- The New High Newsletter

- Posts

- Default Market Signal: Bullish

Default Market Signal: Bullish

If you're not long, what are you doing? Tell me. The market will give setups before the election. Are you paying attention?

Welcome to Q4. With volatility rolling over (VIX at $20.33, forecasted to fall), the calm before the storm may just be settling in. Remember, bull markets thrive on boredom, and we are right on time for it. If VIX stays under 19, it’s cruise control.

WULF stands out, up 21.76% in the last 5 days—bitcoin correlations here are a tale to watch (BTC at a 41% linkage). Miners are running hot, and the price is set to rise with bull signals stacking up.

Meanwhile, CRVS just put in 47% for the month, a parabolic climb with a BTC correlation of 87%. When crypto rages, this stock follows, like thunder after lightning. Momentum is bullish, and the trend isn't breaking just yet.

DASH is showing surprising resilience, up 66% over the last year, with only 8% gains over the month. The bearish weekly sentiment? Just noise. The long-term bulls are firmly in control, preparing for a breakout on increasing volume.

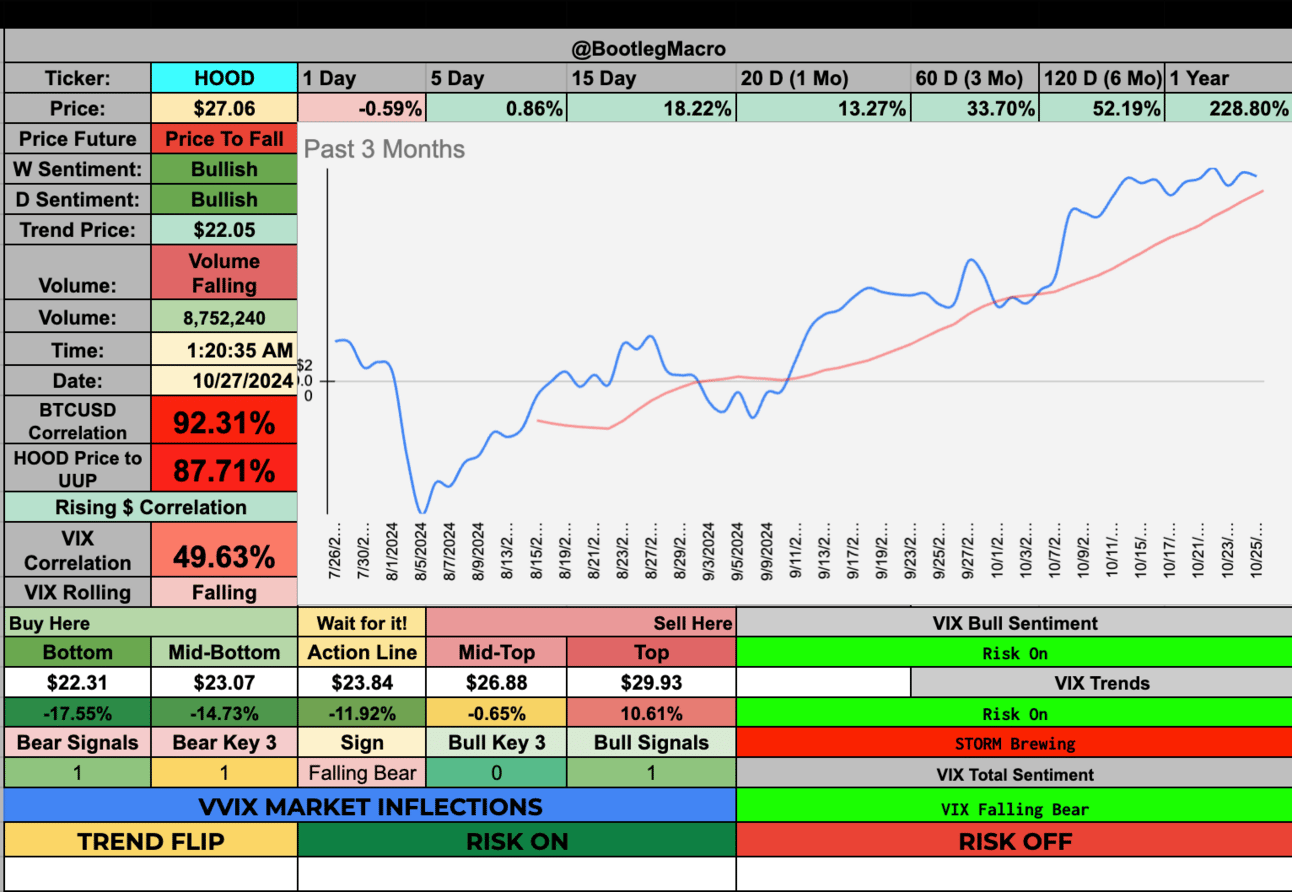

HOOD (Robinhood) is still a mixed bag—price slipping but clinging to a bullish structure. If you’re long, watch the $29.93 top. Get out clean at that level or face downside risk as the volume dries up.

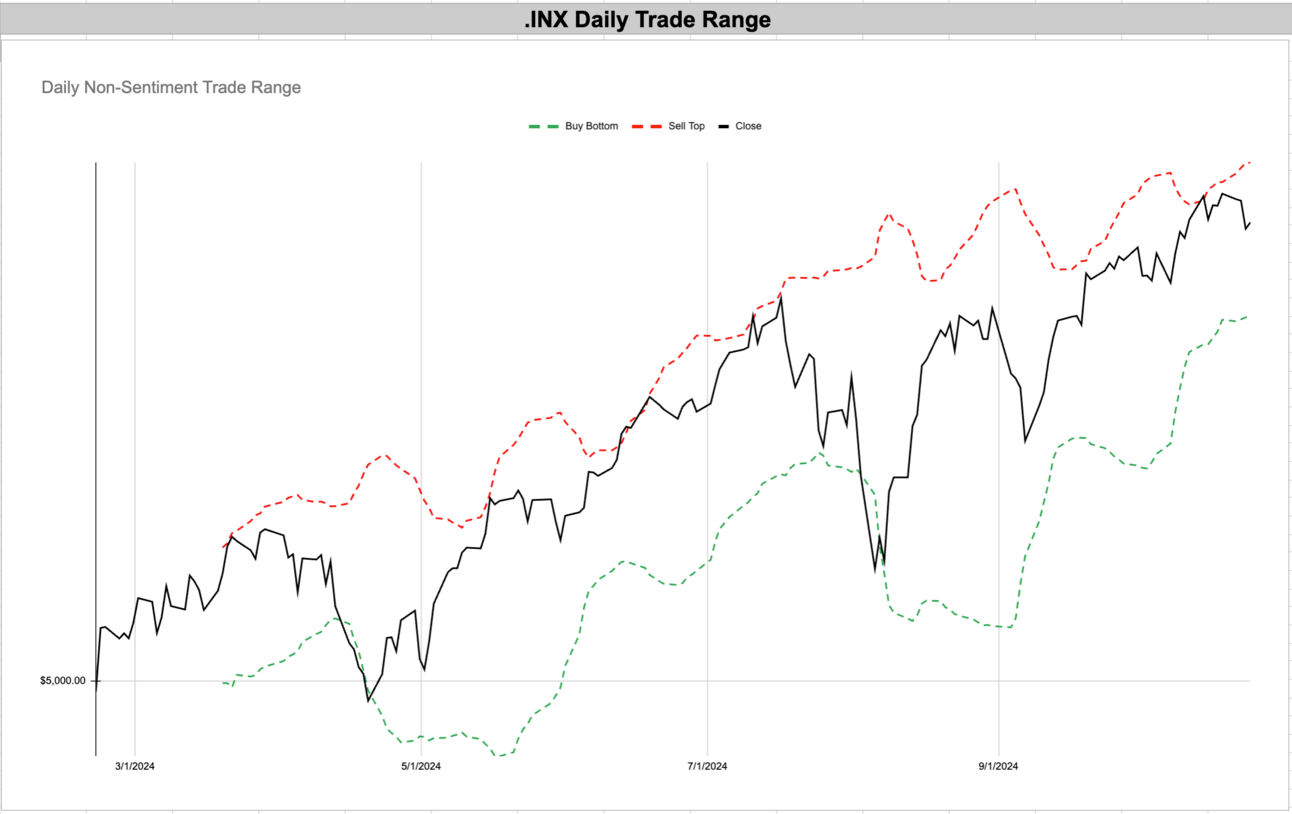

Market Performance

Indexes holding steady. VIX flashing signals, but no panic yet.

NASDAQ at $18,518 and trending higher. Bullish weekly and daily sentiment—volume is light, but the path ahead looks clear. Expect short bursts of noise, but the broader trend remains intact. Watch the BTC correlation (86%); this linkage hints that when crypto rallies, so will tech. Buy the dips as they come—target around $18,007-$18,090 for a smooth re-entry.

The Dow Jones is holding at $42,114. It’s in grind mode, with slight drawdowns this week (-2%), but bullish trends persist. Target the $42,920-$43,617 range to trim positions. Don’t expect the VIX to stay quiet forever, though. VIX inflections suggest a minor volatility pop soon, but it’s all noise until VIX breaks $19.

The dollar will be devalued over the next 12-18 months—this trend is your friend. Ride it. As refinancing and rate cuts kick in, the flow of liquidity will fuel growth. Tech and cyclicals like the NASDAQ will be where you want exposure. Remember: volatility isn’t the enemy; it’s a feature of opportunities to reload when the market panics for no reason.

Risk is on. Look for quiet gains to continue as we close out 2024. The game plan: stay patient, trust the dips, and let the noise fade.

Volatility Corner:

VIX / VVIX Update – Clarity Incoming?

Blue up is good, blue down is bad—simple. Right now, the VIX to VVIX relationship is flat. No real trend yet, and without a trend, we default to bullish behavior. We are still below the 10-week and 23-week averages, which typically signals lower volatility ahead. But as we approach November, the seasonal tendency for market gains kicks in.

I expect the VIX to collapse into next week. We’re seeing noise now, but the underlying drivers—rate cuts, loan growth, and weaker dollar trends—are on their way. This mix could pull volatility down sharply, opening the door for a smooth, upward ride.

When the markets went bearish early in 2022, the 10/23-week averages drifted lower—you can see it right in the chart. But notice what happened at the start of 2023: both lines trended higher, indicating a return to bullish market behavior.

Right now? Nothingness. We are floating without a clear signal. And when I see nothing, I go with bullish bias. Why fight the seasonal trend? VIX already rolling downward tells me we stick with the plan: buy dips, lean into the trend, and let volatility continue to fade.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

Enjoying this?

& Invite a friend.

New Highs $5-$20:

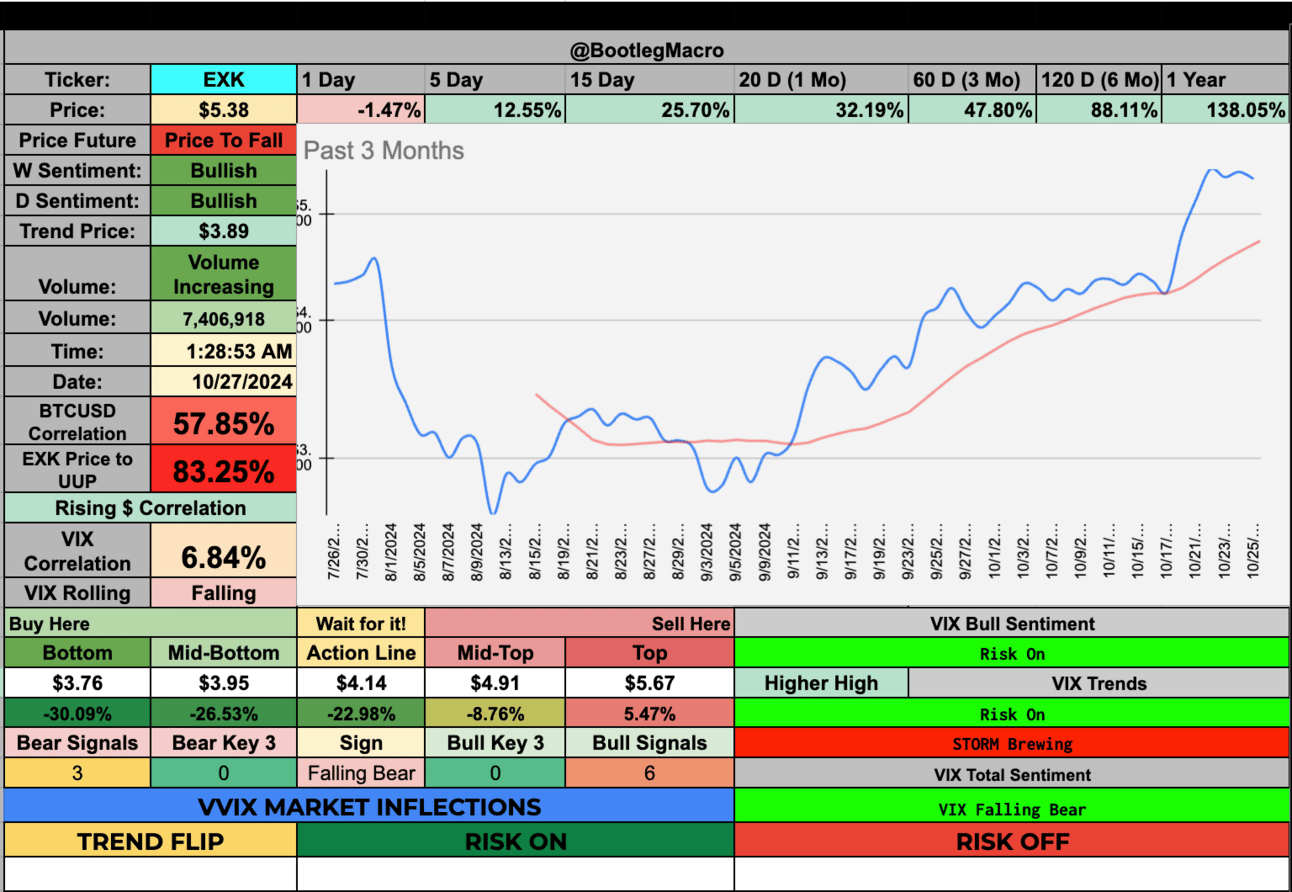

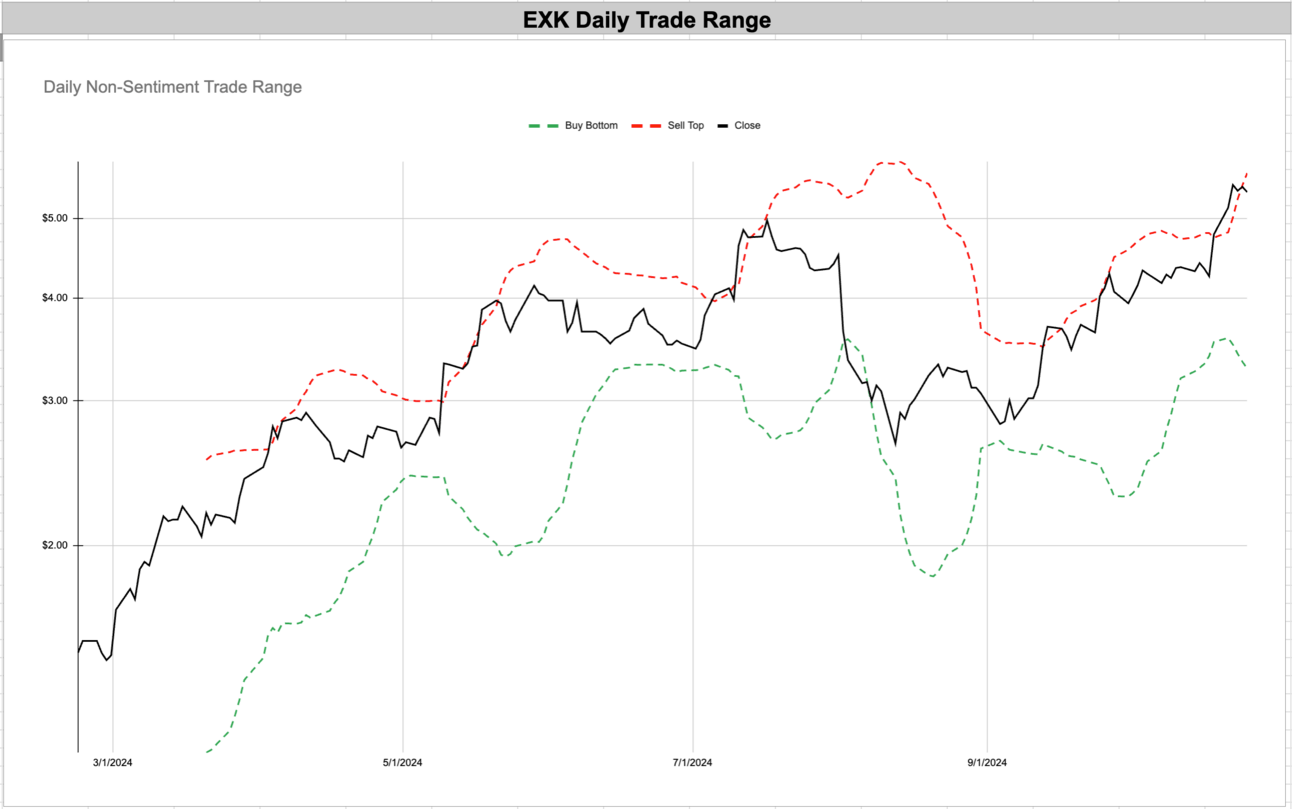

EXK - Endeavour Silver Corp | Basic Materials | Canada 🇨🇦

WULF - TeraWulf Inc | Financial | USA 🇺🇸

CRVS - Corvus Pharmaceuticals Inc | Healthcare | USA 🇺🇸

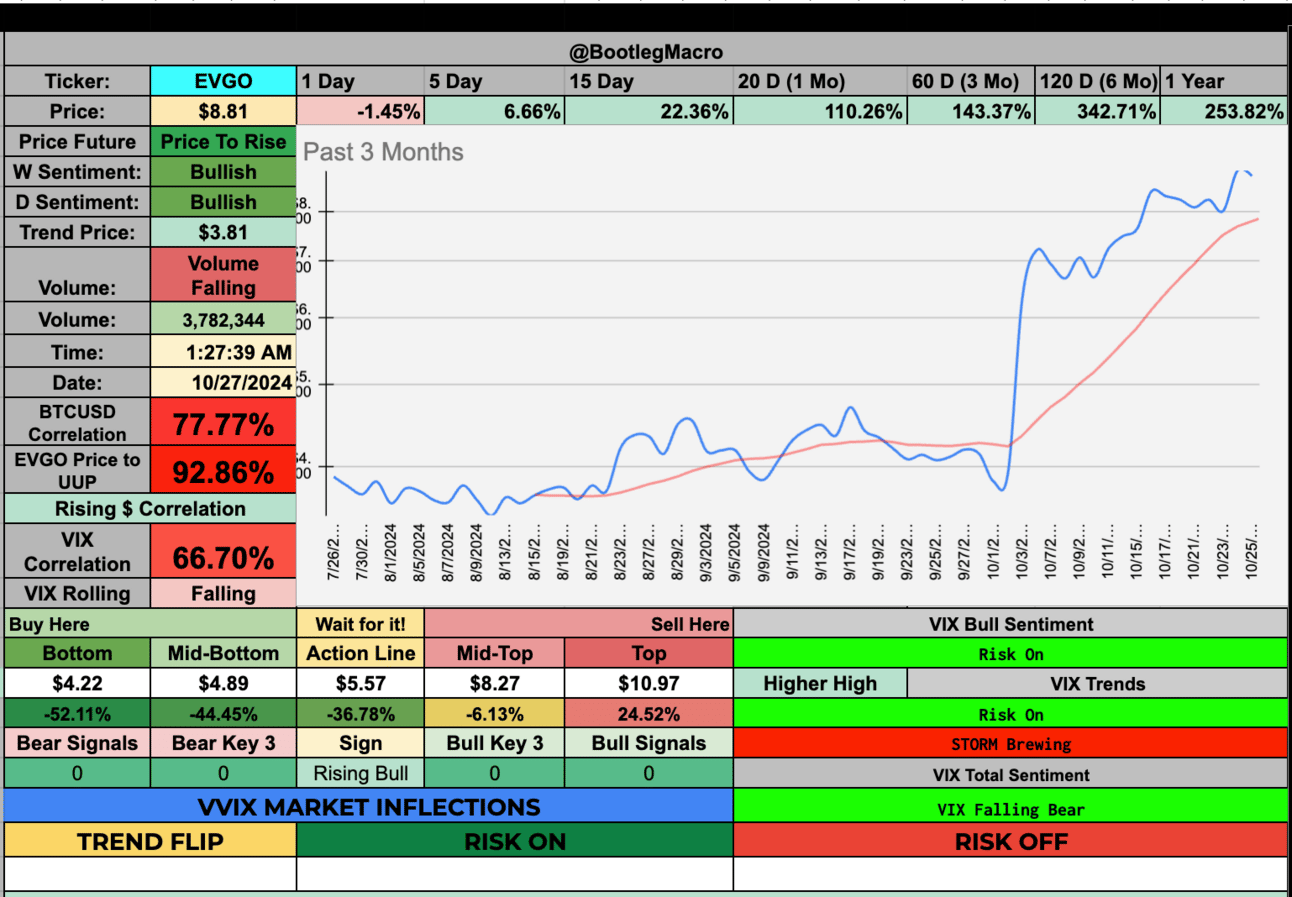

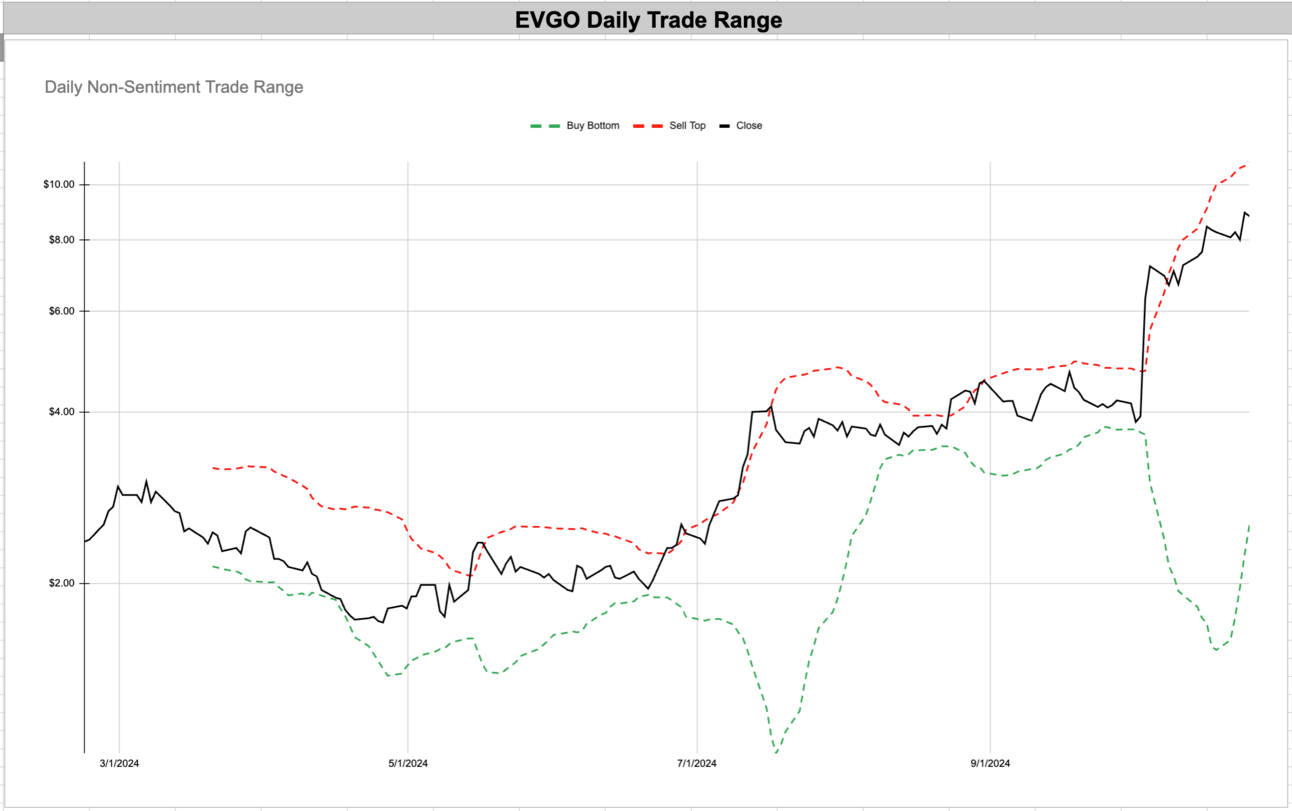

EVGO - EVgo Inc | Consumer Cyclical | USA 🇺🇸

SUPV - Grupo Supervielle S.A. ADR | Financial | Argentina 🇦🇷

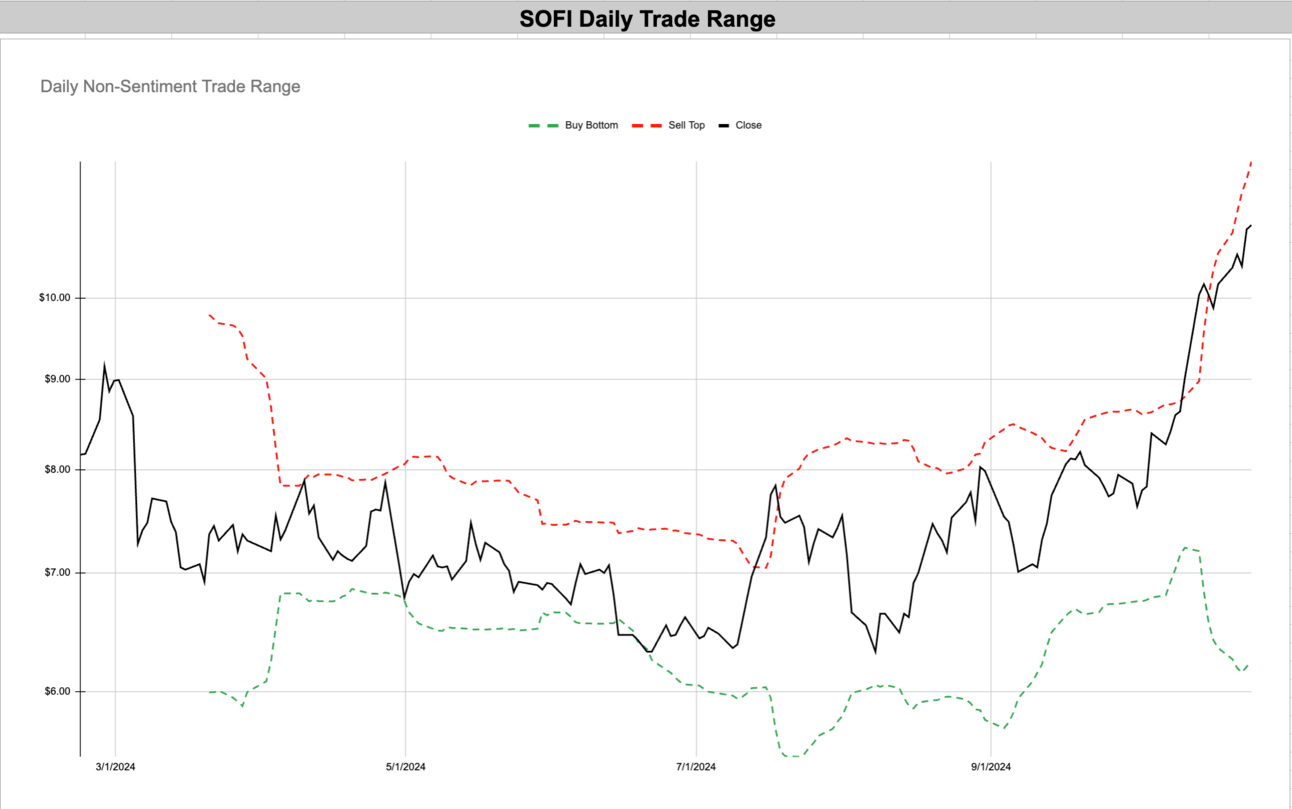

SOFI - SoFi Technologies Inc | Financial | USA 🇺🇸

CRMD - CorMedix Inc | Healthcare | USA 🇺🇸

BBAR - BBVA Argentina ADR | Financial | Argentina 🇦🇷

PCT - PureCycle Technologies Inc | Industrials | USA 🇺🇸

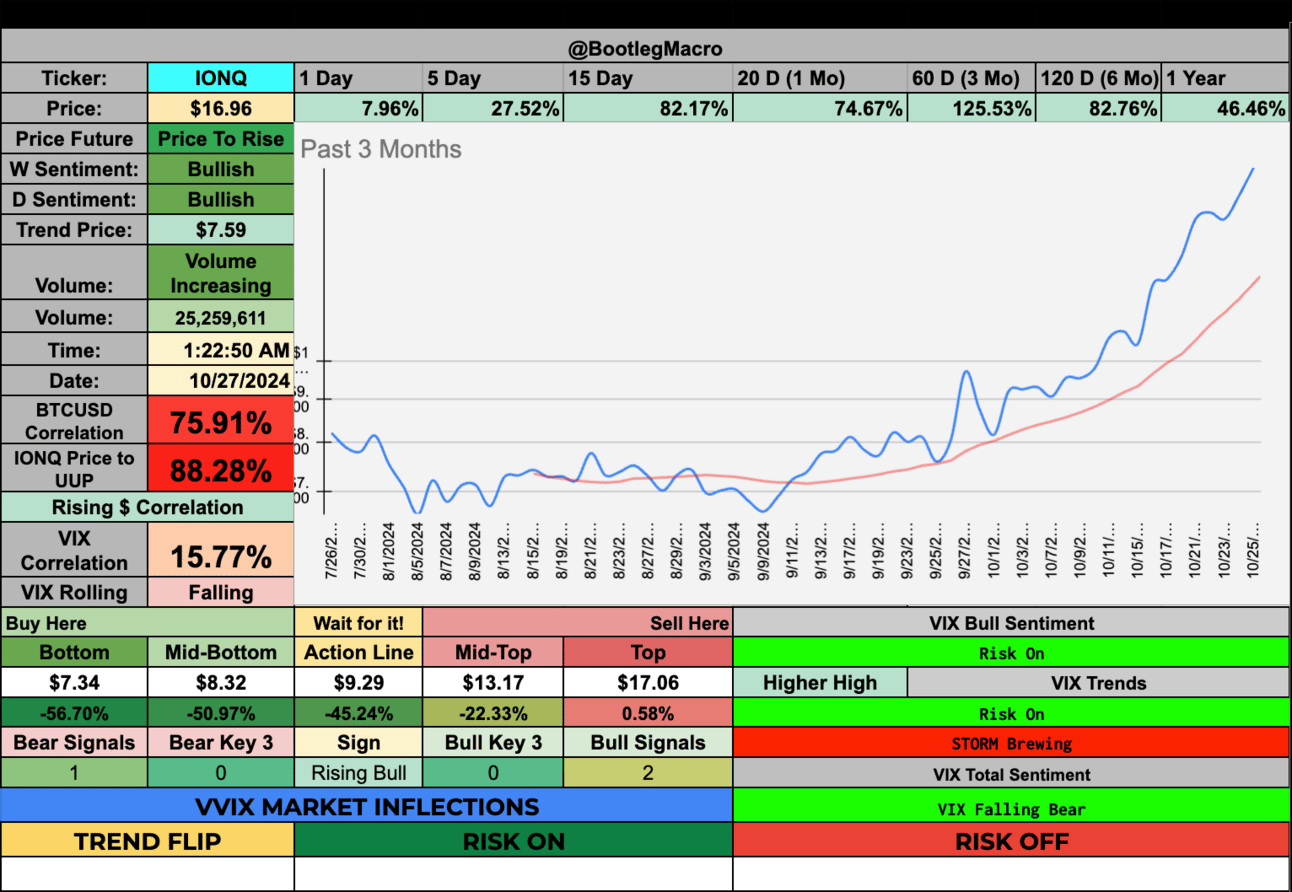

IONQ - IonQ Inc | Technology | USA 🇺🇸

EXK - Endeavour Silver Corp | Basic Materials | Canada 🇨🇦

WULF - TeraWulf Inc | Financial | USA 🇺🇸

CRVS - Corvus Pharmaceuticals Inc | Healthcare | USA 🇺🇸

EVGO - EVgo Inc | Consumer Cyclical | USA 🇺🇸

SUPV - Grupo Supervielle S.A. ADR | Financial | Argentina 🇦🇷

SOFI - SoFi Technologies Inc | Financial | USA 🇺🇸

CRMD - CorMedix Inc | Healthcare | USA 🇺🇸

BBAR - BBVA Argentina ADR | Financial | Argentina 🇦🇷

PCT - PureCycle Technologies Inc | Industrials | USA 🇺🇸

IONQ - IonQ Inc | Technology | USA 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

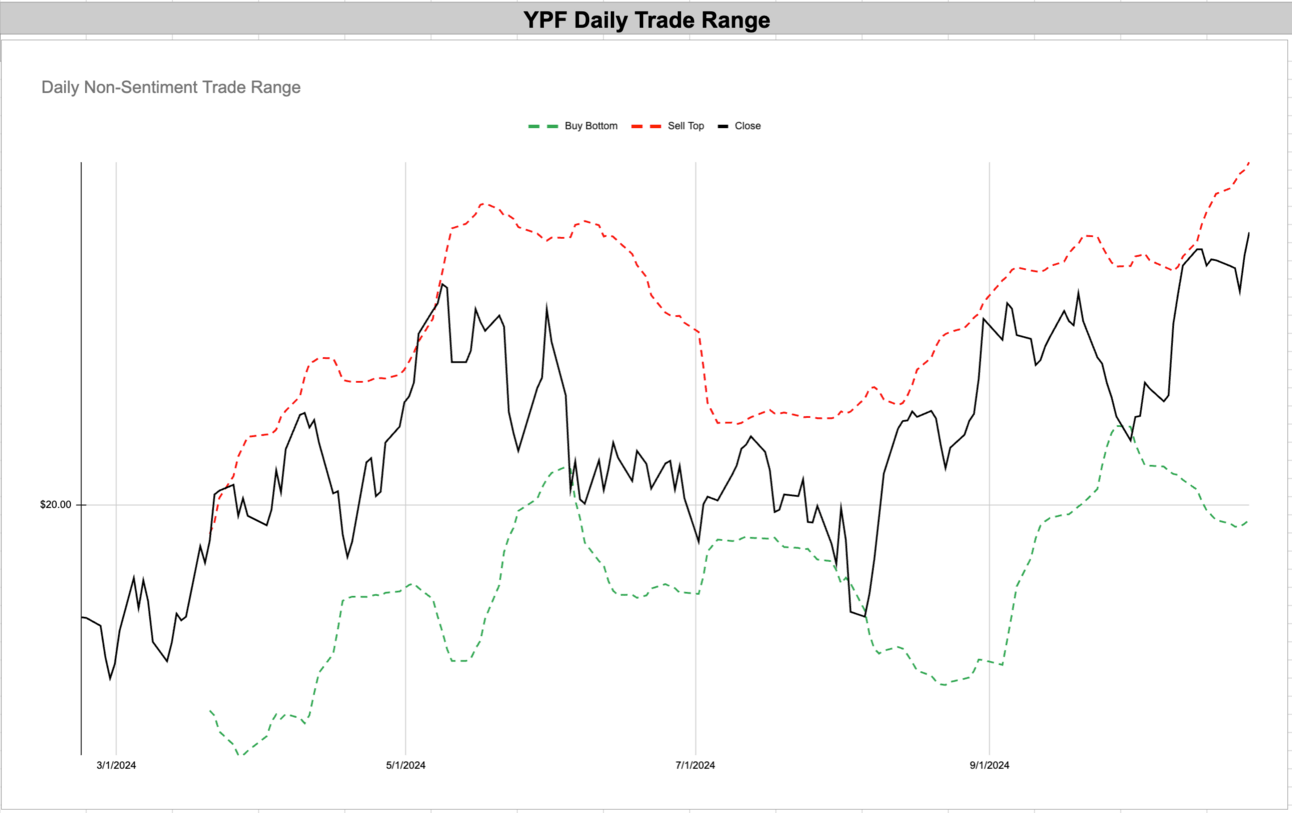

YPF - YPF S.A. ADR | Energy | Argentina 🇦🇷

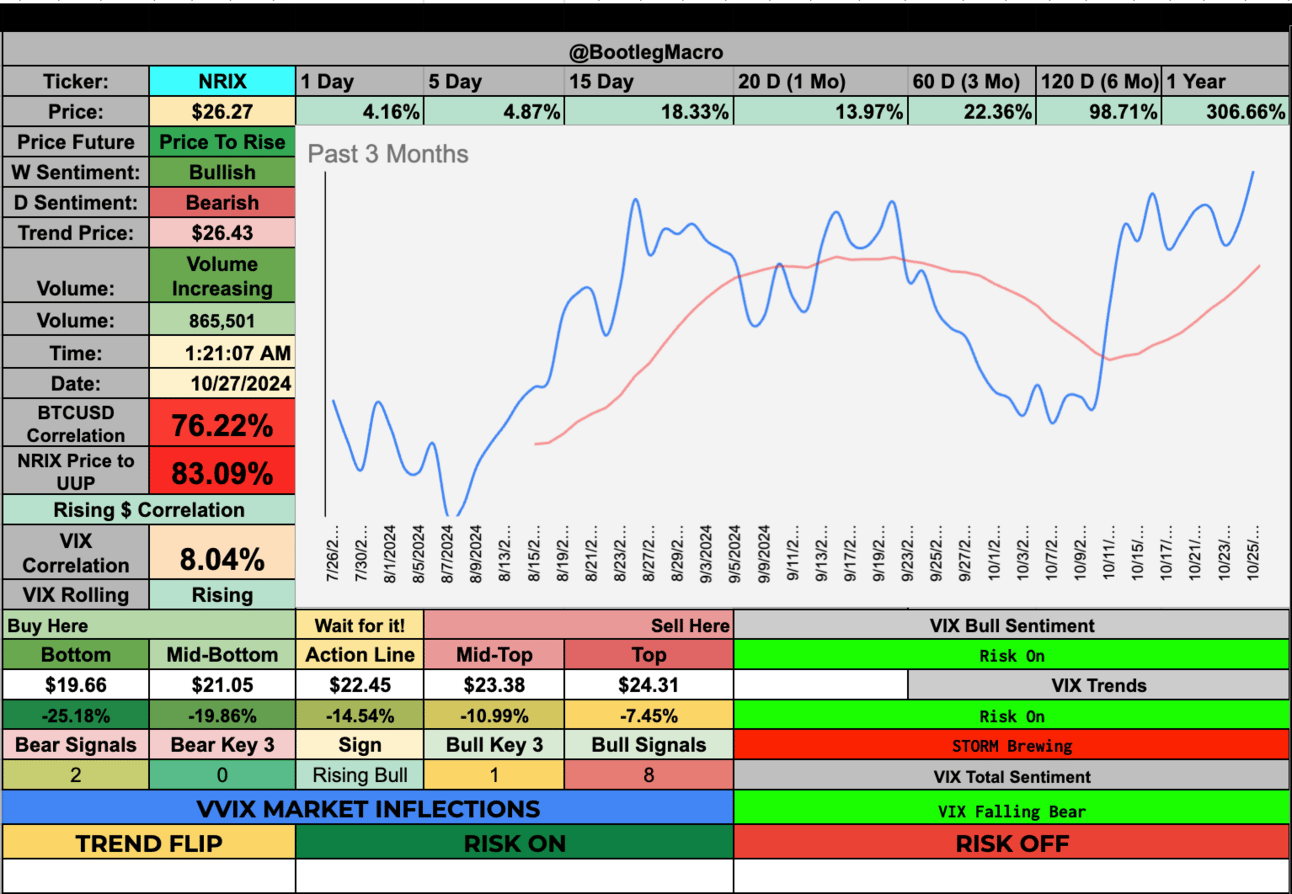

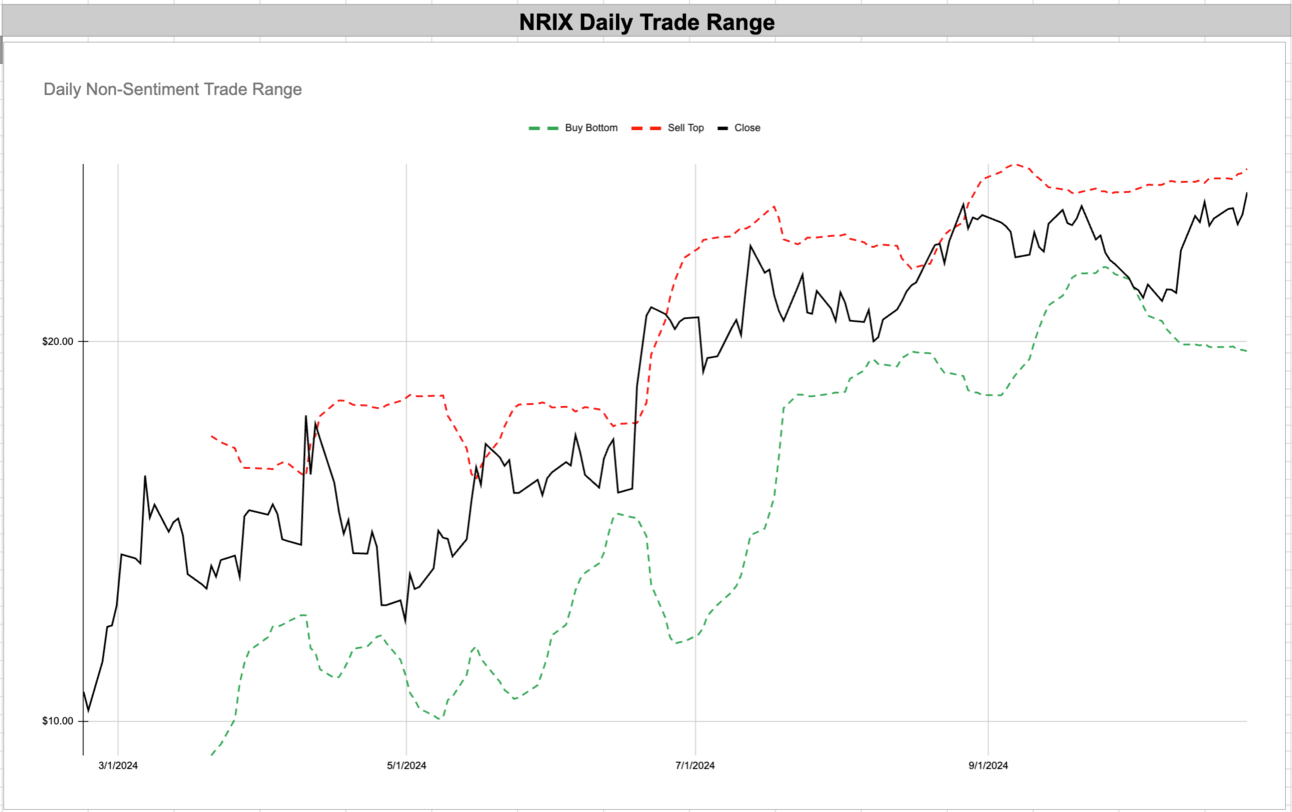

NRIX - Nurix Therapeutics Inc | Healthcare | USA 🇺🇸

HOOD - Robinhood Markets Inc | Financial | USA 🇺🇸

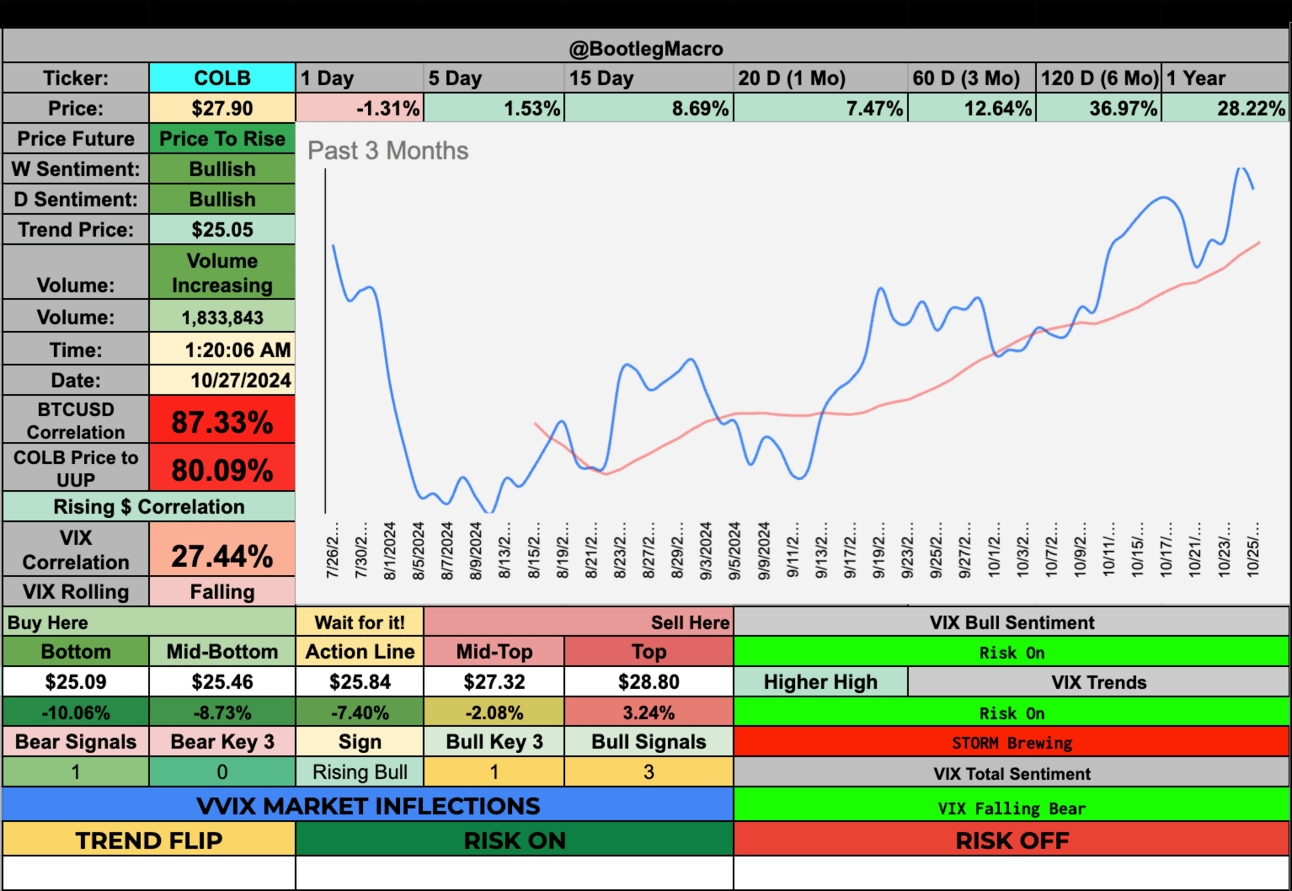

COLB - Columbia Banking System Inc | Financial | USA 🇺🇸

DASH - DoorDash Inc | Communication Services | USA 🇺🇸

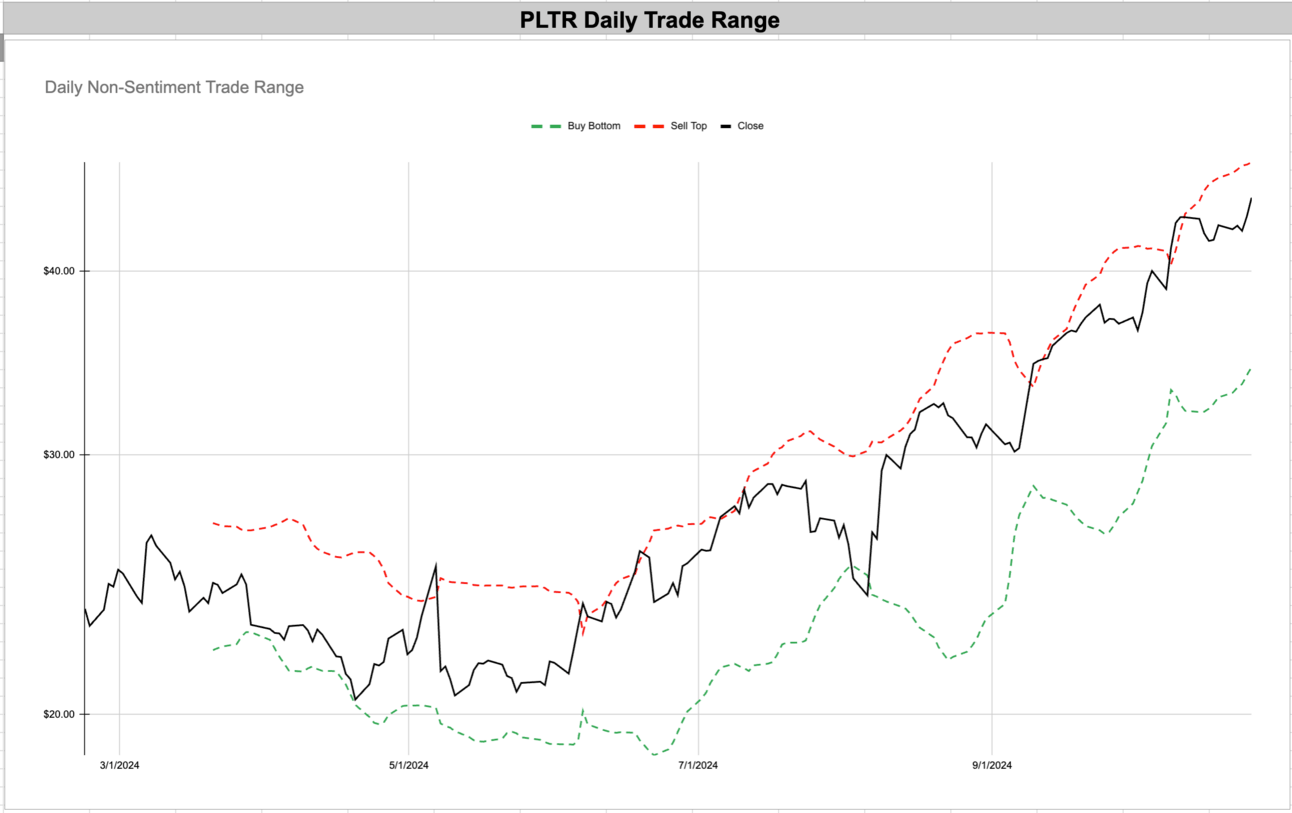

PLTR - Palantir Technologies Inc | Technology | USA 🇺🇸

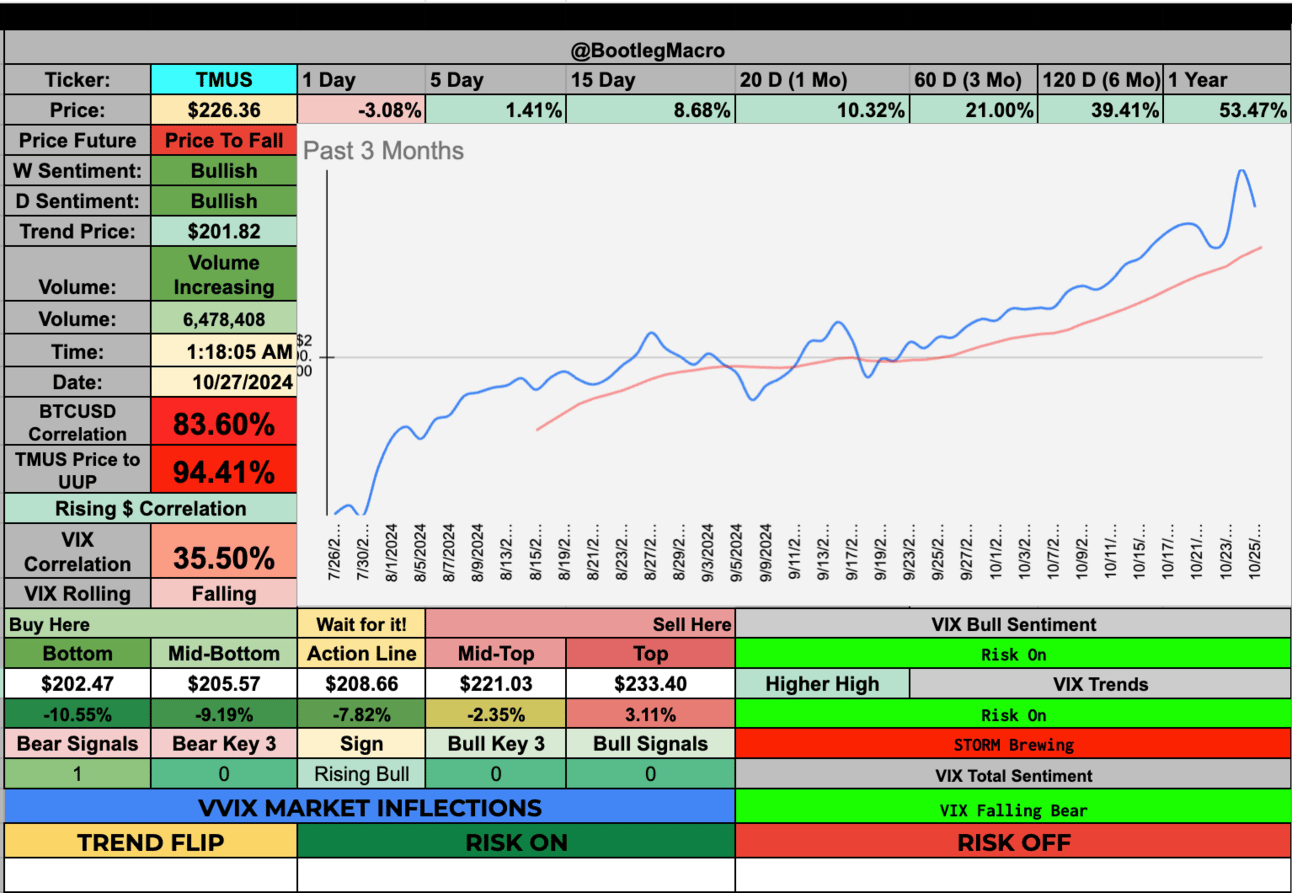

TMUS - T-Mobile US Inc | Communication Services | USA 🇺🇸

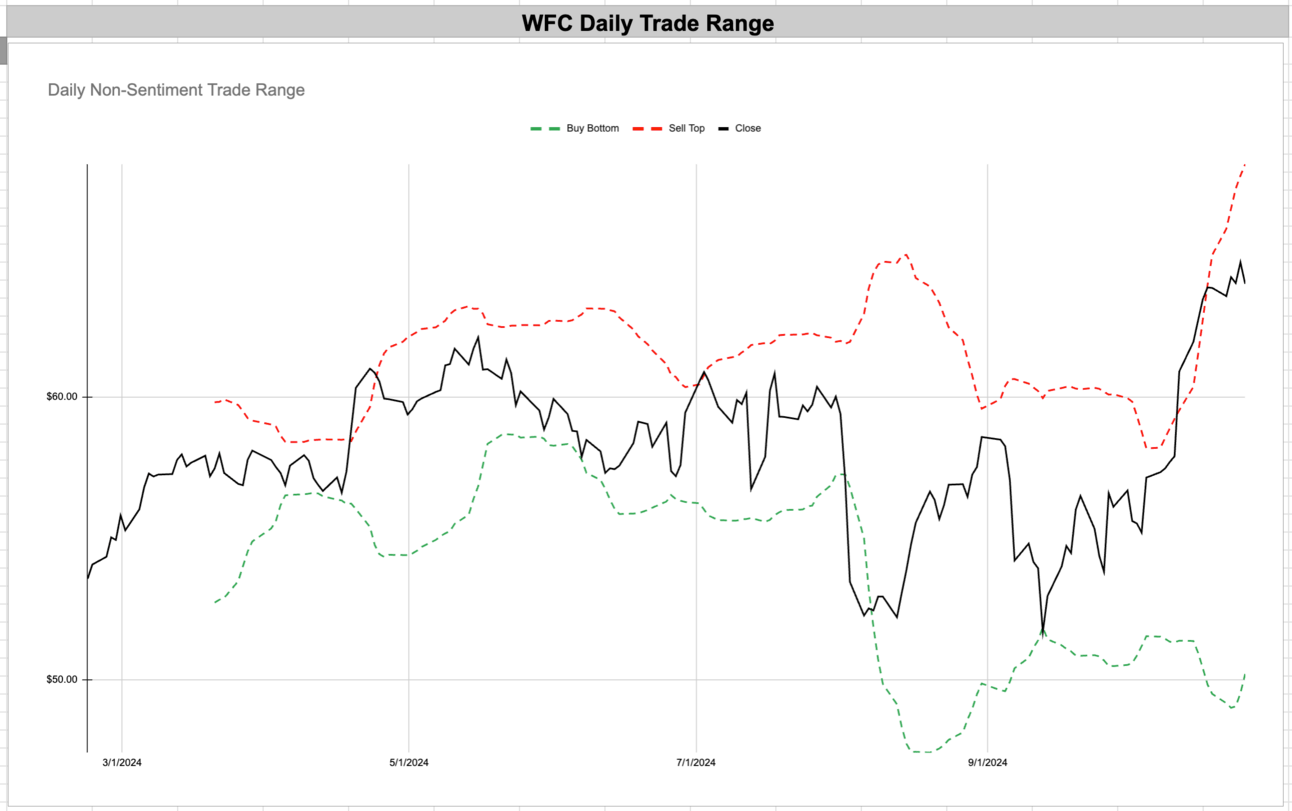

WFC - Wells Fargo & Co. | Financial | USA 🇺🇸

MSTR - MicroStrategy Inc | Technology | USA 🇺🇸

NDAQ - Nasdaq Inc | Financial | USA 🇺🇸

YPF - YPF S.A. ADR | Energy | Argentina 🇦🇷

NRIX - Nurix Therapeutics Inc | Healthcare | USA 🇺🇸

HOOD - Robinhood Markets Inc | Financial | USA 🇺🇸

COLB - Columbia Banking System Inc | Financial | USA 🇺🇸

DASH - DoorDash Inc | Communication Services | USA 🇺🇸

PLTR - Palantir Technologies Inc | Technology | USA 🇺🇸

TMUS - T-Mobile US Inc | Communication Services | USA 🇺🇸

WFC - Wells Fargo & Co. | Financial | USA 🇺🇸

MSTR - MicroStrategy Inc | Technology | USA 🇺🇸

NDAQ - Nasdaq Inc | Financial | USA 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro