- The New High Newsletter

- Posts

- The Great Bull Awakens: Breakouts Across the Board

The Great Bull Awakens: Breakouts Across the Board

Small caps, high beta, and growth stocks are stealing the show. Are you riding the wave?

This market is chock-full of high-flying, brand-name tech companies ready to go to the moon. 🚀 It’s like a throwback to the “apes” era—remember that? Diamond hands, rocket emojis, and stonks only go up? Feels like a lifetime ago, but here we are again. Nostalgic, isn’t it? Or exhausting, depending on how much GME you’re still holding.

We’ve shed so much froth from the market it’s like a well-poured pint of beer—settling nicely, but you know the foam will rise again. And guess what? That froth seems poised to return in early 2025. Why, you ask? Honestly, I don’t know. Could be Trump, could be NVDA, could be Elon tweeting about Dogecoin while launching Cybertrucks into space. Either way, small-cap, high-beta, growth themes are back to strut their stuff like it’s prom night.

But here’s the deal—understanding the moment is critical to trading like a pro. How do I gauge sentiment? I keep it simple with three relative strength setups:

Growth vs. Value

Small Cap vs. Large Cap

Low Beta vs. High Beta

Three inputs, one clear output right now:

Buy Growth. Buy Small Cap. Buy High Beta.

Let’s take SOFI as a prime example. This fintech darling is up over 14.45% in just the past week and crushing it year-to-date with an impressive 127.41% gain. Talk about high-beta swagger! 📈 Its rising Bitcoin correlation (96.48%) only adds to the narrative. SOFI’s out here saying, "We’re not just a bank; we’re the bank of the future!" And with a trend price of $9.77, it’s still got plenty of room to run.

Now, pair that with SQ (Block, Inc.), which is practically the poster child for this setup. It’s got growth aspirations (still unproven), it’s small (sub-$100B), and its beta? A fiery 2.48. Sprinkle in Bitcoin, and you've got a cocktail spicy enough to give traders FOMO-induced heartburn.

And don’t sleep on MSTR (MicroStrategy). Michael Saylor’s turned it into a full-blown Bitcoin proxy. With BTC teasing $100K, MSTR could become the drum major of the high-beta crypto parade. If SOFI’s the fintech disruptor and SQ’s the scrappy innovator, MSTR’s the pied piper, leading all the Bitcoin believers to the promised land.

So buckle up, apes and traders alike. The froth is bubbling, the narratives are hot, and it’s looking like 2025 could kick off with a champagne pop. 🍾

Market Performance

The market wrapped up the week on an upbeat note, with all three major indexes showing resilience. However, NVDA’s red week stole some of the spotlight. It's a fascinating subplot when a mega-cap stock like NVDA, which has dictated the market's tempo, suddenly stumbles despite a lineup of promising catalysts. Add in the frenzy of 0DTE options swarming the stock, and you get a market that collectively shrugs and says, "Been there, done that." Call it market fatigue or a recalibration, but the focus is shifting.

INX (S&P 500): Riding the Middle Lane

The S&P 500 eked out a 0.35% gain on Friday and a steady 1.68% for the week. It’s the reliable middle child of the market—steady but not stealing the show. The weekly bullish sentiment reflects confidence, but the falling volume raises eyebrows. Are traders cautiously optimistic, or just taking an early Thanksgiving break? With a strong BTC correlation of 71.85%, it seems crypto’s moves are syncing with broader market vibes. But let’s not overlook that the trend price of $6,017.31 looms as a pivotal resistance level. Eyes on the prize, INX.

A big up week for the SPY too - Things really turned around this week considering the expectations.

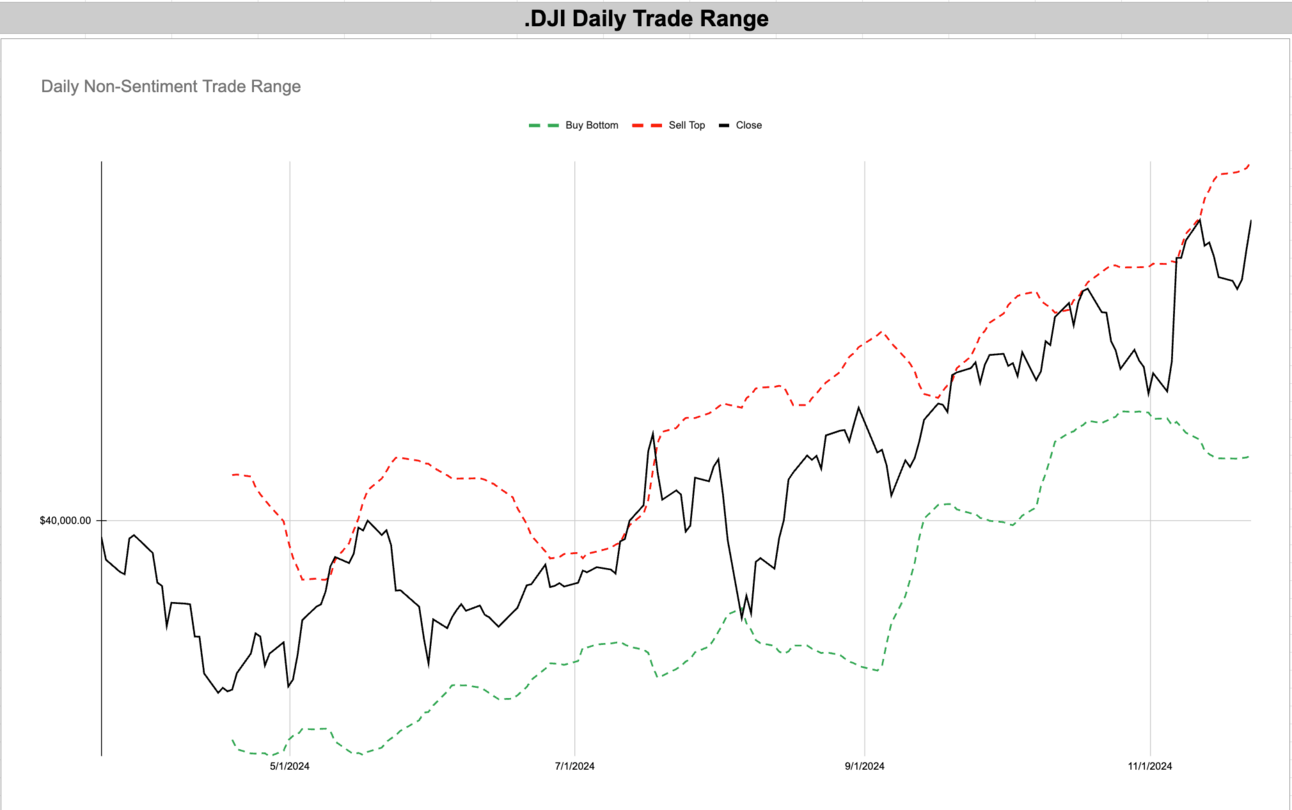

DJI (Dow Jones): Grandpa’s Still Got It

The Dow Jones added 1.96% this week, flexing its old-school charm. It’s the index equivalent of your grandpa pulling out a new gadget and saying, “See, I’m still with it.” Volume is up, bullish weekly sentiment is locked in, and BTC correlation at 81.62% suggests the Dow isn’t just for blue-chip lovers anymore—it’s winking at risk assets. With a trend price above current levels at $44,486.70, there’s room for a breakout if the rally sustains. But don’t sleep on this: the Dow’s steady climb could quietly lead the charge into the end of the year.

Dow Jones continues to show it belongs in the top indexes in the world as it notched a 1.96% up week.

IXIC (NASDAQ): High Beta, Higher Hopes

Meanwhile, the NASDAQ, the home of high beta and growth names, inched up 1.73% on the week. Volume may be falling, but sentiment remains bullish, and a year-to-date return of 33.35% reminds us why this index still feels like the market’s adrenaline rush. Its BTC correlation of 66.23% makes it the high-flyer that flirts with crypto’s volatility, but also rides the broader market wave. With a trend price of $18,083.95, NASDAQ’s growth themes are firmly entrenched, and the chart says there’s gas left in the tank. Could it lead the froth revival of 2025? Don’t bet against it.

A very nice week for tech being up 1.73% for the week - respectable.

So, while NVDA took a breather, the broader market didn’t miss a beat. The indexes are humming along, each playing its part in the great market symphony. The Dow's methodical rise, the S&P’s steady tempo, and the NASDAQ’s electrifying rhythm create a balanced yet compelling melody. Whether we’re heading for a crescendo or a quiet fade, one thing is clear: the market’s still got moves, and we’re all along for the ride. 🎢

Volatility Corner:

The VIX/VVIX dynamic just pulled off a major glow-up! 💙 Blue up? That’s our cue for celebration—bullish vibes are officially back in style. Blue down? Let’s not even talk about that; we’re leaving those bearish blues in the rearview.

For the past couple of weeks, I’ve been shouting from the rooftops about how primed this market was for a bullish setup. “The market was down for the week but the longer-term turbulence indicator still shows a rising risk on environment.” And now? It’s not just a whisper of optimism—it’s a full-blown symphony of breakouts. 📈 Across sectors, across market caps, this week was the fireworks finale we’ve been waiting for. From small caps making big moves to large caps flexing their dominance, it’s clear we’re in a bull market renaissance.

Look at the charts—the VIX is deflating like an old party balloon, and the VVIX is signaling stability. This is the kind of environment where risk-on strategies thrive. And that’s not just me talking; it’s the data practically screaming it.

So, what’s next? It’s time to hang on tight and enjoy the ride. 🚀 The market’s back in its bullish groove, and all signs point to momentum carrying through the holidays and beyond. Just don’t forget to buckle your seatbelt—this could get exhilarating.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 8/24/24🟢

MICRO WEATHER: BULLISH Since 11/8/24🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

SOFI - SoFi Technologies Inc - Financial - United States - 🇺🇸

PTON - Peloton Interactive Inc - Consumer Cyclical - United States - 🇺🇸

YEXT - Yext Inc - Technology - United States - 🇺🇸

HNST - Honest Company Inc - Consumer Defensive - United States - 🇺🇸

NXE - NexGen Energy Ltd - Energy - Canada - 🇨🇦

GBTG - Global Business Travel Group Inc - Technology - United States - 🇺🇸

APLD - Applied Digital Corporation - Technology - United States - 🇺🇸

PAYO - Payoneer Global Inc - Financial - United States - 🇺🇸

WT - WisdomTree Inc - Financial - United States - 🇺🇸

LC - LendingClub Corp - Financial - United States - 🇺🇸

OUT - Outfront Media Inc - Real Estate - United States - 🇺🇸

SOFI - SoFi Technologies Inc - Financial - United States - 🇺🇸

What an absolute beauty in SOFI!

PTON - Peloton Interactive Inc - Consumer Cyclical - United States - 🇺🇸

Believe in the bike! It’s breaking out.

YEXT - Yext Inc - Technology - United States - 🇺🇸

An ole but a goodie is back!

HNST - Honest Company Inc - Consumer Defensive - United States - 🇺🇸

Last week, we had HNST and it was 17% less than it is today! Whoooo!

NXE - NexGen Energy Ltd - Energy - Canada - 🇨🇦

GBTG - Global Business Travel Group Inc - Technology - United States - 🇺🇸

Up 25% in 1 month — that’s a great move.

APLD - Applied Digital Corporation - Technology - United States - 🇺🇸

I love the low price on this and the pending ATH breakout.

PAYO - Payoneer Global Inc - Financial - United States - 🇺🇸

High breakout in the payment space.

WT - WisdomTree Inc - Financial - United States - 🇺🇸

A nothing burger of a company, brand and stock but it’s bullish with a massive tailwind.

LC - LendingClub Corp - Financial - United States - 🇺🇸

Lending is so cool in a growth environment - watch out for AFRM too!

OUT - Outfront Media Inc - Real Estate - United States - 🇺🇸

A nice move is setting up here.

Enjoying this?

& Invite a friend.

New Highs $20+:

TSLA - Tesla Inc. - Consumer Cyclical - United States - 🇺🇸

WMT - Walmart Inc. - Consumer Defensive - United States - 🇺🇸

JPM - JPMorgan Chase & Co - Financial - United States - 🇺🇸

COST - Costco Wholesale Corporation - Consumer Defensive - United States - 🇺🇸

BAC - Bank of America Corporation - Financial - United States - 🇺🇸

NOW - ServiceNow Inc. - Technology - United States - 🇺🇸

ISRG - Intuitive Surgical Inc. - Healthcare - United States - 🇺🇸

KKR - KKR & Co. Inc. - Financial - United States - 🇺🇸

BSX - Boston Scientific Corporation - Healthcare - United States - 🇺🇸

TEAM - Atlassian Corporation - Technology - United States - 🇺🇸

SQ - Block Inc. - Technology - United States - 🇺🇸

DDOG - Datadog Inc. - Technology - United States - 🇺🇸

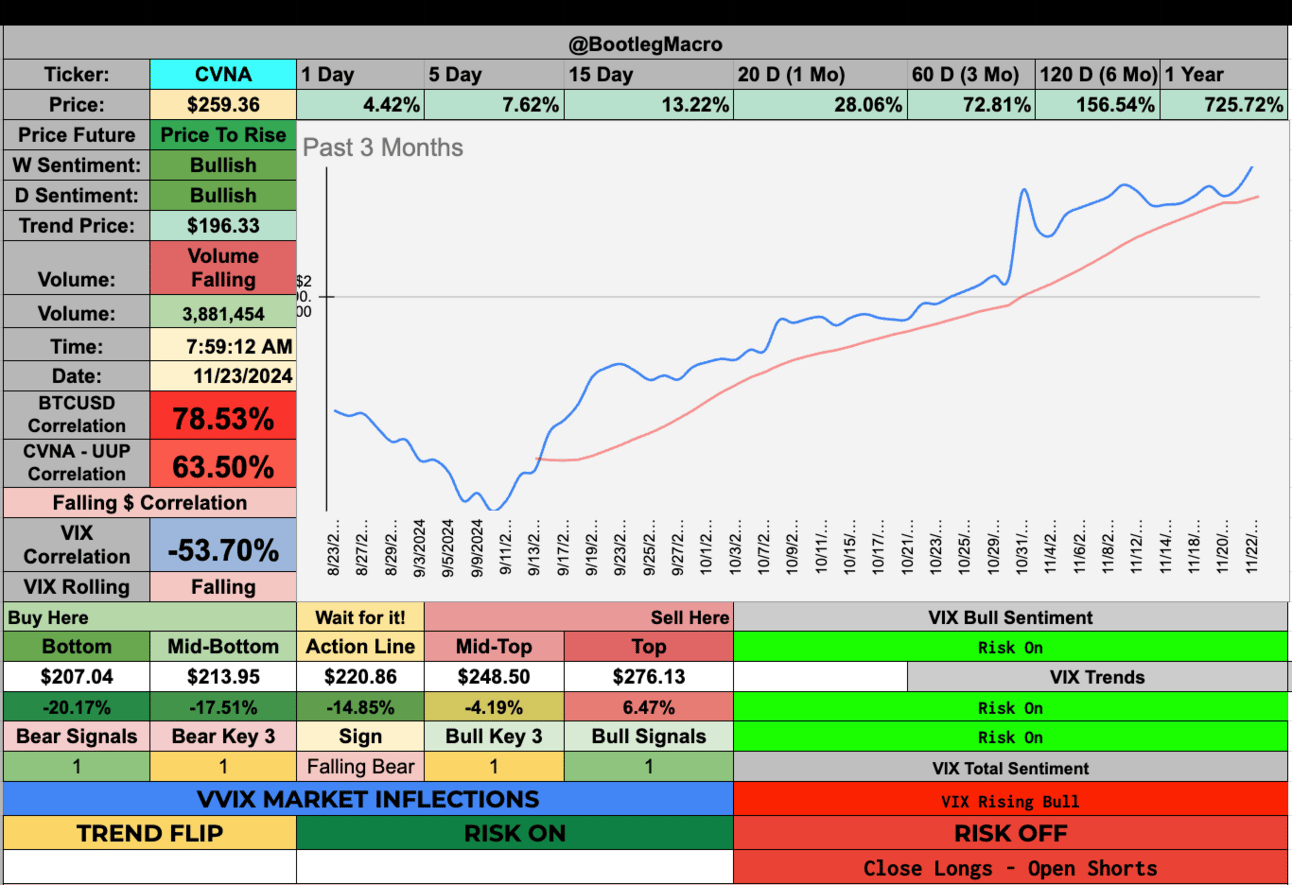

CVNA - Carvana Co. - Consumer Cyclical - United States - 🇺🇸

TSLA - Tesla Inc. - Consumer Cyclical - United States - 🇺🇸

The highest volatility, highest beta stock in the market is up 41% in 3 weeks! Whaaaat!

WMT - Walmart Inc. - Consumer Defensive - United States - 🇺🇸

Walmart is now a growth company? I dunno but it’s not going down. Easy money.

JPM - JPMorgan Chase & Co - Financial - United States - 🇺🇸

COST - Costco Wholesale Corporation - Consumer Defensive - United States - 🇺🇸

Costco is a winner of a company and the stock is no different.

BAC - Bank of America Corporation - Financial - United States - 🇺🇸

De-regulation is expected and banks will benefit…maybe?

NOW - ServiceNow Inc. - Technology - United States - 🇺🇸

ServiceNow is a big example of the breakout

ISRG - Intuitive Surgical Inc. - Healthcare - United States - 🇺🇸

A darling of the previous cycle, ISRG is back for higher high and breakouts!

KKR - KKR & Co. Inc. - Financial - United States - 🇺🇸

Investments are about to explode.

BSX - Boston Scientific Corporation - Healthcare - United States - 🇺🇸

It’s remarkable BSX continues considering healthcare is a short right now

TEAM - Atlassian Corporation - Technology - United States - 🇺🇸

These IT tools will be hot in a market where IT is going to be given tax cuts and opportunity.

SQ - Block Inc. - Technology - United States - 🇺🇸

DDOG - Datadog Inc. - Technology - United States - 🇺🇸

DataDog is so fucking back for the masses to YOLO call into for the next cycle!

CVNA - Carvana Co. - Consumer Cyclical - United States - 🇺🇸

Carvana continues the trend of small cap, high beta, high growth breaking out.

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

$NVDA Rant - Why are you people doing this to yourself?

— BootlegMacro (@bootlegmacro)

11:41 PM • Nov 21, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro