- The New High Newsletter

- Posts

- Trump, Tariffs and Higher Gold Price?

Trump, Tariffs and Higher Gold Price?

What makes sense in this world? Do we still believe the market will be higher in the next 12-18 months? What does February bring us? Do we get blanket tariffs? Do we see GOLD breakout even higher? Gold has been interesting even though I’m not covering it.

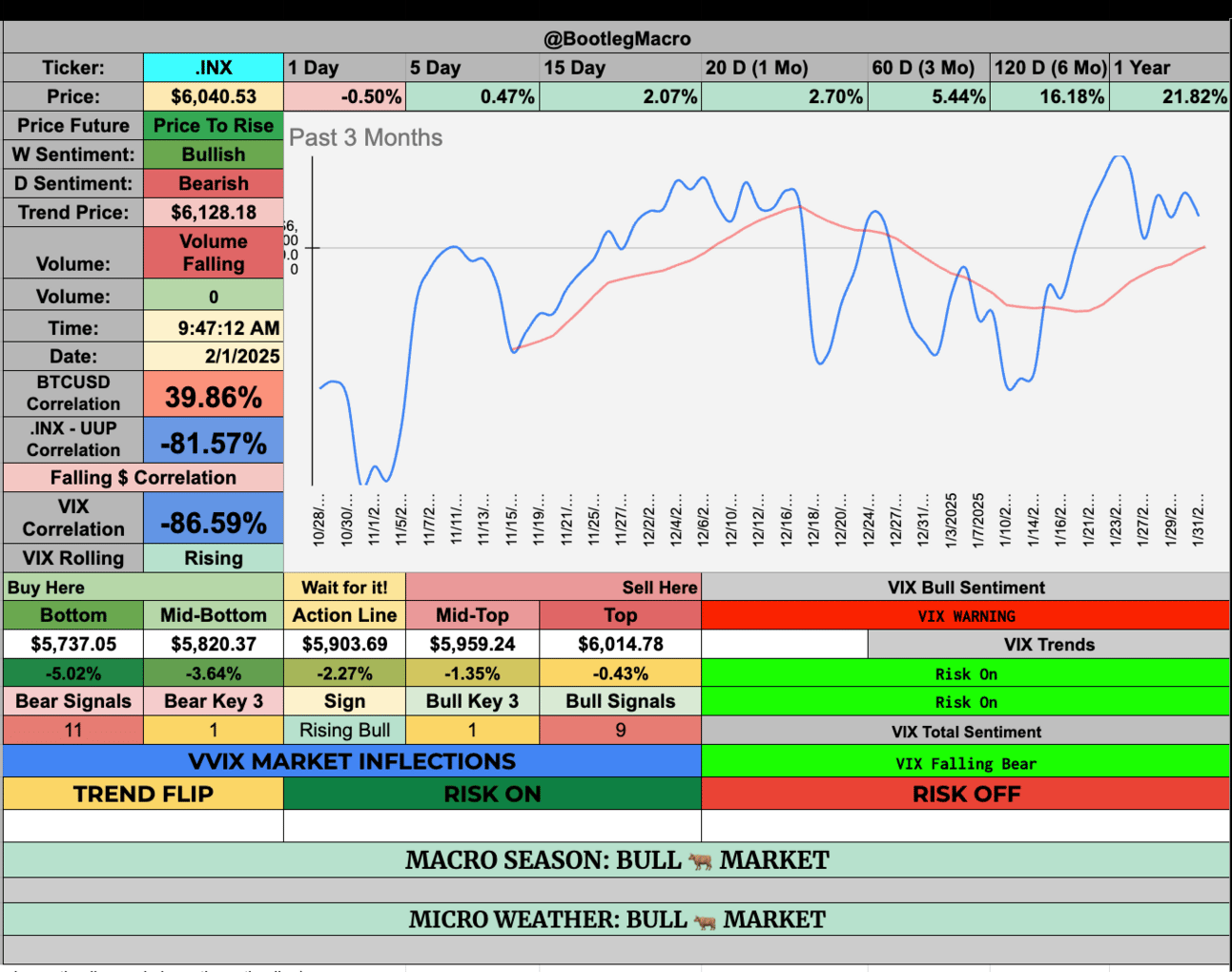

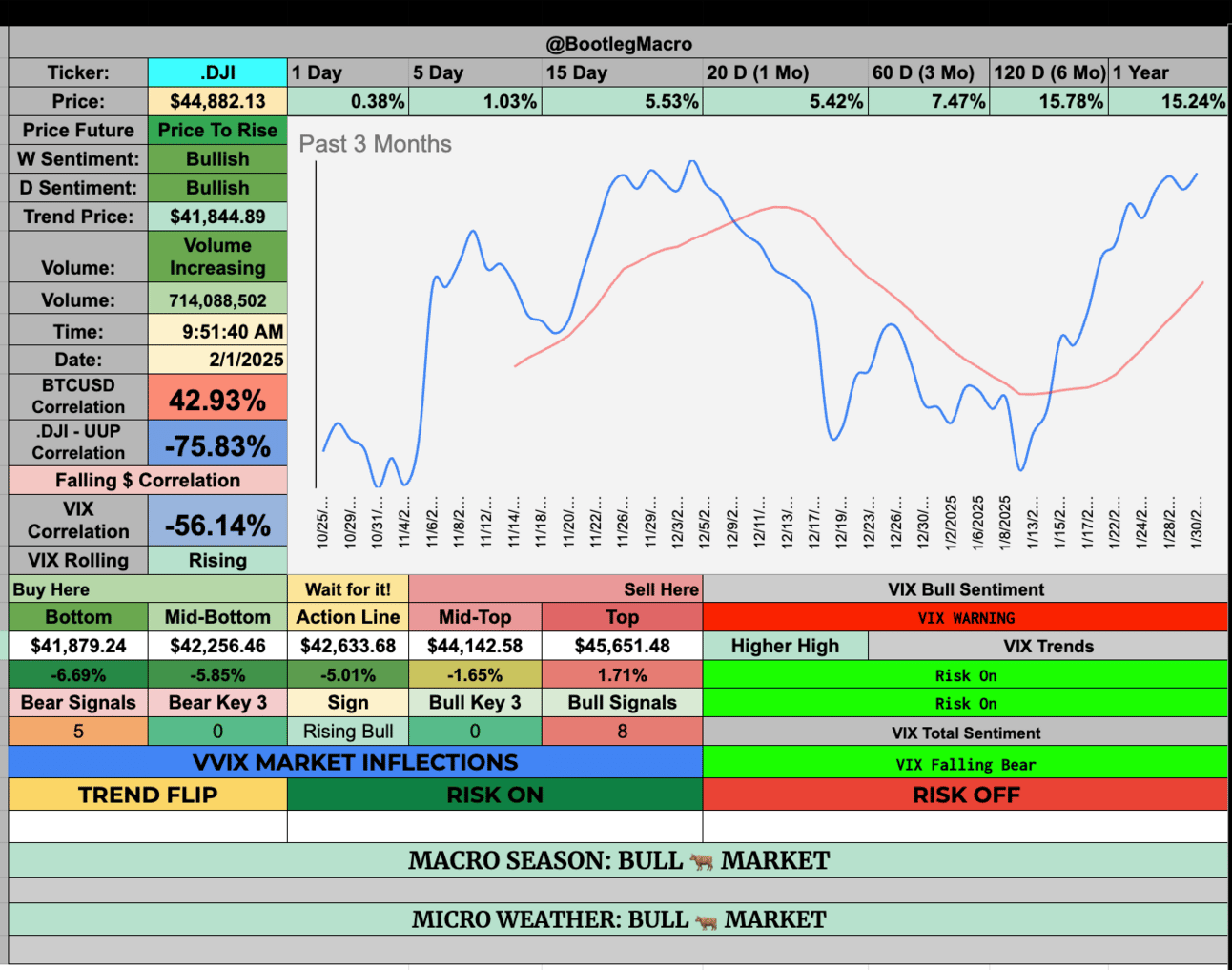

Market Overview: SPY and Nasdaq have been choppy. The tech index, in my opinion, is going through an internal re-org. Leadership is changing hands so the flows a increased but it’s met with selling in other areas. The results in sideways action, until it resolves. I predict higher prices in the future. But for now the DOW is king, up over 5.5% for the past 3 weeks. It’s been hard to keep up with the Dow Jones’.

New Highs $5-$20: We have some beauties in the new highs under $20. $WEAV $ATEN $KC are all very interesting. You’ll find something to watch next week, I promise.

New Highs $20+: Large cap growth is back baby! Walmart, JP Morgan and more we all showing signs of acceleration. Shopify, Spotify and Warby Parker are some of my favorite setups below.

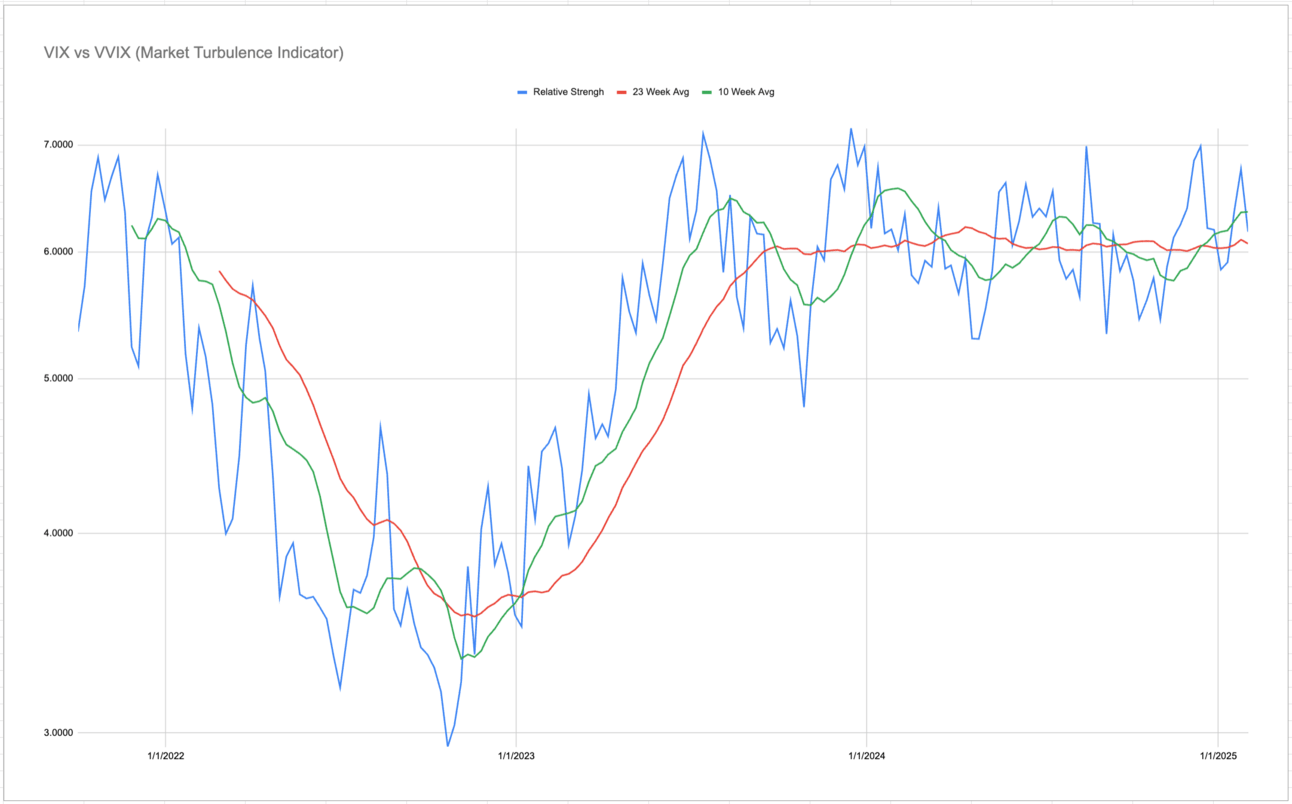

Turbulence Indicator: Based on what I see in the vol space, I expect BULLISH behavior despite market volatility.

Looking Ahead: With a new administration in the USA and Tariffs being the most widely used tool, it’s time to be patient. Using position sizing and focusing on stops will become the only way to stay profitable. This period of time will have massive shifts in the market without much warning. I’ll let price be my guide.

Market Performance Framework

Market Overview:

The week was fantastic in the markets until Friday. We had a tariff tantrum unleashed on the markets after a press conference in the USA. All things considered, it’s still a bullish environment.

Key Focus Area:

The DOW Jones has been the best indicator for the past 3 weeks. Things happen quick and the Nasdaq and SPY are doing more organization of the top of the index than real selling. This means I expect higher-highs by summer. I’ll be a buyer of tech, energy, industrials and anything else not dependent on interest rates to grow sales and margin. This means I’ll avoid staples, real estate and utilities for now.

Current Outlook and Indicators:

When see opportunities on the horizon 12-18 months from now, we still expect a massive spending bill and tax cut in the USA. If it’s debt creating, it should hurt the dollar which is good for American business and markets.

Long-Term View:

By summer 2025, we should have higher inflation, tax cuts and potentially lower government spending. This could all result in a massive boom. We need growth in the USA and even 2.5% will do if we are essentially giving businesses a stimulus check in the form of tax cuts. Higher inflation and higher growth is very, very good for everything except farmer. Because exporting will be hard when you’re crop is expensive.

Closing Speculation or Questions:

What does February bring us? Do we get blanket tariffs? Do we see GOLD breakout even higher? Gold has been interesting even though I’m not covering it.

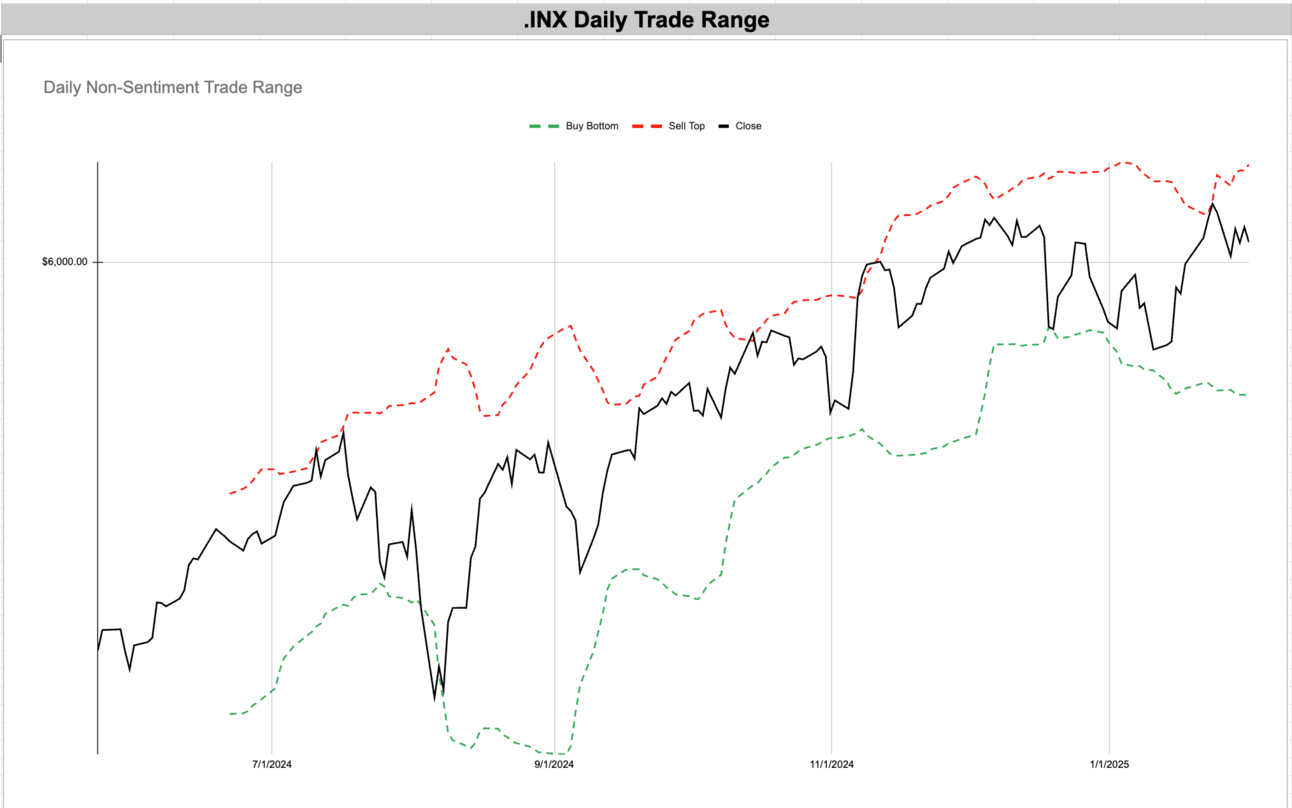

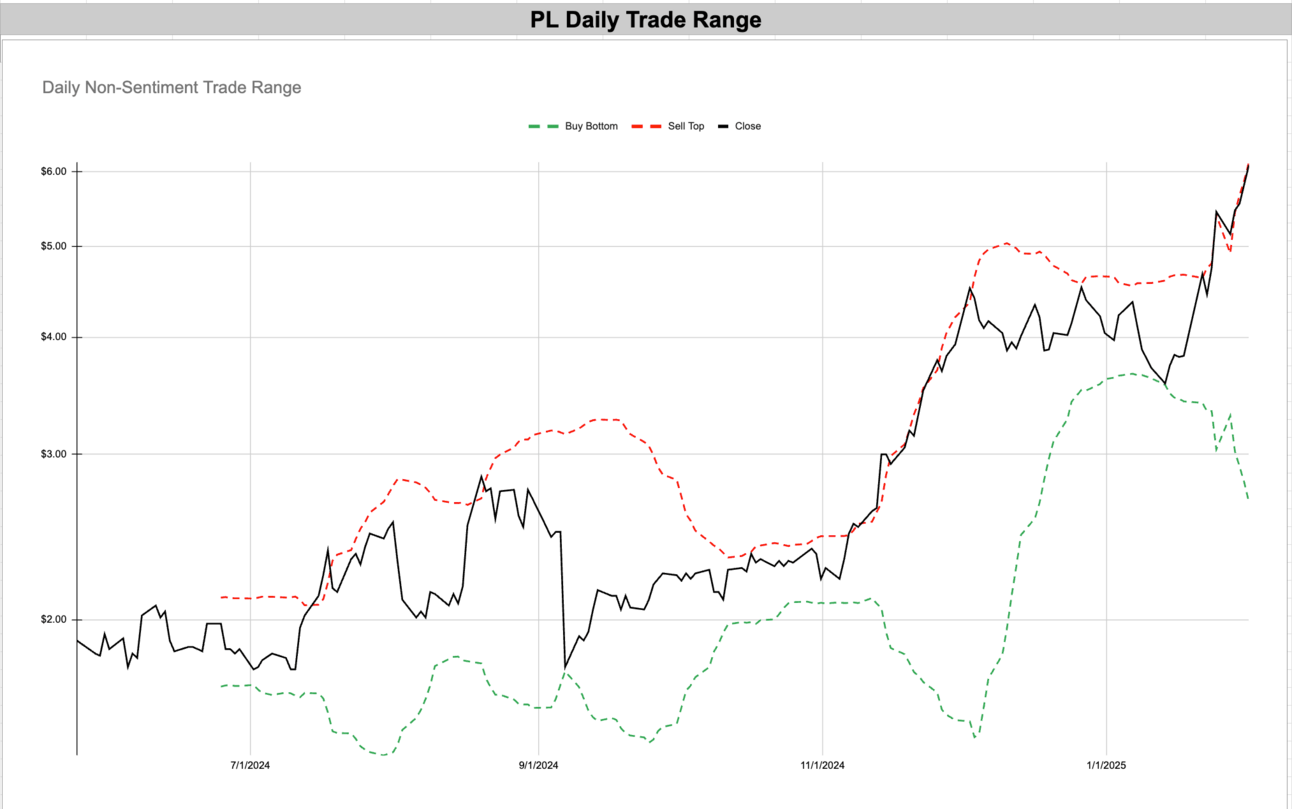

A choppy week but still positive. The range tells a better story.

The range is breaking higher and we’ve reclaimed highs recently

Tremendous recovery into the end of the month.

Sideways action for the tech index, I think is because of an internal reorg. The index is a trend following index. It’s populated by the largest cap names and as liquidity flows into new names, the previous leaders lose while the index churns.

Volatility Corner Framework

Indicator Update😀

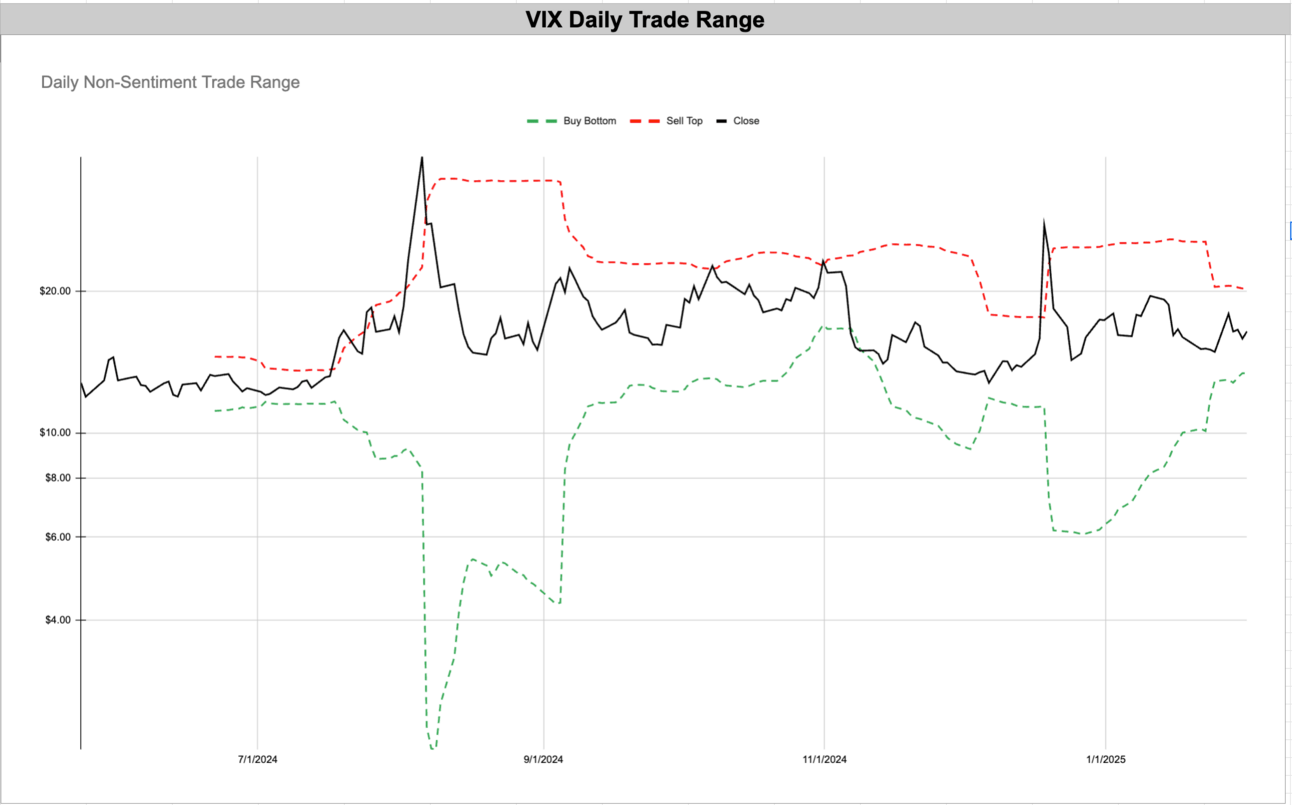

Overall, the market is choppy on the longer-term. The short-term VIX has shown a drop in the top of the range.

A down week for the VIX was BULLISH until the Friday sell off due to political events.

Regarldess the range is showing BULLISH signals. You can see here on the daily trade range, the drop from $25 to $20 at the top of the range. This happened on 1/24/25. Very bullish.

That indicates depressed volatility which is very BULLISH for equities, especially indexes.

Longer-term we continue to see sideways action in volatility. In a rich stock market, all you see is price bumping up against all-time highs again and again. Volatility are dips to be bought, not to be sold.

The VIX has a step lower in it’s trade range, we are going to see $20 or less at the top which is very bullish.

MACRO INDICATOR:

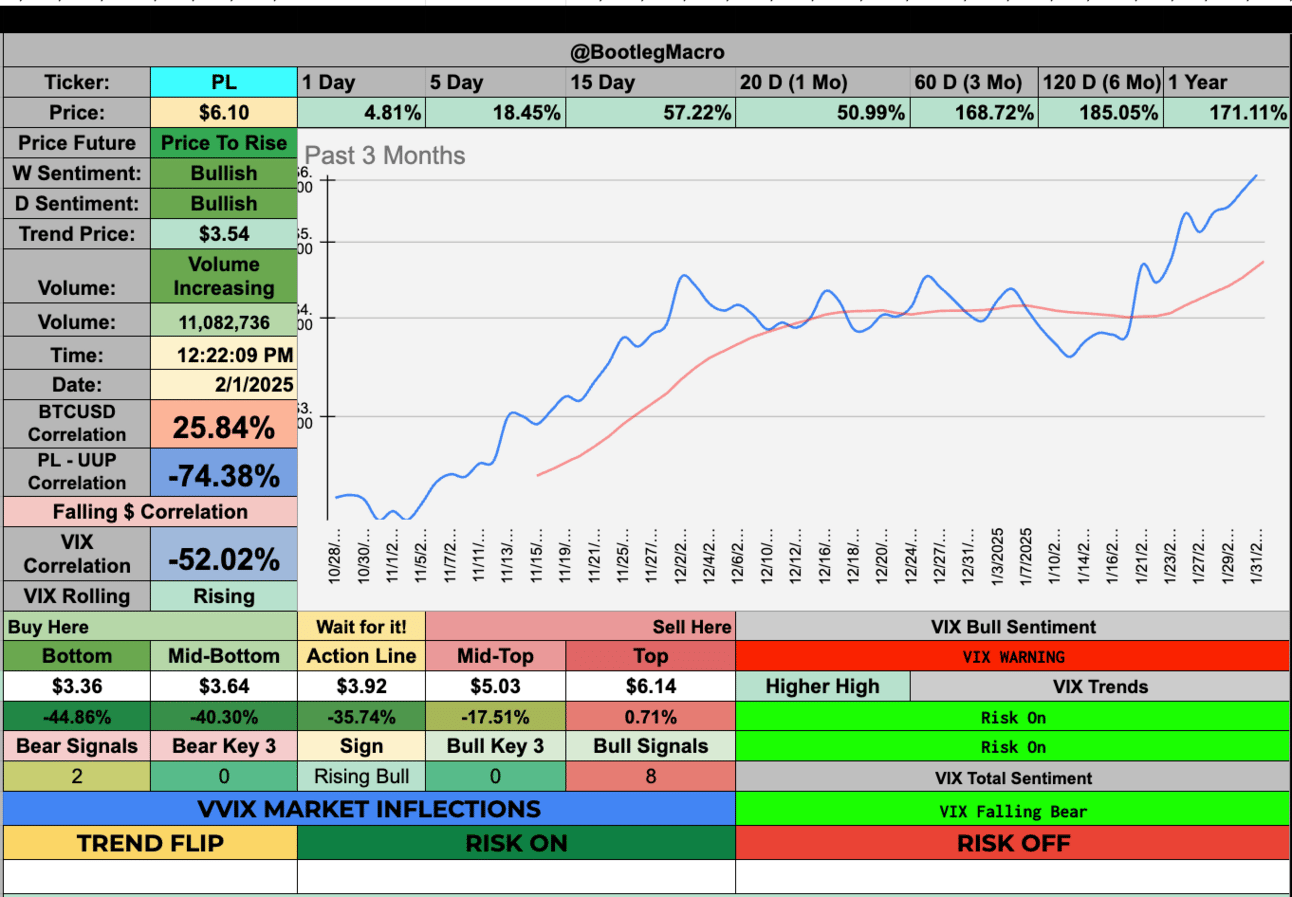

MACRO SEASON: BULLISH Since 12/13/24🟢

MICRO WEATHER: BULLISH Since 1/27/25🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

MFG - Mizuho Financial Group, Inc. ADR - Financial - Japan 🇯🇵

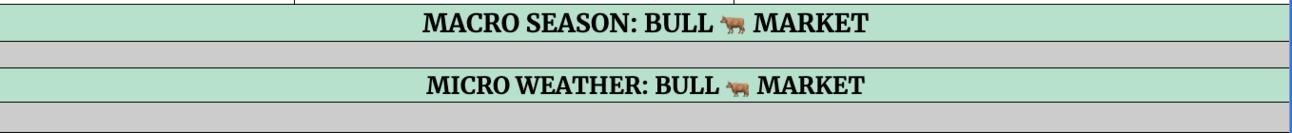

PL - Planet Labs PBC - Industrials - USA 🇺🇸

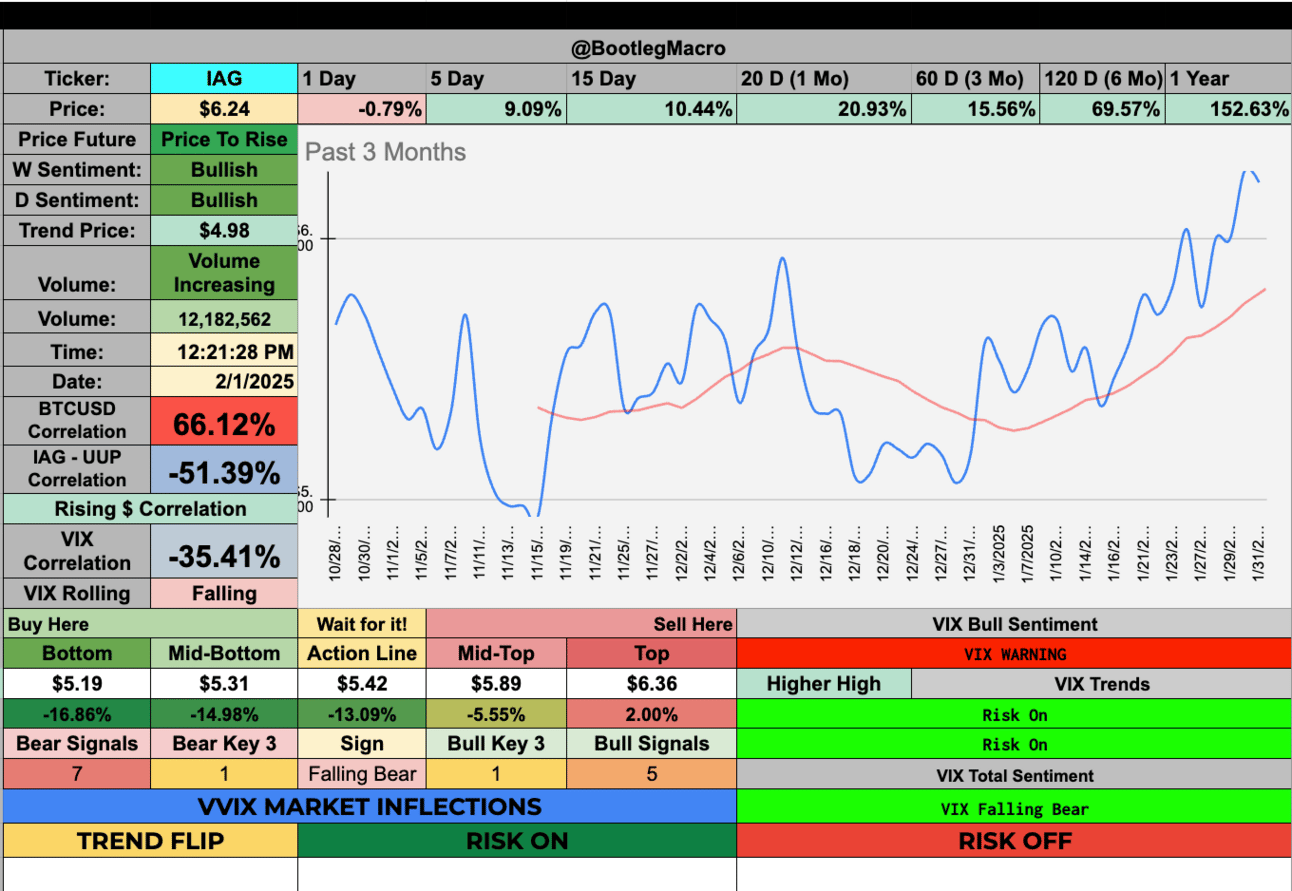

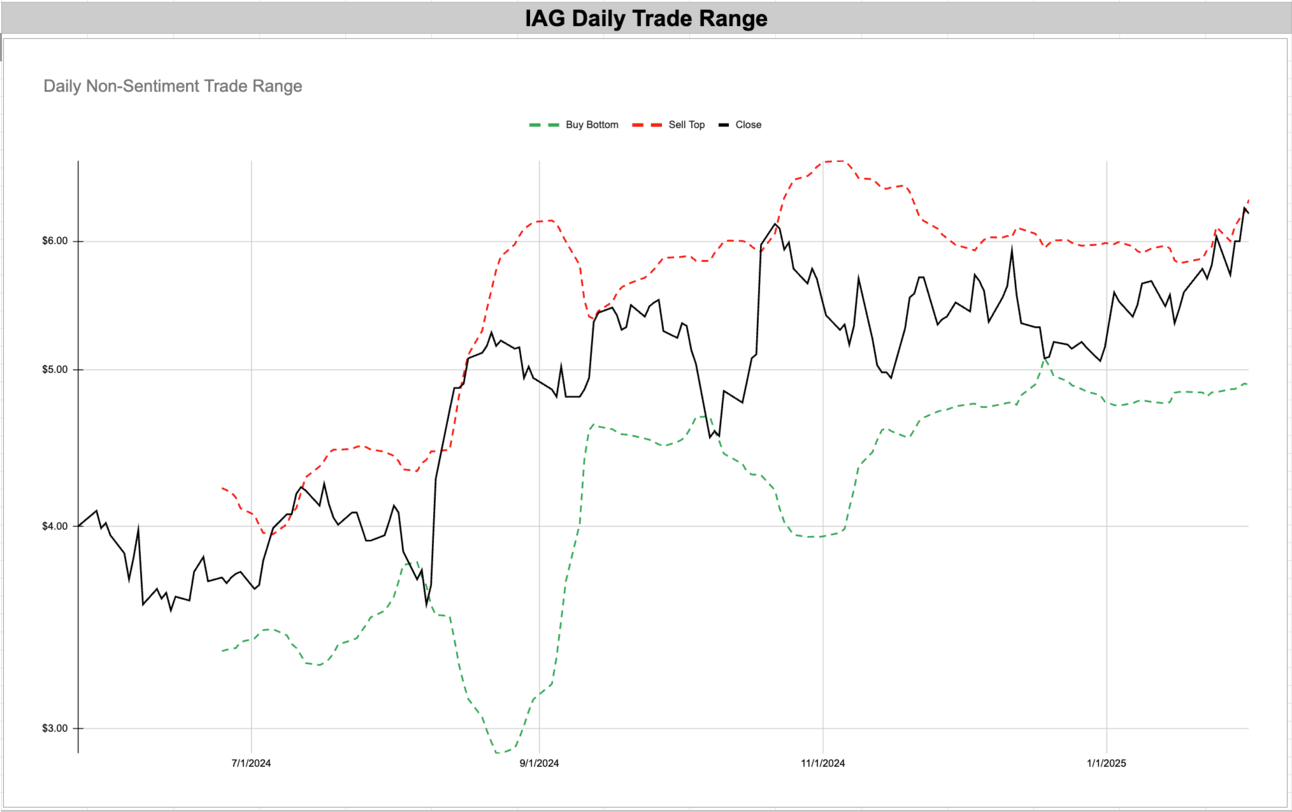

IAG - Iamgold Corp - Basic Materials - Canada 🇨🇦

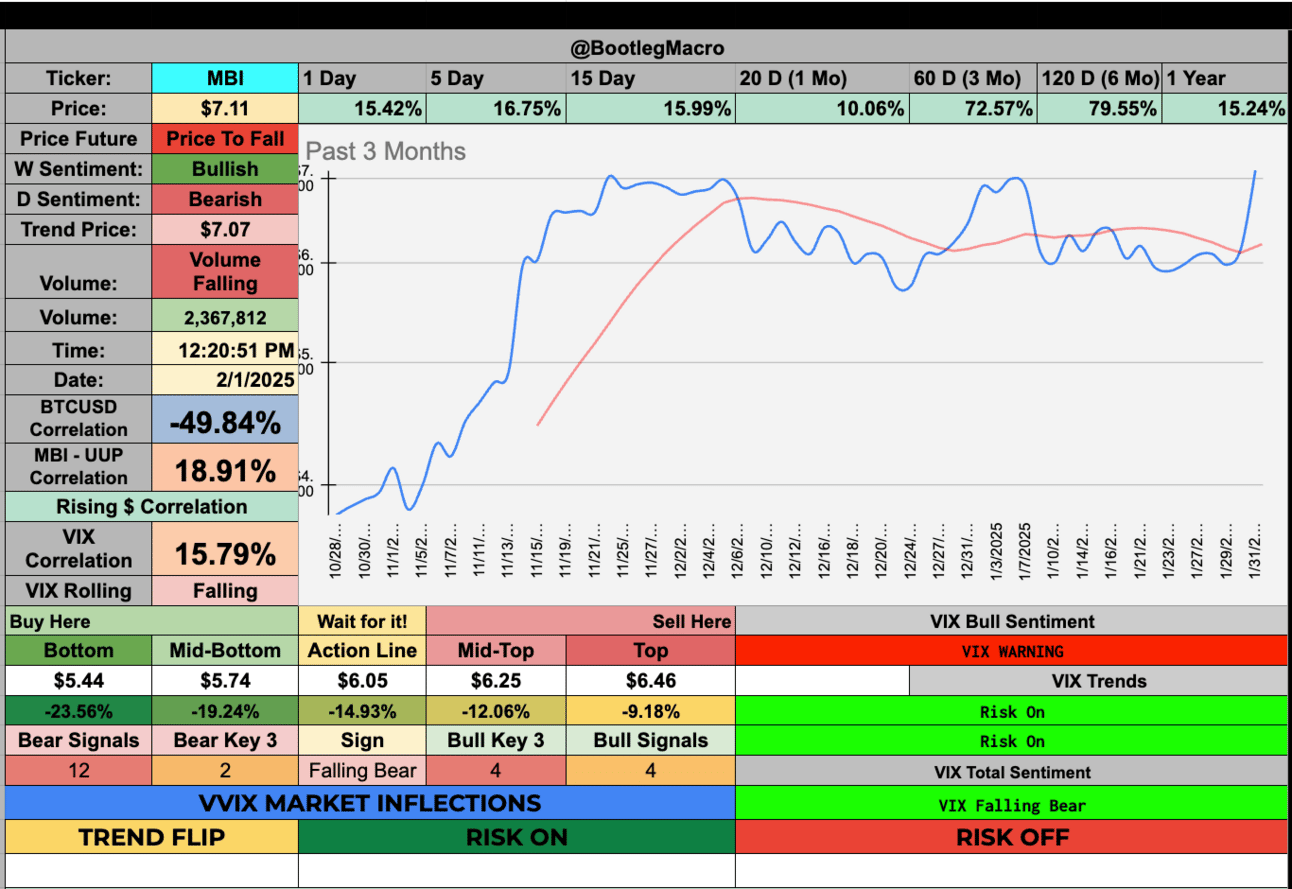

MBI - MBIA Inc - Financial - USA 🇺🇸

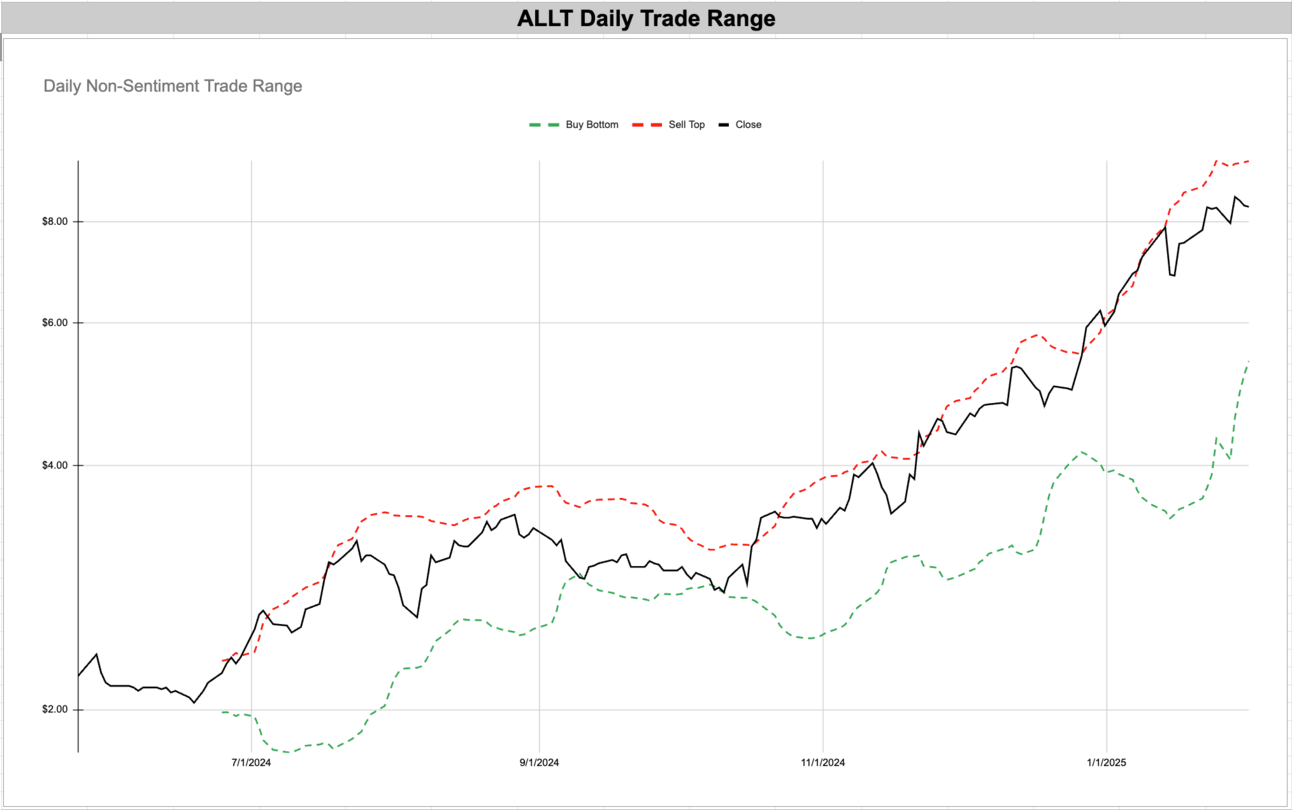

ALLT - Allot Ltd - Technology - Israel 🇮🇱

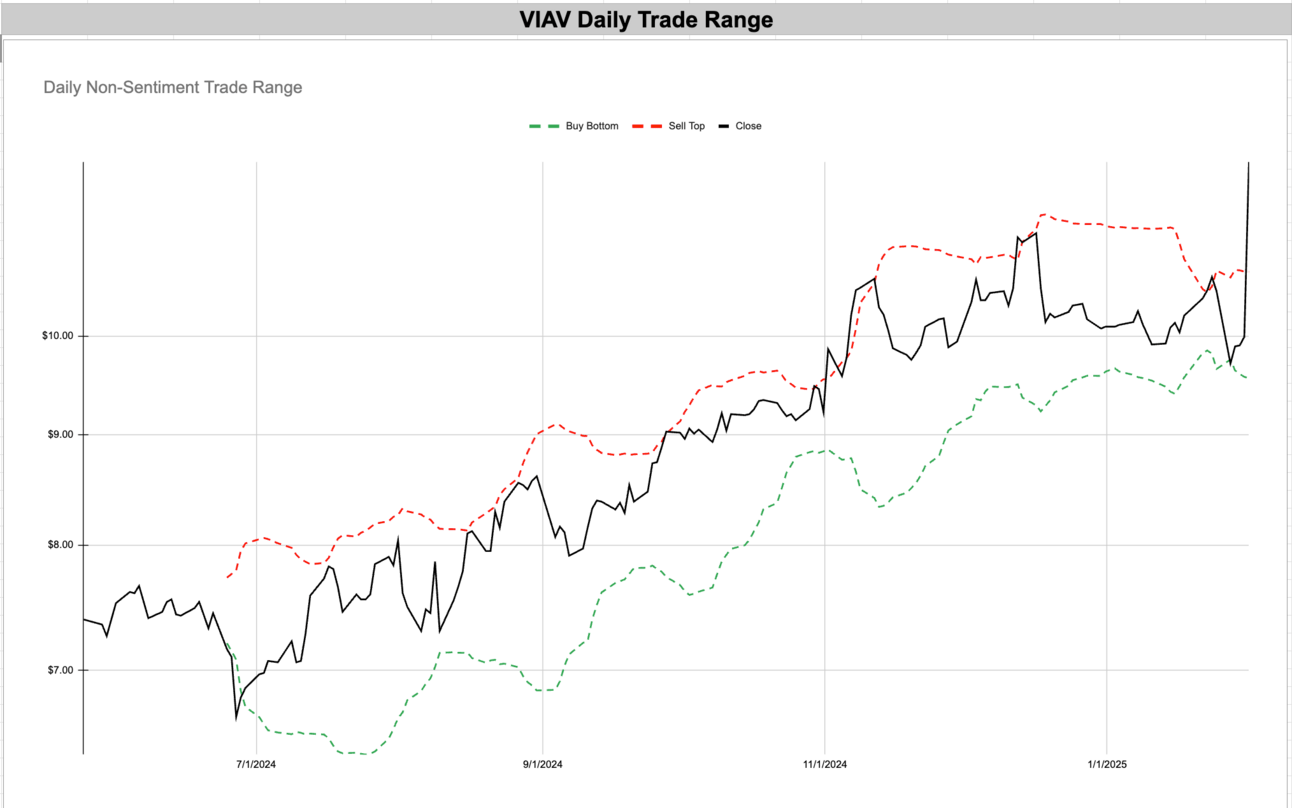

VIAV - Viavi Solutions Inc - Technology - USA 🇺🇸

KC - Kingsoft Cloud Holdings Ltd ADR - Technology - China 🇨🇳

DX - Dynex Capital, Inc - Real Estate - USA 🇺🇸

WEAV - Weave Communications Inc - Healthcare - USA 🇺🇸

AVPT - AvePoint Inc - Technology - USA 🇺🇸

ATEN - A10 Networks Inc - Technology - USA 🇺🇸

MFG - Mizuho Financial Group, Inc. ADR - Financial - Japan 🇯🇵

PL - Planet Labs PBC - Industrials - USA 🇺🇸

IAG - Iamgold Corp - Basic Materials - Canada 🇨🇦

MBI - MBIA Inc - Financial - USA 🇺🇸

ALLT - Allot Ltd - Technology - Israel 🇮🇱

VIAV - Viavi Solutions Inc - Technology - USA 🇺🇸

Amazing but ugly breakout. Give this time digest.

Quite the move.

KC - Kingsoft Cloud Holdings Ltd ADR - Technology - China 🇨🇳

This is beautiful. It’s very low-volatility.

DX - Dynex Capital, Inc - Real Estate - USA 🇺🇸

This is ugly. It’s breaking out to new highs but I don’t like the look of this trend. Too choppy for me but playing the ranges clearly works.

WEAV - Weave Communications Inc - Healthcare - USA 🇺🇸

This price is in a good spot considering the type of move we’ve seen over the past 3 months. There is room for the 1 month return to get positive double-digits.

AVPT - AvePoint Inc - Technology - USA 🇺🇸

Fantastic recovery of being down in December. High volatility, so I’ll be patient.

ATEN - A10 Networks Inc - Technology - USA 🇺🇸

This is a very nice stock under $20 - this came out of a similar base as many of the large caps.

Enjoying this?

& Invite a friend.

New Highs $20+:

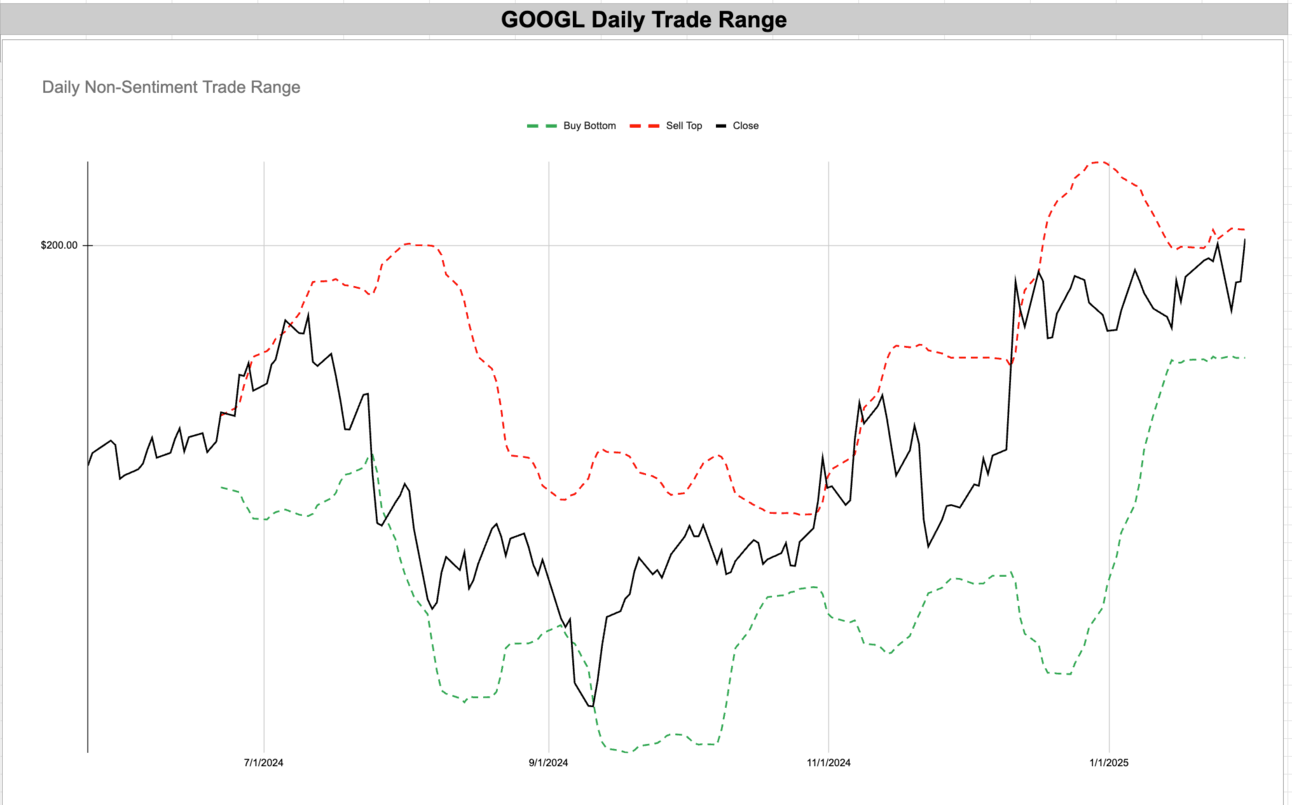

GOOGL - Alphabet Inc. (Class A) - Technology - USA 🇺🇸

GOOG - Alphabet Inc. (Class C) - Technology - USA 🇺🇸

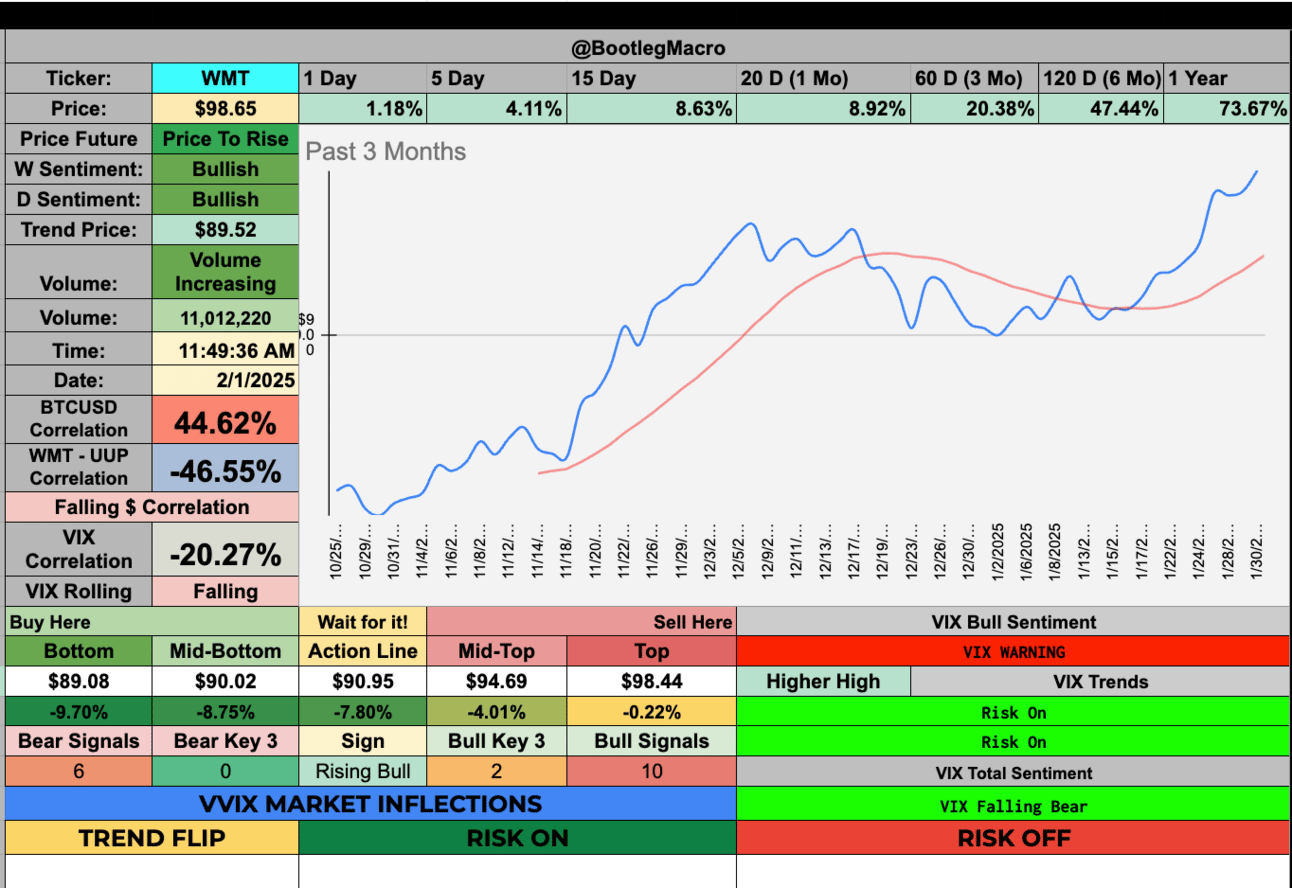

WMT - Walmart Inc. - Consumer Defensive - USA 🇺🇸

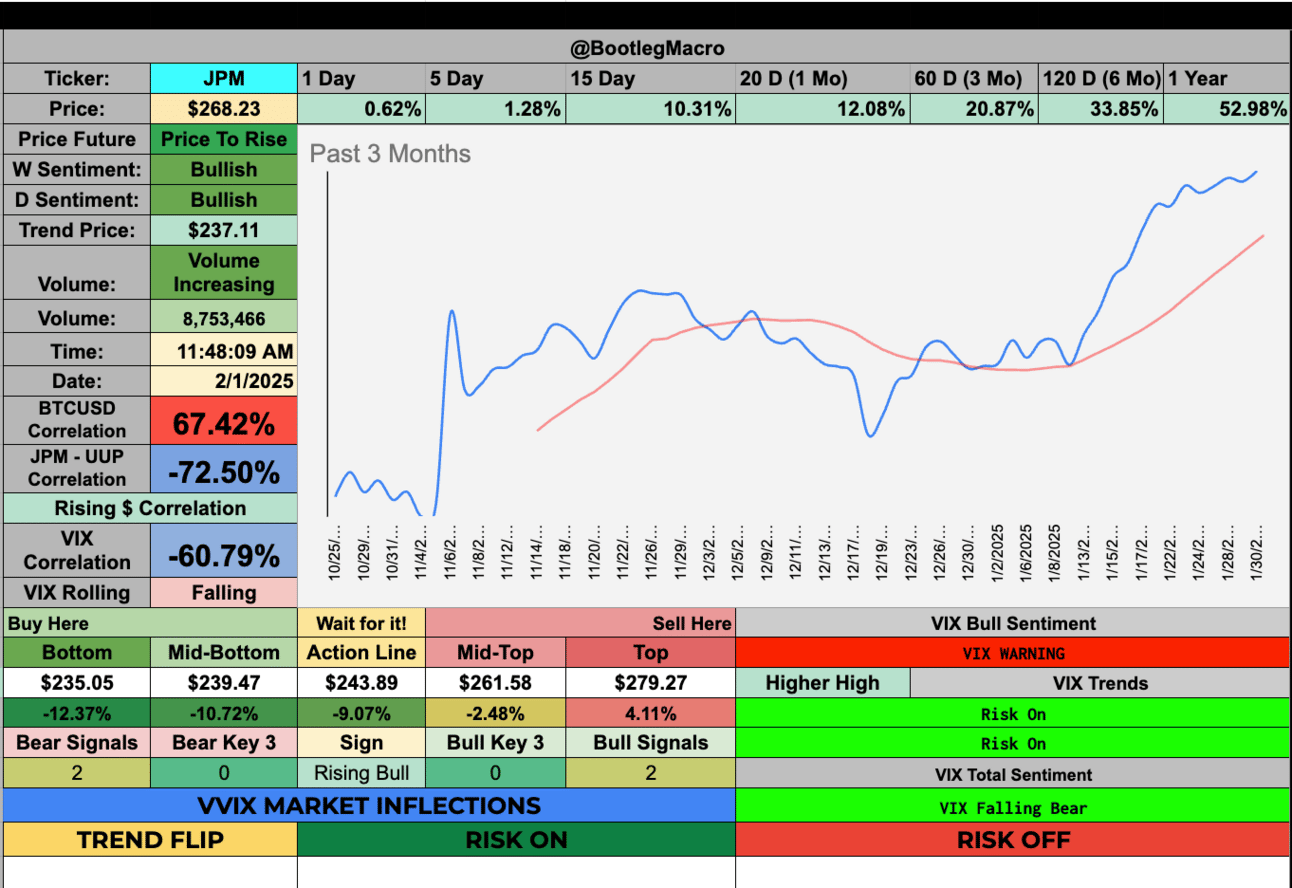

JPM - JPMorgan Chase & Co. - Financial - USA 🇺🇸

V - Visa Inc. - Financial - USA 🇺🇸

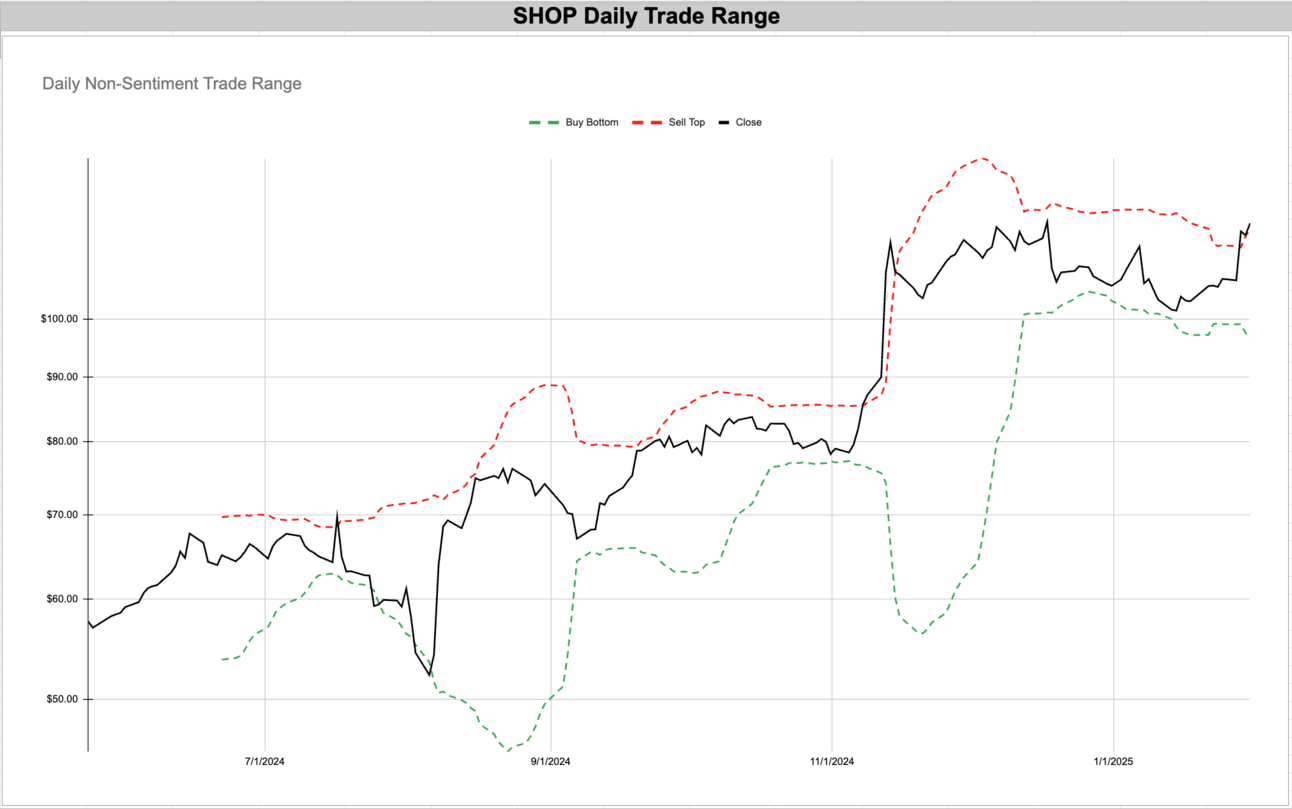

SHOP - Shopify Inc. - Technology - Canada 🇨🇦

SPOT - Spotify Technology S.A. - Communication Services - Luxembourg 🇱🇺

MMM - 3M Company - Industrials - USA 🇺🇸

WRBY - Warby Parker Inc - Healthcare - USA 🇺🇸

PHYS - Sprott Physical Gold Trust - Financial - Canada 🇨🇦

GOOGL - Alphabet Inc. (Class A) - Technology - USA 🇺🇸

This breakout above $200 is the first time in history of the stock. Incredible signal.

GOOG - Alphabet Inc. (Class C) - Technology - USA 🇺🇸

Google breaking out above$200 for the first time ever. This is remarkable because it’s based for so long since 12/11.

WMT - Walmart Inc. - Consumer Defensive - USA 🇺🇸

An incredible recovery in Walmart, this is like a ton of all-time-high breakouts among large cap value names.

JPM - JPMorgan Chase & Co. - Financial - USA 🇺🇸

This move speaks for itself. JPM has momentum after a turbulent period in December.

V - Visa Inc. - Financial - USA 🇺🇸

SHOP - Shopify Inc. - Technology - Canada 🇨🇦

SHOP was under $100 for all of 2022 - 2024 (mostly) - now it’s breaking out above $100. A good purchase for the next 12-18 months.

SPOT - Spotify Technology S.A. - Communication Services - Luxembourg 🇱🇺

We see another base built in December which is now resolved higher. Fantastic look.

A fanstastic breakout after seeing a nice base for 6 weeks.

MMM - 3M Company - Industrials - USA 🇺🇸

A massive breakout after a massive base being created from 2022-2025 - Good times ahead for MMM

WRBY - Warby Parker Inc - Healthcare - USA 🇺🇸

This is a beautiful, low-volatility breakout in Warby Parker. Any pullback, I’ll participate.

PHYS - Sprott Physical Gold Trust - Financial - Canada 🇨🇦

Gold is now where it’s at with rates being

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro