- The New High Newsletter

- Posts

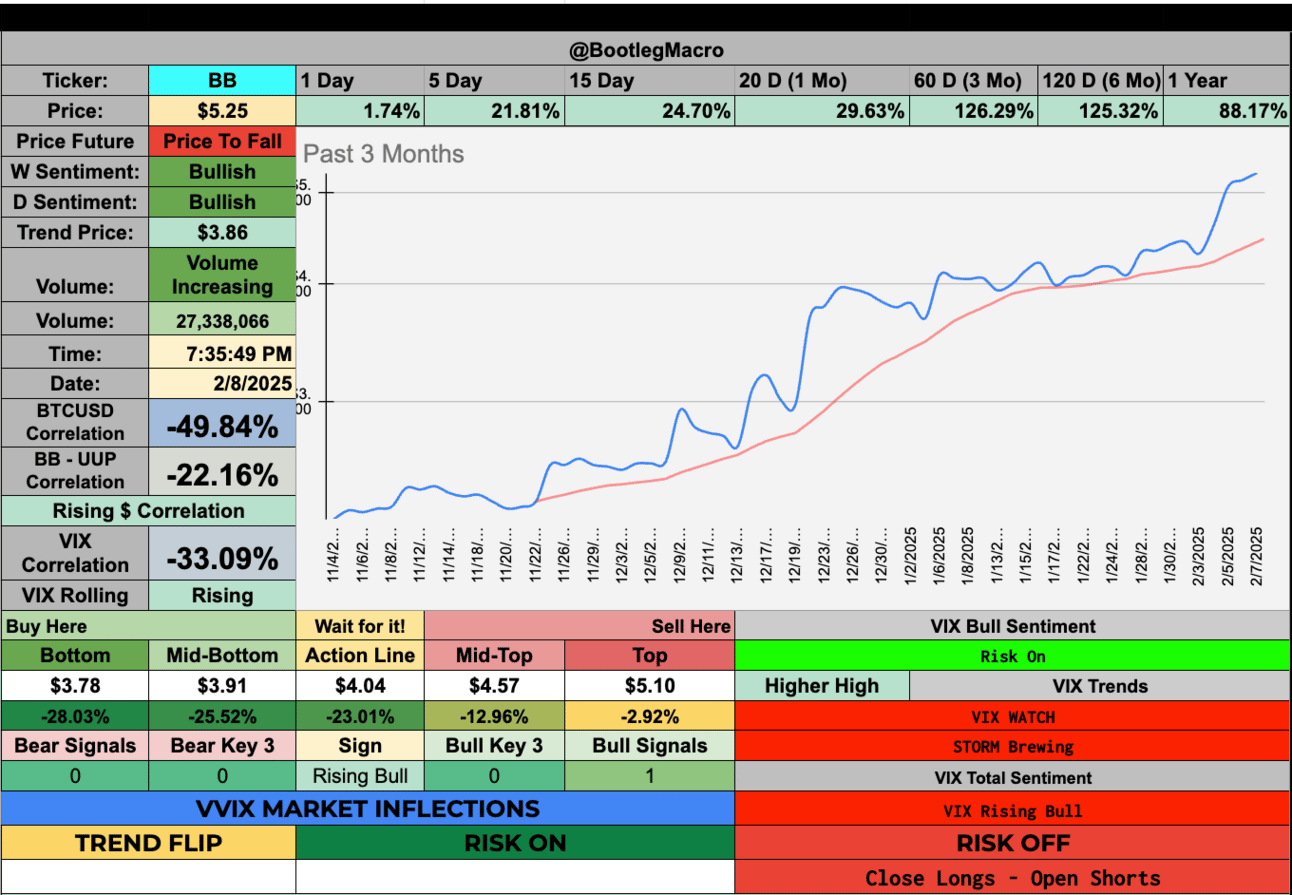

- Blackberry is breaking out!

Blackberry is breaking out!

I enjoy doing this list because you find out random stocks who have returned quietly and are having resurgence.

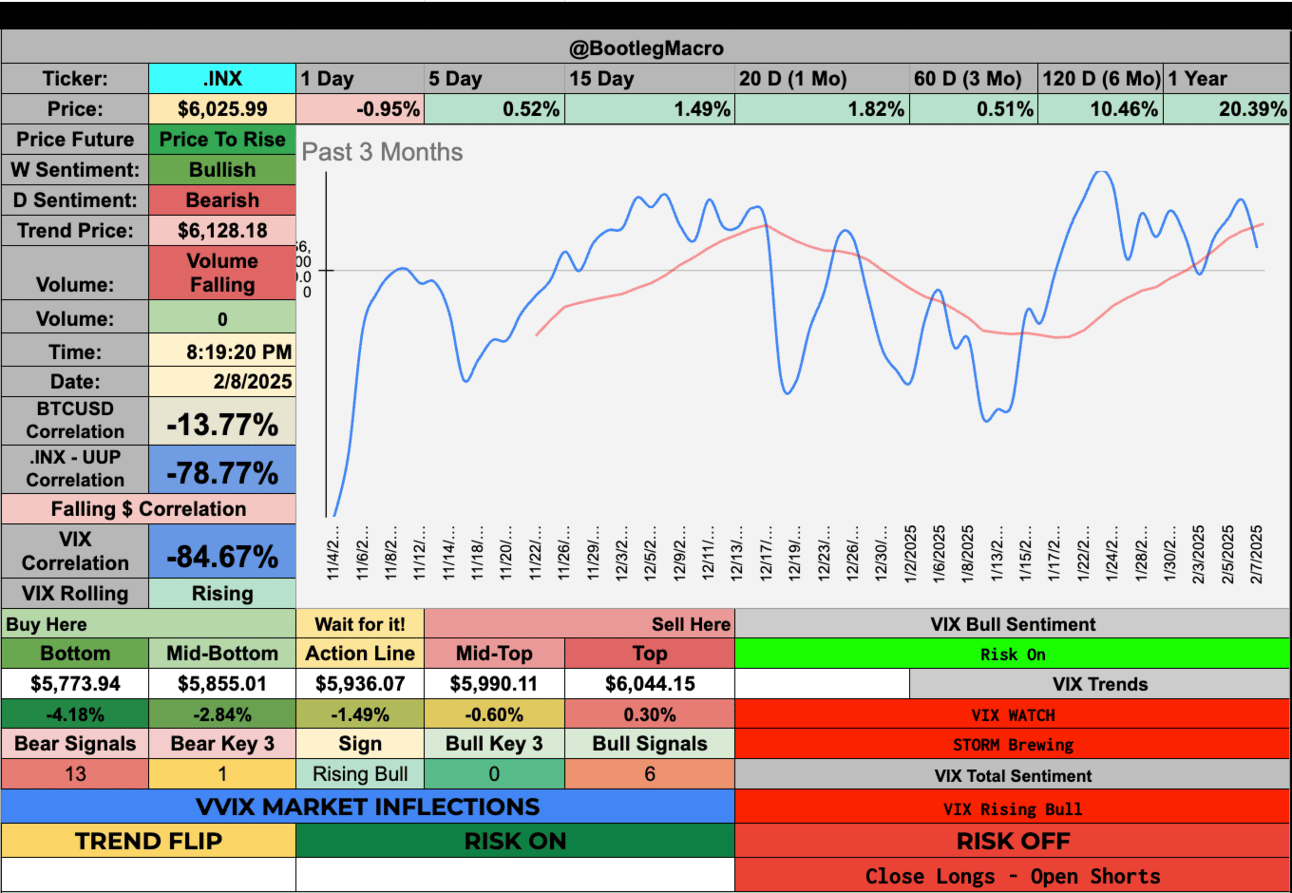

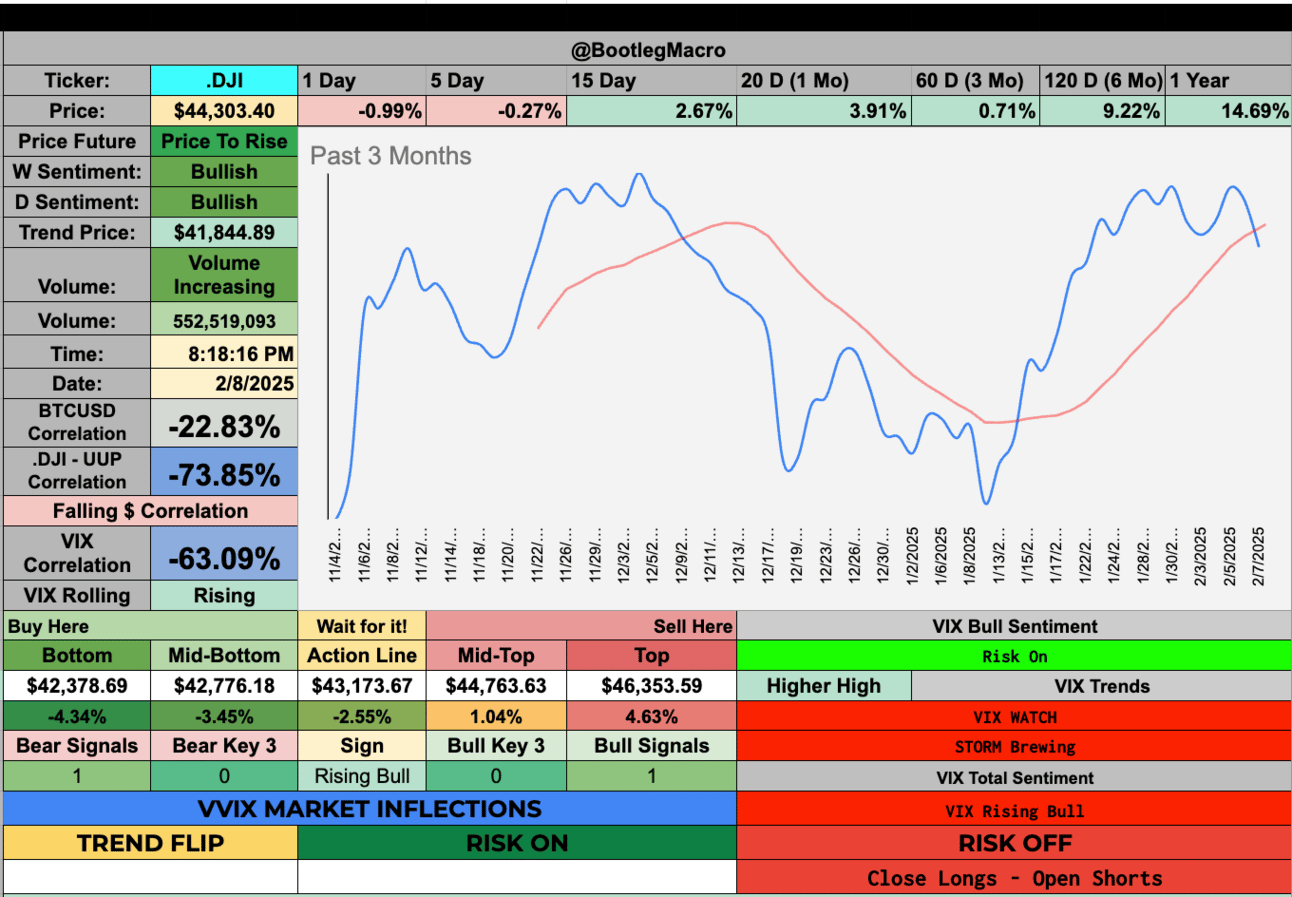

Market Overview: All indexes moved by less than 1% this week. The volatility indicator is choppy too. We’ve seen a whole different market style enter over the past 2 weeks. Uncertainty re-entered the market.

New Highs $5-$20: This section has some interesting names. BlackBerry is an interesting name on the list. It’s having a great year so far. I like it when we have household-names hitting new highs when their under $20.

New Highs $20+: Since the market has lost a bit of it’s mojo, the only things really breaking out are the mega-caps. Which if you’ll notice only META is leading the MAG 7. The rest of them aren’t on the list.

Turbulence Indicator: Side-to-side isn’t only a good move in the bedroom. It’s a great setup in markets. If you struggle to find entry points, when a market is choppy you’ll get days and moments of fantastic prices. Don’t miss out.

Looking Ahead: We never know what will happen in markets when Trump is President. So we have to be nimble for the fact we can get flash-crashes and breaking news for us to hit-all time highs. We never know because I don’t think he does either.

Market Performance Framework

Market Overview:

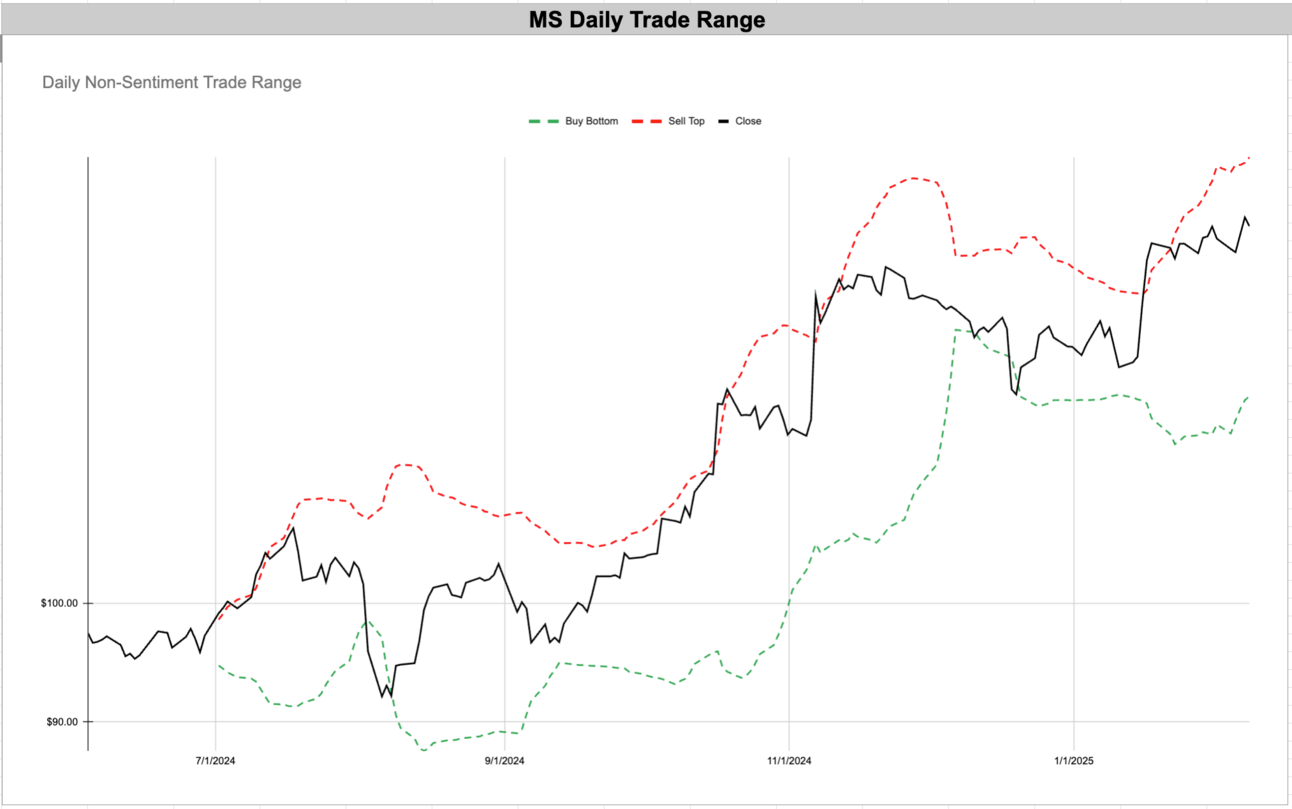

The trade ranges speak for themselves on all the indexes. We’re in a side-ways or choppy arena for movement. Since markets tend to go higher, this a fantastic time for Dollar-Cost-Averaging into a retirement account. Sideways action is tough on trading.

Key Focus Area:

The DOW Jones seems to be the strongest, considering the past rolling 1 month return. If it’s really the strong long-term is still yet to be seen.

Current Outlook and Indicators:

Side-ways and chop, it’s what we can expect at least for the rest of February. March and April have a chance to show us a direction. I’d love one-direction.

Long-Term View:

Long-term we should still get a tax cut. We should see unemployment rise. We should see smaller-government. We should see a mini-recession before a boom.

Volatility Corner Framework

Indicator Update:

The overall Market Turbulence Indicator is side ways. Things don’t have a clear direction. Which is good for things breakout and bad for things breaking down. Momentum can run in a variety of different ways.

The overall market is sideways - we’ve seen chop but I hope we see a resolution higher.

I’d like to see the top of the range come under $20

MACRO INDICATOR:

Enjoying this?

& Invite a friend.

New Highs $5-$20:

BB - BlackBerry Ltd - Technology - Canada 🇨🇦

ORLA - Orla Mining Ltd - Basic Materials - Canada 🇨🇦

MBI - MBIA Inc - Financial - USA 🇺🇸

ADTN - ADTRAN Holdings Inc - Technology - USA 🇺🇸

KGC - Kinross Gold Corp - Basic Materials - Canada 🇨🇦

EZPW - EZCorp, Inc - Financial - USA 🇺🇸

XPEV - XPeng Inc ADR - Consumer Cyclical - China 🇨🇳

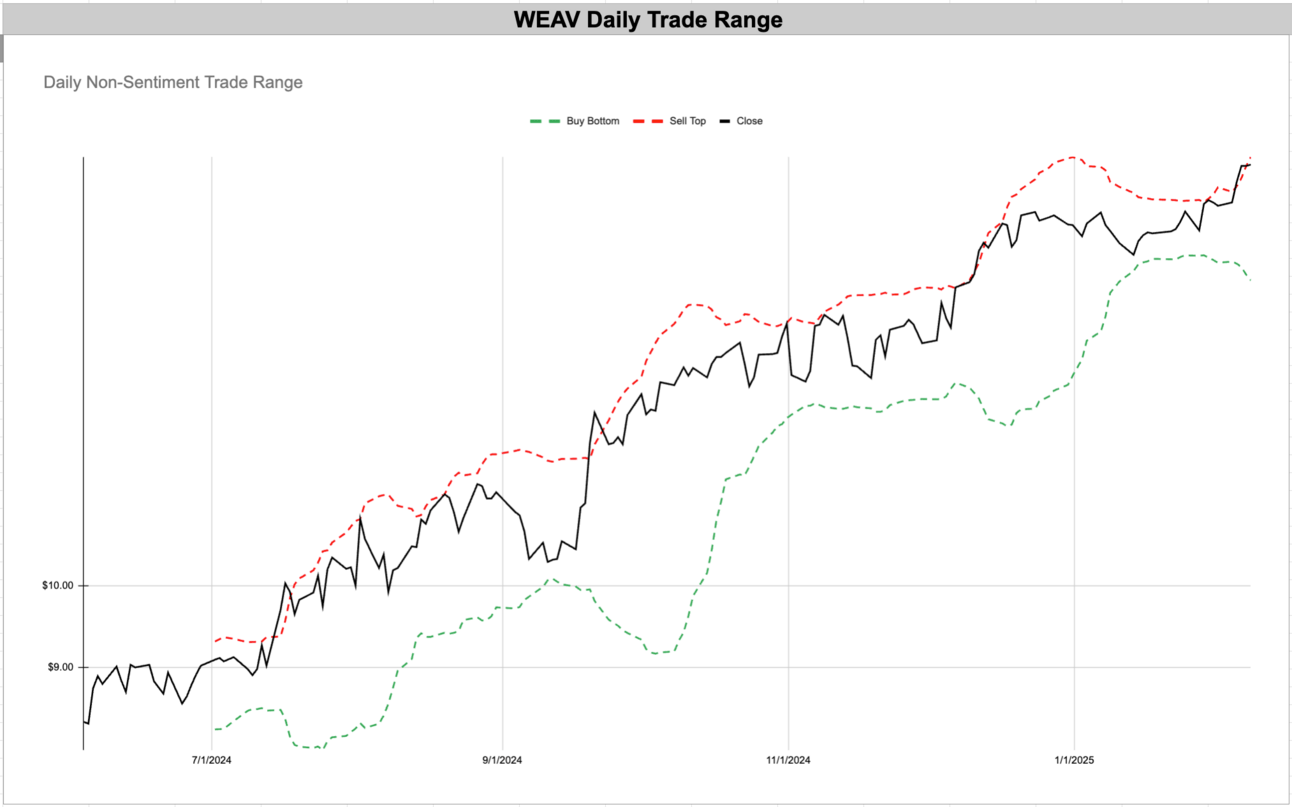

WEAV - Weave Communications Inc - Healthcare - USA 🇺🇸

CNTA - Centessa Pharmaceuticals plc ADR - Healthcare - United Kingdom 🇬🇧

TVTX - Travere Therapeutics Inc - Healthcare - USA 🇺🇸

BB - BlackBerry Ltd - Technology - Canada 🇨🇦

ORLA - Orla Mining Ltd - Basic Materials - Canada 🇨🇦

MBI - MBIA Inc - Financial - USA 🇺🇸

ADTN - ADTRAN Holdings Inc - Technology - USA 🇺🇸

KGC - Kinross Gold Corp - Basic Materials - Canada 🇨🇦

EZPW - EZCorp, Inc - Financial - USA 🇺🇸

XPEV - XPeng Inc ADR - Consumer Cyclical - China 🇨🇳

WEAV - Weave Communications Inc - Healthcare - USA 🇺🇸

CNTA - Centessa Pharmaceuticals plc ADR - Healthcare - United Kingdom 🇬🇧

TVTX - Travere Therapeutics Inc - Healthcare - USA 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

META - Meta Platforms Inc - Communication Services - USA 🇺🇸

WMT - Walmart Inc - Consumer Defensive - USA 🇺🇸

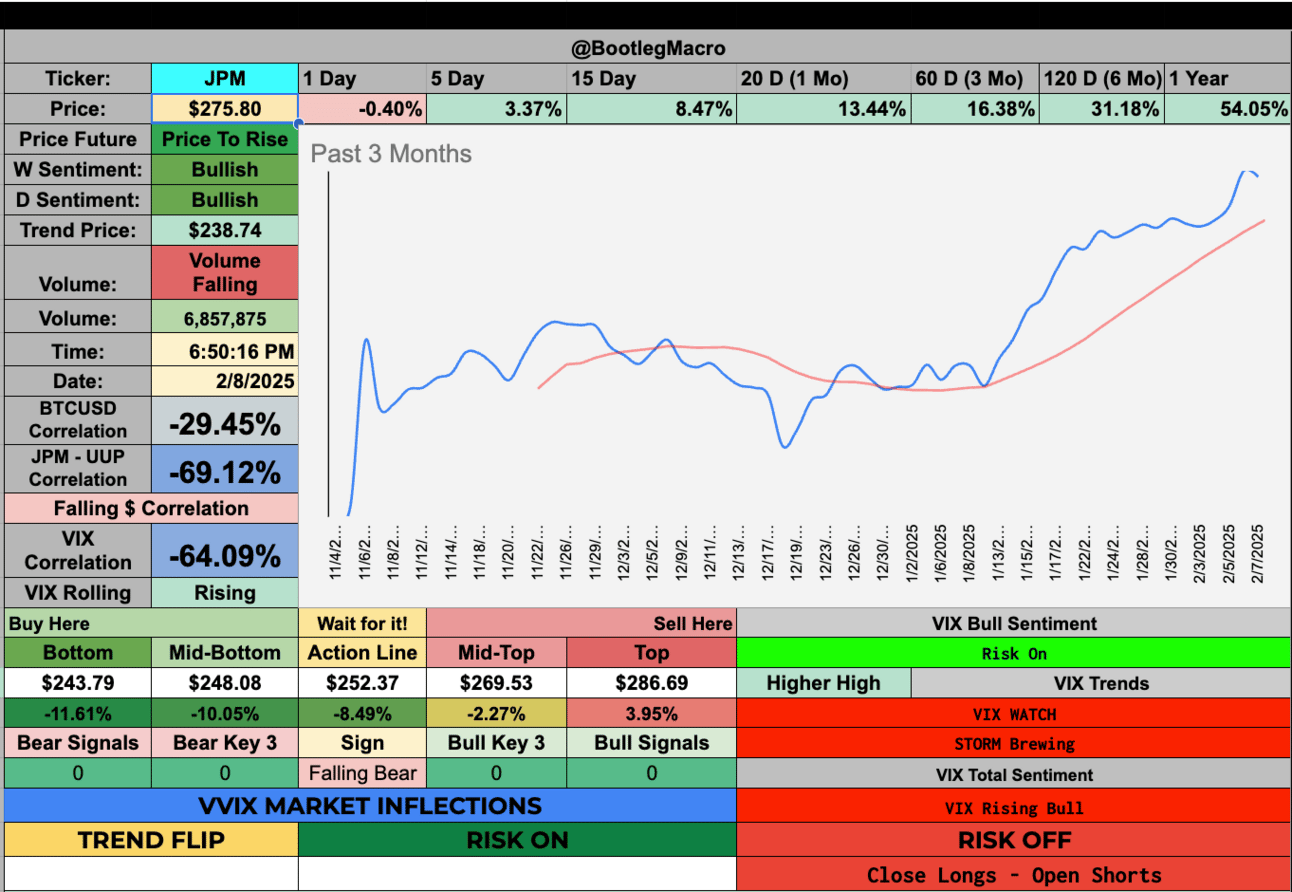

JPM - JPMorgan Chase & Co - Financial - USA 🇺🇸

NFLX - Netflix Inc - Communication Services - USA 🇺🇸

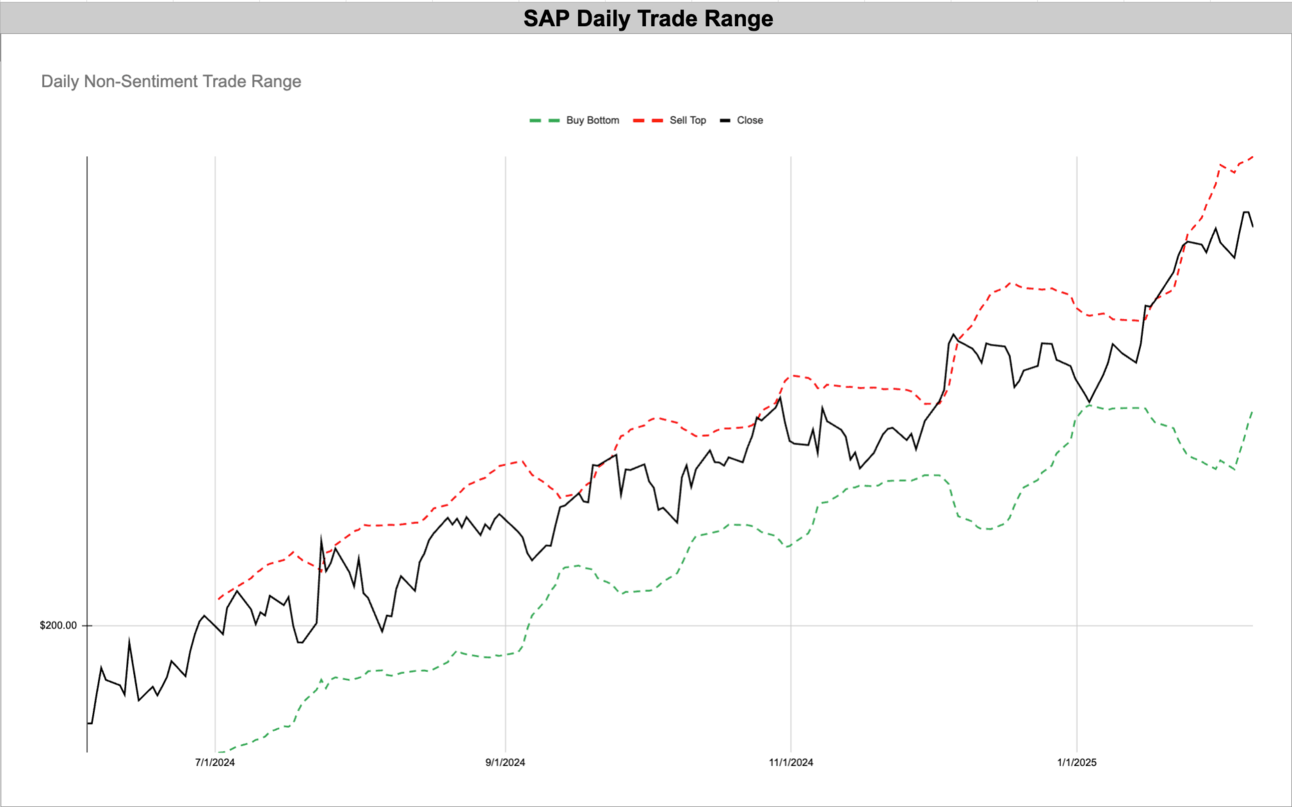

SAP - Sap SE ADR - Technology - Germany 🇩🇪

TMUS - T-Mobile US Inc - Communication Services - USA 🇺🇸

PLTR - Palantir Technologies Inc - Technology - USA 🇺🇸

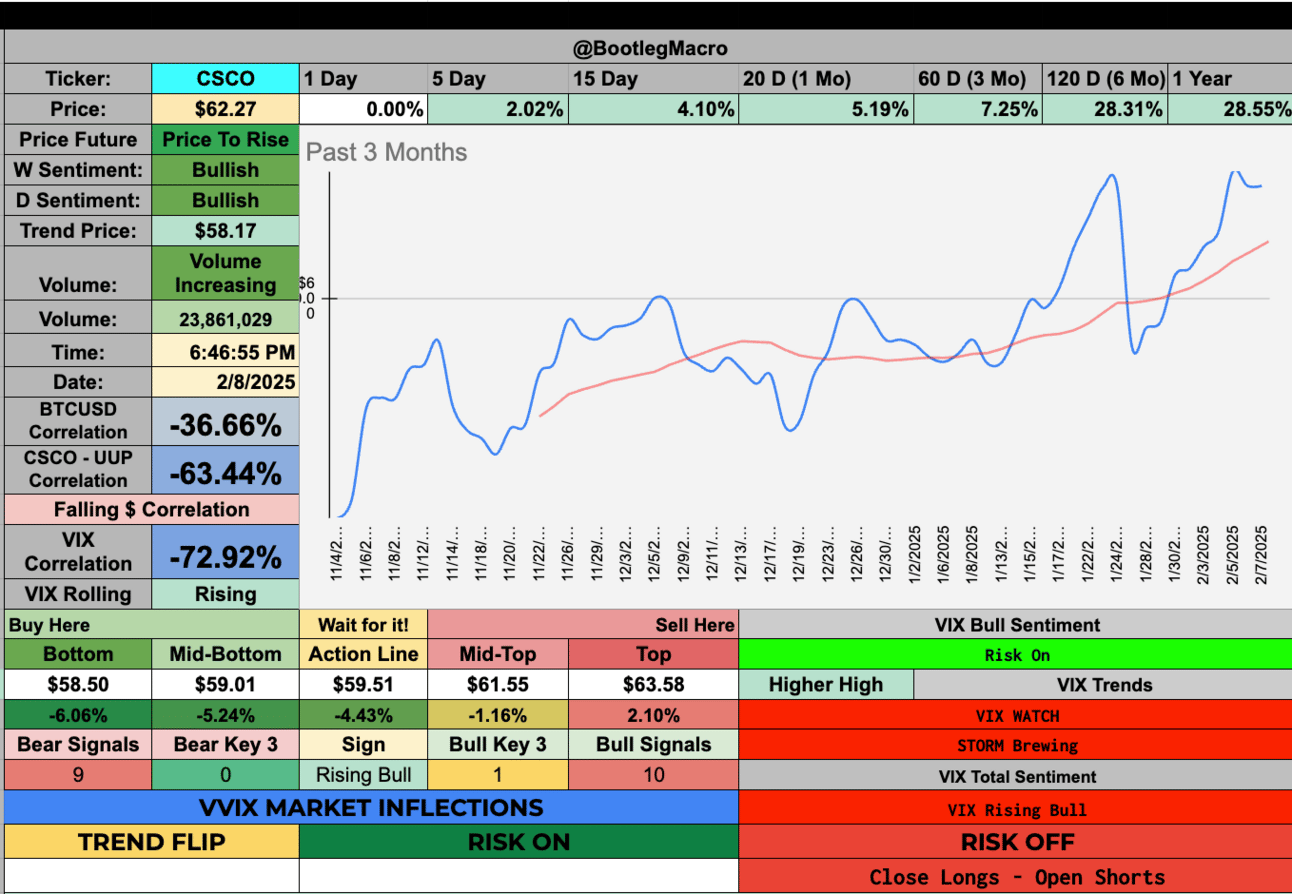

CSCO - Cisco Systems, Inc - Technology - USA 🇺🇸

MS - Morgan Stanley - Financial - USA 🇺🇸

GE - GE Aerospace - Industrials - USA 🇺🇸

META - Meta Platforms Inc - Communication Services - USA 🇺🇸

WMT - Walmart Inc - Consumer Defensive - USA 🇺🇸

JPM - JPMorgan Chase & Co - Financial - USA 🇺🇸

NFLX - Netflix Inc - Communication Services - USA 🇺🇸

SAP - Sap SE ADR - Technology - Germany 🇩🇪

TMUS - T-Mobile US Inc - Communication Services - USA 🇺🇸

PLTR - Palantir Technologies Inc - Technology - USA 🇺🇸

CSCO - Cisco Systems, Inc - Technology - USA 🇺🇸

MS - Morgan Stanley - Financial - USA 🇺🇸

GE - GE Aerospace - Industrials - USA 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro