- The New High Newsletter

- Posts

- Who Spooked Markets?

Who Spooked Markets?

Is the market sniffing out the US government shutdown which is now only 3 weeks away? I suspect July 2025 prices will be higher than today's...so I know what I'll do with these spooked markets.

Market Performance Framework

Market Overview:

Did Friday’s price action scare you? Well maybe the market’s uncertainty surrounding the US governments funding in March is clouding it’s vision. Because we should be expecting tax cuts, government spending and moderate growth/inflation into summer. Those are all moderately bullish factors for the market.

Key Focus Area:

In a moderate growth environment, I’ll focus on massive growth stocks. As shocking as it seems, I’m looking at things like AT&T or Mr. Cooper (mortgage servicer) because domestic businesses have an upper hand in earnings.

Current Outlook and Indicators:

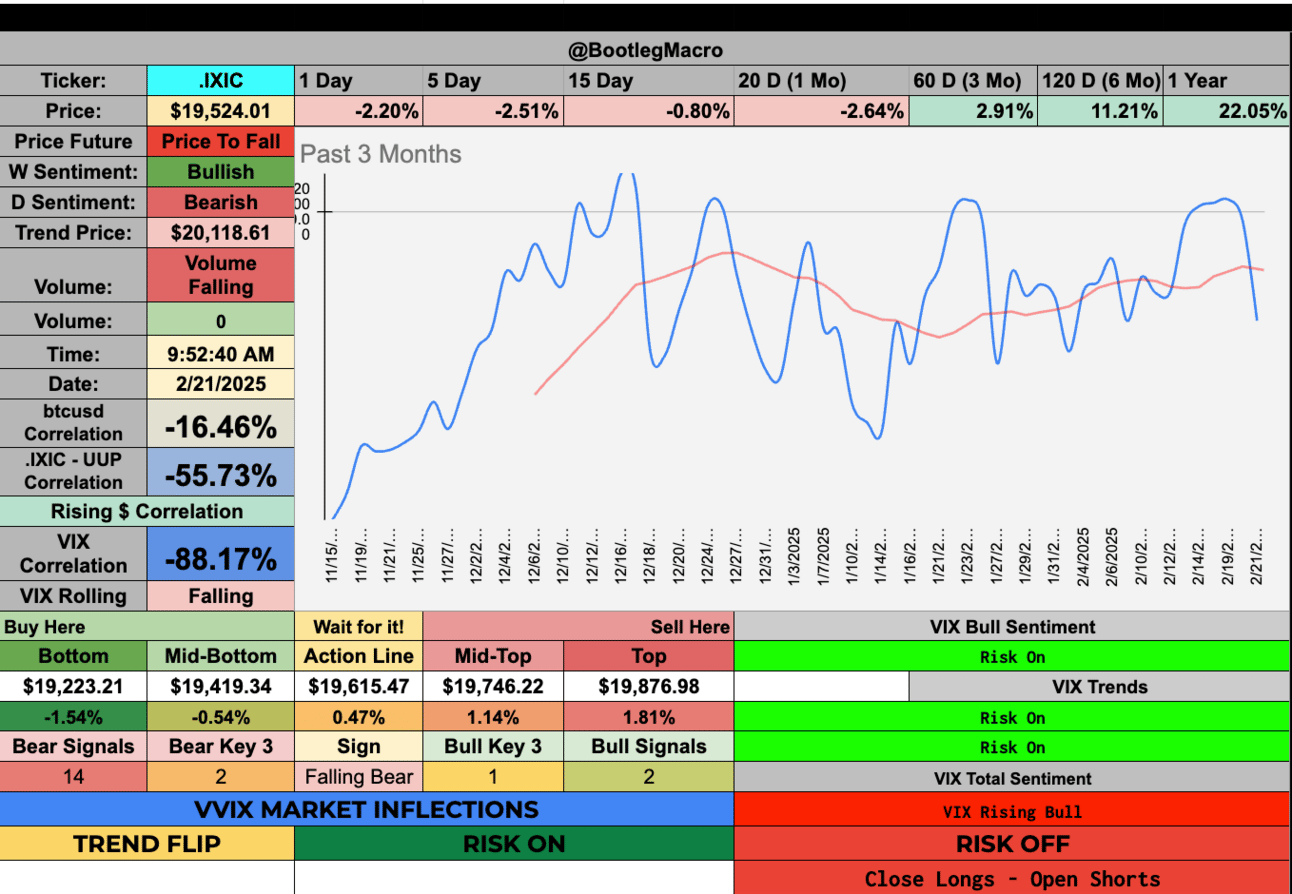

The VIX showed a massive breakout due to Friday’s sell off. This should be short-lived but it can offer opportunities. Downside slides will give prices you’ll wish for in July of 2025. This is how I’m viewing the recent volatility.

Long-Term View:

Long-term like 12-18 months from now, I could see massive government deficits. Tax cuts implemented and a resolution to the Ukraine-Russia war. It looks BULLISH still but I’ll be wary of any major changes.

Closing Speculation or Questions:

Indexes all need to carry through and close higher by April 1st…which means…these prices are going to be fantastic entries if this BULL MARKET continues into the summer. What will you wish you did in July 2025? Because you can make wonderful decisions this week.

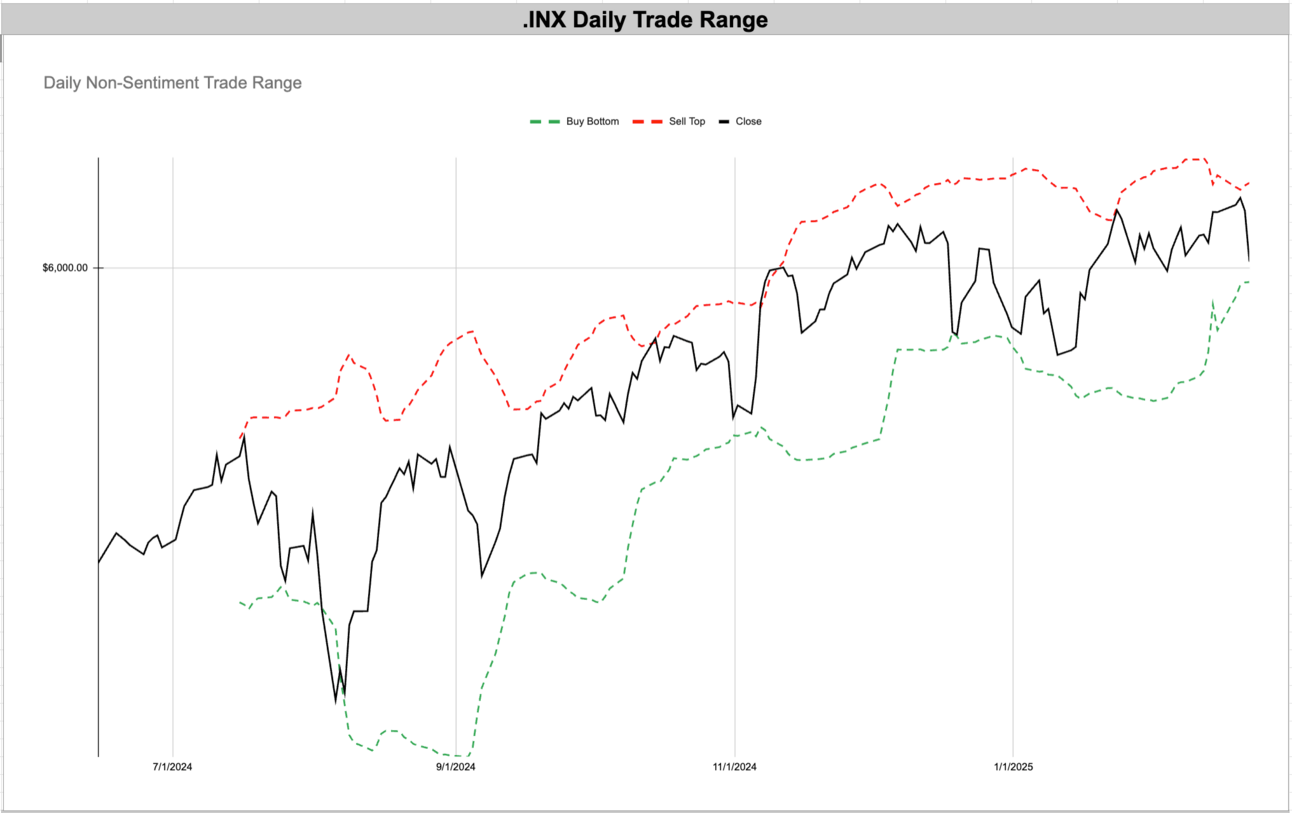

The index appear to be in a great spot to buy — price needs to hold the 3 month rolling return.

I’ll like to see the top of the range break higher. That’s the type of signal I’d need to be more bullish.

The DOW looks terrible compared — It’s negative on a 3 month rolling return — sell all exposure for now.

Yuck, that’s a bad range.

This is normal behavior after breaking an all-time-high during consolidation - make people true believers.

I need to see the top of the range breakout to an ALL-TIME-HIGH. Price can make it happen.

Volatility Corner Framework

Indicator Update:

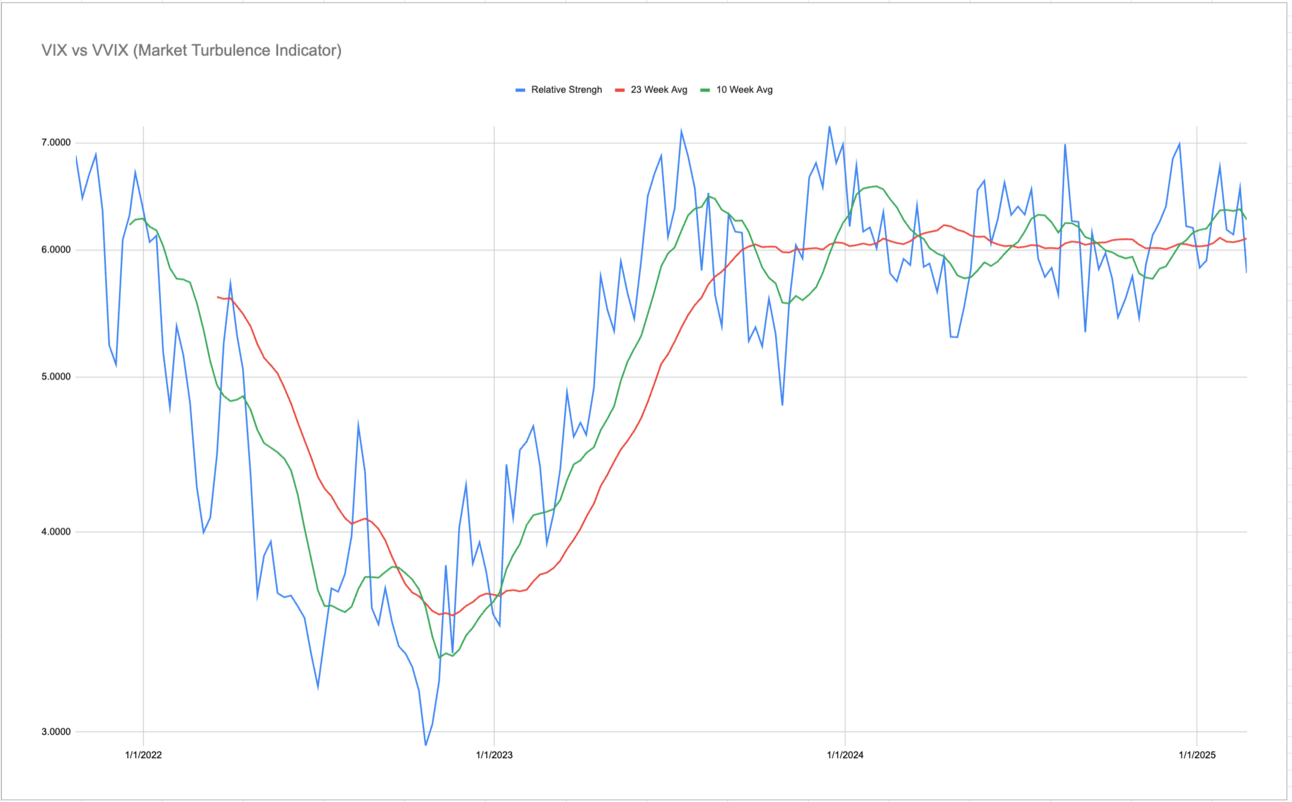

The turbulence indicator slashed lower. Historically, down moves during this sideways channel are BULLISH. We can talk headlines, expectations, rate cuts, tariffs, tweets or whatever…history says ignore and buy the dip. I’ll follow it unless I see the indexes break their 5 month rolling positive returns.

We’ve been in this sideways channel since 7/24/23 - markets are up over 50% since then!

Technical Context:

The VIX can break up to $20 but I don’t suspect anything sustained above the level. We should see this as opportunity to enter into the market for the summer breakouts. (That’s how I’m playing this setup.)

Risk Assessment:

Long-term optimistic. Short-term realistic. Medium-term, agnostic to anything except paradigm shifting panics.

Actionable Insight:

I’m buying dips and DCA into growth indexes. What is my other choice? Expect a BEARISH turn in a world gaining certainty?

The chop of the turbulence indicator has been BULLISH - this was a big drop.

Big up week for the VIX - up 23% for the week - Friday’s close was an opportunity.

MACRO INDICATOR:

Big week for the VIX

MACRO SEASON: BULLISH Since 1/24/25🟢

MICRO WEATHER: BEARISH Since 12/26/24🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

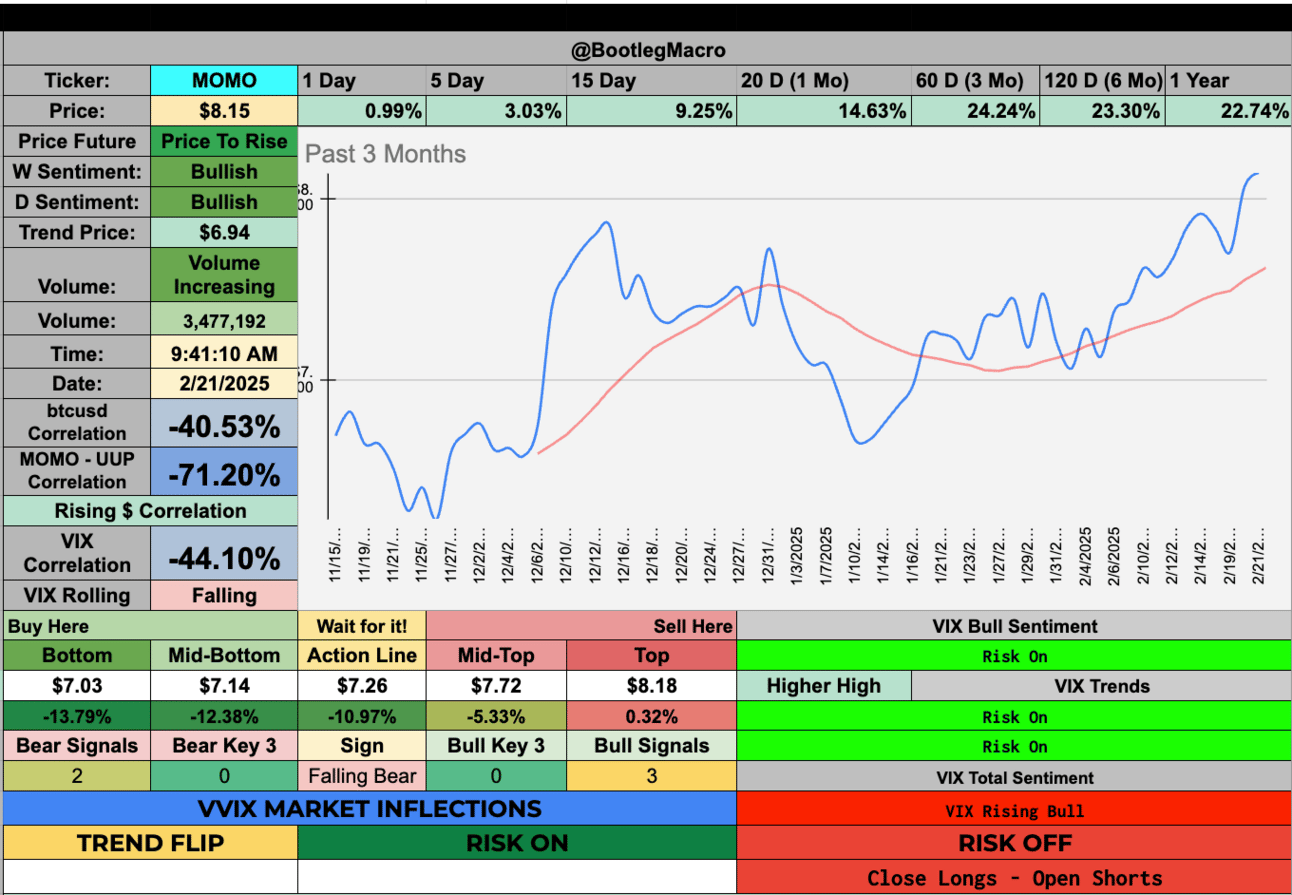

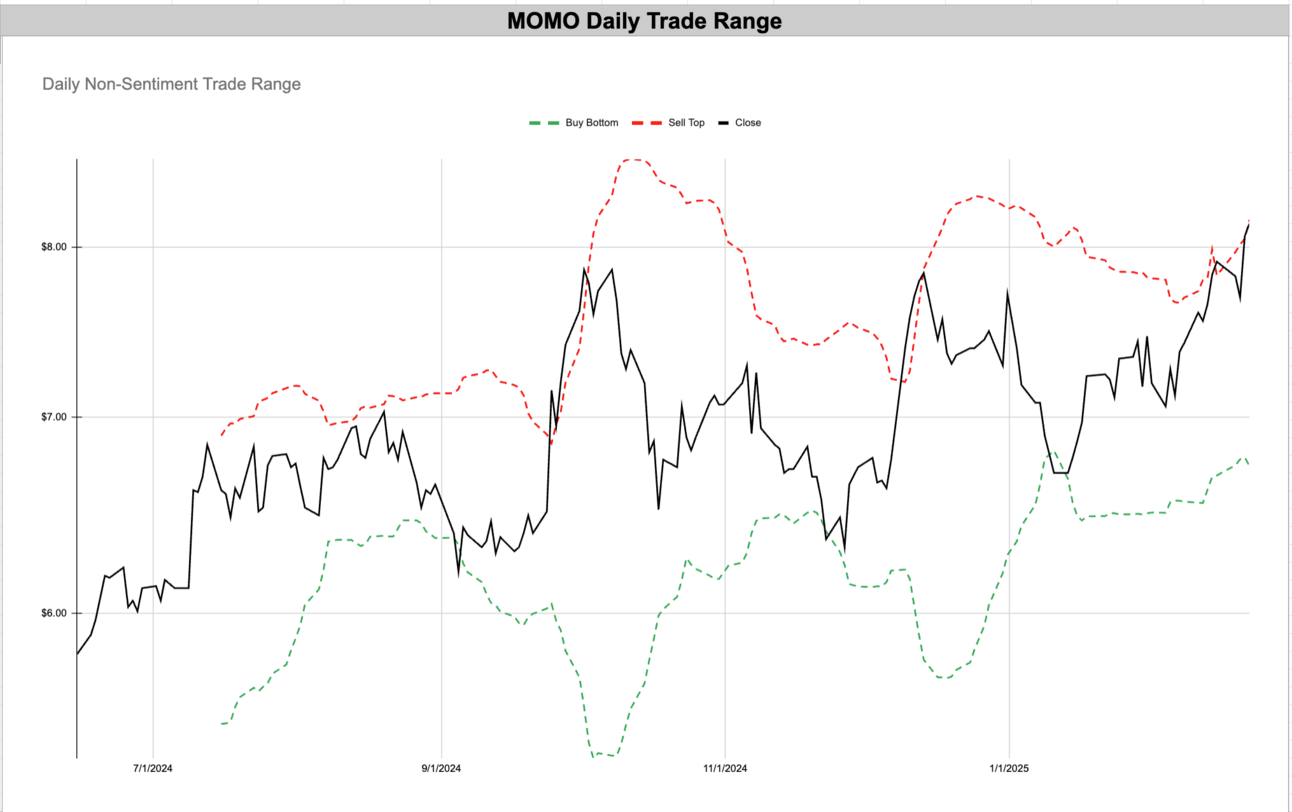

MOMO – Hello Group Inc ADR – Communication Services – China 🇨🇳

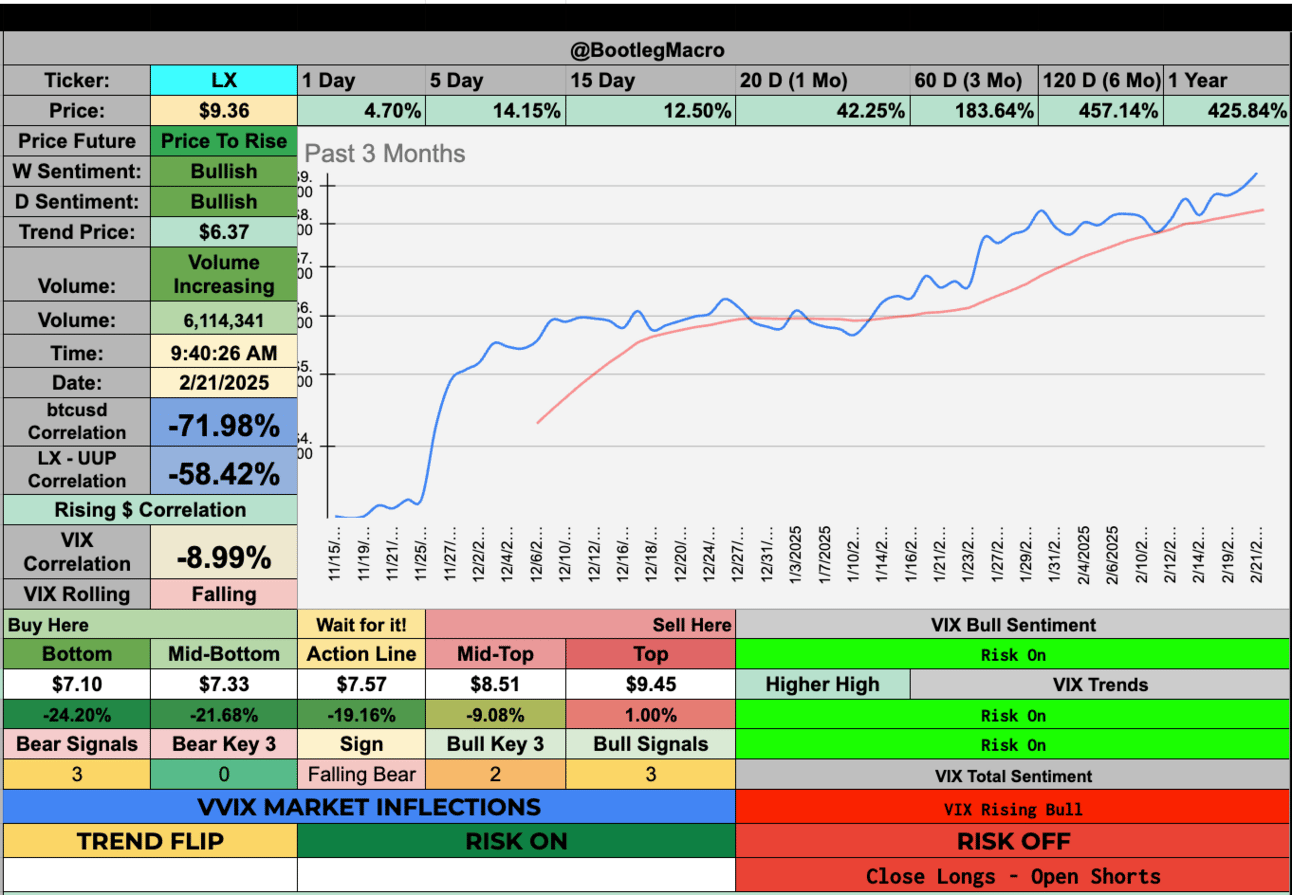

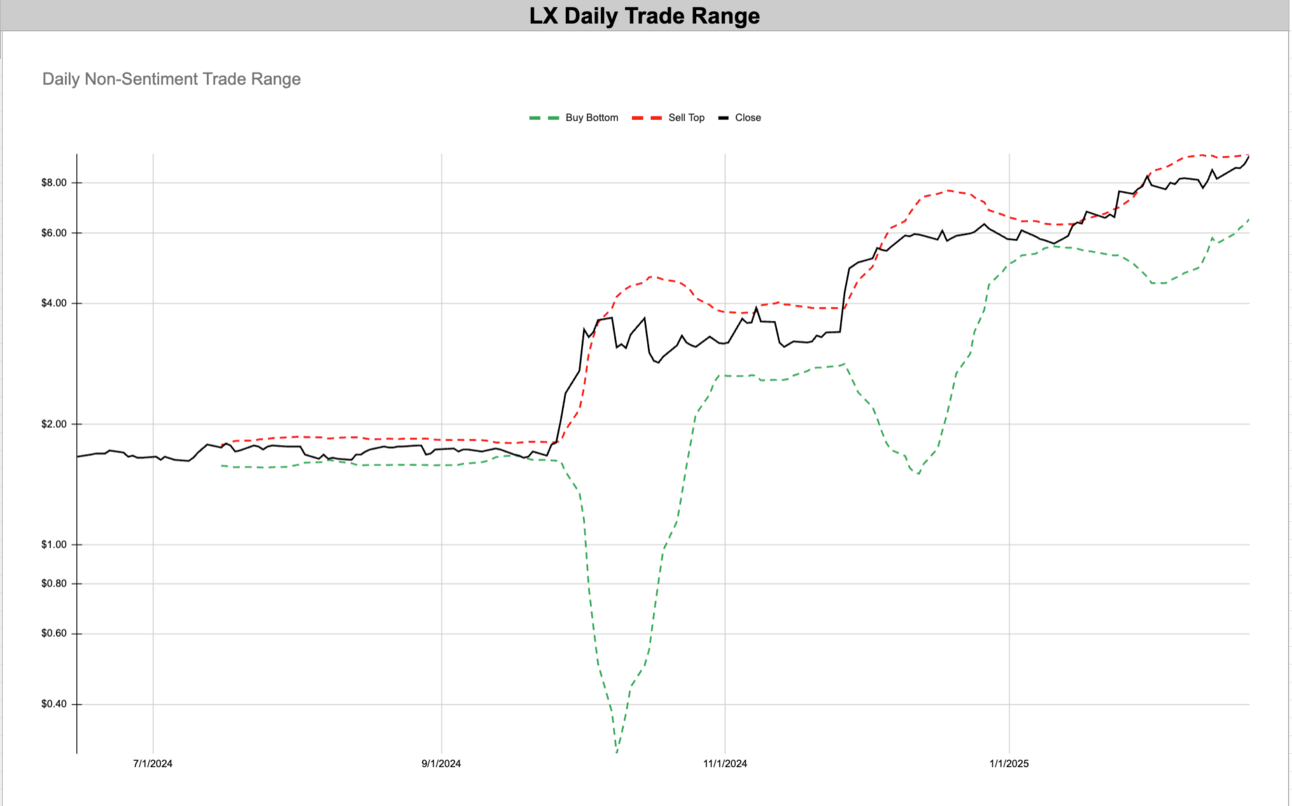

LX – LexinFintech Holdings Ltd ADR – Financial – China 🇨🇳

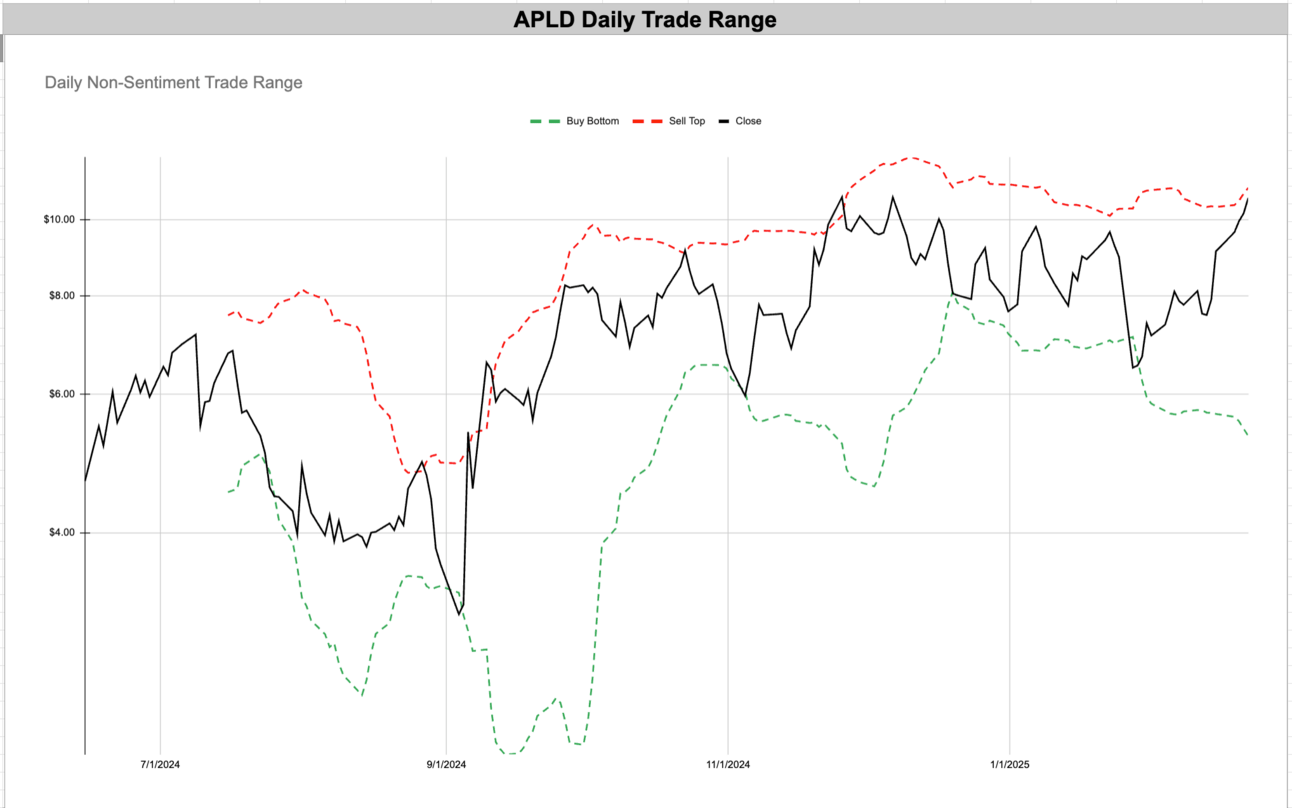

APLD – Applied Digital Corporation – Technology – USA 🇺🇸

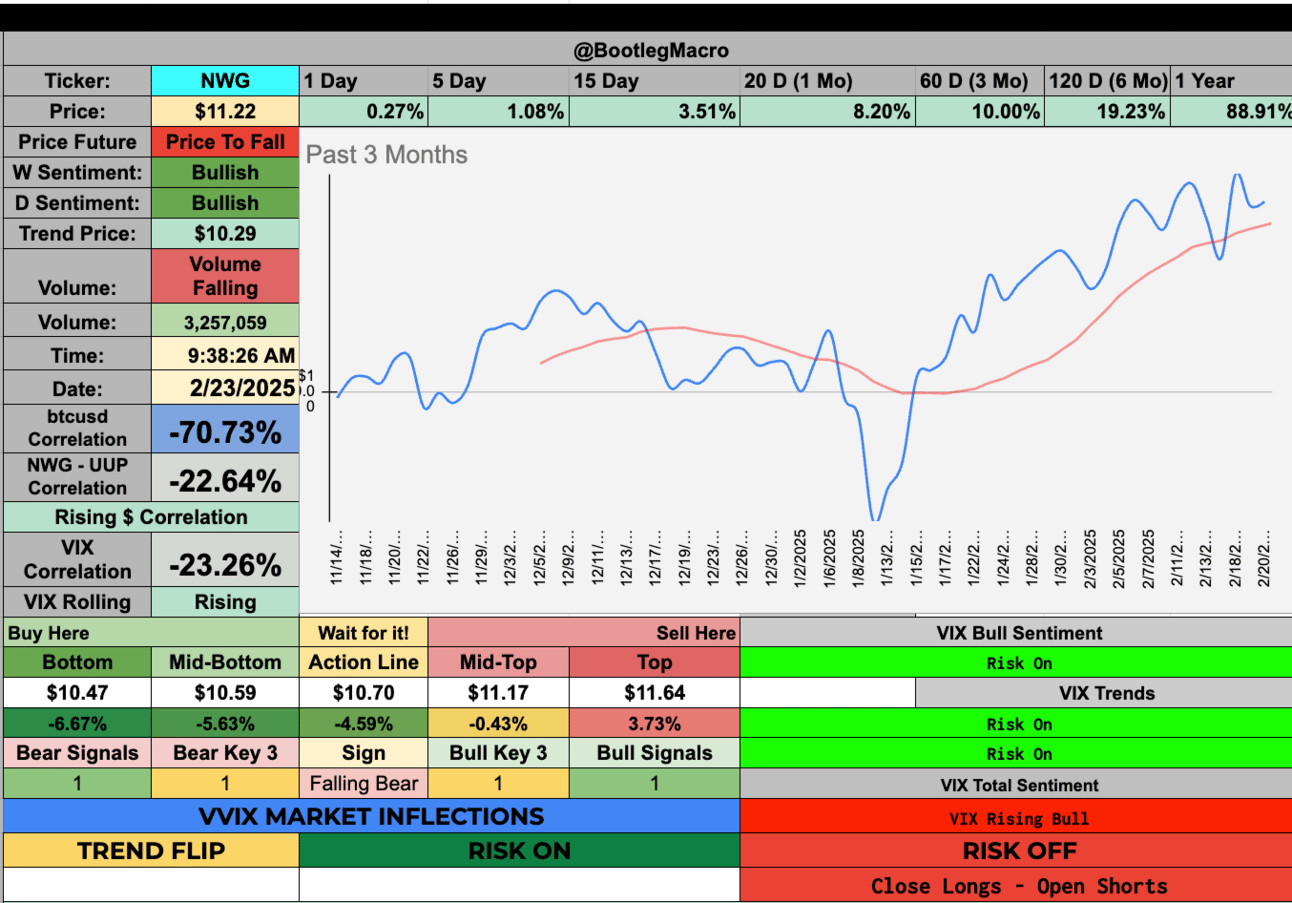

NWG – NatWest Group Plc ADR – Financial – United Kingdom 🇬🇧

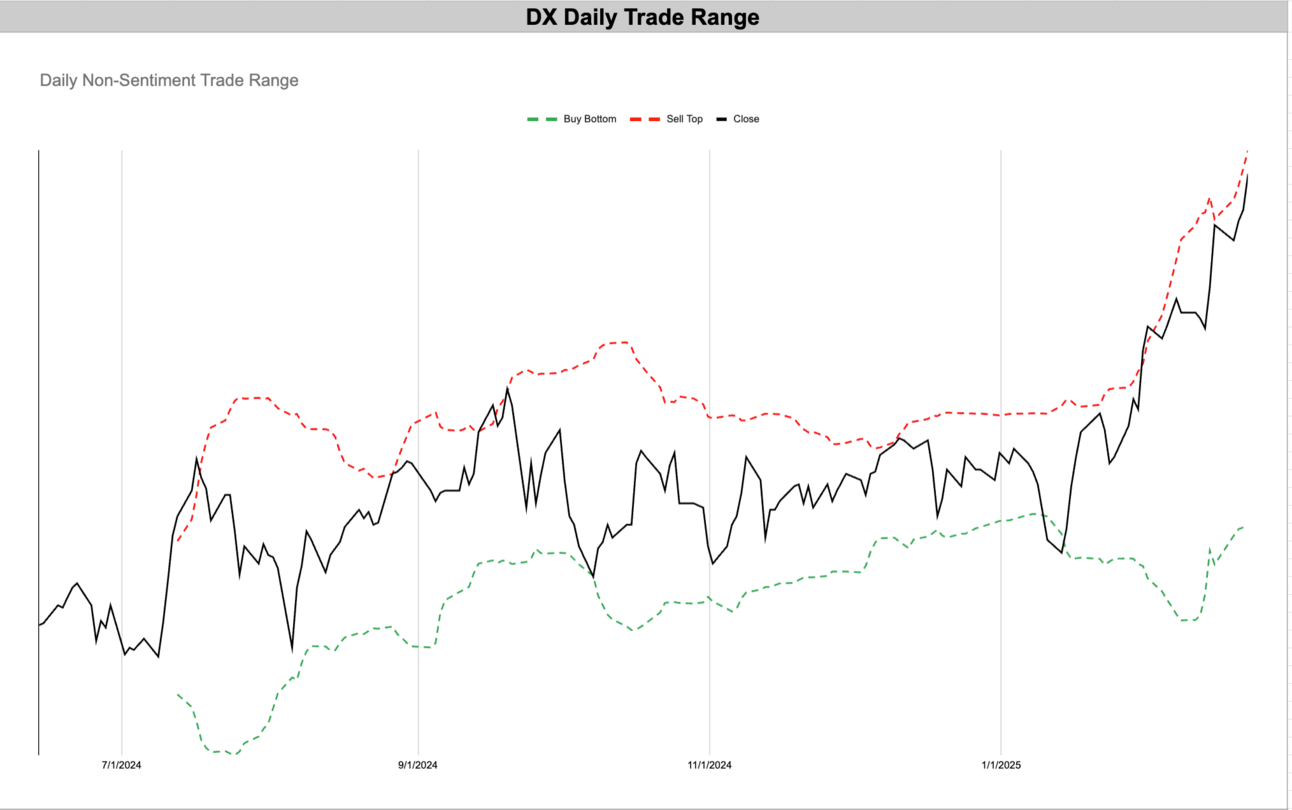

DX – Dynex Capital, Inc – Real Estate – USA 🇺🇸

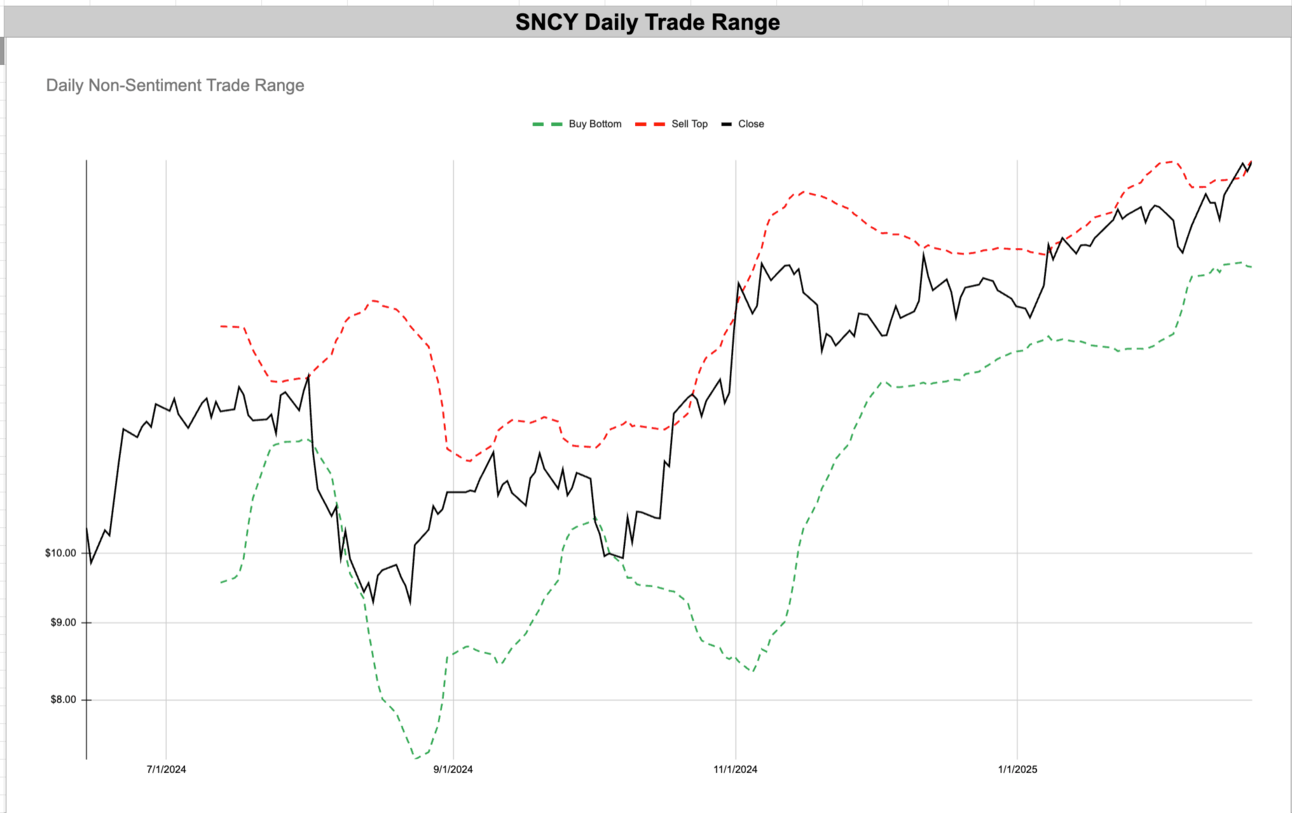

SNCY – Sun Country Airlines Holdings Inc – Industrials – USA 🇺🇸

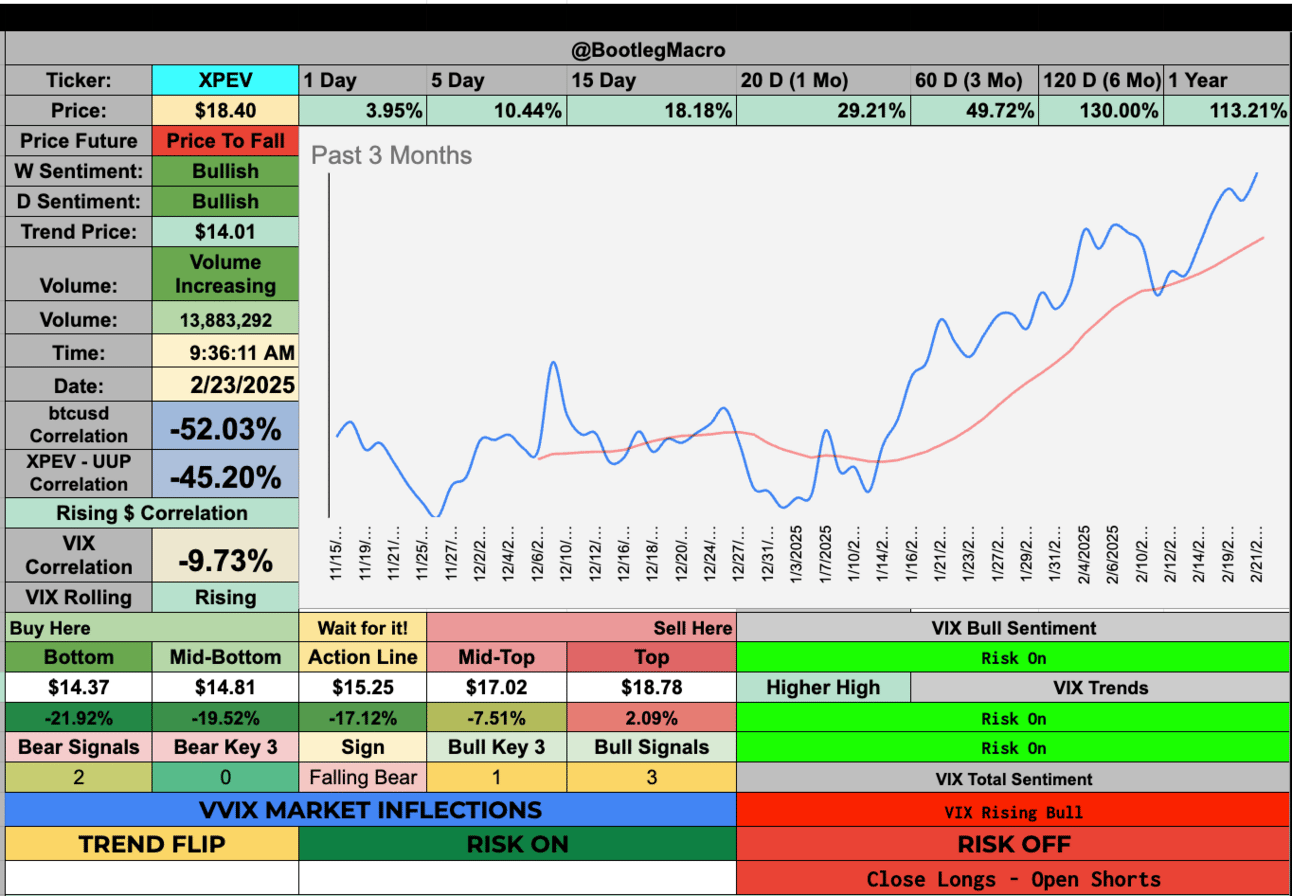

XPEV – XPeng Inc ADR – Consumer Cyclical – China 🇨🇳

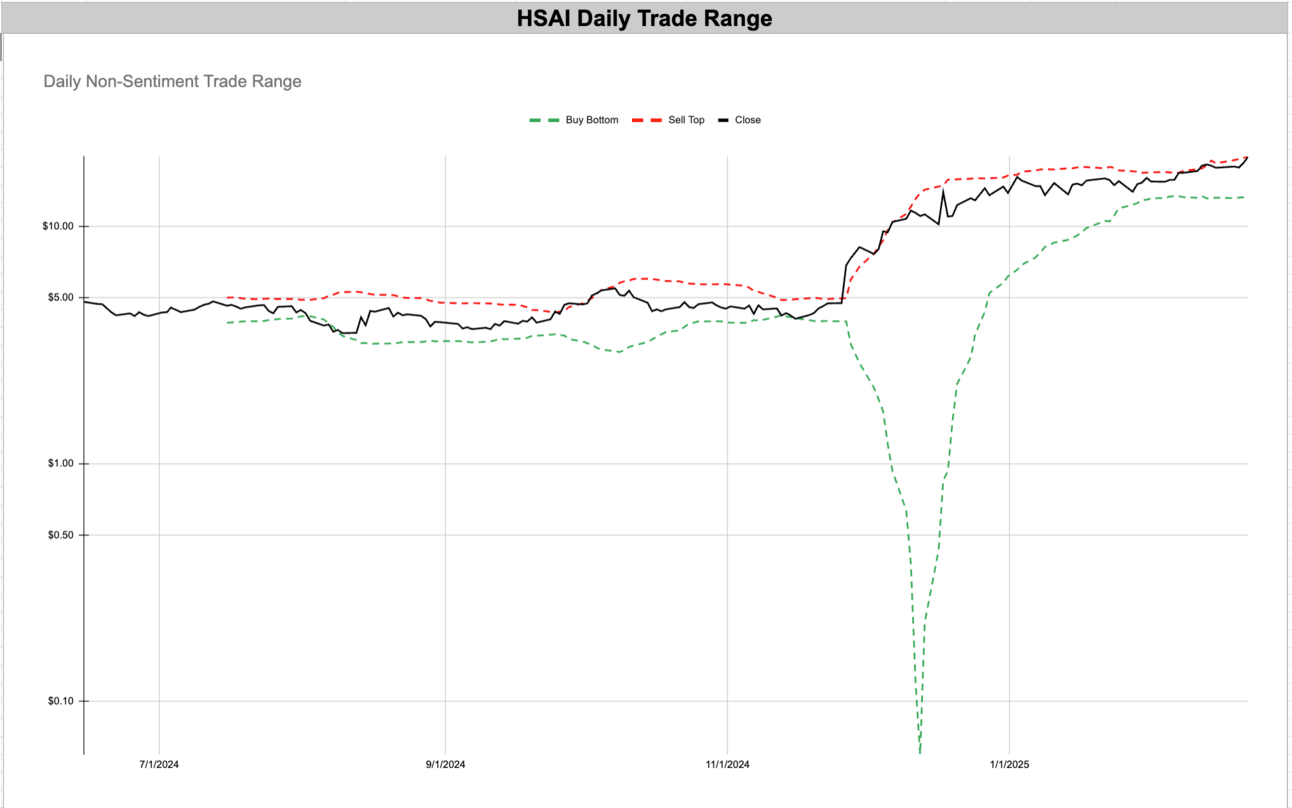

HSAI – Hesai Group ADR – Consumer Cyclical – China 🇨🇳

MOMO – Hello Group Inc ADR – Communication Services – China 🇨🇳

LX – LexinFintech Holdings Ltd ADR – Financial – China 🇨🇳

APLD – Applied Digital Corporation – Technology – USA 🇺🇸

NWG – NatWest Group Plc ADR – Financial – United Kingdom 🇬🇧

DX – Dynex Capital, Inc – Real Estate – USA 🇺🇸

SNCY – Sun Country Airlines Holdings Inc – Industrials – USA 🇺🇸

XPEV – XPeng Inc ADR – Consumer Cyclical – China 🇨🇳

HSAI – Hesai Group ADR – Consumer Cyclical – China 🇨🇳

Enjoying this?

& Invite a friend.

New Highs $20+:

COOP – Mr. Cooper Group Inc – Financial – USA 🇺🇸

WH – Wyndham Hotels & Resorts Inc – Consumer Cyclical – USA 🇺🇸

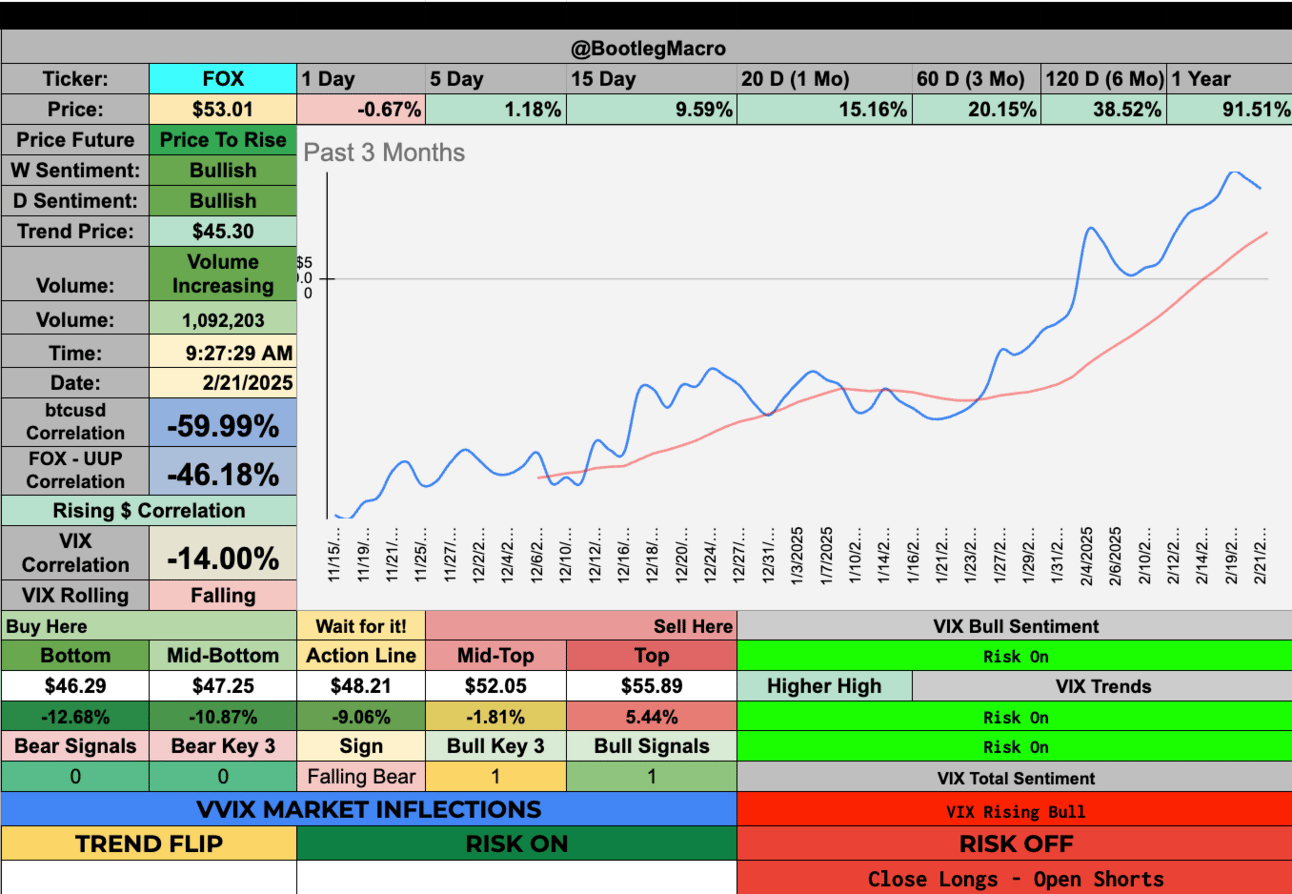

FOX – Fox Corporation – Communication Services – USA 🇺🇸

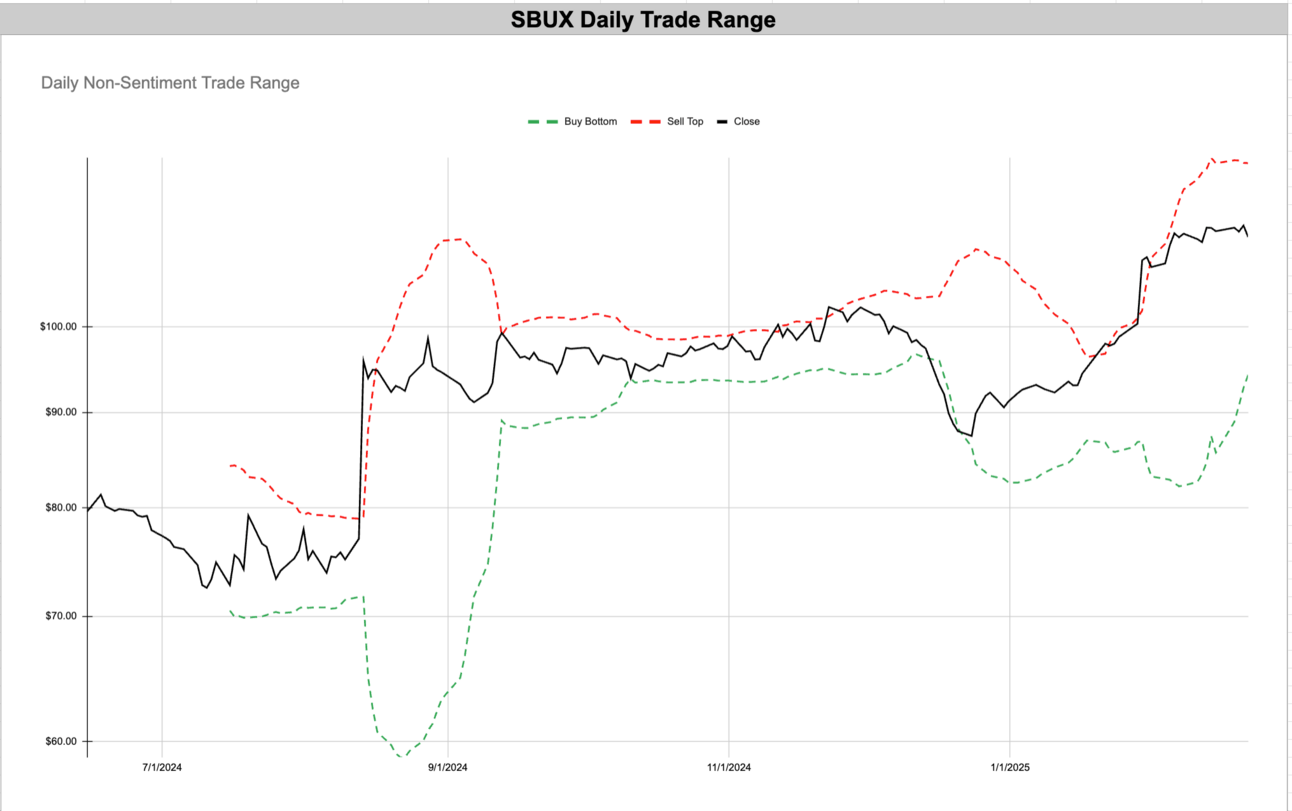

SBUX – Starbucks Corp – Consumer Cyclical – USA 🇺🇸

T – AT&T, Inc – Communication Services – USA 🇺🇸

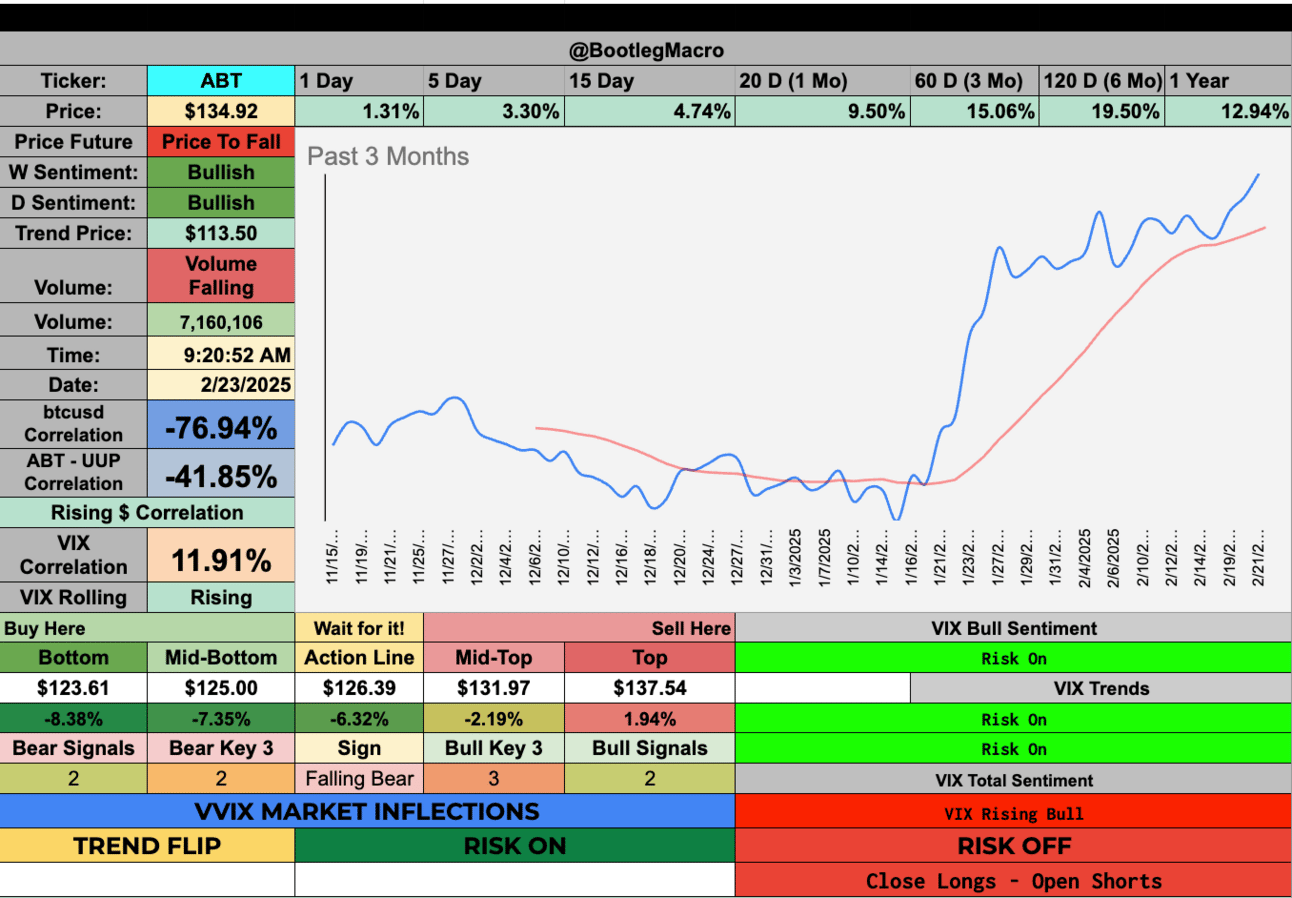

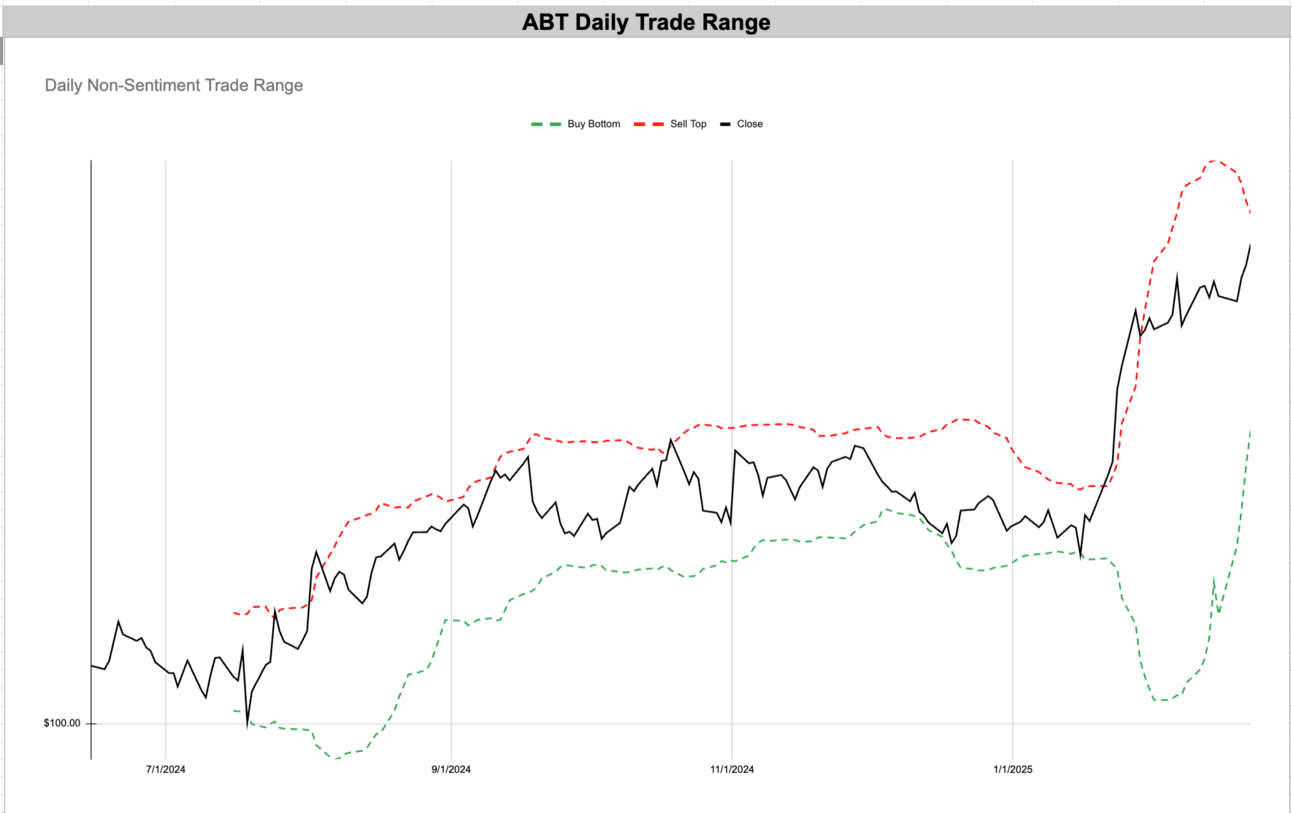

ABT – Abbott Laboratories – Healthcare – USA 🇺🇸

PM – Philip Morris International Inc – Consumer Defensive – USA 🇺🇸

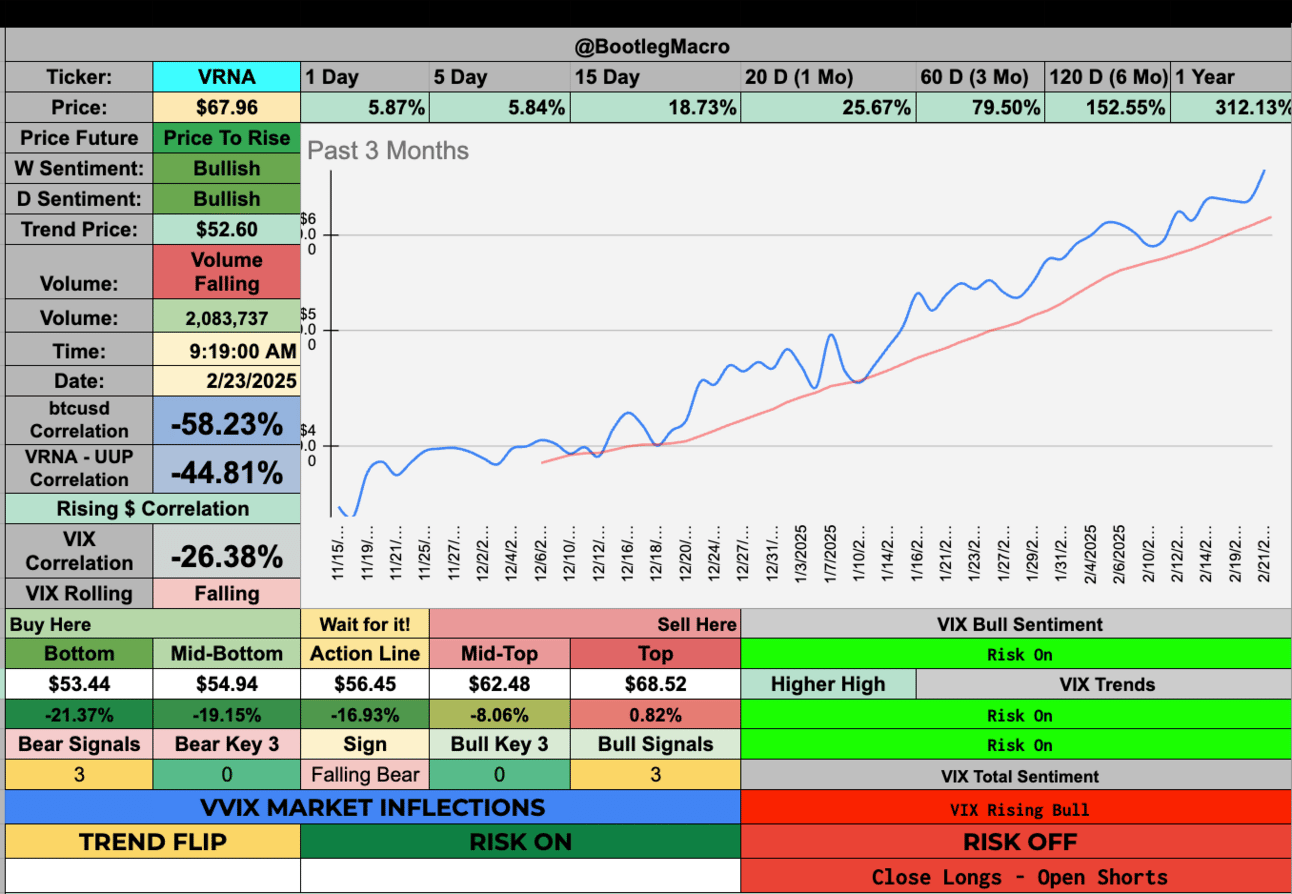

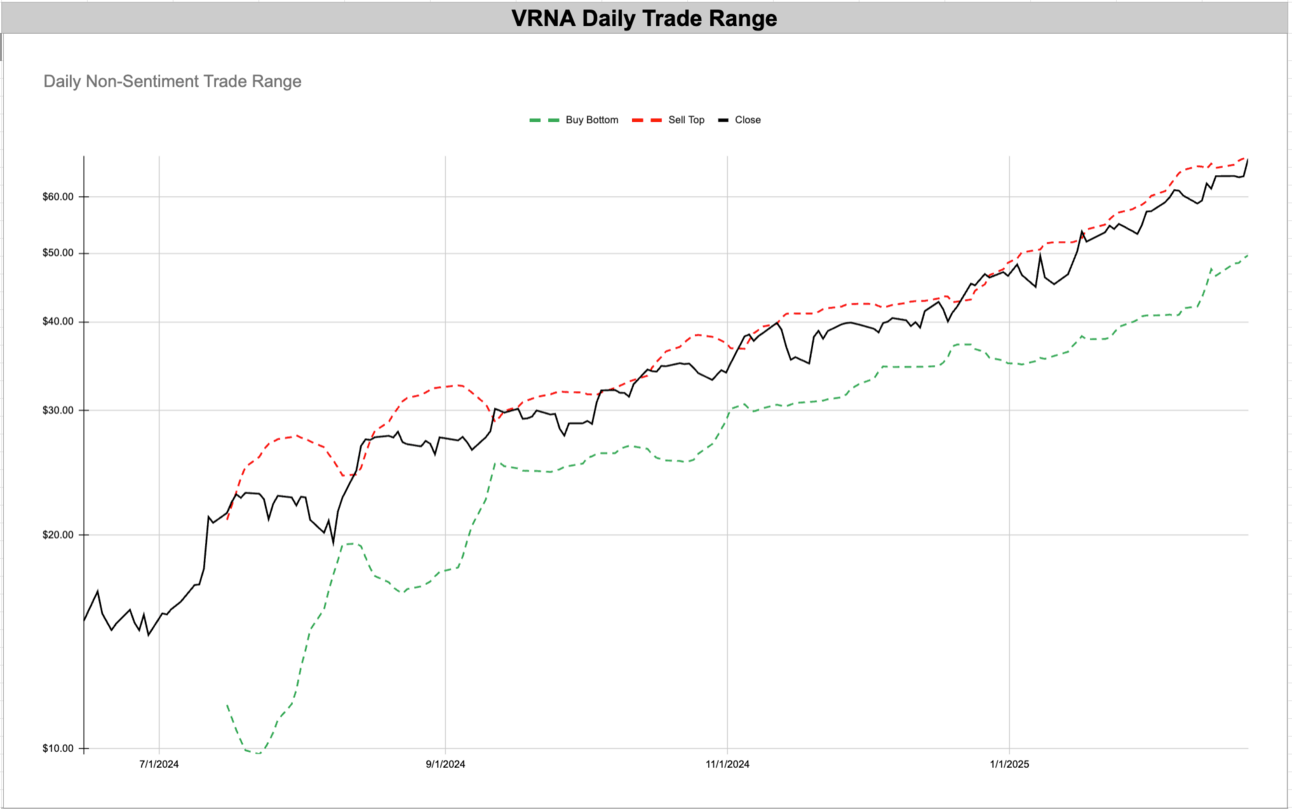

VRNA – Verona Pharma Plc ADR – Healthcare – United Kingdom 🇬🇧

COOP – Mr. Cooper Group Inc – Financial – USA 🇺🇸

FOX – Fox Corporation – Communication Services – USA 🇺🇸

WH – Wyndham Hotels & Resorts Inc – Consumer Cyclical – USA 🇺🇸

SBUX – Starbucks Corp – Consumer Cyclical – USA 🇺🇸

T – AT&T, Inc – Communication Services – USA 🇺🇸

ABT – Abbott Laboratories – Healthcare – USA 🇺🇸

PM – Philip Morris International Inc – Consumer Defensive – USA 🇺🇸

VRNA – Verona Pharma Plc ADR – Healthcare – United Kingdom 🇬🇧

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

What's happening with the USD? $UUP - that's the biggest question...it's had consolidation for the past few weeks.

It dropped and now it's not trending...yet.

— BootlegMacro (@bootlegmacro)

5:01 PM • Feb 9, 2025

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro