- The New High Newsletter

- Posts

- Fatigue & Flux: Market Compression Before the Storm?

Fatigue & Flux: Market Compression Before the Storm?

No new highs. No green indices. Just a market that wants to rally but can’t catch its breath. Maybe that’s why this week’s post came late — the fatigue is everywhere. Inflation prints soon. Trade carefully. This thing is leaning bullish, but one surprise could knock it sideways.

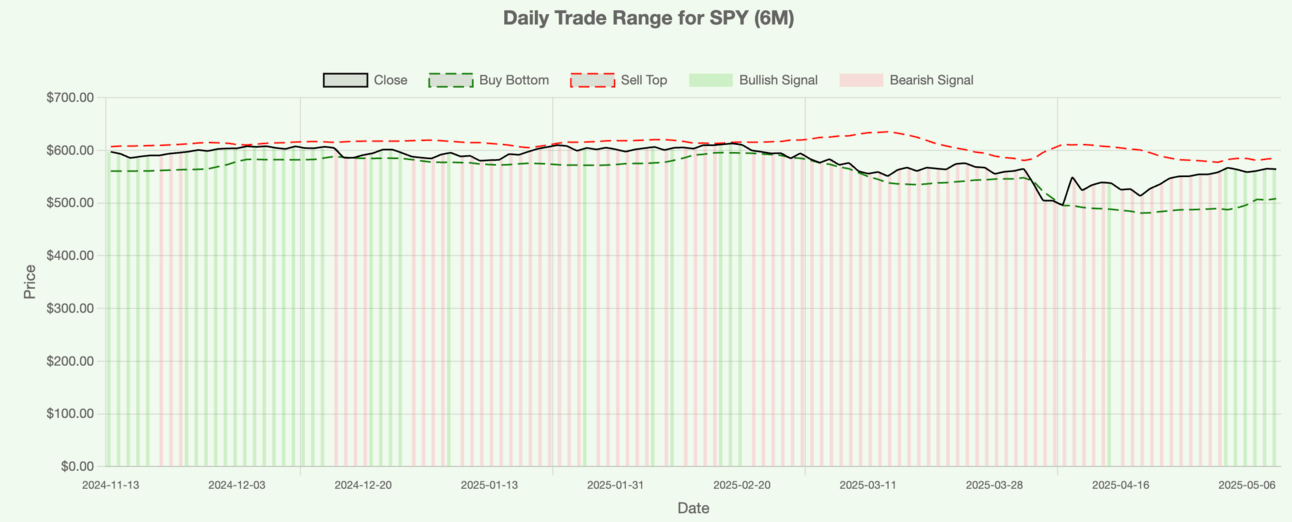

Market Overview: No US index was up for the week, interesting, right? They are all BULLISH but none of them were able to muster a positive week. Even with US trade agreements with the UK. It’s very telling the ranges in both SPY and Nasdaq saw Higher-Lows but no Higher-Highs. That’s consolidation with an upward bias but it’s not showing yet. Buying dips is fine but I’m cautious.

New Highs $5-$20: No new highs week, I’m doing work as a donor for someone with Leukemia so I’m artificially fatigued. Hence why this came out later.

Turbulence Indicator: We’re at the 10 week moving average of turbulence. We can slice through it or see turbulence rise. I’ll let the market tell me how to respond.

Looking Ahead: There is more to come this week with CPI coming out. If inflation is suprising to the upside, that’s not going to do well for a market on the brink.

Market Performance Framework

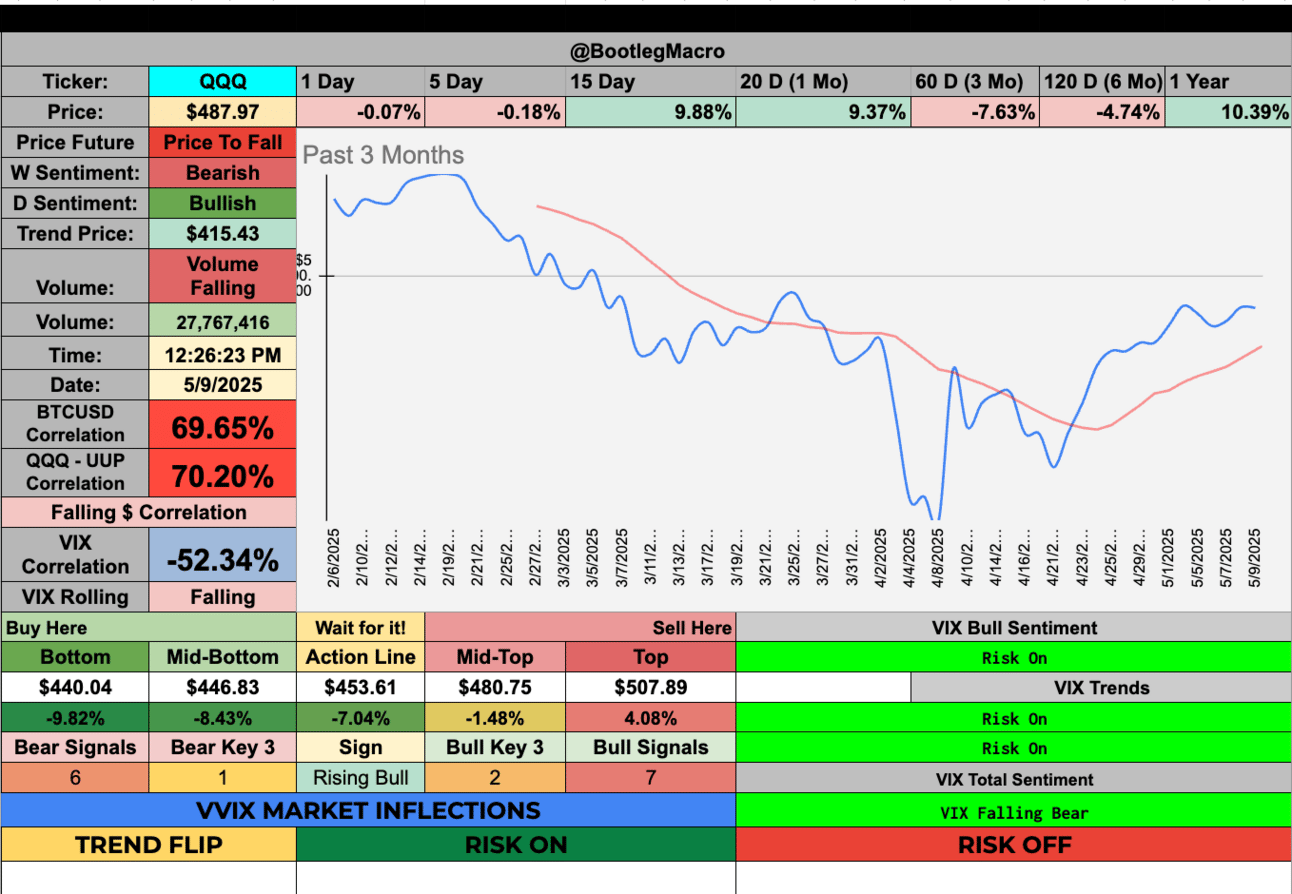

The market’s talking out both sides of its mouth. Nasdaq says “bullish,” but volume is falling and higher highs are MIA. The Dow’s still choking on bearish weekly sentiment, and SPX is caught mid-stride. We're technically in "Risk On" across the board, but VIX volatility inflections and tightening ranges say we’re nearing a decision point. CPI could be the spark. Until then: higher lows, lower volume, and a tired bull trying to grind uphill.

Volatility Corner Framework

Indicator Update:

Bullishness has returned. Which is a delight for investors and traders alike. The reality of the indicator here is that turbulence in markets is now part of our environment. We may not notice it now, it may dampen down from where it was in March of 2025 but it’s here. That’s a fact none of use can ignore. I’ll use it as a way to pay attention to ranges.

Turbulence has certainly calmed in the markets but now we’ve hit an interesting level.

We are right at the level where volatility has a chance to really rip.

MACRO INDICATOR:

MACRO SEASON: BEARISH Since 3/7/25🛑 (Watch for a flip)

MICRO WEATHER: BEARISH Since 2/21/25🛑

US Index ETF Review:

SPY

Bullish Trend Since 5/6/25🟢

Go LONG Since 5/6/25🟢

Price to RISE Since 4/30/25🟢

d

DIA

BEARISH Trends Since 2/24/25🛑 (pending a flip to BULLISH on Monday)

Go LONG Since 5/6/25🟢

Price to RISE Since 5/7/25🟢

QQQ

BULLISH Trend Since 5/6/25🟢

Go LONG Since 5/2/25🟢

Price to RISE Since 4/29/25🟢

IWM

Bearish Since 2/24/25🛑

Go LONG Since 5/6/25🟢

Price to RISE Since 5/2/25🟢

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

The market needs to make a choice.

— BootlegMacro (@bootlegmacro)

2:22 PM • May 4, 2025

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro