- The New High Newsletter

- Posts

- Spooktober and 20+ Stocks Hitting Scary Highs!

Spooktober and 20+ Stocks Hitting Scary Highs!

Markets rose, mortgage rates rose and the fed still is pricing in a cut...scary stuff! If you're even remotely bearish go eat at Chilli's ($EAT) and try to build a bear $(BBW) and you'll see...we are in a great economy for the top 40%.

Spooktober is upon us. (h/t to Bussin with the Boys) Uranium is running, oil is falling and the equal weight SPY ($RSP) has the best forward outlook of any index. WHAAAAT! That’s right, we are about to enter into a period of time where large cap growth dissipates due to mean reversion and the broad market starts to take over.

It can happen in 1 of 2 ways. Either we have massive growth or simply nominal inflation. My bet is on the latter due to creeping, spooky, silent inflation which steals in the night and pumps during the day.

Unless you believe the middle eastern war is coming to a close and oil inflation is about to disappear. Because right now the Atlanta Fed has a Q3 nowcast of 3.4% GDP in the USA. Is that all growth? Probably more based on inflation pumping those numbers up. We’re not in rookie numbers anymore!

Below in our new highs we have a smattering of all sorts of stocks. The entire range of sectors is represented, even staples rose. What world are we entering?

Mortgage rates rose after a fed cut? What can it be? Well inflation my friends has returned in time for spooktober.

Market Performance

Markets rose, mortgage rates rose and the fed still is pricing in a cut…who is wrong?

Not a glaring policy mistake ofc… 🤡

— KKGB Kitty (@INArteCarloDoss)

11:18 AM • Oct 19, 2024

GS: $RSP The current high level of market concentration suggests the equal-weight S&P 500 will outperform the aggregate index by an annualized 8 pp during the next decade

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi)

9:55 PM • Oct 18, 2024

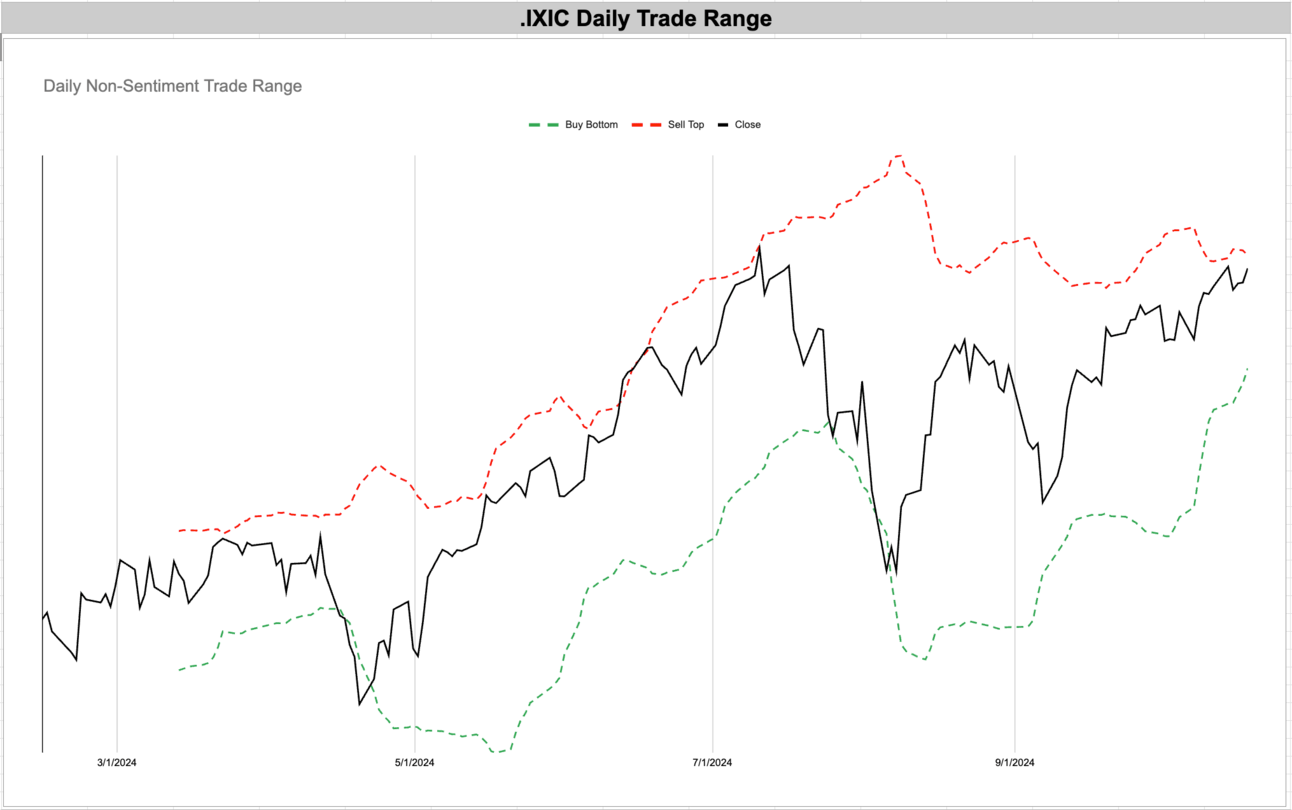

There is nothing to stop this train from running higher and higher. Buy dips.

The Dow Jones has continued to lead and over the past few months has really seen the bid come back. I’m buying dips.

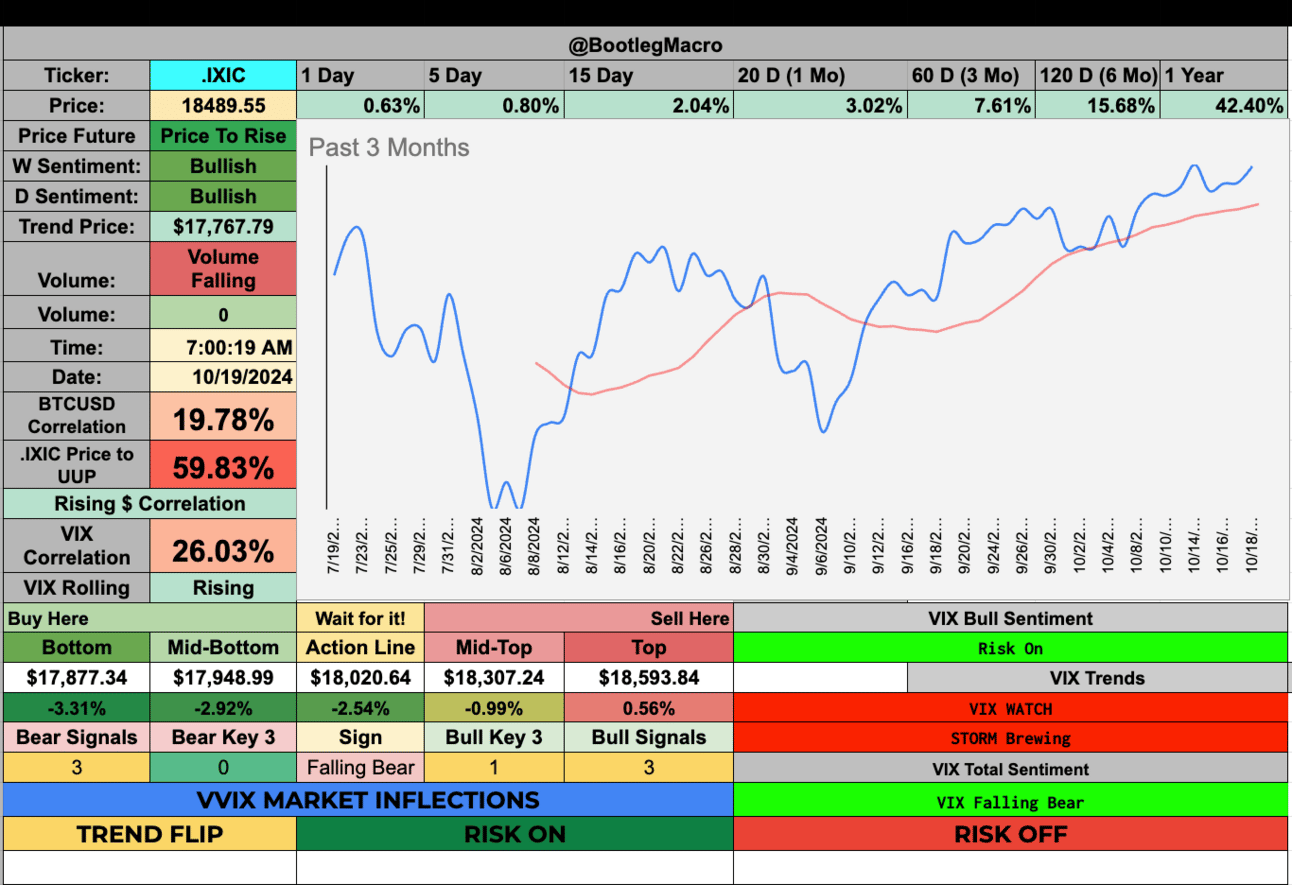

Tech has surprisingly been the laggard between SPY, DJ and COMPQ but we are seeing a resurgence. It’s time to buy dips in tech and let em rip. Even better to buy the components individual for a bit more alpha hunting.

Volatility Corner:

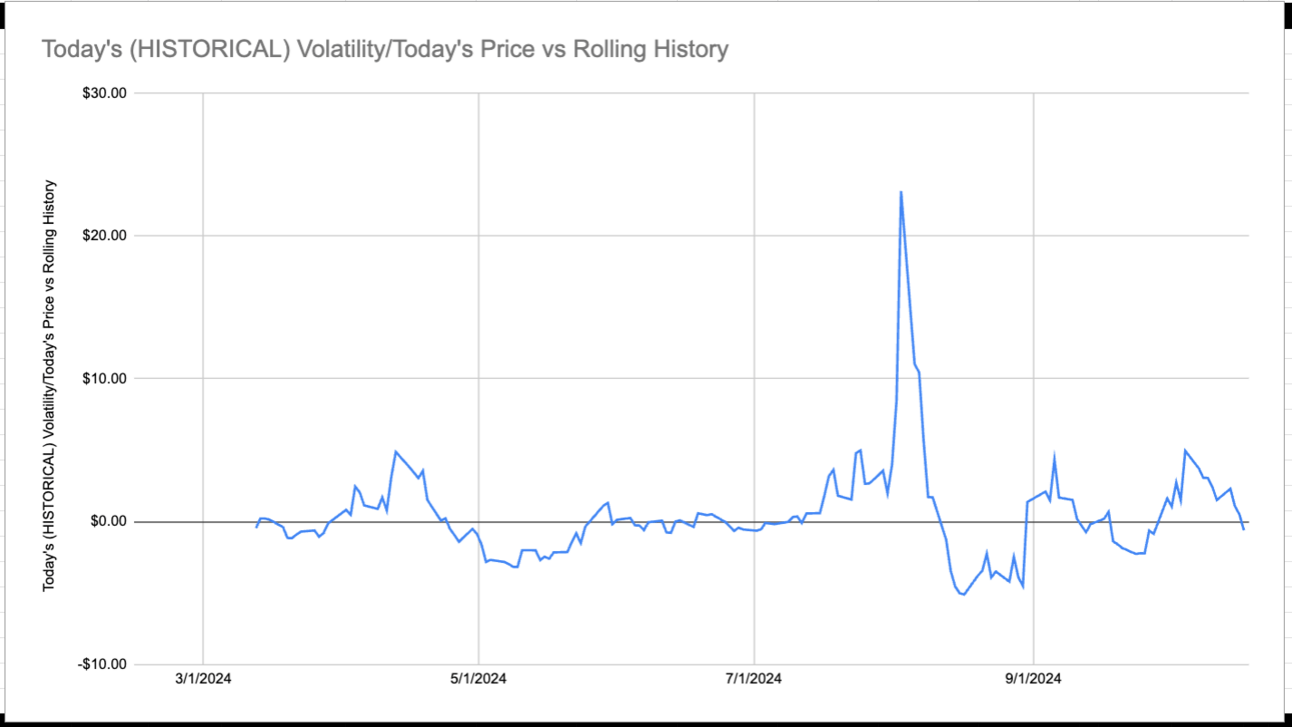

The Market Turbulence Indicator improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets.

The Market Turbulence Indicator appears to be sideways and consistently bullish. Until things change, I’ll buy the dip.

Because of this breakdown in the indicator over the past week, I suspect we are in for a very BULLISH ride between now and the first week of November. The market is ready for bullish behavior to dominate. What will you do with the information?

The VIX continues to breakdown. We should see the 15 on the VIX by the end of 2 weeks.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 8/30/24🟢

MICRO WEATHER: BEARISH Since 8/16/23🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

HBI - Hanesbrands Inc | Consumer Cyclical | USA 🇺🇸

JBLU - Jetblue Airways Corp | Industrials | USA 🇺🇸

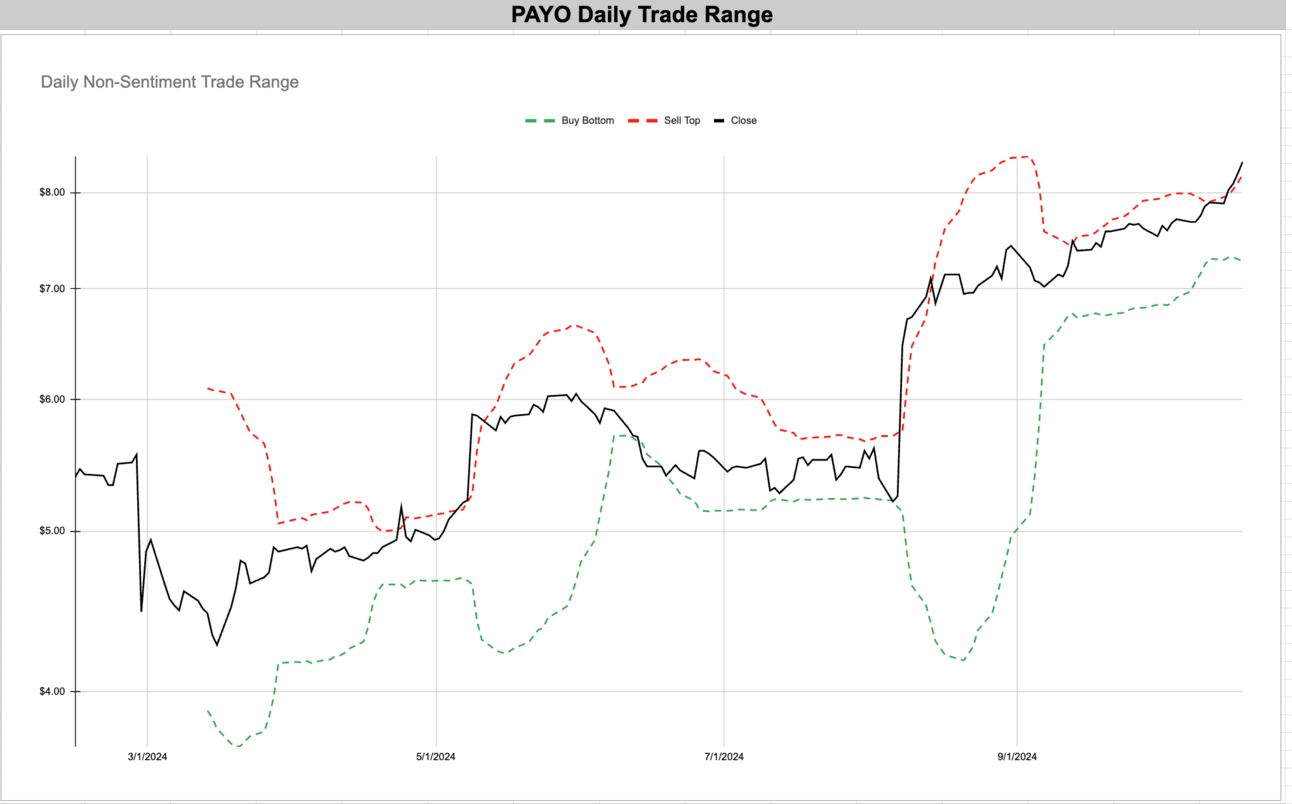

PAYO - Payoneer Global Inc | Technology | USA 🇺🇸

KGC - Kinross Gold Corp. | Basic Materials | Canada 🇨🇦

PCT - PureCycle Technologies Inc | Industrials | USA 🇺🇸

CRMD - CorMedix Inc | Healthcare | USA 🇺🇸

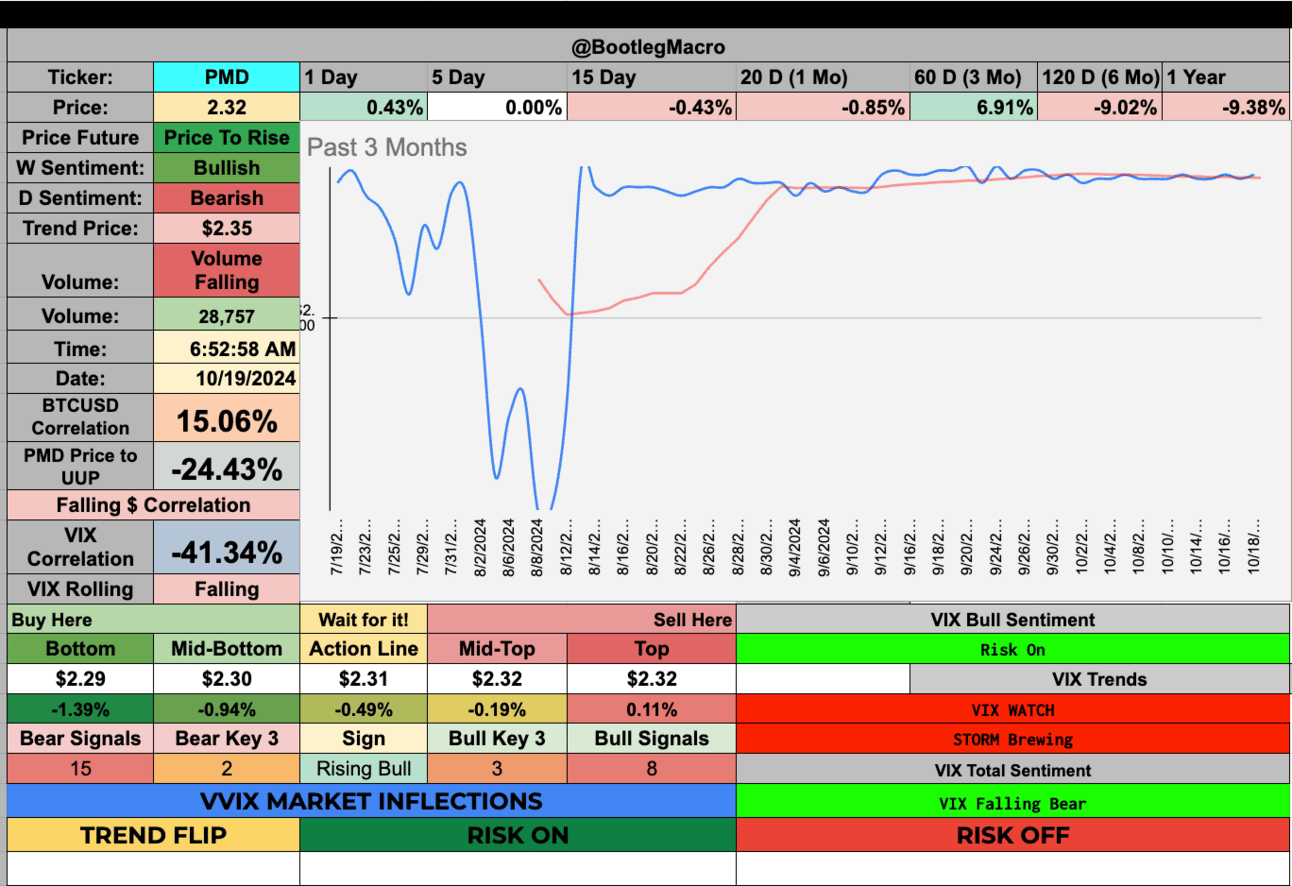

PMD - Piedmont Office Realty Trust Inc | Real Estate | USA 🇺🇸

SILV - SilverCrest Metals Inc | Basic Materials | Canada 🇨🇦

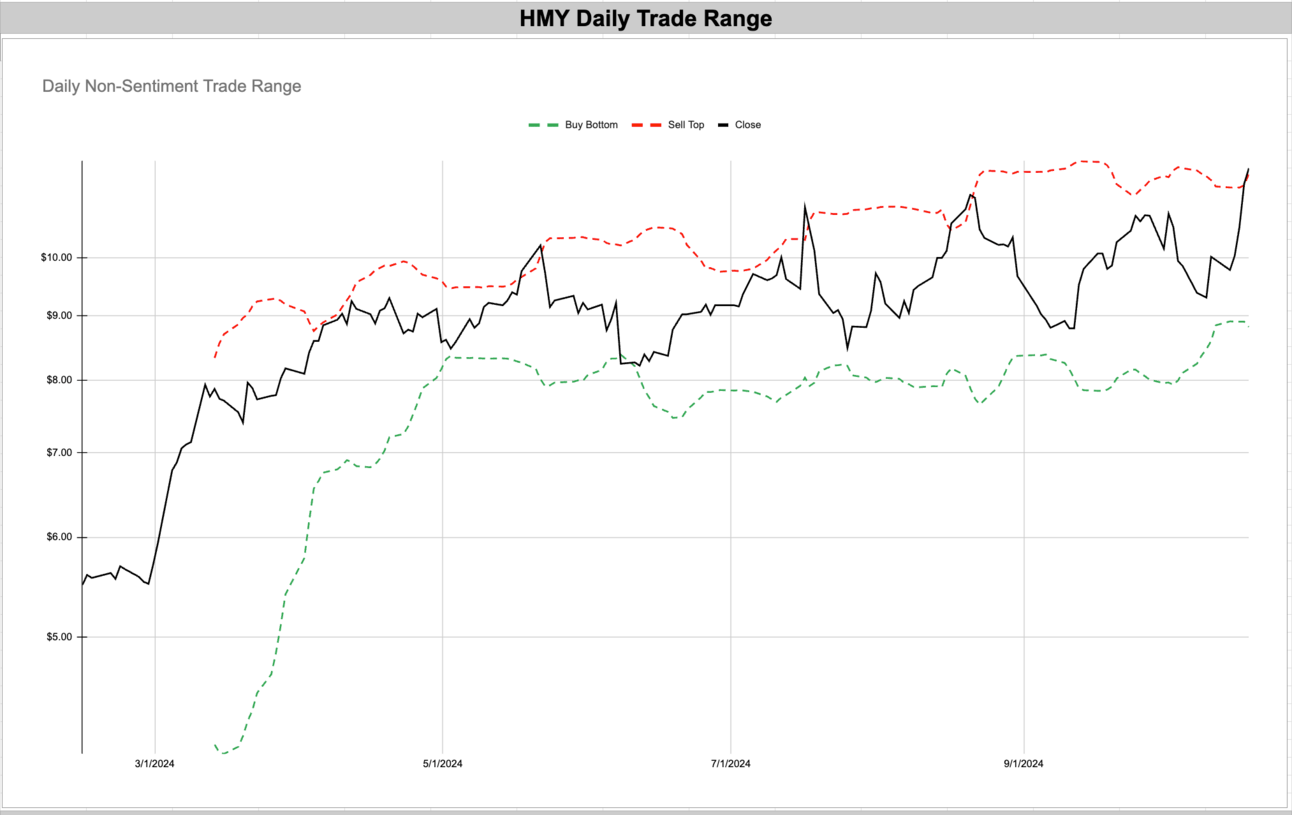

HMY - Harmony Gold Mining Co Ltd ADR | Basic Materials | South Africa 🇿🇦

GLDD - Great Lakes Dredge & Dock Corporation | Industrials | USA 🇺🇸

HBI - Hanesbrands Inc | Consumer Cyclical | USA 🇺🇸

One of the low volatility and best breakouts in the entire market is happening in an underwear brand! We are so back. Pump it all baby!

JBLU - Jetblue Airways Corp | Industrials | USA 🇺🇸

The turn around in JBLU has been due to recent developments, give this time to develop and pull back.

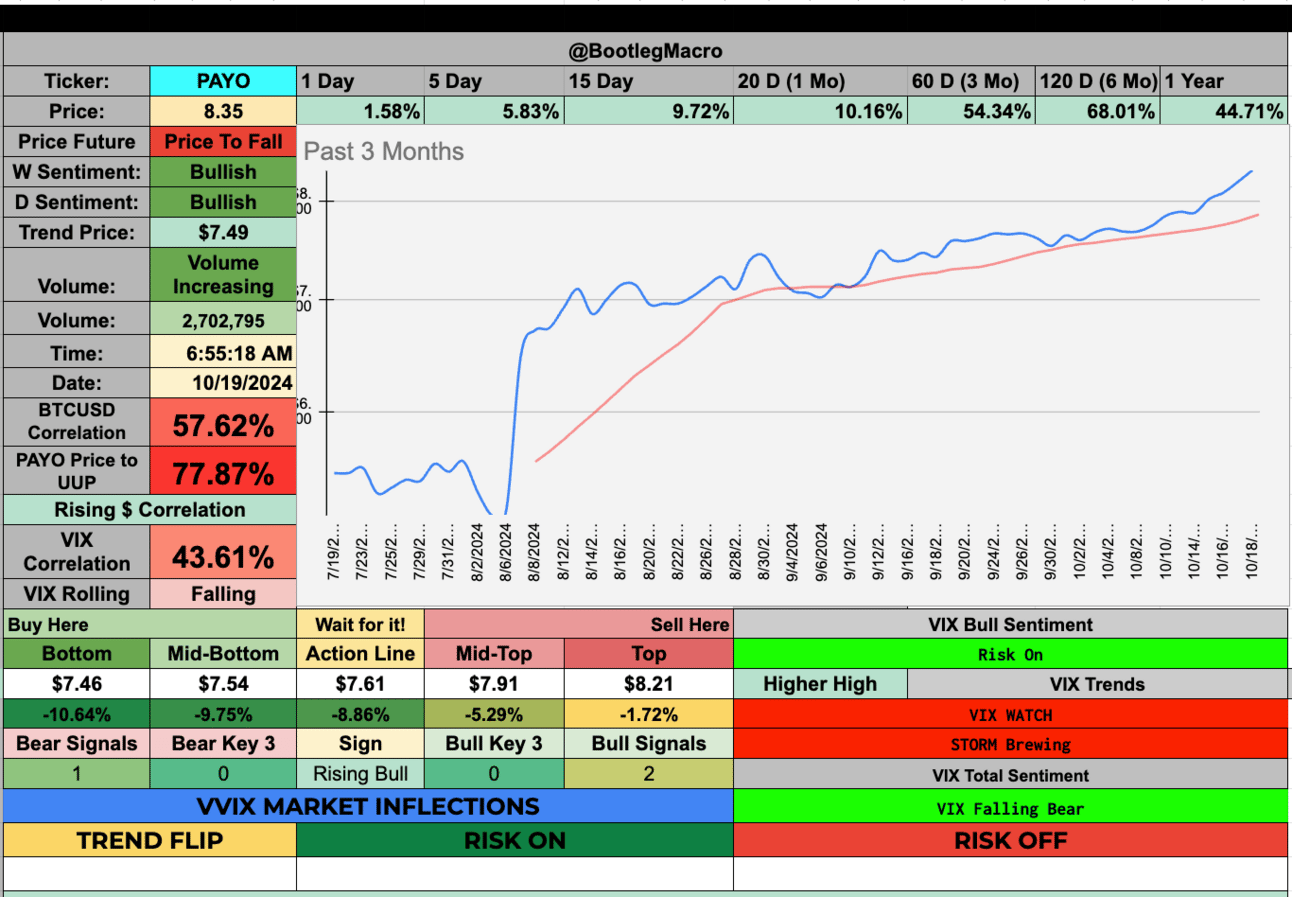

PAYO - Payoneer Global Inc | Technology | USA 🇺🇸

This has really been the elevator up instead of the stairs and I like the angle we see price going now too. This has a bright future.

KGC - Kinross Gold Corp. | Basic Materials | Canada 🇨🇦

24% over 3 months is a perfect place to be when you consider it’s up 100% nearly on the year. Love to see these kinds of low volatility trends where I can buy massively in dips.

PCT - PureCycle Technologies Inc | Industrials | USA 🇺🇸

Personal bet favorite for me. We are seeing life after a long base developed in 2023.

CRMD - CorMedix Inc | Healthcare | USA 🇺🇸

Can we find a more beautiful trend? Up 133% in 3 months!!! Here we go.

PMD - Piedmont Office Realty Trust Inc | Real Estate | USA 🇺🇸

This might be a take over, the price is frozen - this is a reminder how filters can be tricked and every ticker must be investigaged.

SILV - SilverCrest Metals Inc | Basic Materials | Canada 🇨🇦

Silver is hot, metals are precious and prices are rising. Up only 22% in 3mo we have space to run higher!

HMY - Harmony Gold Mining Co Ltd ADR | Basic Materials | South Africa 🇿🇦

Up 38% in 3mo - we do we see? High vol and higher prices! That’s a dead combo when buying options or dips.

GLDD - Great Lakes Dredge & Dock Corporation | Industrials | USA 🇺🇸

Nice breakout in industrial company. Buy dips. This is a massive breakout.

Enjoying this?

& Invite a friend.

New Highs $20+:

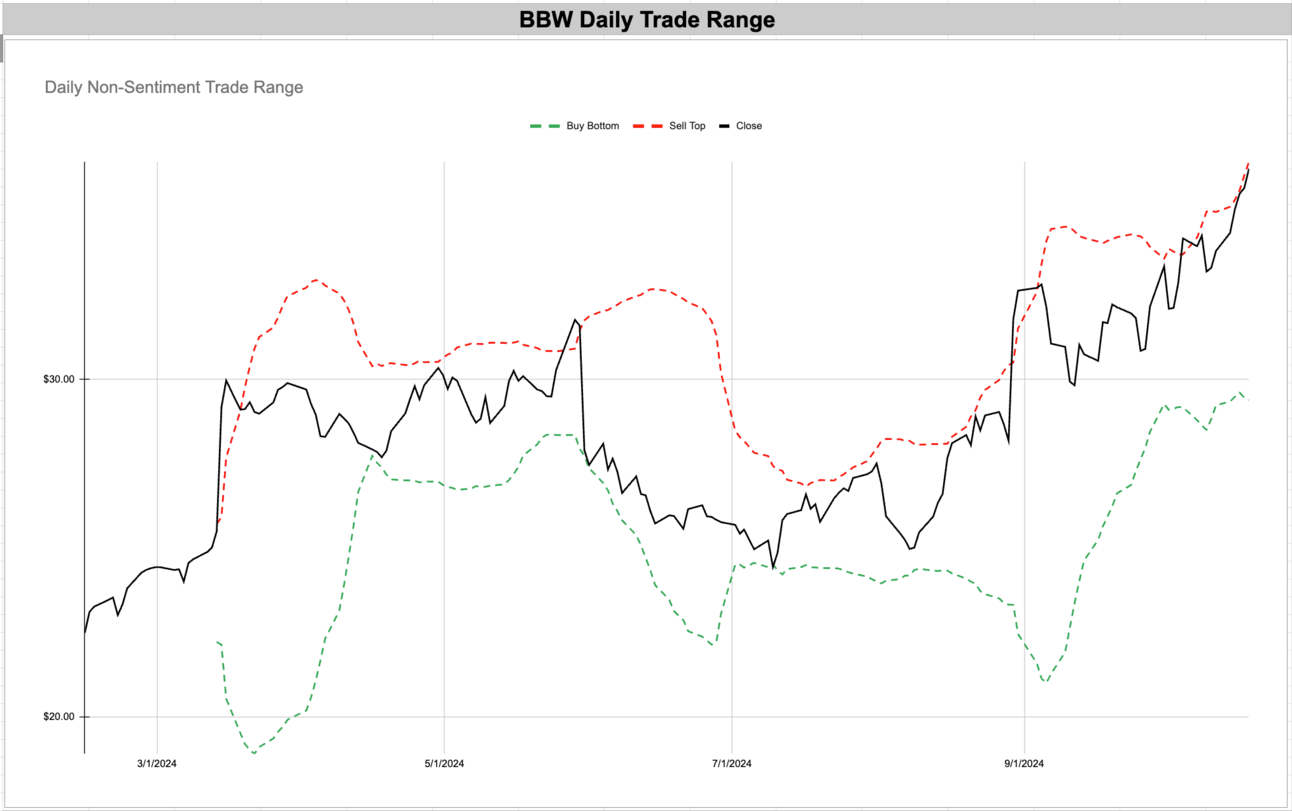

BBW - Build-A-Bear Workshop Inc | Consumer Cyclical | USA 🇺🇸

LEU - Centrus Energy Corp | Energy | USA 🇺🇸

MA - Mastercard Incorporated | Financial | USA 🇺🇸

NFLX - Netflix Inc | Communication Services | USA 🇺🇸

TMUS - T-Mobile US Inc | Communication Services | USA 🇺🇸

MCD - McDonald's Corp | Consumer Cyclical | USA 🇺🇸

CSCO - Cisco Systems Inc | Technology | USA 🇺🇸

WFC - Wells Fargo & Co. | Financial | USA 🇺🇸

ISRG - Intuitive Surgical Inc | Healthcare | USA 🇺🇸

BSX - Boston Scientific Corp | Healthcare | USA 🇺🇸

MDT - Medtronic plc | Healthcare | Ireland 🇮🇪

SO - Southern Company | Utilities | USA 🇺🇸

CAKE - Cheesecake Factory Inc | Consumer Cyclical | USA 🇺🇸

BBW - Build-A-Bear Workshop Inc | Consumer Cyclical | USA 🇺🇸

You’re telling me you see a recession when BUILD A BEAR is breaking out? lol

LEU - Centrus Energy Corp | Energy | USA 🇺🇸

Uranium had a hell of a breakout this week.

MA - Mastercard Incorporated | Financial | USA 🇺🇸

Mastercard is accelerating. Fun time ahead.

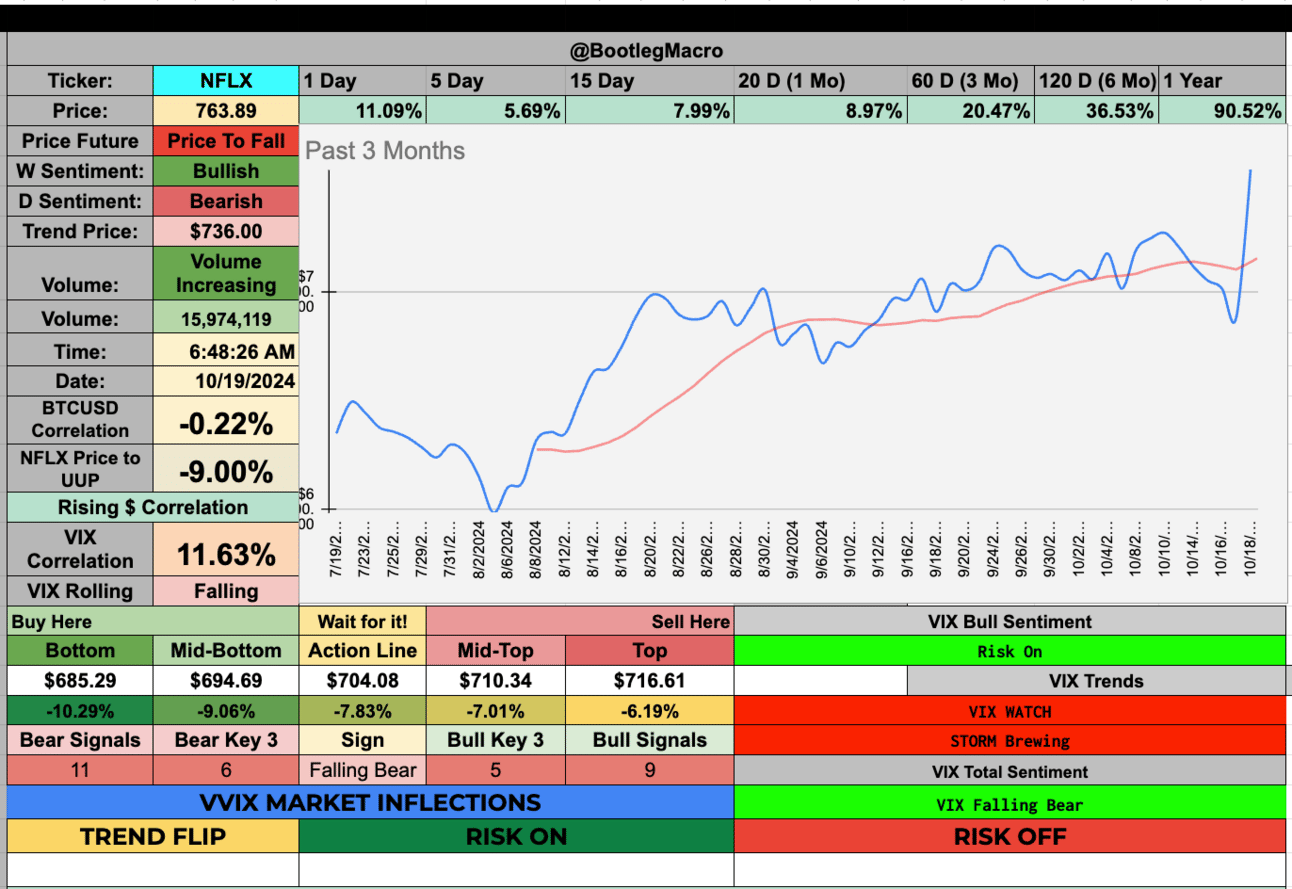

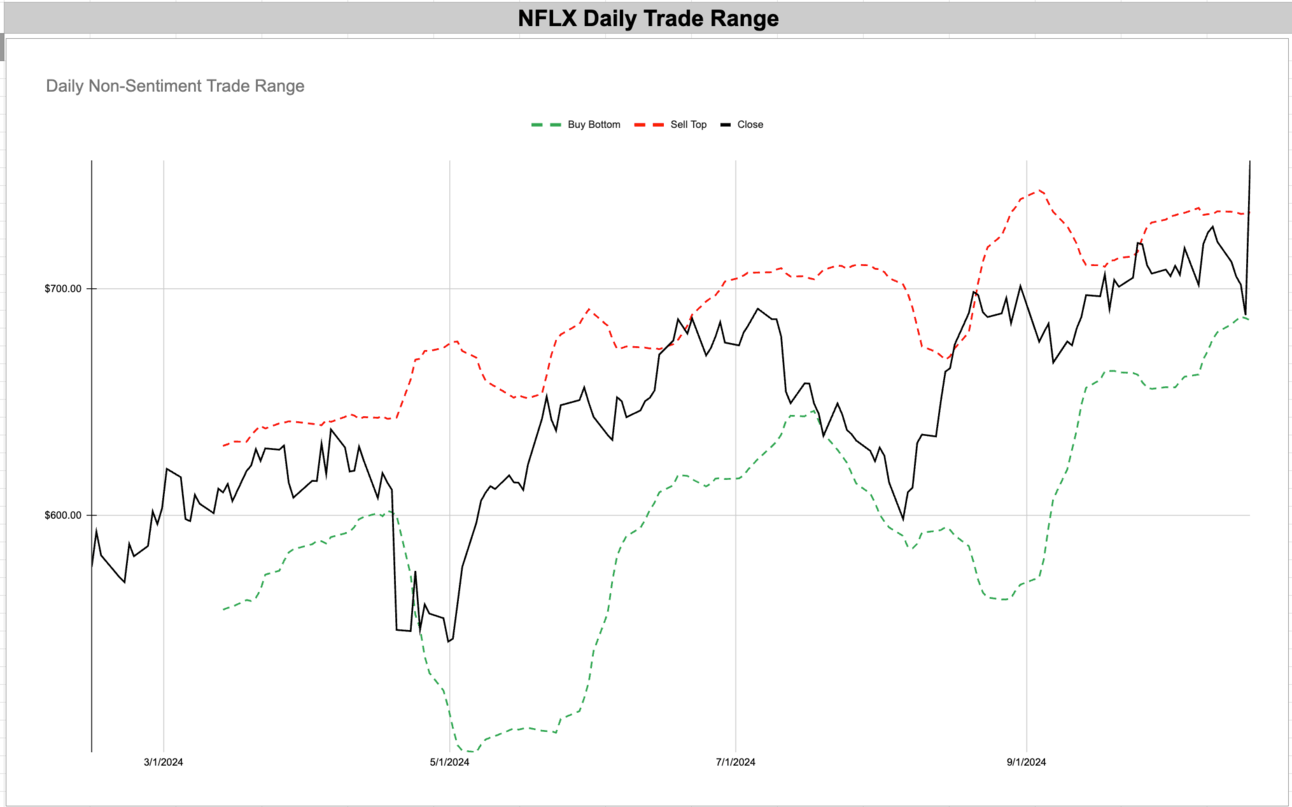

NFLX - Netflix Inc | Communication Services | USA 🇺🇸

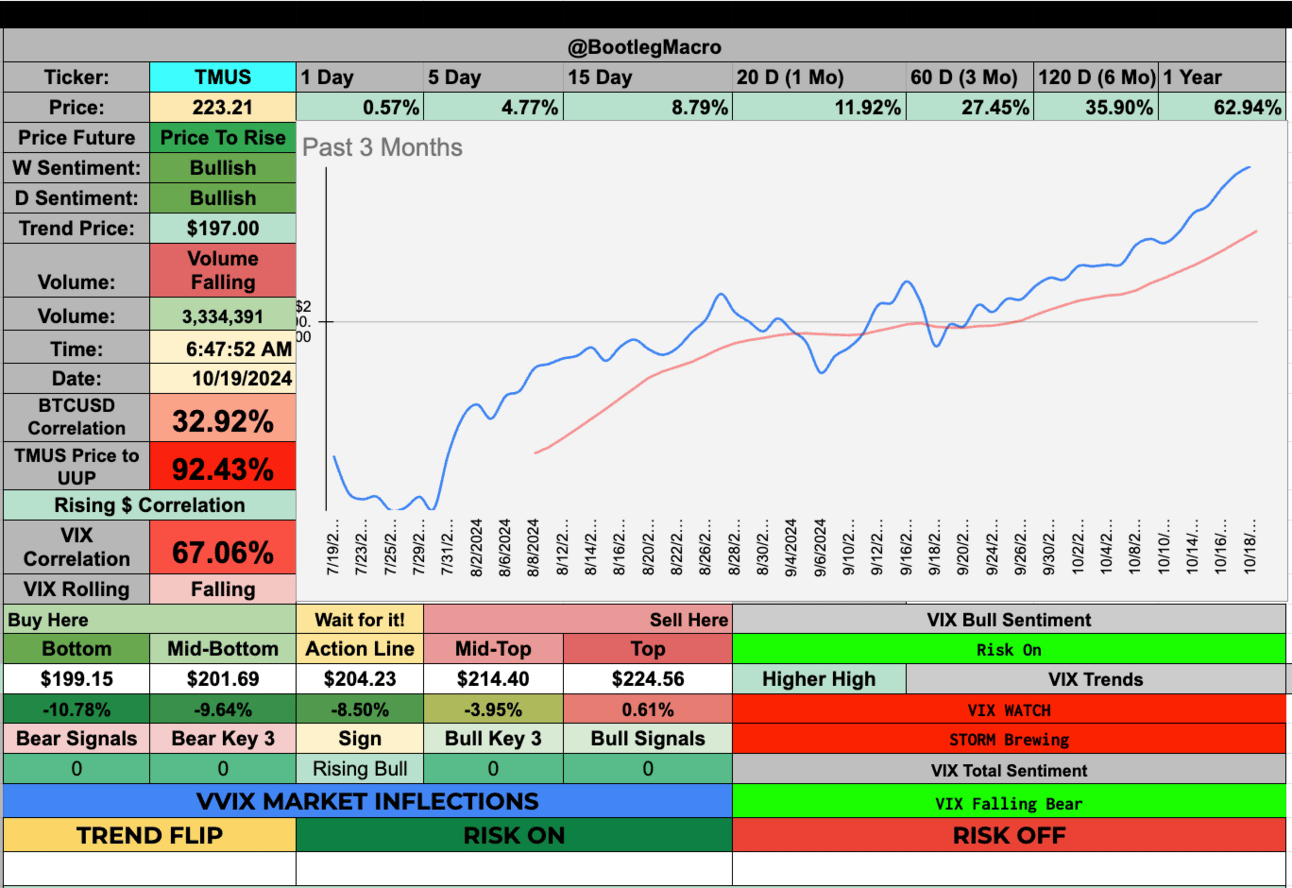

TMUS - T-Mobile US Inc | Communication Services | USA 🇺🇸

MCD - McDonald's Corp | Consumer Cyclical | USA 🇺🇸

CSCO - Cisco Systems Inc | Technology | USA 🇺🇸

WFC - Wells Fargo & Co. | Financial | USA 🇺🇸

ISRG - Intuitive Surgical Inc | Healthcare | USA 🇺🇸

BSX - Boston Scientific Corp | Healthcare | USA 🇺🇸

MDT - Medtronic plc | Healthcare | Ireland 🇮🇪

SO - Southern Company | Utilities | USA 🇺🇸

CAKE - Cheesecake Factory Inc | Consumer Cyclical | USA

🇺🇸Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

What can I expect in the weeks ahead? More of the same: dips bought, rallies sustained. That’s my slogan for the next 12 months. Asset inflation is back, and I don’t see anything on the horizon to slow it down.

bootlegmacro.beehiiv.com/p/bulls-charge…

— BootlegMacro (@bootlegmacro)

11:00 AM • Oct 15, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro