- The New High Newsletter

- Posts

- Can Apple 🍎 Pull Down The Whole Market?

Can Apple 🍎 Pull Down The Whole Market?

I think so, you'll want to catch this update. The first time since January this stock is BEARISH.

Welcome back to the New Highs Newsletter. We are here to celebrate the BULL MARKET 🐂 as always.

But we have to be honest. Things look different in the big names.

The 1st 🍎 and 2nd 🧑💻 largest companies in the world have both gone BEARISH 🐻 on based on daily price action.

What I noticed though, Oil 🛢️ & Gas⛽ are having a resurgence on the breakout lists. Pay attention to the name associated to black gold!

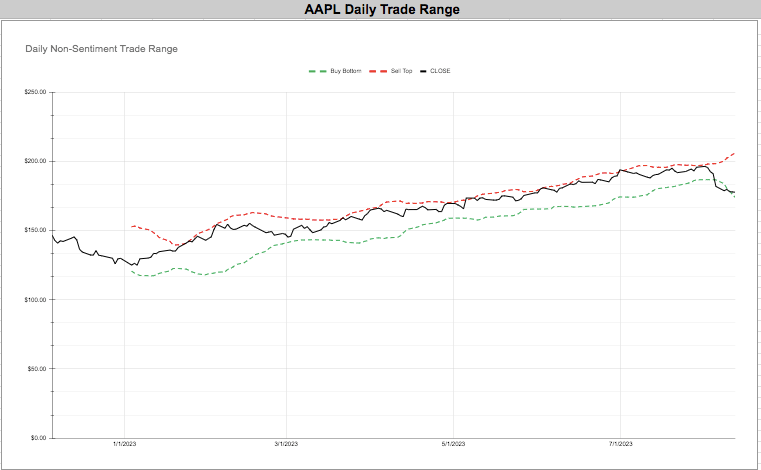

Apple’s Bad Week:

Apple’s weekly trend officially went BEARISH 🐻. I made a 10 minute video where I review how APPLE could go bearish 🐻 earlier in the week.

It’s official now. Apple has flipped BEARISH 🐻 on the short, intermediate and longer-term based on Daily Price Action. (Watch is at 1.5x)

Apple’s price action suddenly went from low-volatility to high-volatility. 🚩

Apple’s Volatility was falling for months. After 1 earnings call, the volatility reversed and it now breaking out. 🚩

Apple’s trade range, posted a lower-bottom range then the previous week for the first time in months. 🚩

Apple’s stock behavior changed in a big way in the past 2 weeks. We can see the largest stock in the world has a different personality now.

Market Performance:

We will review the indexes, then review $SPY $DIA $QQQ $IWM and rounding out our market review in the volatility corner.

You’ll want to see the volatility corner update, it’s getting worse for now. We use this high level review to understand market conditions.

Index Review

Only the Dow Jones as up over the past week.

When it comes to indexes, you’d be surprised to know the DJI is the only bright spot ☀️ this week. Which makes sense because Apple is a heavy weighing in both the S&P500 and Nasdaq.

Volatility Corner:

VIX / VVIX deteriorated. Blue up is good, blue down is bad. The ratio almost fell below it’s 23 week average.

It would have been the first time since January 2023! This signal shouldn’t be ignored. This is an important week to watch indexes.

US Index ETF Review:

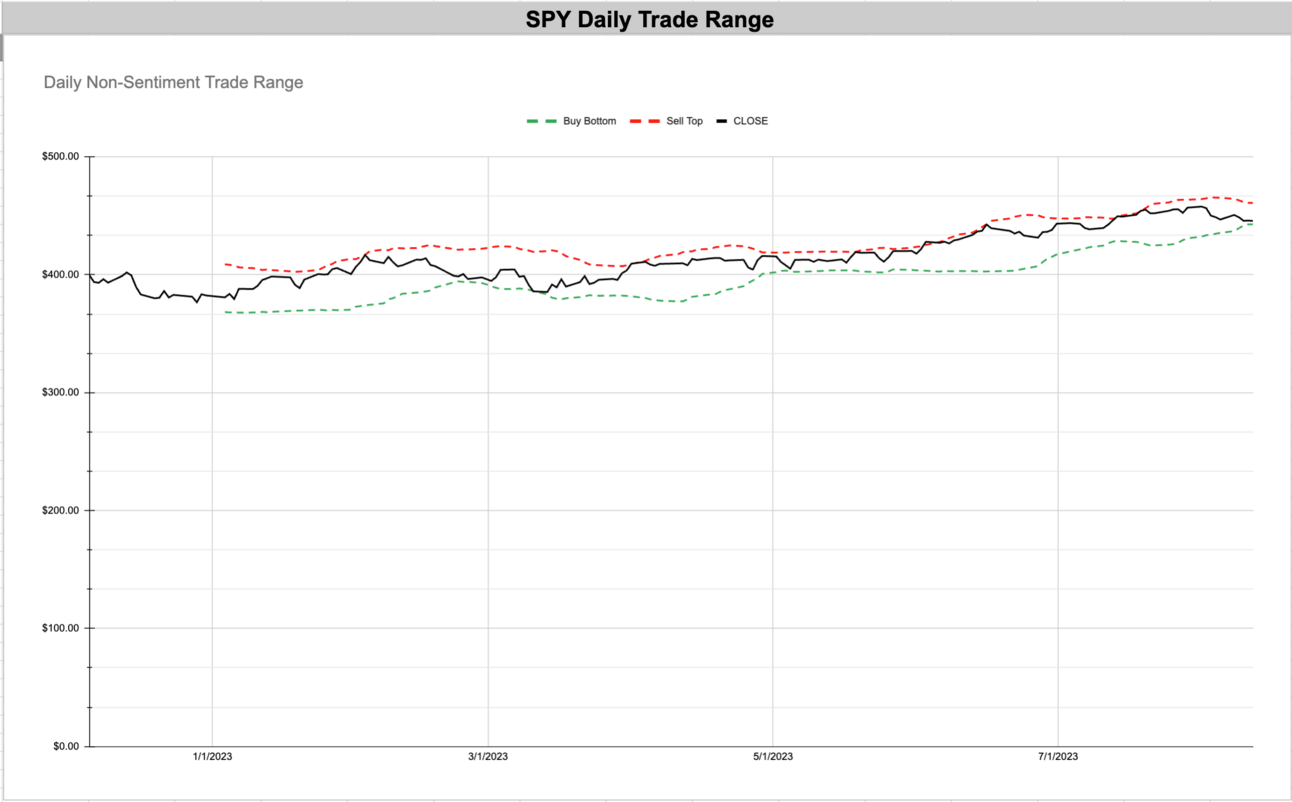

SPY

Bullish Trend Since 5/31/23🟢

Go SHORT Since 8/11/23🛑****

Price to FALL Since 8/8/23🛑***

DIA

Bullish Trend Since 6/30/23🟢

Go Long Since 7/13/23🟢

Price to Rise Since 7/7/23🟢

QQQ

QQQ’s price profile has changed.

QQQ Bullish Trend Since 5/16/23🟢

Go SHORT Since 8/10/23🛑***

Price to Fall Since 7/28/23**🛑

IWM

Bullish Trend Since 5/24/23🟢

Go SHORT Since 8/10/23🛑****

Price to Rise Since 6/29/23🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

HPE - Communication Equipment (USA) 🇺🇸

KTOS - Aerospace and Defense (USA) 🇺🇸

PAA - Oil & Gas Midstream (USA) 🇺🇸

PR - Oil & Gas E&P (USA) 🇺🇸

TAST - Restaurants (USA) 🇺🇸

EVLV - Security & Protection Services (USA) 🇺🇸

HLLY - Auto Parts (USA) 🇺🇸

RIG - Oil & Gas Drilling (Switzerland) 🇨🇭

CBAY - Biotechnology (USA) 🇺🇸

TDS - Telecom Services (USA) 🇺🇸

GCI - Publishing (USA) 🇺🇸

SVRA - Biotechnology (USA) 🇺🇸

HPE - Communication Equipment (USA) 🇺🇸

KTOS - Aerospace and Defense (USA) 🇺🇸

PAA - Oil & Gas Midstream (USA) 🇺🇸

PR - Oil & Gas E&P (USA) 🇺🇸

TAST - Restaurants (USA) 🇺🇸

EVLV - Security & Protection Services (USA) 🇺🇸

HLLY - Auto Parts (USA) 🇺🇸

RIG - Oil & Gas Drilling (Switzerland) 🇨🇭

CBAY - Biotechnology (USA) 🇺🇸

TDS - Telecom Services (USA) 🇺🇸

GCI - Publishing (USA) 🇺🇸

SVRA - Biotechnology (USA) 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

EXEL - Biotechnology (USA) 🇺🇸

UBS - Bank (Switzerland) 🇨🇭

HCKT - Information Technology Services (USA) 🇺🇸

PBF - Oil & Gas Marketing (USA) 🇺🇸

LMB - Engineering & Construction (USA) 🇺🇸

PRIM - Engineering & Construction (USA) 🇺🇸

PARR - Oil & Gas Marketing (USA) 🇺🇸

STRL - Engineering & Construction (USA) 🇺🇸

CBOE - Financial Data & Stock Exchanges (USA) 🇺🇸

MCK - Medical Distribution (USA) 🇺🇸

GPI - Auto & Truck Dealerships (USA) 🇺🇸

EME - Engineering & Construction (USA) 🇺🇸

EXEL - Biotechnology (USA) 🇺🇸

UBS - Bank (Switzerland) 🇨🇭

HCKT - Information Technology Services (USA) 🇺🇸

PBF - Oil & Gas Marketing (USA) 🇺🇸

LMB - Engineering & Construction (USA) 🇺🇸

PRIM - Engineering & Construction (USA) 🇺🇸

PARR - Oil & Gas Marketing (USA) 🇺🇸

STRL - Engineering & Construction (USA) 🇺🇸

CBOE - Financial Data & Stock Exchanges (USA) 🇺🇸

MCK - Medical Distribution (USA) 🇺🇸

GPI - Auto & Truck Dealerships (USA) 🇺🇸

EME - Engineering & Construction (USA) 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. Every month, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

Apple looks fucked. Now let's begin.

$AAPL on a weekly closing basis needs to close above $190 to break a (2) consecutive 5 WEEK rolling negative return...you think it's not a big deal...sure...maybe not but it has been POSITIVE SINCE JANUARY 13th, 2023 (a great time to buy)

— Bootleg Macro (@bootlegmacro)

10:30 AM • Aug 8, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro