- The New High Newsletter

- Posts

- Two Hikes and Jerome Powell is Out of Here!

Two Hikes and Jerome Powell is Out of Here!

Welcome back to the New Highs Newsletter. Hope you enjoy your long July 4th weekend. 🎆🎆

My plans are to golf ⛳, fish🎣, swim👙, drink🧉, eat🍖, listen to a little Morgan Wallen 📻 and socialize my way into the fireworks. 🎇

What holiday memory are you making?

Jerome’s European Talking Tour Du Jour:

Good ole, J. Powell jittered markets again.

Jerome sat on 2 panels this week in Europe. Only 1 moment was seized upon by media. Duh he wants 2 more rate hikes. Nothing unexpected.

Here is the video of Chairman Jerome Powell talking about what he sees, softening job creation and falling CPI.

AI Chip Wars (Proposed) Are Heating Up:

The Wall street Journal reported the US is considering an additional ban on selling A.I. chips made by US companies to China. This gave a BTFD opportunity to $NVDA $AMD $VSH

So you know, the US already has “Export Controls on Advanced Computing and Semiconductors” to sell to China. They announced them in October, 2022.

Q1, 2023 GDP - Revision 🚀🚀🚀

GDP in Q1, 2023 was 2.0% not 1.3%. It’s the 3rd revision.

Are the bears🐻 alright?

Japan’s Rocket Market Continues:

Japan Stocks Climb - Starting the week the Nikkei 225 was only 18% below the all-time highs. It’s been 30+ years since we’ve come this close! Keep your eyes on your fries.

Market Performance

Happy Sunday. First month of summer in the books! Earnings start next month…does the heat turn up in the market or does the volume go cold?

Market Performance:

The market started the week on a mixed note. Closing higher on Friday at quarter and month end. Month-end mark up or not, people are happy headed into a long-weekend. (Except the bears 🐻)

All Indexes are BULLISH right now.

It’s a bull market in the Nasdaq (.IXIC) and the S&P 500 (.INX)

In proper form we have numerous stocks breaking to new highs.

US Index Review:

This market has been led by a few big names. But looking at the equal-weight SPY, we see bullish progress. $RSP is positive on a rolling 3 month and 1 year return. That’s important for BULLs. Bears needs to watch the price action, it’s positive.

You don’t need price to see this has been range bound for 9 months.

Sentiment is currently slightly bullish.

It’s not pretty but it’s working.

Bullish Trend Since 5/31/23

Go Long Since 5/18/23

Price to Fall Since 6/16/23

Demand is in control for now.

High volatility. A lot of rotation must be occurring.

Bullish Since 6/23/23*

Go Long Since 6/5/22

Price to Rise Since 6/5/22

QQQ Bullish Trend Since 5/16/23

GO Long Signal Since 5/1/23

Price to Fall Since 6/8/23

Bullish Trend Since 5/24/23

Go Short Since 6/26/23

Price to Rise Since 6/29/23

Enjoying this?

& Invite a friend.

New Highs $5-$20:

ATEC - Medical Devices (USA)

NR - Oil & Gas Equipment Services (USA)

SBS - Utilities Regulated Water (Brazil)

WEAV - Technology (USA)

ENIC - Utilities (Chile)

EOSE - Electrical Equipment & Parts (USA)

VRRM - Infrastructure Operations (USA)

AAL - Airlines (USA)

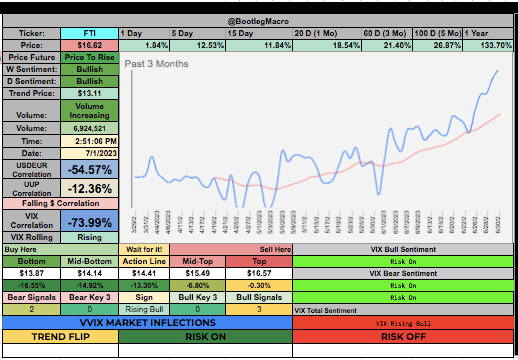

FTI - Oil & Gas Equipment Services (UK)

NVRI - Waste Management (USA)

ARLO - Building Products & Equipment (USA)

UGP - Oil & Gas Refining & Marketing (Brazil)

NVTS - Semiconductors (USA)

$VRRM below is about to come off this $5-20 list and hit the $20+ list. It’s low volatility and upward trajectory have made it fun to follow. Light commentary below, it’s the holiday weekend. If you have a direct question, message me on twitter @BootlegMacro

‘

Enjoying this?

& Invite a friend.

New Highs $20+:

APG - Engineering and Construction

VECO- Semiconductor (USA)

VSH - Semiconductors (USA)

ABCM - Biotechnology (UK)

FROG - Software Application(USA)

FLEX - Electronic Components (Singapore)

DBX - Software - Infrastructure (USA)

DKNG - Gambling (USA)

EXTR - Communication Equipment (USA)

PLAB - Semiconductor Equipment & Materials (USA)

VRT - Electrical Equipment - (USA)

/i

Next Week:

Next week will be a holiday-shortened trading week, with U.S. markets closed on Tuesday for Independence Day.

The latest updates on the labor market will become available, with the Job Openings and Labor Turnover Survey (JOLTS), ADP’s National Employment Report, and the June nonfarm payrolls report.

The Federal Reserve will release meeting minutes from its latest policy meeting.

Credit to Investopedia

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For free, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro