- The New High Newsletter

- Posts

- Bulls Charge Ahead, and Dips Keep Paying Off

Bulls Charge Ahead, and Dips Keep Paying Off

This week’s action has been exceptional. Kinder Morgan ($KMI) jumped more than 4%, while Caterpillar ($CAT) surged past its April 2024 highs to set new all-time records. It feels like we’ve emerged from the choppy markets that defined the first half of the year, just as I forecasted back in January. Bulls are firmly in control, and the bears are running out of places to hide.

In my last post, I said, "Be prepared to be bullish and bored." Well, the bulls have certainly lived up to that message. The rally continues, delivering a stellar ride. These days, buying the dips has become second nature for me.

We’re seeing new highs across sectors, with several posting massive 10%+ gains in just a few weeks. Indicators point to broad market participation, likely stretching through the spring, suggesting the rally isn’t losing steam.

This week’s action has been exceptional. Kinder Morgan ($KMI) jumped more than 4%, while Caterpillar ($CAT) surged past its April 2024 highs to set new all-time records. It feels like we’ve emerged from the choppy markets that defined the first half of the year, just as I forecasted back in January. Bulls are firmly in control, and the bears are running out of places to hide.

What can I expect in the weeks ahead? More of the same: dips bought, rallies sustained. That’s my slogan for the next 12 months. The only factor that could derail this momentum is real-world risks. Even then, my strategy remains consistent—buy more. Asset inflation is back, and I don’t see anything on the horizon to slow it down.

“Inflation is back, back again—tell a friend.”

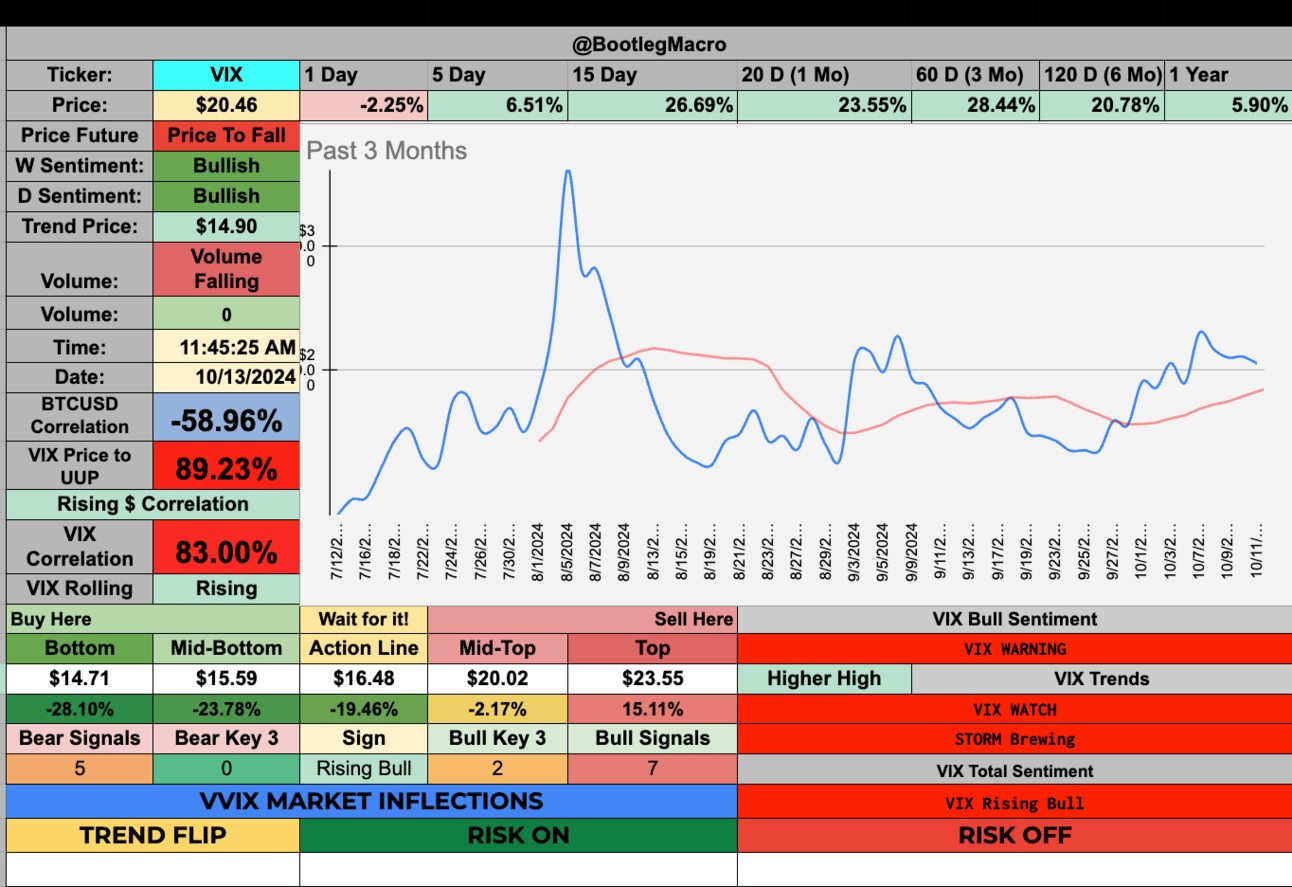

The only wild card here is volatility. The VIX and the rise of 0DTE (zero days to expiration) options have amplified risk, as derivatives often do. While these instruments can enhance returns, they also introduce market instability that traders should monitor closely.

On a positive note, election-related uncertainty will soon be behind us. As volatility eases, I expect the VIX to retreat from the 20s into the low teens—perhaps even down to 11.

Bulls are charging forward, and the playbook remains simple: buy the dips and ride the wave.

Market Performance

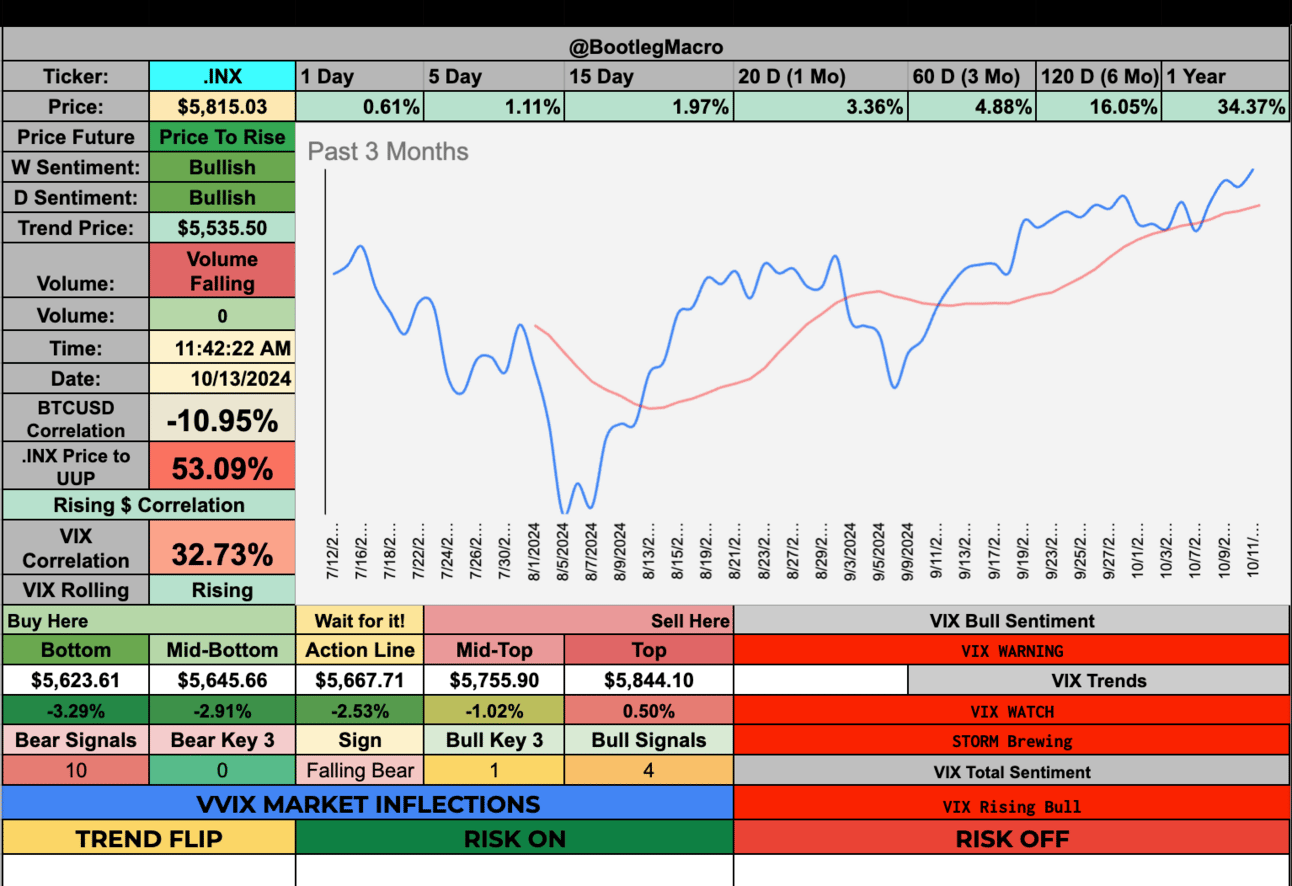

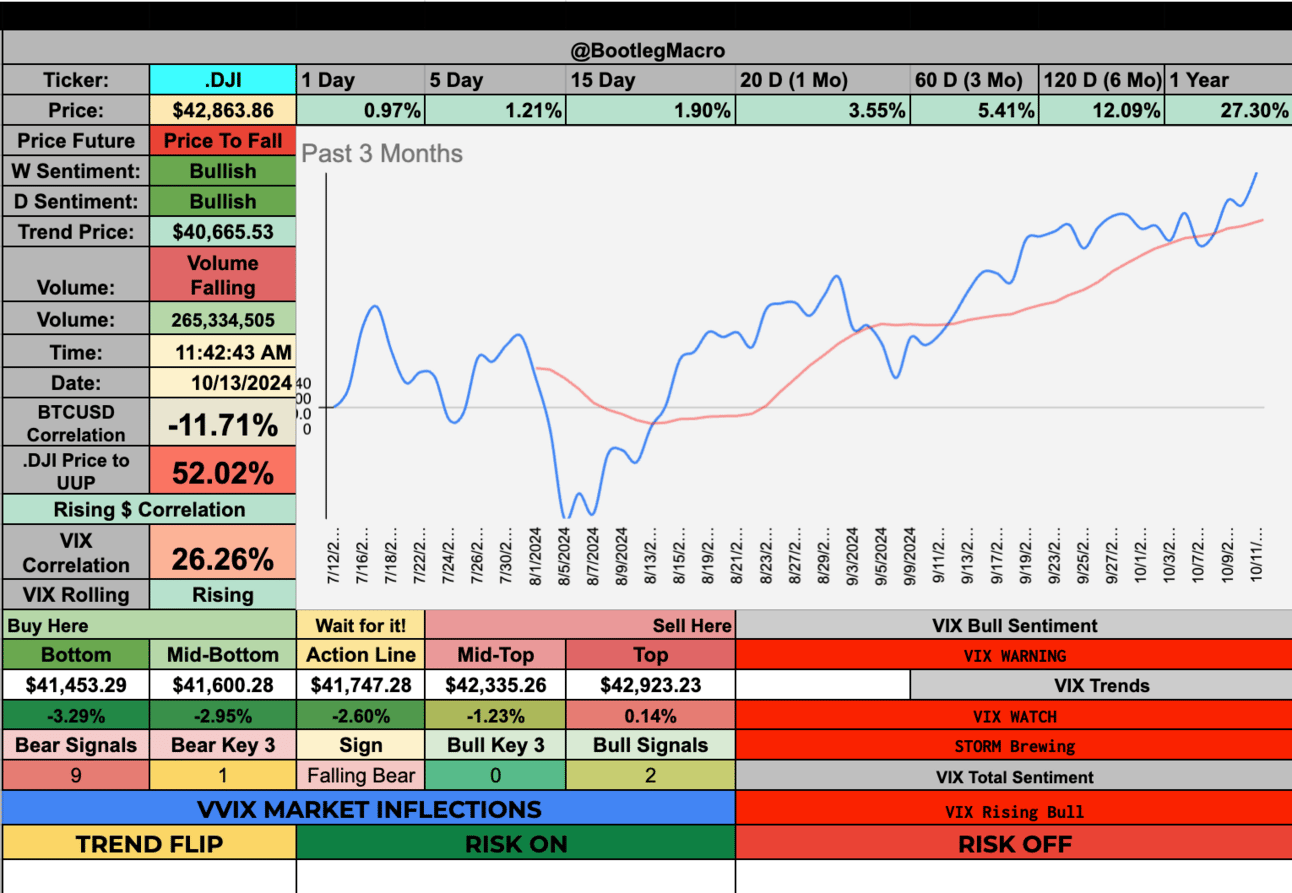

The major U.S. indexes continue to trend upward, reinforcing the bullish sentiment across sectors. The NASDAQ Composite (.IXIC) shows steady gains, climbing 36.81% over the past year, with recent buy signals indicating further strength ahead. Meanwhile, Dow Jones Industrial Average (.DJI) has gained 27.3% over the same period, breaking through resistance levels as volume trends lower—signaling potential consolidation before the next leg up. The S&P 500 (.INX) remains robust with a 34.37% annual gain, staying comfortably above key trendlines.

However, volatility remains a wildcard. The rising correlation between the VIX and these indexes suggests some choppiness in the weeks ahead. For now, "buying the dips" continues to pay off as bulls maintain control, with asset inflation likely driving further gains into the new year.

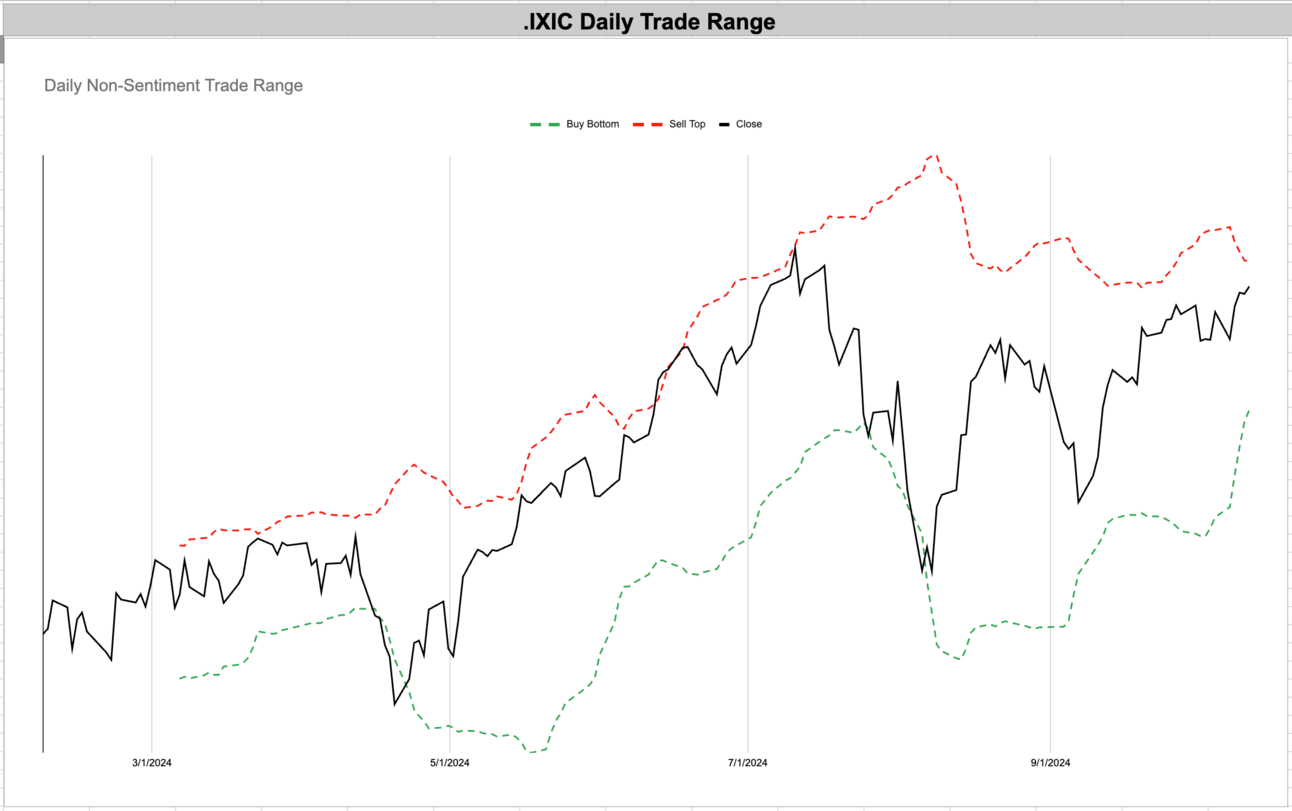

In a shocking turn, Nasdaq looks like the best buy of the 3 indexes right now. I’ll take note.

Volatility Corner:

The Market Turbulence Indicator improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets.

The Market Turbulence Indicator appears to be sideways and consistently bullish. Until things change, I’ll buy the dip.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

Enjoying this?

& Invite a friend.

New Highs $5-$20:

TKNO - Alpha Teknova Inc | Healthcare | USA 🇺🇸

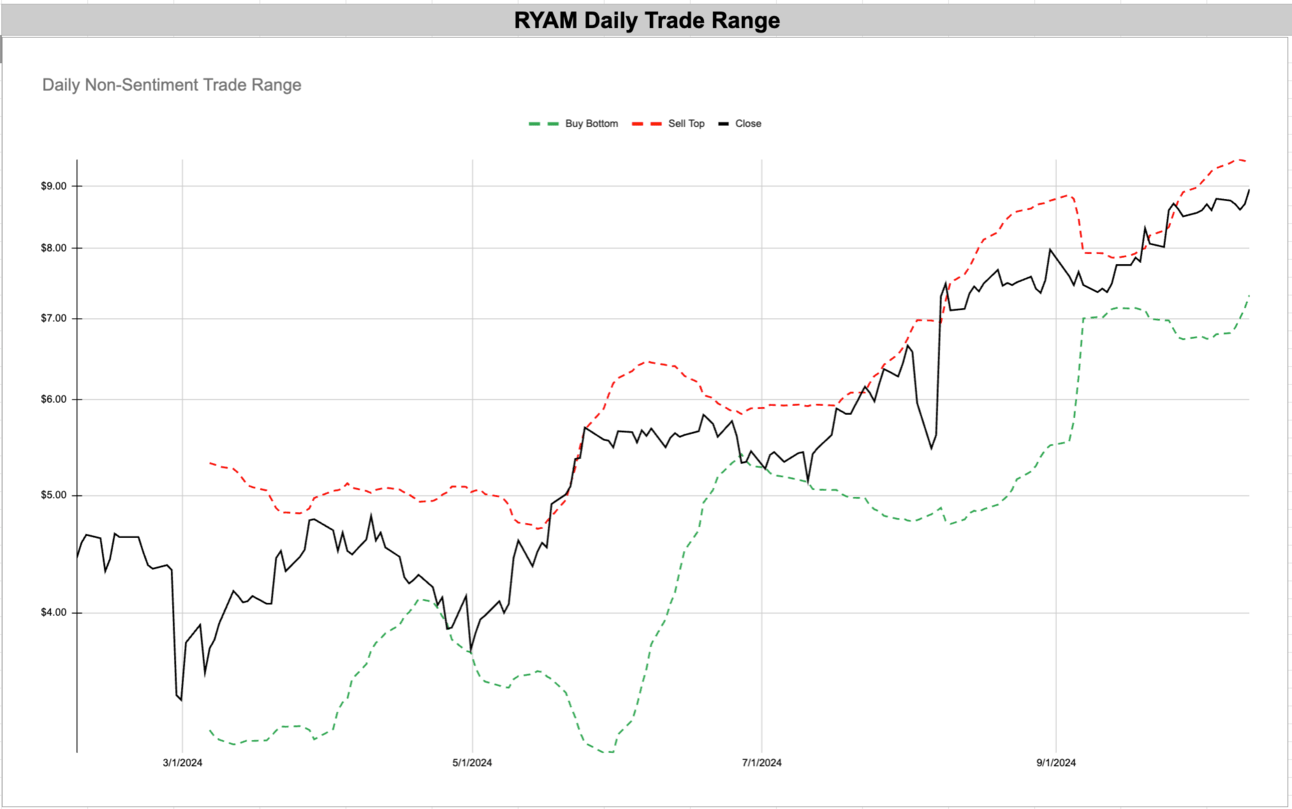

RYAM - Rayonier Advanced Materials Inc | Basic Materials | USA 🇺🇸

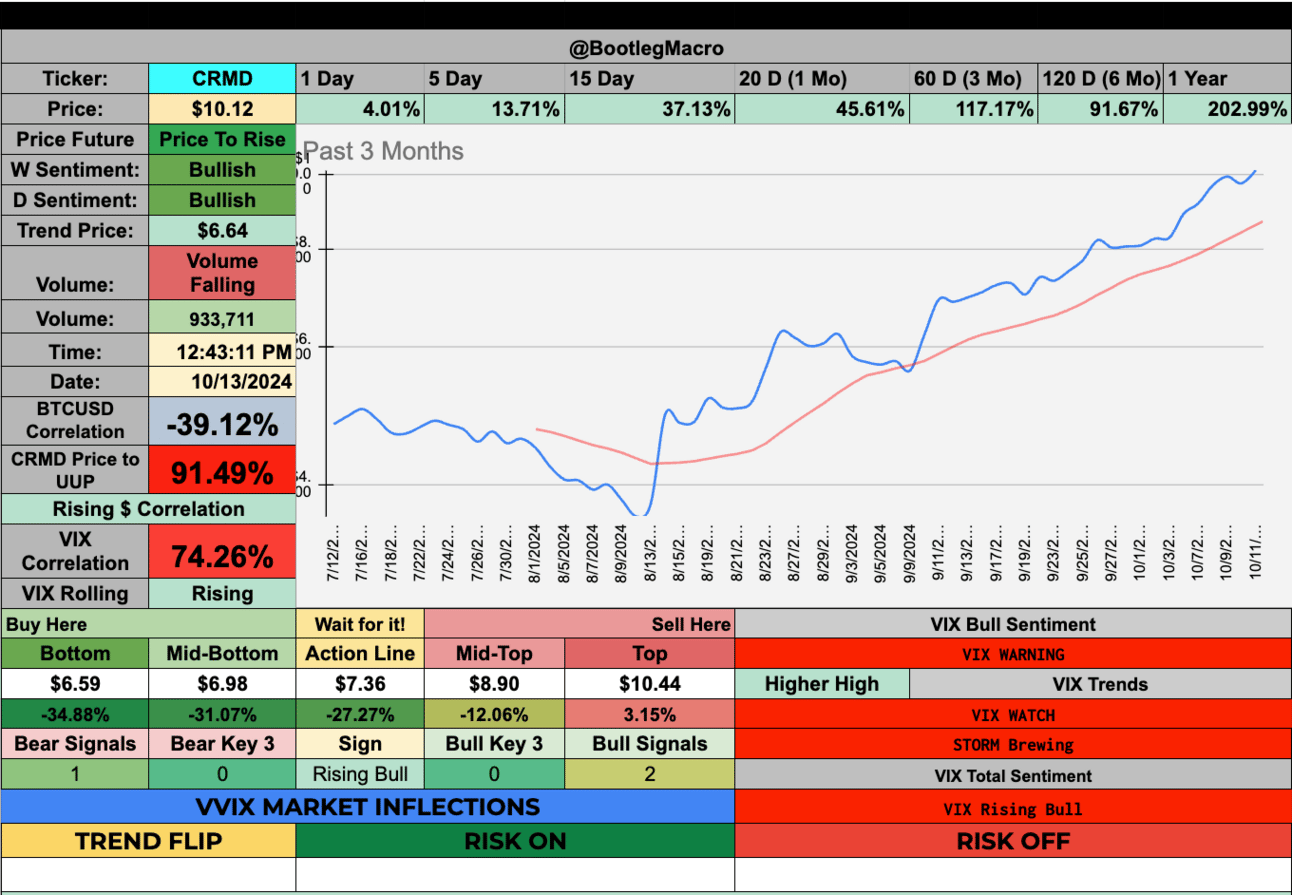

CRMD - CorMedix Inc | Healthcare | USA 🇺🇸

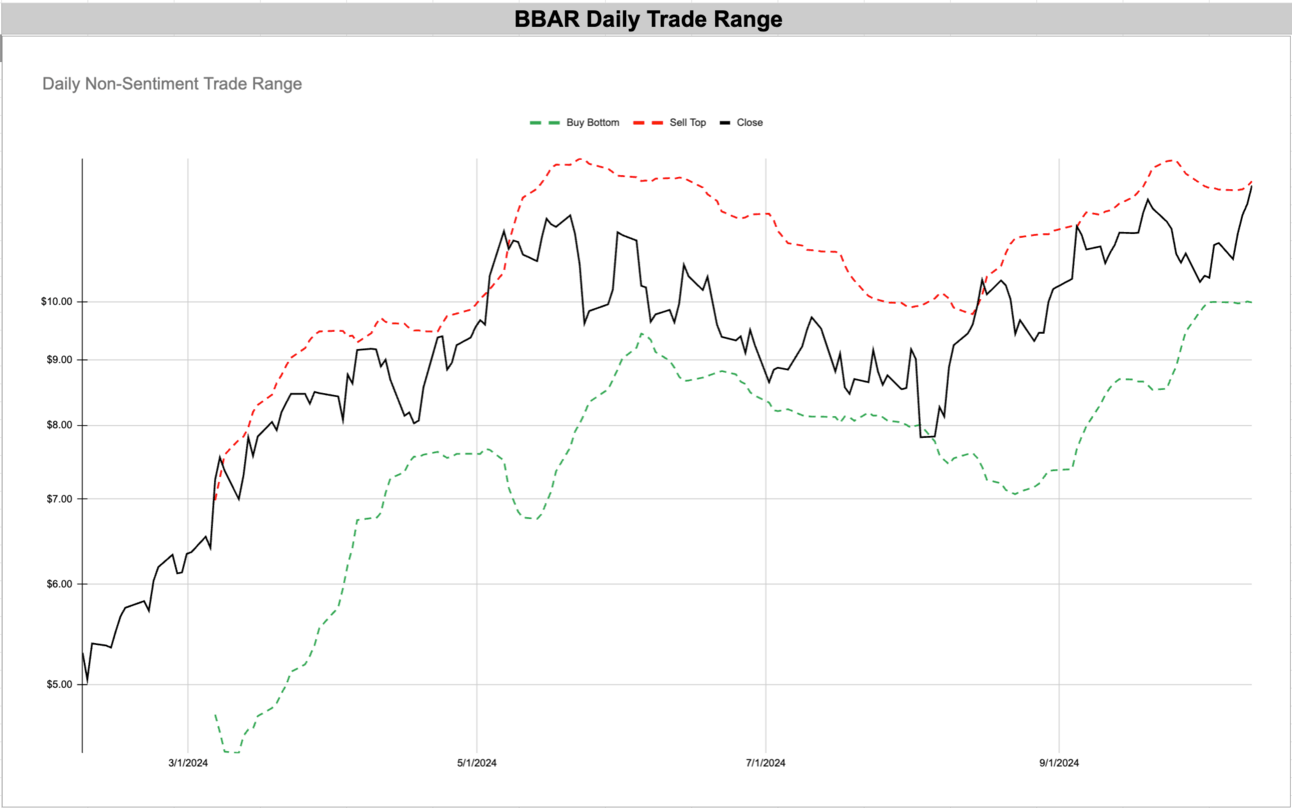

BBAR - BBVA Argentina ADR | Financial | Argentina 🇦🇷

AVPT - AvePoint Inc | Technology | USA 🇺🇸

SWI - SolarWinds Corp | Technology | USA 🇺🇸

CORZ - Core Scientific Inc | Technology | USA 🇺🇸

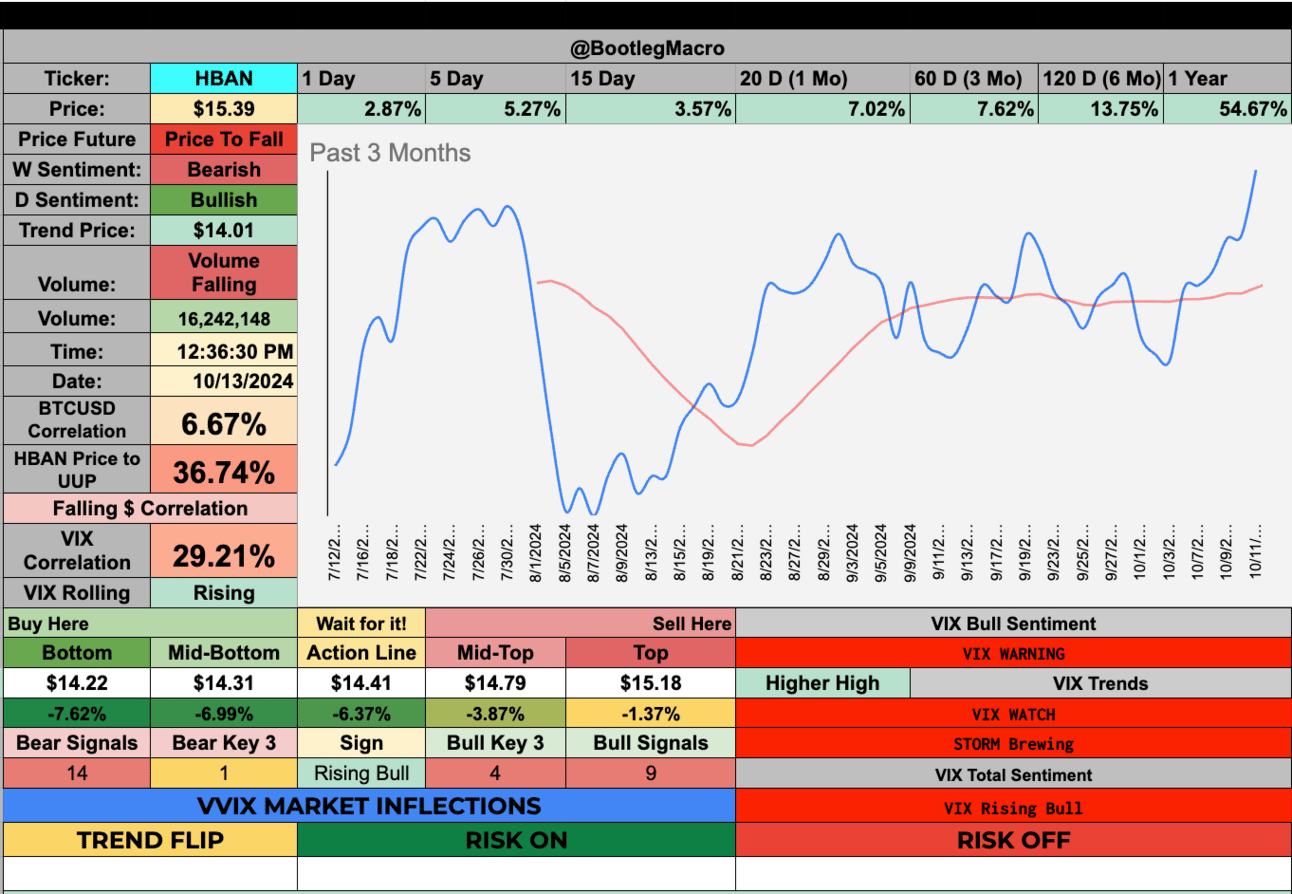

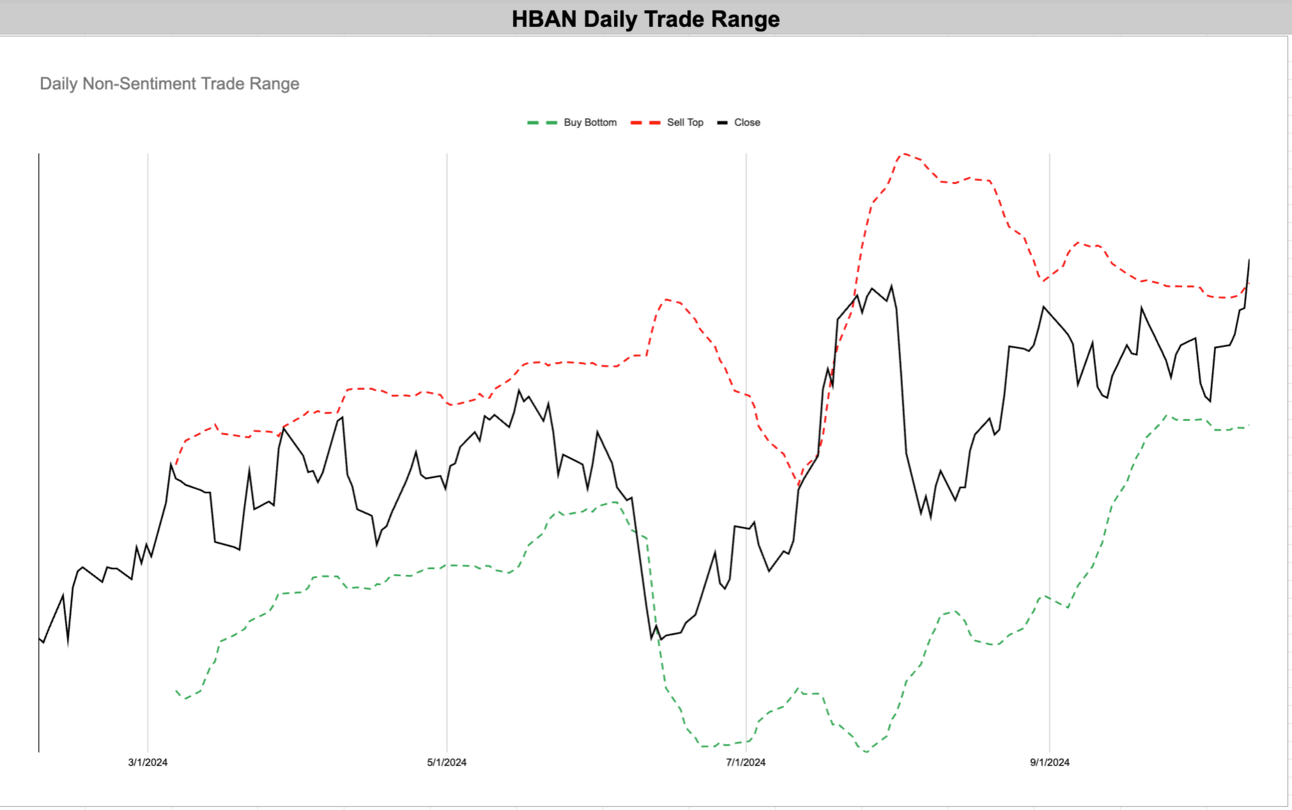

HBAN - Huntington Bancshares, Inc. | Financial | USA 🇺🇸

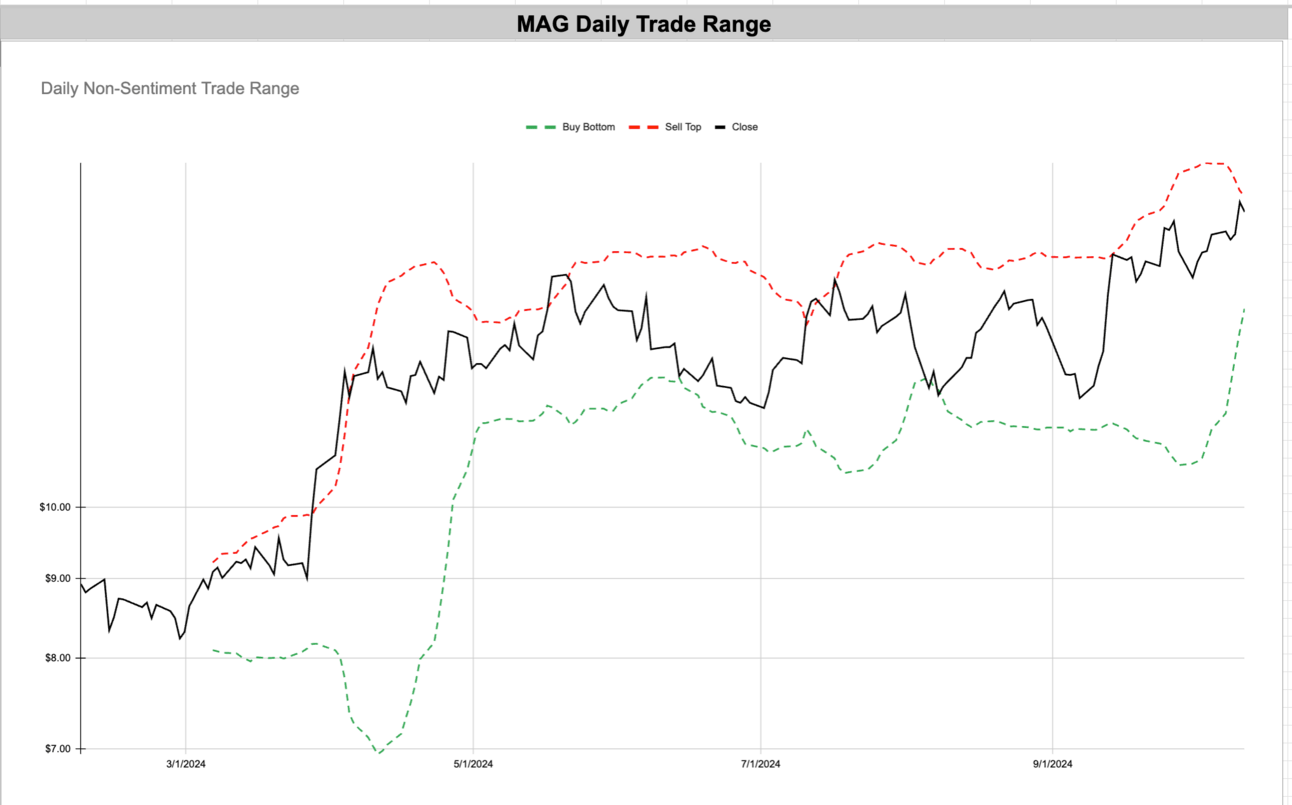

MAG - MAG Silver Corp. | Basic Materials | Canada 🇨🇦

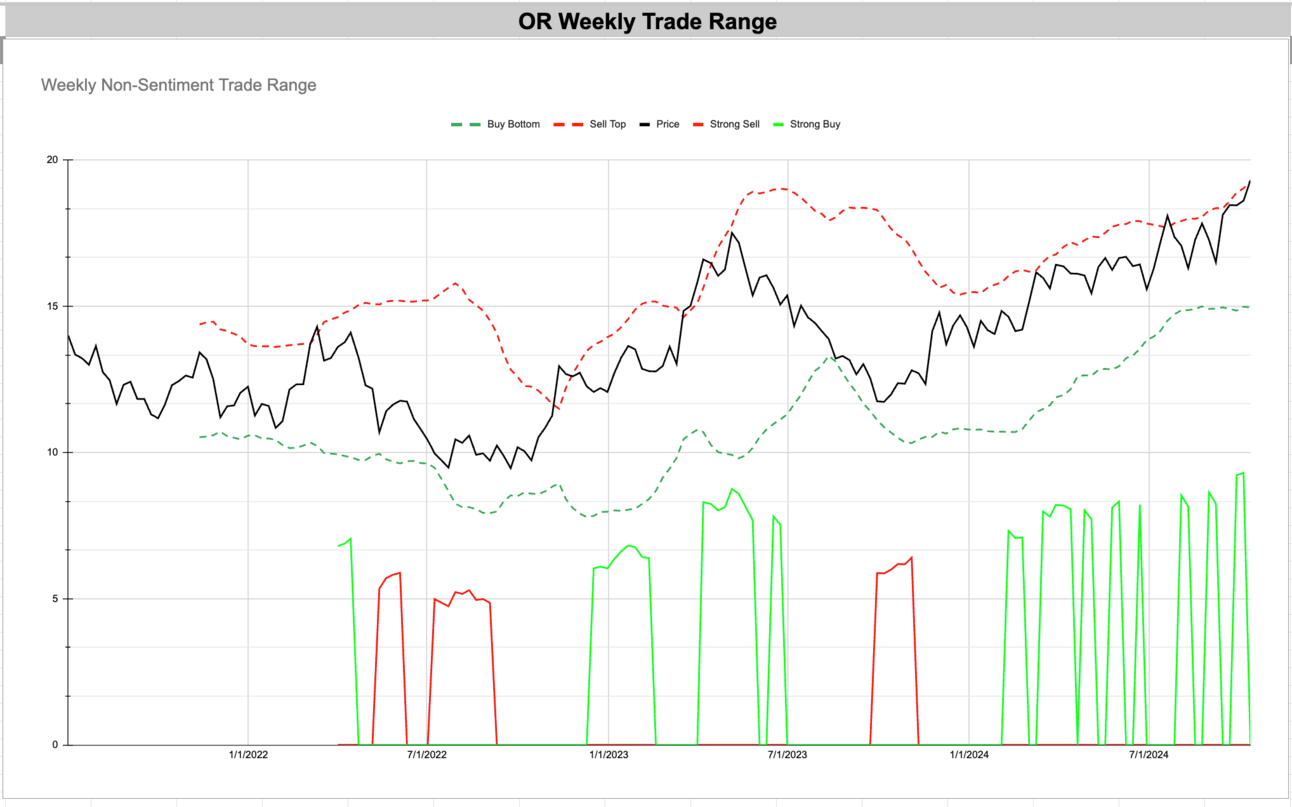

OR - Osisko Gold Royalties Ltd | Basic Materials | Canada 🇨🇦

TKNO - Alpha Teknova Inc | Healthcare | USA 🇺🇸

RYAM - Rayonier Advanced Materials Inc | Basic Materials | USA 🇺🇸

CRMD - CorMedix Inc | Healthcare | USA 🇺🇸

BBAR - BBVA Argentina ADR | Financial | Argentina 🇦🇷

AVPT - AvePoint Inc | Technology | USA 🇺🇸

SWI - SolarWinds Corp | Technology | USA 🇺🇸

CORZ - Core Scientific Inc | Technology | USA 🇺🇸

HBAN - Huntington Bancshares, Inc. | Financial | USA 🇺🇸

MAG - MAG Silver Corp. | Basic Materials | Canada 🇨🇦

OR - Osisko Gold Royalties Ltd | Basic Materials | Canada 🇨🇦

Enjoying this?

& Invite a friend.

New Highs $20+:

CAT - Caterpillar Inc | Industrials | USA 🇺🇸

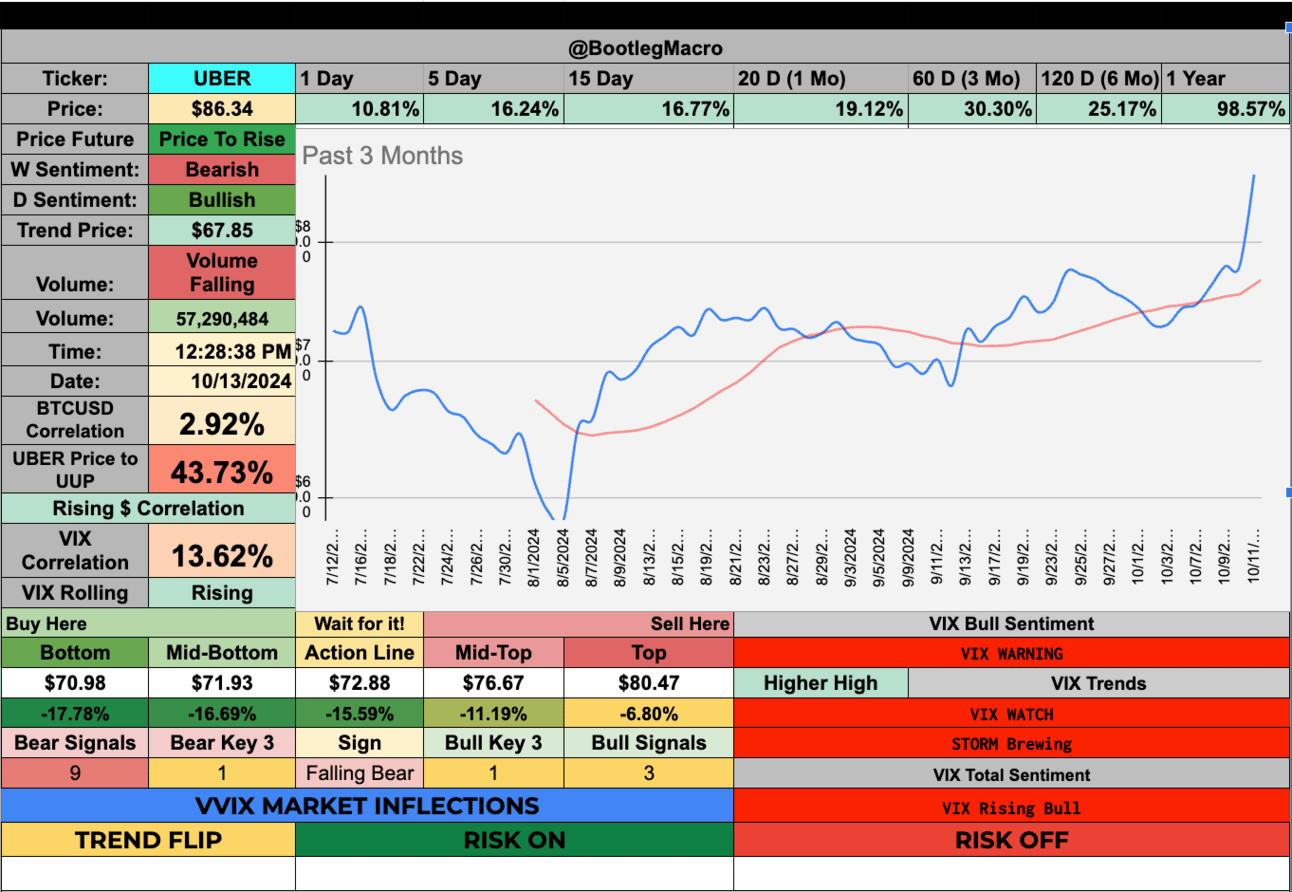

UBER - Uber Technologies Inc | Technology | USA 🇺🇸

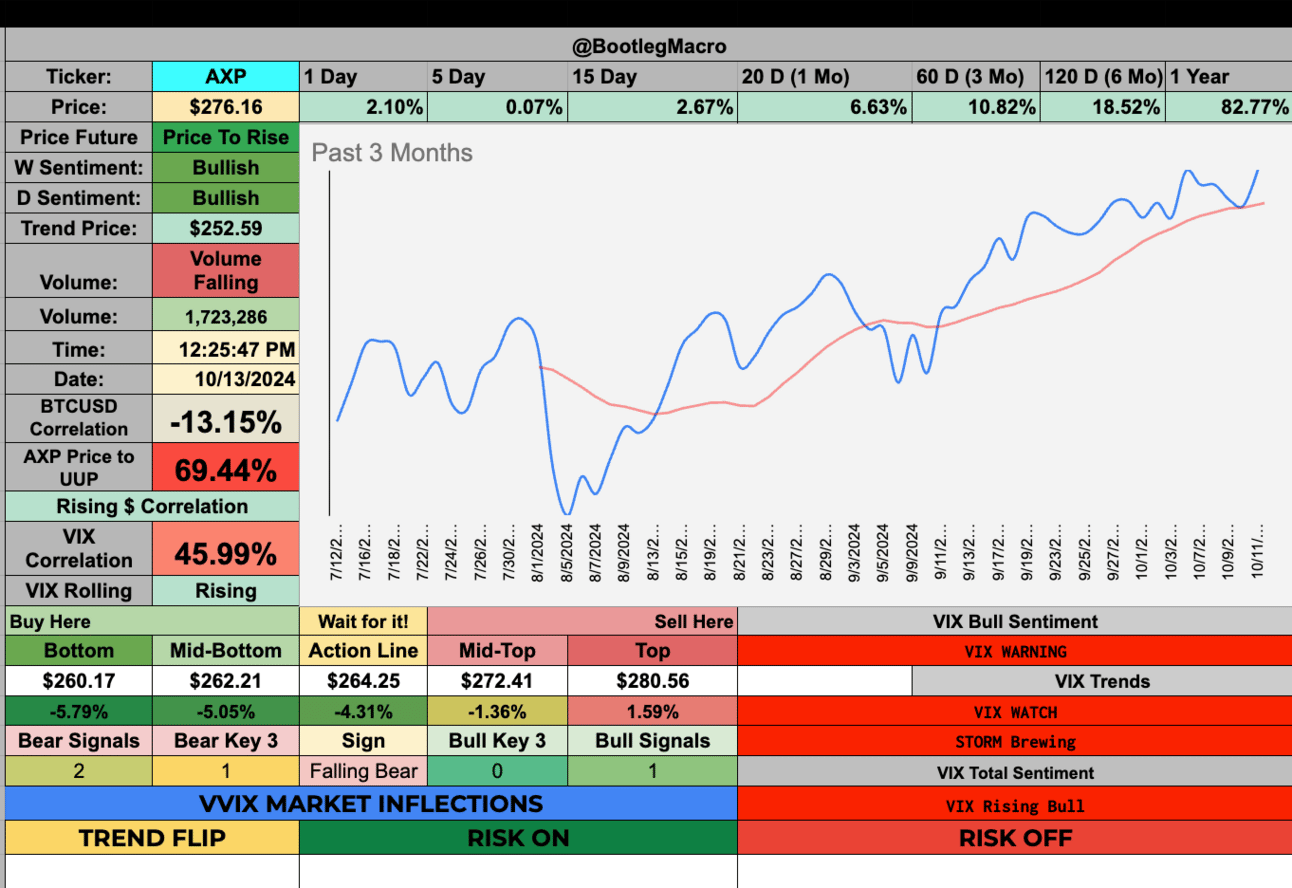

AXP - American Express Co. | Financial | USA 🇺🇸

NFLX - Netflix Inc. | Communication Services | USA 🇺🇸

MA - Mastercard Incorporated | Financial | USA 🇺🇸

PLTR - Palantir Technologies Inc | Technology | USA 🇺🇸

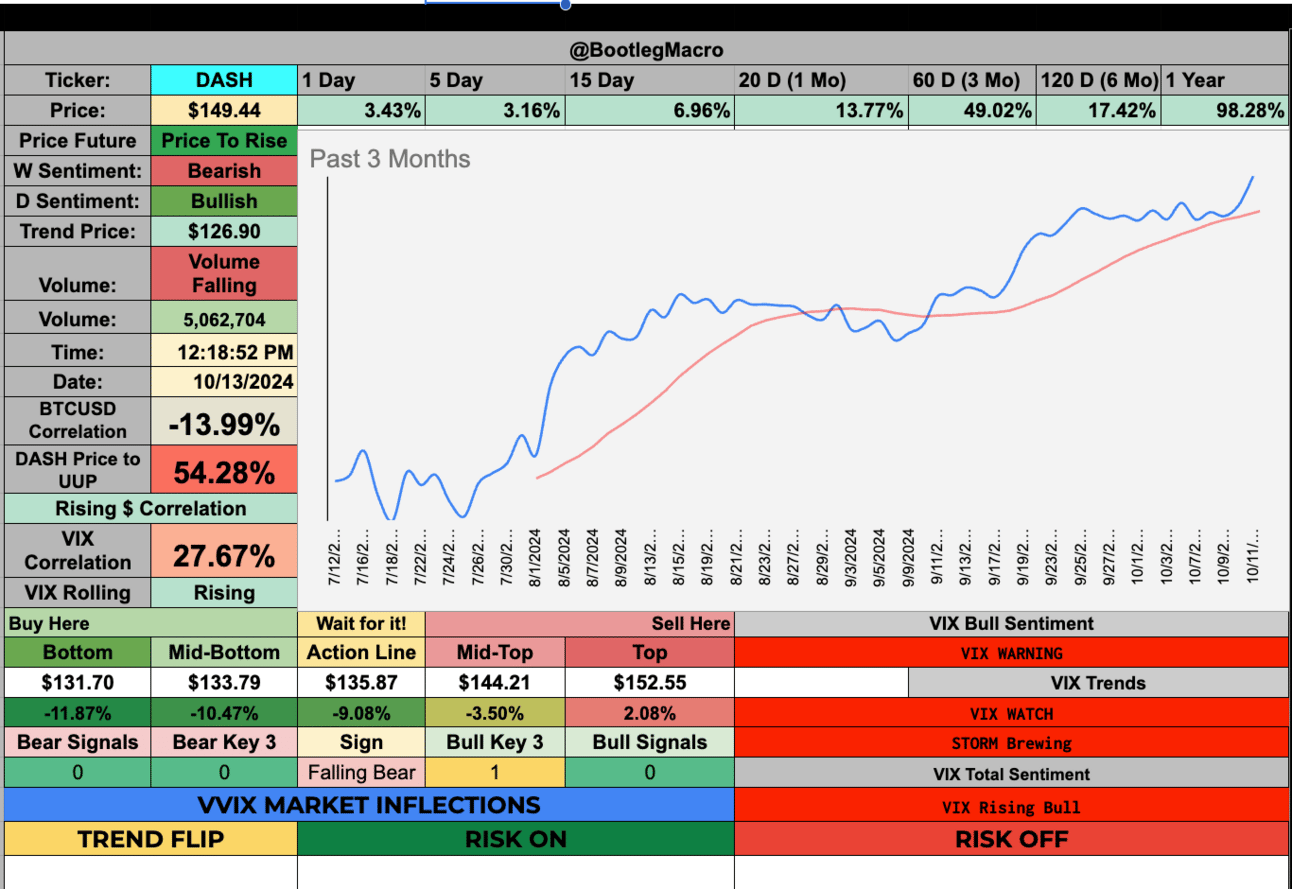

DASH - DoorDash Inc | Communication Services | USA 🇺🇸

TTD - Trade Desk Inc | Technology | USA 🇺🇸

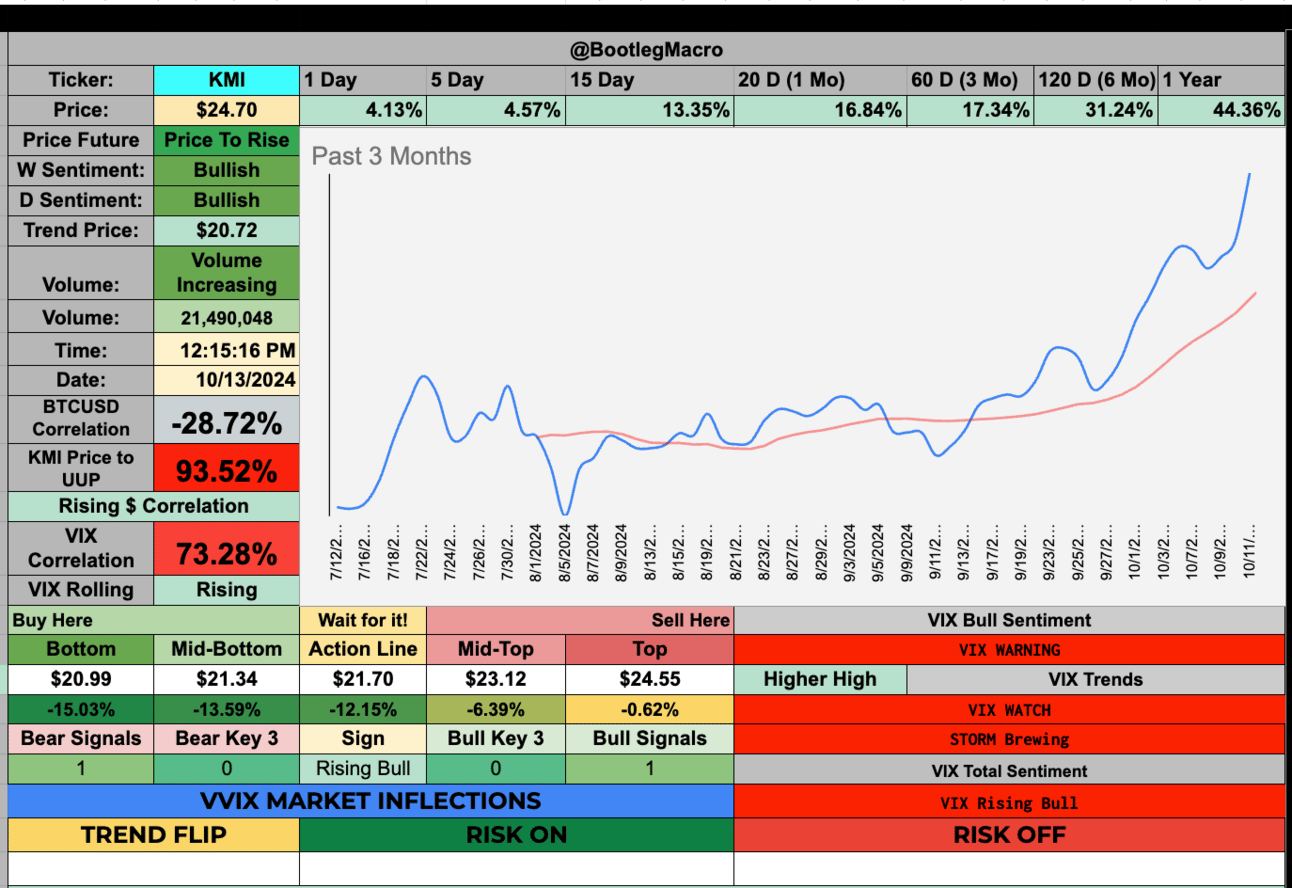

KMI - Kinder Morgan Inc | Energy | USA 🇺🇸

WMB - Williams Cos Inc | Energy | USA 🇺🇸

CAT - Caterpillar Inc | Industrials | USA 🇺🇸

As remarkable as the move has been in CAT. We can see more from there. This is a breakout going back to April 2024.

UBER - Uber Technologies Inc | Technology | USA 🇺🇸

Massive up day and week. Uber has a catalyst and presumably it will come back into the range after a bit of consolidation.

AXP - American Express Co. | Financial | USA 🇺🇸

Big up day, small up week. The price opportunity was this week. It’s probably going higher but the range will need to signal higher too.

NFLX - Netflix Inc. | Communication Services | USA 🇺🇸

Medium down day and small up week. A little shop which brought the price off the top of the range.

MA - Mastercard Incorporated | Financial | USA 🇺🇸

Medium up day and week. Even though the price is above the range, I’d buy it. I think volatility is low here and vol expansions with price breakouts are one of the purest trend following signals on the planet.

PLTR - Palantir Technologies Inc | Technology | USA 🇺🇸

Big up week and small down move on Friday. I’ll be patient here.

DASH - DoorDash Inc | Communication Services | USA 🇺🇸

Big day and week for day to the upside. It’s a higher in the range than I’d like for an initial position.

TTD - Trade Desk Inc | Technology | USA 🇺🇸

KMI - Kinder Morgan Inc | Energy | USA 🇺🇸

This moves this week are nuts.Wait for it to come back into the range at least.

WMB - Williams Cos Inc | Energy | USA 🇺🇸

A nice breakout, I’d track it but wait for it to pull lower in the range. At least after some consolidation.

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

$DIA, $RSP, $IWN, $IWO, $IWM, $SPY, $QQQ, $EEM, $EMXC, $UUP, $RVX, $VIX, $VVIX, $TLT, $IEF, $SHY, $TNX, $FVX, $FXI, $OVX, $USO, $OILK, $GLD, $GVZ, $SLV, $CPER, $GBTC, $ETHE, $AAPL, $AMZN, $CRM, $NVDA, $META, $GOOG, $MSFT, $TSLA, $UNH

— BootlegMacro (@bootlegmacro)

5:21 AM • Oct 11, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro