- The New High Newsletter

- Posts

- Bombs Fly, Time to Buy?

Bombs Fly, Time to Buy?

When we find ourselves with an opportunity in the market to buy, does it matter what created the moment? It does for many but here I'll be mechanical in my process. I don't want war yet I have to wonder...when conflict escalates, should you buy stocks?

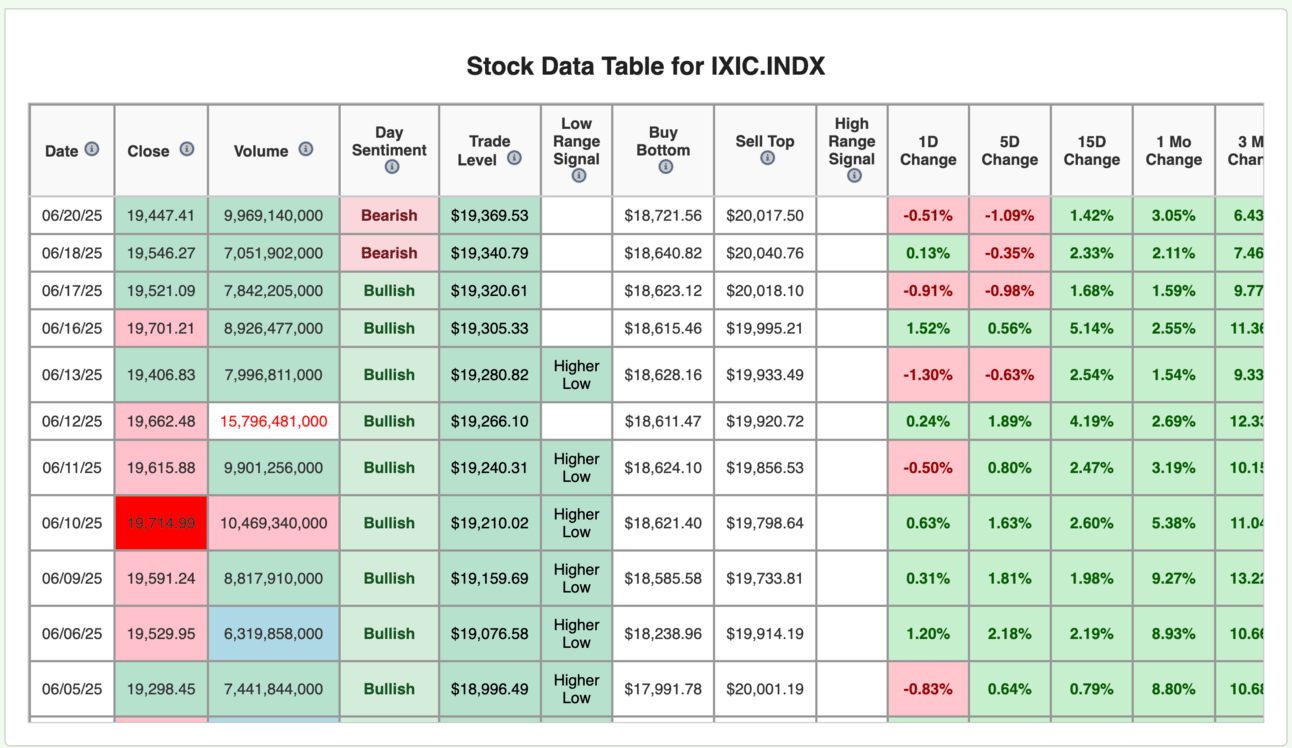

Market Overview: Indexes sniffed out an escalation in the war. We’ve seen all 3 indexes flip bearish during the previous week. It’s amazing how much markets stay on top of the news. You’ll see below tighter ranges, negative returns and bearish sentiment in the indexes.

It’s clear the market across the board flipped bearish this week in US equities.

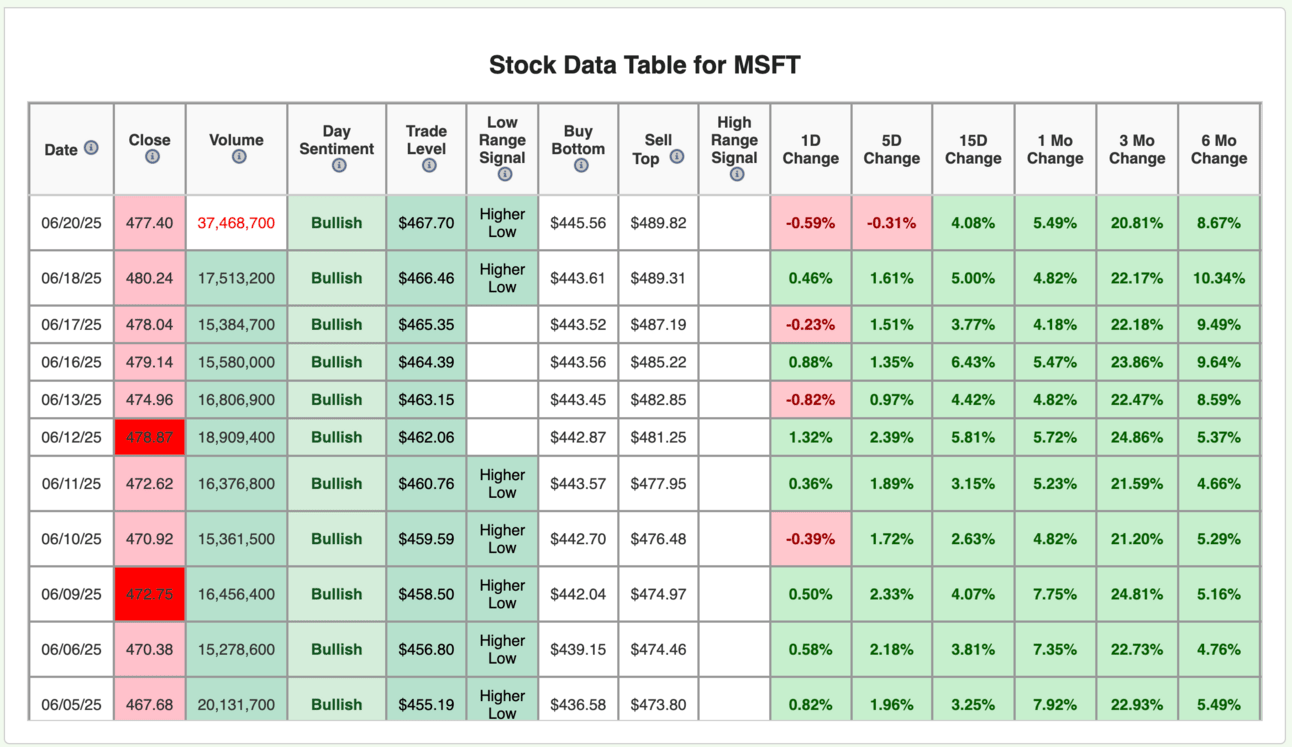

New Highs $20+: If you can’t make money in the big names, hitting all time highs. Can you even make money? This week we’re led by $MSFT ( ▼ 0.13% ) $SNOW ( ▲ 5.43% ) $HOOD ( ▲ 6.82% ) and others which show, large cap tech, financials and a little energy are starting to lead the mix. This is a recipe for higher inflation and tech bull runs.

Turbulence Indicator: Right as we get the volatility to a level giving people the impression of security, we see a massive catalyst which will give markets a good rattle this week.

Looking Ahead: The world hangs by a thin thread — that’s a quote from Carl Jung. When we have US attacks on Iranian Nuclear Facilities, we will find out how much this thin thread can handle. Markets will tell us by Monday evening, how fertile this market is for a real bull run.

Market Performance

All indexes show a narrower range, bearish sentiment and weekly losses. It’s clear, if the BULL MARKET continues from here, it’s a great time to buy.

Volatility Corner Framework

Indicator Update:

Volatility spiked at the end of this week. Yet the overall turublance indicator is still in a BULL MARKET. If you remember back in April on “Liberation Day” we saw the speed of a market in decline with a driving force behind it. With a new massive catalyst on the horizion (WAR) we should be mindful of the additional spending required by the government for any military conflict. Usually spending is a good thing but not when you’re battling inflation too…it’s going to be fun to watch the market climb a wall of worry.

Actionable Insight:

The daily and weekly turbulence indicators are showing solid recovery from the April spike in volatility. It’s yet to be seen if the Iranian/US conflict rattles markets as much as increasing global tariffs.

MACRO INDICATOR:

Long-term, we are in a BULL MARKET. Daily, we are in a BEAR MARKET

MACRO SEASON: BULLISH Since 6/6/25🟢

MICRO WEATHER: BEARISH Since 6/10/25🟢

Enjoying this?

& Invite a friend.

New Highs $20+:

MSFT – Microsoft Corporation – Technology – USA 🇺🇸

CSCO – Cisco Systems, Inc – Technology – USA 🇺🇸

SCHW – Charles Schwab Corp – Financial – USA 🇺🇸

TD – Toronto Dominion Bank – Financial – Canada 🇨🇦

DASH – DoorDash Inc – Consumer Cyclical – USA 🇺🇸

MCK – McKesson Corporation – Healthcare – USA 🇺🇸

SNOW – Snowflake Inc – Technology – USA 🇺🇸

HOOD – Robinhood Markets Inc – Financial – USA 🇺🇸

RBLX – Roblox Corporation – Communication Services – USA 🇺🇸

NET – Cloudflare Inc – Technology – USA 🇺🇸

COOP – Mr. Cooper Group Inc – Financial – USA 🇺🇸

MSFT – Microsoft Corporation – Technology – USA 🇺🇸

CSCO – Cisco Systems, Inc – Technology – USA 🇺🇸

SCHW – Charles Schwab Corp – Financial – USA 🇺🇸

TD – Toronto Dominion Bank – Financial – Canada 🇨🇦

DASH – DoorDash Inc – Consumer Cyclical – USA 🇺🇸

MCK – McKesson Corporation – Healthcare – USA 🇺🇸

SNOW – Snowflake Inc – Technology – USA 🇺🇸

HOOD – Robinhood Markets Inc – Financial – USA 🇺🇸\

RBLX – Roblox Corporation – Communication Services – USA 🇺🇸

NET – Cloudflare Inc – Technology – USA 🇺🇸

COOP – Mr. Cooper Group Inc – Financial – USA 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro