- The New High Newsletter

- Posts

- Breakout or Bull Trap?

Breakout or Bull Trap?

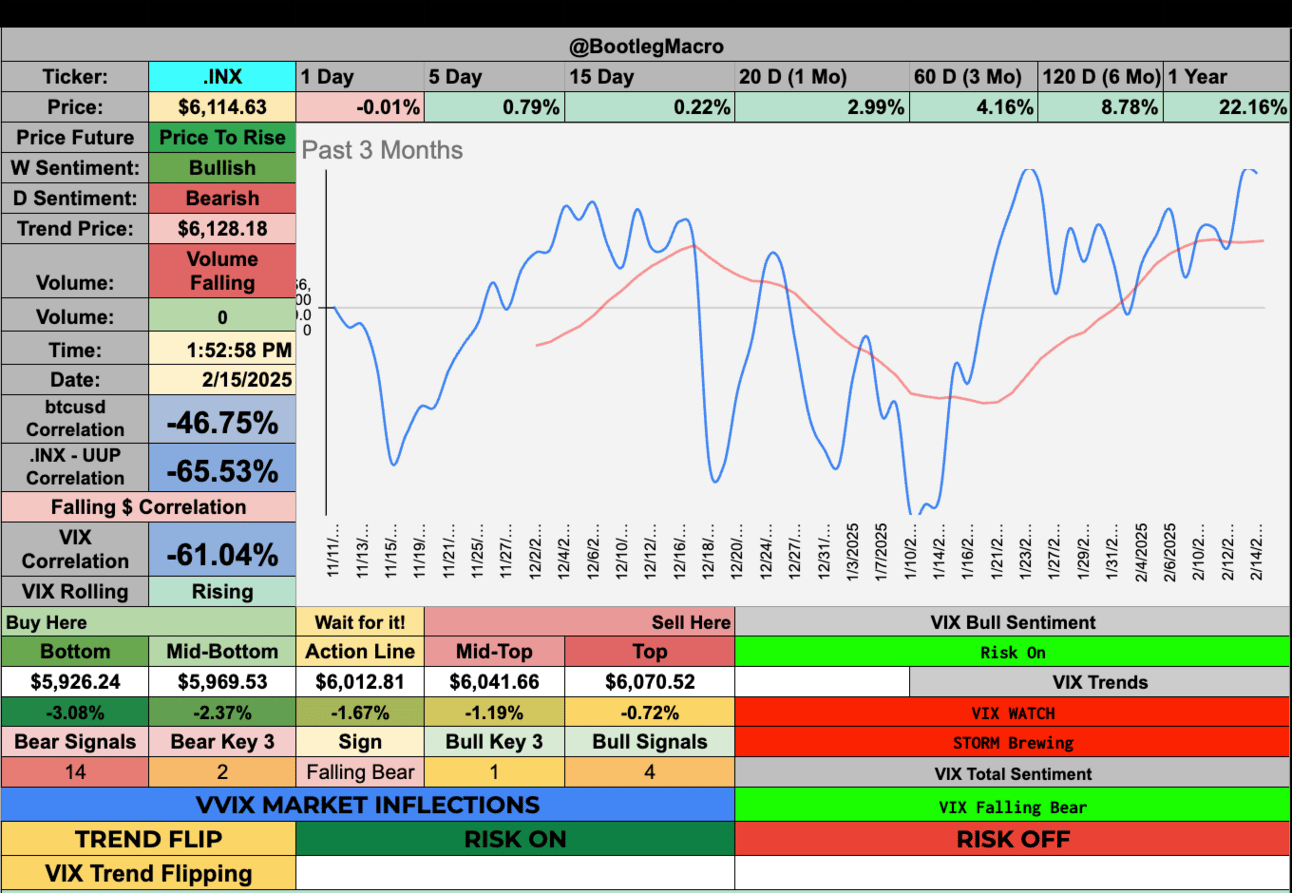

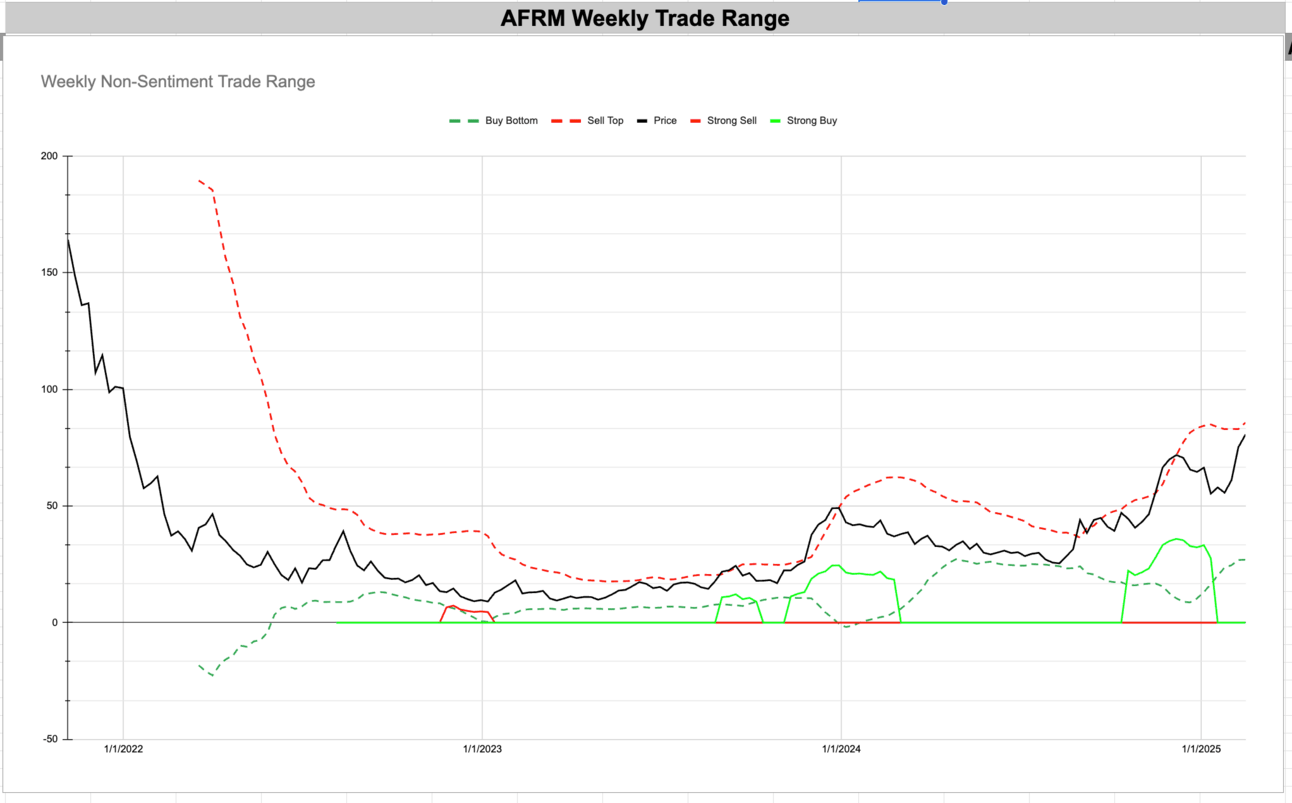

Time is ticking on this market. We've gone sideways for months now. Which way will the market break? Under the hood, we have many names at new highs. For example, AFRM has a beautiful setup. The indexes are all with in a few percent of their all-time-highs. You need to review the volatility setup below.

Market Snapshot: Momentum or Mirage?

The Setup:

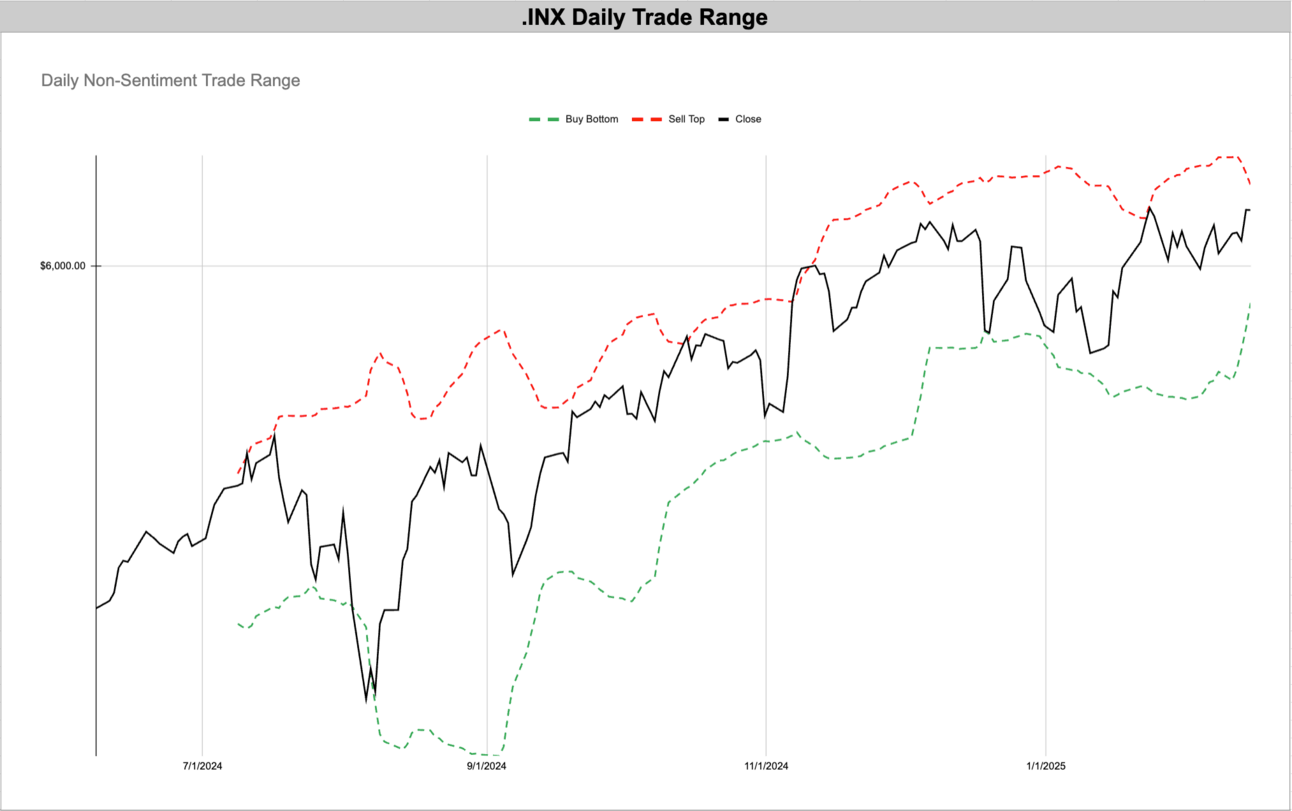

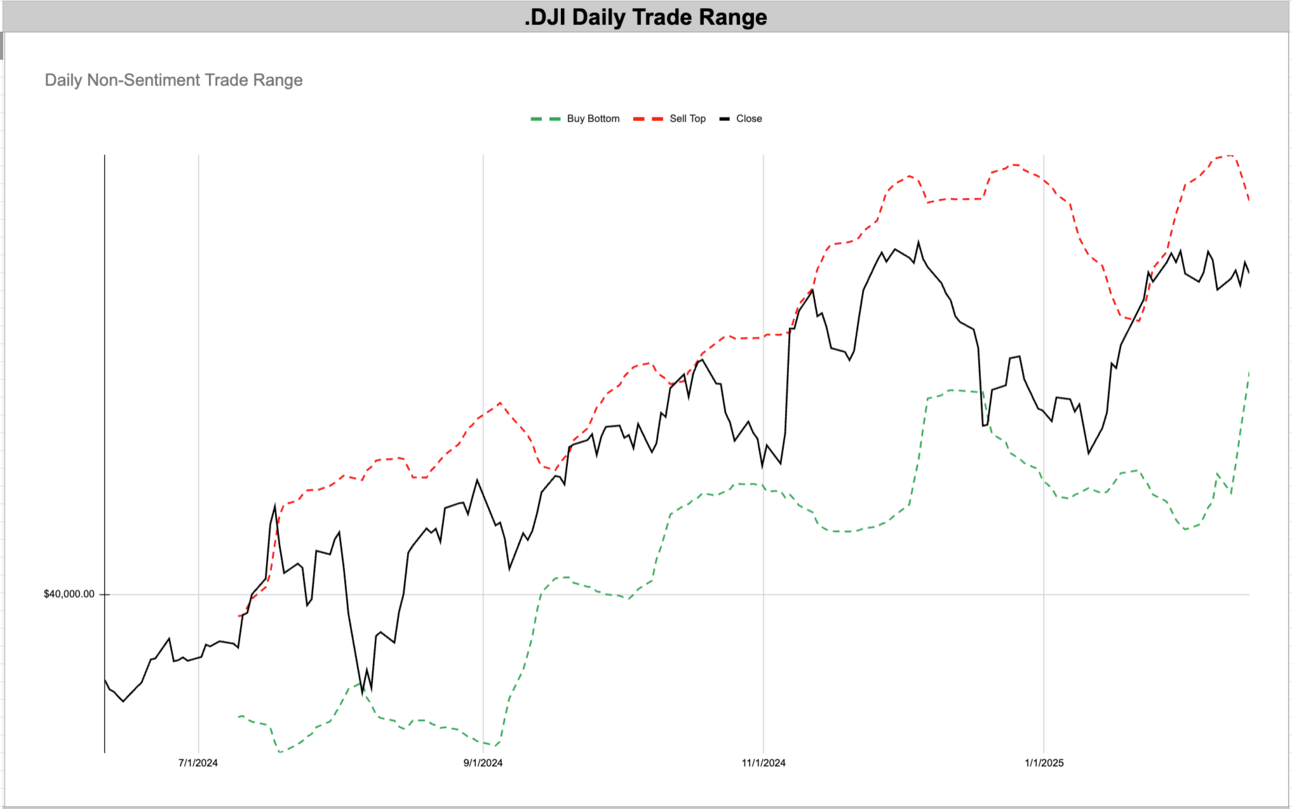

Markets are pushing higher, but cracks are showing. Indexes are strong but the large cap mega names are not showing strength except for $META. The Dow around $44,500, Nasdaq and S&P still bullish, but volume’s fading. VIX stays quiet, but VVIX is creeping up—volatility could be stretching before the sprint.

What’s Moving:

A lot of mega caps still run the show, but small caps and high-beta names are stirring. Liquidity and rate expectations will decide if this rally’s got legs.

Key Signals:

VIX Rising Bull flag = caution.

BTC correlation fading = less speculative risk.

Dollar down and possibly about to break much lower~but if that flips, so does the trend.

Bigger Picture:

Fed’s next move is everything. If rates stay high, choppiness is coming. If they pivot? Risk-on gets a second wind. Trump wants lower rates. Will he get them?

The Question:

Breakout or bull trap? Markets are late-cycle, but that doesn’t mean out of gas. Watch for the next move—the setup is there, but the trigger isn’t pulled yet.

Volatility Corner Framework

Technical Context:

VIX at $14.77, hovering over trend price ($14.58) but still bleeding (-11% in a month, -8.5% in three months). We love to see a falling VIX, complacency is king. VVIX correlation at 79.62%? Volatility’s stretching before a sprint?

Support at $15.06 held, but $16.97/$18.49 resistance looms. A break over $15.44 cracks the calm and risks this breakout being a bull trap. Meanwhile, VIX-UUP correlation (40.61%) hints the dollar sees something stocks don’t. The dollar is about to fall in my estimation.

Risk Assessment:

"Risk On" feels good, but falling volume says the party’s winding down. The tripwires you ask?

Mean reversion: VIX this low? It’s a coiled spring.

Macro catalysts: Inflation, Fed pivots, geopolitics—pick your poison.

Crowded longs: 14 bulls vs. 5 bears—this is how rugs get pulled.

"VIX Watch" and "Storm Brewing" are flashing. Don’t get caught sleeping. This market has the speed of the Trump Whipsaw.

Historical Parallels:

Seen this before—late 2021, August 2015, Q4 2018—VIX naps, then chaos. Every calm ends the same way: fast.

Actionable Insight:

VIX < $15? Cheap risk. Hedges are a bargain now. Break $15.44, expect a little turbulence. Buy the dip with anything under $20 VIX. If we drift lower, patience is the play.

Stay nimble. Stay ready. The quiet won’t last forever. 🚀

The VIX range is now compressing and falling even lower. These are good signals for now.

The collapse of the vix has been silent yet wonderful. Under the surface many names are breaking out.

MACRO INDICATOR:

I’ll ignore the selling opportunity for now. It’s been choppy so this indicator can’t trend how we would prefer.

MACRO SEASON: BULLISH Since 1/24/25🟢

MICRO WEATHER: BEARISH Since 12/26/24🟢

Enjoying this?

& Invite a friend.

New Highs $5-$20:

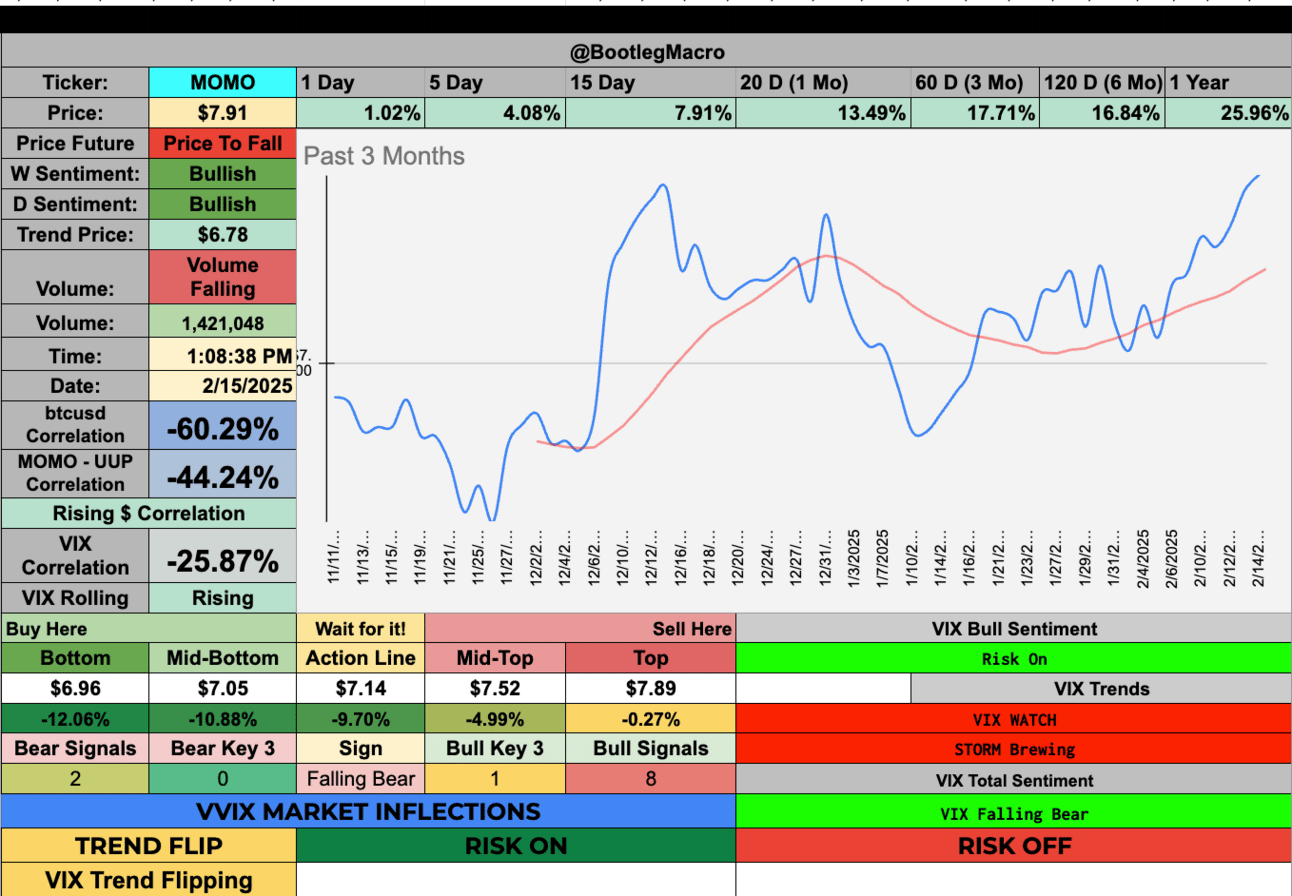

MOMO - Hello Group Inc ADR - Communication Services - China 🇨🇳

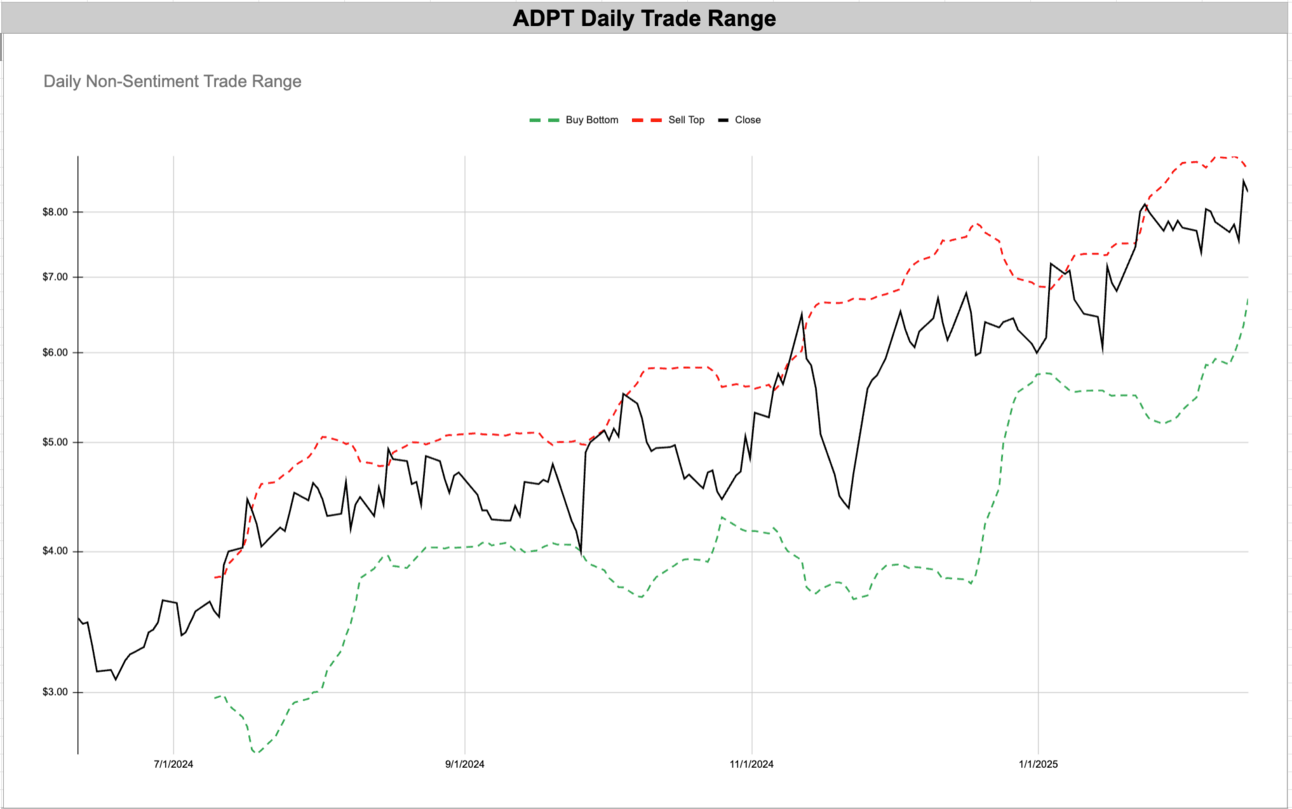

ADPT - Adaptive Biotechnologies Corp - Healthcare - USA 🇺🇸

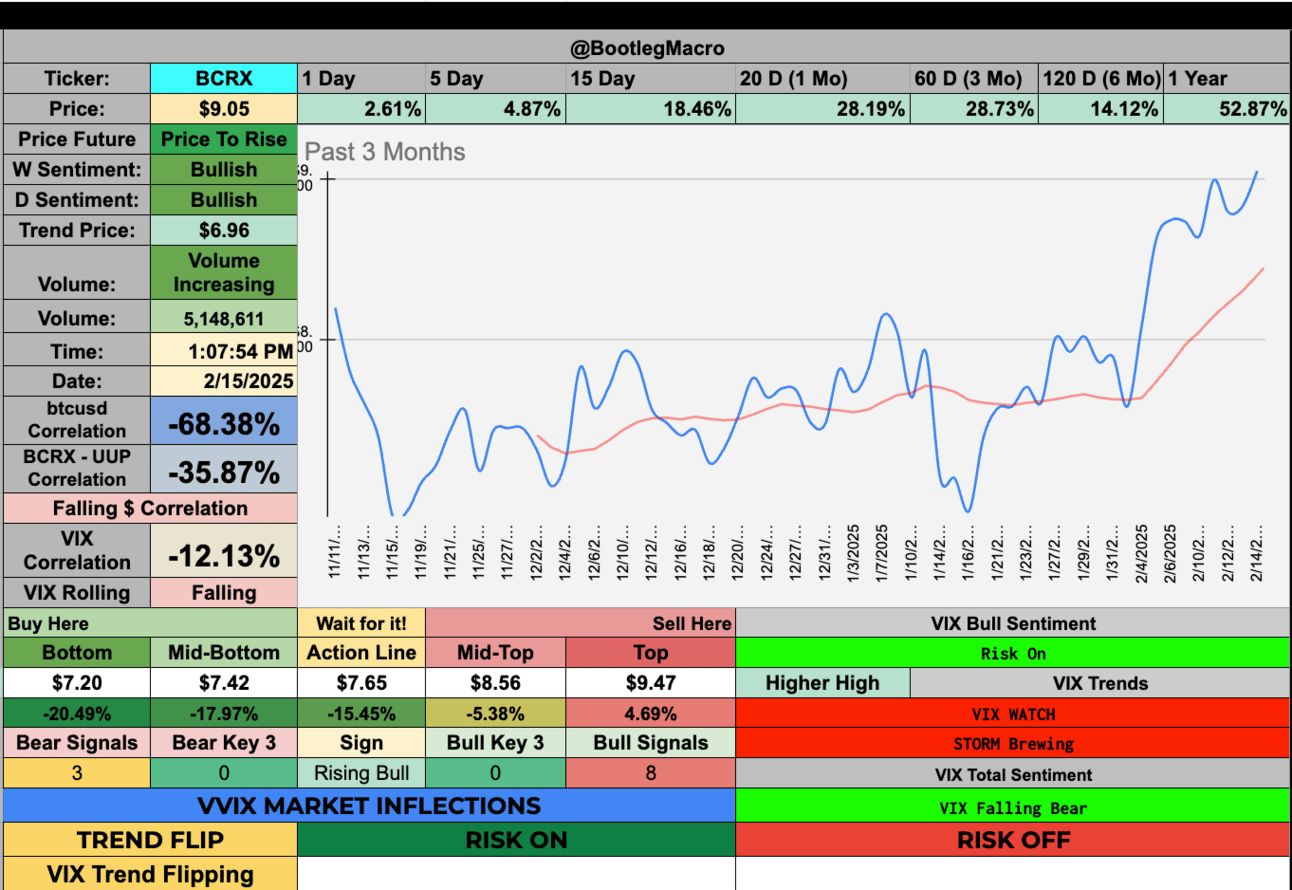

BCRX - Biocryst Pharmaceuticals Inc - Healthcare - USA 🇺🇸

AUR - Aurora Innovation Inc - Technology - USA 🇺🇸

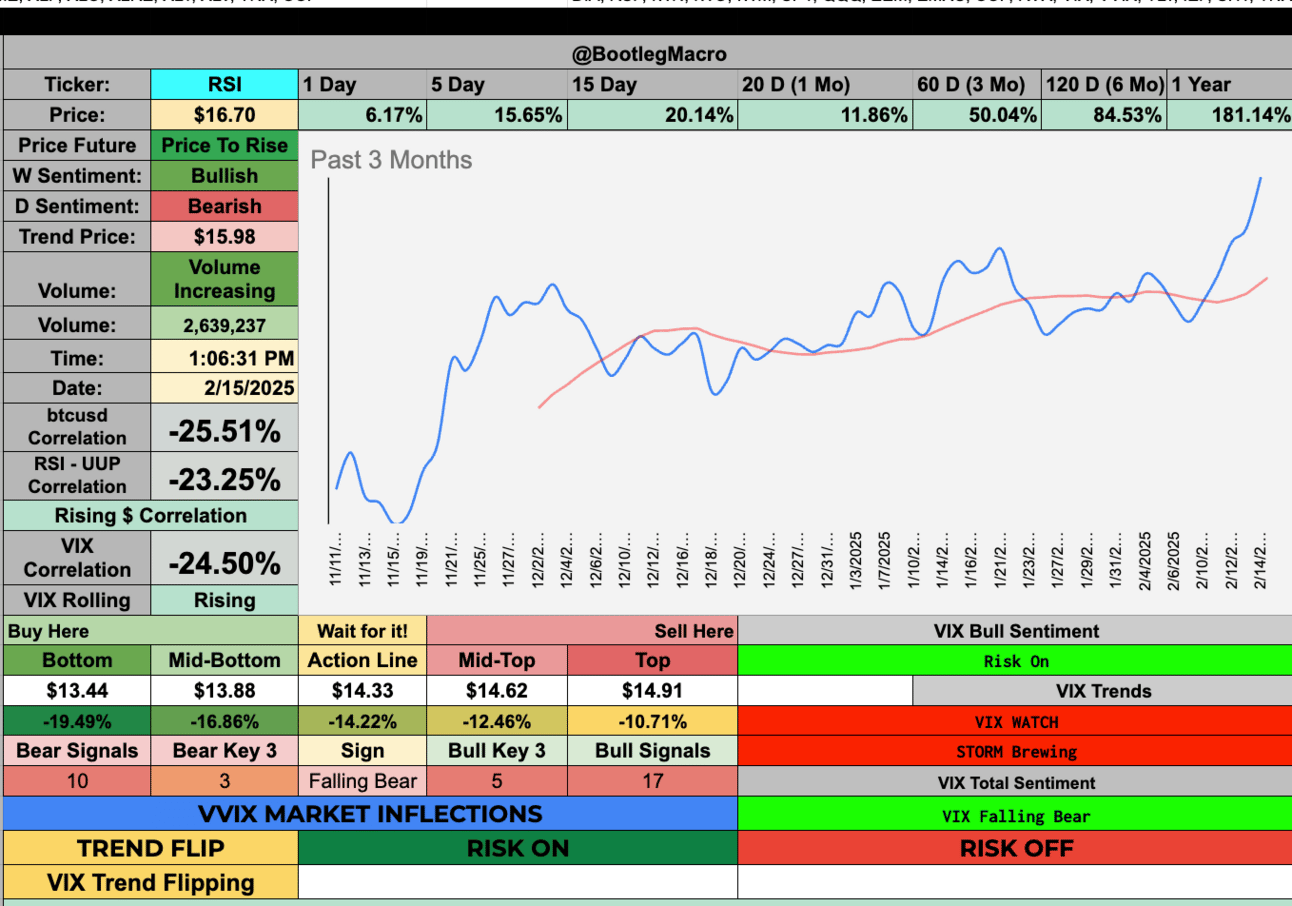

RSI - Rush Street Interactive Inc - Consumer Cyclical - USA 🇺🇸

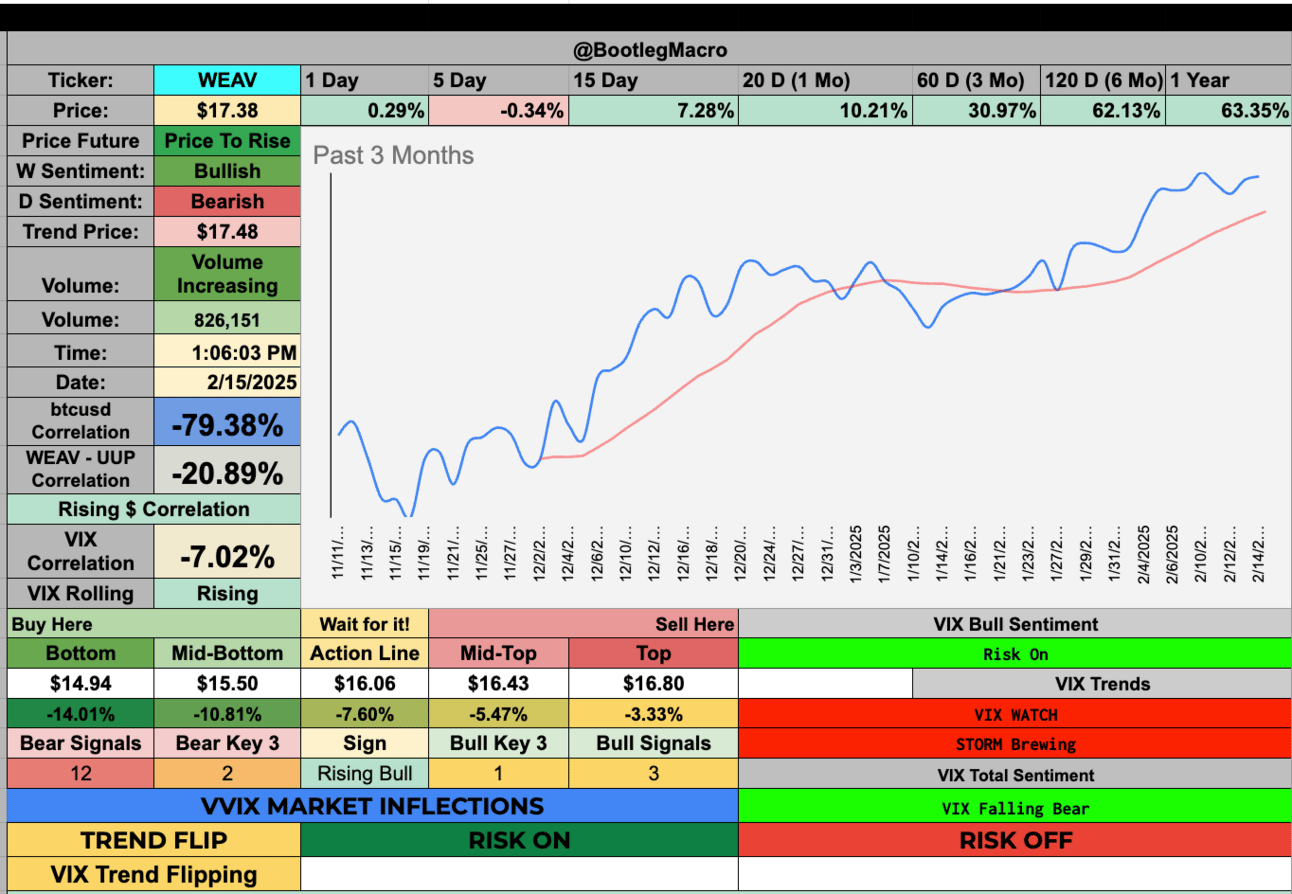

WEAV - Weave Communications Inc - Healthcare - USA 🇺🇸

AVPT - AvePoint Inc - Technology - USA 🇺🇸

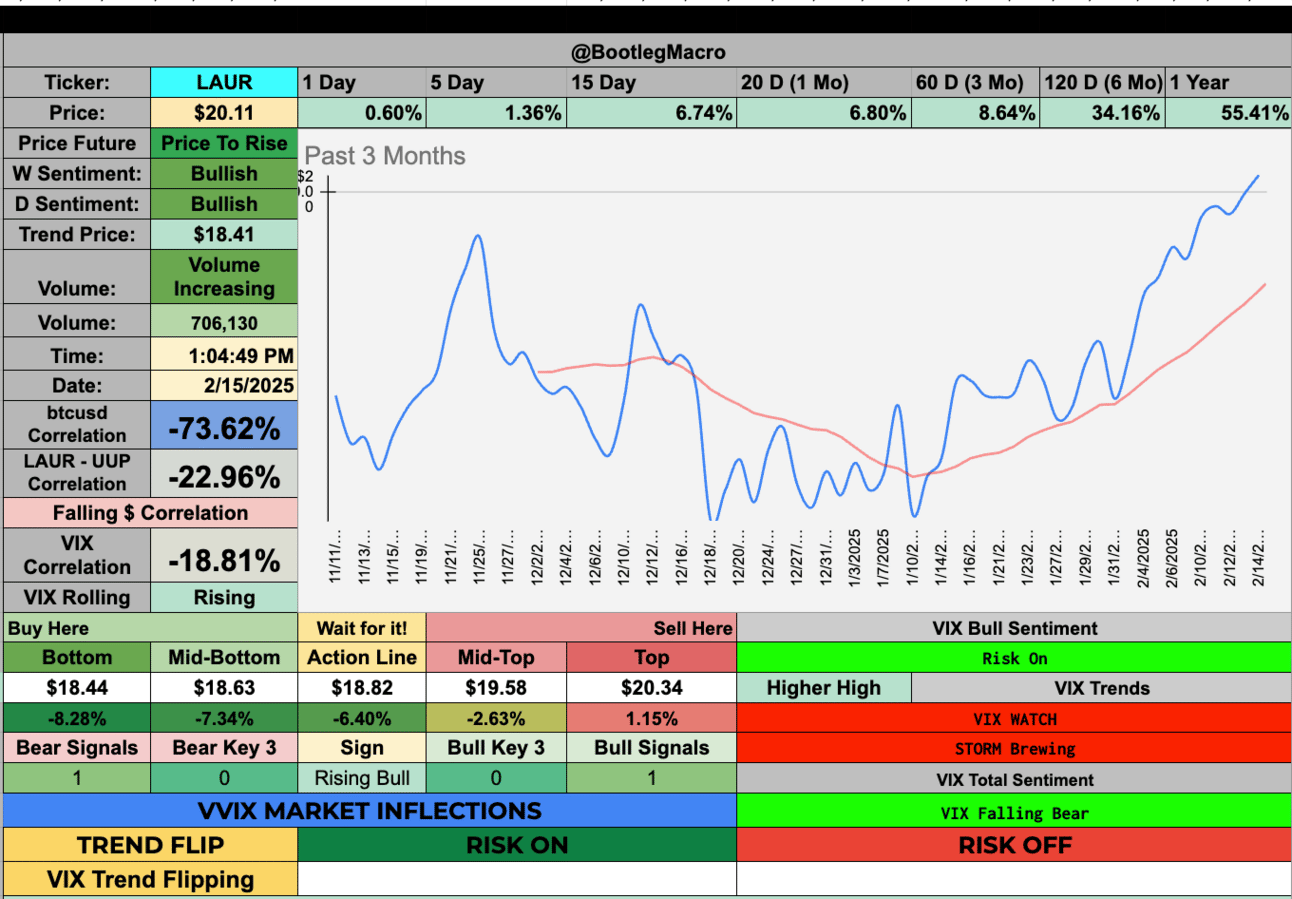

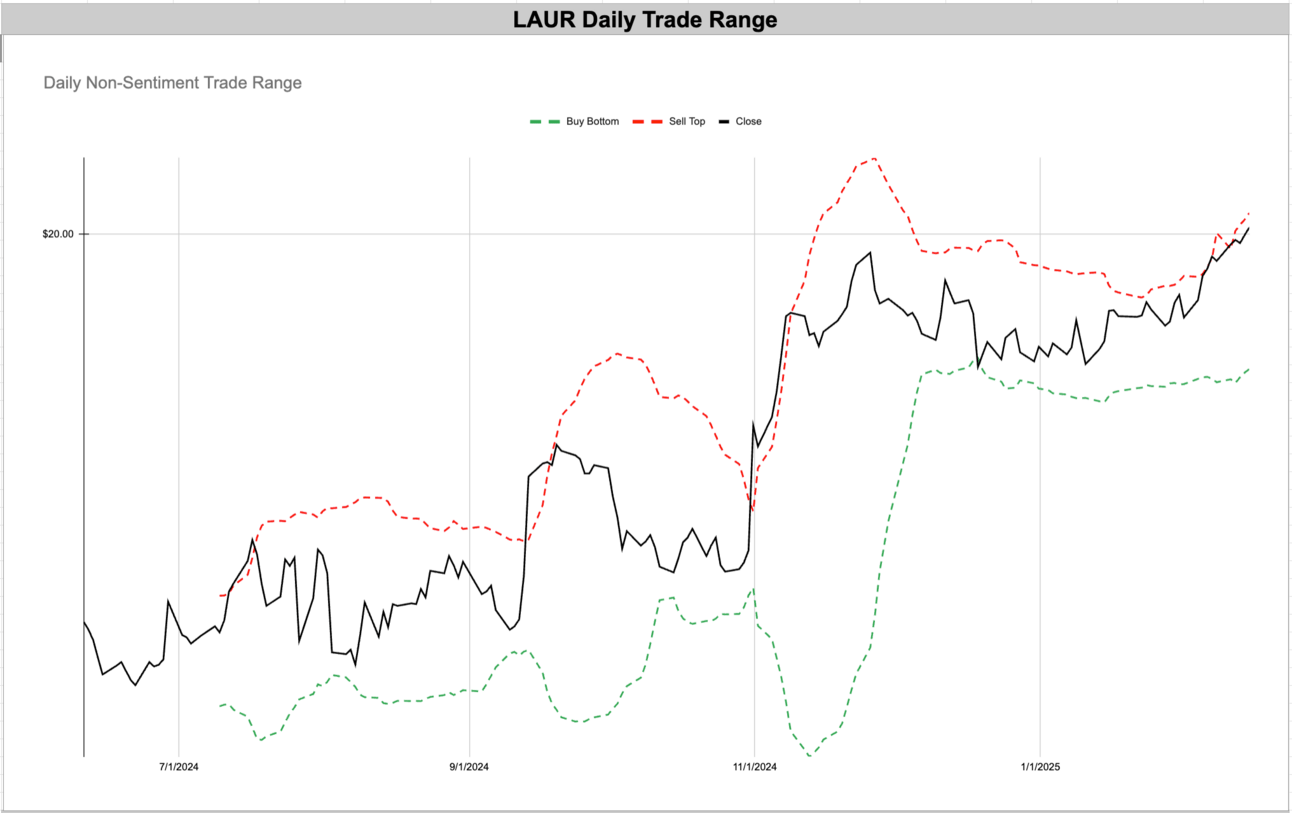

LAUR - Laureate Education Inc - Consumer Defensive - USA 🇺🇸

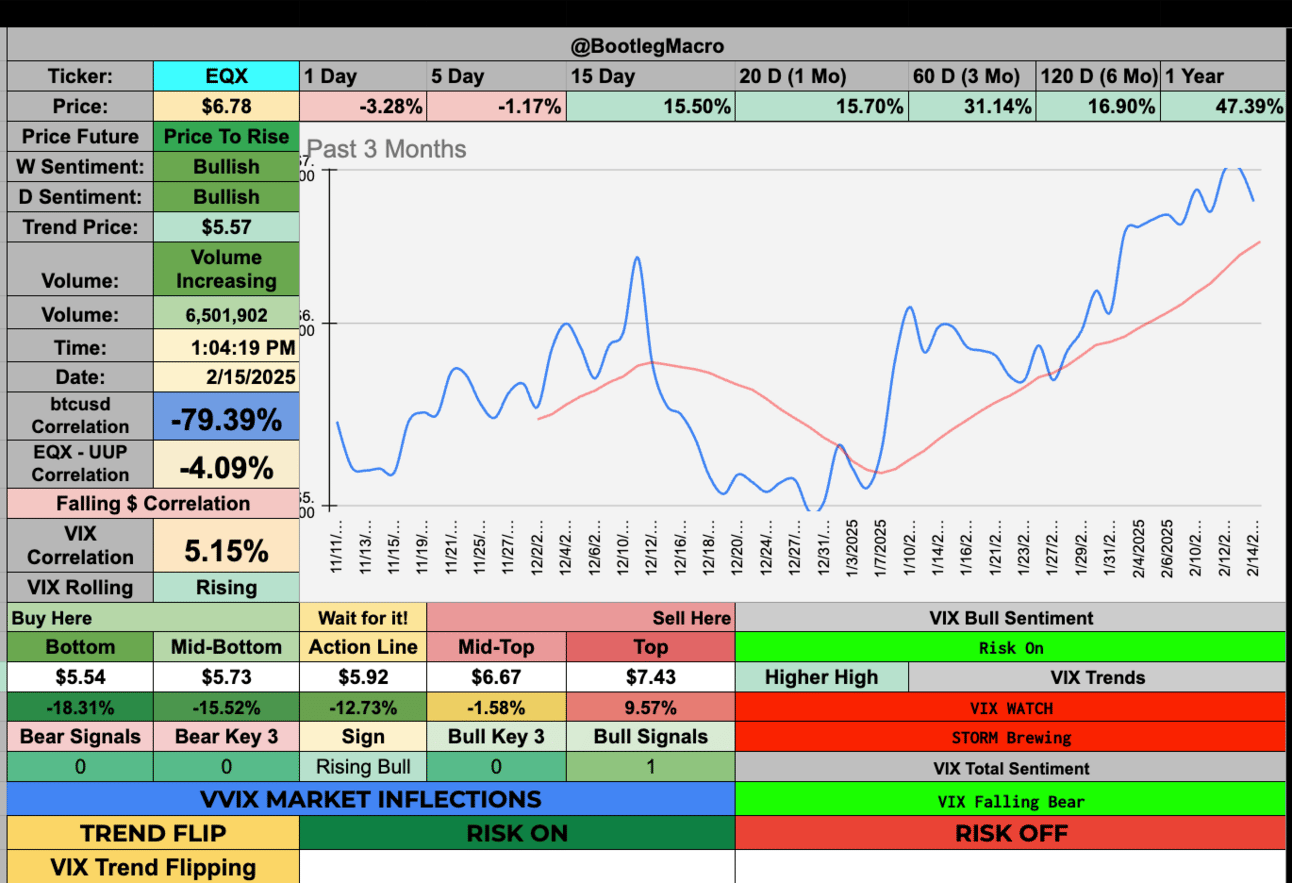

EQX - Equinox Gold Corp - Basic Materials - Canada 🇨🇦

MFG - Mizuho Financial Group, Inc. ADR - Financial - Japan 🇯🇵

MOMO - Hello Group Inc ADR - Communication Services - China 🇨🇳

ADPT - Adaptive Biotechnologies Corp - Healthcare - USA 🇺🇸

BCRX - Biocryst Pharmaceuticals Inc - Healthcare - USA 🇺🇸

AUR - Aurora Innovation Inc - Technology - USA 🇺🇸

RSI - Rush Street Interactive Inc - Consumer Cyclical - USA 🇺🇸

WEAV - Weave Communications Inc - Healthcare - USA 🇺🇸

AVPT - AvePoint Inc - Technology - USA 🇺🇸

LAUR - Laureate Education Inc - Consumer Defensive - USA 🇺🇸

EQX - Equinox Gold Corp - Basic Materials - Canada 🇨🇦

MFG - Mizuho Financial Group, Inc. ADR - Financial - Japan 🇯🇵

Enjoying this?

& Invite a friend.

New Highs $20+:

AFRM - Affirm Holdings Inc - Technology - USA 🇺🇸

META - Meta Platforms Inc - Communication Services - USA 🇺🇸

WMT - Walmart Inc - Consumer Defensive - USA 🇺🇸

NFLX - Netflix Inc - Communication Services - USA 🇺🇸

TMUS - T-Mobile US Inc - Communication Services - USA 🇺🇸

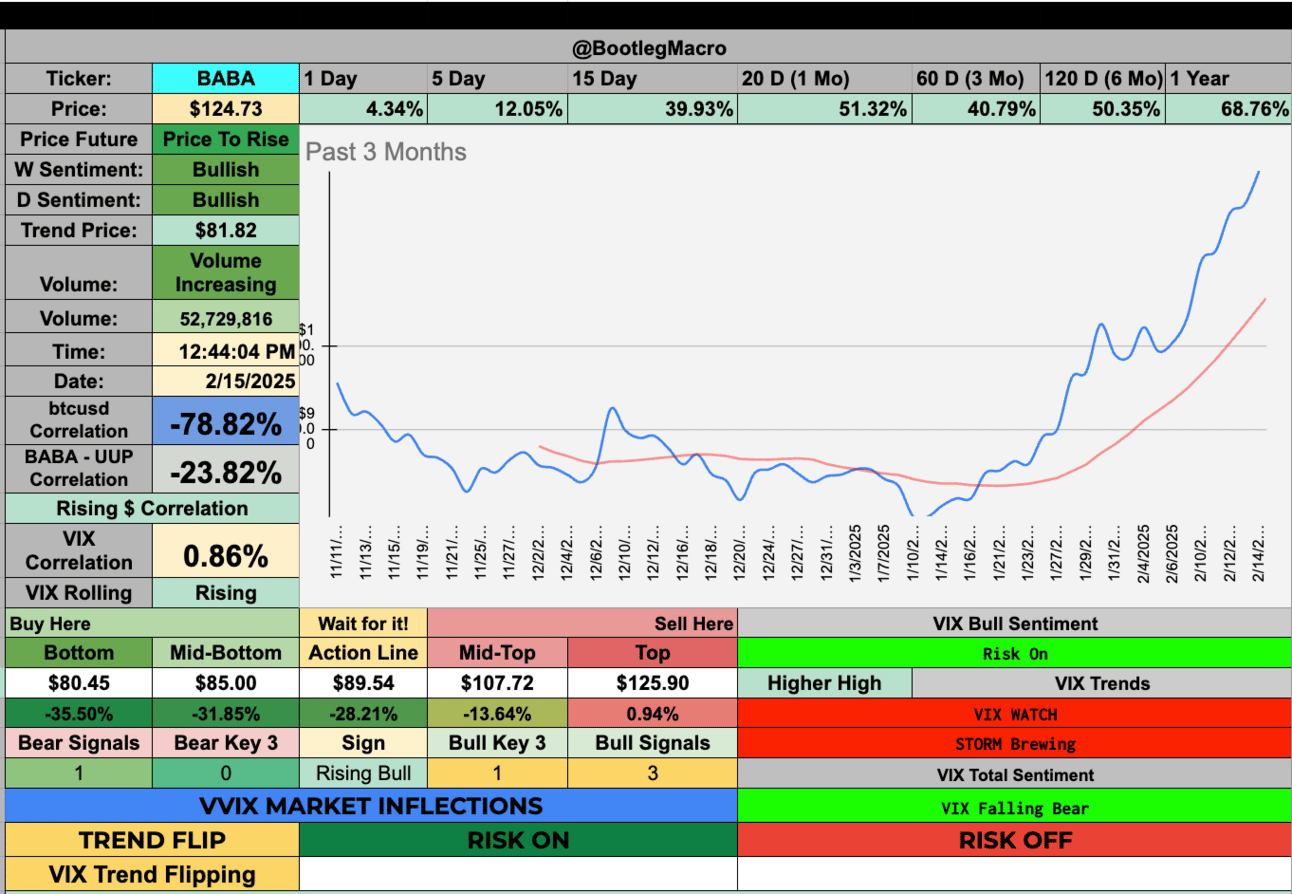

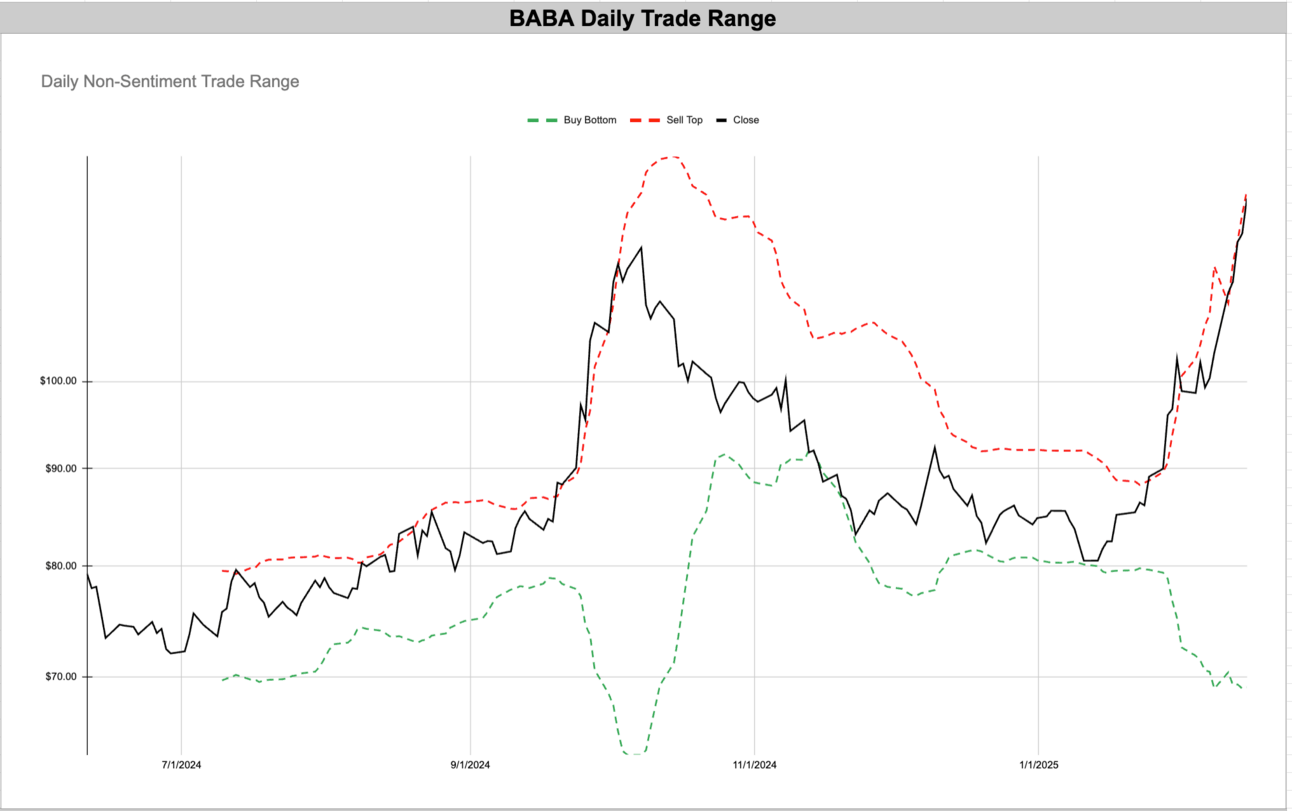

BABA - Alibaba Group Holding Ltd ADR - Consumer Cyclical - China 🇨🇳

PLTR - Palantir Technologies Inc - Technology - USA 🇺🇸

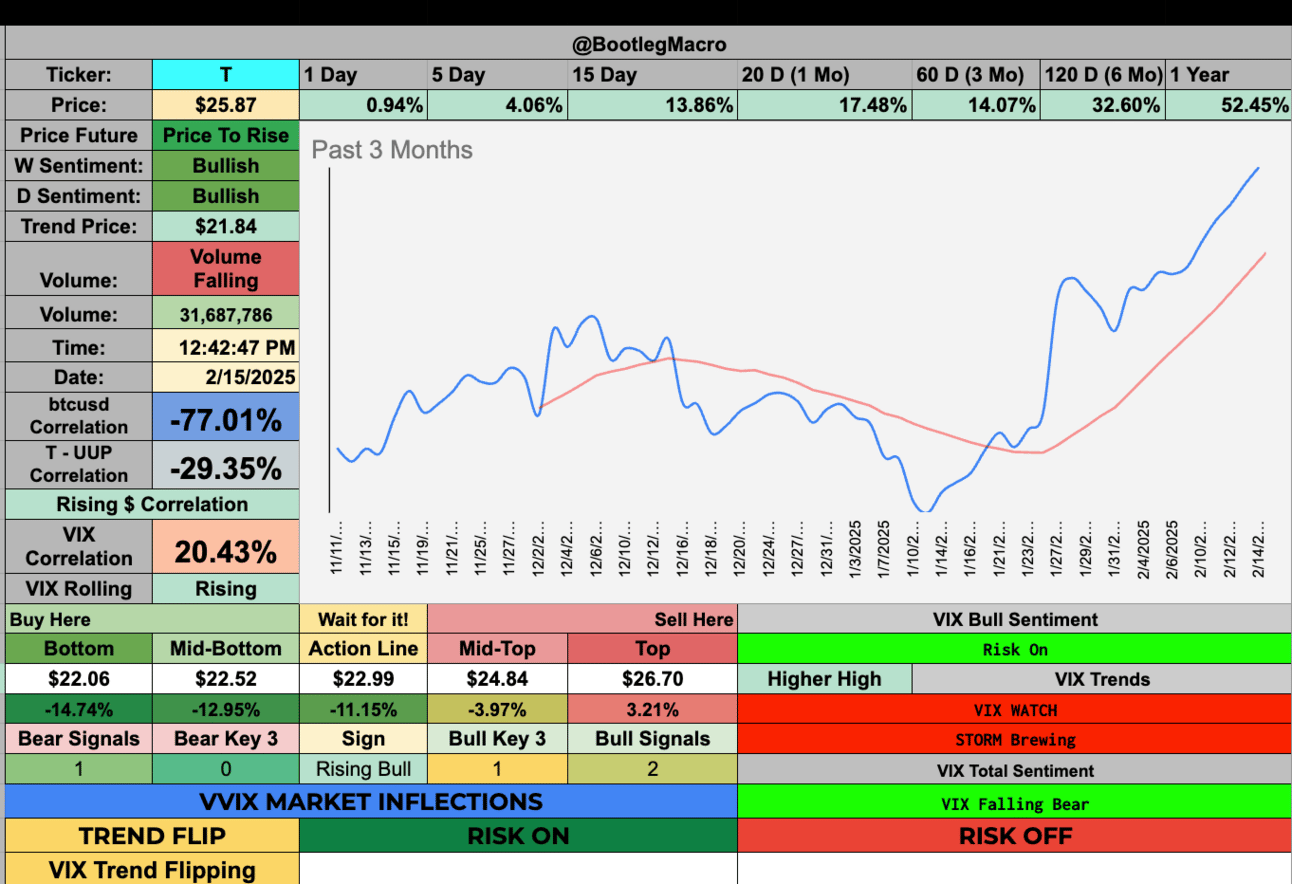

T - AT&T, Inc - Communication Services - USA 🇺🇸

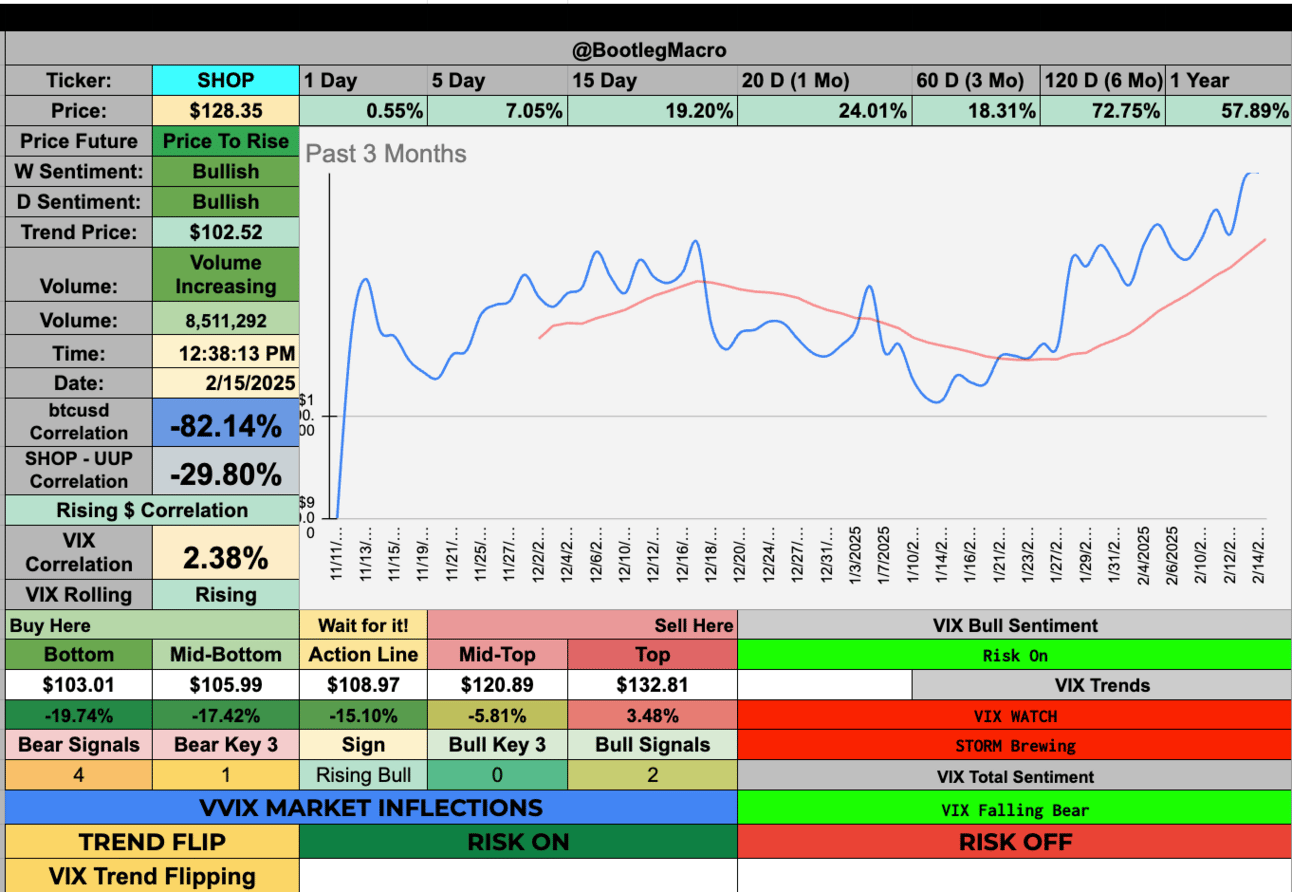

SHOP - Shopify Inc - Technology - Canada 🇨🇦

SBUX - Starbucks Corp - Consumer Cyclical - USA 🇺🇸

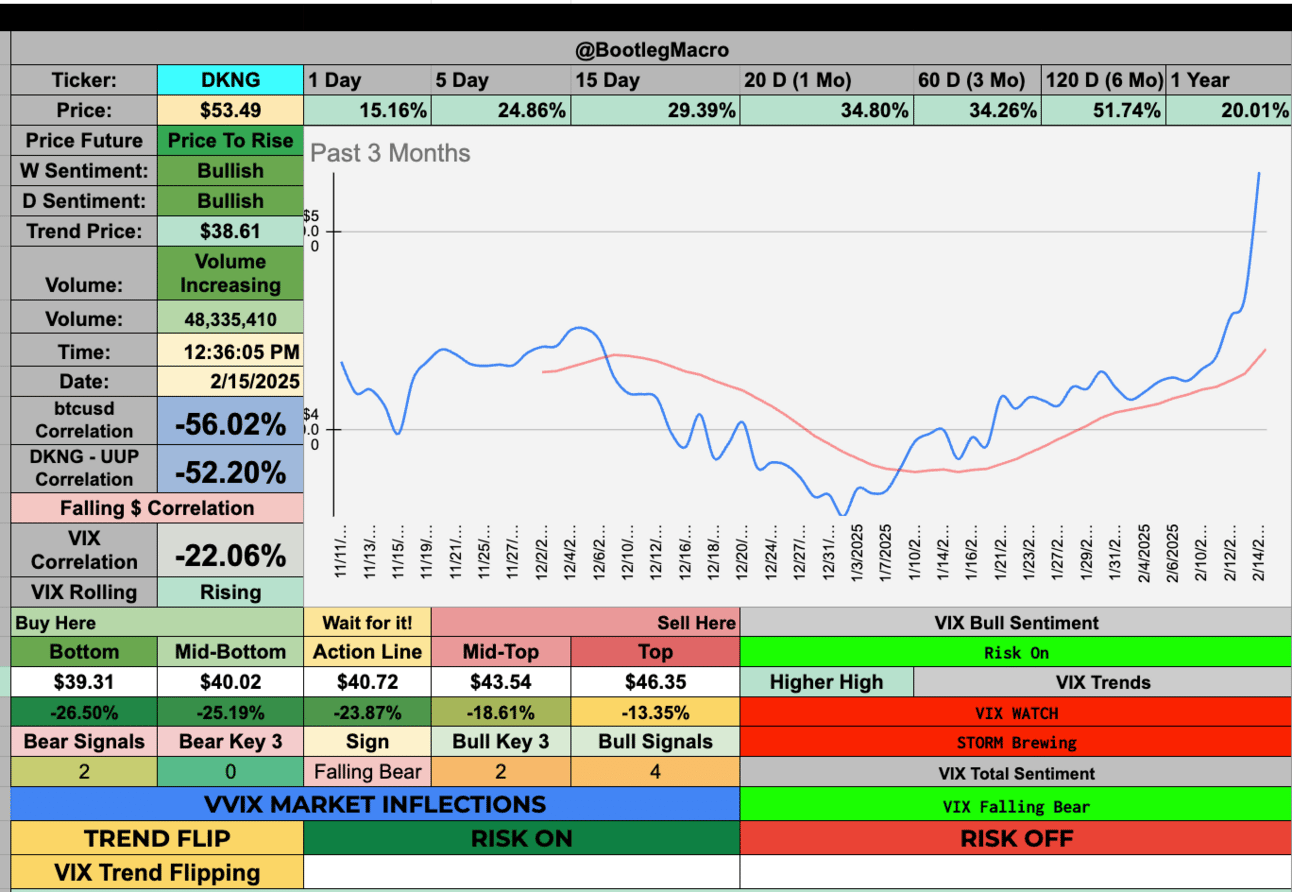

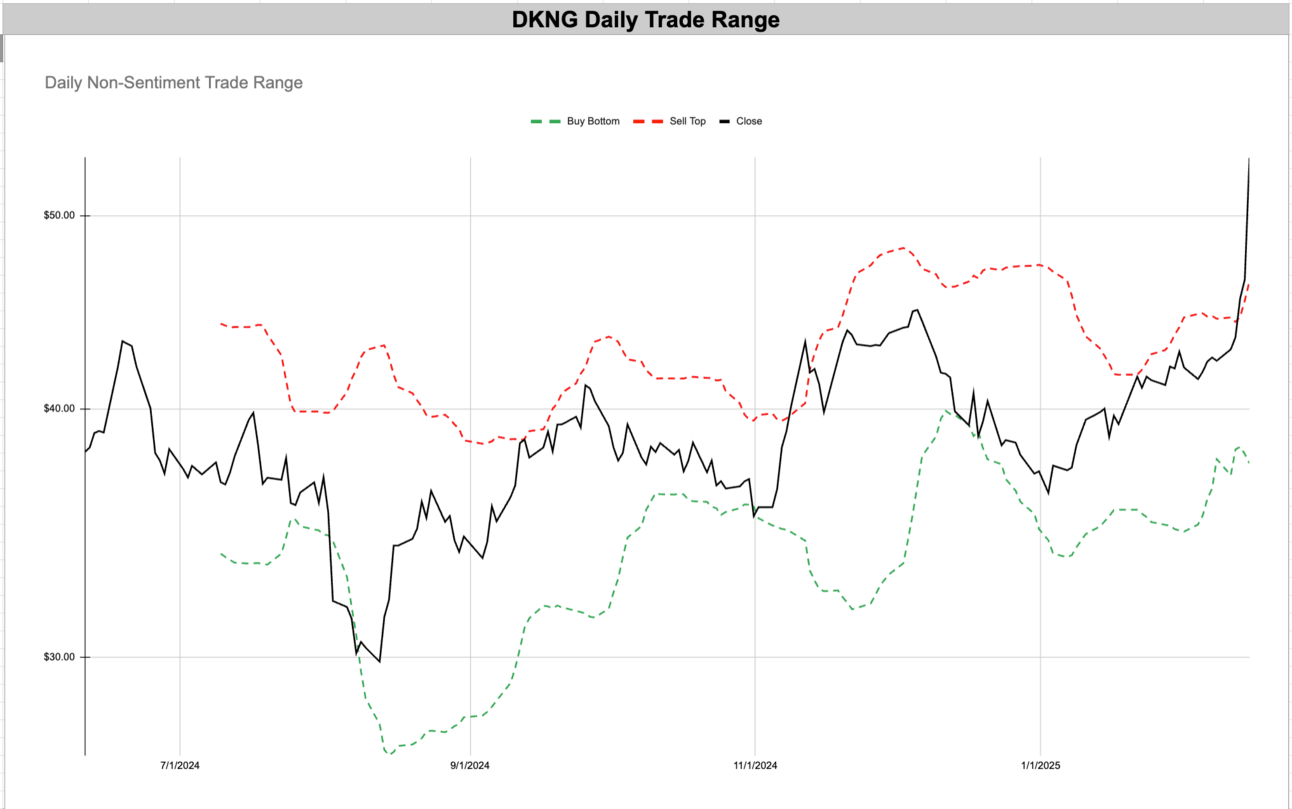

DKNG - DraftKings Inc - Consumer Cyclical - USA 🇺🇸

AFRM - Affirm Holdings Inc - Technology - USA 🇺🇸

META - Meta Platforms Inc - Communication Services - USA 🇺🇸

WMT - Walmart Inc - Consumer Defensive - USA 🇺🇸

NFLX - Netflix Inc - Communication Services - USA 🇺🇸

TMUS - T-Mobile US Inc - Communication Services - USA 🇺🇸

BABA - Alibaba Group Holding Ltd ADR - Consumer Cyclical - China 🇨🇳

PLTR - Palantir Technologies Inc - Technology - USA 🇺🇸

T - AT&T, Inc - Communication Services - USA 🇺🇸

SHOP - Shopify Inc - Technology - Canada 🇨🇦

SBUX - Starbucks Corp - Consumer Cyclical - USA 🇺🇸

DKNG - DraftKings Inc - Consumer Cyclical - USA 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

What's happening with the USD? $UUP - that's the biggest question...it's had consolidation for the past few weeks.

It dropped and now it's not trending...yet.

— BootlegMacro (@bootlegmacro)

5:01 PM • Feb 9, 2025

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro