- The New High Newsletter

- Posts

- Good Buy Charlie

Good Buy Charlie

Charlie Munger’s tribute this week from Warren Buffett shows the power of compounding in life. Time together, spent well and in pursuit of common goals. Be those goals financial, emotional, cultural or otherwise they give dividends in their forms. Make sure and collect then reflect. Warren wrote beautifully and left us all one more treasured gem from his wisdom.

Charlie Munger’s tribute this week from Warren Buffett shows the power of compounding in life. Time together, spent well and in pursuit of common goals. Be those goals financial, emotional, cultural or otherwise they give dividends in their forms. Make sure and collect then reflect. Warren wrote beautifully and left us all one more treasured gem from his wisdom.

NVDA reminded us all of the paradigm shift. Another S-curve kicking off for markets to absorb. We’ve started on a global path of synchronized growth (prepare for the return of this phrase).

If you’re looking at the world things are picking up. We see the core of the European economy showing “green chutes” (by the way, I hate to hear this term again, it’s like 2013 all over again).

Asia’s markets are starting to show signs of potentially bottoming. India is still fantastic. It’s all coming together.

There is much to see and much to do, let us get started for you.

Market Performance

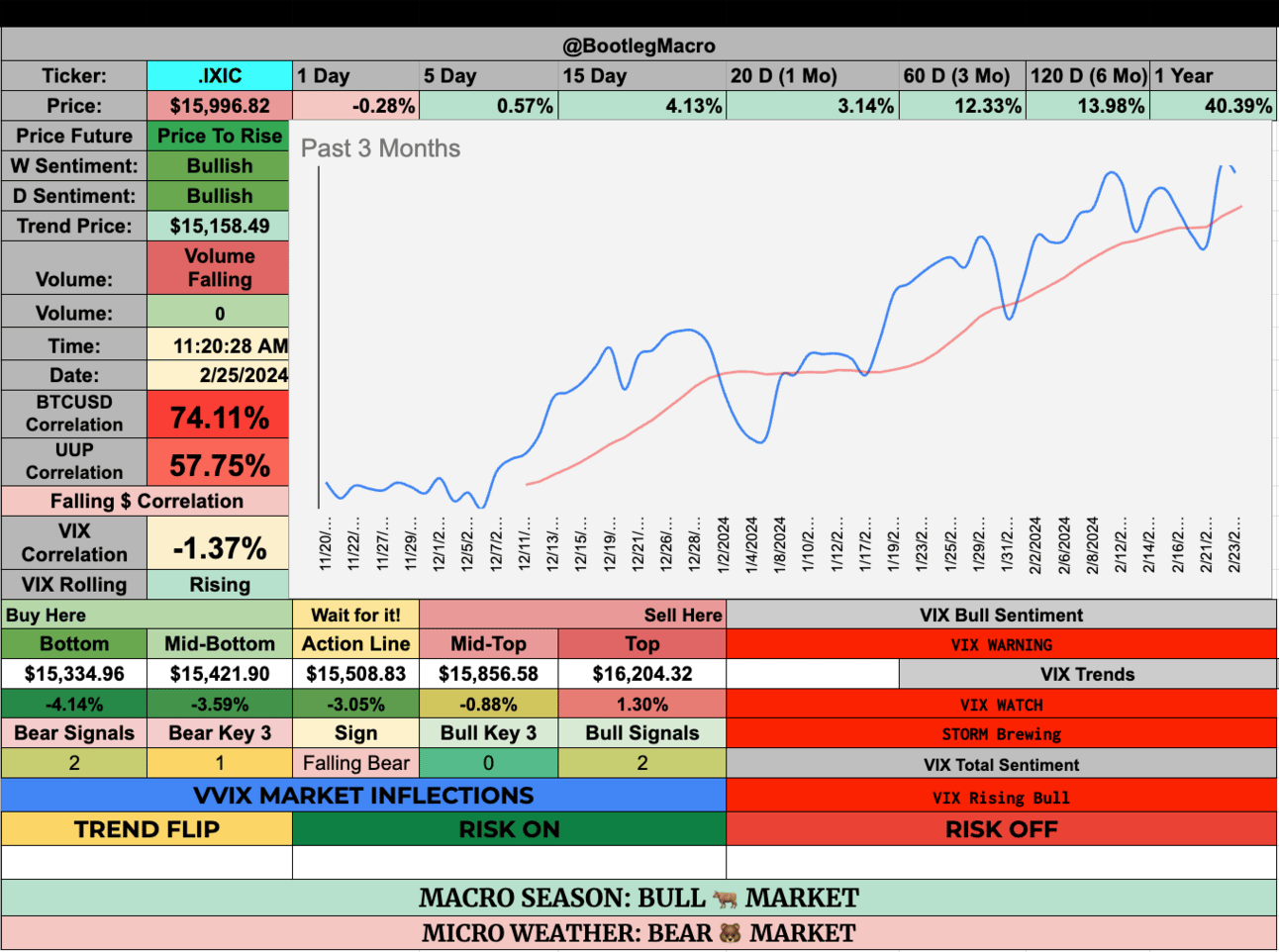

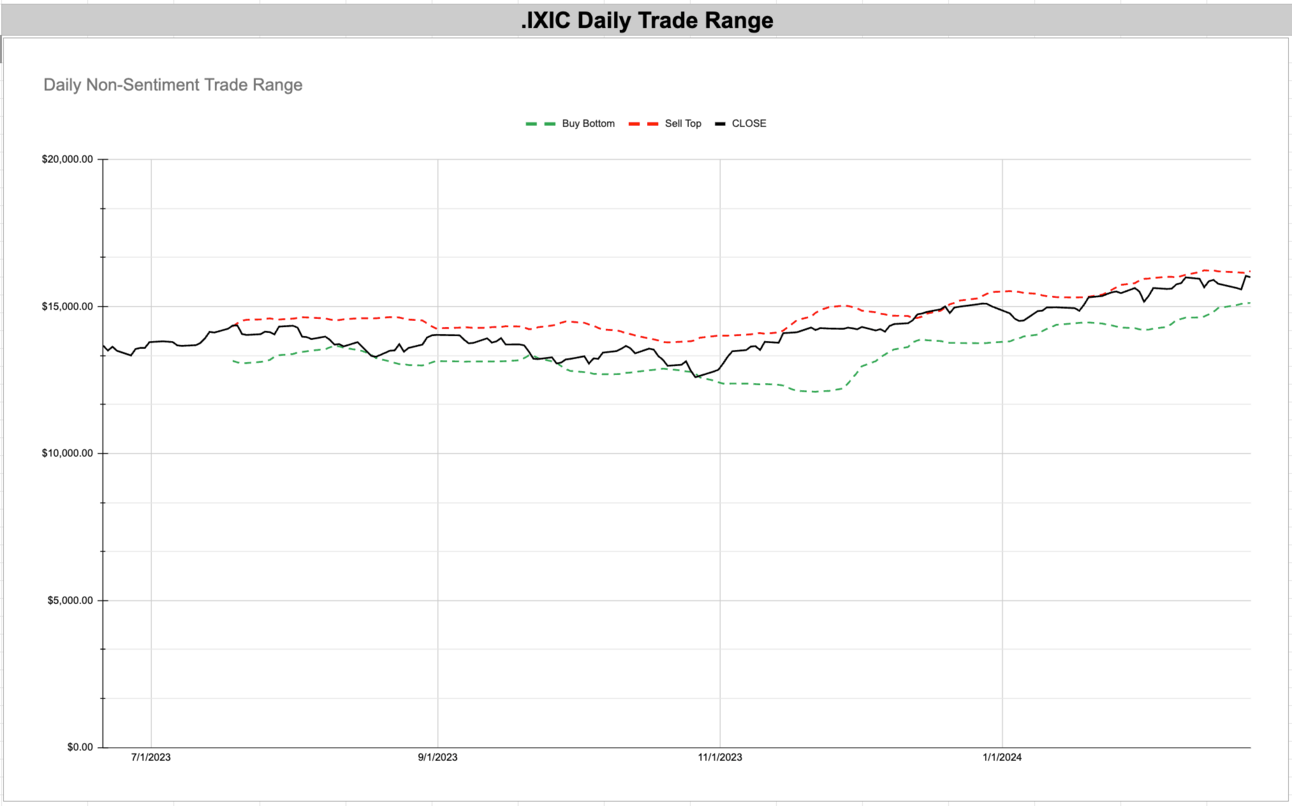

All markets are up for the week. We see strength continuing. What we wonder is about inflation. What will oil do for the rest of the quarter? How does March 2024 look with respect to oil and the dollar?

They are going up while the market is going up currently, can this continue? Is this how prices for generations before went from 50 cents for a gallon of gas to $3?

Other than the questions around potential inflation, the market has no issues. It’s growth, earnings and fundamental talk on TV. There’s no bubble to be seen by me right now.

What I expect is 5500 SPY (at some point), 41,000 Dow and 17,000 Nasdaq. It’s all possible this year under these conditions. It should be slow, it should be a grind and it should surprise.

Warren Buffett's tribute to Charlie Munger:

— Investment Wisdom (@InvestingCanons)

1:54 PM • Feb 24, 2024

Volatility Corner:

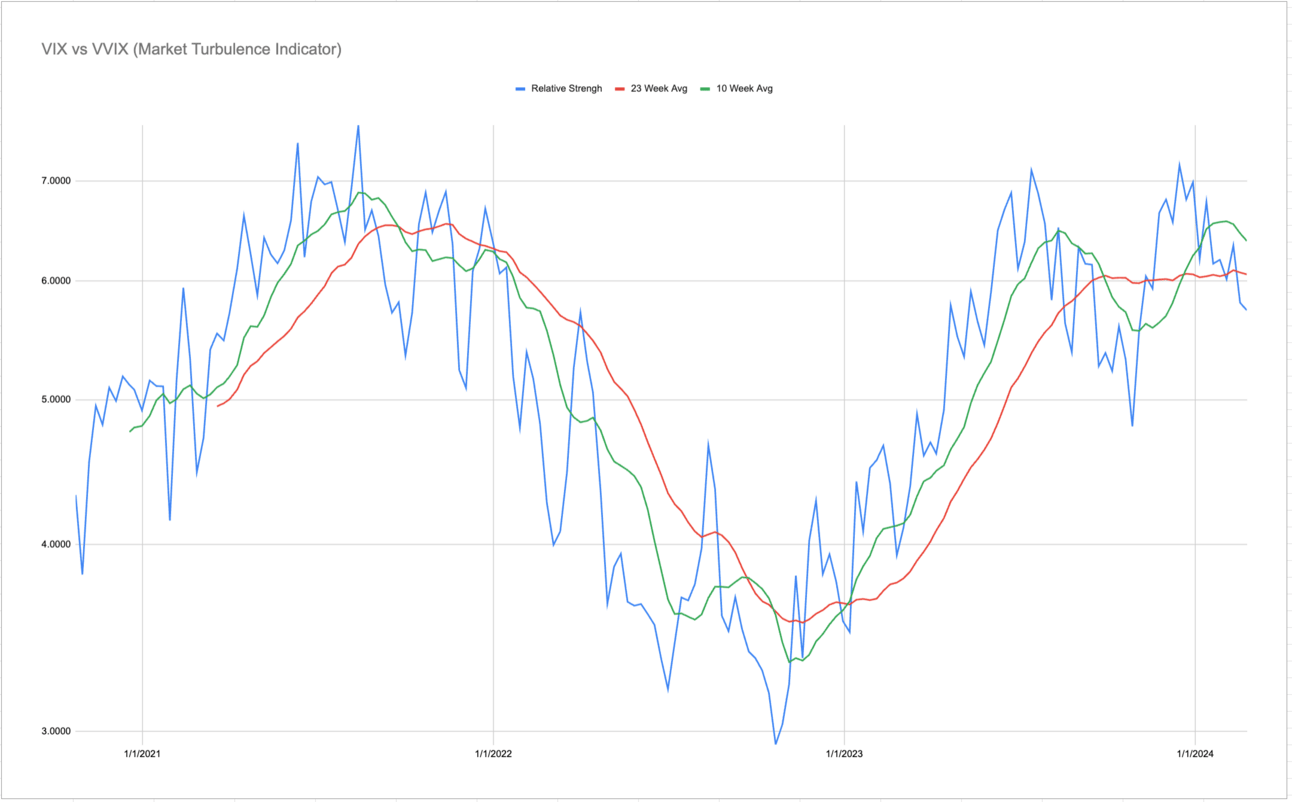

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. The ratio here looks terrible. Honestly, I’m watching but if you see the sharp bottom recently, it was Halloween 2023.

I famously (to myself mostly) went full bear. For real, you can read it here: It’s Officially a Bear Market - So I am patient to let the price action tell me the truth. Indicators can indicate but prices are what change the account. For now, SPY, Nasdaq and Dow Jones do not care about this ratio.

If anything we have a true market for a stock picker. We are seeing true winners get money and losers getting left. Check out NVDA vs AAPL - Trust me, I’ve been bearish APPLE since August of 2023.

If you like it and the market likes it, who cares if volatility is rising? The prices should jump higher faster in those conditions.

The top of the range is now above $16 which is spicy. I’m not expecting VIX to fall much below $13

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

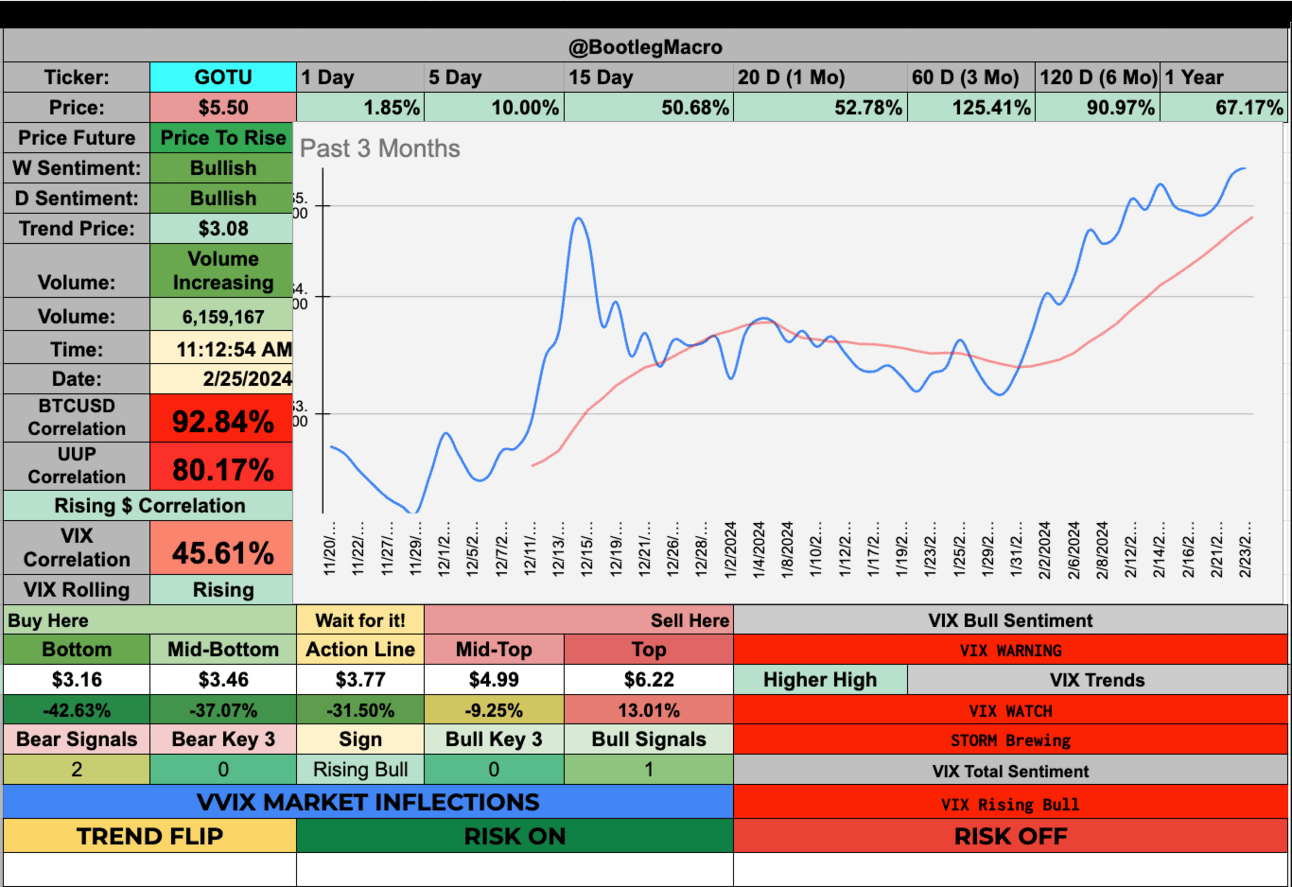

GOTU - Gaotu Techedu Inc ADR - Consumer Defensive - Education & Training Services - 🇨🇳

WT - WisdomTree, Inc. - Financial - Asset Management - 🇺🇸

CCCC - C4 Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

ASX - ASE Technology Holding Co.Ltd ADR - Technology - Semiconductors - 🇹🇼

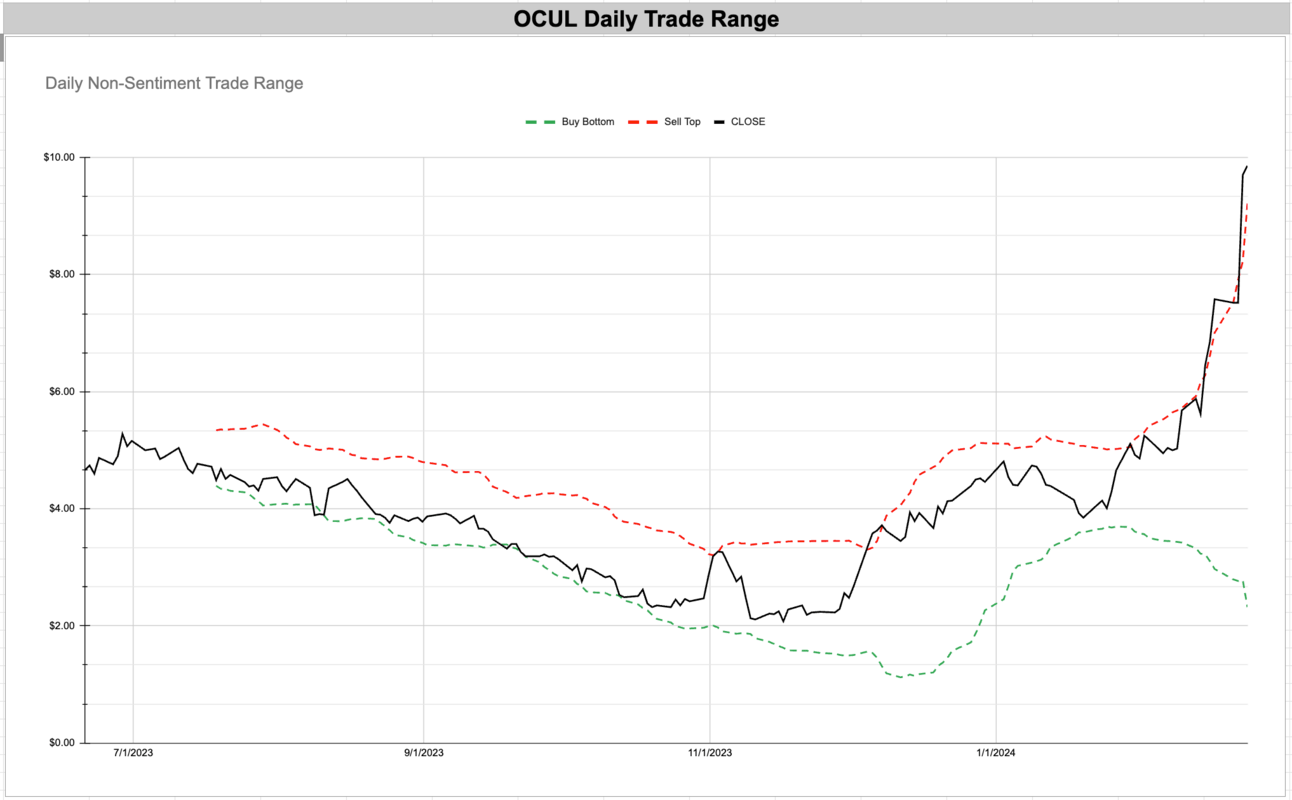

OCUL - Ocular Therapeutix Inc - Healthcare - Biotechnology - 🇺🇸

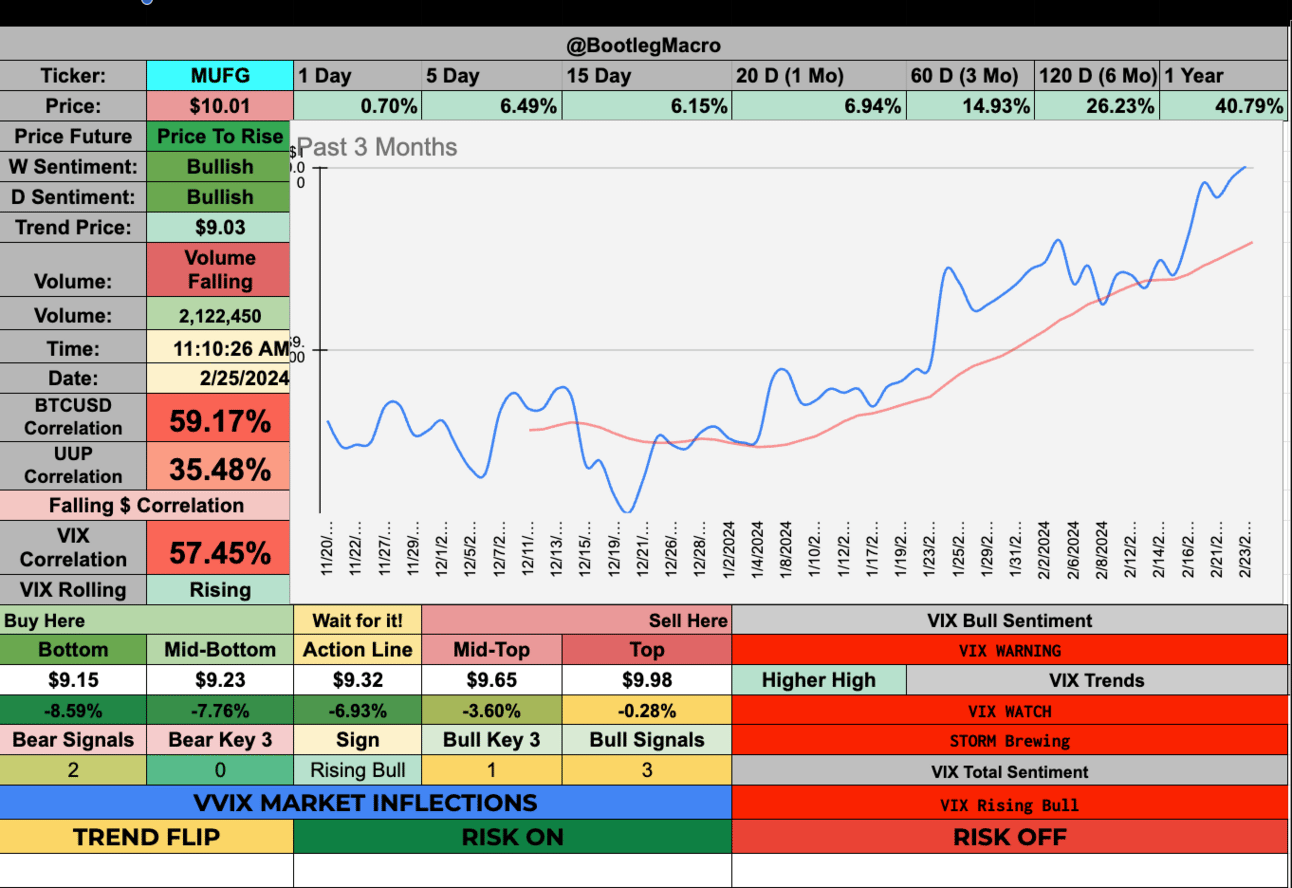

MUFG - Mitsubishi UFJ Financial Group, Inc. ADR - Financial - Banks - Diversified - 🇯🇵

BBVA - Banco Bilbao Vizcaya Argentaria. ADR - Financial - Banks - Diversified - 🇪🇸

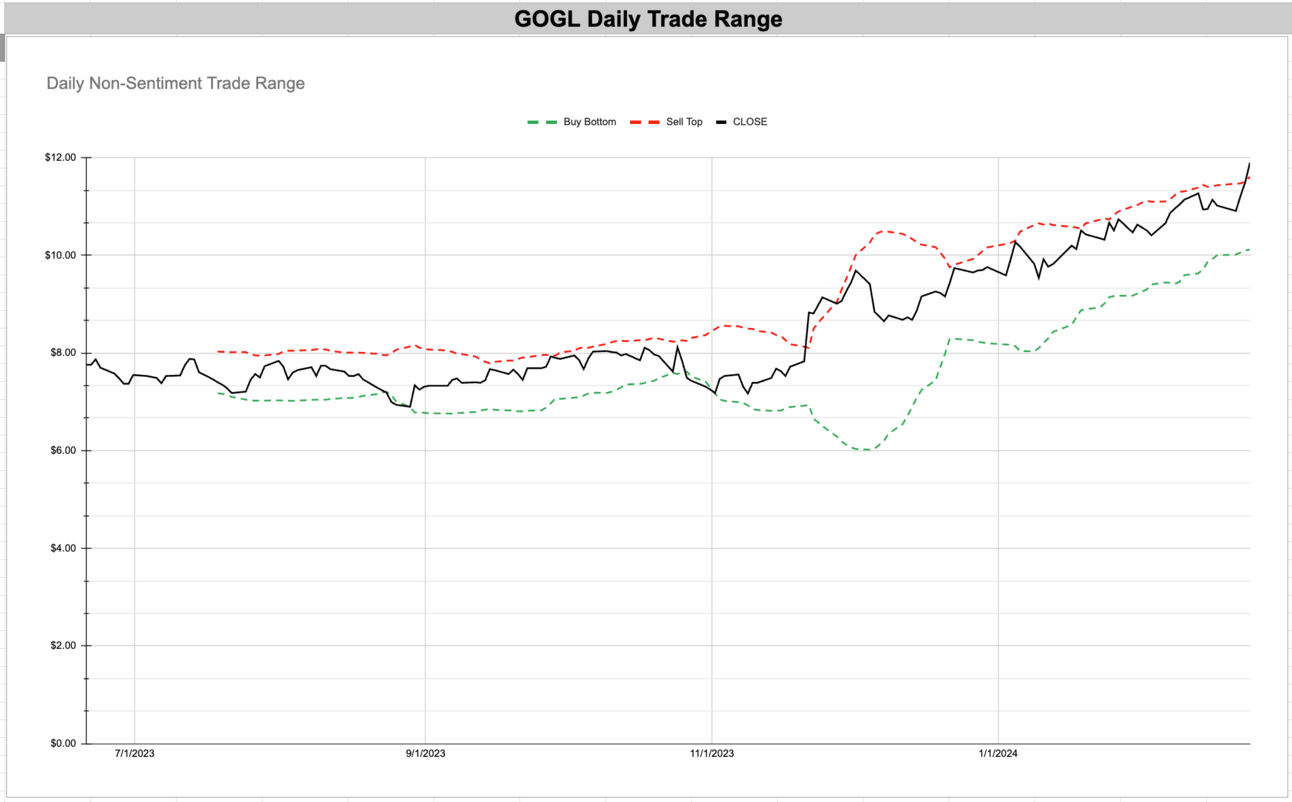

GOGL - Golden Ocean Group Limited - Industrials - Marine Shipping - 🇧🇲

HST - Host Hotels & Resorts Inc - Real Estate - REIT - Hotel & Motel - 🇺🇸

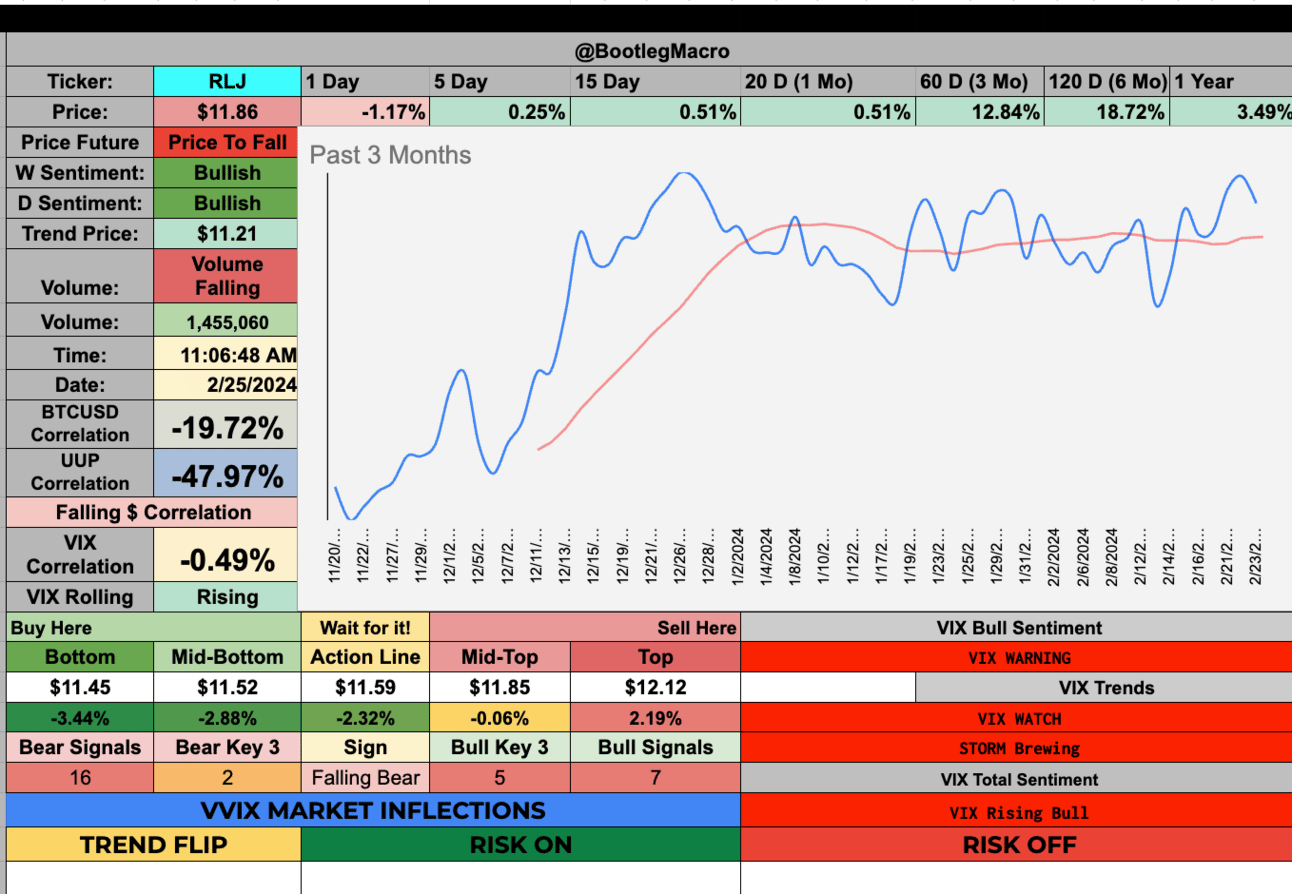

RLJ - RLJ Lodging Trust - Real Estate - REIT - Hotel & Motel - 🇺🇸

GOTU - Gaotu Techedu Inc ADR - Consumer Defensive - Education & Training Services - 🇨🇳

WT - WisdomTree, Inc. - Financial - Asset Management - 🇺🇸

CCCC - C4 Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

ASX - ASE Technology Holding Co.Ltd ADR - Technology - Semiconductors - 🇹🇼

OCUL - Ocular Therapeutix Inc - Healthcare - Biotechnology - 🇺🇸

MUFG - Mitsubishi UFJ Financial Group, Inc. ADR - Financial - Banks - Diversified - 🇯🇵

BBVA - Banco Bilbao Vizcaya Argentaria. ADR - Financial - Banks - Diversified - 🇪🇸

GOGL - Golden Ocean Group Limited - Industrials - Marine Shipping - 🇧🇲

HST - Host Hotels & Resorts Inc - Real Estate - REIT - Hotel & Motel - 🇺🇸

RLJ - RLJ Lodging Trust - Real Estate - REIT - Hotel & Motel - 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

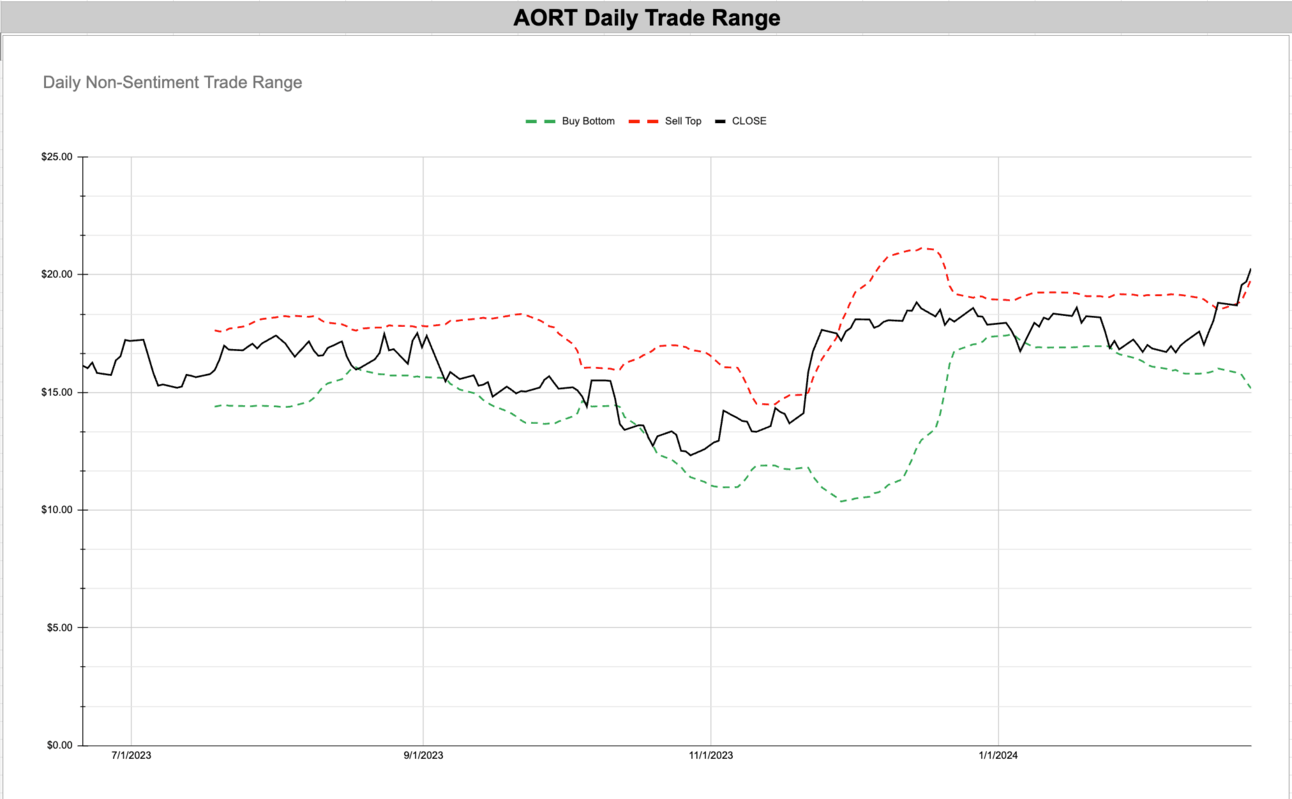

1. AORT - Artivion Inc - Healthcare - Medical Devices - 🇺🇸

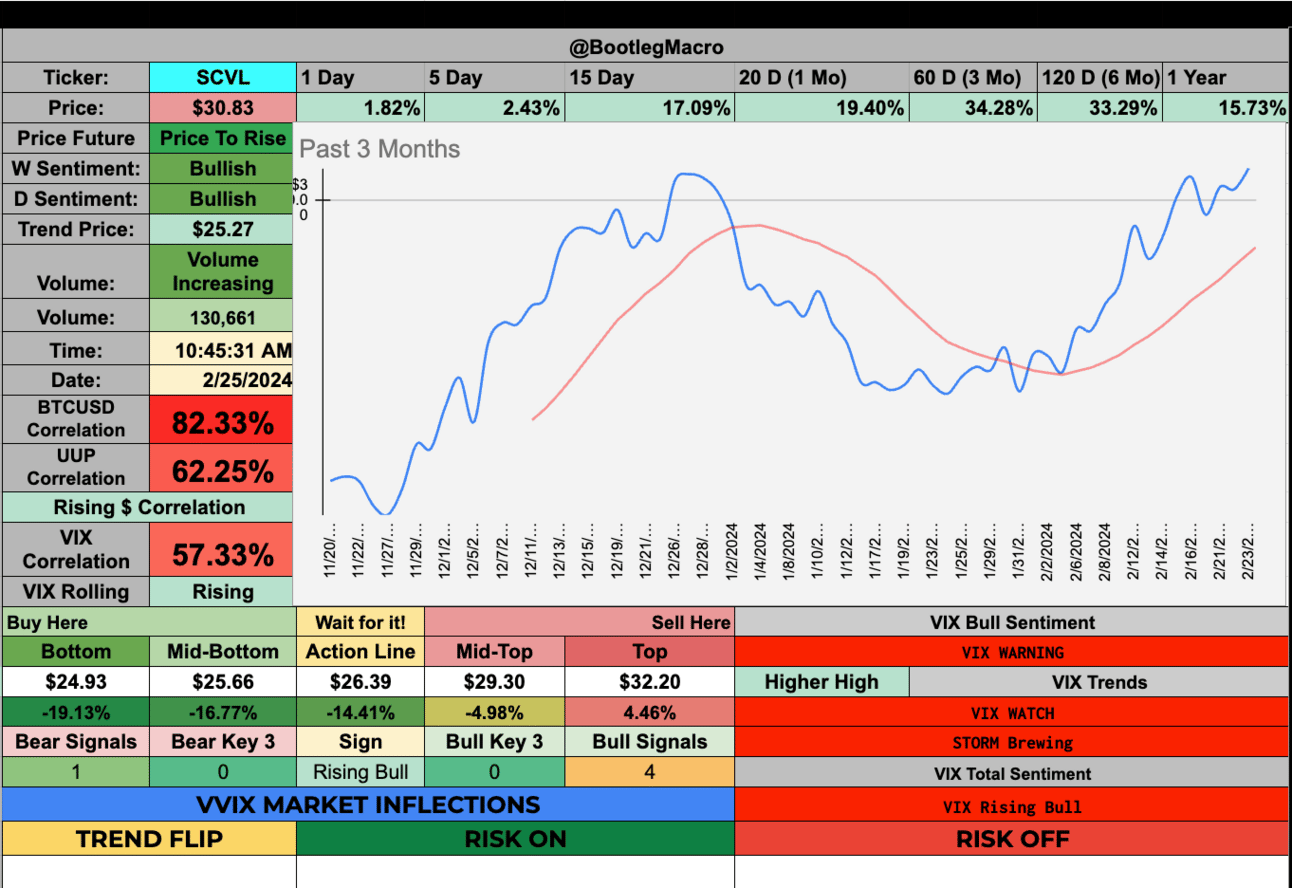

2. SCVL - Shoe Carnival, Inc. - Consumer Cyclical - Apparel Retail - 🇺🇸

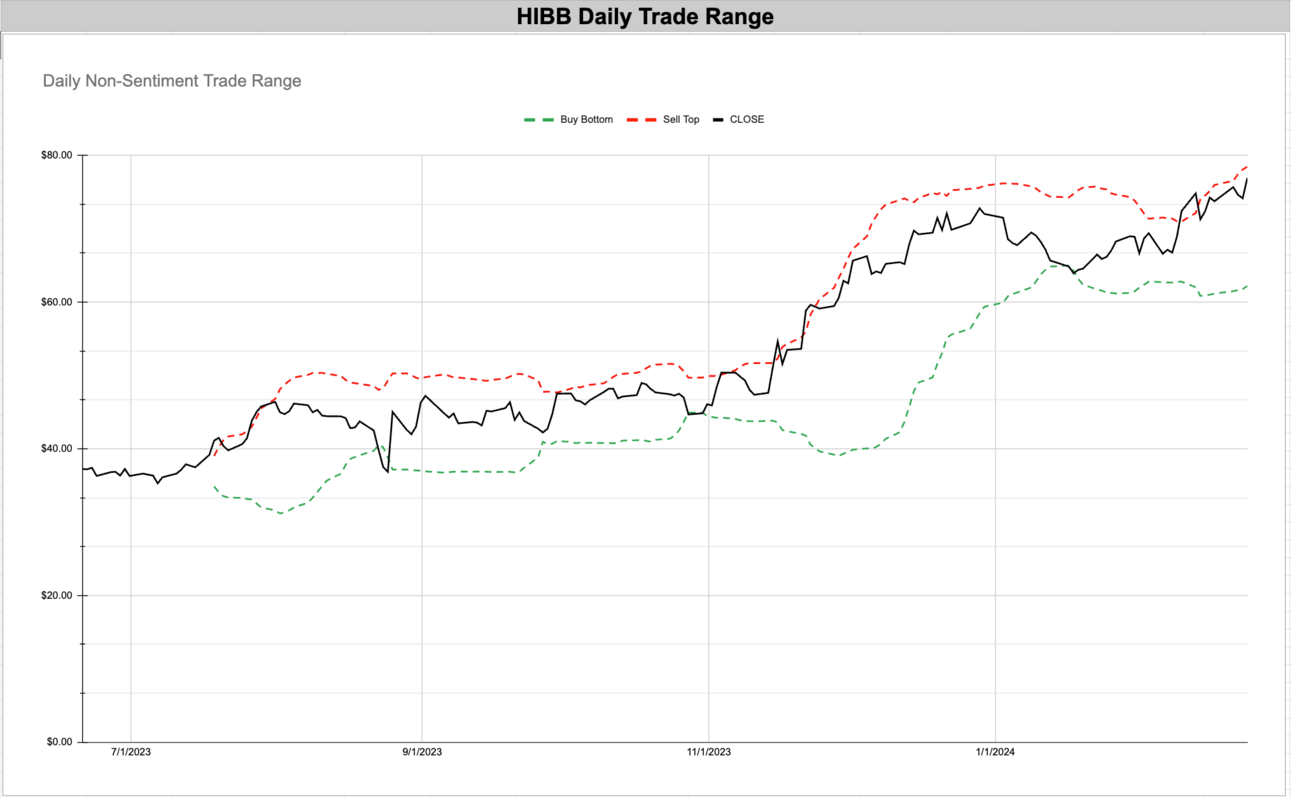

3. HIBB - Hibbett Inc - Consumer Cyclical - Apparel Retail - 🇺🇸

4. CDRE* - Cadre Holdings Inc - Industrials - Aerospace & Defense - 🇺🇸

5. EPAC - Enerpac Tool Group Corp - Industrials - Specialty Industrial Machinery - 🇺🇸

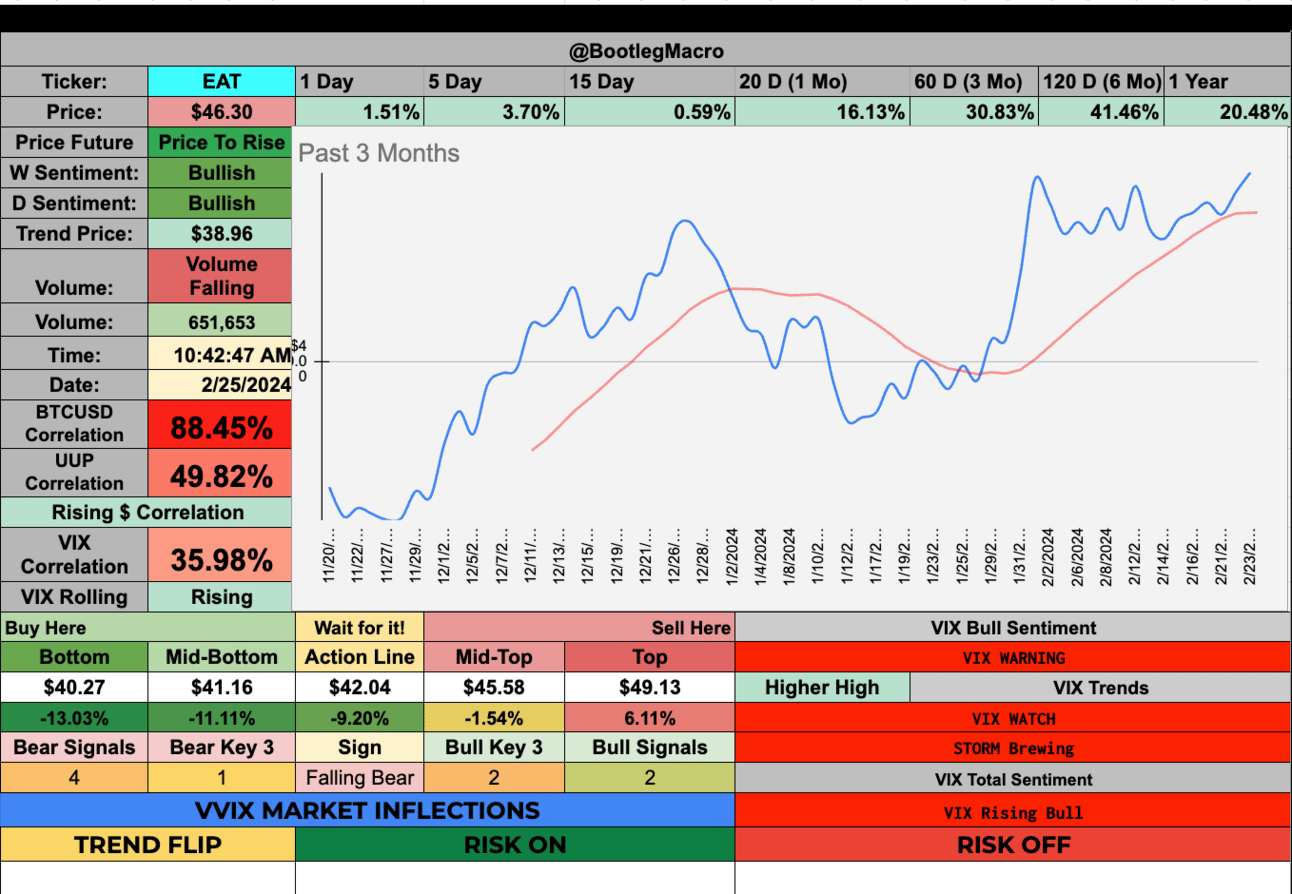

6. EAT - Brinker International, Inc. - Consumer Cyclical - Restaurants - 🇺🇸

7. KROS - Keros Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

8. ALPN - Alpine Immune Sciences Inc - Healthcare - Biotechnology - 🇺🇸

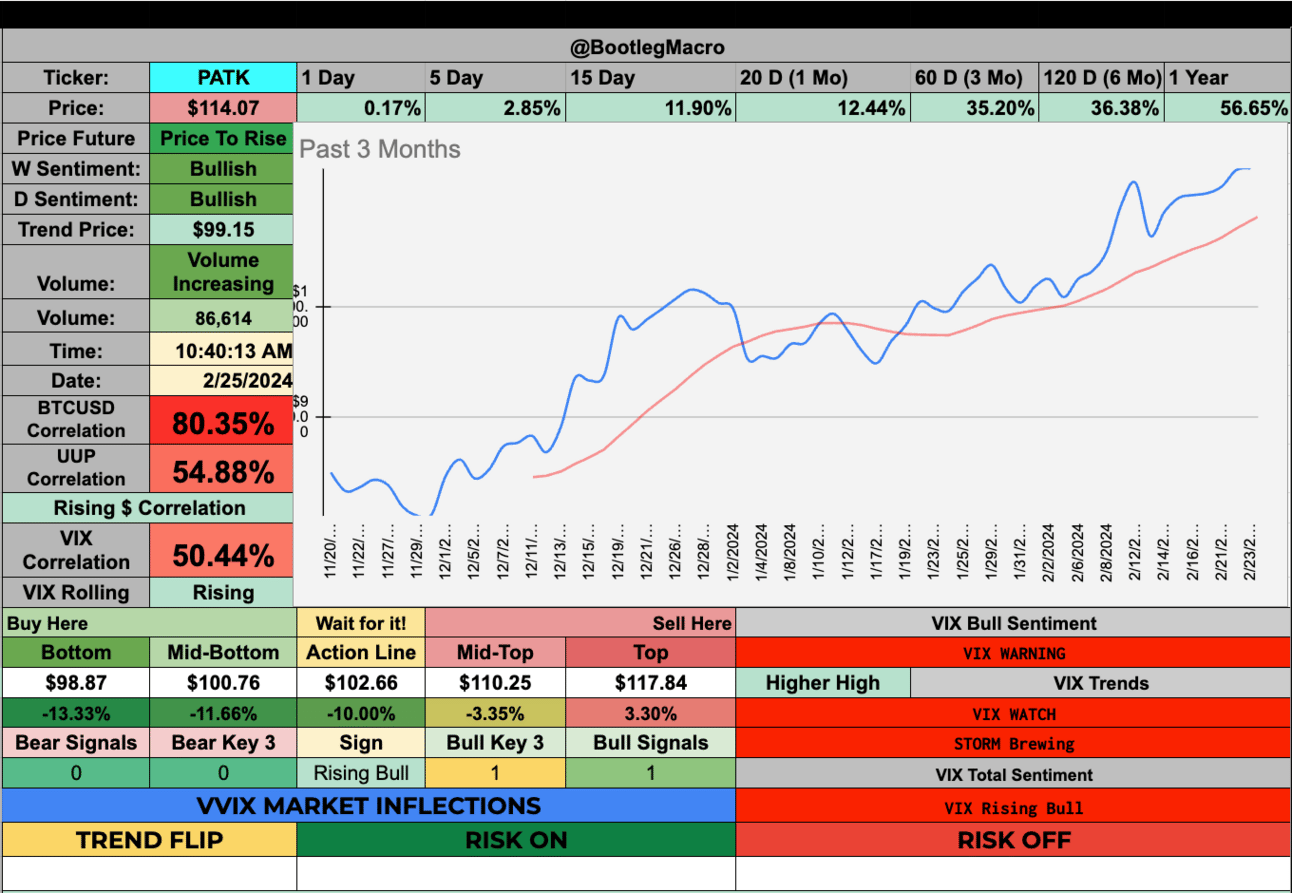

9. PATK - Patrick Industries, Inc. - Consumer Cyclical - Furnishings, Fixtures & Appliances - 🇺🇸

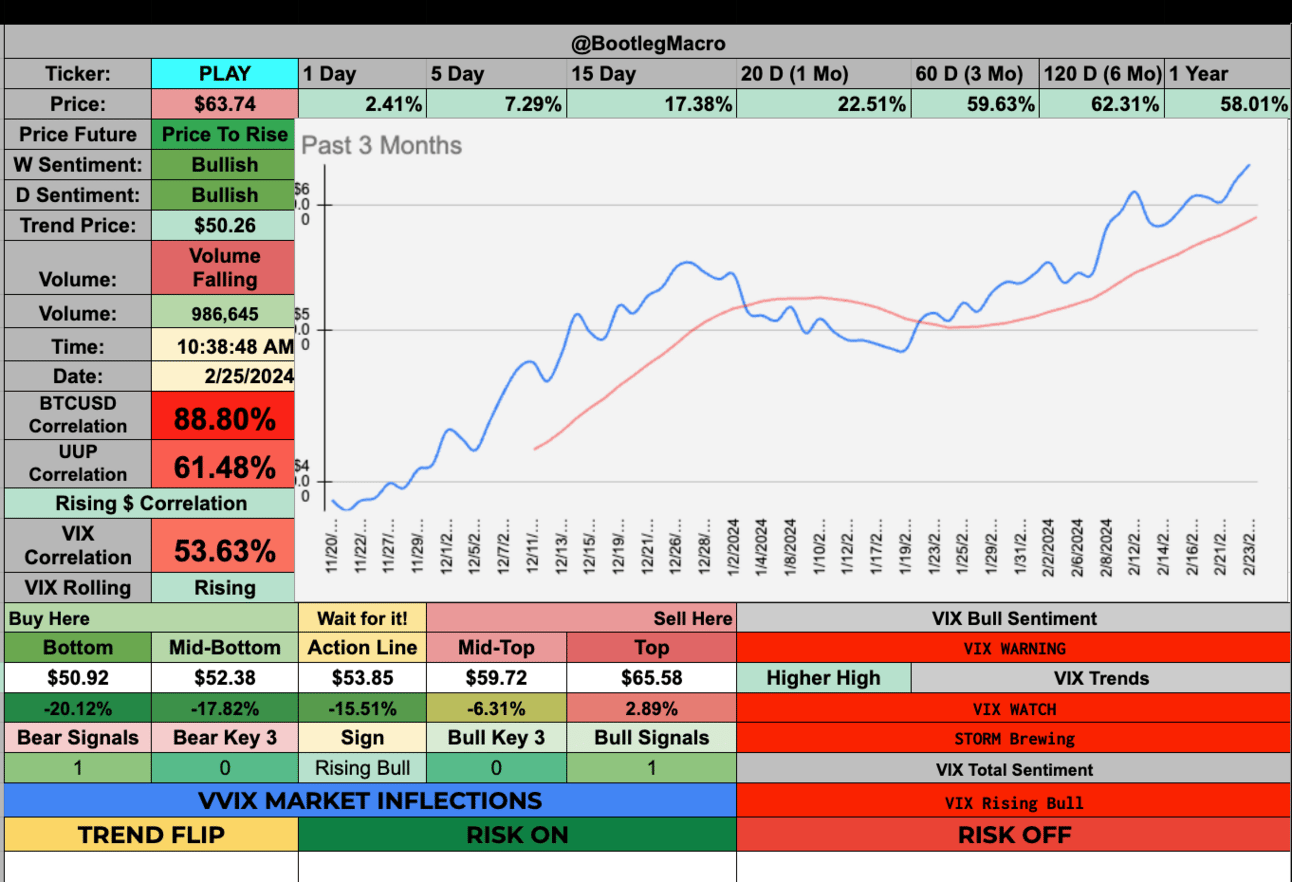

10. PLAY - Dave & Buster's Entertainment Inc - Communication Services - Entertainment - 🇺🇸

AORT - Artivion Inc - Healthcare - Medical Devices - 🇺🇸

SCVL - Shoe Carnival, Inc. - Consumer Cyclical - Apparel Retail - 🇺🇸

HIBB - Hibbett Inc - Consumer Cyclical - Apparel Retail - 🇺🇸

CDRE* - Cadre Holdings Inc - Industrials - Aerospace & Defense - 🇺🇸

EPAC - Enerpac Tool Group Corp - Industrials - Specialty Industrial Machinery - 🇺🇸

EAT - Brinker International, Inc. - Consumer Cyclical - Restaurants - 🇺🇸

KROS - Keros Therapeutics Inc - Healthcare - Biotechnology - 🇺🇸

ALPN - Alpine Immune Sciences Inc - Healthcare - Biotechnology - 🇺🇸

PATK - Patrick Industries, Inc. - Consumer Cyclical - Furnishings, Fixtures & Appliances - 🇺🇸

PLAY - Dave & Buster's Entertainment Inc - Communication Services - Entertainment - 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro