- The New High Newsletter

- Posts

- How to Kill 👹 a Bull 🐂 Market 📉 in 2 🗓️Months! - Tariffs On!

How to Kill 👹 a Bull 🐂 Market 📉 in 2 🗓️Months! - Tariffs On!

Every single index 📉 in America! 🇺🇸 S&P500, Nasdaq and Dow Jones are all down on a rolling 1 year look back now. 👀🤯This whole issue centers around volatility. There are no highs to be found!

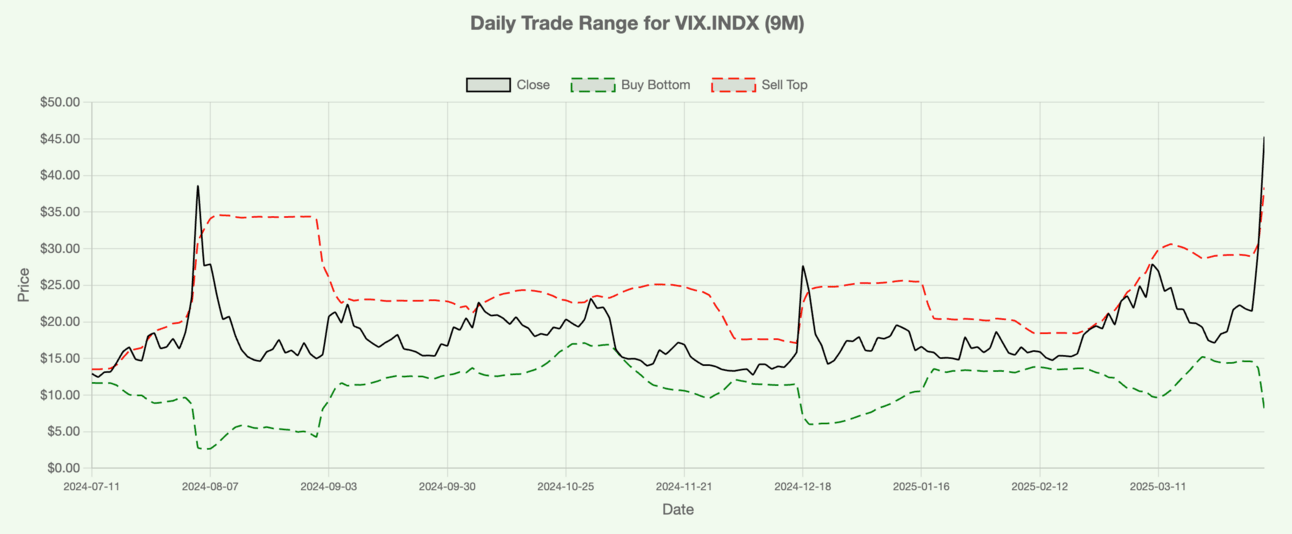

Market Overview: We need to be honest with each other…right now. There are no new highs this week. None. I can’t make it rain in the desert and I can’t make stocks hit new highs after the VIX closes the week at $45.31. Now that’s out of the way, this week will be an examination of the macro indicators. Think volatility.

New Highs $5-$20: N/A

New Highs $20+: N/A

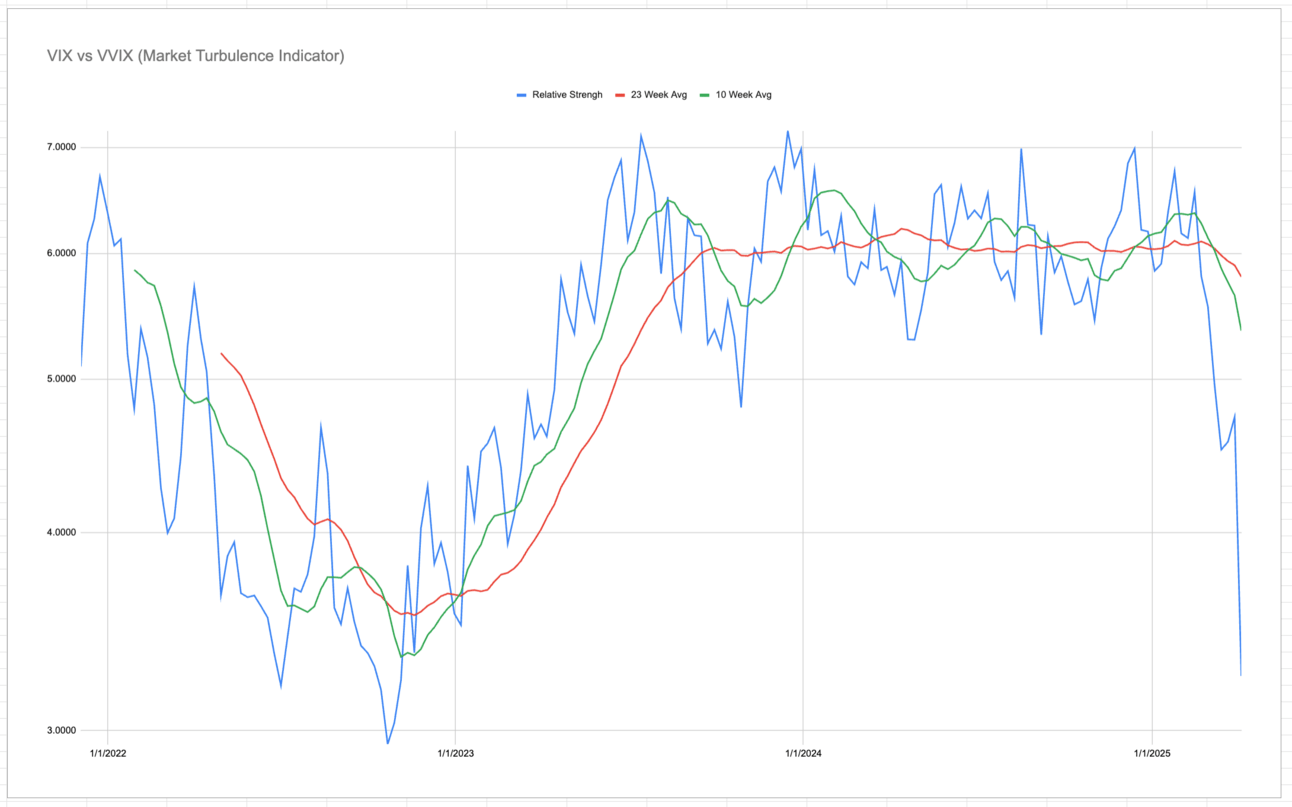

Turbulence Indicator: I’ve never seen anything like this before in my entire life. The turbulence indicator did in 1 month what it took all of 2022 to do…It went from above 6.00 to under 3.25. That completely reset volatility across the whole market. There will be a bullish response to these moves and it will be massive! (Be patient)

Can you believe what we experienced in 1 month? March wooped global markets.

Looking Ahead: I have no idea what will happen this week. I’ll be patient. This week, personally I bought $CHWY and $PCT calls for 2027. I’m not interested in getting tangled in the volatility we can expect in markets in the short-term or intermediate term. Not financial advice, this is what I’m doing for me.

Market Performance Framework

Market Overview:

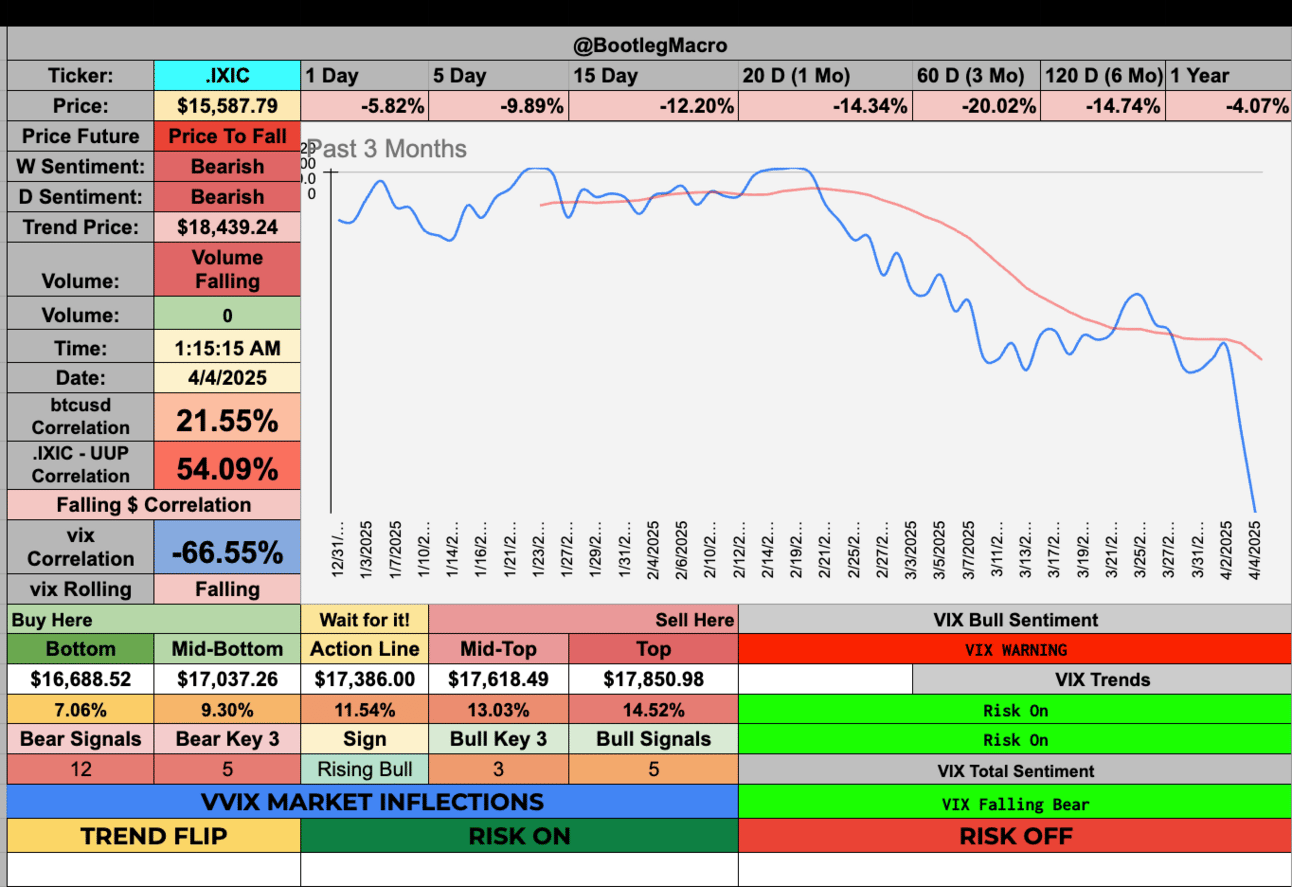

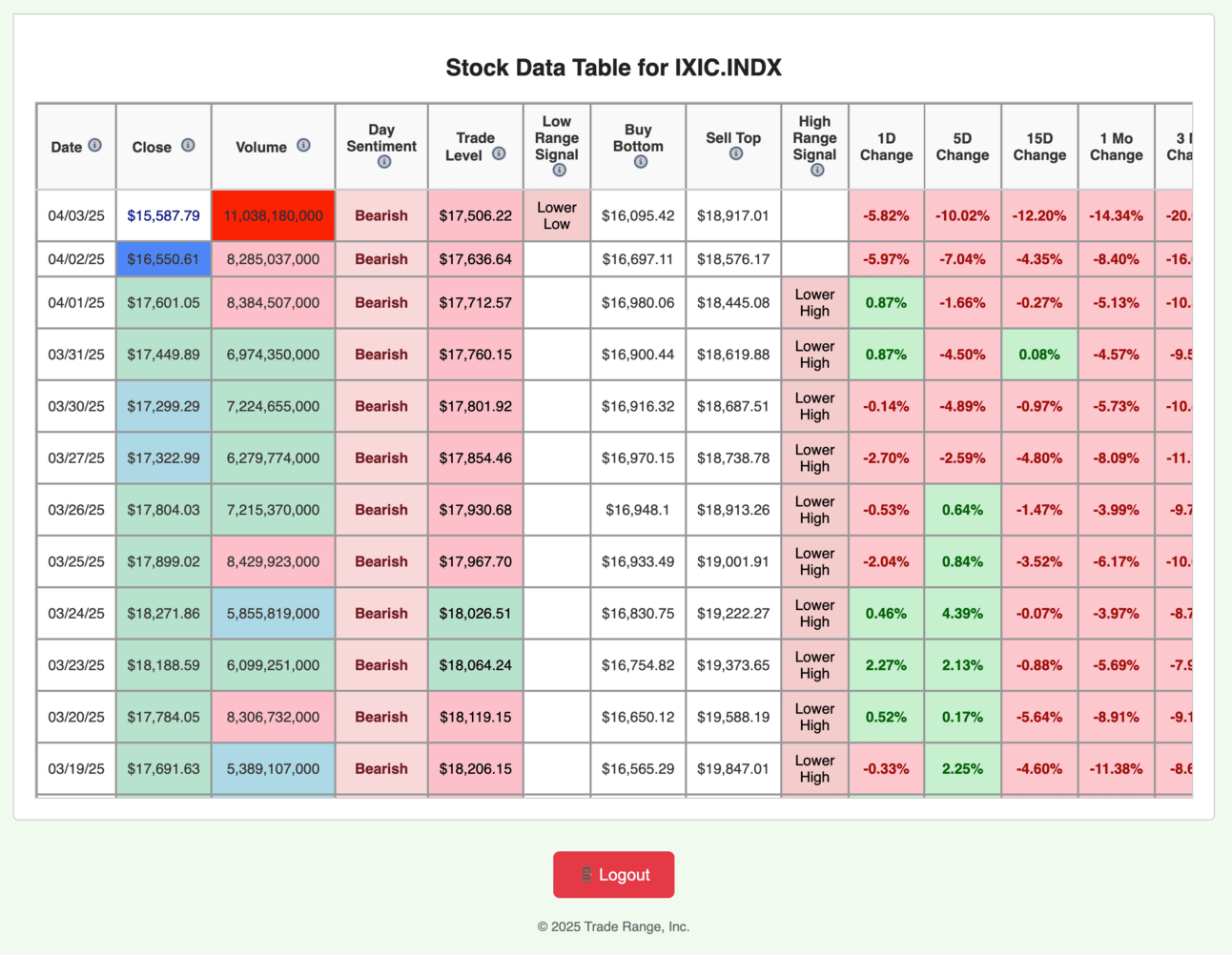

I’m blending my original model and my new app in the images below. But as you review my images, please don’t confuse up days with bull markets. But do believe a down 10% week with enduring uncertainty is a signal market sentiment has changed.

Key Focus Area:

Volatility is everything right now. Volatility can fall and we can see bullish spikes. The trend is still BEARISH. Which means for now, I’ll be buying dips in GLD, TLT and sitting mostly in Money Market Funds.

Current Outlook and Indicators:

The Turbulence indicator has reset itself. This is an opportunity for it to grind up slowly higher (BULLISH) over the course of a year or 18 months. We might only be going back to the old highs but the path of 1% or 4% a month will add up. Markets have short-memories.

Long-Term View:

If we get past this tariff talk, the uncertainty and possibly see resolution to some of the largest trading partners. There is a real opportunity for this to be a buying opportunity like no other for markets looking back from 2027 or 2028.

Closing Speculation or Questions:

The biggest up days happen in bear markets. This is the hardest part of staying solvent during bear markets. Not thinking it’s over too soon. The next part is going to be the hardest. Sitting on my hands until the coast is truly clear. I’ll need to trust my indicators, pay attention to the signals and let the market speak.

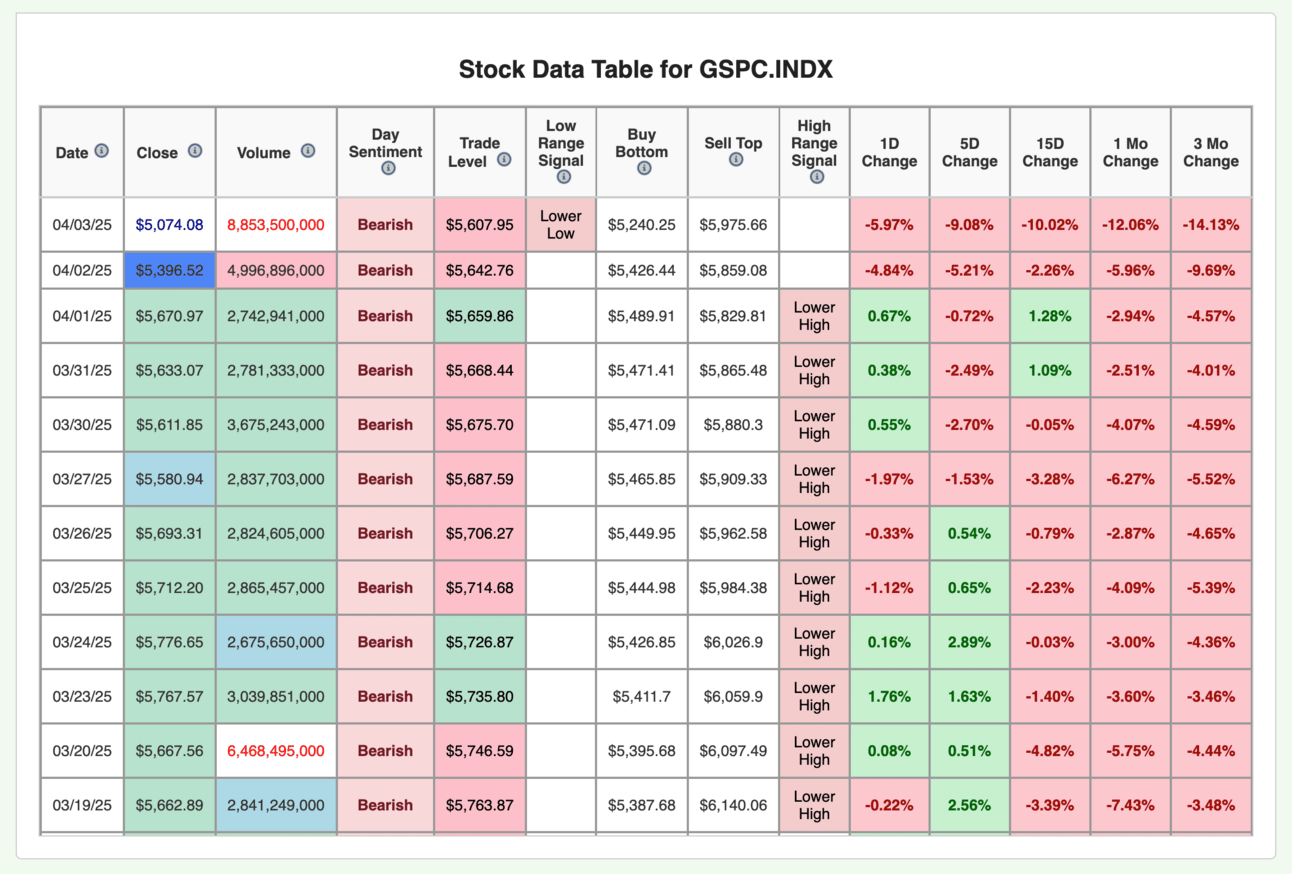

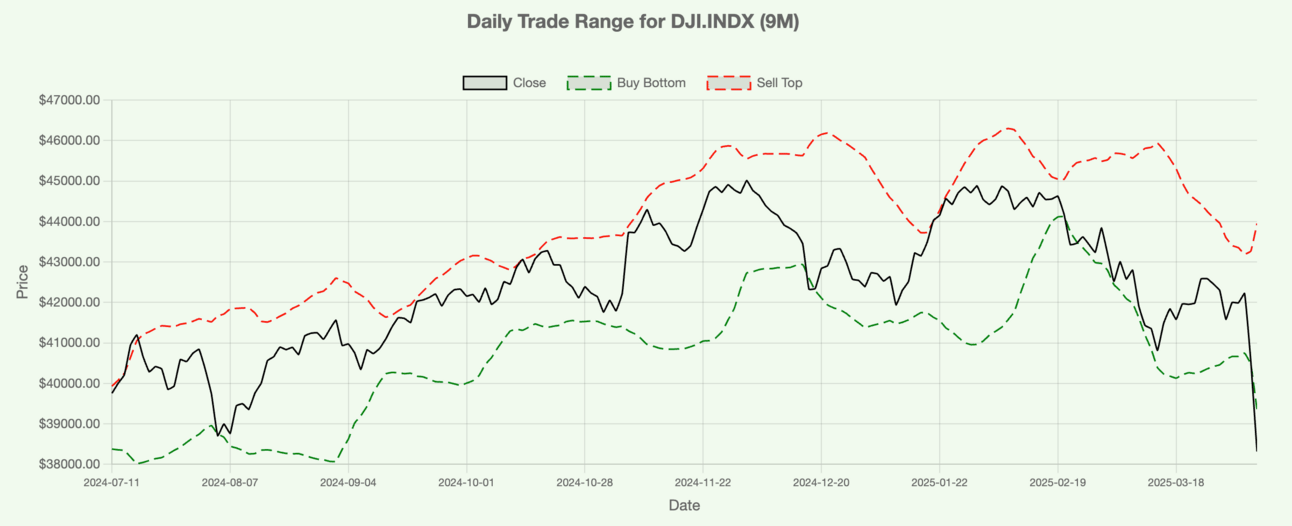

The range has been blown out. Next week is all about letting the math reset. It will take 2-4 weeks.

I’ll look for when this goes positive on the 3 month rolling return. Until then, I’m bearish.

I’ll look for when this goes positive on the 3 month rolling return. Until then, I’m bearish.

I’ll look for when this goes positive on the 3 month rolling return. Until then, I’m bearish.

Volatility Corner Framework

Indicator Update:

The Turbulence indicator hasn’t moved this quick since March 2020. This week was the the equivalent of oil going negative in 2020. Everything changed. No matter what people say, markets are telling us.

Technical Context:

The Turbulence indicator gave a market selling opportunity on 2/14/25 which in hindsight was ample warning. But this indicator has flipped to falling indicator before but in 2024, it chopped. The year change brought volatility change. Sentiment is different now.

Risk Assessment:

Risk was only higher before the drop last week. Risk going forward is still high because the volatility sentiment will take 4-8 weeks to ring out of indexes. You don’t get in a car-crash and in shake it off the next day. Nope. Markets are at worst in shock and at minimum traumatized. They will behave erratic for the intermediate-future.

Historical Parallels:

The only previous experience like this is COVID. We did that with TRUMP too. Before this week, I wondered how the stalemate of 2024 volatility would end. Because it had too. You can look back on this chart and see 2020, 2022 and now 2025 — there have been quick drops in markets. We have certainty why volatility spiked this time too.

This chart doesn’t show the drop from this week, you’ll see it in the chart under this one.

Actionable Insight:

I’ll respect volatility. It’s not worth it to try and “buy the bottom” for any trade. It will take a few weeks for the 23 week and 10 week to catch up to this volatility. I’ll wait for signals to inform me.

MACRO INDICATOR:

MACRO SEASON: BEARISH Since 3/7/25🛑

MICRO WEATHER: BEARISH Since 2/21/25🛑

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

$NVDA - Ugly chart and data.

— BootlegMacro (@bootlegmacro)

7:04 AM • Apr 6, 2025

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro