- The New High Newsletter

- Posts

- 20+ New Highs to Prove, It's STILL a BULL MARKET

20+ New Highs to Prove, It's STILL a BULL MARKET

Who do you believe pundits or price? Everyone is worried they will lose. It’s natural to be risk-averse. Humans survive due to our respect for risk. But when evidence shows itself you...believe it.

Doesn’t it seem like everything is scary and terrible in markets? When I watch youtube shows, everyone is selling fear.

“Is SPY 5000 time to sell?”

“Market-choppiness ahead?”

“Market surprise? We see one you might not!”

It’s all clickbait for views. None of it is for markets. The content of the internet has a general sentiment too. Just like markets. The question is, are you letting the sentiment impact your market view?

Don’t.

Everyone is worried they will get rug pulled again? Yes, it’s true in 2021 when the good-times were rolling…people did get rug pulled.

But remember…that was due to bad actors (Raoul Pal), not the markets themselves. Markets have both sinners and saints. Patrons, pensioners and prisoners.

Everyone is worried they will lose. It’s natural to be risk-averse. Humans survive due to our respect for risk.

But when evidence shows itself you…believe it. Listen to this talk with Jeremy Siegel, he lays out evidence of a BULLISH bias.

Bullishness is rampant right now. This week alone we saw S&P500 up 1.37%, Nasdaq up 2.31% and Dow Jones up 0.04%

Who do you believe pundits or price?

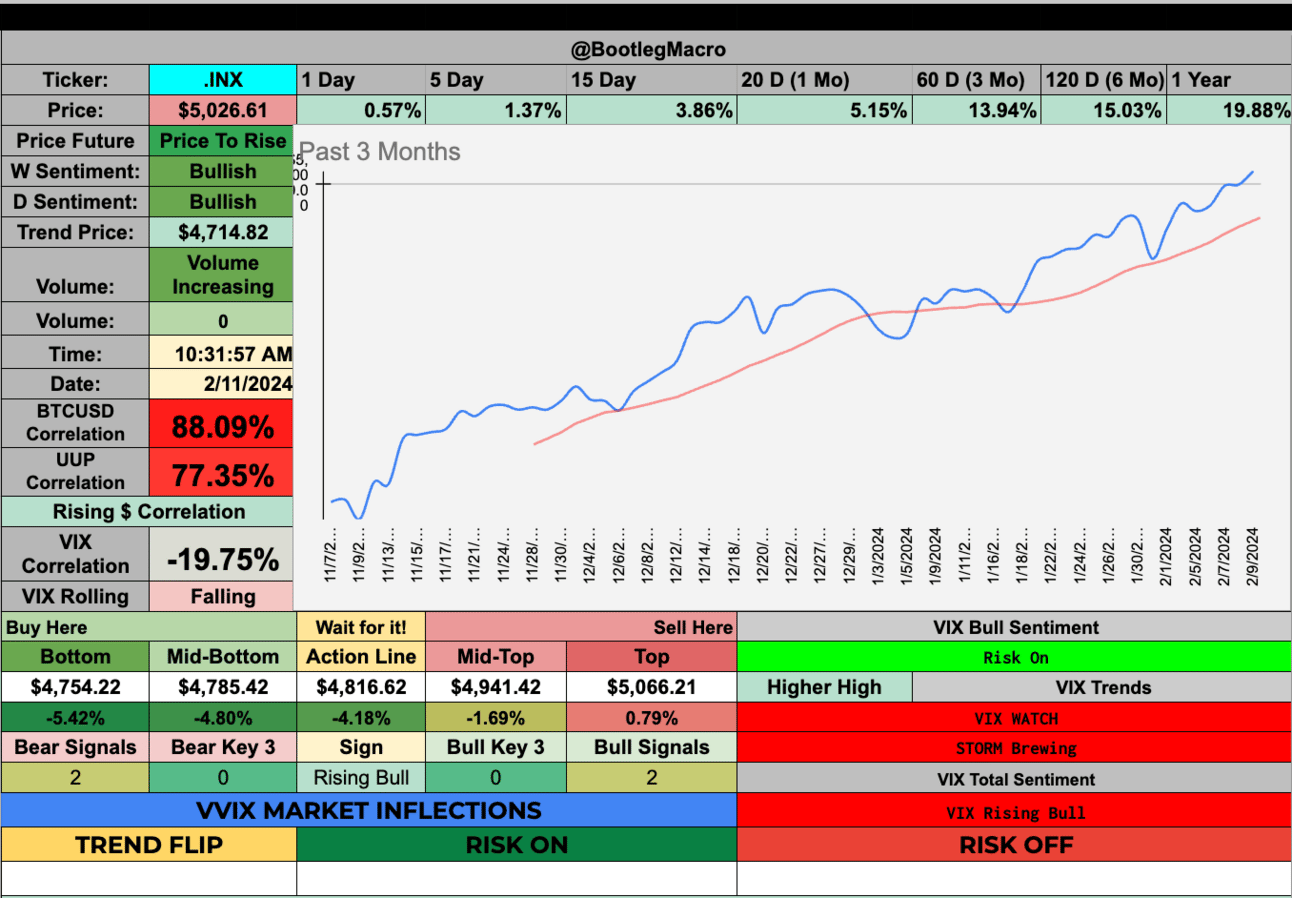

Market Performance

Below there are weekly charts for the S&P500 (.INX), Dow Jones (.DJI) and Nasdaq (.IXIC) - remind yourself, we see BULLISH sentiment on the weekly. Weekly sentiment is very LONG-TERM, this reflects MONTHLY SENTIMENT and QUARTERLY SENTIMENT.

The strongest BULLISH SIGNAL is HIGHER-HIGHs in the WEEKLY RANGE and HIGHER-LOWs. The reverse is true for BEARISH SIGNALS…but we see no BEARISHNESS in the index.

The index continues a steady rise. Red-days should be bought.

The DOW is doing well but tech is really starting to perform pulling the other indexes much more in the market recently.

Tech continues it’s dominance. All weakness will be bought by me.

Volatility Corner:

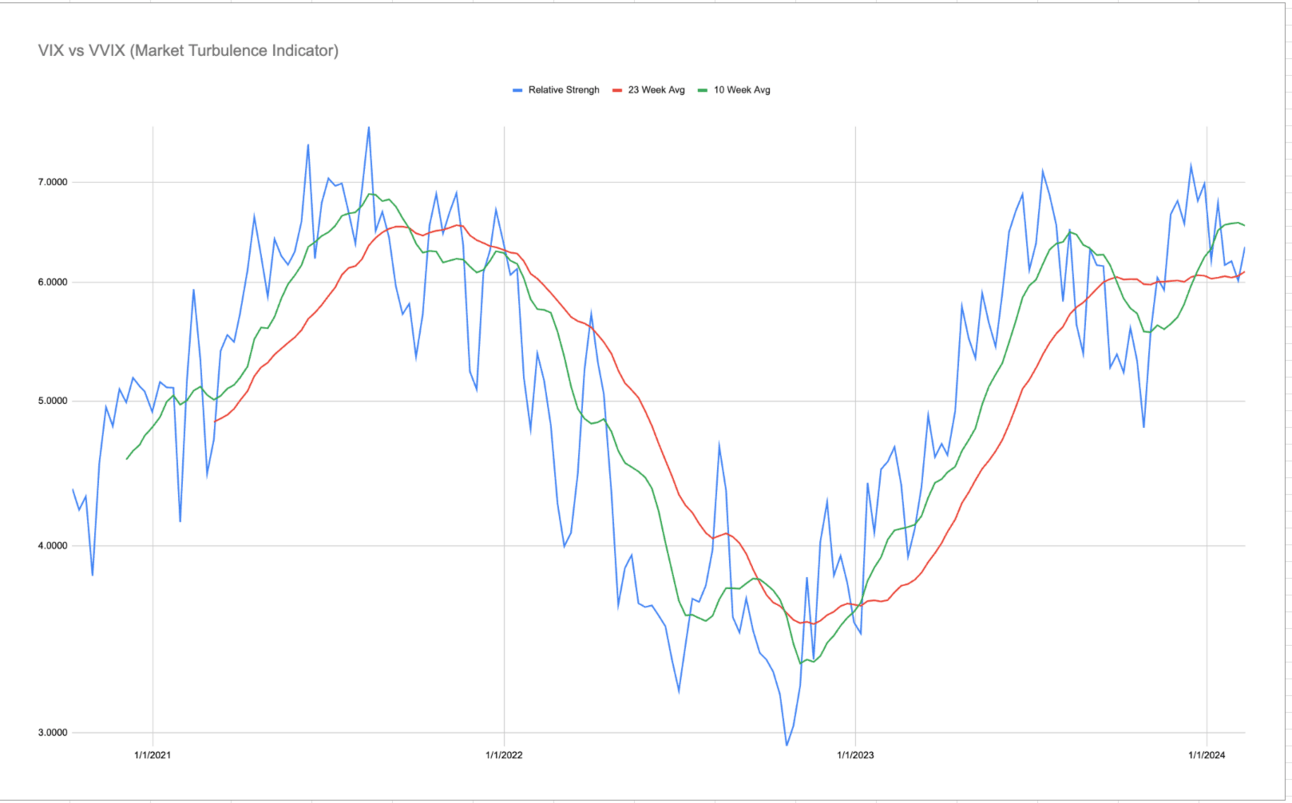

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. You see the up and down…

Right now we see a bounce off the 23 week average of the ratio. We continue to see BULLISHNESS in indexes. Volatility has potential to flair up but we don’t see volatility trending, for now we see it going sideways.

Sideways volatility should give opportunities across the market. Stocks should be able to explore their entire range of possibilities. Which gives a nimble trader many setups per week, month and quarter.

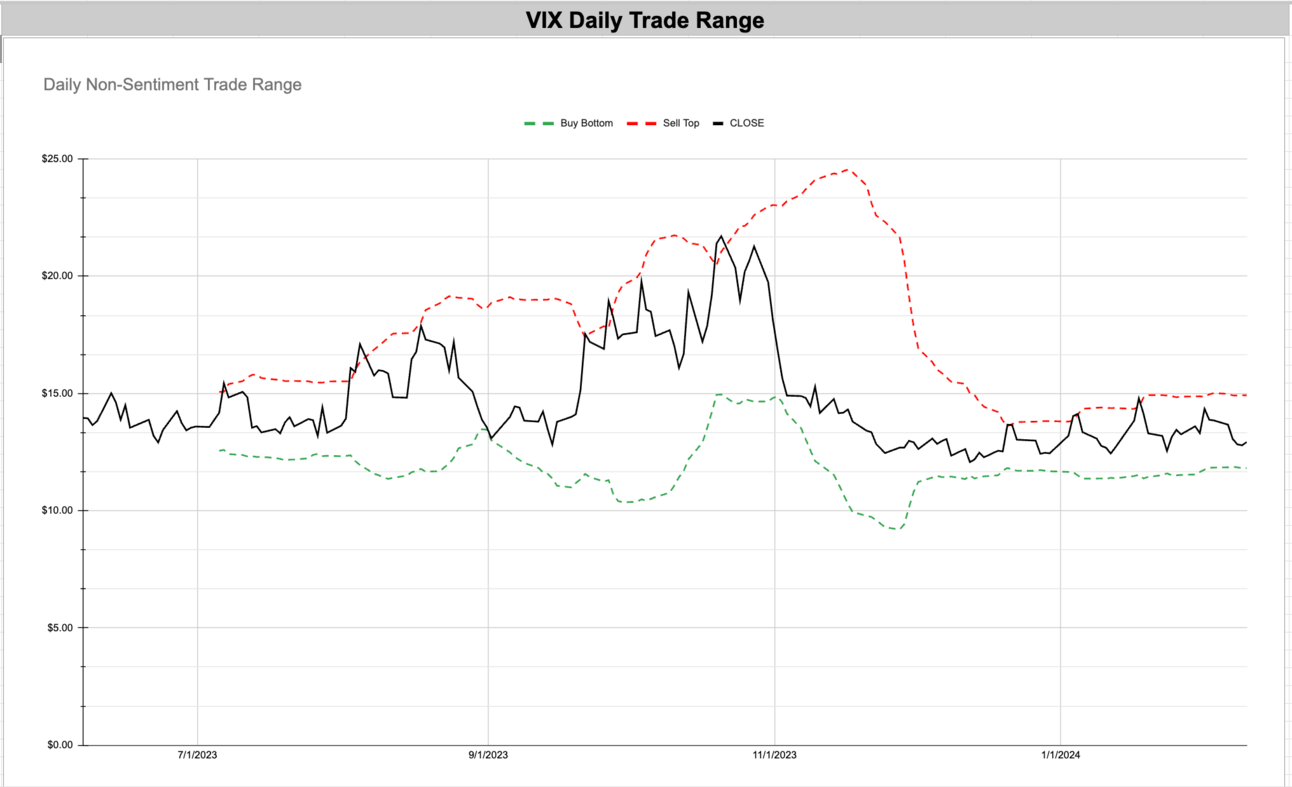

Upside VIX potential be we stay subdued under $15.

We see upside potential in the VIX - makes sense with all indexes higher in their respective ranges.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑 *We ignore this for now and go long - trust price.

Enjoying this?

& Invite a friend.

New Highs $5-$20:

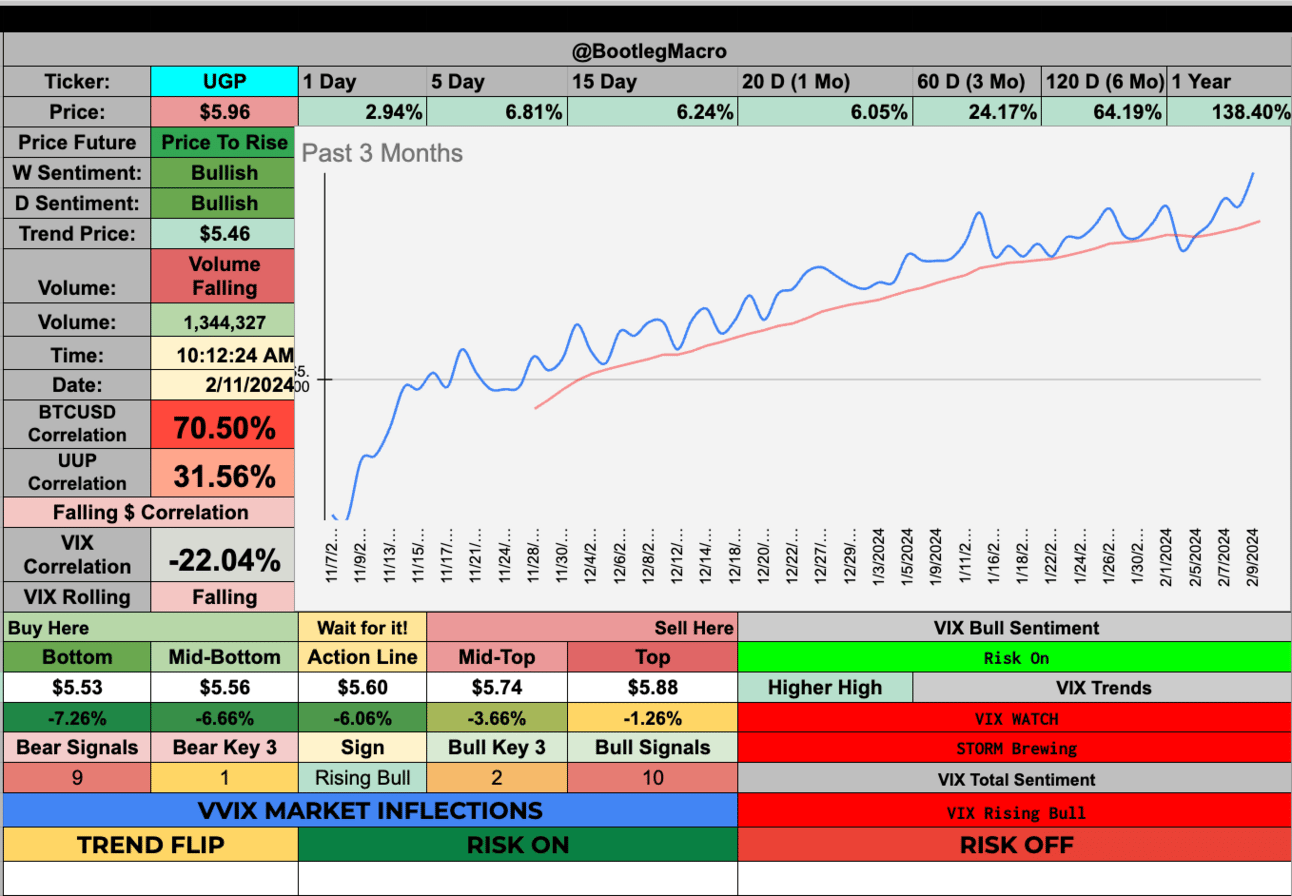

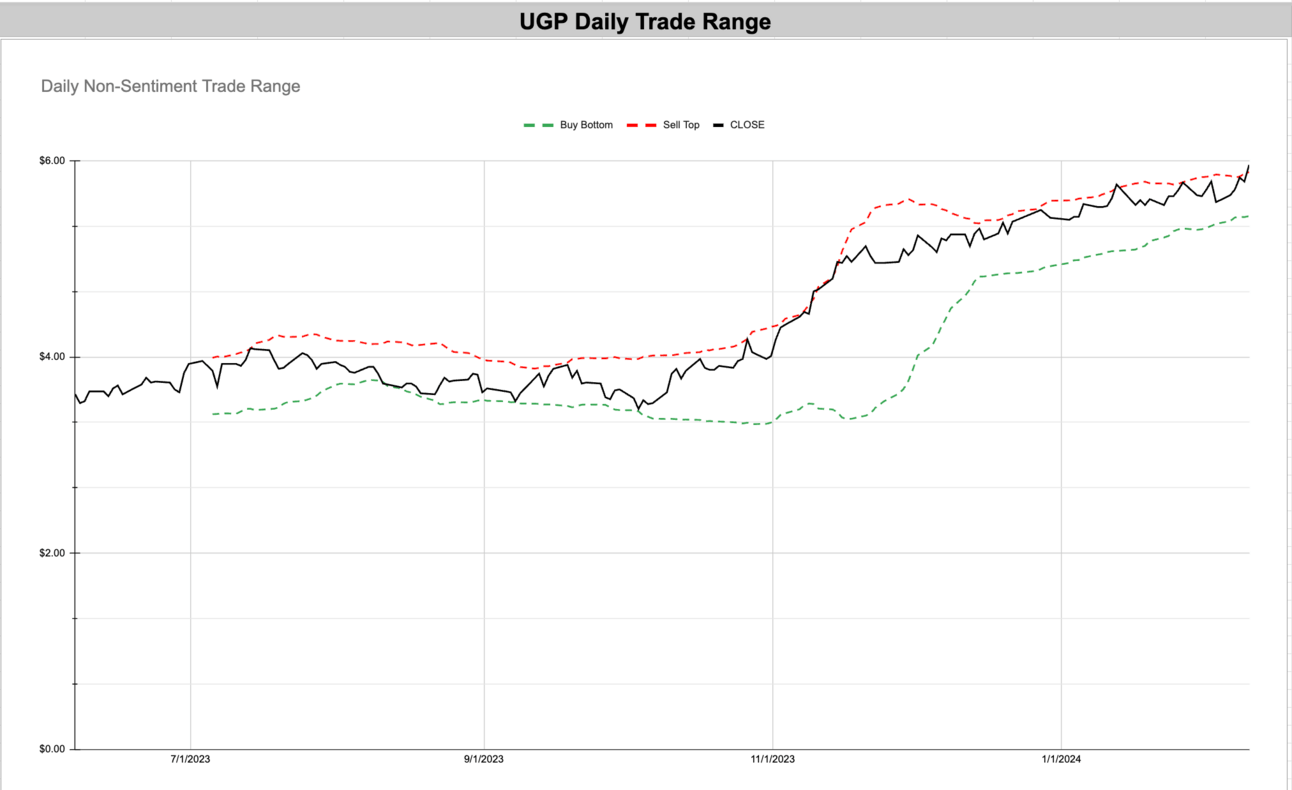

UGP - Ultrapar Participacoes S.A. ADR - Energy - Oil & Gas Refining & Marketing - 🇧🇷

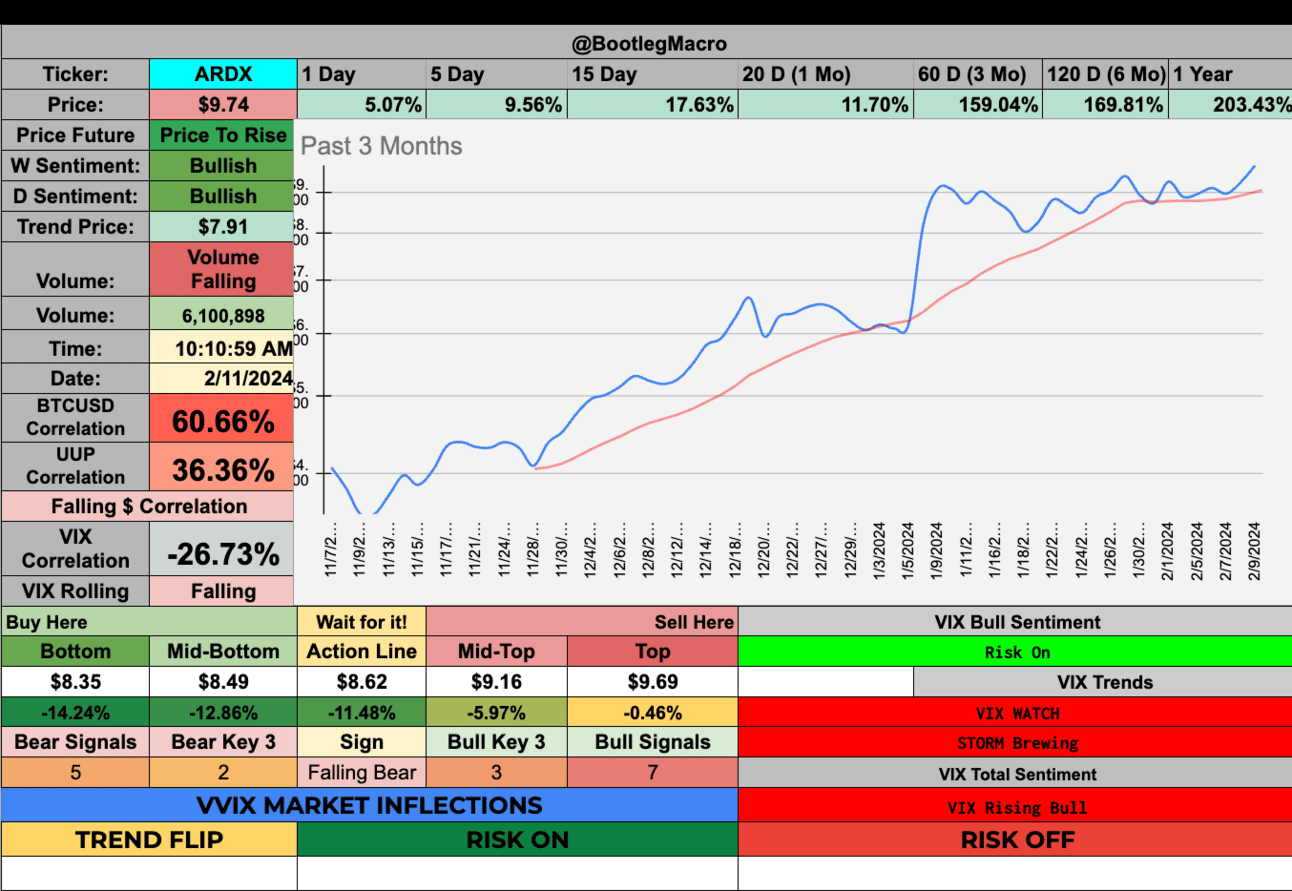

ARDX - Ardelyx Inc - Healthcare - Biotechnology - 🇺🇸

BBVA - Banco Bilbao Vizcaya Argentaria ADR - Financial - Banks - Diversified - 🇪🇸

GOGL - Golden Ocean Group Limited - Industrials - Marine Shipping - 🇧🇲

ADEA - Adeia Inc - Technology - Software - Application - 🇺🇸

EOLS - Evolus Inc - Healthcare - Drug Manufacturers - Specialty & Generic - 🇺🇸

LQDA - Liquidia Corp - Healthcare - Biotechnology - 🇺🇸

JBI - Janus International Group Inc - Industrials - Building Products & Equipment - 🇺🇸

IRWD - Ironwood Pharmaceuticals Inc - Healthcare - Drug Manufacturers - Specialty & Generic - 🇺🇸

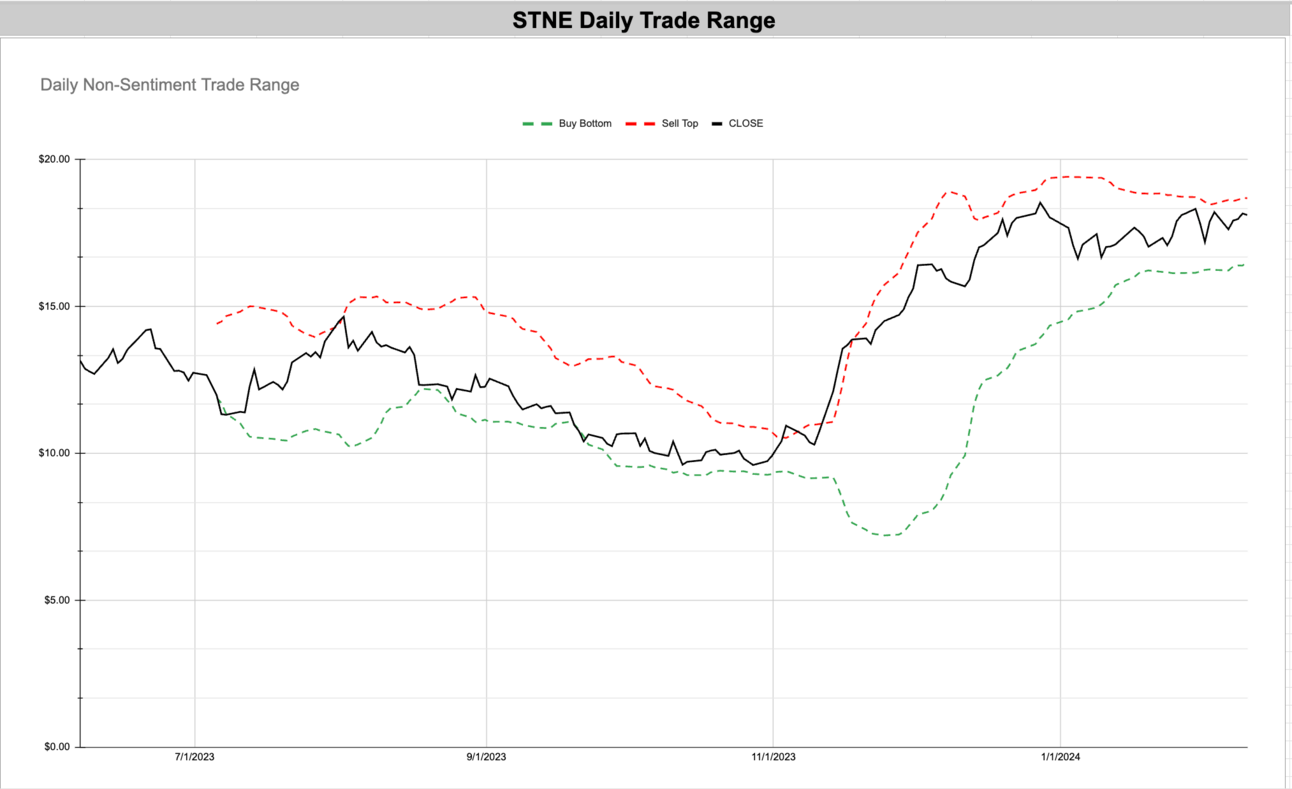

STNE - StoneCo Ltd - Technology - Software—Infrastructure - 🇧🇷

UGP - Ultrapar Participacoes S.A. ADR - Energy - Oil & Gas Refining & Marketing - 🇧🇷

ARDX - Ardelyx Inc - Healthcare - Biotechnology - 🇺🇸

BBVA - Banco Bilbao Vizcaya Argentaria ADR - Financial - Banks - Diversified - 🇪🇸

GOGL - Golden Ocean Group Limited - Industrials - Marine Shipping - 🇧🇲

ADEA - Adeia Inc - Technology - Software - Application - 🇺🇸

EOLS - Evolus Inc - Healthcare - Drug Manufacturers - Specialty & Generic - 🇺🇸

LQDA - Liquidia Corp - Healthcare - Biotechnology - 🇺🇸

JBI - Janus International Group Inc - Industrials - Building Products & Equipment - 🇺🇸

IRWD - Ironwood Pharmaceuticals Inc - Healthcare - Drug Manufacturers - Specialty & Generic - 🇺🇸

STNE - StoneCo Ltd - Technology - Software—Infrastructure - 🇧🇷

Enjoying this?

& Invite a friend.

New Highs $20+:

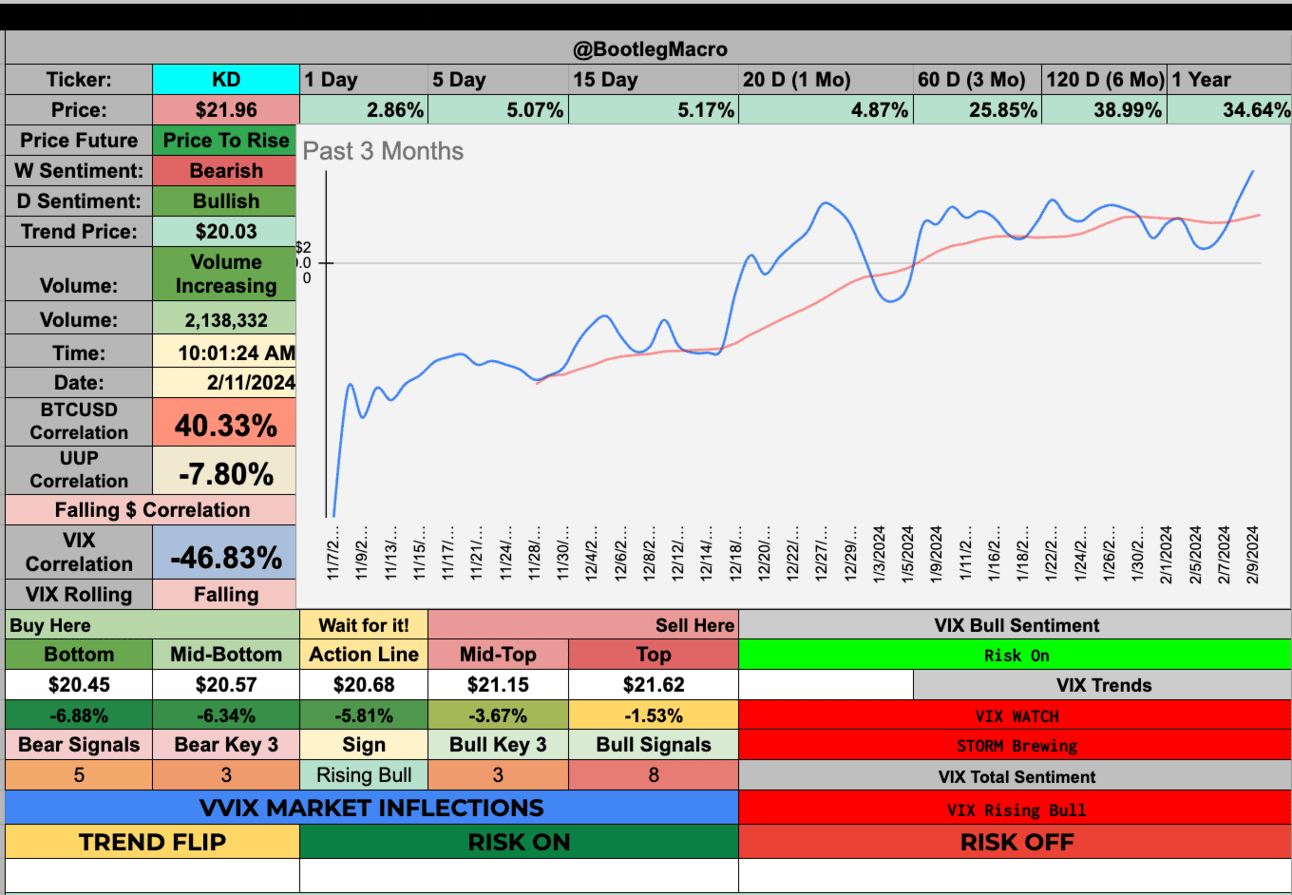

KD - Kyndryl Holdings Inc - Technology - Information Technology Services - 🇺🇸

AEO - American Eagle Outfitters Inc - Consumer Cyclical - Apparel Retail - 🇺🇸

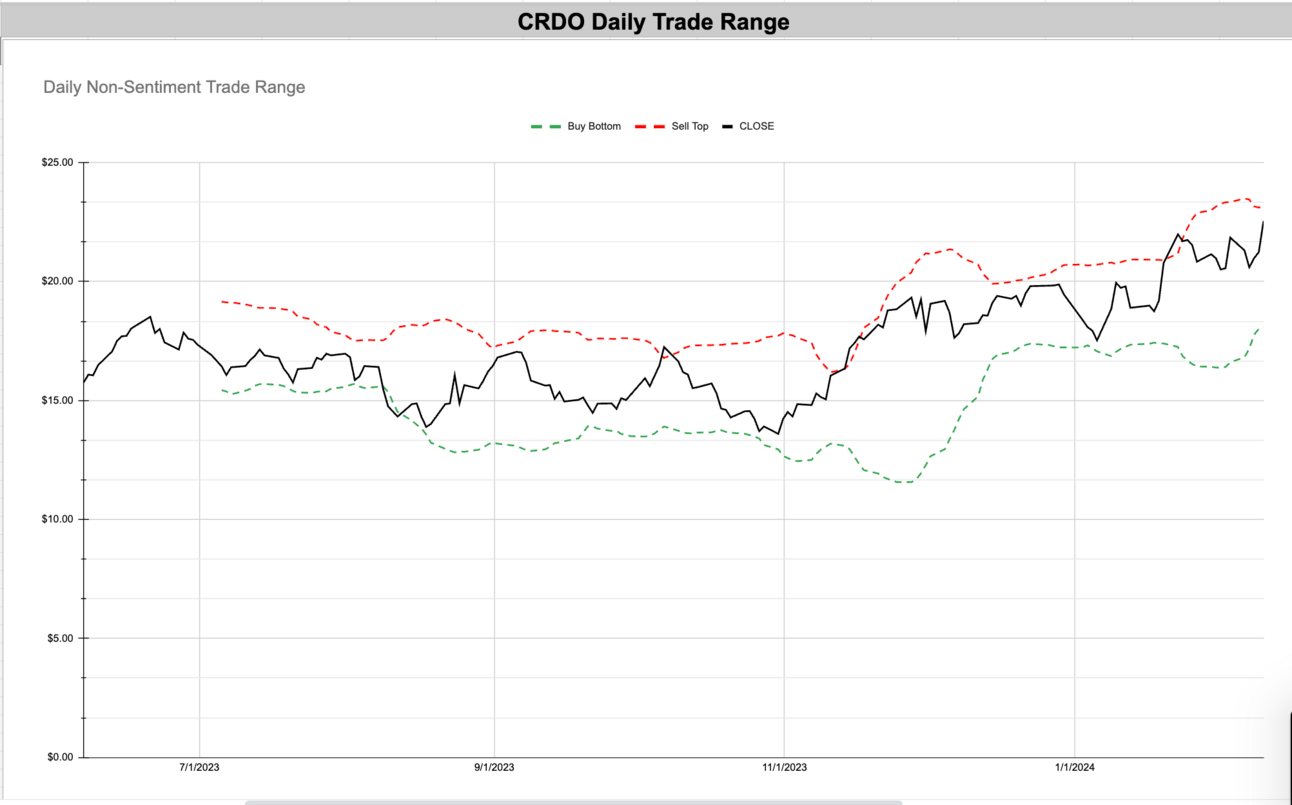

CRDO - Credo Technology Group Holding Ltd - Technology - Communication Equipment - 🇰🇾

MFC - Manulife Financial Corp. - Financial - Insurance - Life - 🇨🇦

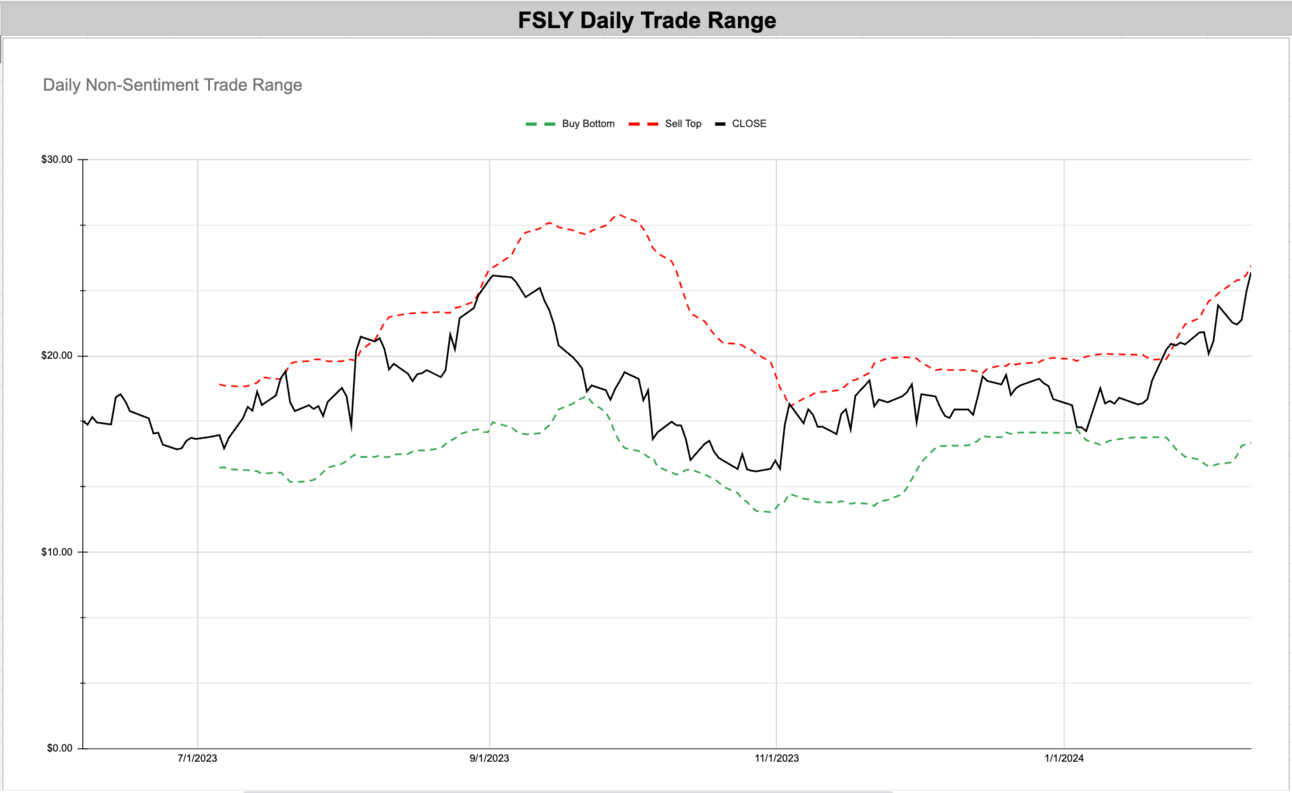

FSLY - Fastly Inc - Technology - Software - Application - 🇺🇸

PLTR - Palantir Technologies Inc - Technology - Software - Infrastructure - 🇺🇸

STLA - Stellantis N.V. - Consumer Cyclical - Auto Manufacturers - 🇳🇱

CBAY - Cymabay Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

FLEX - Flex Ltd - Technology - Electronic Components - 🇸🇬

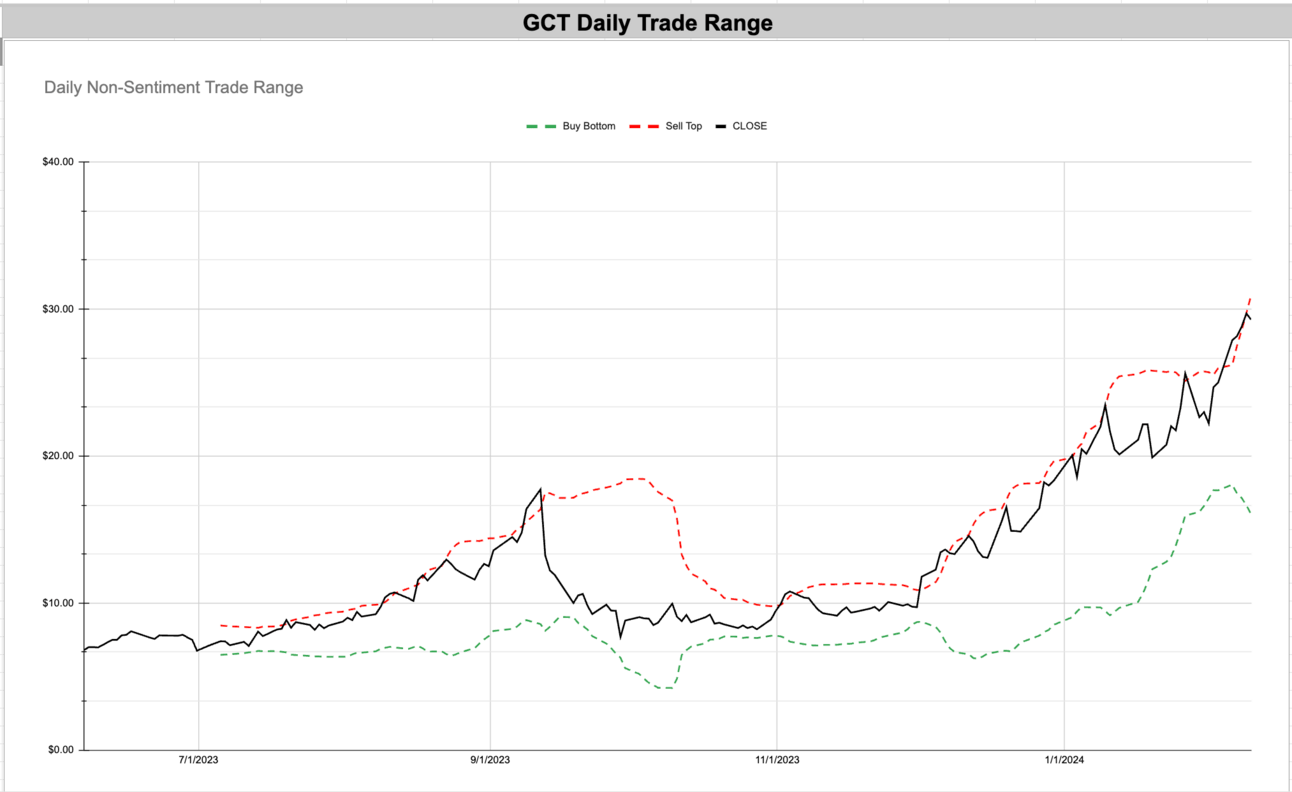

GCT - GigaCloud Technology Inc - Technology - Software - Infrastructure - 🇺🇸

ALPN - Alpine Immune Sciences Inc - Healthcare - Biotechnology - 🇺🇸

S - SentinelOne Inc - Technology - Software - Infrastructure - 🇺🇸

KD - Kyndryl Holdings Inc - Technology - Information Technology Services - 🇺🇸

AEO - American Eagle Outfitters Inc - Consumer Cyclical - Apparel Retail - 🇺🇸

CRDO - Credo Technology Group Holding Ltd - Technology - Communication Equipment - 🇰🇾

MFC - Manulife Financial Corp. - Financial - Insurance - Life - 🇨🇦

I really perfer this type of low range breakout. Especially when volatility has fallen is now picking up with price rising.

FSLY - Fastly Inc - Technology - Software - Application - 🇺🇸

PLTR - Palantir Technologies Inc - Technology - Software - Infrastructure - 🇺🇸

STLA - Stellantis N.V. - Consumer Cyclical - Auto Manufacturers - 🇳🇱

CBAY - Cymabay Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

FLEX - Flex Ltd - Technology - Electronic Components - 🇸🇬

GCT - GigaCloud Technology Inc - Technology - Software - Infrastructure - 🇺🇸

ALPN - Alpine Immune Sciences Inc - Healthcare - Biotechnology - 🇺🇸

S - SentinelOne Inc - Technology - Software - Infrastructure - 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

J. Powell might go down as the greatest fed chair ever. So far he has learned on the job, improved his skill as managing the committee and market.

Everyone has 20/20 hindsight, if we land soft. He is the 🐐

— Bootleg Macro (@bootlegmacro)

10:30 AM • Jun 22, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro