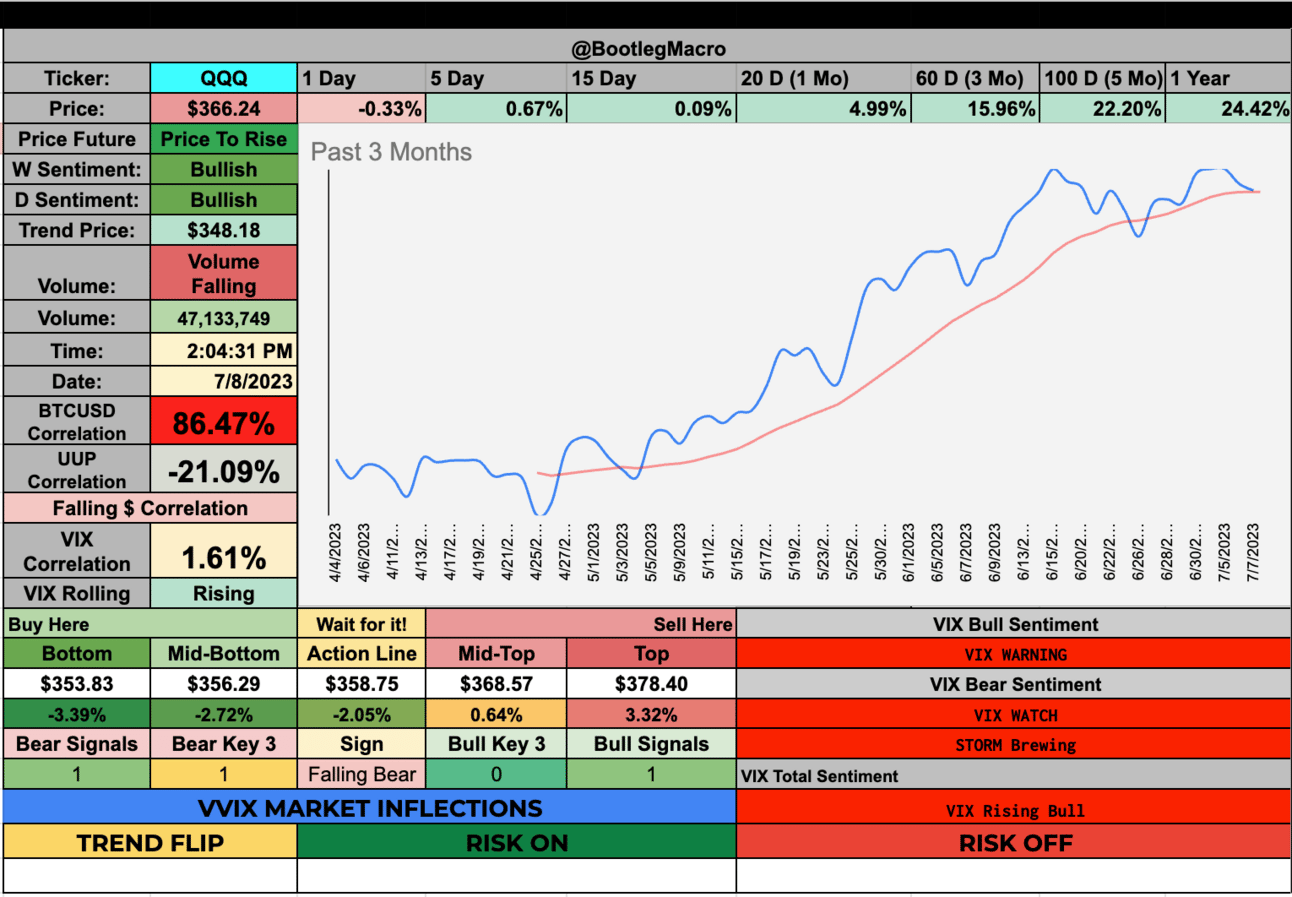

QQQ had a nice week. Sideways action could easily be expected.

QQQ Bullish Trend Since 5/16/23🟢

No Signal (Long or Short)**🆘

Price to Rise Since 6/27/23🟢

QQQ-VIX Correlation Graph. Slightly positive.

QQQ Daily Trade Range closer to the middle of the range than the top.

QQQ Trade Range Weekly at the top of the range. But again, in 2021, that was good.

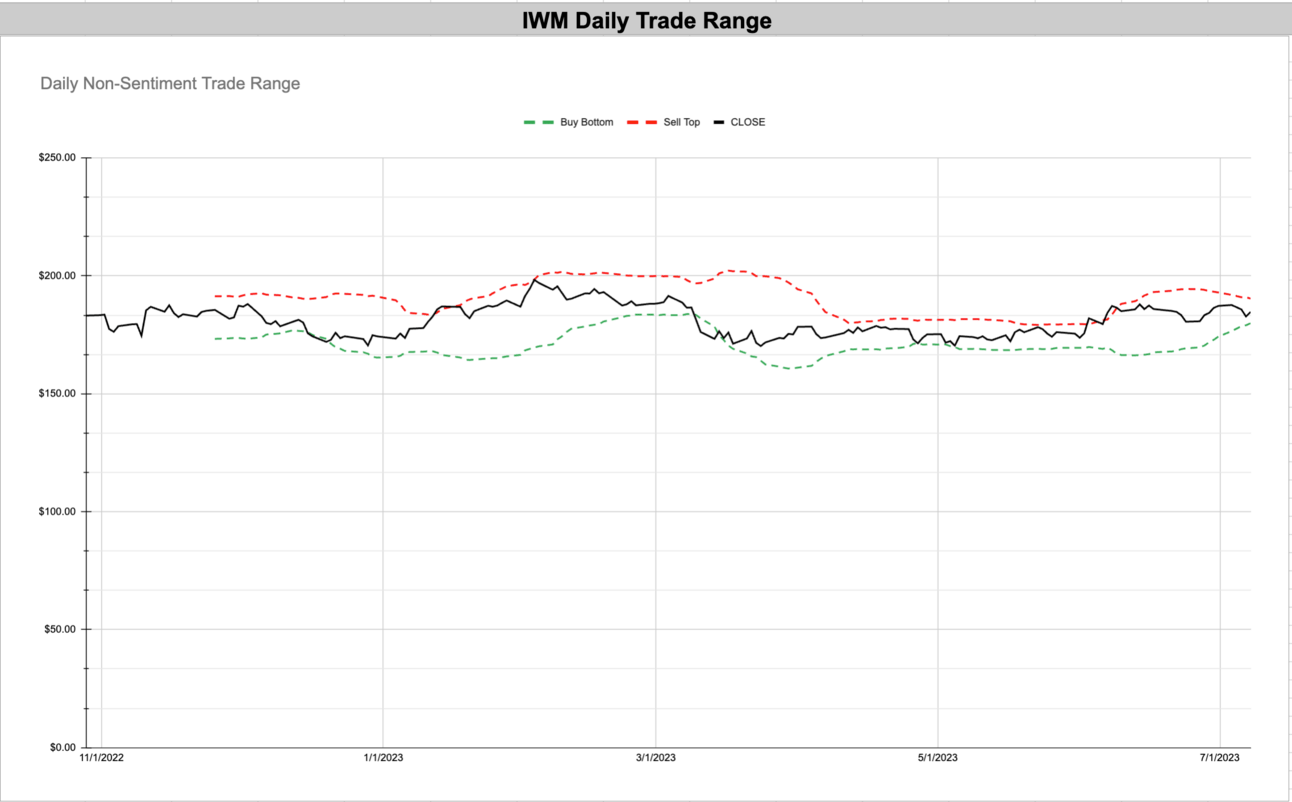

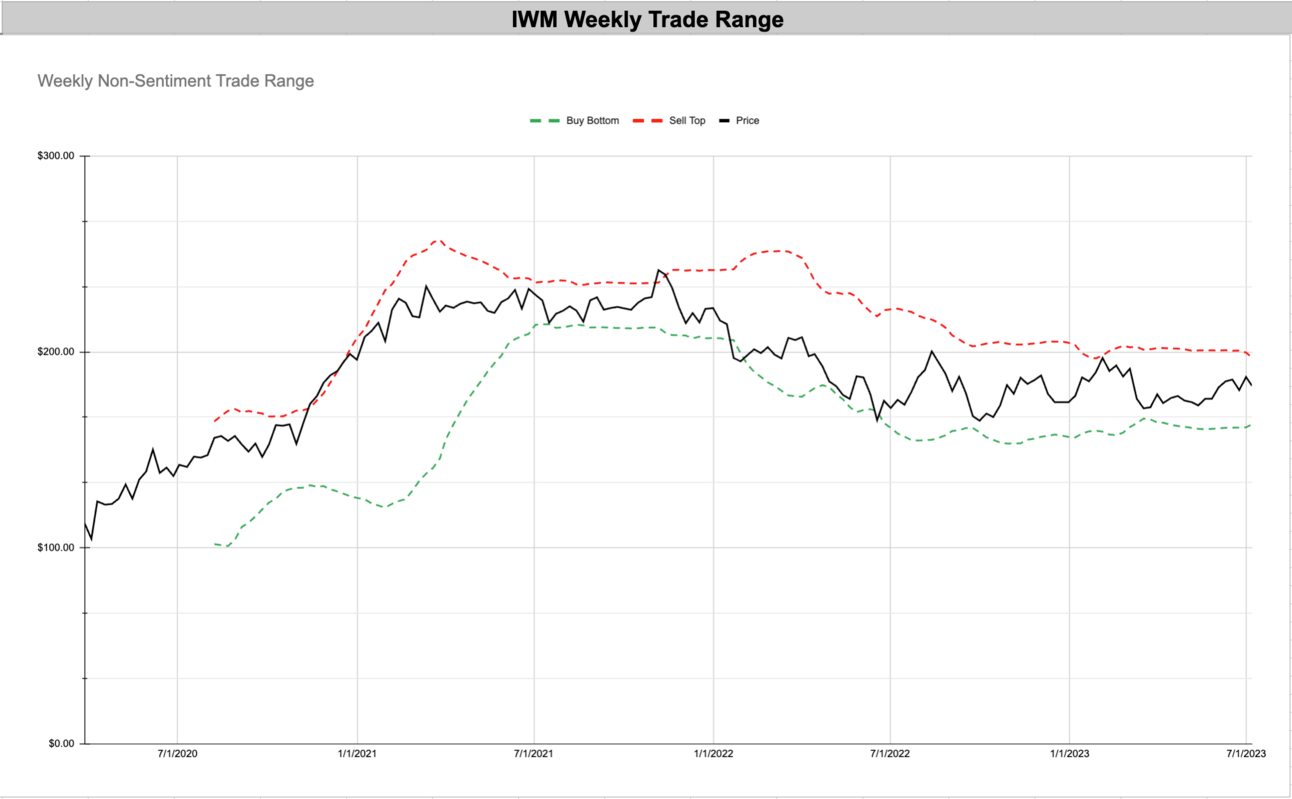

Bullish Trend Since 5/24/23🟢

No Signal (Long or Short)**🆘

Price to Rise Since 6/29/23🟢

IWM-VIX Correlation Graph. All the indexes share a common correlation to the VIX right now.

IWM Daily Trade Range. Price closer to the low end than the top end.

IWM Weekly Trade Range. Price in the middle of the range.

Enjoying this?

& Invite a friend.

New Highs $5-$20:

VRRM - Infrastructure Operations (USA)

PCT - Pollution & Treatment Controls (USA)

PAA - Oil & Gas Midstream (USA)

DO - Oil & Gas Drilling (USA

CSTM - Aluminum (France)

CCL - Travel Services (USA)

IREN - Capital Markets (Australia)

AAOI - Communication Equipment (USA)

CLS - Electronic Components (Canada)

RIOT - Capital Markets (USA)

AAL - Airlines (USA)

VRRM (highlighted on 6/4/23) continues to run on. It’s a a spectacle to behold. It’s the best idea this week.

VRRM - Infrastructure Operations (USA)📶🇺🇸

VRRM keeps running.

Riding the top of the range is very bullish.

PCT - Pollution & Treatment Controls (USA)🏭🇺🇸

A nice move in the past 15 days. Up nearly 30%.

High volatility but a clear trend.

PAA - Oil & Gas Midstream (USA)🛢️🇺🇸

Big breakout this week.

Back at the top of the range.

DO - Oil & Gas Drilling (USA)🛢️🇺🇸

Huge breakout this week! Up 17% in 5 days!

Breaking above the trade range. It will pullback I’m sure.

CSTM - Aluminum (France)⛏️🇫🇷

Nice trend. Good spot to buy.

Great trend, price is staying in the top half of the trade range.

CCL - Travel Services (USA)🚢🇺🇸

Leisure is running baby. Are you agreeing with the signals?

CCL stays at the top trade range. It runs very bullish.

IREN - Capital Markets (Australia)💰🇦🇺

AAOI - Communication Equipment (USA)📡🇺🇸

What a run! Up 32% in 5 days!?!

This might be a little overbought.

CLS - Electronic Components (Canada)⚙️🇨🇦

Great trend so far. Nice run.

Great moves and good times.

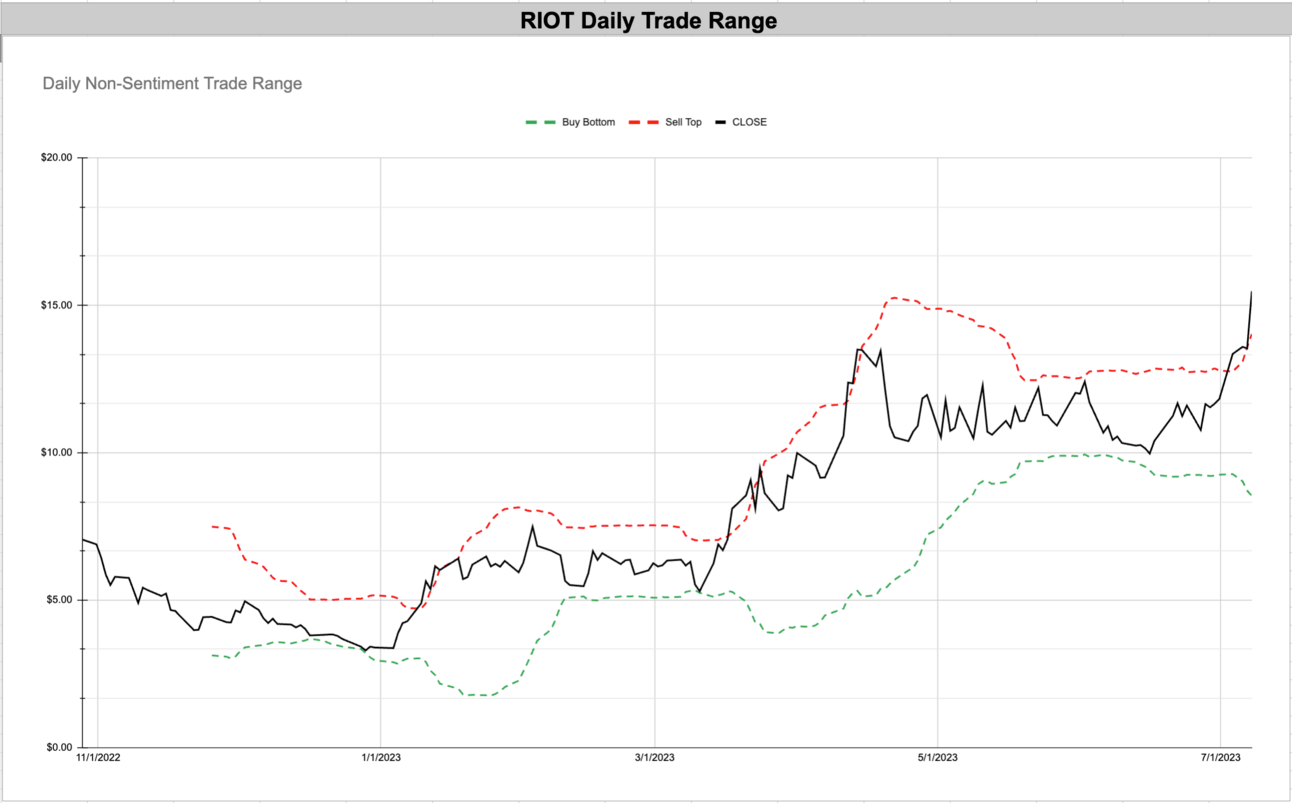

RIOT - Capital Markets (USA)💰🇺🇸

Must have been a good week for Bitcoin.

9 month high…I mean…I trust that look back period.

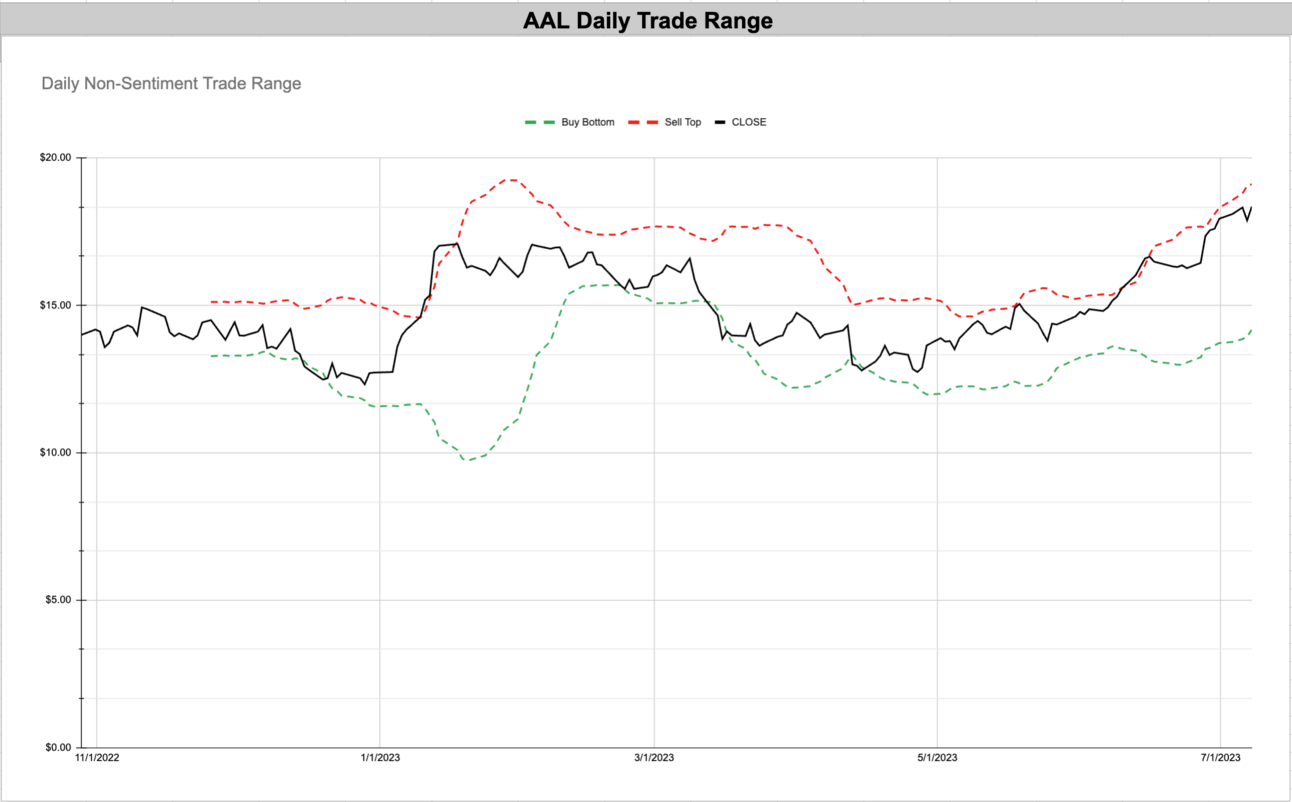

AAL - Airlines (USA)🛫🇺🇸

Airlines and Cruise stocks rising? I’m impressed.

Price continues to stay at the top of trade range.

Enjoying this?

& Invite a friend.

New Highs $20+:

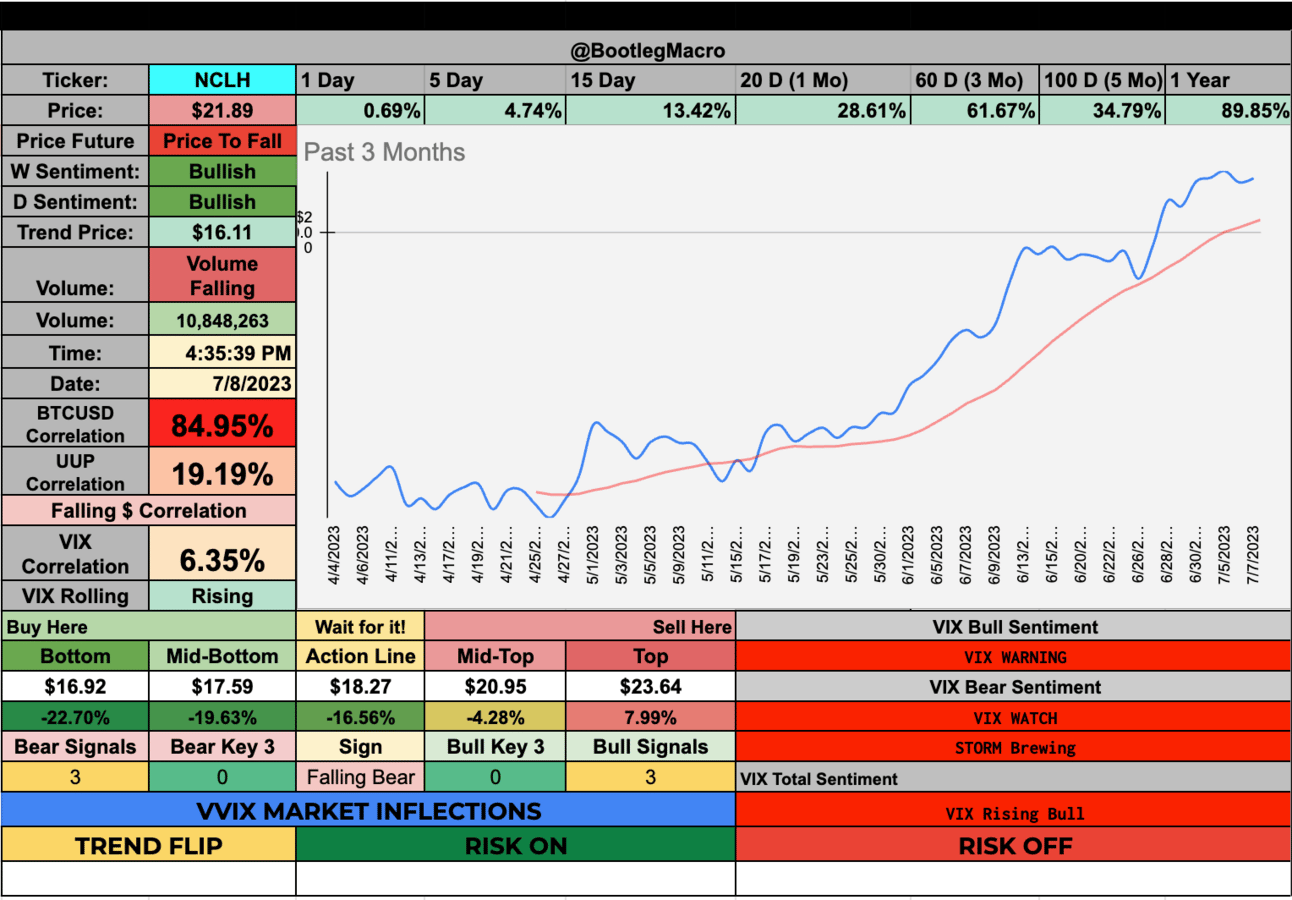

NCLH - Travel Services (USA)

LPG - Oil & Gas Midstream (USA)

VSH - Semiconductors (USA)

RAMP - Software - (USA)

BZH - Residential Construction (USA)

LMB - Engineering & Construction (USA)

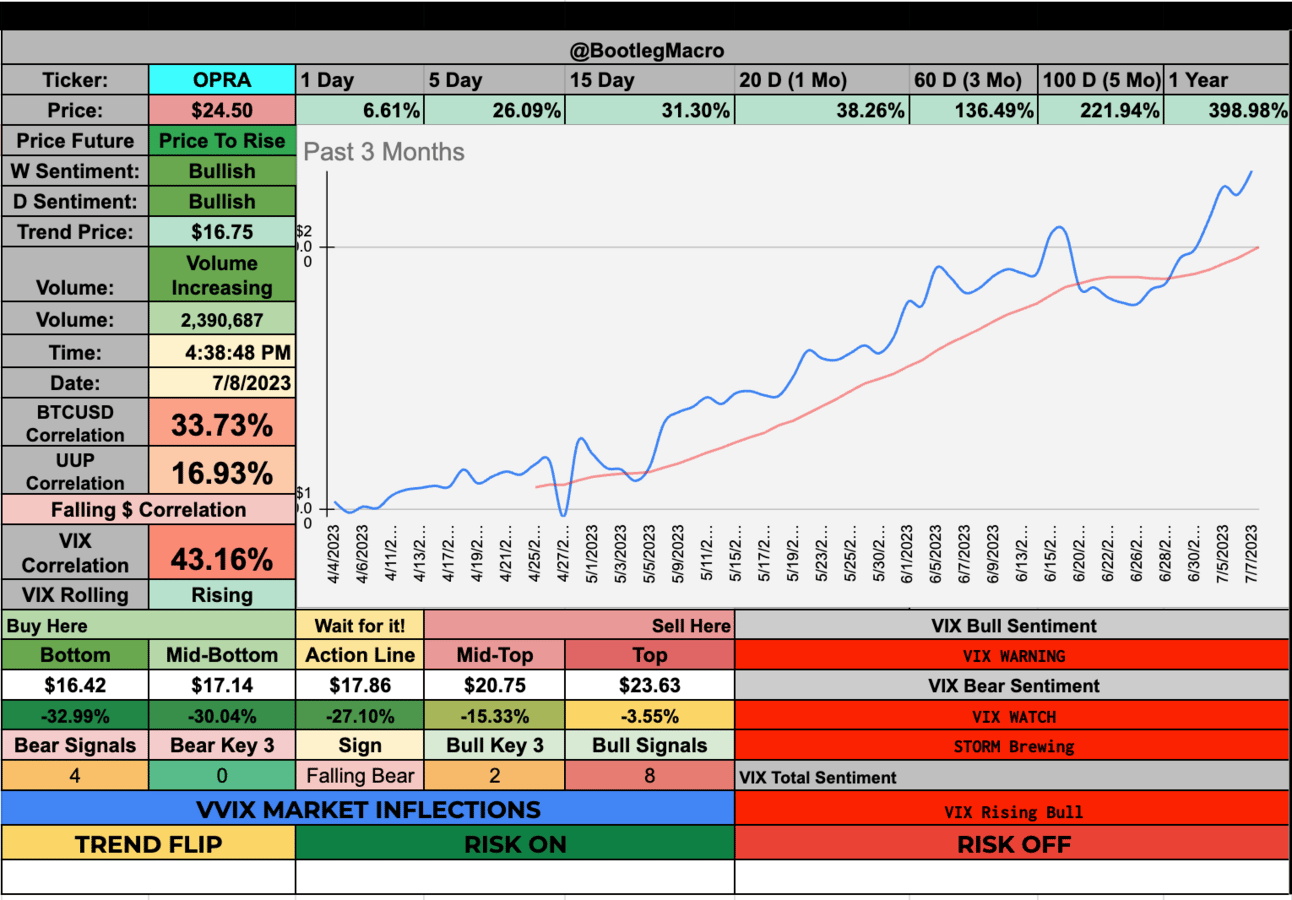

OPRA - Internet Content & Information (Norway)

DBX - Software - Infrastructure (USA)

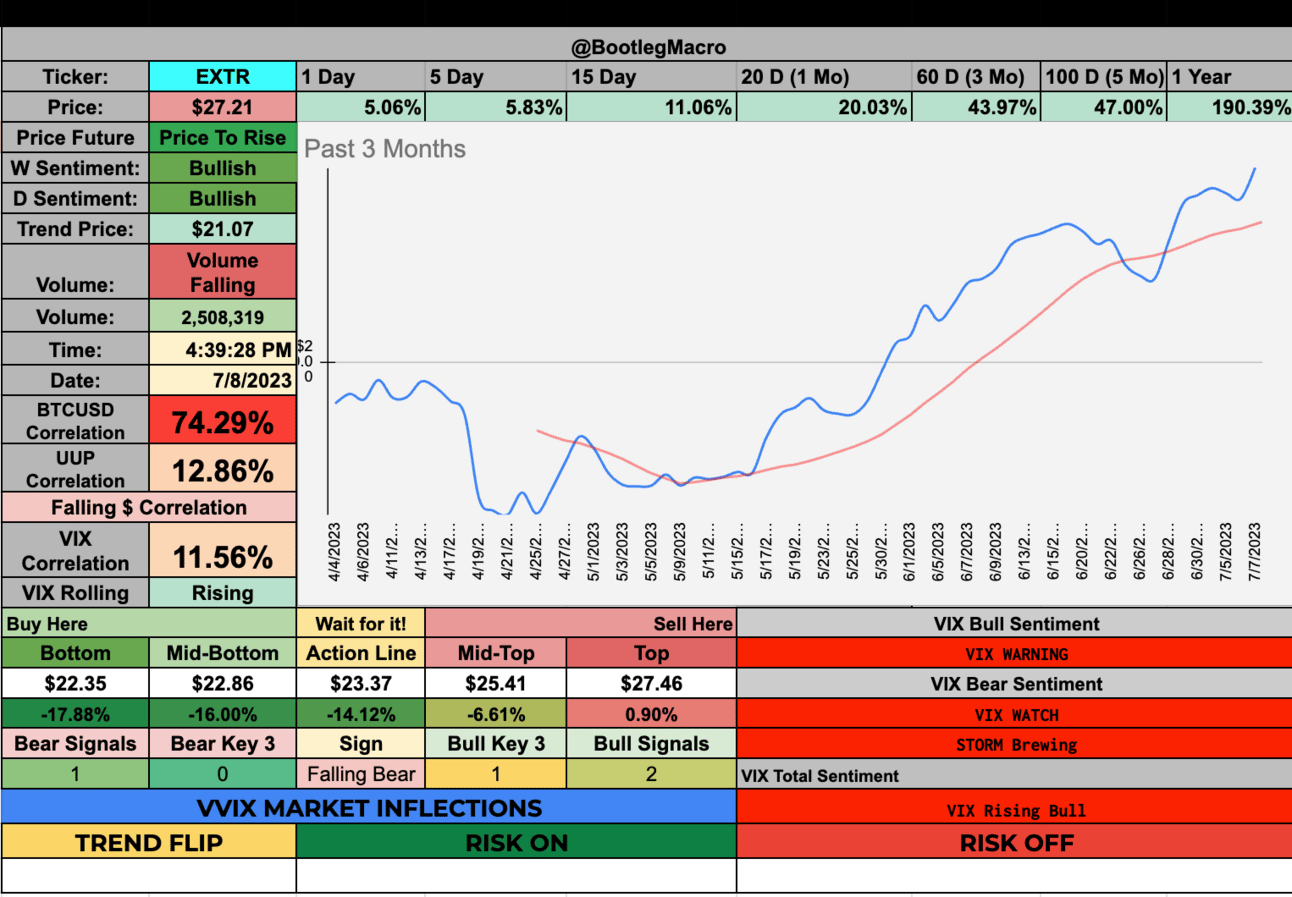

EXTR - Communication Equipment (USA)

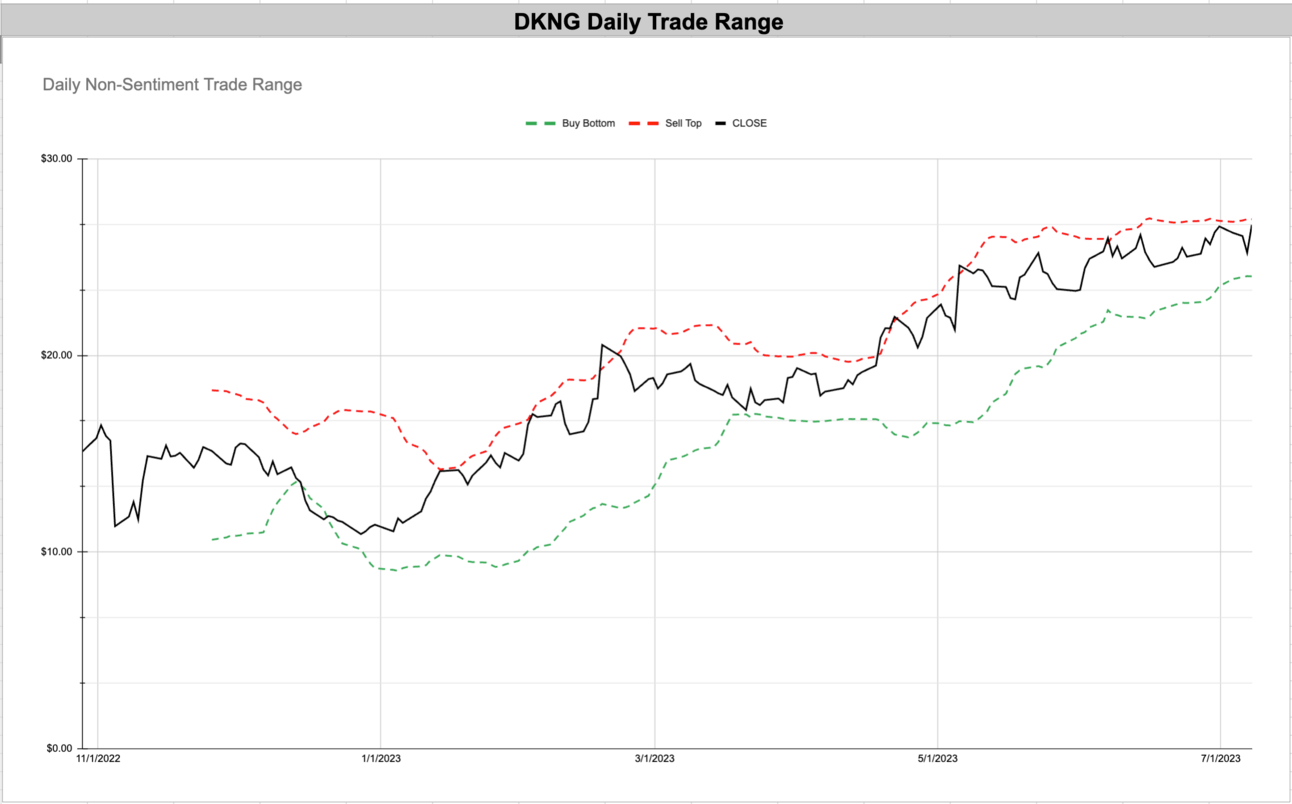

DKNG - Gambling (USA)

NCLH - Travel Services (USA)🚢🇺🇸

A part of S&P 500 and a cruise company. Incredibly bullish.

NCLH continues to rise higher.

LPG - Oil & Gas Midstream (USA)🛢️🇺🇸

LPG Continues to go higher and higher.

A simple trend with higher-highs and nice pullback opportunities.

VSH - Semiconductors (USA)💻🇺🇸

A nice pullback this week but it’s still up over 31% in the past 3 months. Nice opportunity.

Price continues to ride the top of the trade range. Very bullish signal.

RAMP - Software - (USA)💽🇺🇸

RAMP has a jerky trend. It’s up, then it’s down…so right now, I’d expect it to drop a bit and go higher again.

Interesting spot to watch. Ramp could be at a double top or ready for a new high.

BZH - Residential Construction(USA)🏘️🇺🇸

Nice trend but surprising it’s in housing construction.

Higher-highs in this stock. It’s a nice smooth trend.

LMB - Engineering & Construction(USA)🏗️🇺🇸

A very jagged but smooth trend. What a nice run it’s had, 300%+ in 1 year.

Nice pullbacks and new highs. Great trade range.

OPRA - Internet Content & Information (Norway)🌐🇳🇴

This move is incredible. Up 26% in 5 days!

Might be a little overbought. But nice moves.

DBX - Software - Infrastructure (USA)💿🇺🇸

A fantastic name brand company getting the bid.

After the drop in mid-2023 it’s been up and to the right.

EXTR - Communication Equipment (USA)📡🇺🇸

Anything up 190% in 1 year is a hot stock.

$20 was a big level. When a breakout happens sometime it becomes magical. This is one of those times.

DKNG - Gambling (USA)🎰🇺🇸

What a run for Draftkings. I’ll look for a new pullback to buy soon.

Price keeps running up to the top of the trade range.

Next Week:

Business Events (Earnings, Conferences, etc)

Monday July 10th

WD-40 Company (WDFC) and PriceSmart Inc. (PSMT) report earnings

Tuesday July 11th

Wednesday July 12th

Washington Federal Inc. (WAFD), Winmark Corp. (WINA), and MillerKnoll Inc. (MLKN) report earnings

Thursday July 13th

PepsiCo. (PEP), Cintas Corp. (CTAS), Fastenal Company (FAST), Delta Air Lines (DAL), and ConAgra Brands Inc. (CAG) report earnings

Friday July 14th

UnitedHealth Group (UNH), JPMorgan Chase (JPM), Wells Fargo & Company (WFC), BlackRock (BK), Citigroup (C), State Street Corporation (STT), and Ericsson (ERIC) report earnings

Central Banks (Speeches, Decisions, Meetings)

Monday July 10th

Speech -- Vice Chair for Supervision Michael S. Barr

Watch Live - Bank Capital

At the Bipartisan Policy Center, Washington, D.C.

Thursday July 13th

Speech -- Governor Christopher J. Waller

Economic Outlook

At the Money Marketeers Speech, New York, N.Y.

Government (Elections, Legislation, International Politics)

Monday July 10th

Wholesale Inventories (May)

Consumer Inflation Expectations (Jun)

Used Car Prices (Jun)

Tuesday July 11th

NFIB Business Optimism Index (Jun)

IBD/TIPP Economic Optimism Index (Jul)

Euro Area ZEW Economic Sentiment Index (Jul)

Wednesday July 12th

Consumer Price Index (CPI) Inflation (Jun)

Fed Beige Book Release

China Trade Balance (Jun)

Thursday July 13th

Producer Price Index (PPI) Inflation (Jun)

U.K. Gross Domestic Product - MoM Rate (May)

Friday July 14th

University of Michigan Consumer Sentiment Index - Preliminary Reading (Jul)

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For $0 a month, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro