- The New High Newsletter

- Posts

- Bearishness in August Ravaged The Stock Market, Is It Over?

Bearishness in August Ravaged The Stock Market, Is It Over?

The Bootleg Macro Stock Market MACRO INDICATOR In This Edition Gave A Crystal Clear Answer. Read Here.

👋 Welcome back. September 17th! 🍁 Can you believe it? 😳

Homecoming season 🏈 is kicking off across the USA. I’m ready for fall, 🍁 I feel like a pumpkin 🎃 spice stock market ripper is upon us. What about you?

We have a lot of Uranium ☢️, Coking Coal and Oil/Gas 🛢️ names in the BREAKOUTS BELOW. What does it mean?

Industrials 🏭 are having a resurgence at all price points. Increased inflation brings VOLATILITY.

We’ve seen MASSIVE developments in the TURBULENCE indicator this week. The VOLATILITY CORNER has more but you may for this week at least appreciate the MICRO WEATHER ☀️ flip.

You’re probably thinking, “Say less”. I will.

Lets get into it.

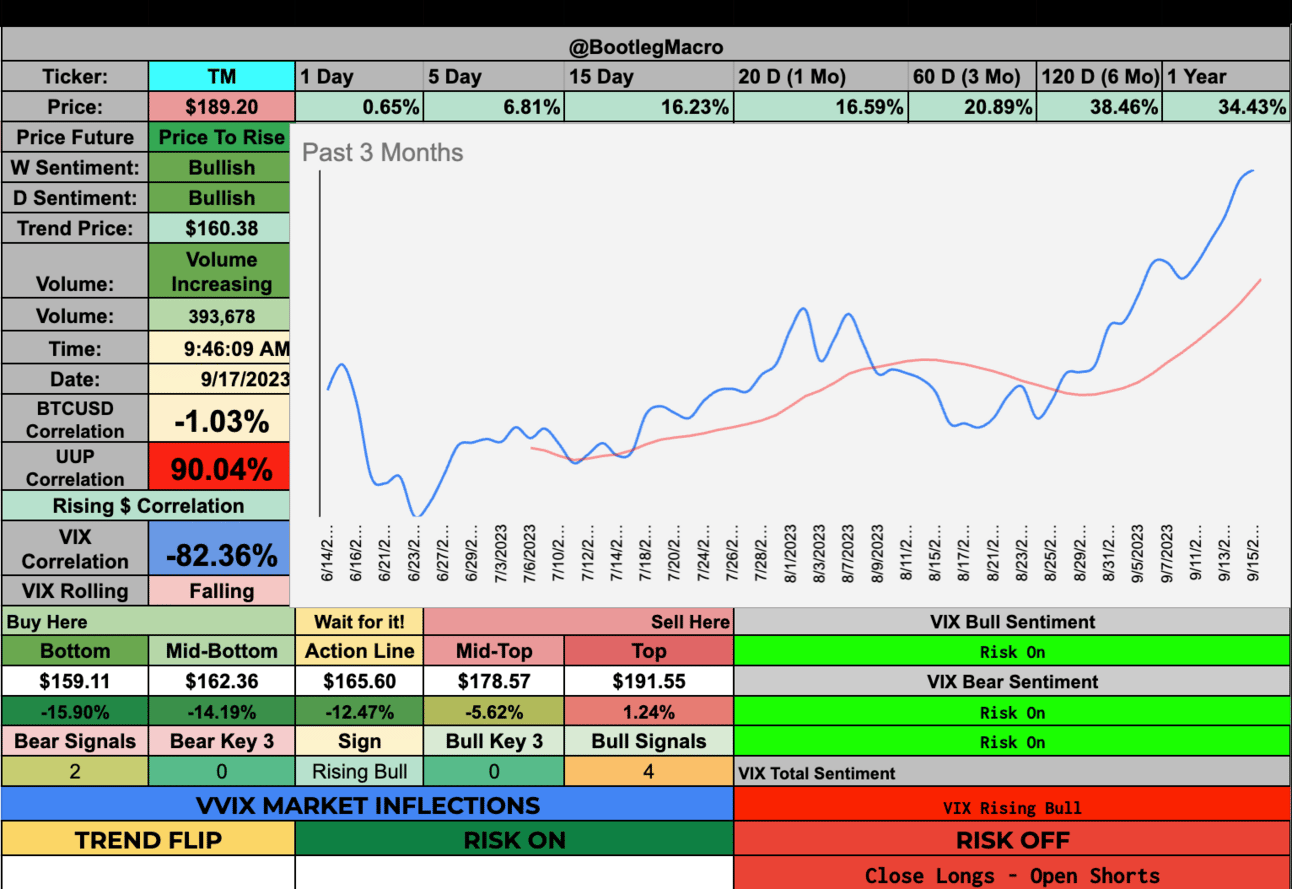

p.s.. if you read nothing else, Toyota Motors is at 52 week highs! (🇯🇵 🐂!)

Market Performance

Friday was bad. It’s wasn’t BULLISH 🐂. But we got an important indicator flip this week. Below on the VOLATILITY CORNER, you’ll see the MACRO INDICATOR. We saw BULL MARKET 🐂 action in the MICRO WEATHER ☀️, which is positive.

We can highlight POSITIVE ROLLING RETURNS beyond 1 Month for ALL INDEXES. 🐂

Indexes are reflecting the BULLS 🐂 coming back into the market.

More upside potential than downside for the SPY500

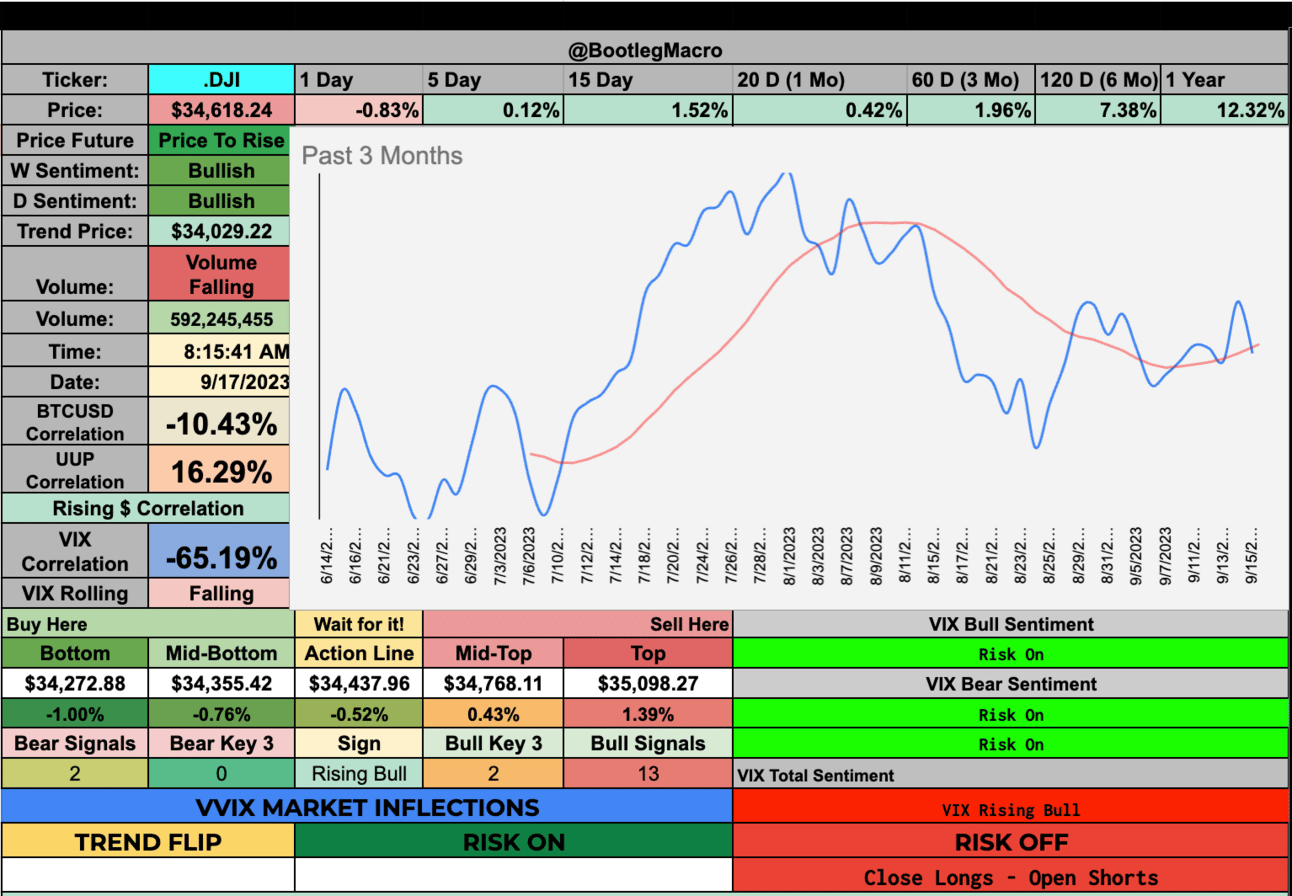

The 15 Day Moving Average is Rising for The DOW…and it’s BULLISH. Good Signs.

Nasdaq continues to show the most strength. We respect the 13.5k line and expect a bounce from here.

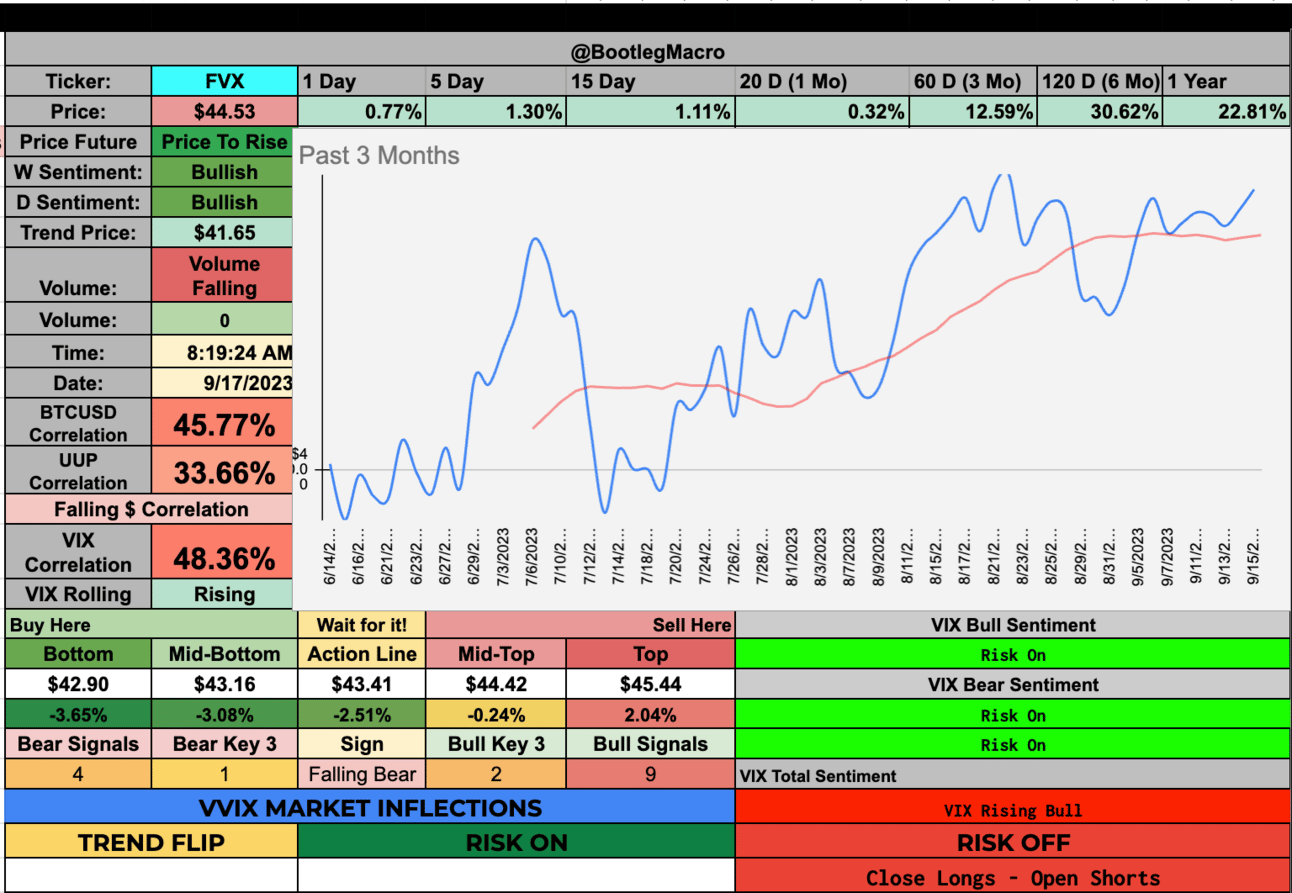

If this was a stock, would you buy it? Yeah, the 10-year yield continues to break out higher.

The 5-year yield continues to break out higher too.

Volatility Corner:

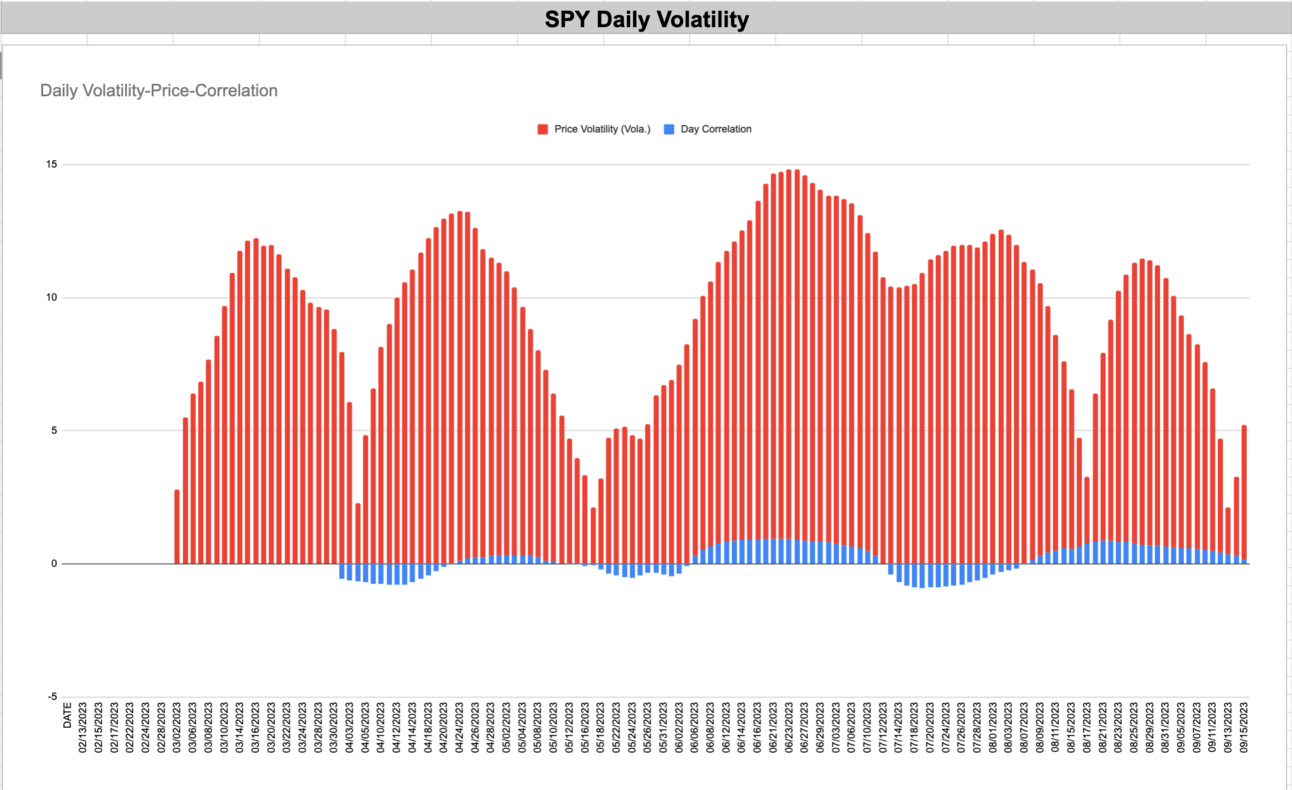

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. You see the up and down…we had a big move this week BOUNCING BACK BELOW the 10 Week, which isn’t a big deal now but we hope it can prove to break higher.

The market has been choppy but not down. All indexes are positive over their 15 Day and longer for their rolling returns. That’s a good signal considering how we saw the negative rolling returns in August 2023.

We expect BULLISH 🐂 action in the SHORT-TERM. This market will allow for CHOP 🪓 and RANGES.

VIX 15 day SMA is down and price is underneath. We could see a slow bleed 🩸 out of VOL down to 12.50 or a snap explosion.

MACRO INDICATOR:

MACRO SEASON: BULLISH Since 12/2/22🟢 🐂

MICRO WEATHER: BEARISH Since 9/11/23🟢***(Never Forget 🇺🇸) 🐂

US Index ETF Review:

SPY 🐂

This is BULLISH but it’s not the strongest move.

Trend: BULLISH Since 8/31/23🟢

Trade Signal: Go LONG Since 9/1/23🟢

Future Price Path: Price to RISE Since 9/1/23🟢

SPY Volatility, reset and correlation is diving, I’d expect a sharp move down then sideways.

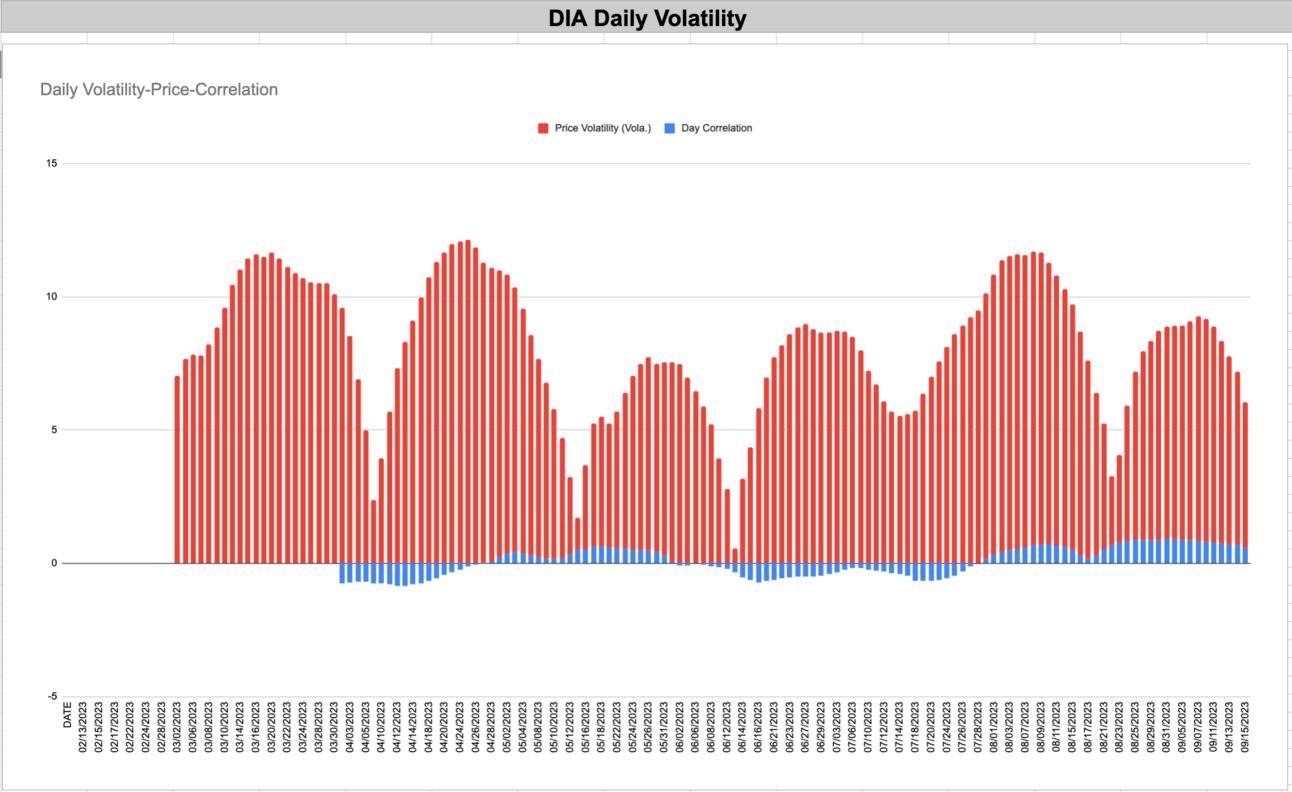

DIA 🐂

DIA is the strongest index but has the smallest range. It’s BULLISH as inflation comes back and commodites / industrials have pricing power.

Trend: BULLISH Since 9/1/23🟢

Trade Signal: Neutral Since 9/12/23🟡

Future Price Path: RISE Since 9/14/23🟢***

Volatility is falling while correlation is falling, this is what makes a PRICE to RISE SIGNAL.

Very tight TRADE RANGE. This will resolve and it should be violent when volatility resets…this week maybe a place to buy before the breakout.

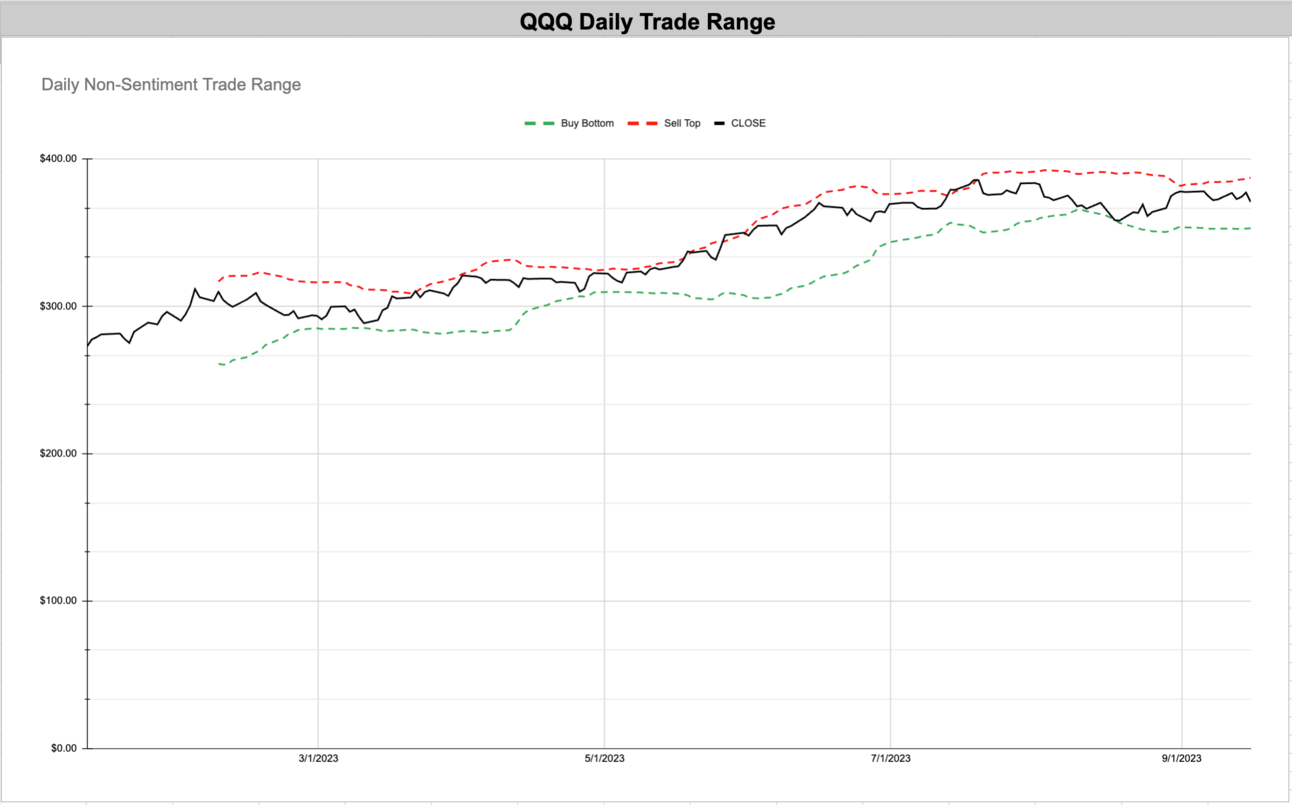

QQQ 🐂

Tech continues to show the biggest range. Everything looks like we are ready to run into October.

Trend: BULLISH Since 8/31/23🟢

Trade Signal: NEUTRAL Since 9/15/23🟡***

Future Price Path: FALL Since 7/28/23**🛑

Volatility has started to breakout. Correlation is negative, we could see down ward then upward moves rapidly over the next 5-10 days.

Flat range for now but it’s starting to go higher. The VOLATILITY BREAKOUT is appreciated to make this TRADE RANGE turn BULLISH.

IWM 🐻

Small Caps are giving a bad signal. Overall, we want to see these participate but they won’t join the party. Unfortunate for now.

Trend: Bearish Since 8/16/23🛑

Trade Signal: NEUTRAL/SHORT Since 9/15/23🟡🛑***

Future Price Path: FALL Since 9/14/23🛑***

Volatility is falling while correlation is rising, that’s a negative.

TRADE RANGE is lower and lower. Not a good signal.

Enjoying this?

& Invite a friend.

New Highs $5-$20:

WIT - Information Technology Services (India 🇮🇳)

UEC - Uranium 🇺🇸

NXE - Uranium (Canada 🇨🇦)

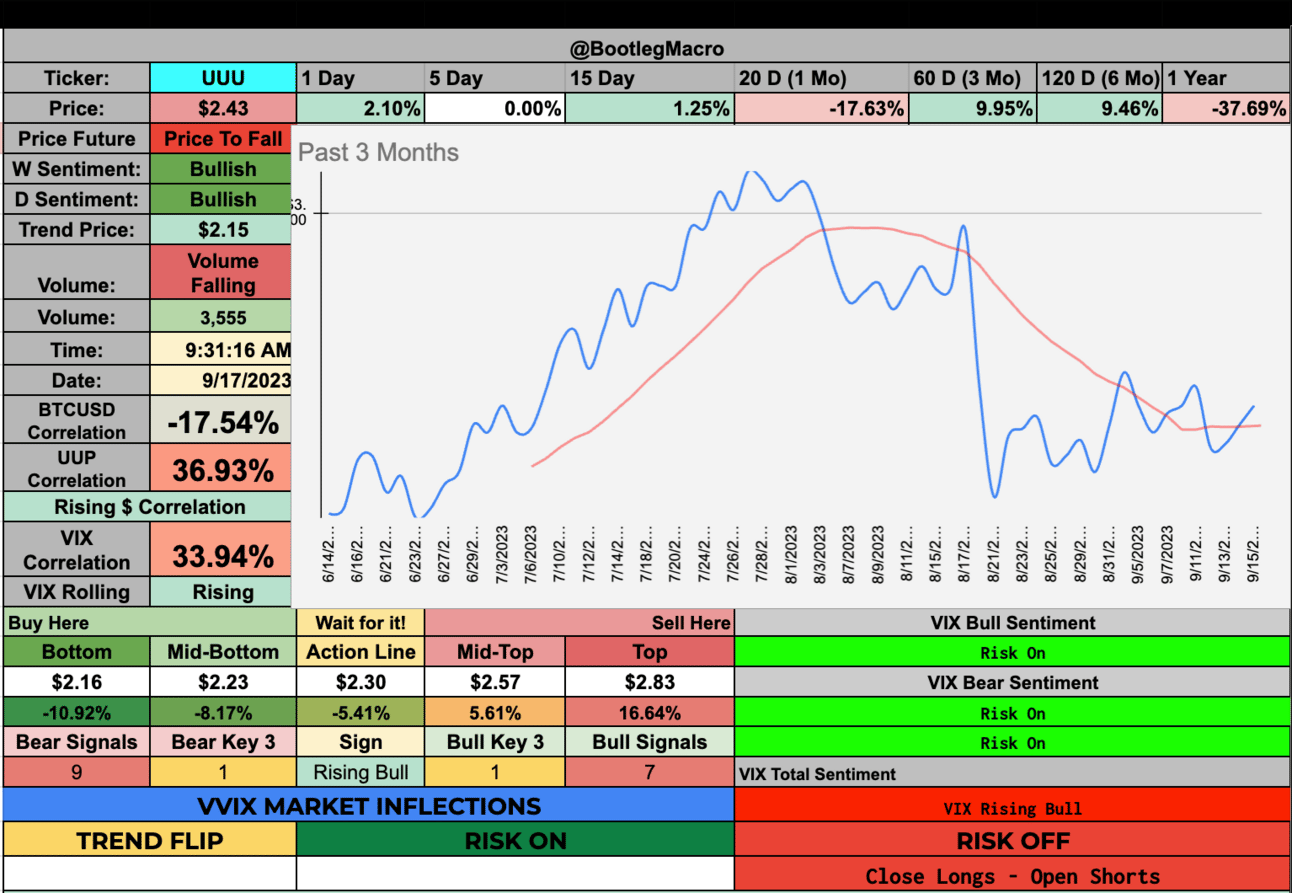

UUU - Uranium 🇺🇸

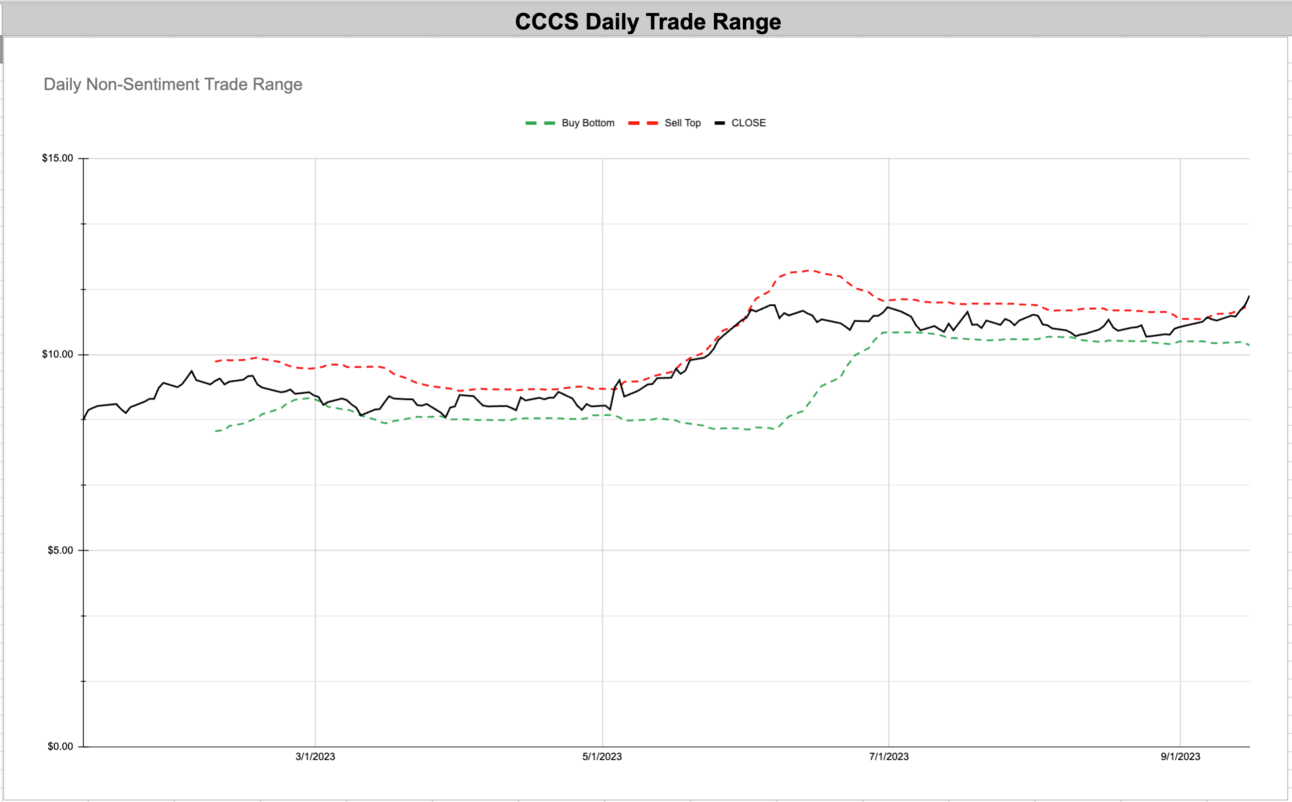

CCCS - Software - Infrastructure 🇺🇸

SBS - Utilities - Regulated Water 🇺🇸

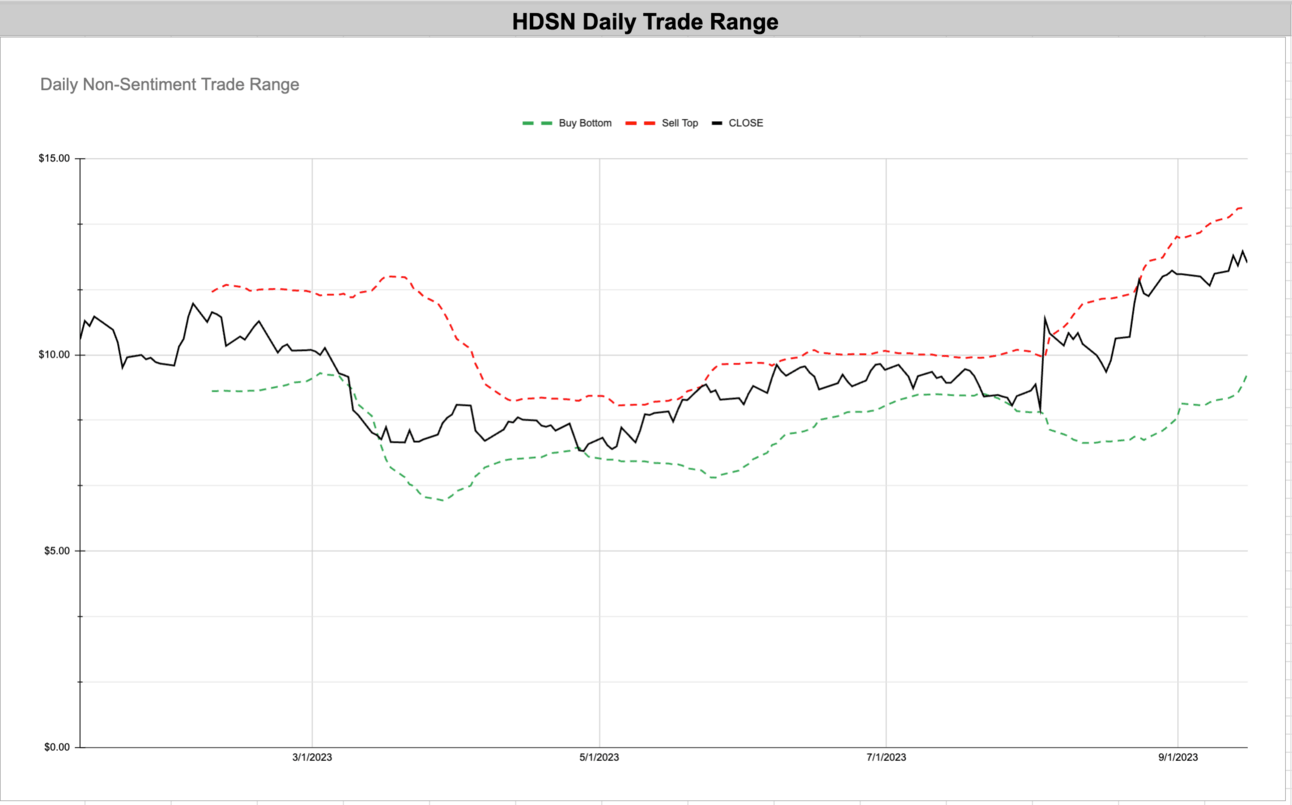

HDSN - Specialty Chemicals 🇺🇸

EC - Oil & Gas Integrated (Columbia)

CDLX - Advertising Agencies 🇺🇸

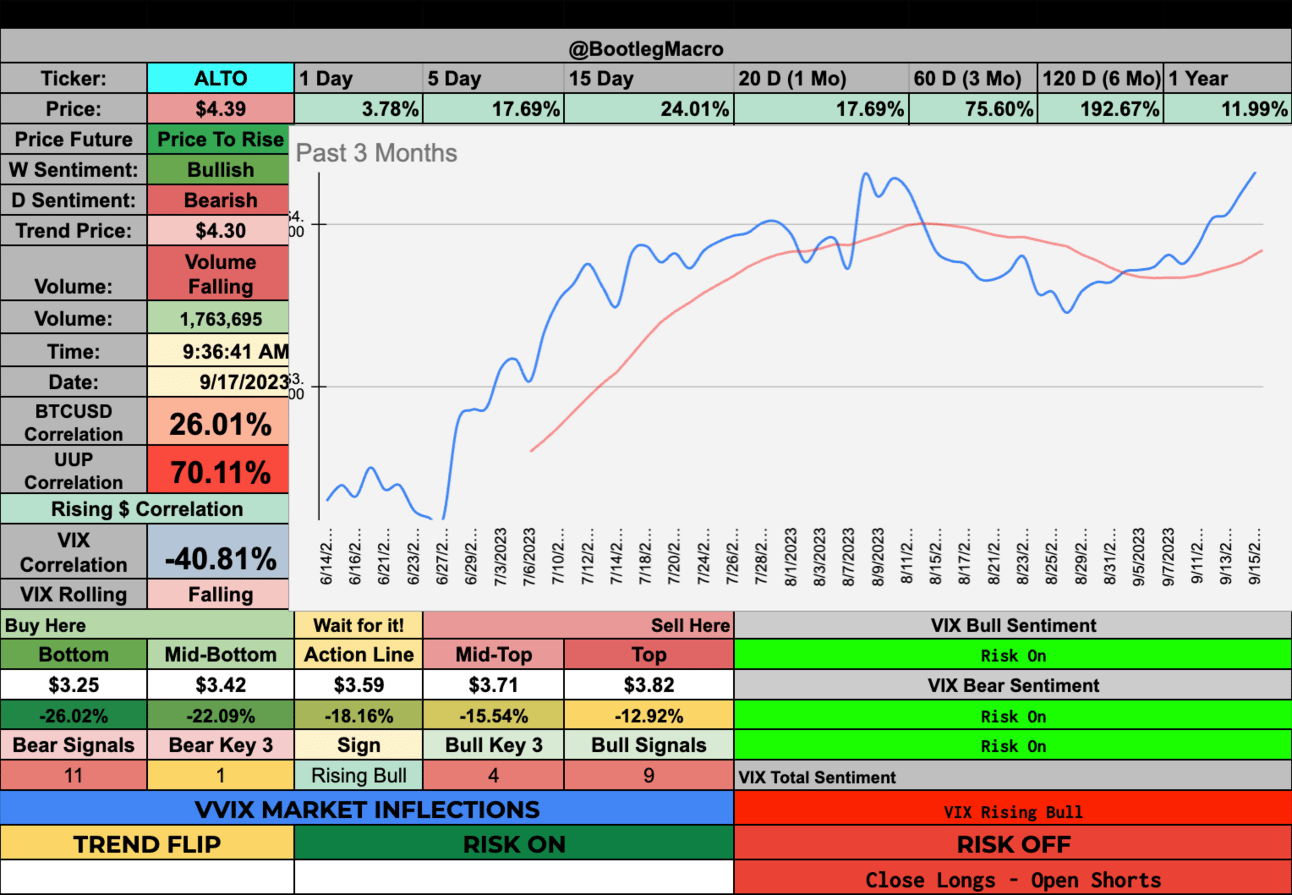

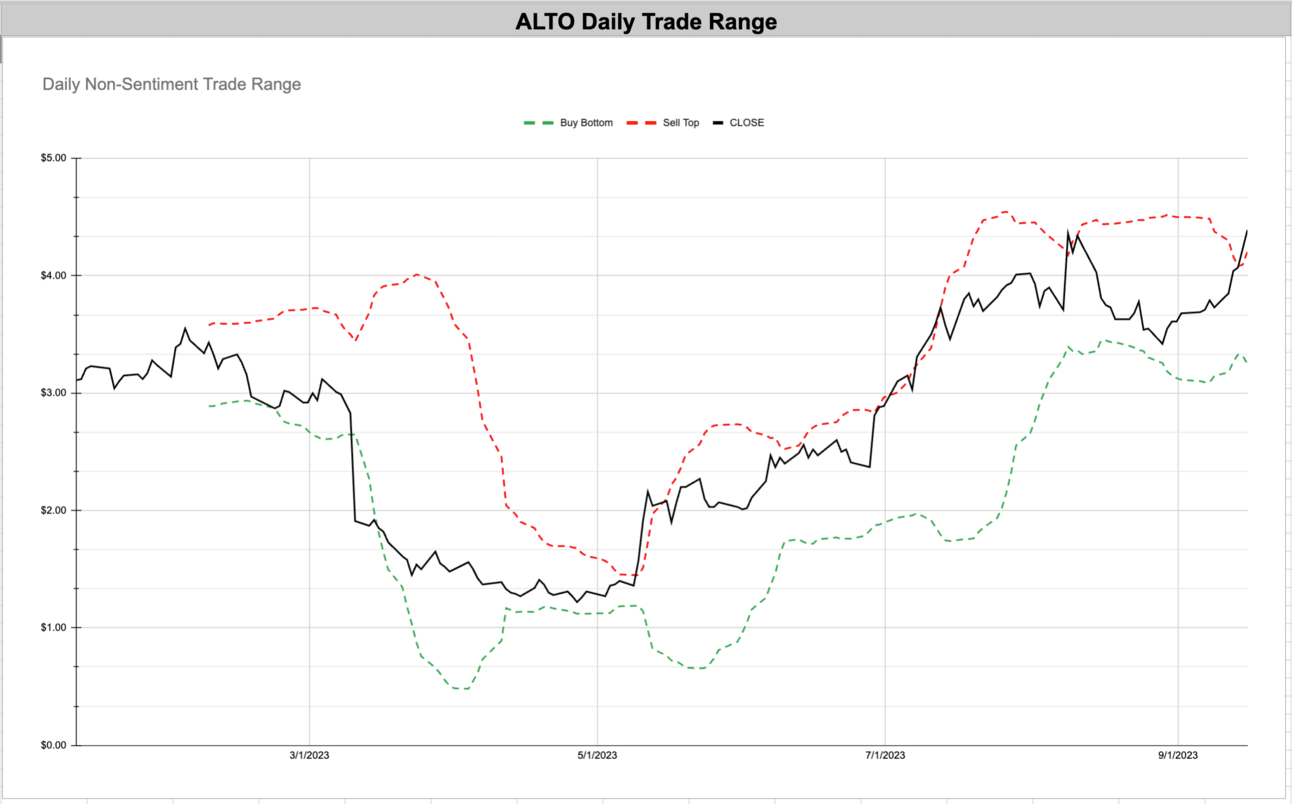

ALTO - Specialty Chemicals 🇺🇸

URG - Uranium 🇺🇸

WIT - Information Technology Services (India 🇮🇳)

UEC - Uranium 🇺🇸

NXE - Uranium (Canada 🇨🇦)

UUU - Uranium 🇺🇸

CCCS - Software - Infrastructure 🇺🇸

SBS - Utilities - Regulated Water 🇺🇸

HDSN - Specialty Chemicals 🇺🇸

EC - Oil & Gas Integrated (Columbia)

CDLX - Advertising Agencies 🇺🇸

ALTO - Specialty Chemicals 🇺🇸

URG - Uranium 🇺🇸

Enjoying this?

& Invite a friend.

New Highs $20+:

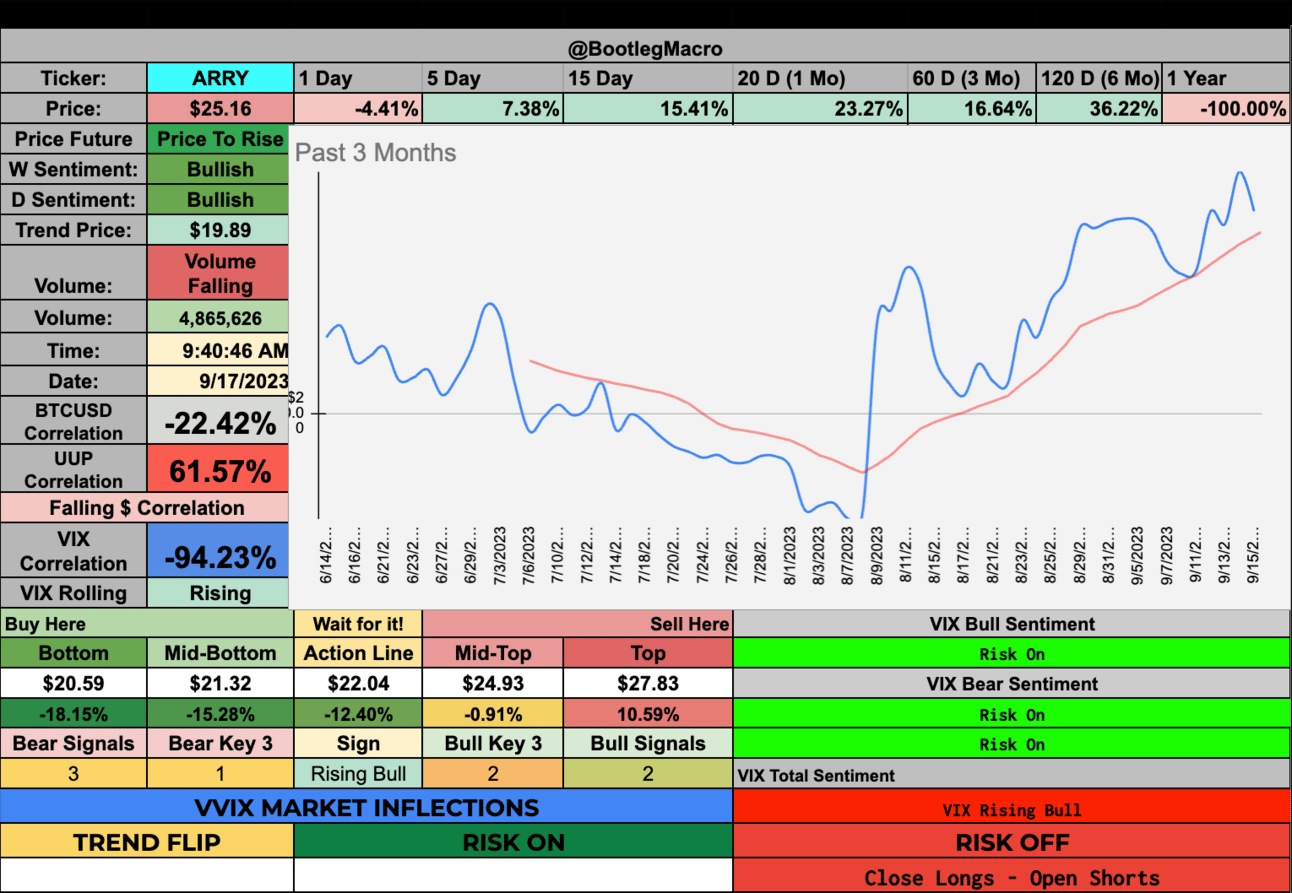

ARRY - Solar 🇺🇸

MNSO - Specialty Retail (China 🇨🇳)

CTAS - Specialty Business Services 🇺🇸

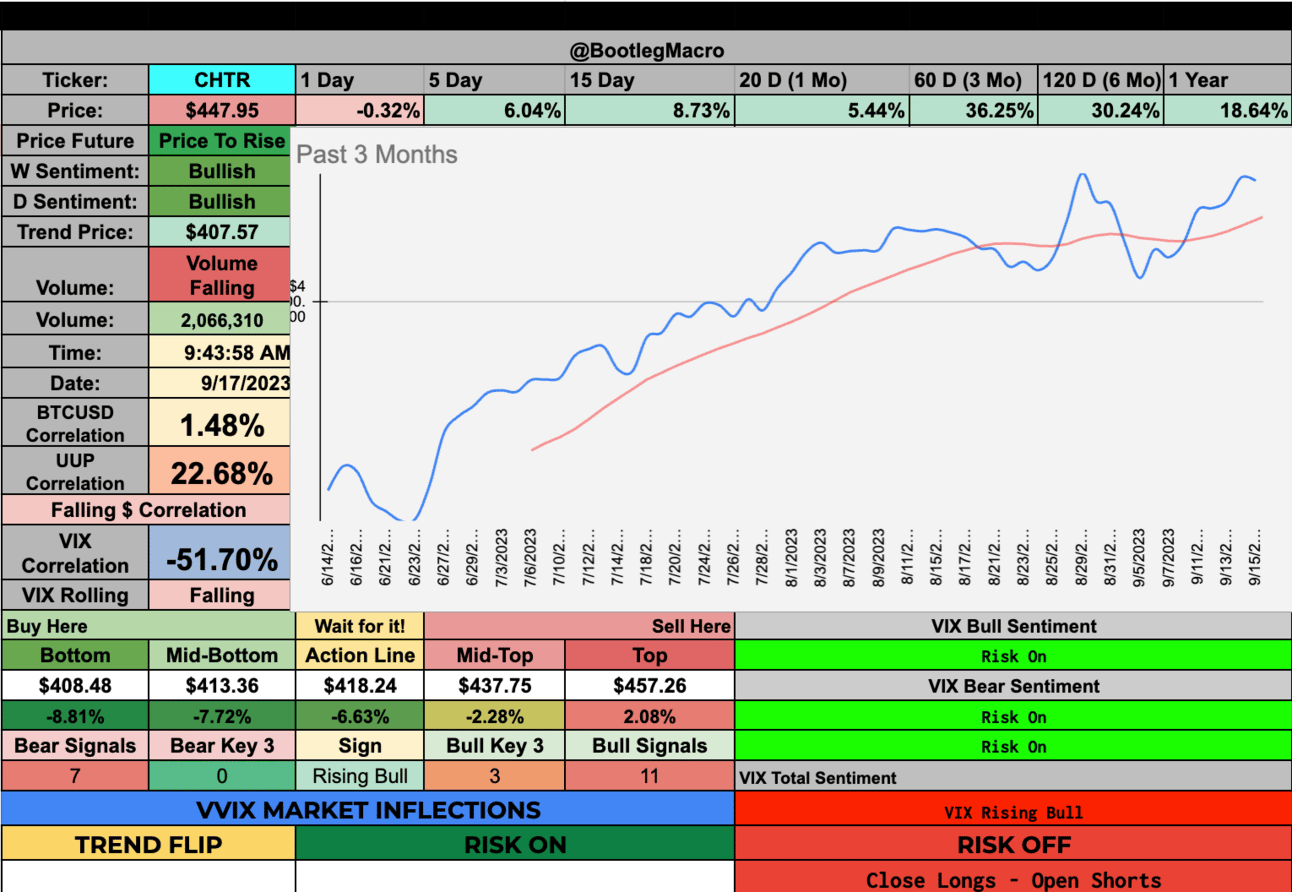

CHTR - Telecom Services 🇺🇸

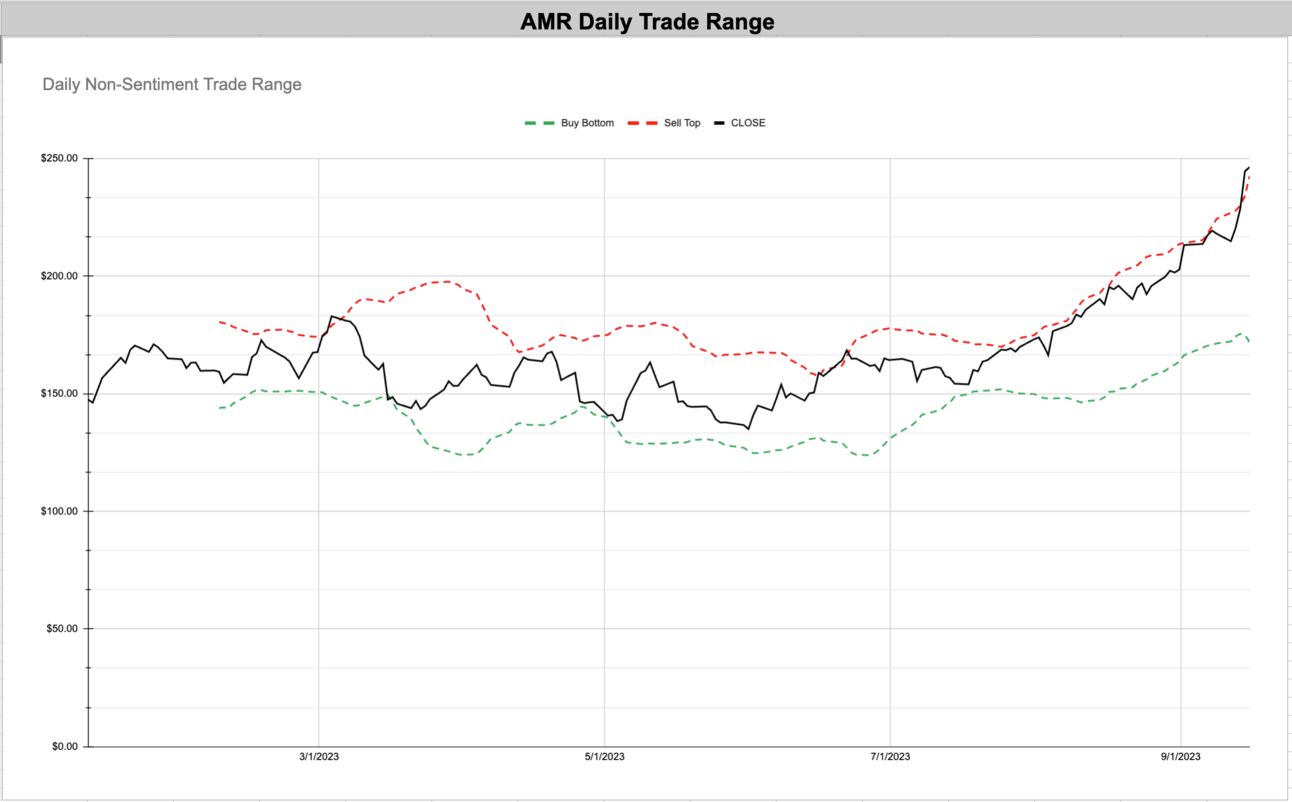

AMR - Coking Coal 🇺🇸

TM - Auto Manufacturers (Japan 🇯🇵)

ARCH - Coking Coal 🇺🇸

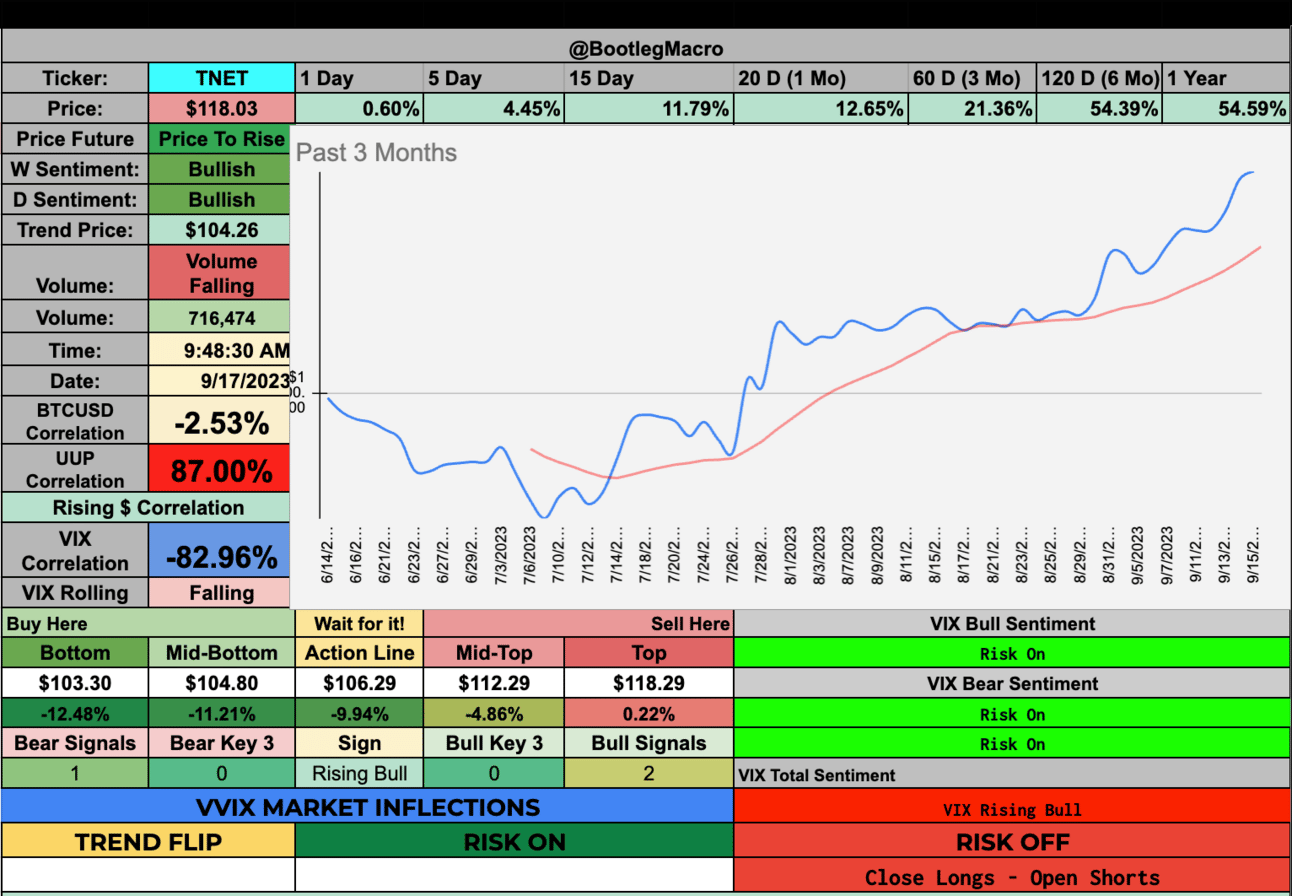

TNET - Staffing & Employment Services 🇺🇸

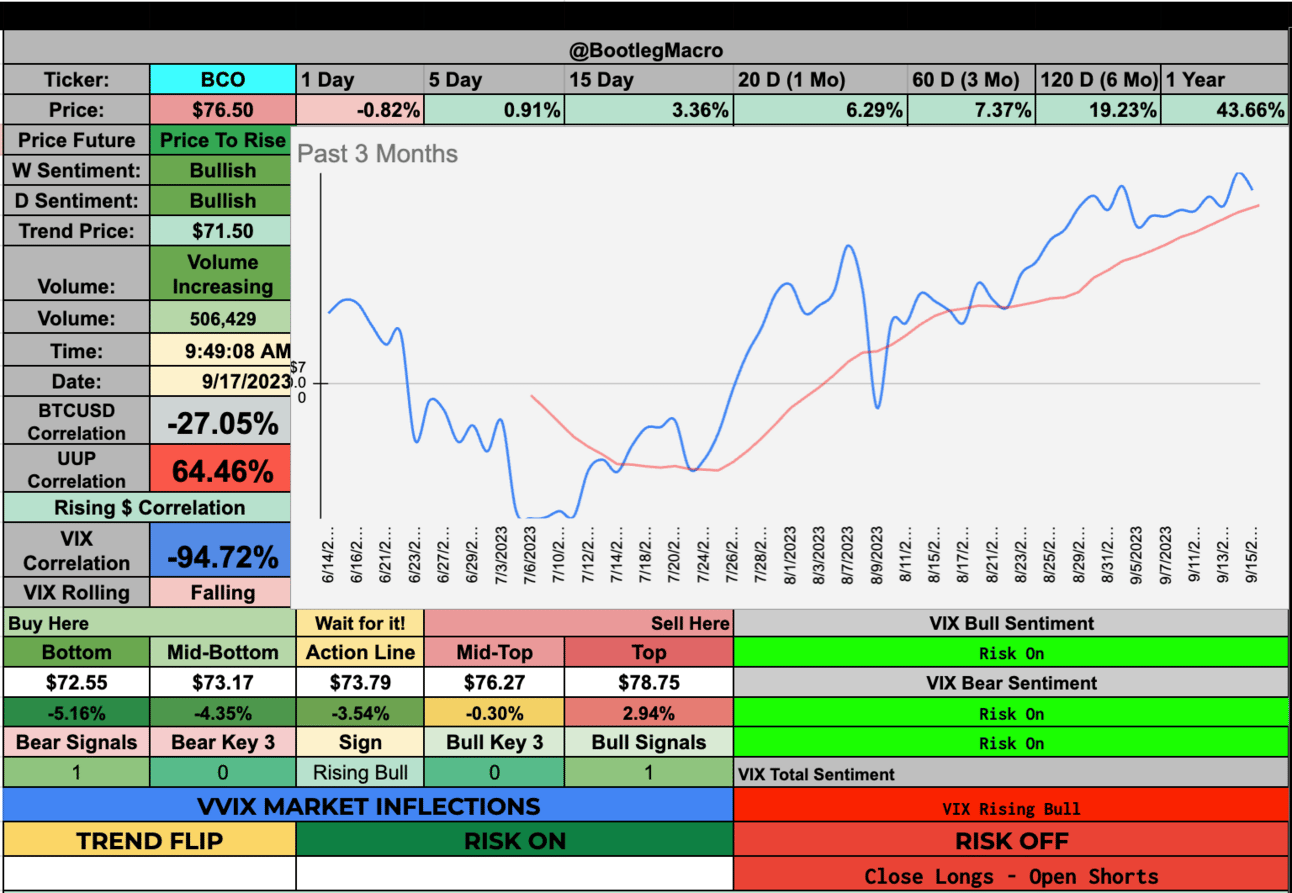

BCO - Security and Protection Services 🇺🇸

LEU - Uranium 🇺🇸

XPRO - Oil and Gas Equipment Services 🇺🇸

RELY - Software - Infrastructure 🇺🇸

ARRY - Solar 🇺🇸

MNSO - Specialty Retail (China 🇨🇳)

CTAS - Specialty Business Services 🇺🇸

CHTR - Telecom Services 🇺🇸

AMR - Coking Coal 🇺🇸

TM - Auto Manufacturers (Japan 🇯🇵)

ARCH - Coking Coal 🇺🇸

TNET - Staffing & Employment Services 🇺🇸

BCO - Security and Protection Services 🇺🇸

LEU - Uranium 🇺🇸

XPRO - Oil and Gas Equipment Services 🇺🇸

RELY - Software - Infrastructure 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

$META - Big fan right now. Good time to buy in with these signals.

Could be a fake out but I see BULLISH SIGNALS all over $META

— Bootleg Macro (@bootlegmacro)

2:02 AM • Sep 14, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro