- The New High Newsletter

- Posts

- Oh Meta, Oh My! - 20+ Breakouts Led by Wingstop! - Chicken is Good Business

Oh Meta, Oh My! - 20+ Breakouts Led by Wingstop! - Chicken is Good Business

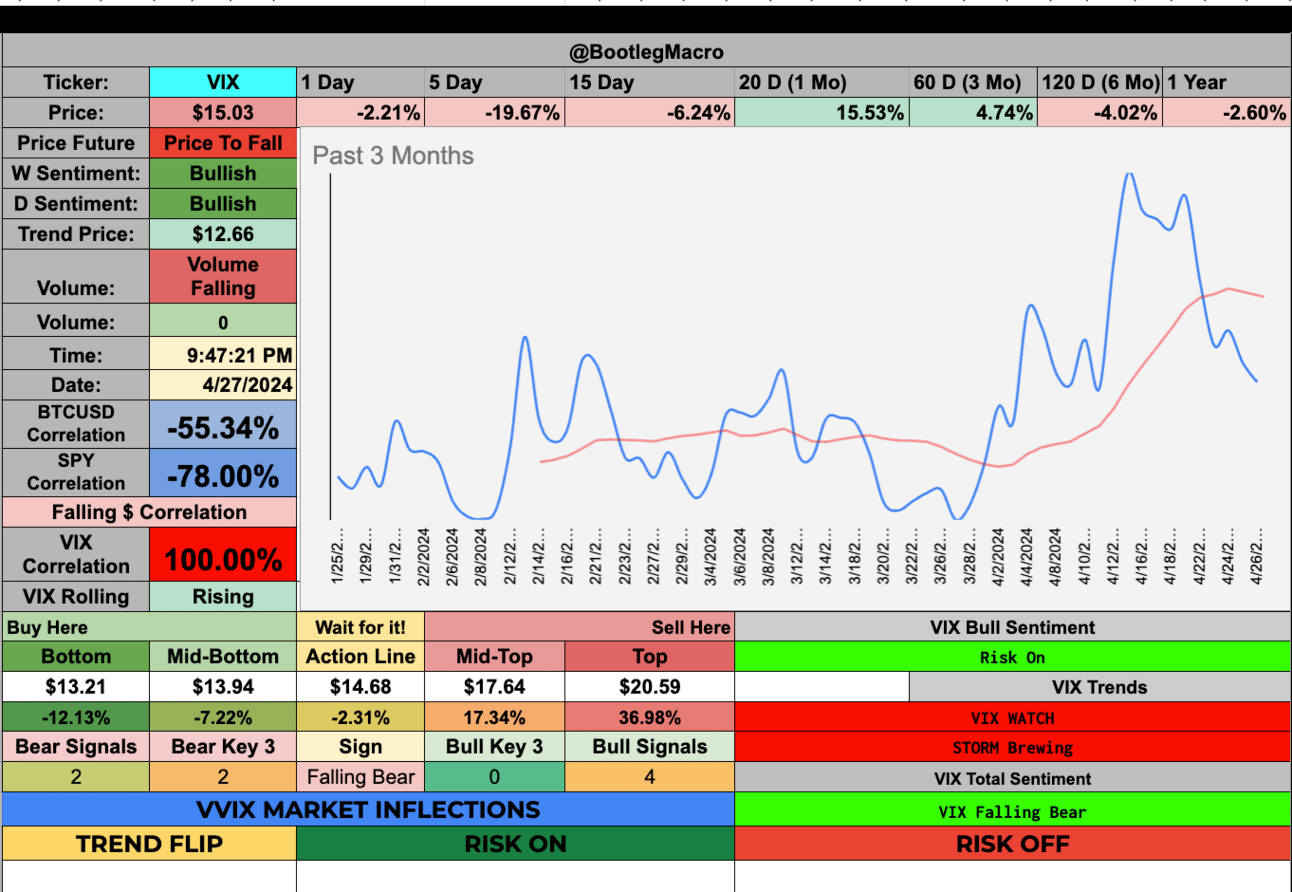

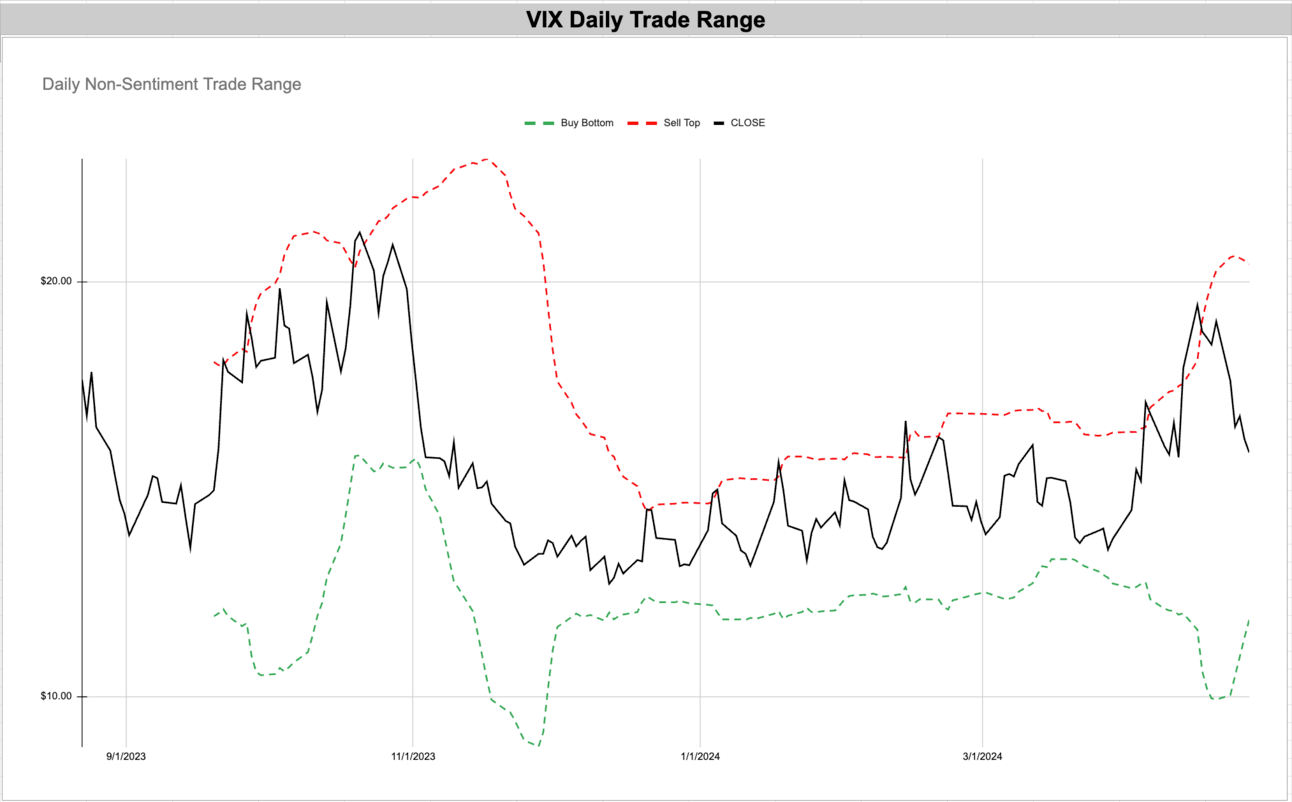

The next week is important to see if we get mean revision in the turbulence indicator. I suspect very nice price returns for the next 6 weeks based on how the VIX has scared people.

Oh Meta, oh my! This week we saw hundred’s of billions of market cap disappear for Meta. Due to a small but important guidance for investment costs going forward. At this point, Mark Zuckerberg isn’t getting the benefit of the doubt.

Investors were concerned about a company which makes 45+ billions of dollars in net profit investing for the future. That’s the market. More often than not, irrational is the default behavior. That’s our opportunity.

Moving from a specific stock to the main theme of the current market. We’re truly transported back in time. It’s like my childhood favorite movie, back to the future.

The indexes all recovered nicely. The SPX was up over 2%, Nasdaq was up over 4% even the Dow Jones was up over 0.5%. All green and up nicely.

Now what are we seeing on the new highs list? Shipping, computer chips and Wingstop — That’s leading the market.

We’re back in the early 1990s. Rates are high, stocks are flying and inflation is our fear. It’s a story as old as money itself. Fear of inflation.

What to expect? The future takes time. Money is like water, it' finds its level. Inflation will take time to wash out of the system. We can hit 2% but how long until we get there? I’m not concerned, for now I’ll bet the market will fear inflation.

While my inflation assumption is an educated guess, I know one thing for certain. Everyone needs the market to rise. There will be a bull market. Where this market arises I don’t know for certain. What I guess is there will be a bull market in emerging markets, commodities and anything tied to inflation.

My idea is that the dollar will need to weaken. The weakening dollar will translate into emerging market rises from them producing goods linked to inflation. If it’s true, we should expect a broad rise in markets.

Market Performance

World markets reacted positively last week. Asia in particular with India and China having fantastic weeks. $INDA for India is challenging for a new All-Time-High. China’s $FXI ETF had a amazing week up over 7% and hitting a new 6 month high.

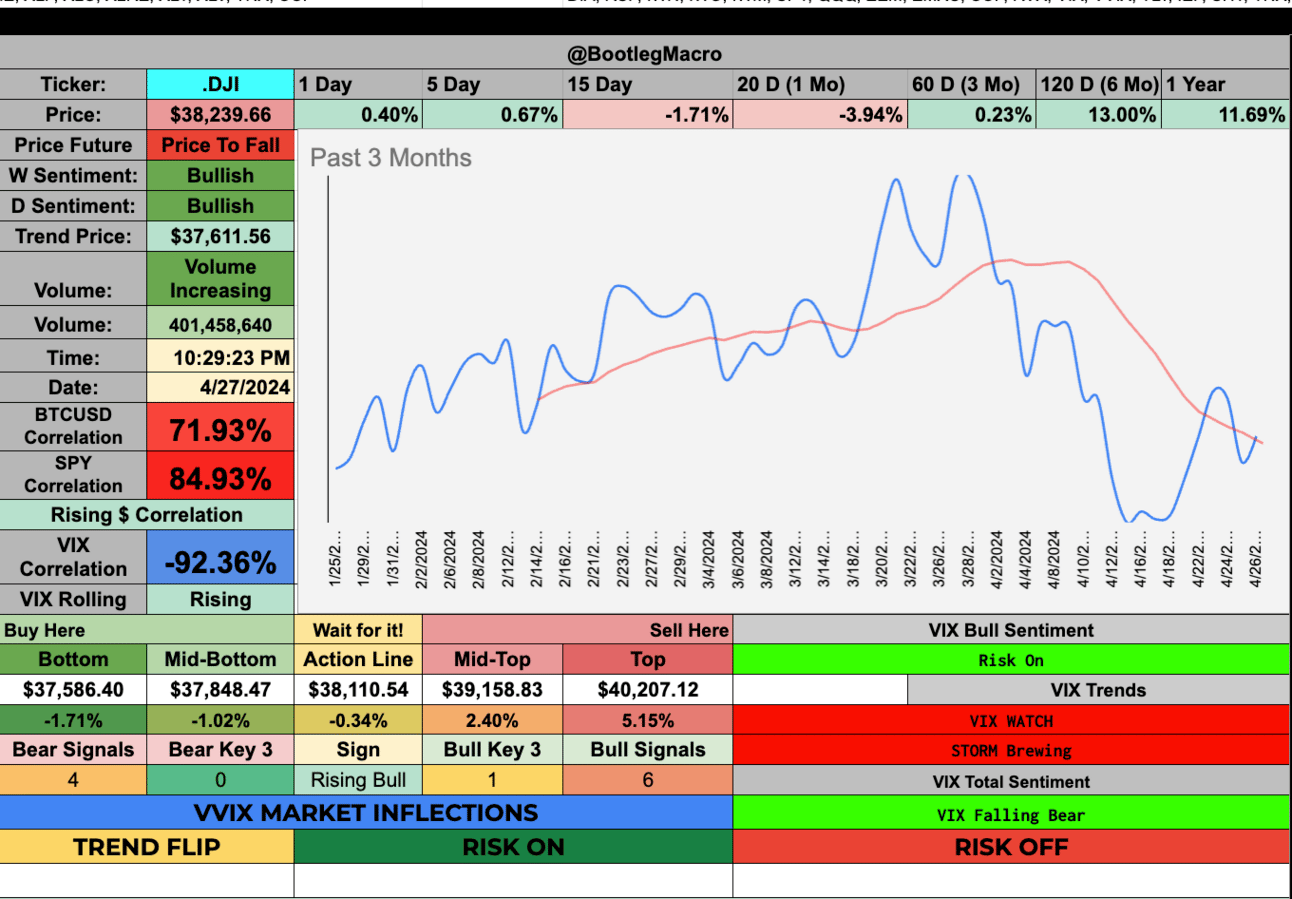

The top of the range is 5% higher, I’ll take that bet.

The top of the range is 6% higher - love to see it.

Even the Dow has 5% upside - it’s incredible after 1 month of volatility.

Volatility Corner:

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. Because I believe in mean reversion, I expect markets to climb from here. The turbulence indicator can certainly hold this downward move.

But I expect this to be the last great opportunity to buy before the broadening occurs into inflation linked small caps. Small caps I expect across the world will print more money through exported inflation from the USA.

The US wants a weaker dollar. Doesn’t it make sense they will create it by either lowering rates or growth returning to the economy. What do you think?

MACRO INDICATOR:

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

GNK - Genco Shipping & Trading Limited - Industrials - USA 🇺🇸

LFMD - LifeMD Inc - Healthcare - USA 🇺🇸

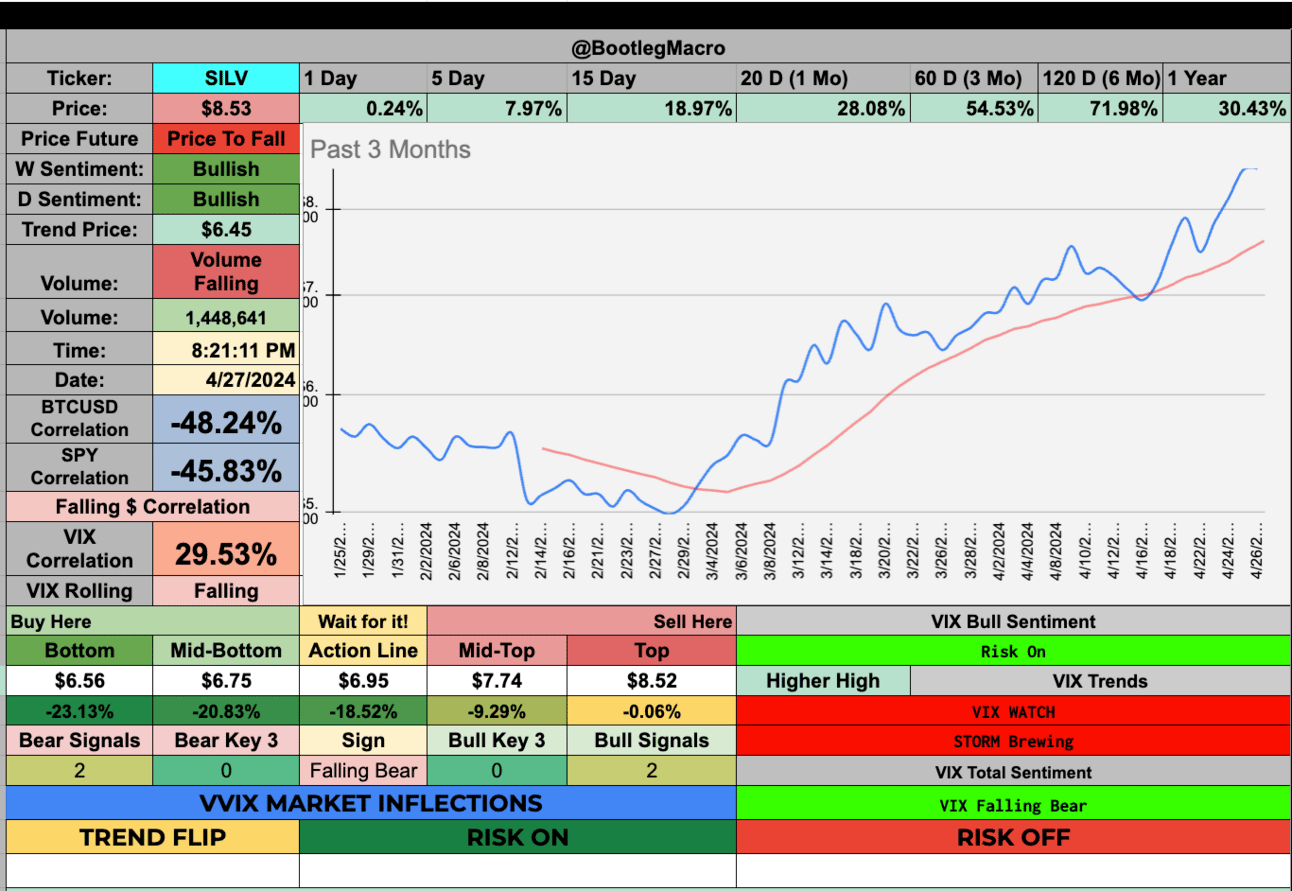

SILV - SilverCrest Metals Inc - Basic Materials - Canada 🇨🇦

GSBD - Goldman Sachs BDC, Inc. - Financial - USA 🇺🇸

GBDC - Golub Capital BDC, Inc. - Financial - USA 🇺🇸

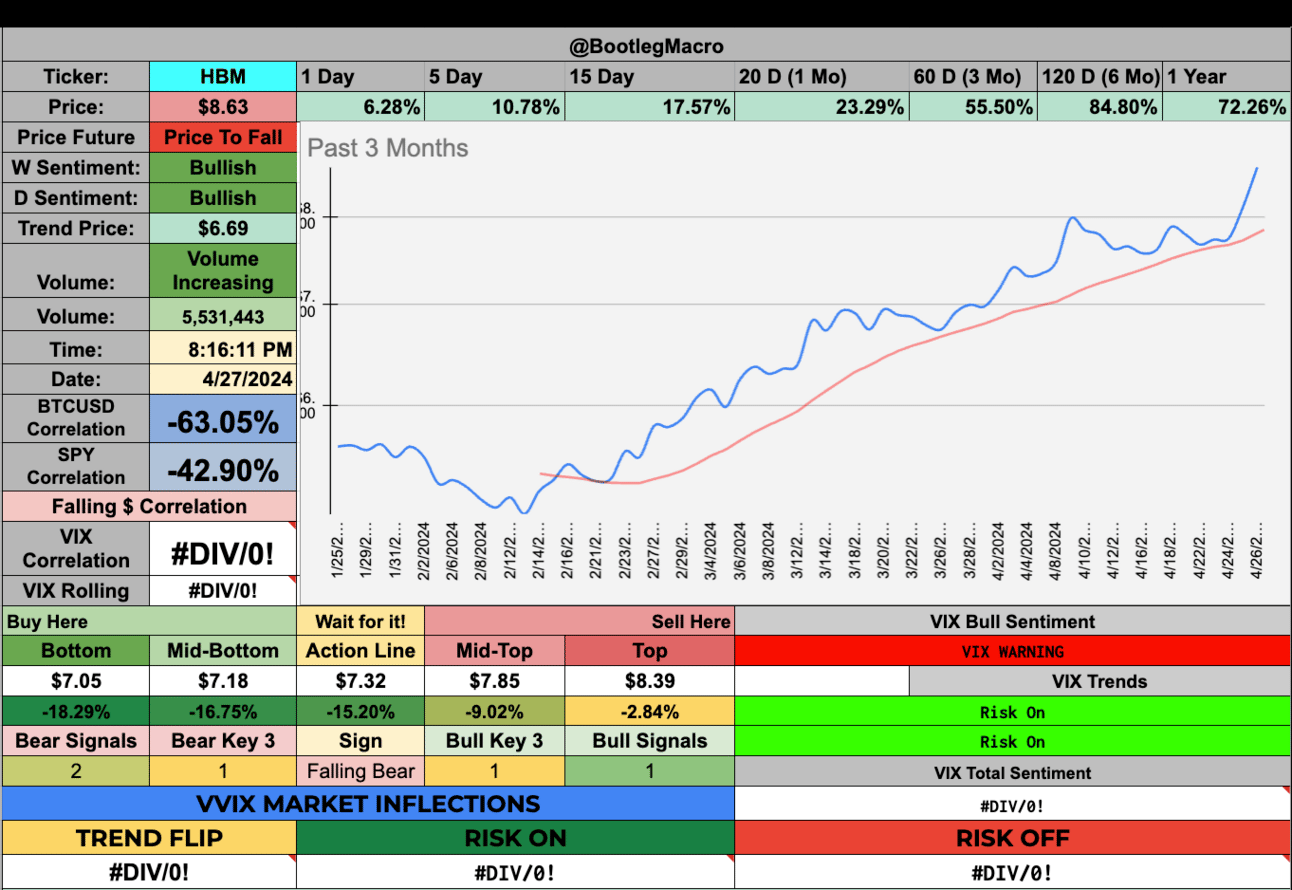

HBM - Hudbay Minerals Inc - Basic Materials - Canada 🇨🇦

CPG - Crescent Point Energy Corp - Energy - Canada 🇨🇦

OBDC - Blue Owl Capital Corp - Financial - USA 🇺🇸

TME - Tencent Music Entertainment Group ADR - Communication Services - China 🇨🇳

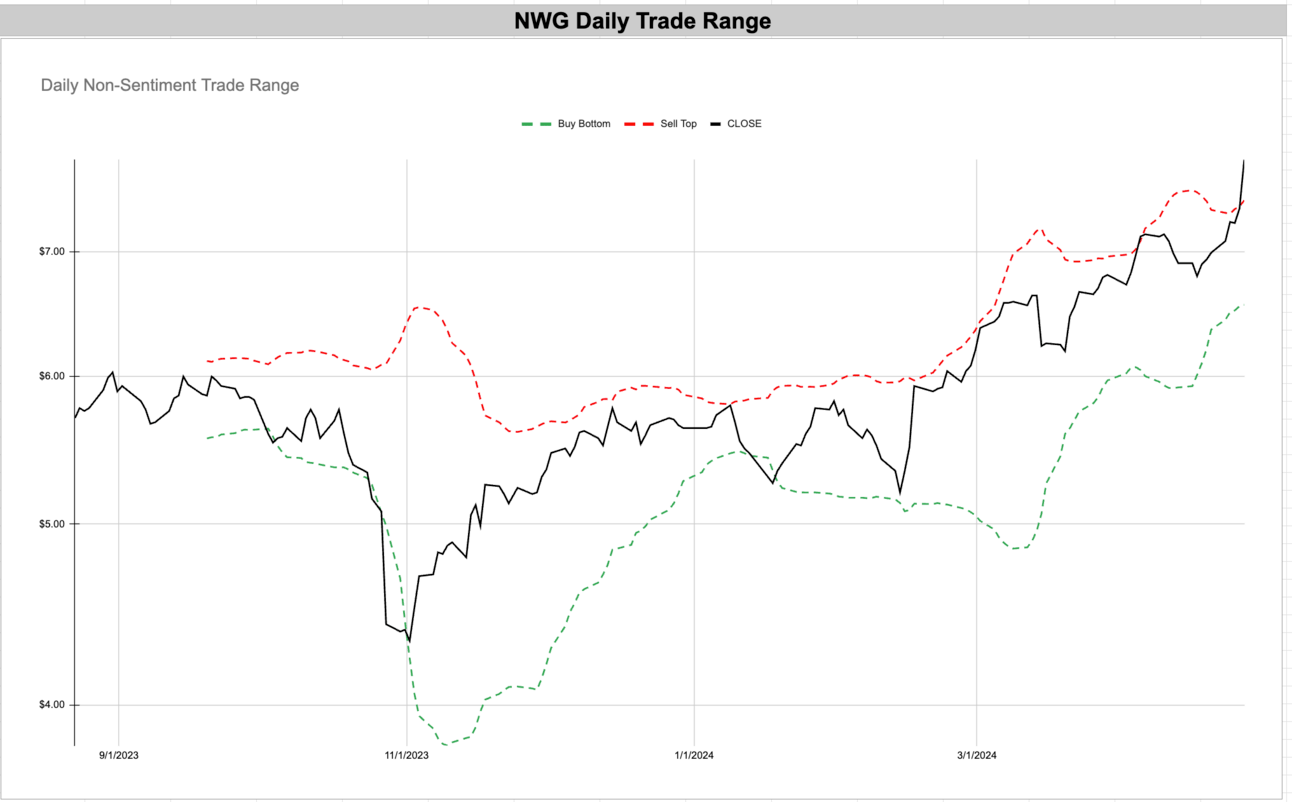

NWG - NatWest Group Plc ADR - Financial - United Kingdom 🇬🇧

SAN - Banco Santander S.A. ADR - Financial - Spain 🇪🇸

GNK - Genco Shipping & Trading Limited - Industrials - USA 🇺🇸

A very nice consistent trend. This must be low volume due to the sharp volatility. It has a tiny market cap and small float.

LFMD - LifeMD Inc - Healthcare - USA 🇺🇸

This is a nice trend and the pullback recently was a gift. Great consolidation.

SILV - SilverCrest Metals Inc - Basic Materials - Canada 🇨🇦

A nice trend.

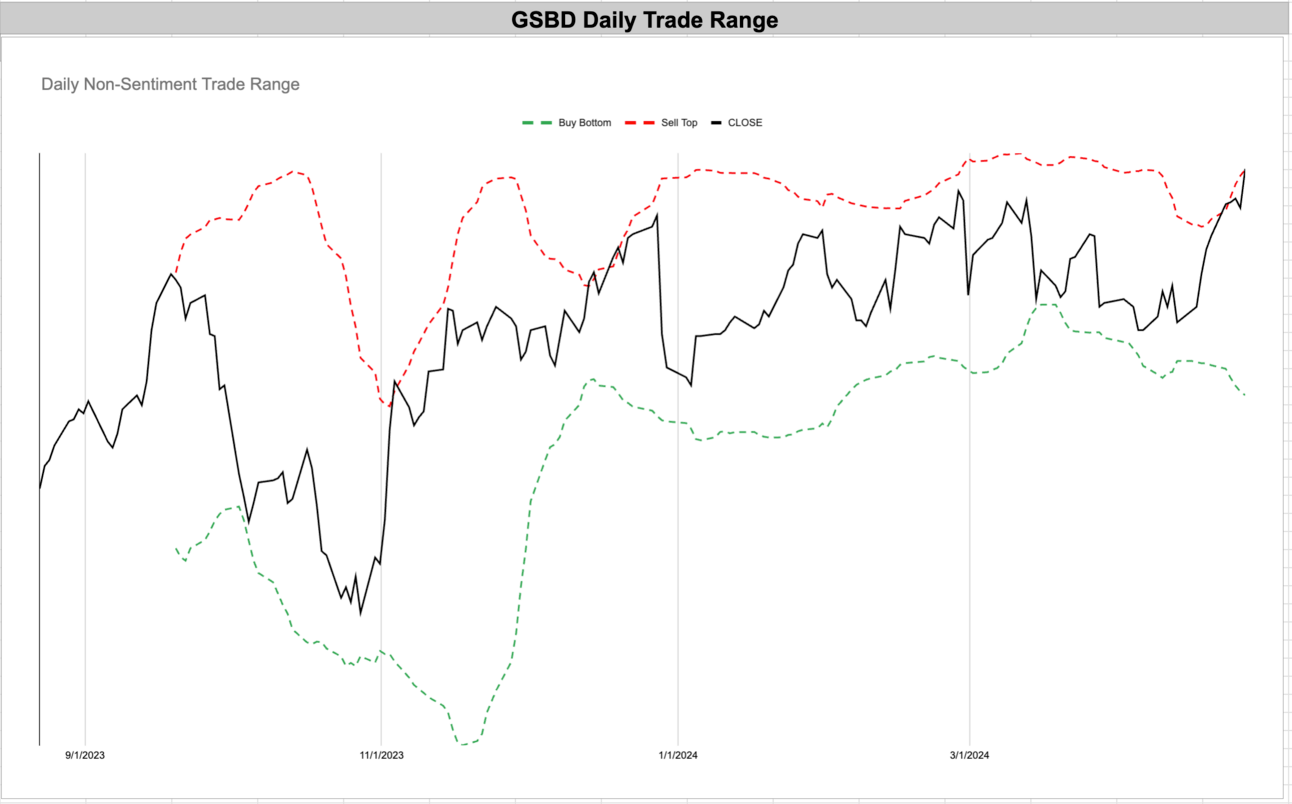

GSBD - Goldman Sachs BDC, Inc. - Financial - USA 🇺🇸

Super high volatility. This is breaking out but it’s not worth participating unless you have the stomach of an astronaut.

GBDC - Golub Capital BDC, Inc. - Financial - USA 🇺🇸

HBM - Hudbay Minerals Inc - Basic Materials - Canada 🇨🇦

Basic materials continue to get a bid and the breakdown of the currency in Canada helps this stock trend easily.

CPG - Crescent Point Energy Corp - Energy - Canada 🇨🇦

Fantastically strong trend.

OBDC - Blue Owl Capital Corp - Financial - USA 🇺🇸

TME - Tencent Music Entertainment Group ADR - Communication Services - China 🇨🇳

This is a very strong trend and continues as part of the expansion happening in China and in emerging markets.

NWG - NatWest Group Plc ADR - Financial - United Kingdom 🇬🇧

This move has been very volatile but the trend continues with strength.

SAN - Banco Santander S.A. ADR - Financial - Spain 🇪🇸

This has a very nice steady steady trend. This pullback was very welcome.

Enjoying this?

& Invite a friend.

New Highs $20+:

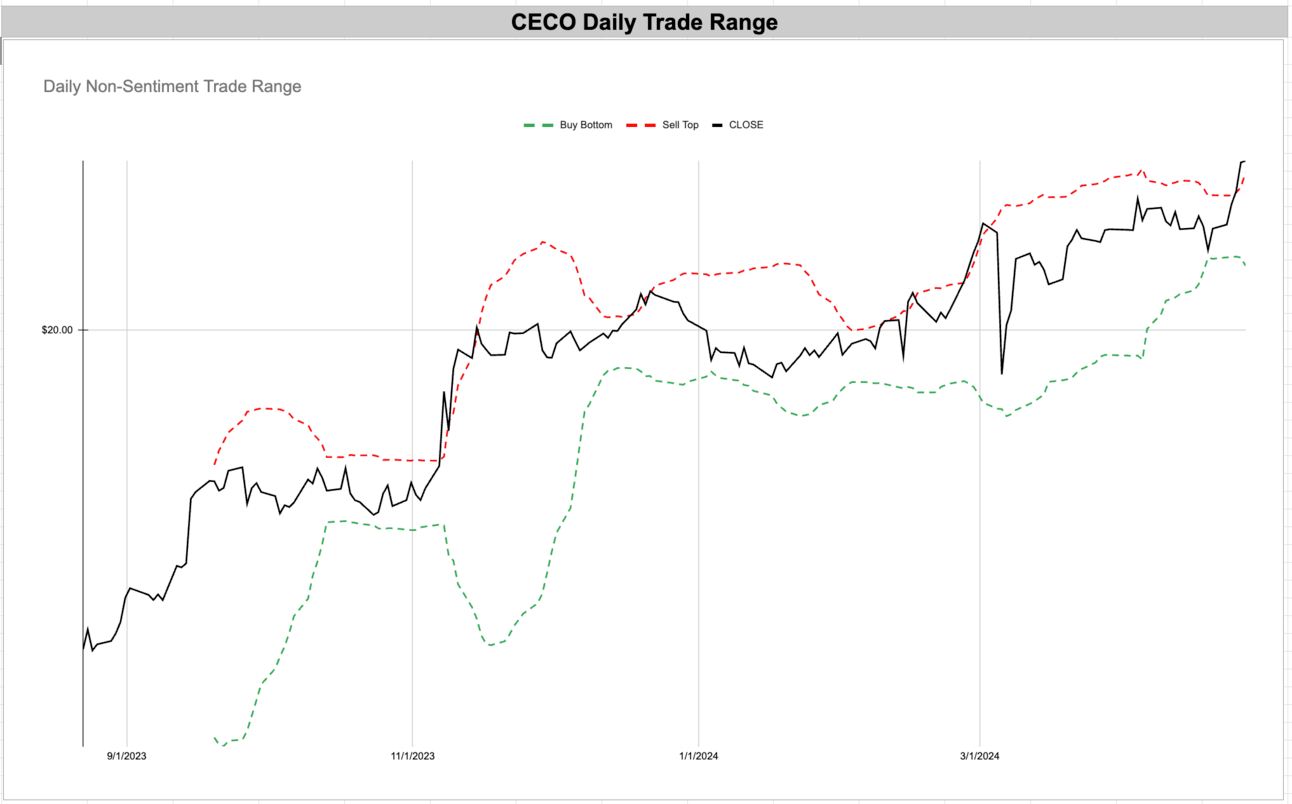

CECO - Career Education Corporation - Consumer Defensive - USA 🇺🇸

TRMK - Trustmark Corporation - Financial - USA 🇺🇸

BXSL - Blackstone Secured Lending Fund - Financial - USA 🇺🇸

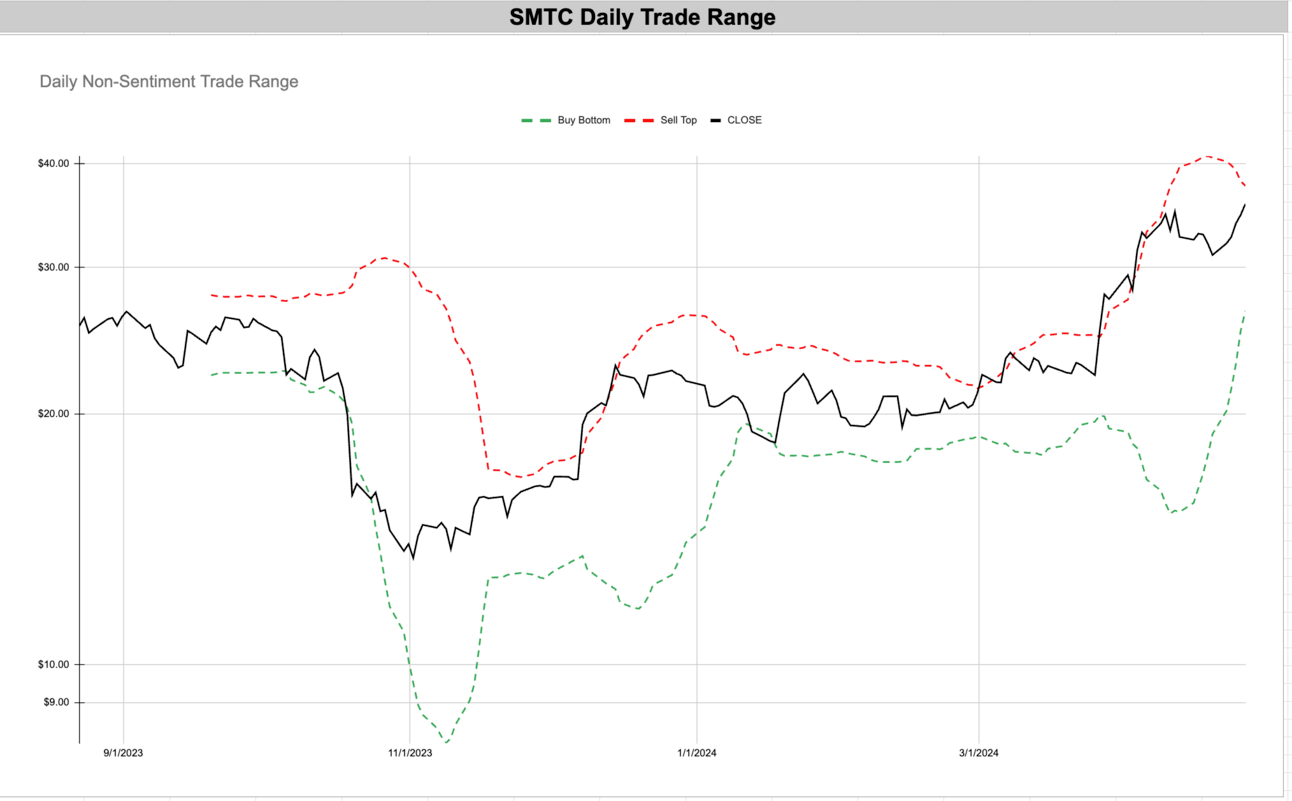

SMTC - Semtech Corporation - Technology - USA 🇺🇸**

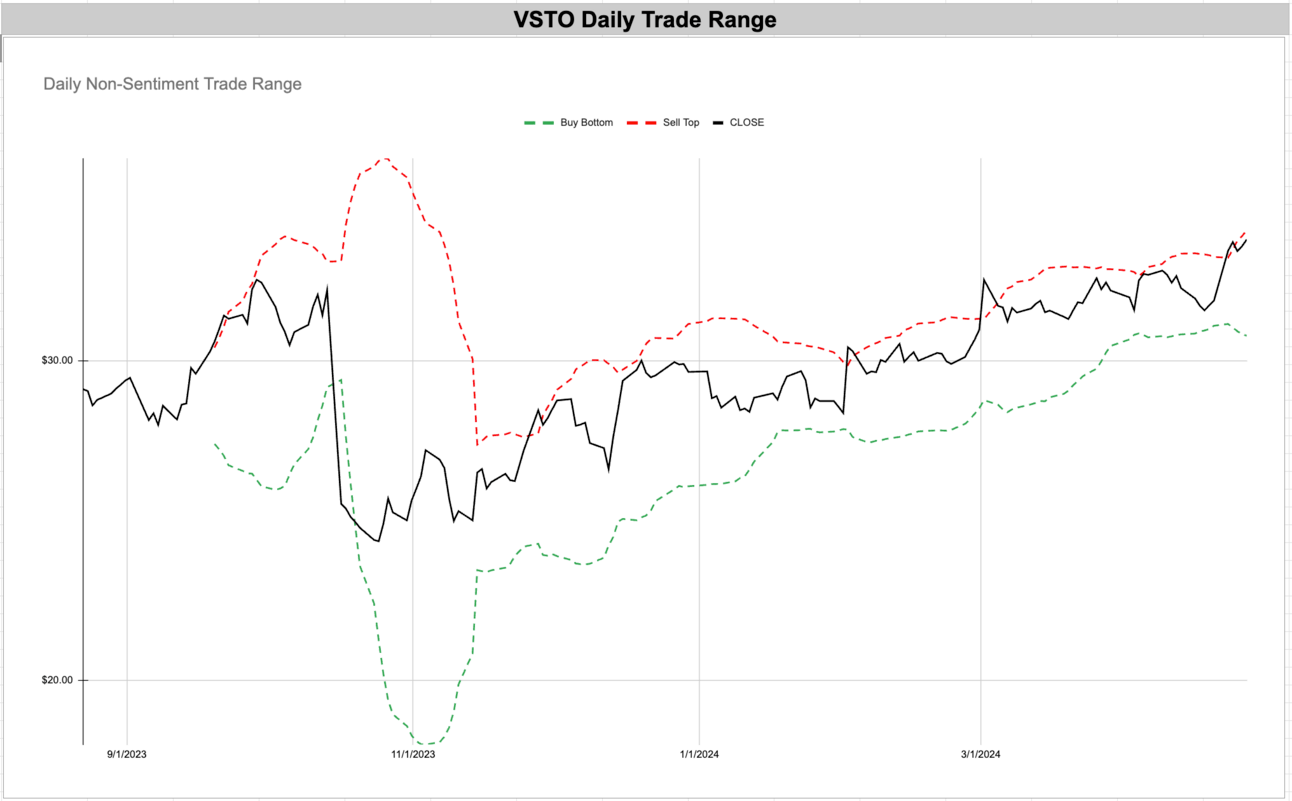

VSTO - Vista Outdoor Inc - Consumer Cyclical - USA 🇺🇸

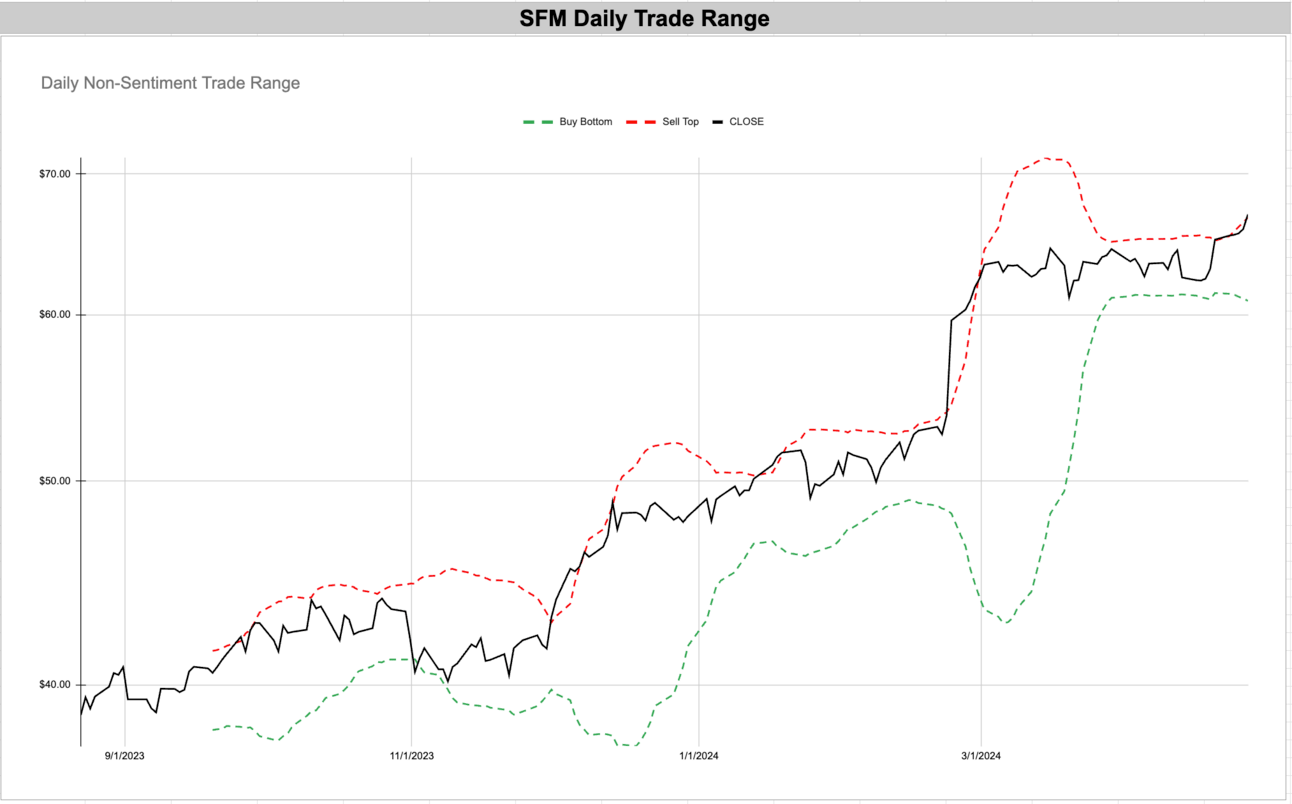

SFM - Sprouts Farmers Market Inc - Consumer Defensive - USA 🇺🇸

HCC - Warrior Met Coal Inc - Basic Materials - USA 🇺🇸

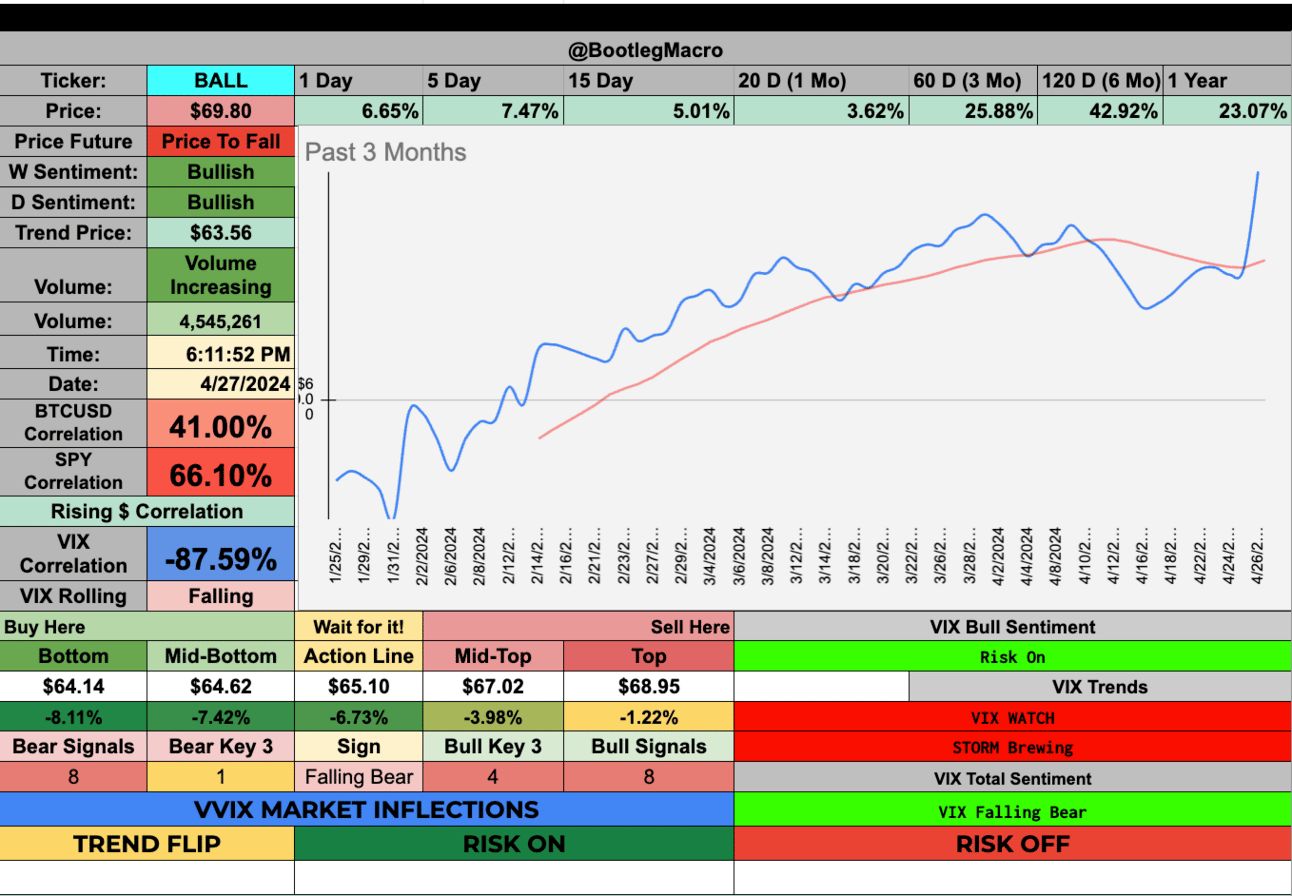

BALL - Ball Corporation - Consumer Cyclical - USA 🇺🇸

CRS - Carpenter Technology Corporation - Industrials - USA 🇺🇸

APH - Amphenol Corporation - Technology - USA 🇺🇸

WING - Wingstop Inc - Consumer Cyclical - USA 🇺🇸**

CECO - Career Education Corporation - Consumer Defensive - USA 🇺🇸

TRMK - Trustmark Corporation - Financial - USA 🇺🇸

BXSL - Blackstone Secured Lending Fund - Financial - USA 🇺🇸

SMTC - Semtech Corporation - Technology - USA 🇺🇸

Pullbacks are beneficial when we find a trend change on a long-term basis. The weekly chart shows this move to be signifiant over the past many years. I’ll buy

VSTO - Vista Outdoor Inc - Consumer Cyclical - USA 🇺🇸

This trend is a bit chaotic. It’s one to buy when it’s down.

SFM - Sprouts Farmers Market Inc - Consumer Defensive - USA 🇺🇸

This is so consistent now. It has low volatility until a catalyst makes this stock move.

HCC - Warrior Met Coal Inc - Basic Materials - USA 🇺🇸

Basic materials continues to get a bid as inflation sentiment is concerned with higher inflation.

BALL - Ball Corporation - Consumer Cyclical - USA 🇺🇸

What I appreciate about this breakout is the consistent character. It’s low volume probably since it’s so choppy but the trend is consistent allowing for compounding.

CRS - Carpenter Technology Corporation - Industrials - USA 🇺🇸

Fantastic recent breakout. This stock has had very high volatility. It’s clear by the size of the range. Incredible if people have been DCA or holding.

APH - Amphenol Corporation - Technology - USA 🇺🇸

When you’re up over 40% in 6 months, a pullback is welcomed.

WING - Wingstop Inc - Consumer Cyclical - USA 🇺🇸

Chicken is a good business when you have a brand. Inflation rising means prices rise and so do earnings…which drive stocks. Nice breakout.

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro