- The New High Newsletter

- Posts

- Homecomings, Leaf Peepers & China's Breakout!

Homecomings, Leaf Peepers & China's Breakout!

Seasons changing -- are you ready for 2025? Markets are giving away the keys to the next move. Do see these opportunities? We have 20 stocks hitting new highs in our list. Take a look, come inside.

Welcome back to the New Highs Newsletter. Fall is officially here in the northern hemisphere. It's time to break out the cozy sweaters and pumpkin spice lattes. The leaves are starting to change colors, making it the perfect time for some leaf peeping adventures. As we settle into the final stretch of 2024, what will you do next? Are you ready for 2025?

It's easy to get caught up in our daily routines and forget that time keeps ticking. But the market feels every second. With the rise of options, especially zero-day expiry (0DTE) contracts, we're seeing markets move faster than ever. Markets showed their speed this week due to the special boost from the federal reserve.

With inflation-driven growth on the horizon, assets are poised to outperform. Expect rising prices, falling interest rates, and a gradual buildup of market valuations. This kind of opportunity doesn't come around often, so it's time to seize the moment.

Stay ahead of the curve by positioning yourself for the market cycle ahead. We're looking at a solid 12-18 months of growth, fueled by higher prices, strong earnings, increased investment, and government spending.

The devalued dollar is already having an impact, as we can see with the rise of Chinese tech companies like GDS. While GDS is certainly making waves, it's worth noting that their growth might not be entirely organic, especially if China isn't experiencing a major economic shift. It's also interesting to see the FXI (a China-focused ETF) making a significant move this week, surprising many speculators.

- Dustin

Awkward Market Close

September has been a wild ride, with the market swinging up and down like a rollercoaster. Friday's choppy trading might have left you scratching your head. While the market is digesting the recent rate cut, it's also positioning itself for a shift in capital flows as refinancing becomes more attractive.

Essentially, we're letting new money into the economy, and this time, it's being driven by the private sector, not government spending. This is a big change from the inflation-fueled growth we saw earlier. Now, it's up to businesses and consumers to drive the next cycle.

S&P500 - Nice Move 52 week highs. All-time highs, good signs.

Longer-term view of the S&P500

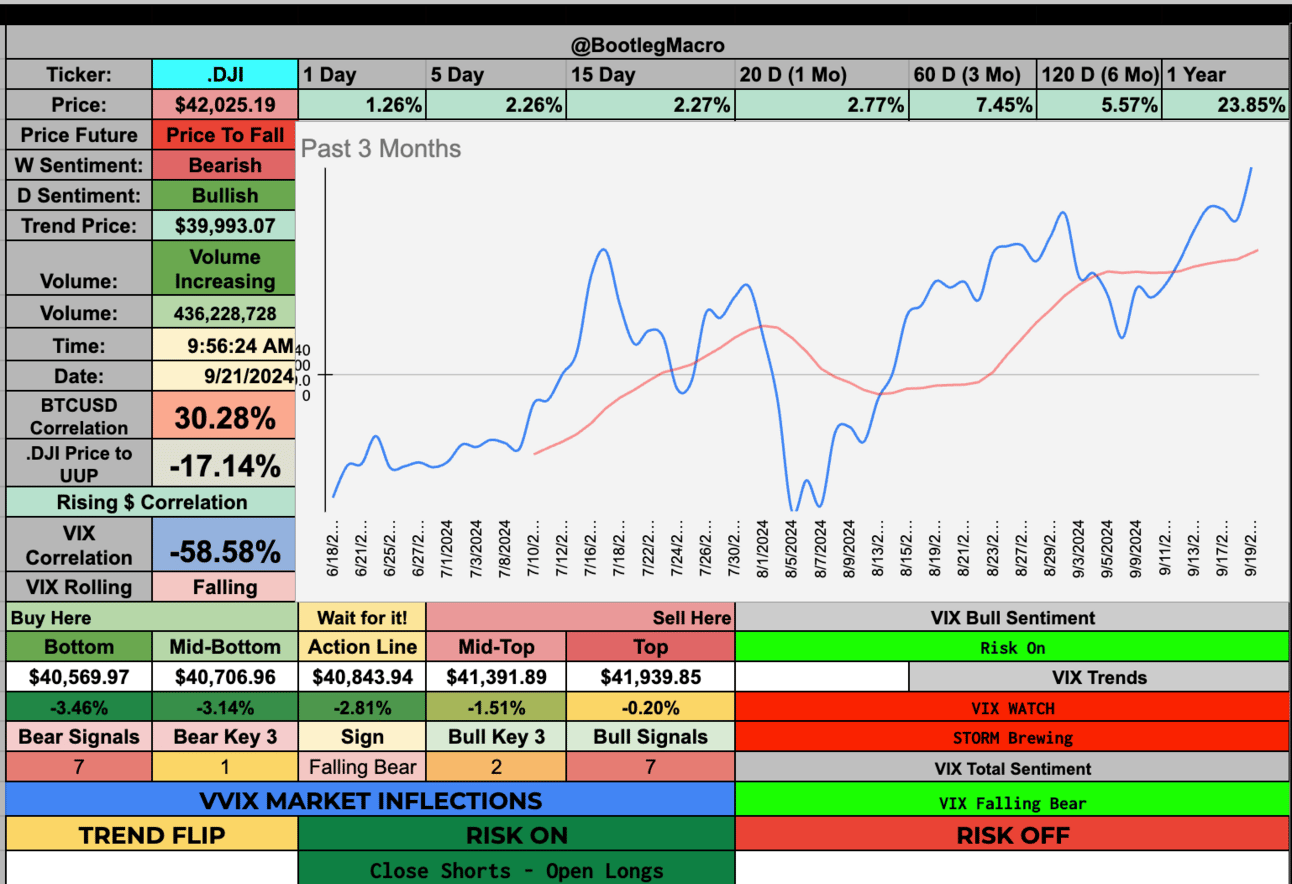

Dow Jones with strong week trends - great returns.

Never lose sight of the long-term here. Dow Jones is seeing a massive breakout at these level which have been resistance for months.

Nasdaq will return to strength. But it’s lagging this new move after rate cuts.

2022 was a tough year. We have a more mixed signal now but bullishness should prevail

Volatility Corner:

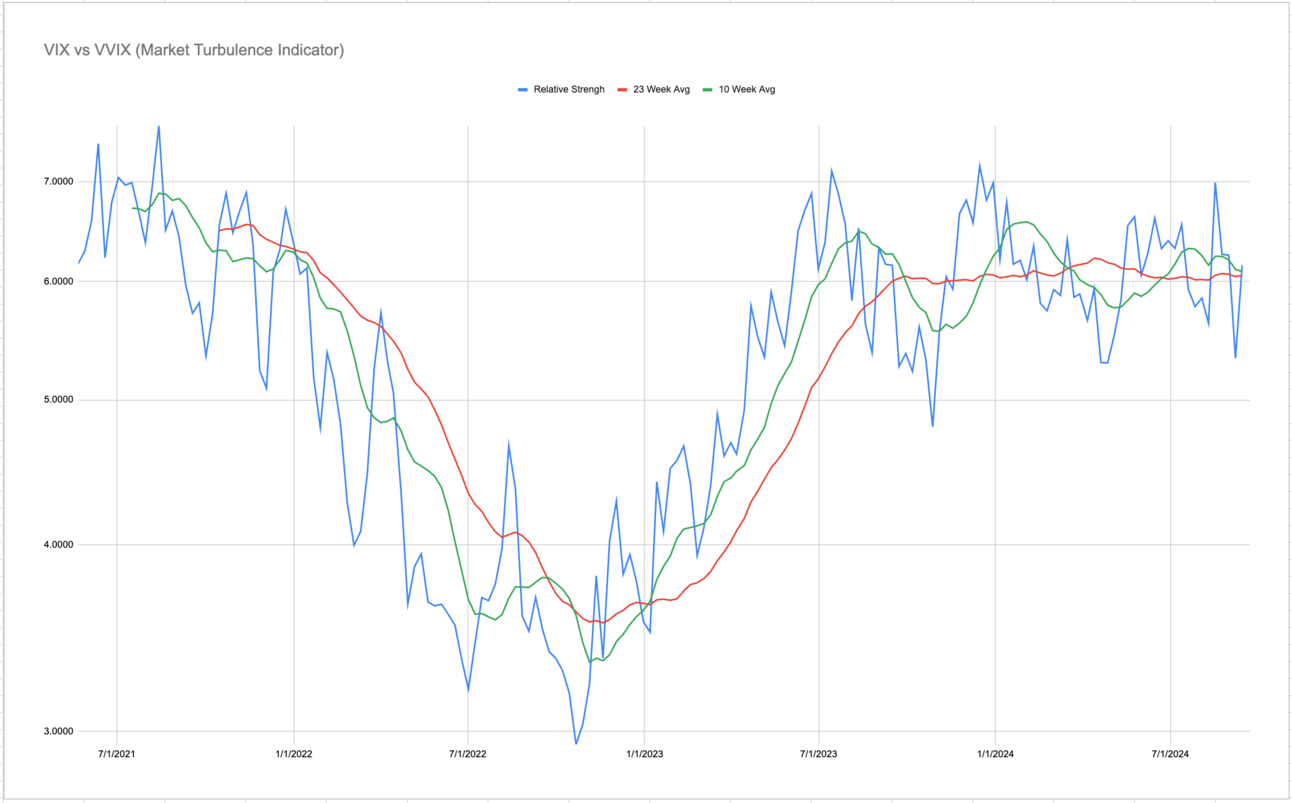

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. Vix is getting crushed - equities are rallying. The issue is the general trend of the VIX is ruined, right now, by these 0DTE options.

Vix below $20 and trending to $14 or lower is an opportunity to get long. But also prepare for a vix spike as an opportunity to rebuy. Patience is required to ensure actions will be swift in the heat of the moment.

Weekly indicator shows a snap back for the moment. RS back above the 10 week and 23 week.

MACRO INDICATOR:

It’s been sideways action for over a year in volatility.

MACRO SEASON: BULLISH Since 8/23/24🟢

MICRO WEATHER: BEARISH Since 9/19/24🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

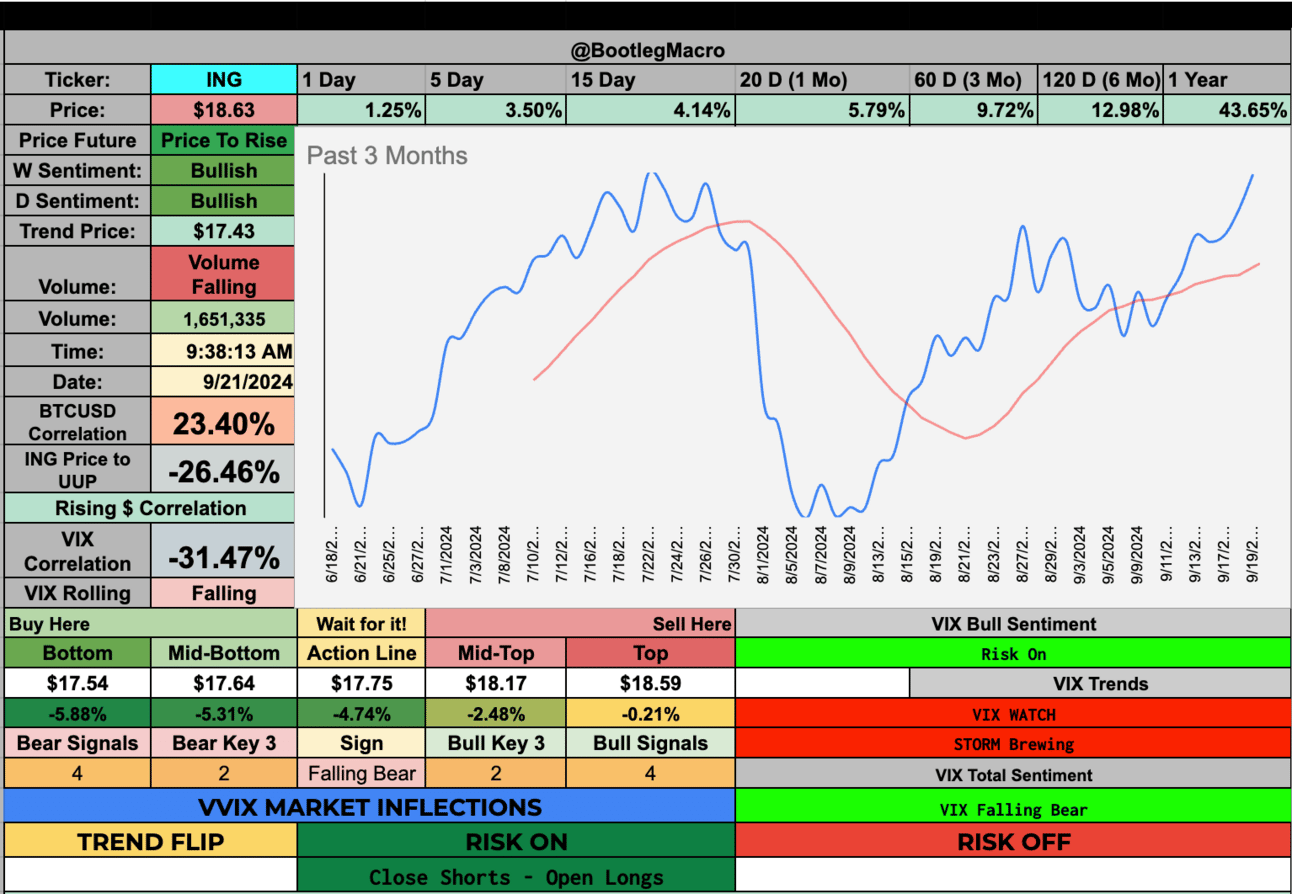

ING - ING Groep N.V. ADR | Financial | Netherlands 🇳🇱

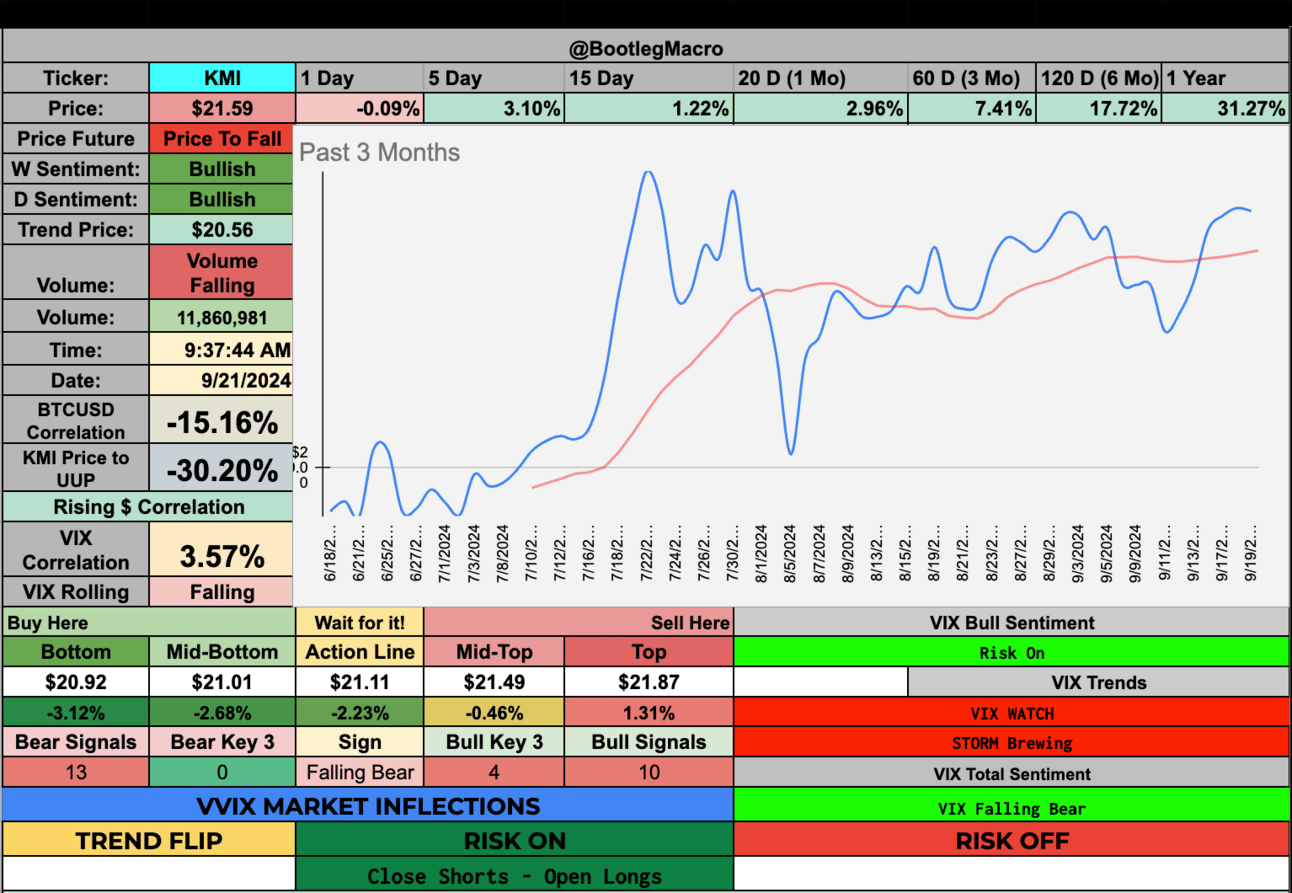

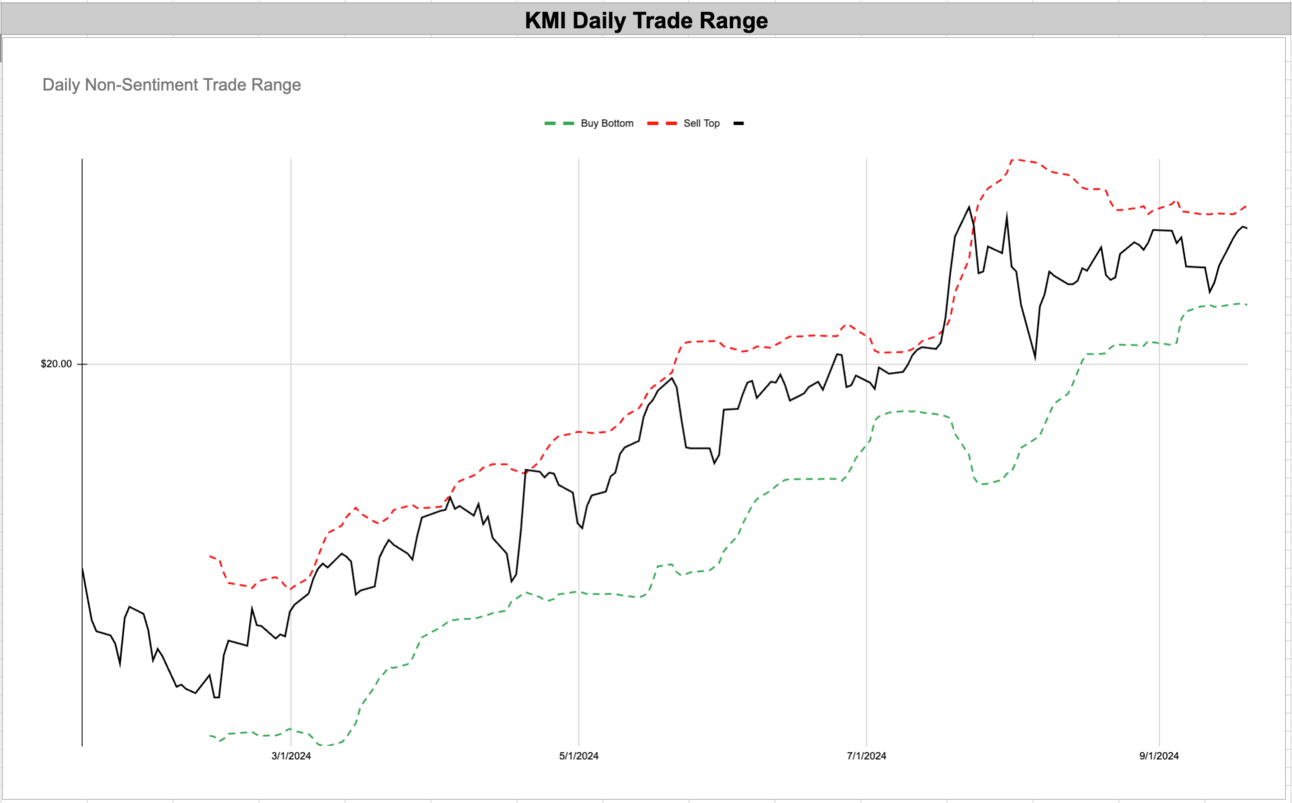

KMI - Kinder Morgan Inc | Energy | USA 🇺🇸

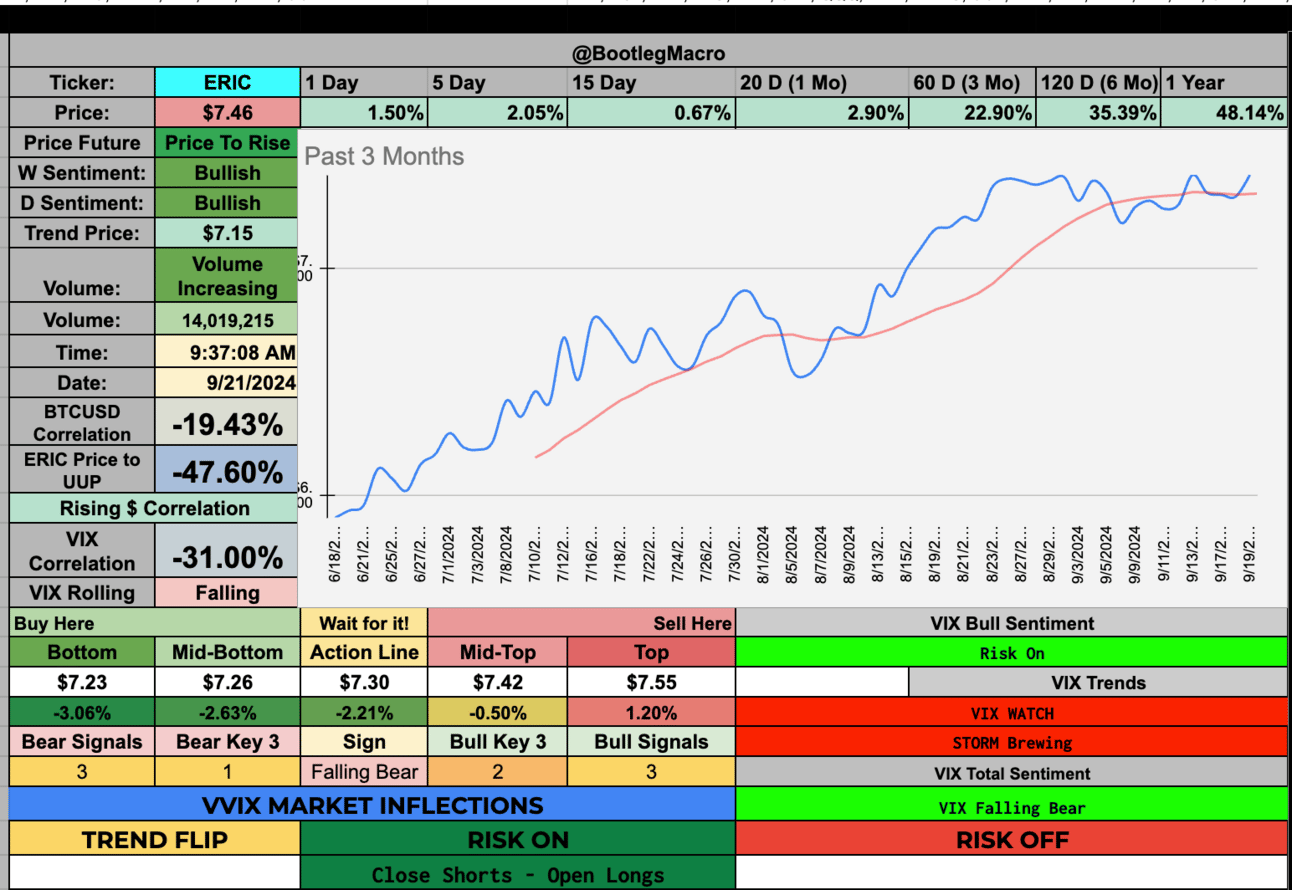

ERIC - Telefonaktiebolaget L M Ericsson ADR | Technology | Sweden 🇸🇪

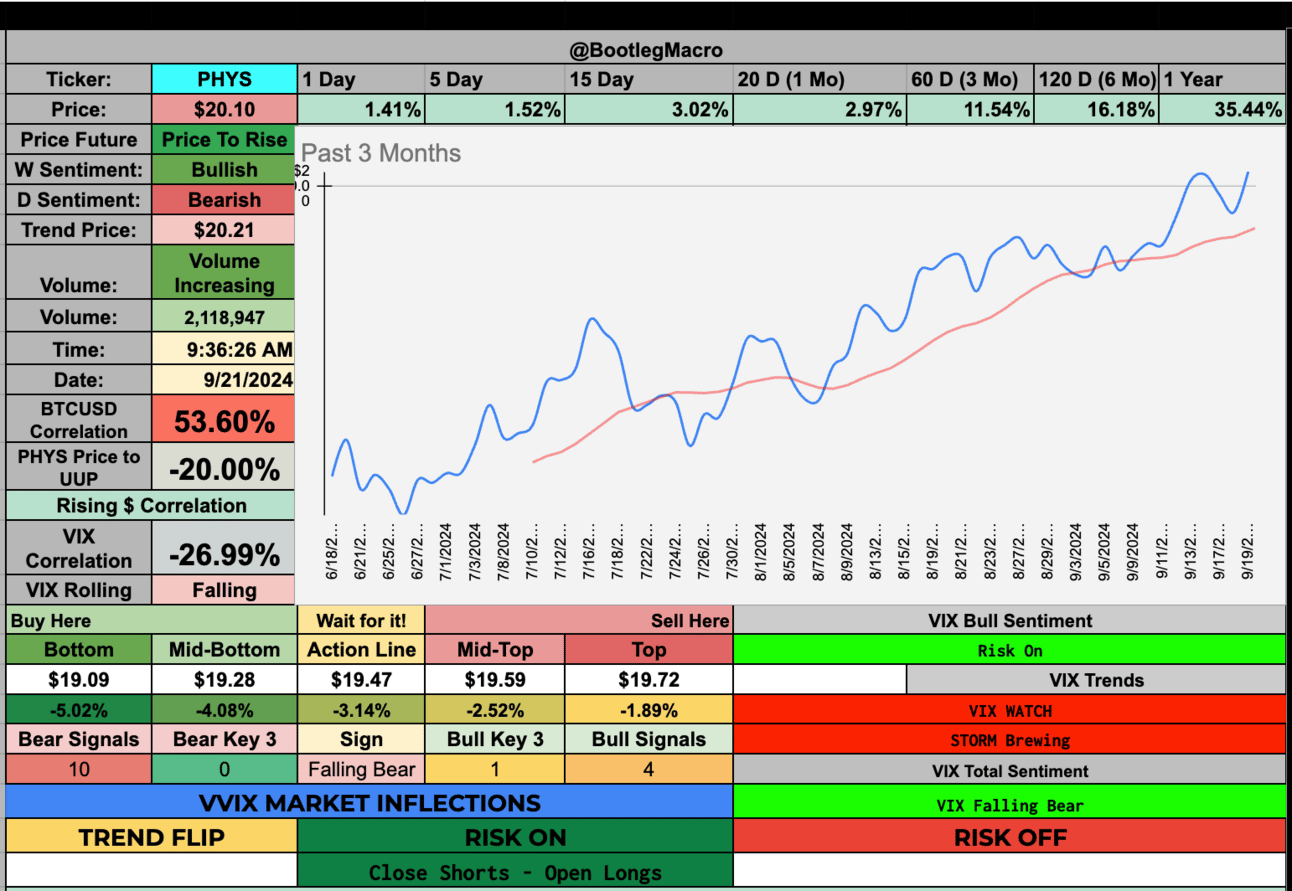

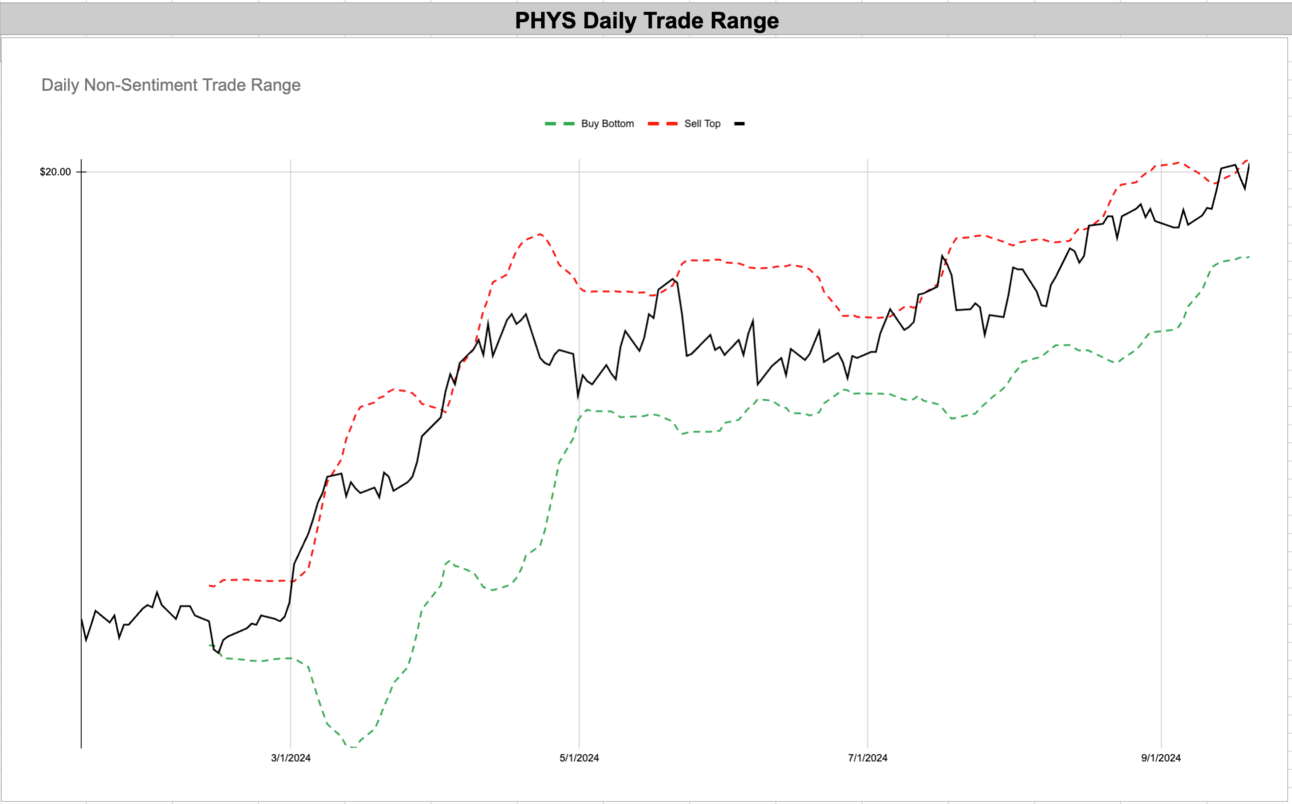

PHYS - Sprott Physical Gold Trust | Financial | Canada 🇨🇦

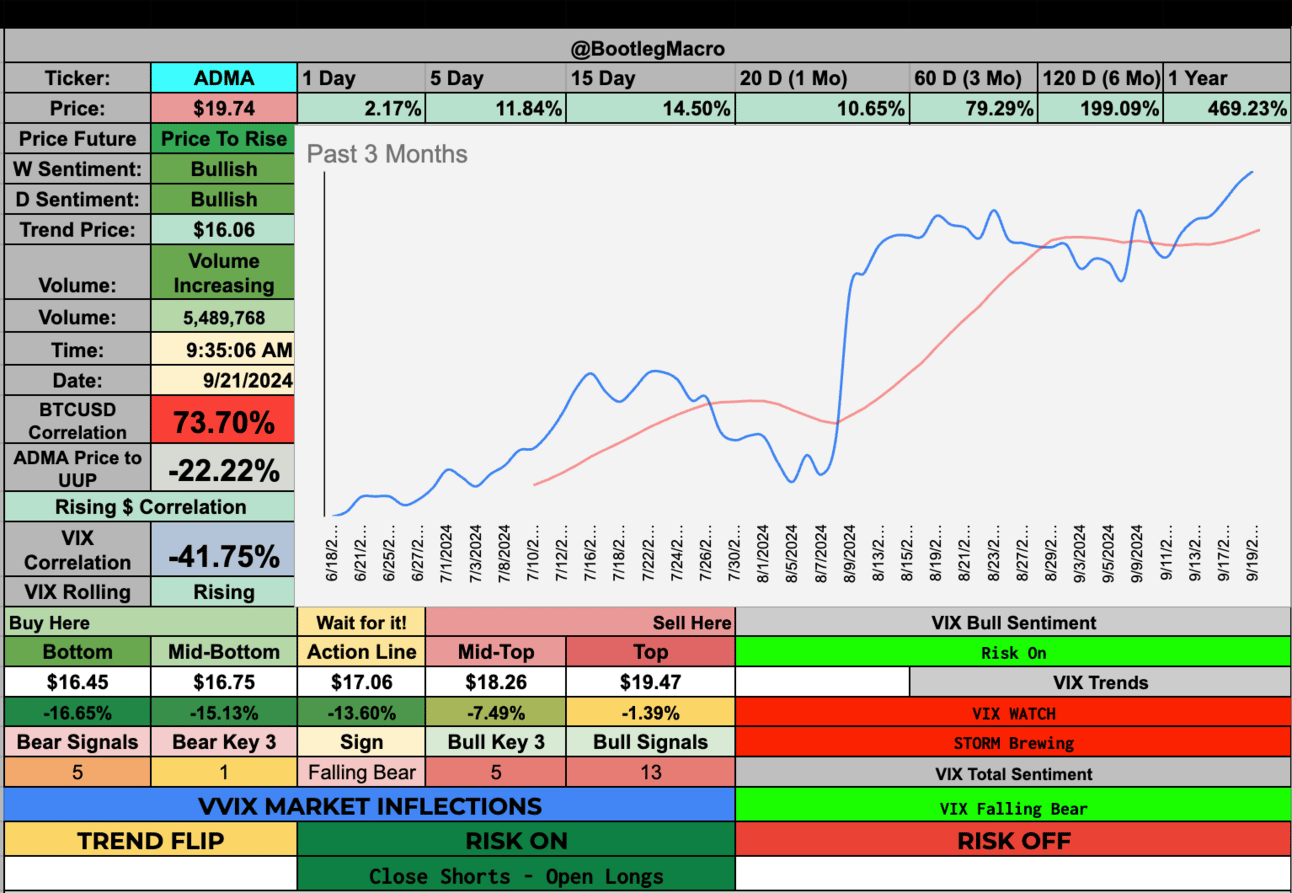

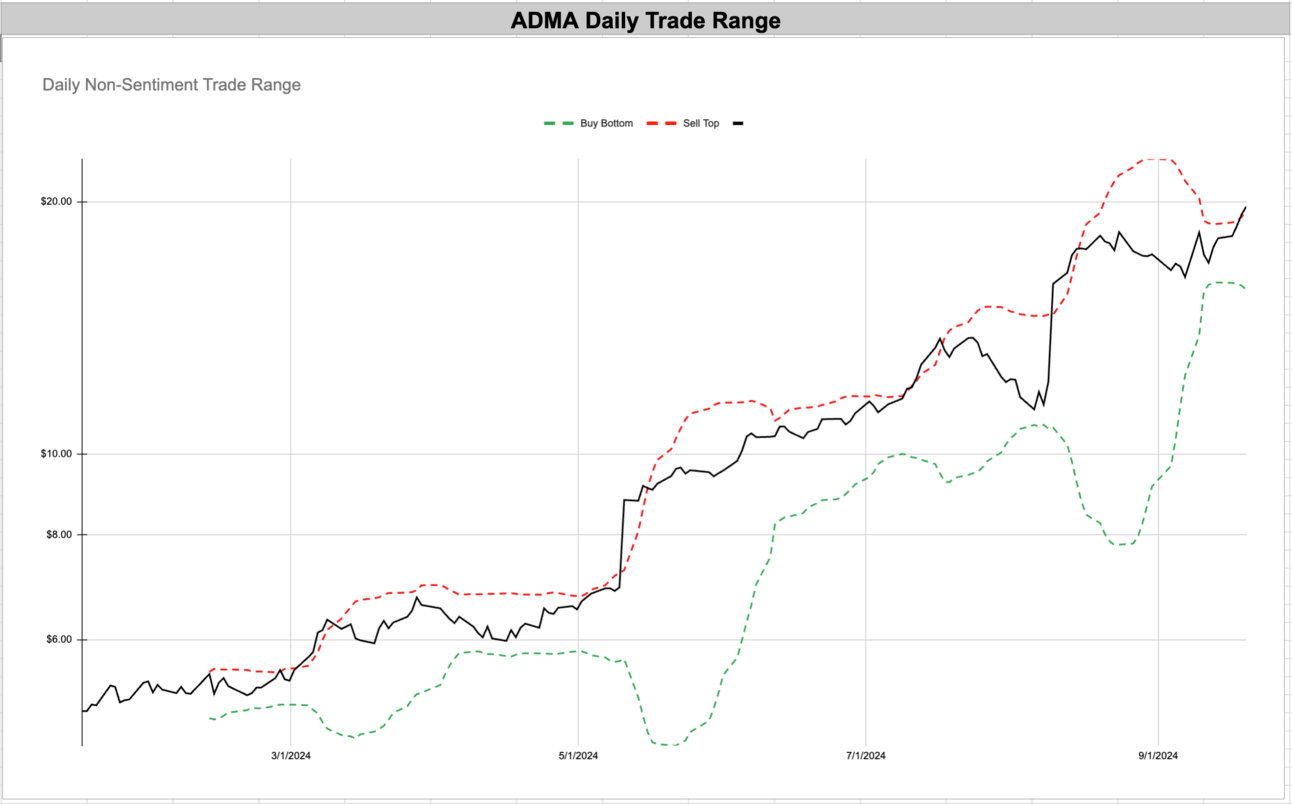

ADMA - Adma Biologics Inc | Healthcare | USA 🇺🇸

GDS - GDS Holdings Limited ADR | Technology | China 🇨🇳

PCT - PureCycle Technologies Inc | Industrials | USA 🇺🇸

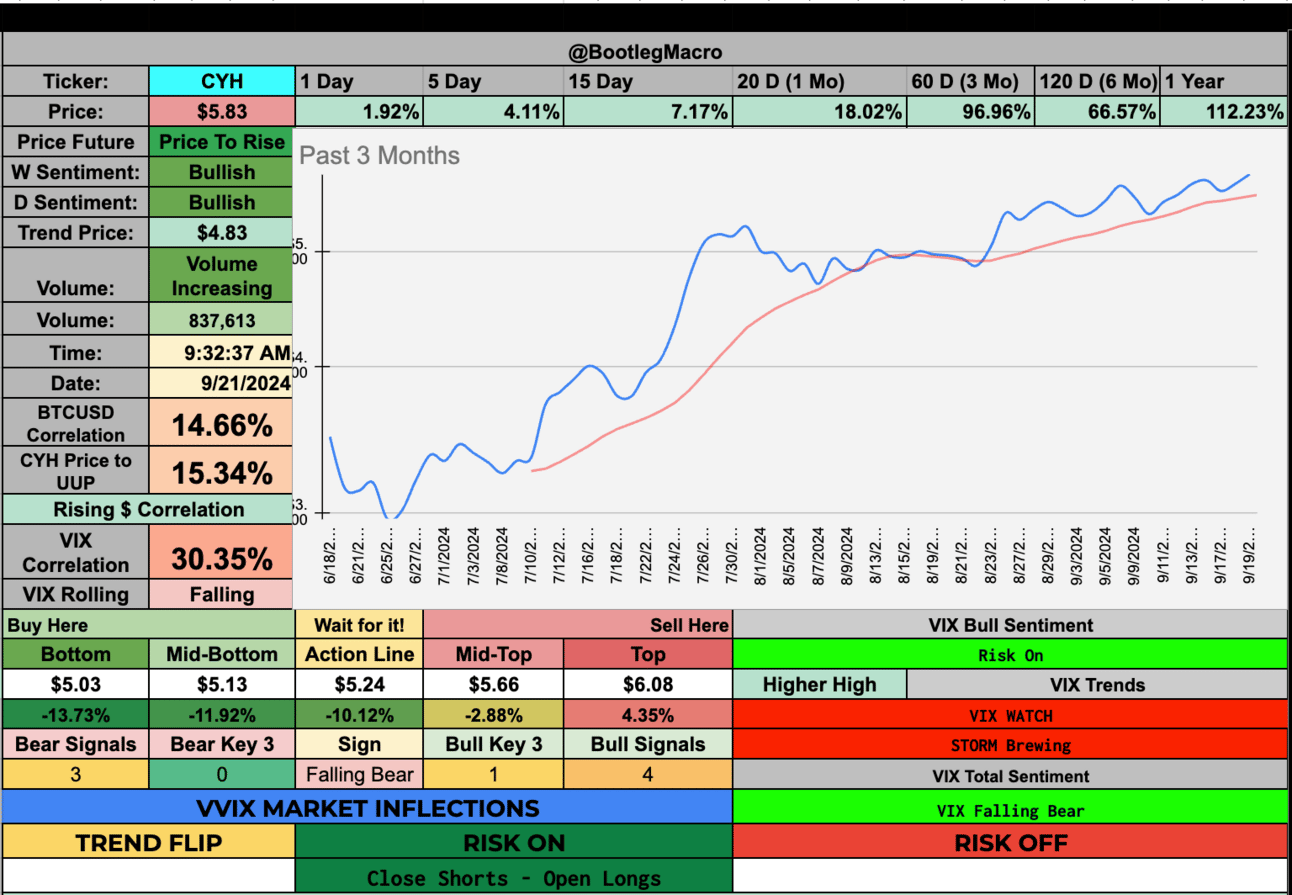

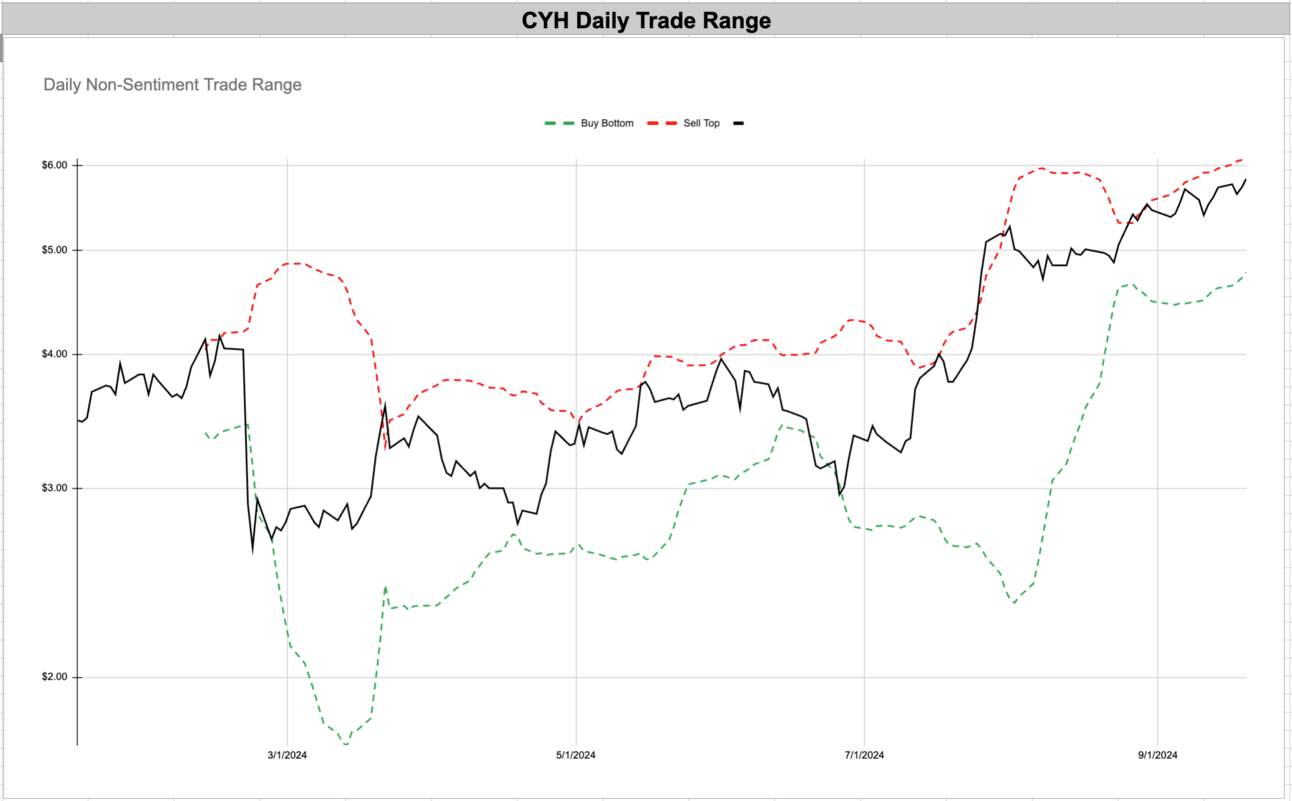

CYH - Community Health Systems, Inc. | Healthcare | USA 🇺🇸

INN - Summit Hotel Properties Inc | Real Estate | USA 🇺🇸

ING - ING Groep N.V. ADR | Financial | Netherlands 🇳🇱

KMI - Kinder Morgan Inc | Energy | USA 🇺🇸

ERIC - Telefonaktiebolaget L M Ericsson ADR | Technology | Sweden 🇸🇪

PHYS - Sprott Physical Gold Trust | Financial | Canada 🇨🇦

ADMA - Adma Biologics Inc | Healthcare | USA 🇺🇸

GDS - GDS Holdings Limited ADR | Technology | China 🇨🇳

Nice mild trend.

Weekly of this breakout is a significant over $20

PCT - PureCycle Technologies Inc | Industrials | USA 🇺🇸

CYH - Community Health Systems, Inc. | Healthcare | USA 🇺🇸

INN - Summit Hotel Properties Inc | Real Estate | USA 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

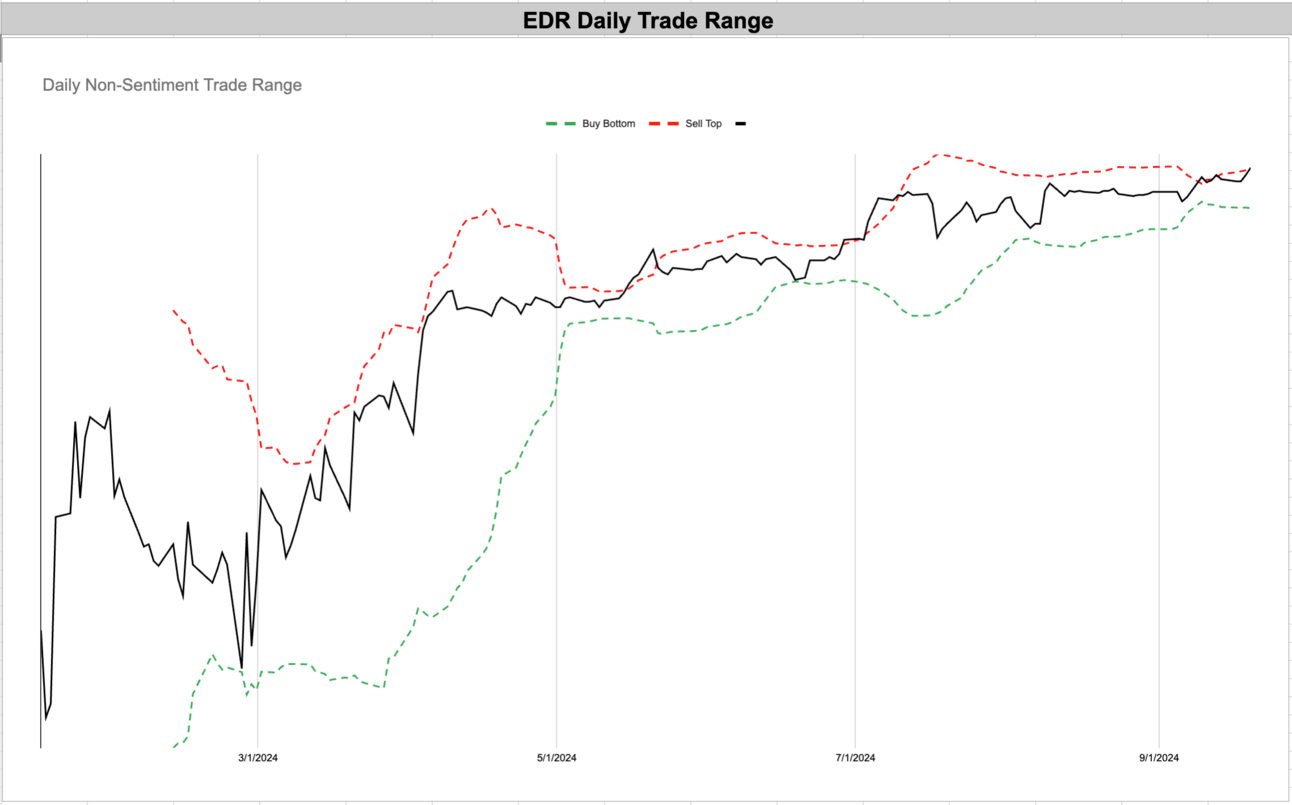

EDR - Endeavor Group Holdings Inc | Communication Services | USA 🇺🇸

META - Meta Platforms Inc | Communication Services | USA 🇺🇸

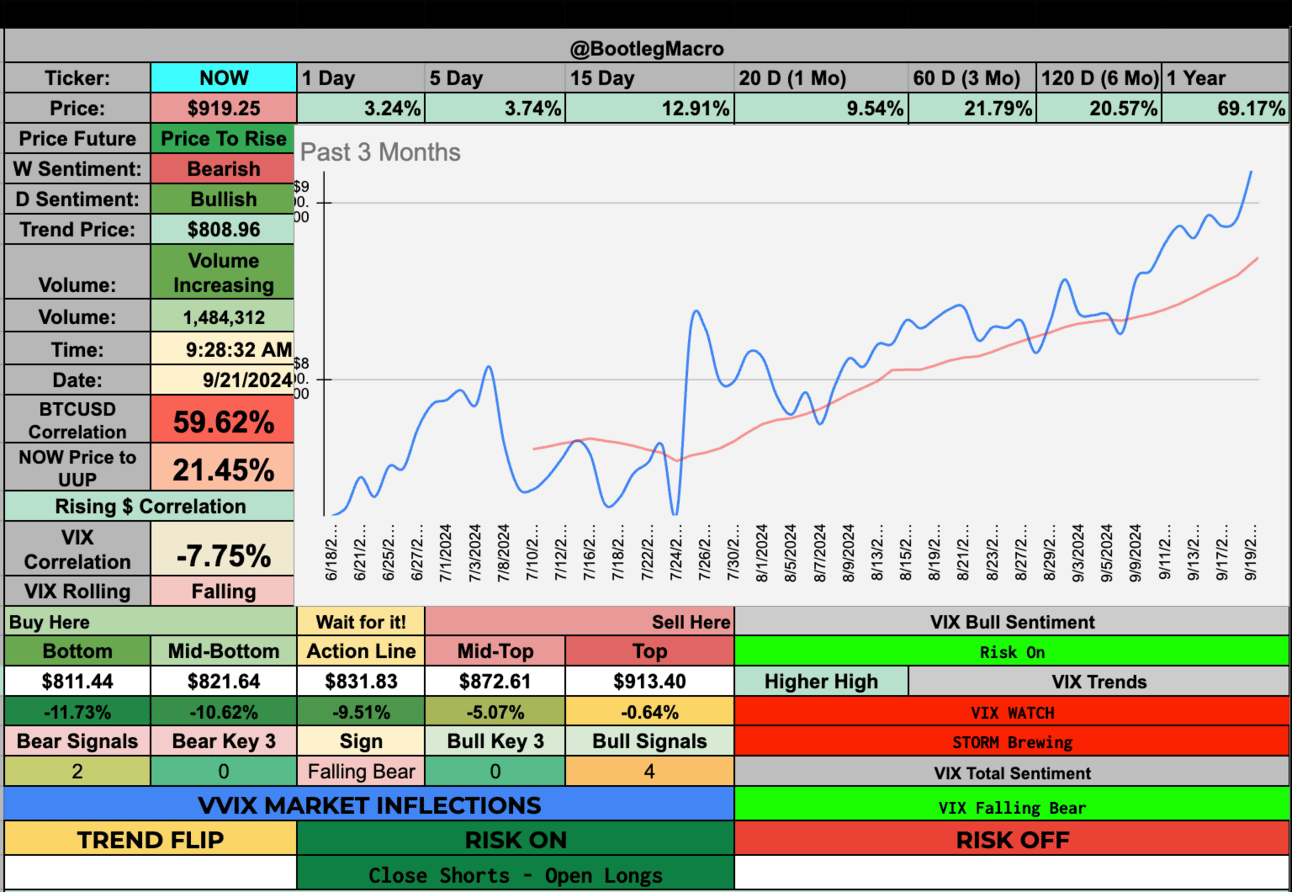

NOW - ServiceNow Inc | Technology | USA 🇺🇸

HCA - HCA Healthcare Inc | Healthcare | USA 🇺🇸

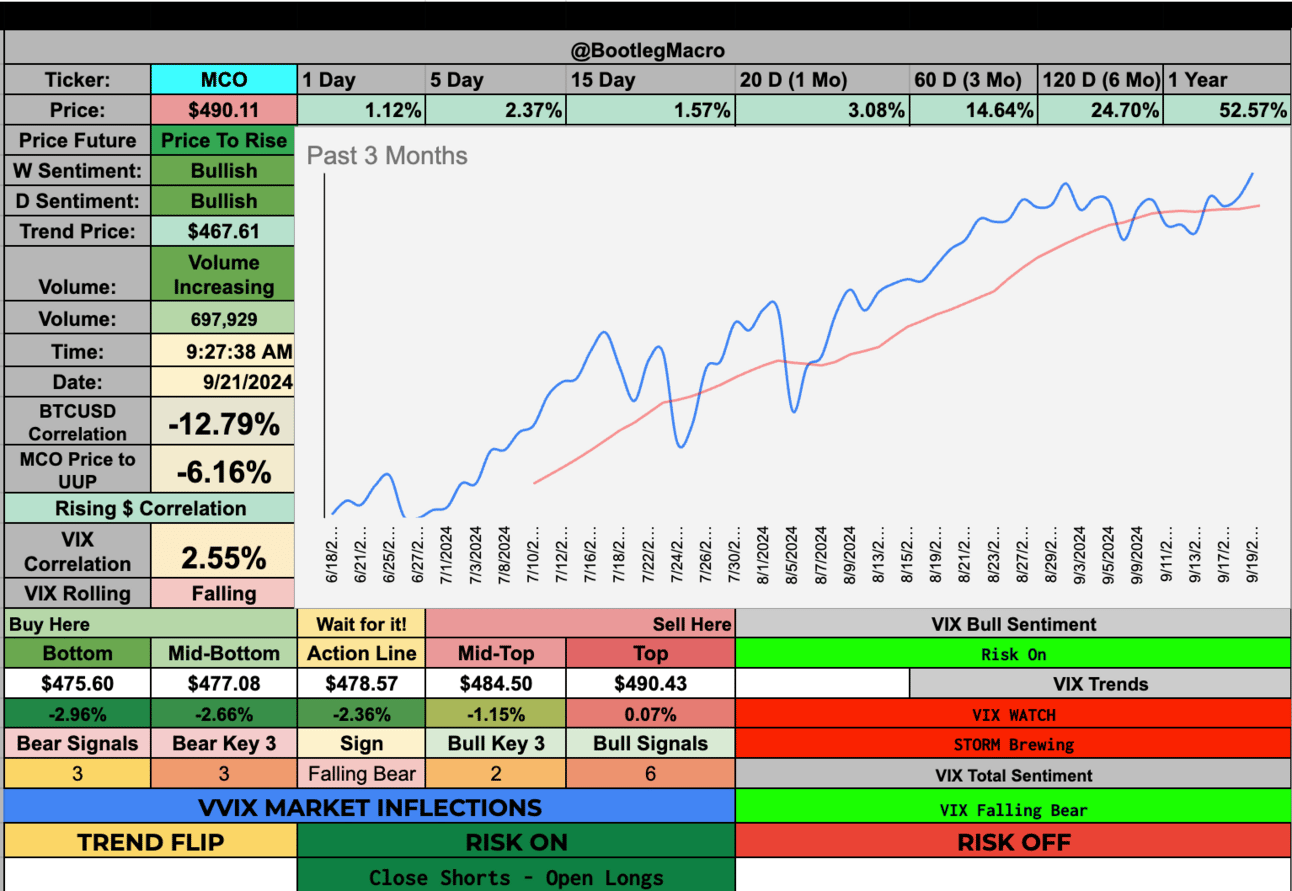

MCO - Moody's Corp. | Financial | USA 🇺🇸

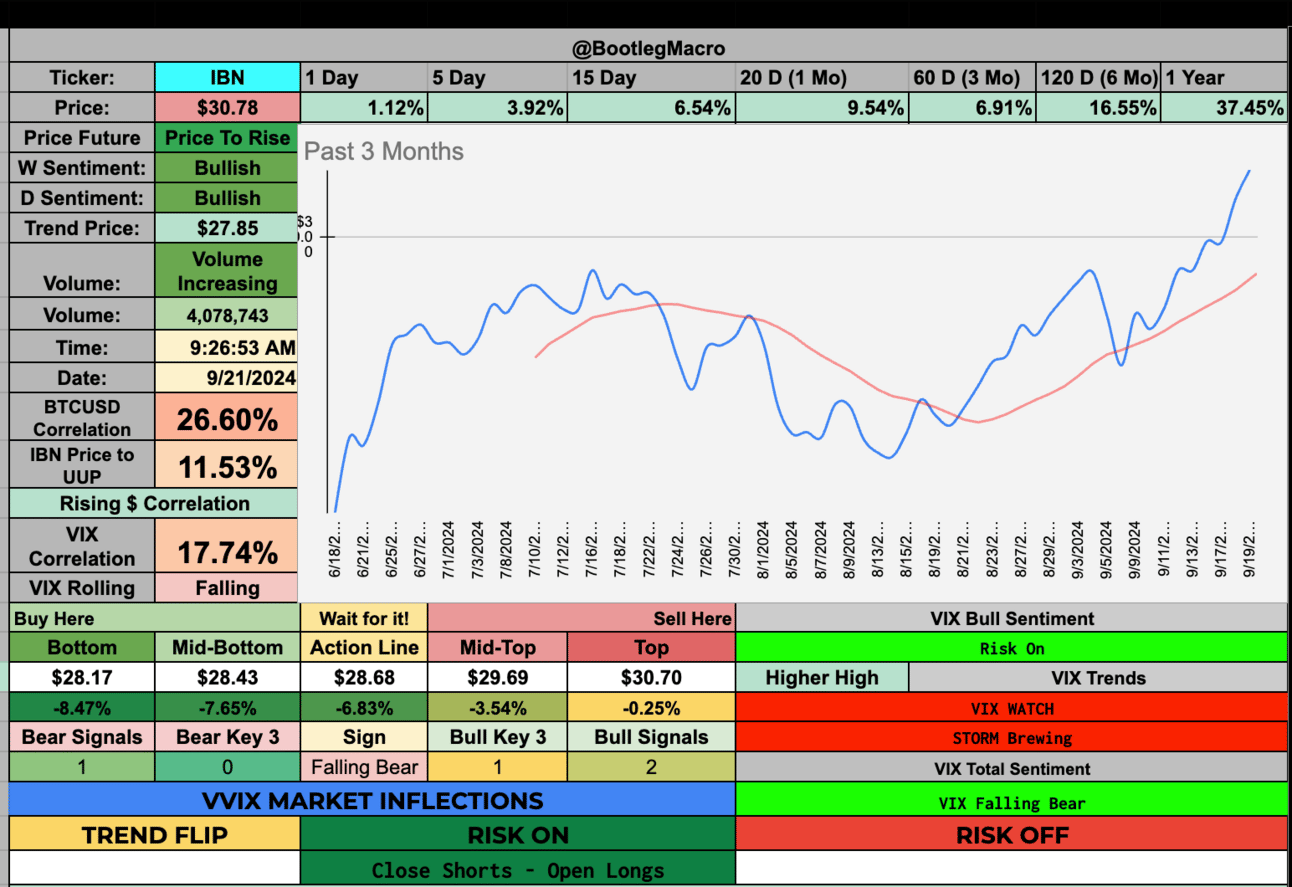

IBN - ICICI Bank Ltd. ADR | Financial | India 🇮🇳

NDAQ - Nasdaq Inc | Financial | USA 🇺🇸

CVNA - Carvana Co. | Consumer Cyclical | USA 🇺🇸

AXON - Axon Enterprise Inc | Industrials | USA 🇺🇸

MNDY - Monday-Com Ltd | Technology | Israel 🇮🇱

EDR - Endeavor Group Holdings Inc | Communication Services | USA 🇺🇸

META - Meta Platforms Inc | Communication Services | USA 🇺🇸

NOW - ServiceNow Inc | Technology | USA 🇺🇸

HCA - HCA Healthcare Inc | Healthcare | USA 🇺🇸

MCO - Moody's Corp. | Financial | USA 🇺🇸

IBN - ICICI Bank Ltd. ADR | Financial | India 🇮🇳

NDAQ - Nasdaq Inc | Financial | USA 🇺🇸

CVNA - Carvana Co. | Consumer Cyclical | USA 🇺🇸

AXON - Axon Enterprise Inc | Industrials | USA 🇺🇸

MNDY - Monday-Com Ltd | Technology | Israel 🇮🇱

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

Now we're watching $USO and $OILK - will OIL FLIP?

— BootlegMacro (@bootlegmacro)

1:08 PM • Sep 16, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro