- The New High Newsletter

- Posts

- Did Bears Prayers Get Answered?

Did Bears Prayers Get Answered?

America's Credit Score Fell and Volatility Rose

Welcome back to the New Highs Newsletter. The United States’ 🇺🇸 credit worthiness 💳 was downgraded. From AAA to AA+.

You may not know what it means in reality, TLT will explain. Bonds values fell like a stone 🪨 this week. TLT was down 3.29%

Bad news spreads. All US indexes were down over 1% for the week. 🤢

Here we celebrate the BULL 🐂 MARKET 📈which is still intact in all indexes but we will see a change in the VOLATILITY CORNER below. No matter the market, risk matters more than reward.

Market Performance

Happy Sunday. We find ourselves at a cross roads for US Bonds. Will the 10 year break above 4.20 on the yield? This is a 3 year chart of the weekly close. The 10 year yield is at the top of it’s weekly Bootleg Macro Trade Range.

We are either range bound or about to breakout.

The rise in yield on the 10-year treasury helped drop $TLT down over(-3.29%) for the week. A ugly week and resumption of down trend in bond values.

Index Review:

Friday’s market close was UGLY. I’ll admit it. Being a perma-bull doesn’t mean you’re dumb. It’s means you’re optimistic. All indexes were negative for the week. The Nasdaq, as expected led to the downside (-2.85%) for the week. S&P500 followed closely down (-2.27%) for the week. Dow Jones held up better than the tech heavy indexes only down (-1.11%) for the week.

It’s a bull market in the Nasdaq (.IXIC), S&P 500 (.INX) and Dow Jones Index (.DJI). This week will tell us if we find a change in trend.

Volatility Corner:

VIX / VVIX deteriorated. Blue up is good, blue down is bad. We went down, indexes reflected the increase in volatility. This signal shouldn’t be ignored. We could get a get a big swing back up or a big drop. This is an important week to watch indexes.

This ratio isn’t level based but we haven’t been above 8.00 since before 2020. We aren’t there yet but we may have hit a peak.

Volatility rose this week and it’s reflected in the New Highs stocks…it’s been a good run but things look different.

In proper form we have numerous stocks breaking to new highs.

US Index Review:

All indexes were down this week. It’s not rare but it’s not common either. Pay attention to the signal. The indexes are in the middle of their ranges. And we’ve hit the slowest volume month of the summer. We could chop for a bit before a very BULLISH fall.

SPY

SPY is in the middle of it’s range, close to the action line. Nice place to enter if you believe in a BULL MARKET.

Bullish Trend Since 5/31/23🟢

Go Long Since 5/18/23🟢

Price to Rise Since 6/29/23🟢

DIA

Stronger than SPY, the Dow Jones shows resilience.

Bullish Trend Since 6/30/23🟢

Go Long Since 7/13/23🟢

Price to Rise Since 7/7/23🟢

QQQ

QQQ is right below it’s action line. The risk to reward is very good in QQQ as long as the BULL MARKET continues.

QQQ Bullish Trend Since 5/16/23🟢

Go Long Since 7/13/23🟢

Price to Fall Since 7/28/23**🛑

IWM

IWM has a bit more to fall to hit it’s action line at $190

Bullish Trend Since 5/24/23🟢

Go Long Since 7/12/23**🟢

Price to Rise Since 6/29/23🟢

You’ve hit the subscriber break! If you subscribe for free to see 25 stocks hitting new highs you’ll want to buy.

The list is right below here…if you don’t like it unsubscribe. We aren’t pirates making you walk the plank here. We are newsletter writers who like to see our list grow. Make it a great day for you and us, join today.

Enjoying this?

& Invite a friend.

New Highs $5-$20:

ROVR - Personal Service (USA)

SOFI - Credit Services (USA)

WW - Personal Services (USA)

WEAV - Software Application (USA)

PCT - Pollution & Treatment (USA)

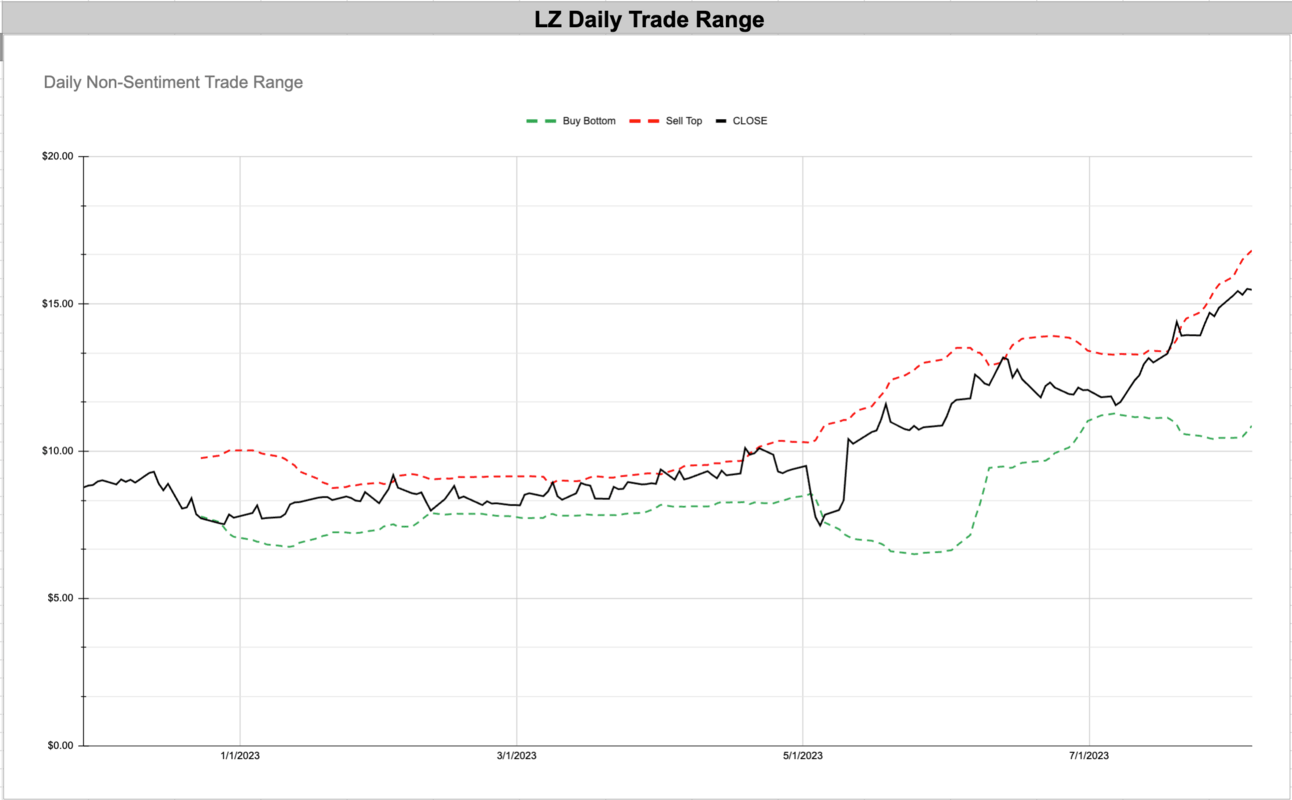

LZ - Specialty Business Service (USA)

PLTR - Software Infrastructure (USA)

ARAY - Medical Devices (USA)

BORR - Oil & Gas (Bermuda)

MOMO - Internet Content & Information (China)

FSLY - Software Application (USA)

ROVR - Personal Service (USA)

This is my favorite micro cap company. It’s under $2B. Incredible, I use it every week.

SOFI - Credit Services (USA)

We rise we fall, we see the BULL trend is intact.

WW - Personal Services (USA)

WW had such a nice run and a huge breakout this month. It’s fall doesn’t mean the BULL Market tis over but it might be a great opportunity to buy more.

WEAV - Software Application (USA)

WEAV continues to run. Things have changed but it’s been a winner over the summer up 70% in 3 months.

PCT - Pollution & Treatment (USA)

PCT has trended higher all summer.

LZ - Specialty Business Service (USA)

Legal Zoom is zooming higher this summer. Up 85% in 3 months.

PLTR - Software Infrastructure (USA)

A fintwit darling, $PLTR shows why people love to own it up 90% in 3 months.

ARAY - Medical Devices (USA)

Healthcare stocks continue to rip in moments of uncertainty. It’s a jerky trend but higher prices make happy traders.

BORR - Oil & Gas (Bermuda)

Give some respect to Oil & Gas names for their return to BULLISH form in the past few weeks.

MOMO - Internet Content & Information (China)

I pray this isn’t like a Luckin Coffee. I want to believe this trend is real and rising.

FSLY - Software Application (USA)

Trades and Fintwit have loved FSLY. Is it time to re-join the trend?

Enjoying this?

& Invite a friend.

New Highs $20+:

STLA - Auto Manufacturers (USA)

IAS - Advertising Agencies (USA)

VRRM - Infrastructure Operations (USA)

CARS - Auto & Truck Dealerships (USA)

VECO - Semiconductors (USA)

LPG - Oil & Gas Midstream (USA)

BZH - Residential Construction (USA)

EPOL - Poland ETF (USA)

EWI - Italy ETF (USA)

UBER - Software Application - (USA)

RDN - Insurance (USA)

VST - Utilities (USA)

CPS - Auto Parts (USA)

CBOE - Financial Data & Stock Exchanges (USA)

OLED - Electronic Components (USA)

STLA - Auto Manufacturers (USA)

IAS - Advertising Agencies (USA)

VRRM - Infrastructure Operations (USA)

CARS - Auto & Truck Dealerships (USA)

VECO - Semiconductors (USA)

LPG - Oil & Gas Midstream (USA)

BZH - Residential Construction (USA)

EPOL - Poland ETF (USA)

EWI - Italy ETF (USA)

UBER - Software Application - (USA)

RDN - Insurance (USA)

VST - Utilities (USA)

CPS - Auto Parts (USA)

CBOE - Financial Data & Stock Exchanges (USA)

OLED - Electronic Components (USA)

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

I covered $UBER this week in the @NewHighsNews because it’s breaking out and at 52 week highs.

I think people know something good.

Here is a link to the post and I give the trade levels.

— Bootleg Macro (@bootlegmacro)

4:19 PM • Jul 30, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro