- The New High Newsletter

- Posts

- Climbing the Wall of Worry: Navigating Volatility and Market Momentum

Climbing the Wall of Worry: Navigating Volatility and Market Momentum

Why fear in the market often signals opportunity, and how strategic positioning during volatile times can lead to long-term gains.

I’d rather play RTS games like Starcraft 🎮 than pay attention to the market right now 📉. Because the market is in a situation where we need a couple weeks for resolution ⏳. Right now I’m 50% fully long 📈 and now with a 20% allocation to bonds 💵 with the expectation of rate cuts 📉. This leaves 30% which is in short-term reserves 💼 waiting patiently for clearer direction 🧭.

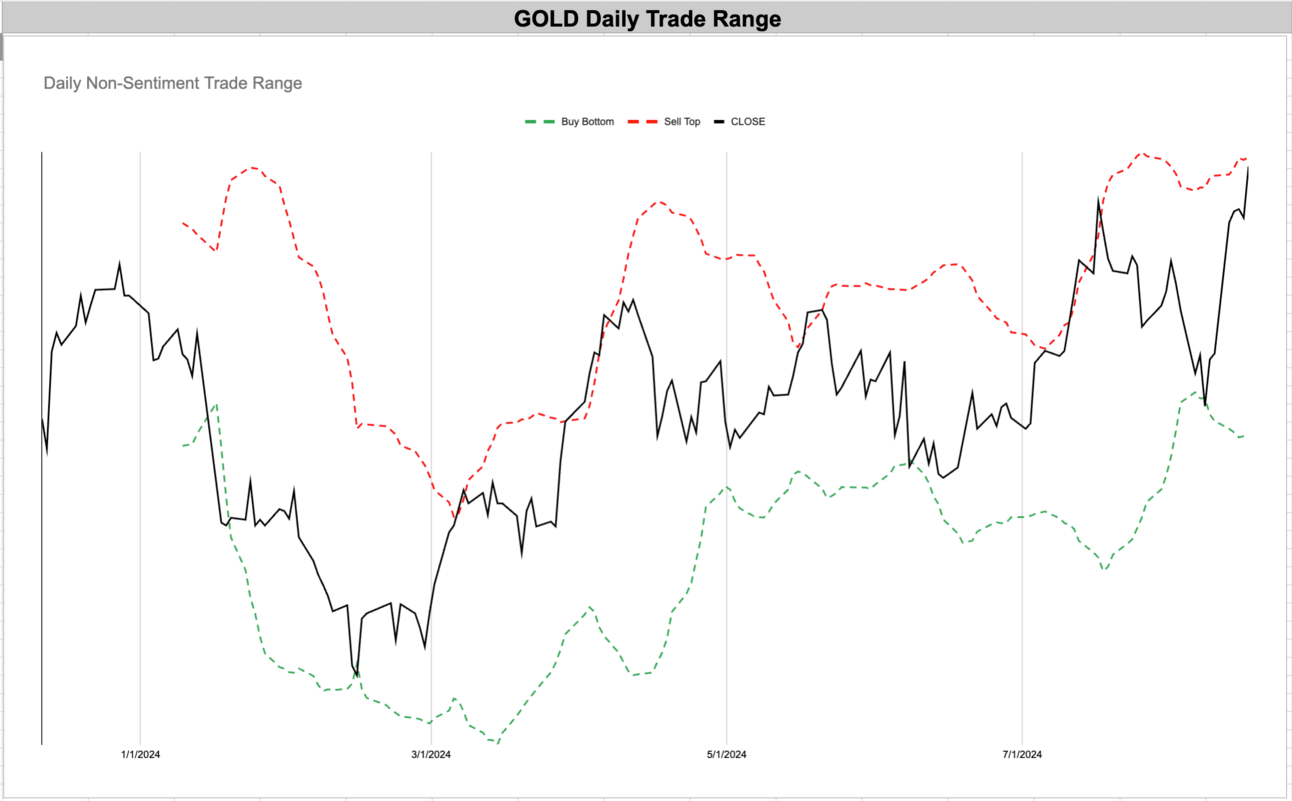

Below, the main sectors showing strength are all in the gold or precious metals space 🏆💰. Which is interesting and reflects the demand on the yields across the market 💹. This is a signal of transformation 🔄, if rates drop ⬇️ we should expect inflation to rise marginally 📊 and that will hurt bond prices 📉 in the intermediate future.

The question of this period is: do we stay with growth 🌱 or is the move in small caps 📊 a sign of broader strength 💪 to come into 2025? 📅

Market Performance

In the past week, we’ve seen indexes 📊 gain back much of their losses since mid-July. The turmoil of mid-summer’s pullback 🌧️ is probably over if we think about what happens between now and the end of the year 📅.

The expectation for the future now is to see fear 😨 persist in the market but for the market to climb a wall of worry 🧗♂️📈. When people fear the market 😱, it’s the best time to buy 🛒 for the intermediate to longer-term ⏳.

Volatility Corner:

VIX / VVIX deteriorated! 📉🔵 Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets 📊. You see the up and down 📈📉…we are back below the 23-week average. In this market, we want to see a rising blue line ⬆️🔵. I suspect volatility will fall over the next few weeks 📉⏳.

The overall market looks to be in a choppy situation 🌊, which isn’t as vulnerable as it appears. The vulnerability isn’t as high because we’ve already had the downturn 📉. Now, we can expect to move upward ⬆️ from here, which will smooth volatility 🌤️ and probably see the market have positive weeks 📅📈.

MACRO INDICATOR:

MACRO SEASON: BULLISH Since 8/2/24🛑

MICRO WEATHER: BEARISH Since 8/9/24🛑

US Index ETF Review:

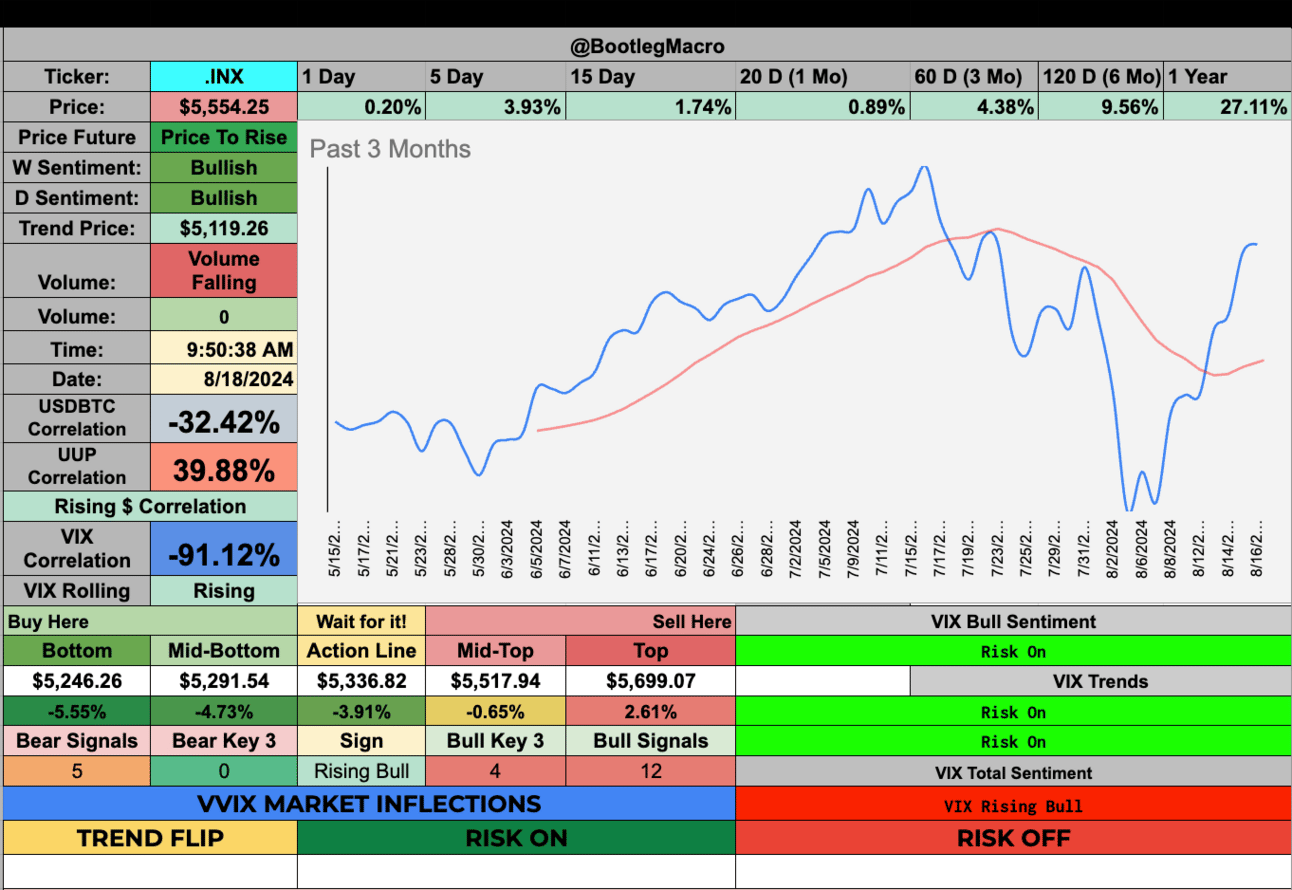

SPY

Bullish Trend Since 8/31/23🟢***

Go LONG Since 9/1/23🟢***

Price to FALL Since 8/8/23🛑***

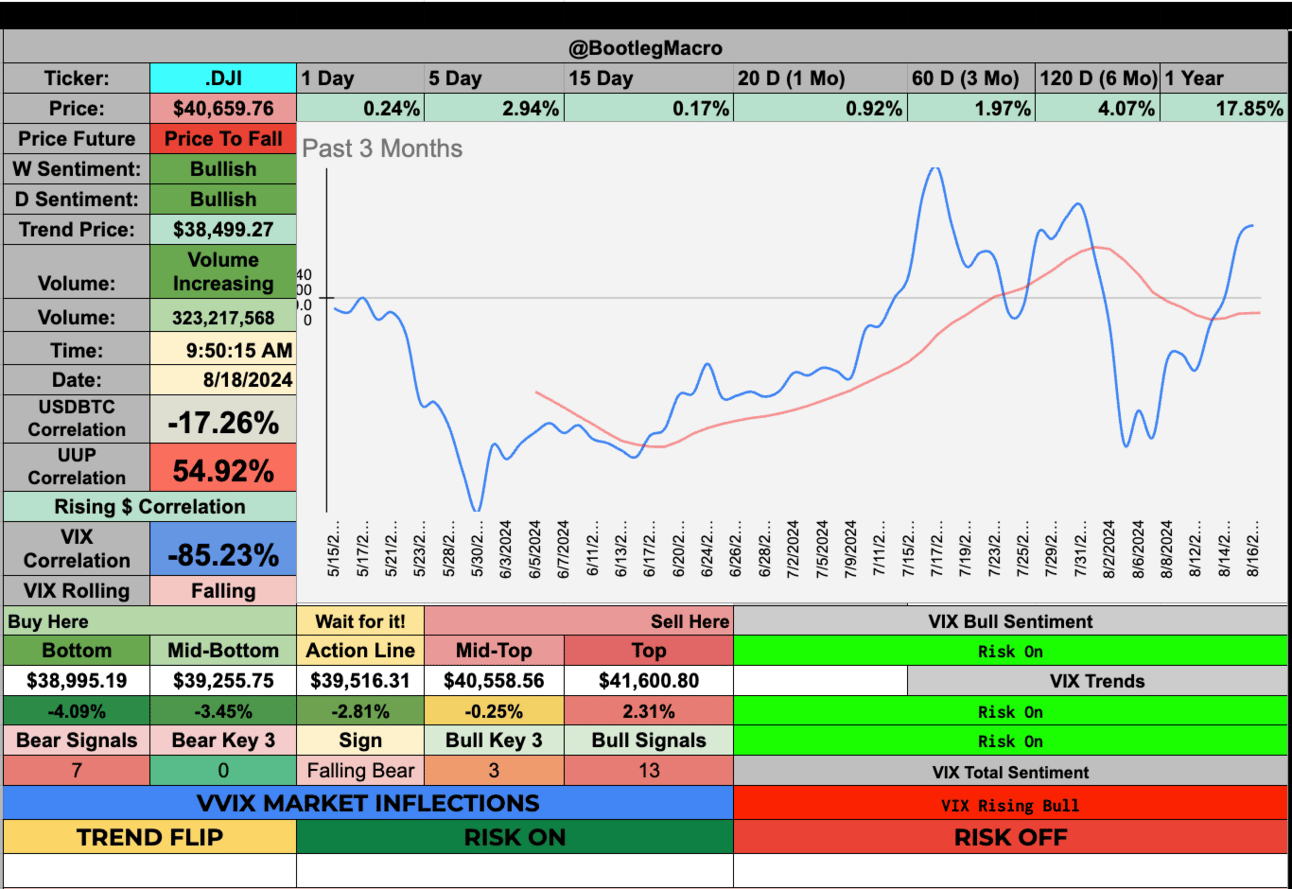

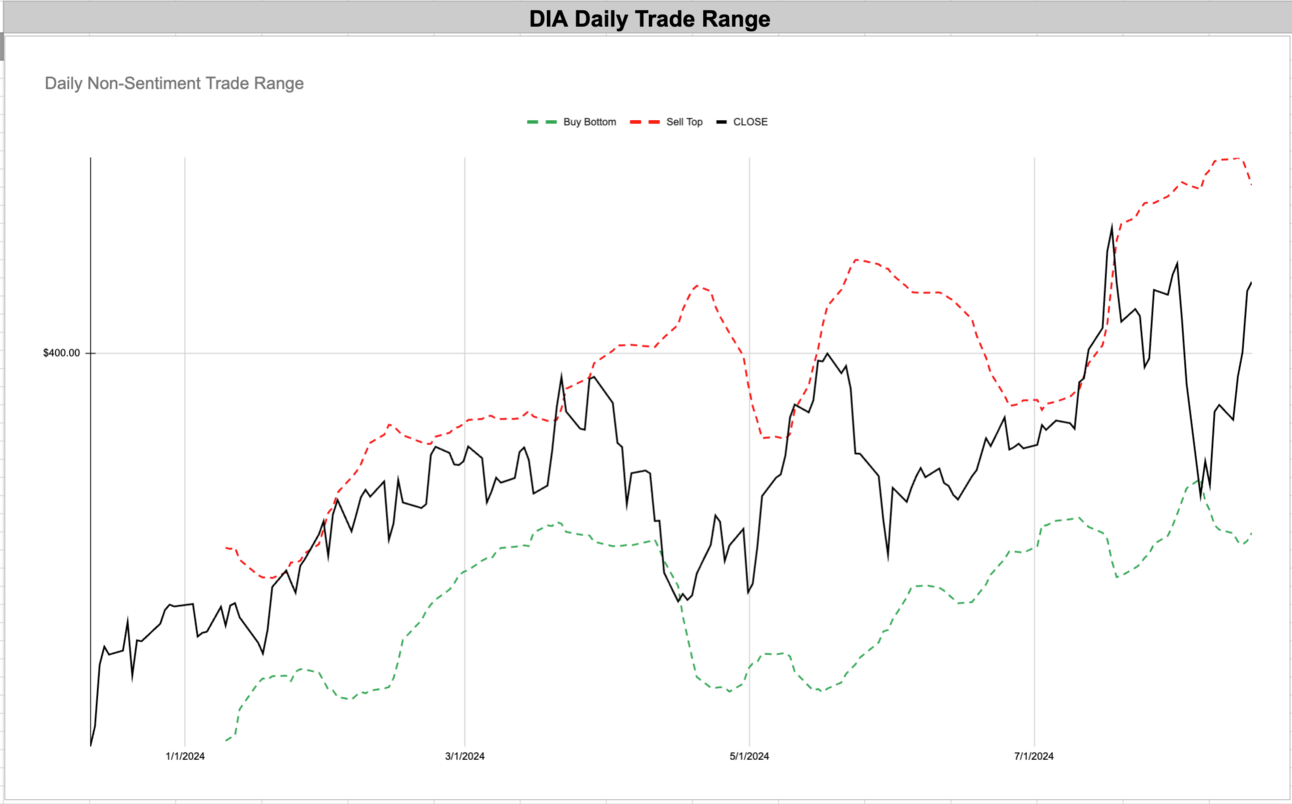

DIA

BULLISH Trends Since 9/1/23🟢***

Go Short Since 8/11/23🛑

Price to RISE Since 8/28/23🟢***

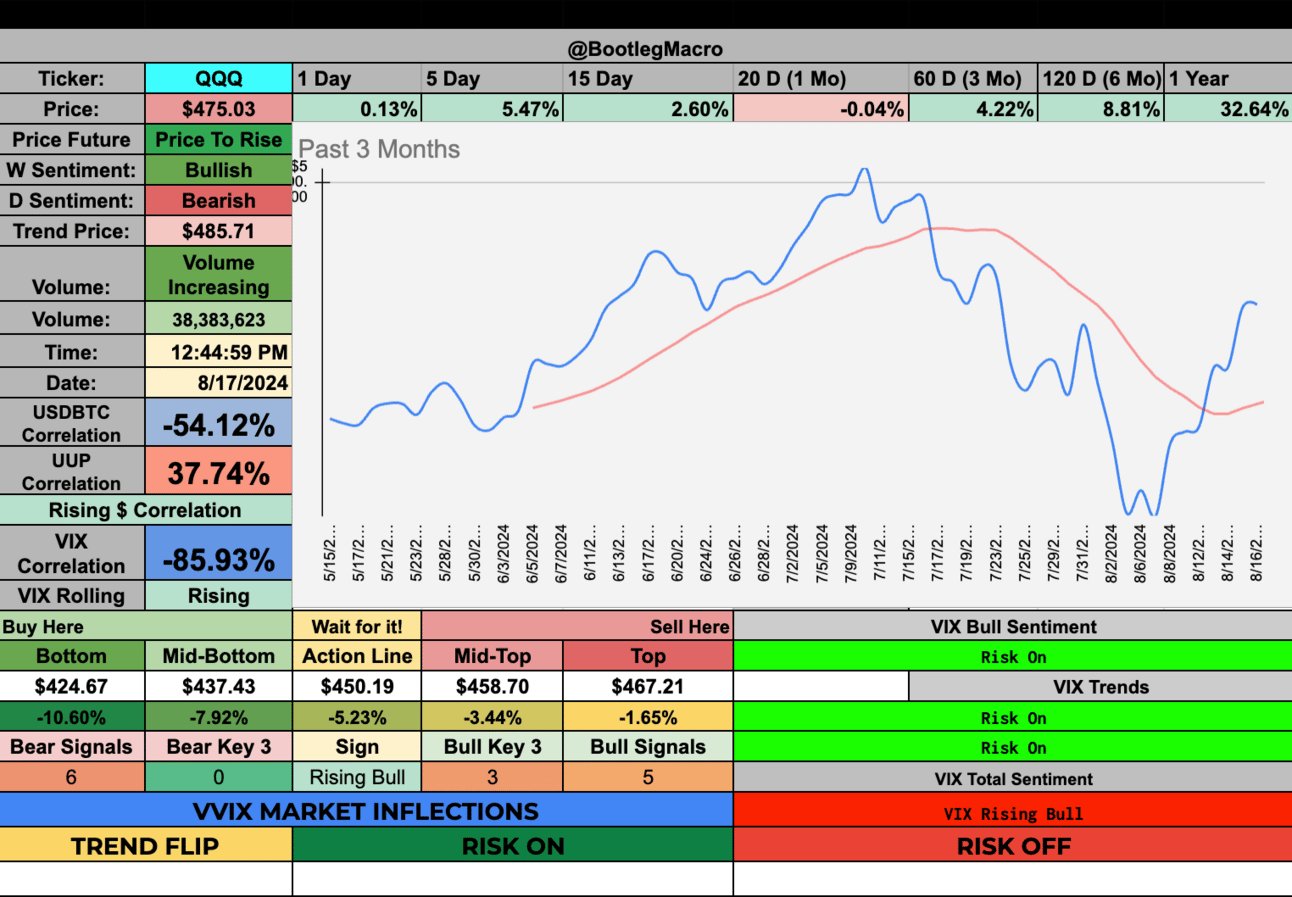

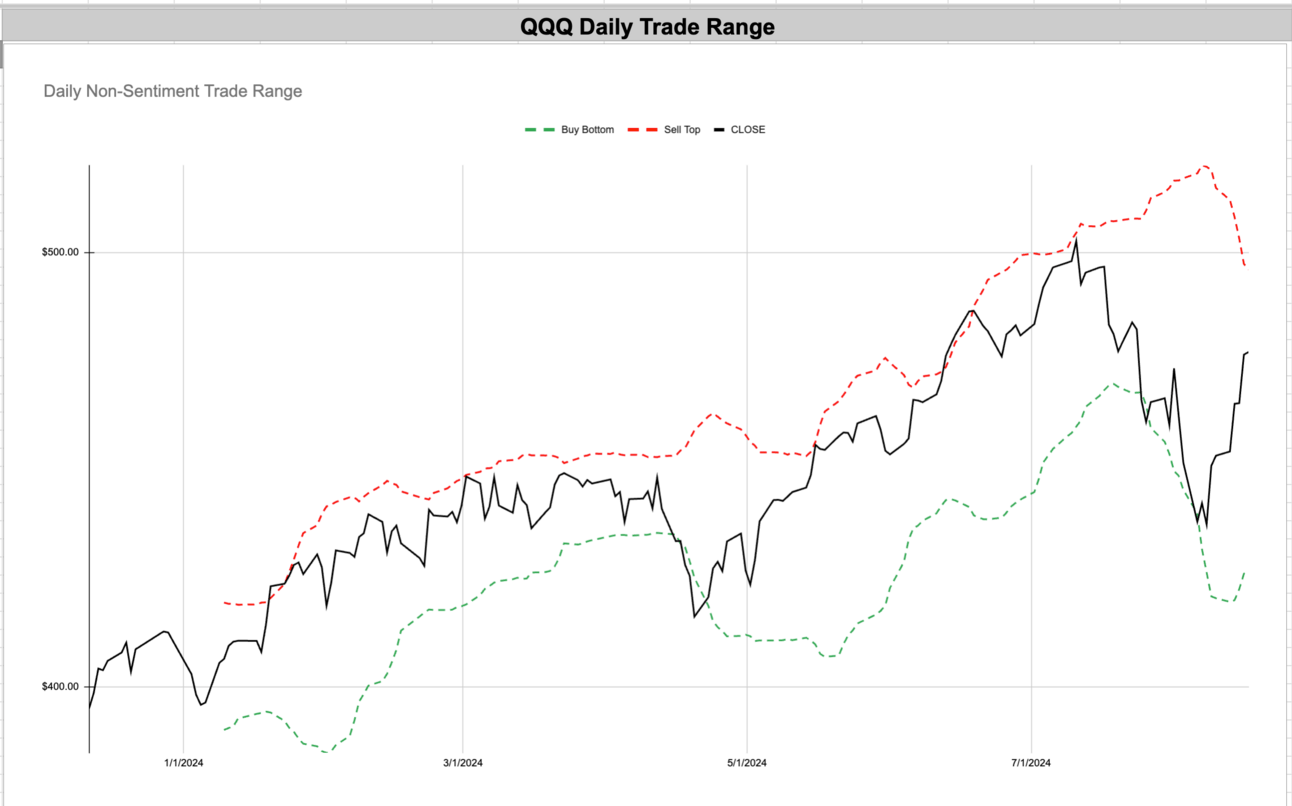

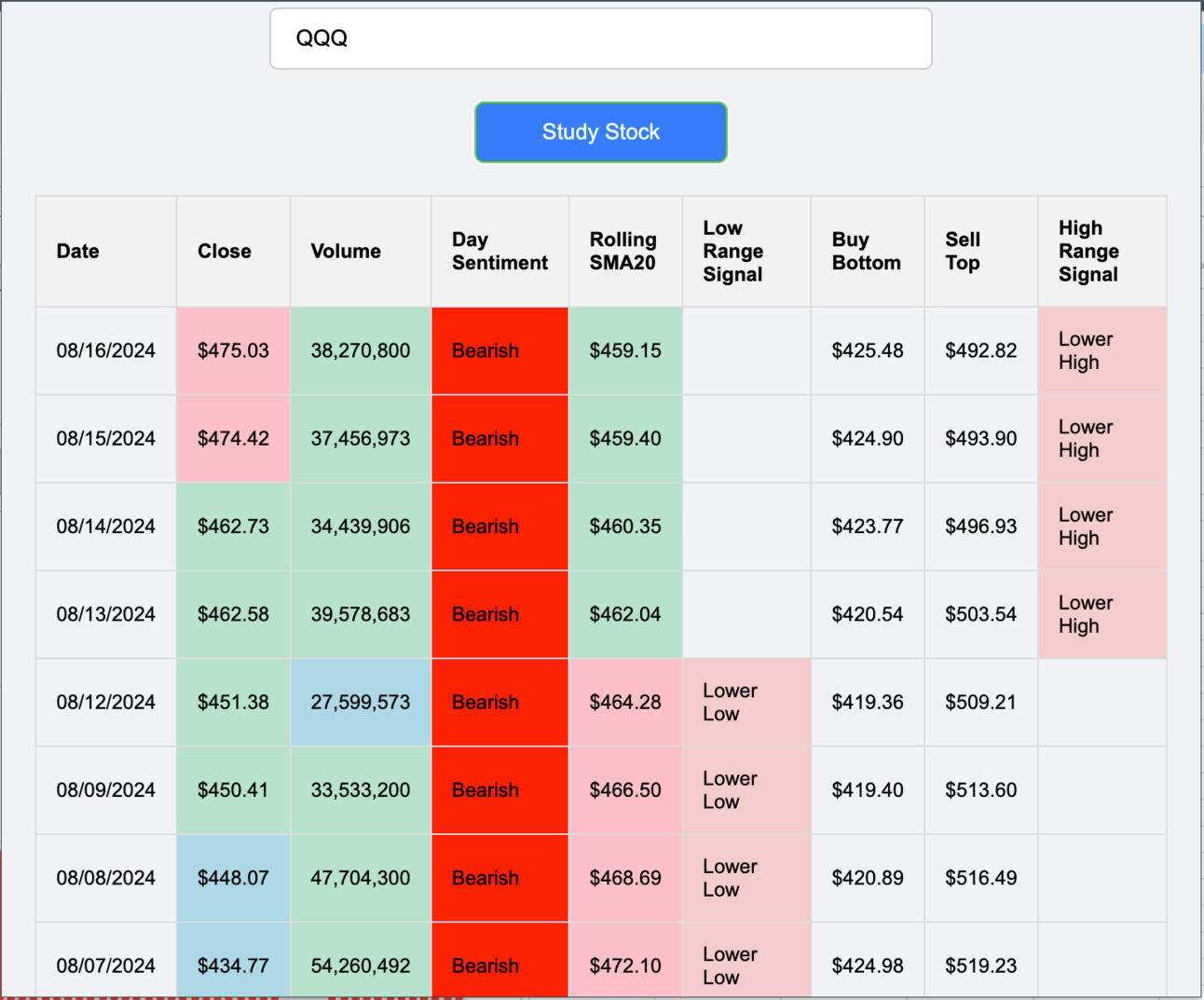

QQQ

BEARISH Trend Since 8/6/24🛑

Neither Long or Short Since 8/16/24🛑

Price to Fall Since 7/25/24🛑

IWM

BULLISH Since 7/16/24🟢

No Long or Short Since 8/14/24🟢

Price to FALL Since 8/13/24🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

GOLD - Barrick Gold Corp. - Basic Materials - Canada 🇨🇦

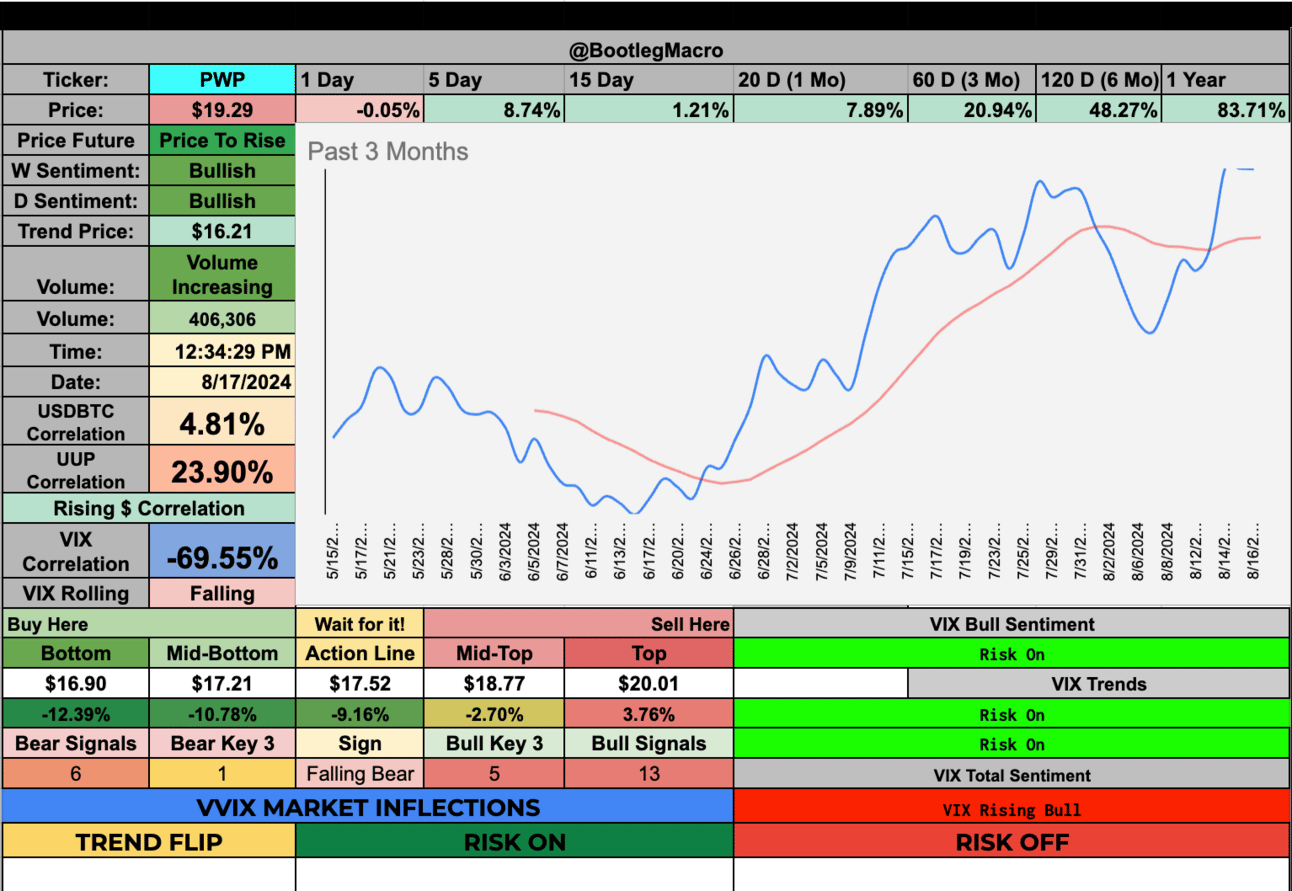

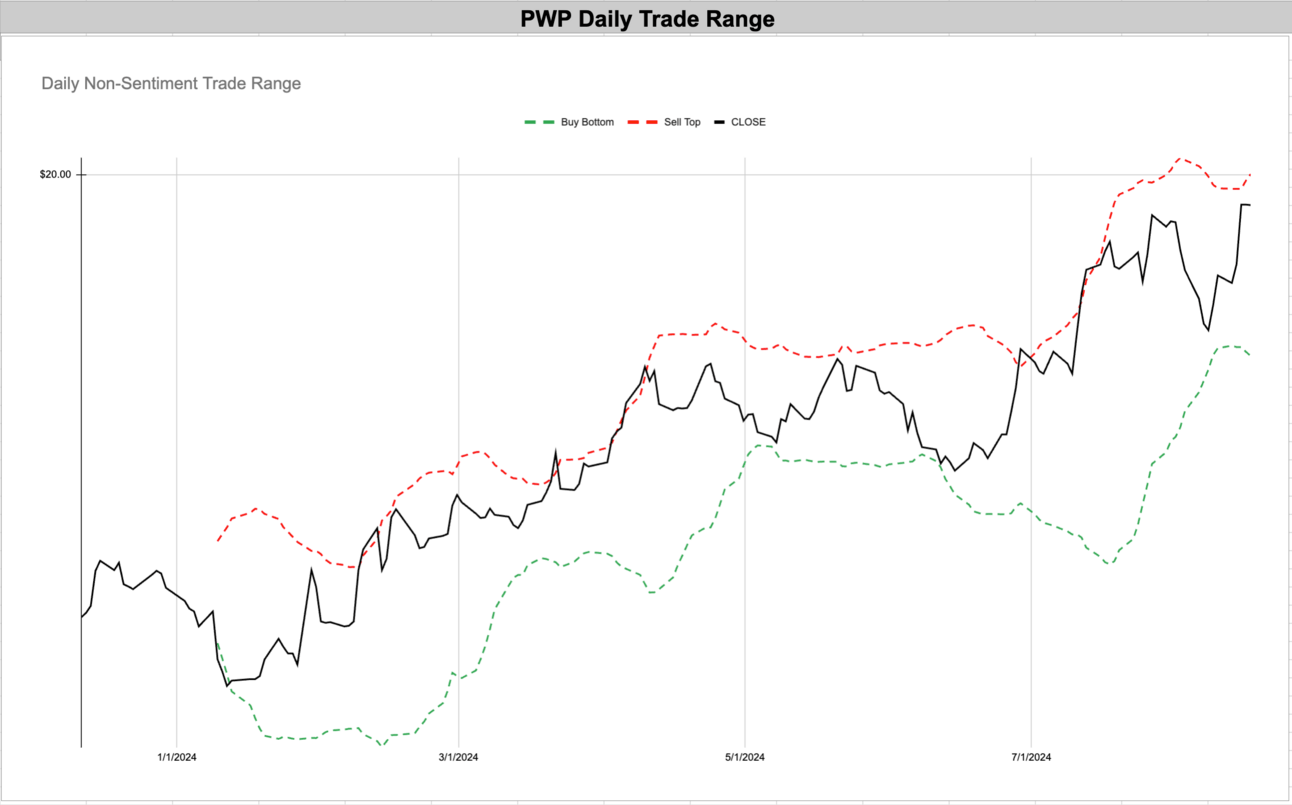

PWP - Perella Weinberg Partners - Financial - USA 🇺🇸

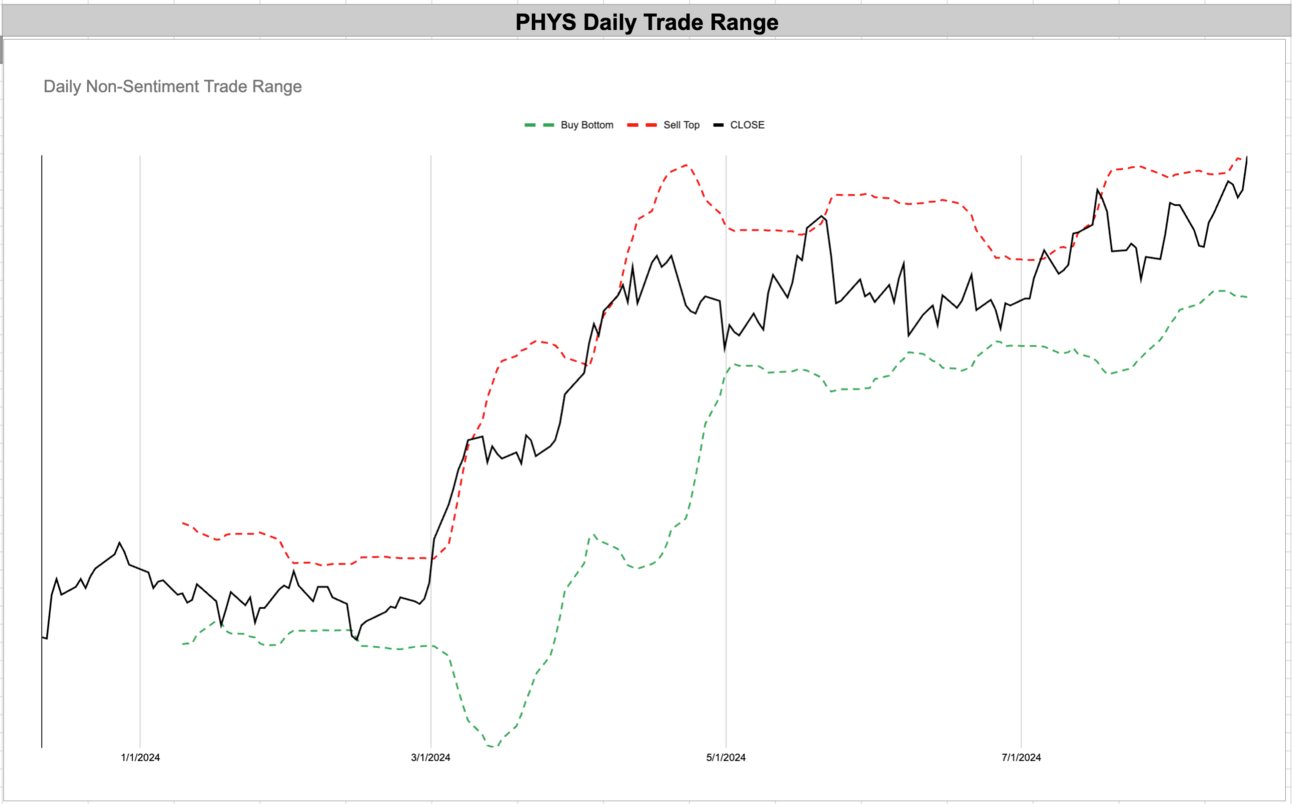

PHYS - Sprott Physical Gold Trust - Financial - Canada 🇨🇦

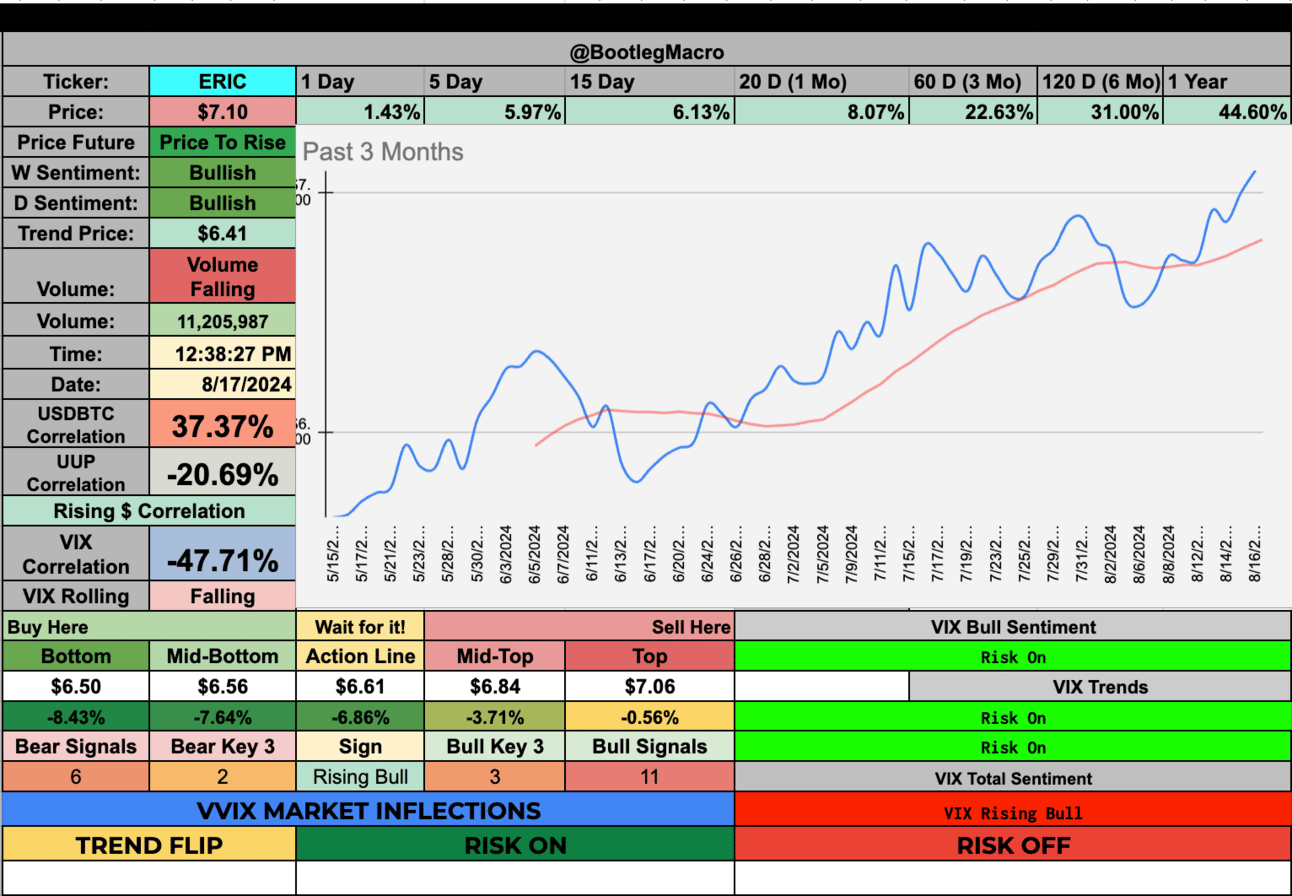

ERIC - Telefonaktiebolaget LM Ericsson ADR - Technology - Sweden 🇸🇪

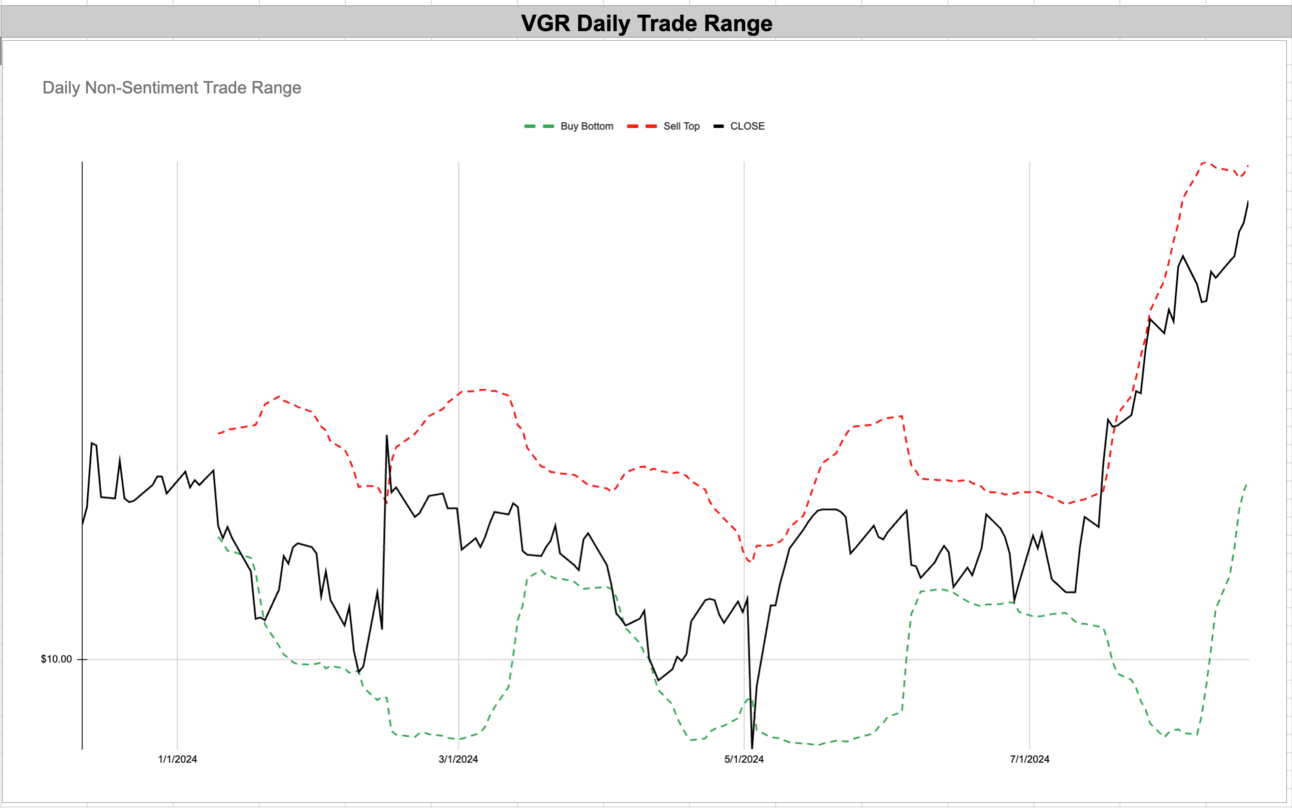

VGR - Vector Group Ltd - Consumer Defensive - USA 🇺🇸

GOLD - Barrick Gold Corp. - Basic Materials - Canada 🇨🇦

PWP - Perella Weinberg Partners - Financial - USA 🇺🇸

PHYS - Sprott Physical Gold Trust - Financial - Canada 🇨🇦

ERIC - Telefonaktiebolaget LM Ericsson ADR - Technology - Sweden 🇸🇪

VGR - Vector Group Ltd - Consumer Defensive - USA 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

Let’s explore the charts, key moving averages, and market indicators to find out where the next opportunities lie. Don’t miss out on my take on whether the growth sector is primed for more upside! 💹 $SPY $QQQ $DIA

— BootlegMacro (@bootlegmacro)

4:37 AM • Aug 16, 2024

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro