- The New High Newsletter

- Posts

- Where did all the good bulls go?

Where did all the good bulls go?

We have a new indicator for you.

It’s easy to get lost in a BULL MARKET. It’s like a wet dream near the end. You’re so satisfied it almost feels real. But it’s not. And you wake up in your bed ready to go but no invitation.

We all got lost in the BULL MARKET. But we woke up in a BEAR MARKET.

We’ve added a new indicator (MACRO SEASON / MICRO WEATHER) in this email in the VOLATILITY CORNER.

It seems many of you really enjoy that section. Keep the compliments coming if you have some THANK YOU SO MUCH for those who wrote to us this week.

Market Performance

We’ve left behind the final Friday of Summer for 2023. The market was positive across all 3 major indexes in the US. A final farewell of summer to us who traded this summer of chop.

Every single index ended up for the Friday session

Indexes reflect the underlying volatility of the market. There is no straight line in markets. All we get is a random walk home.

Only the Dow Jones Average was down for the week.

Please note the VIX correlation of the .INX - The VIX is rising, not good.

The DOW has the lowest VIX correlation. The VIX - DOW correlation is the only rising of all the major US indexes. Interesting.

The Nasdaq shows the most weakness but maybe breaking above it’s 15 day SMA.

Volatility Corner:

VIX / VVIX deteriorated worse! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. You see the up and down…we are below the 23 Week Avg for the first time since January 3rd, 2023.

This signal is important. Be very cautious until things improve.

We can certainly snap back above next week. But overall, change is here.

We are inserting the $VIX trade card for the first time ever. We should be monitor.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑

US Index ETF Review:

SPY

Bullish Trend Since 5/31/23🟢

Go SHORT Since 8/11/23🛑****

Price to FALL Since 8/8/23🛑***

DIA

Bearish Trend Since 8/24/23🛑****

Go Short Since 8/11/23🛑

Price to Fall Since 8/18/23🛑

QQQ

QQQ Bearish Trend Since 8/18/23🛑

Go SHORT Since 8/10/23🛑***

Price to Fall Since 7/28/23**🛑

IWM

Bearish Since 8/16/23🛑

Go SHORT Since 8/10/23🛑

Price to FALL Since 8/14/23🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

NXE - Energy (Canada)

SBS - Utilities (Brazil)

COUR - Education & Trainings (USA)

TSAT - Communication Equipement (Canada)

FSLY - Software Application (USA)

SPNT - Insurance (Bermuda)

NXE - Energy (Canada)

SBS - Utilities (Brazil)

COUR - Education & Trainings (USA)

TSAT - Communication Equipement (Canada)

FSLY - Software Application (USA)

SPNT - Insurance (Bermuda)

Enjoying this?

& Invite a friend.

New Highs $20+:

EXEL - Biotechnology (USA)

CLS - Electronic Components (Canada)

MNSO - Specialty Retail (China)

UBS - Banks (Switzerland)

IDYA - Biotechnology (USA)

RVMD - Biotechnology (USA)

CCJ - Energy (Canada)

VRT - Electrical Equipments and Parts (USA)

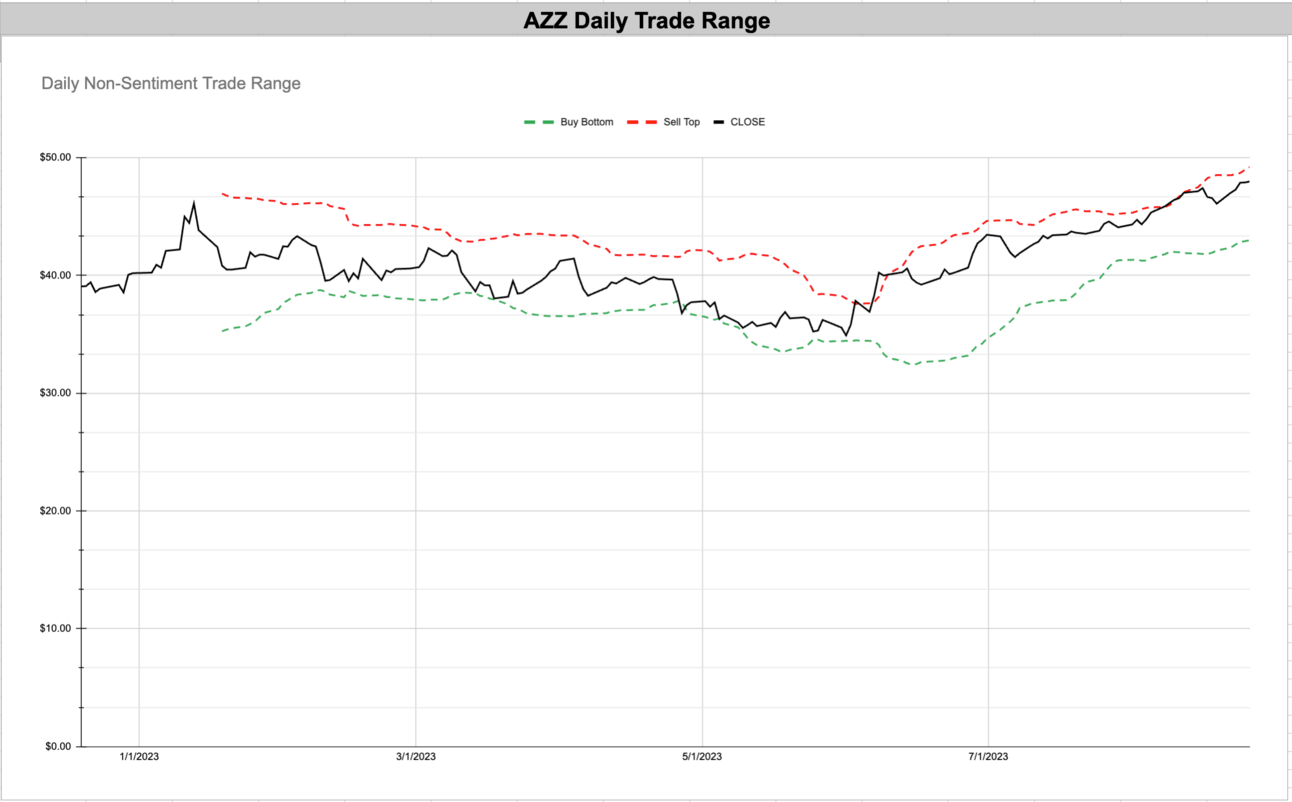

AZZ - Speciality Business (USA)

PRGS - Software Application (USA)

BCO - Security & Protection Services (USA)

SPLK - Software Infrastructure (USA)

ATR - Medical Instruments and Supplies (USA)

NSIT - Electronics and Computer Distribution (USA)

BR - Information Technology (USA)

INTU - Software Application (USA)

EXEL - Biotechnology (USA)

CLS - Electronic Components (Canada)

MNSO - Specialty Retail (China)

UBS - Banks (Switzerland)

IDYA - Biotechnology (USA)

RVMD - Biotechnology (USA)

CCJ - Energy (Canada)

VRT - Electrical Equipments and Parts (USA)

AZZ - Speciality Business (USA)

PRGS - Software Application (USA)

BCO - Security & Protection Services (USA)

SPLK - Software Infrastructure (USA)

ATR - Medical Instruments and Supplies (USA)

NSIT - Electronics and Computer Distribution (USA)

BR - Information Technology (USA)

INTU - Software Application (USA)

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. You will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If I was given $10,000 today here is what I would do.

— Bootleg Macro (@bootlegmacro)

3:37 AM • Jul 14, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro