- The New High Newsletter

- Posts

- 18 New Highs to Remind You - It's a Bull Market

18 New Highs to Remind You - It's a Bull Market

It's hard to prepare for a bear market when we're hitting all time highs! Should I pack a snow jacket for July in Arizona? Be smart, trust the temperature and trust price action. Higher we go!

Well… this might be coming in a tad behind schedule ⏱️, but let's be real - this market’s wild swings 📈🎢 are handing out second chances like candy 🍬! So here's the million-dollar question 💰: How on earth do we brace for a bear market 🐻 when we're busy setting off fireworks 🎆 with all-time highs?" 🚀🤔

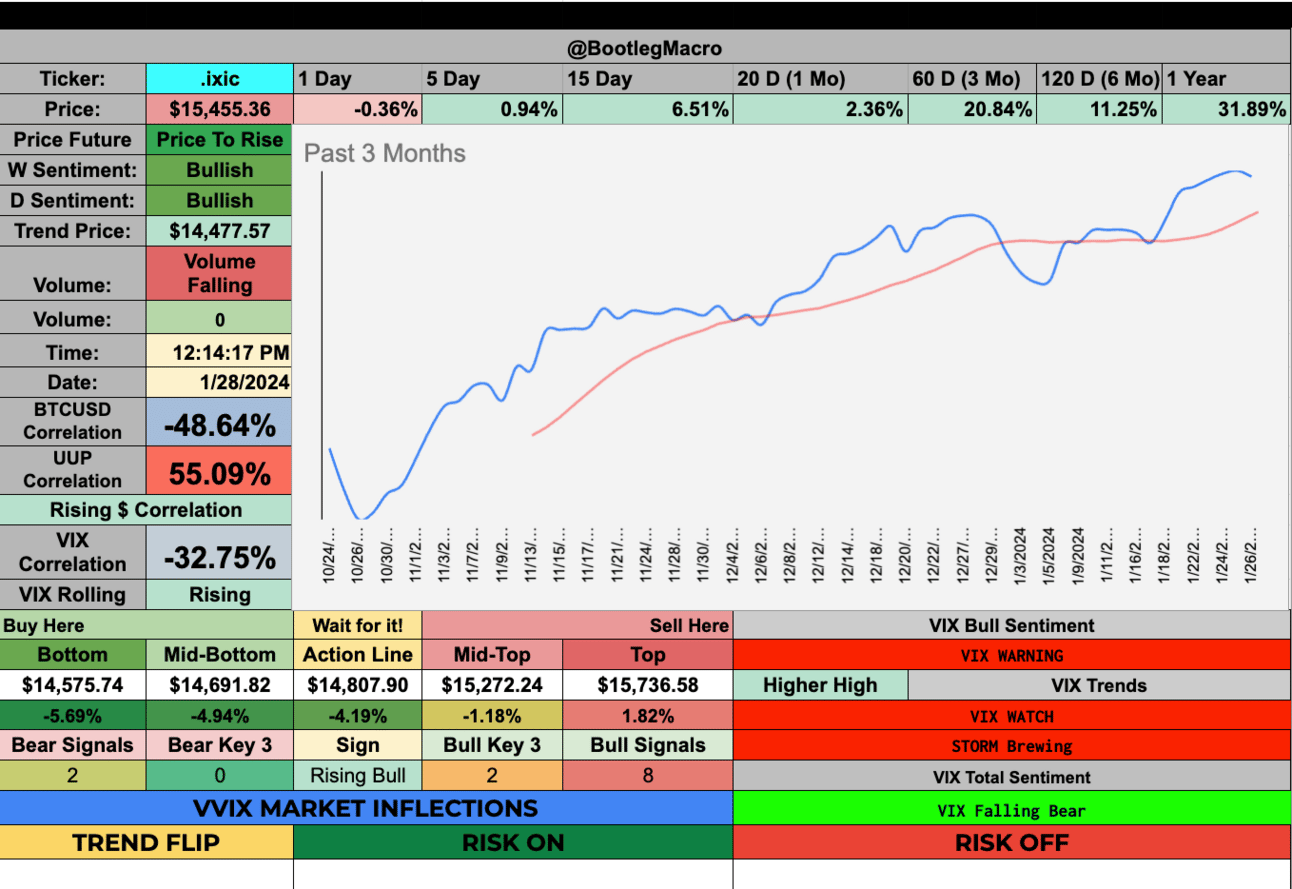

Nasdaq was up 0.94%, S&P500 was up 1.06% and DJIA was up 0.65% for the week. We are hitting or flirting with all-time-highs in all 3 indexes.

Alright, bear buddies 🐻, let's try to square this circle 🔵⬜. We're blasting off 🚀 to escape velocity, and even the little guys (I'm looking at you, small caps) are in on the action. Keep an eye on $IWM; it's flirting with that enticing $200 mark. 🎯 And let's not forget, small caps have been the underdogs 🐕🦺.

Isn't it time we tip our hats 🎩 to the science of the markets? Sometimes, the only research we need is watching the price action 💹. The truth lies in the ticker, and folks, those numbers are climbing 📈.

So gear up 🧳 and raise a toast 🥂 to the grand finale of January 2024 – may the markets be ever in our favor!

Market Performance

Roll out the green carpet 🌟—all indexes are up this week, keeping the bull market charging 🐂 since Halloween 2023 🎃 (or Christmas 2022 🎄 for the long-term visionaries). Trading's as easy as pie 🥧 right now.

Hitting a snag? Scoop up the front-runners 🏃♂️💨 and play the waiting game 🕰️—patience is key 🔑. I mean, who's been left in the red with NVDA or MSFT these last 6 months? That's right, no one! 🚫💸 So, there's no reason you should be the first.

The market's tossing out hints like confetti 🎉. Our strategy? Watch patiently 🧐, strike when the iron's hot 🔥, and rinse and repeat 🔄. With the VIX lounging below $15, we've got a tailwind that's smooth sailing ⛵.

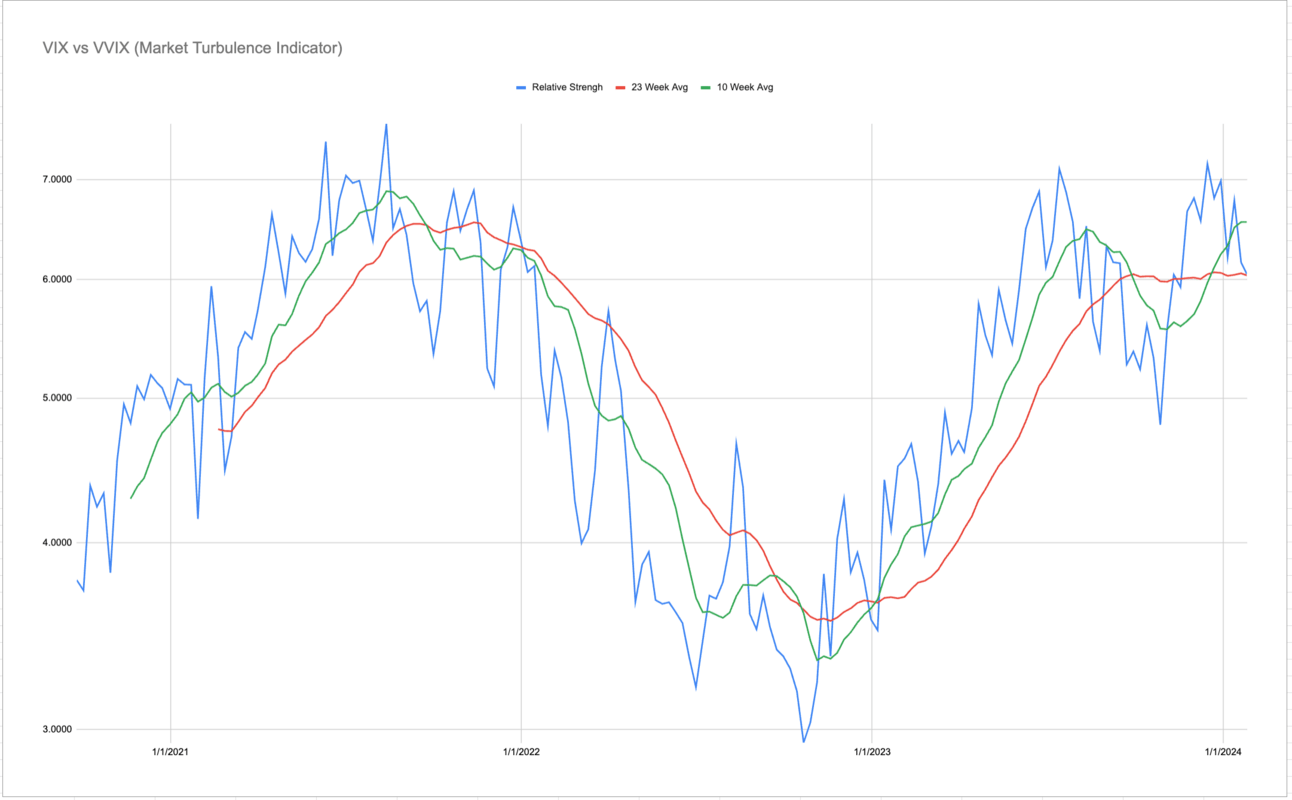

Volatility Corner:

VIX / VVIX improved! Blue up is good, blue down is bad. The blue line has a HIGH CORRELATION to overall markets. We need to respect the possibility the blue line goes south again.

Get ready for a bit of a rollercoaster ride 🎢, folks! We've seen the VIX doing the jitterbug lately, but let's not treat it like some sort of crystal ball ⏳ for the market's moves.

A little shake-up doesn't mean we're off the rails. Volatility might just hang out at the 'new normal' high—no biggie. The magic word? Patience 🧘♂️. We've watched volatility take a dive over the last three weeks, and who says we can't cozy up to a chill sub-12 vibe? 📉

But hey, if the market decides to throw a month-end sale 🛍️, that's our ticket to hop on the bull market express 🐂.

So, let's keep our eyes peeled 👀 and see what this week unfolds. Stay alert, stay smart, and let the market do the talking!" 🗣️📈

MACRO INDICATOR:

This is currently flashing bearish for the macro view too. We must be aware but still follow price.

MACRO SEASON: BULLISH Since 12/2/22🟢

MICRO WEATHER: BEARISH Since 7/27/23🛑

Enjoying this?

& Invite a friend.

New Highs $5-$20:

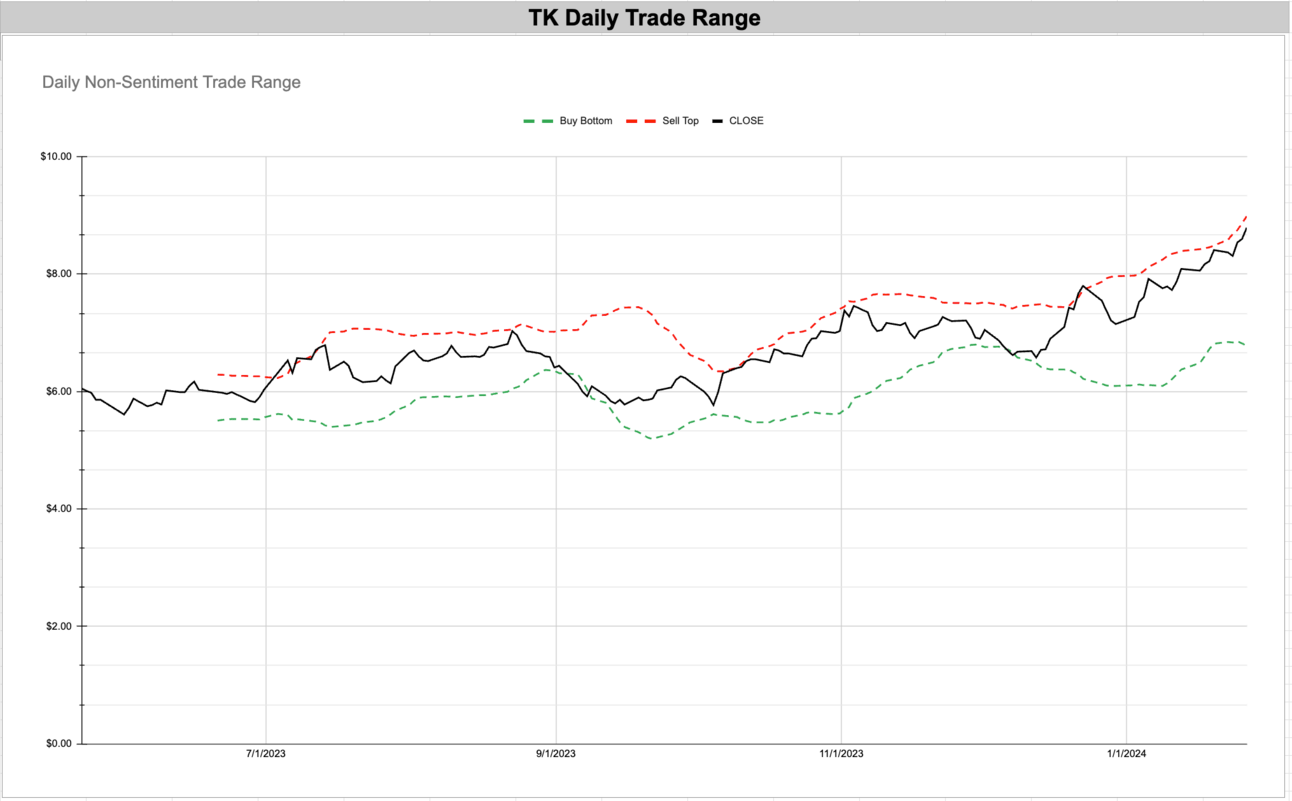

TK - Teekay Corporation - Energy - Oil & Gas Midstream - 🇧🇲

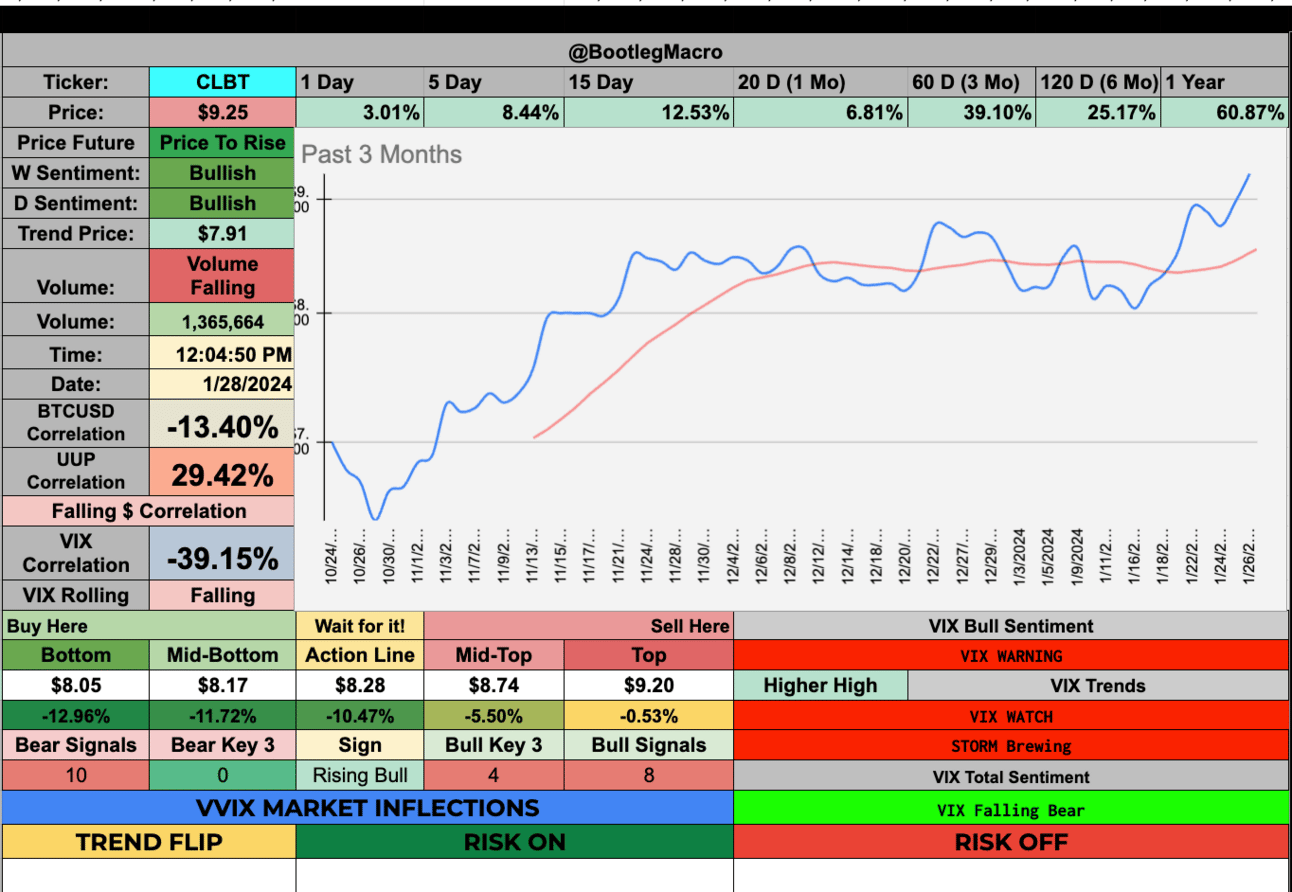

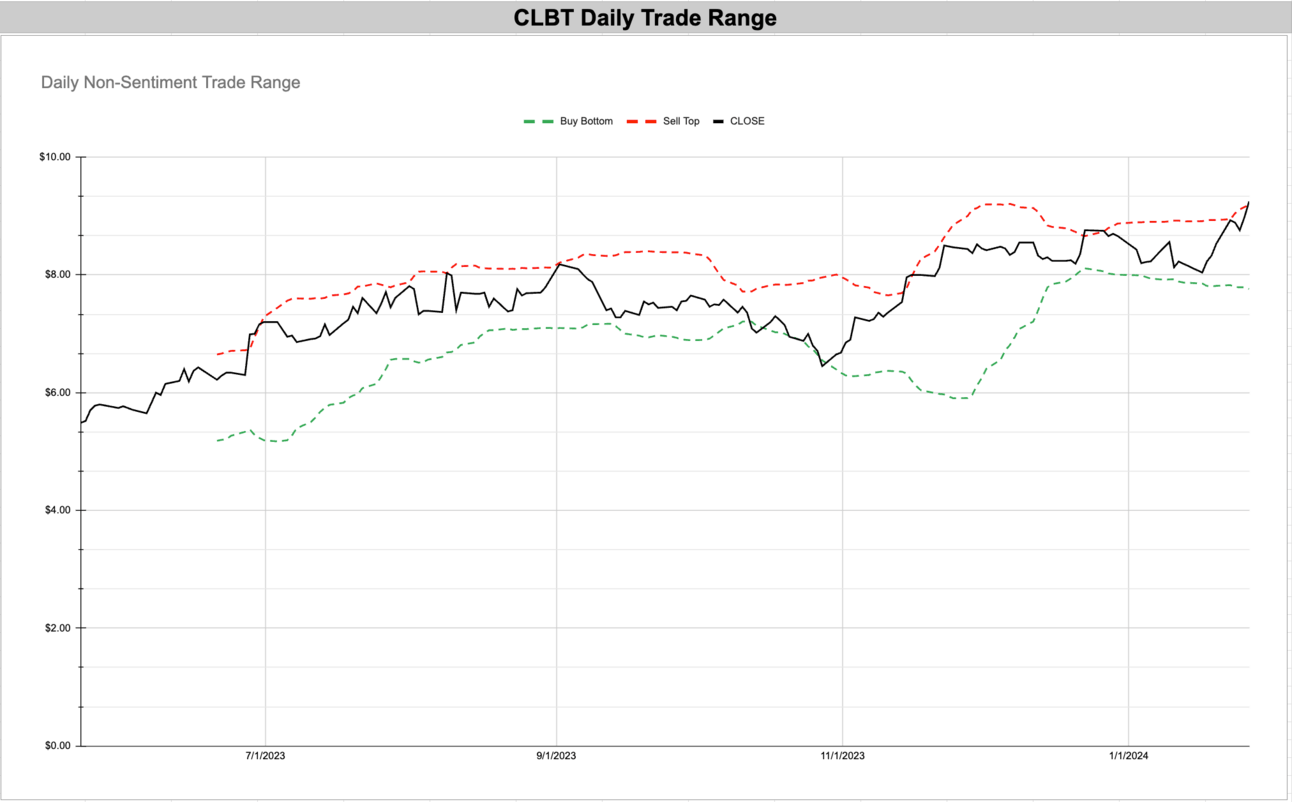

CLBT - ClearBridge All Cap Growth ETF - (Industry not applicable for ETFs) - 🇺🇸

NU - Nu Holdings Ltd. - Financial - Software—Infrastructure - 🇧🇷

FUSN - Fusion Pharmaceuticals Inc. - Healthcare - Biotechnology - 🇺🇸

PAGP - Plains GP Holdings - Energy - Oil & Gas Midstream - 🇺🇸

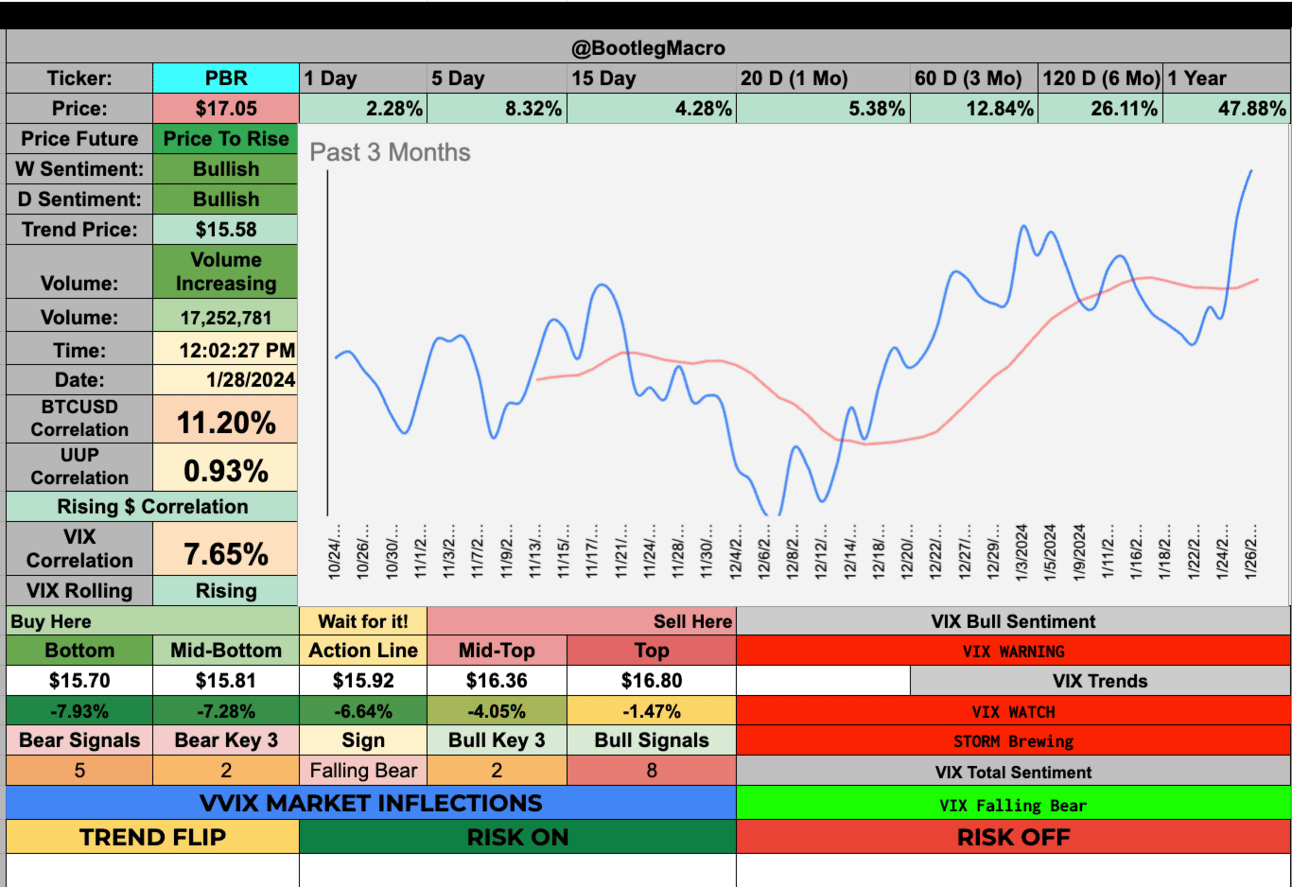

PBR - Petrobras - Energy - Oil & Gas Integrated - 🇧🇷

AKR - Acadia Realty Trust - Real Estate - REIT - Retail - 🇺🇸

MTG - MGIC Investment Corp - Financial - Mortgage Finance - 🇺🇸

TK - Teekay Corporation - Energy - Oil & Gas Midstream - 🇧🇲

CLBT - ClearBridge All Cap Growth ETF - 🇺🇸

NU - Nu Holdings Ltd. - Financial - Software—Infrastructure - 🇧🇷

FUSN - Fusion Pharmaceuticals Inc. - Healthcare - Biotechnology - 🇺🇸

PAGP - Plains GP Holdings - Energy - Oil & Gas Midstream - 🇺🇸

PBR - Petrobras - Energy - Oil & Gas Integrated - 🇧🇷

AKR - Acadia Realty Trust - Real Estate - REIT - Retail - 🇺🇸

MTG - MGIC Investment Corp - Financial - Mortgage Finance - 🇺🇸

& Invite a friend.

New Highs $20+:

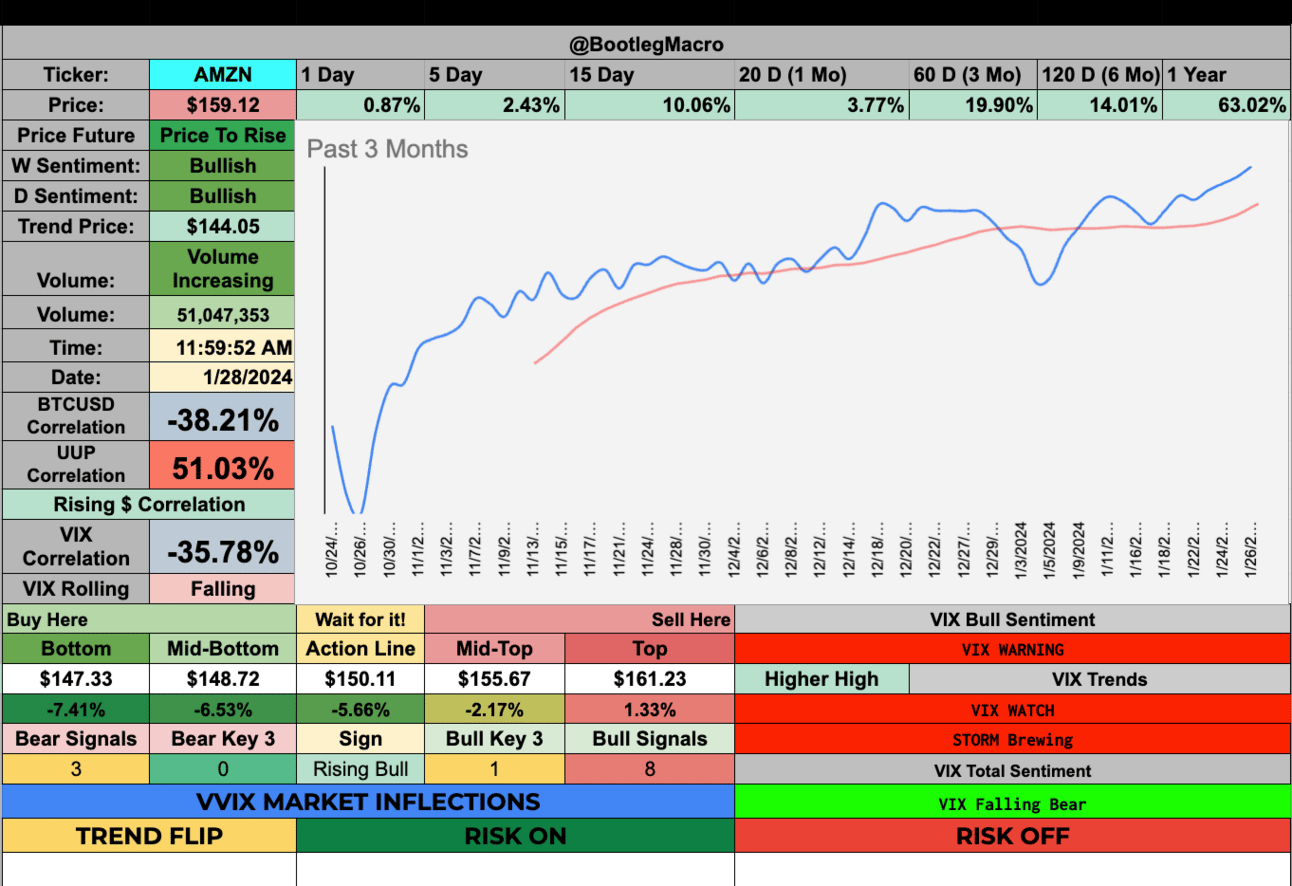

AMZN - Amazon - Consumer Cyclical - Internet Retail - 🇺🇸

META - Meta Platforms Inc. - Communication Services - Internet Content & Information - 🇺🇸

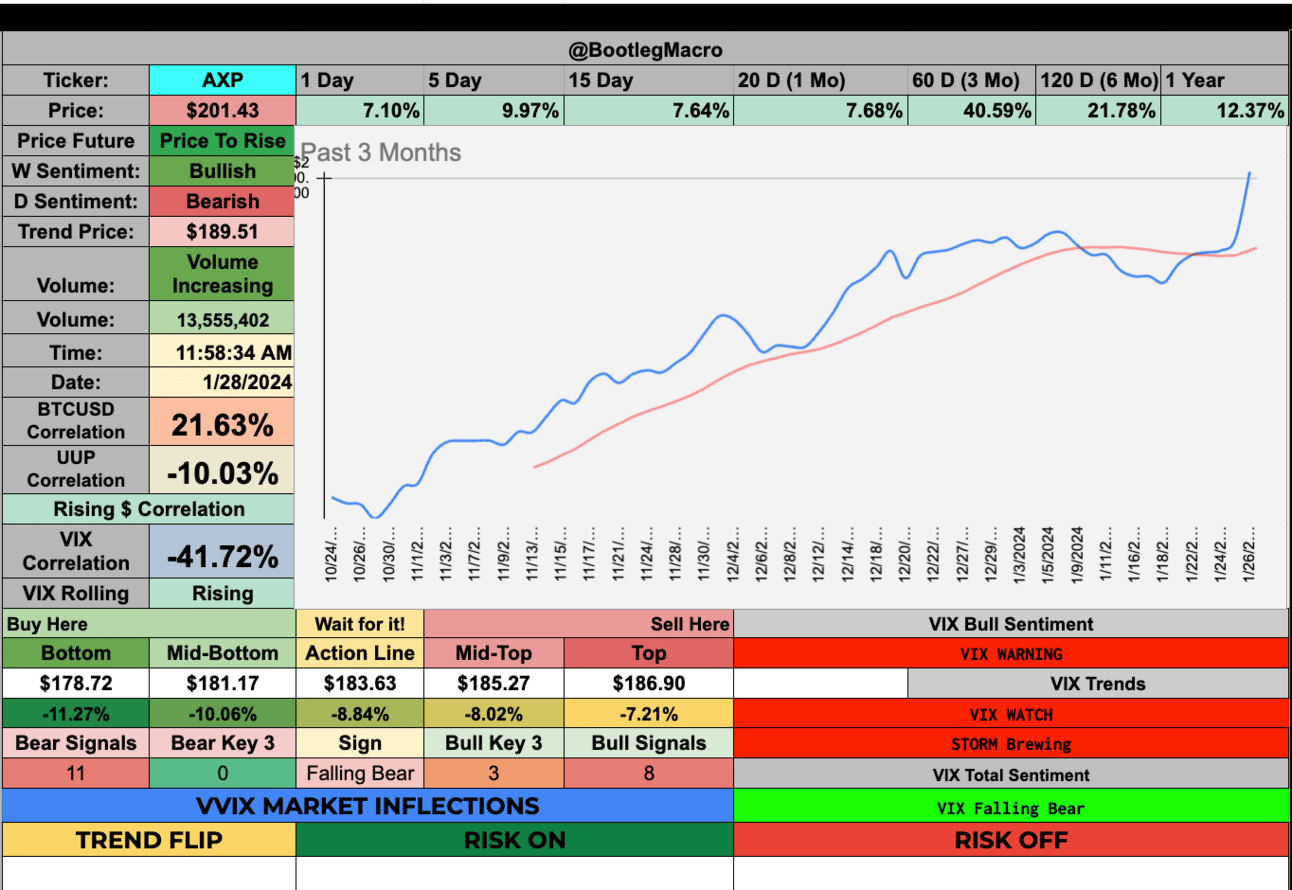

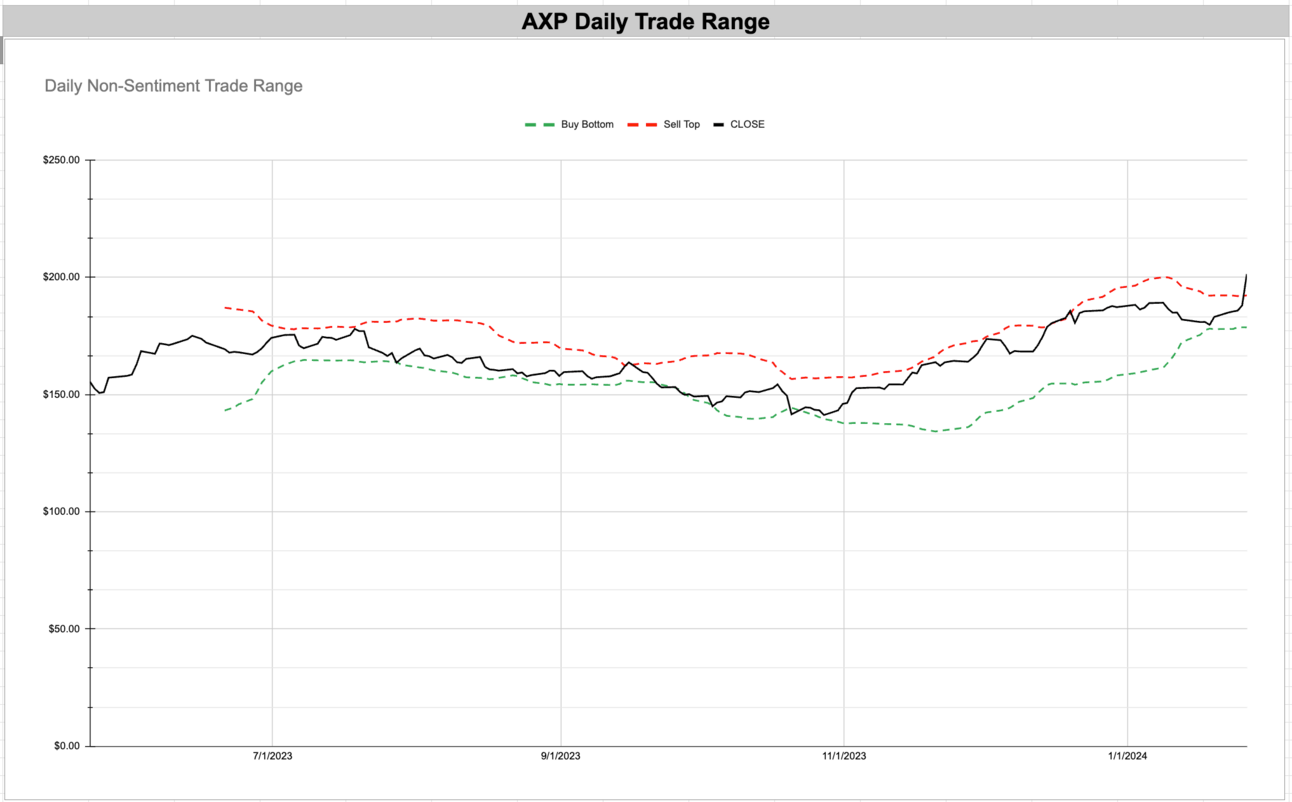

AXP - American Express - Financial Services - Credit Services - 🇺🇸

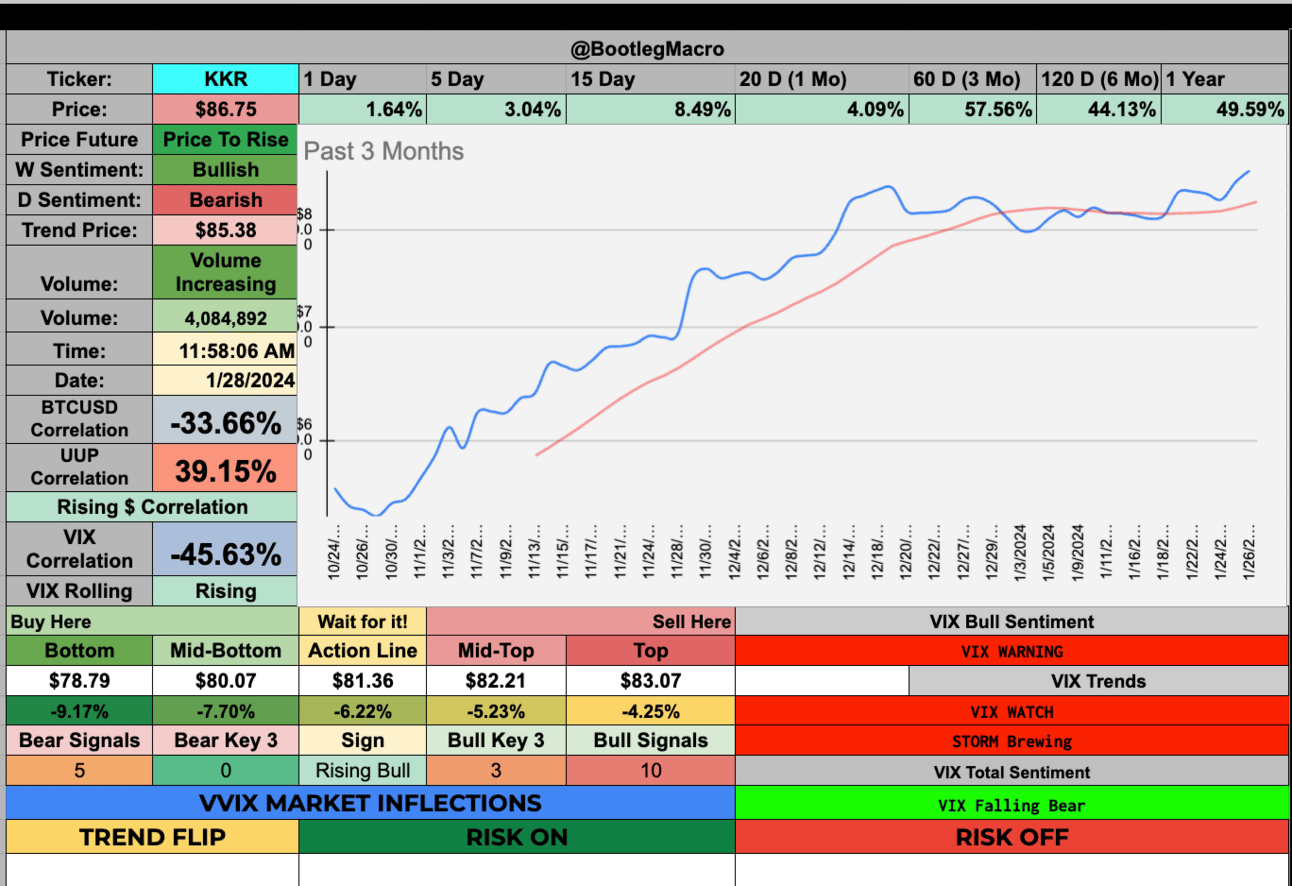

KKR - KKR & Co. Inc. - Financial Services - Asset Management - 🇺🇸

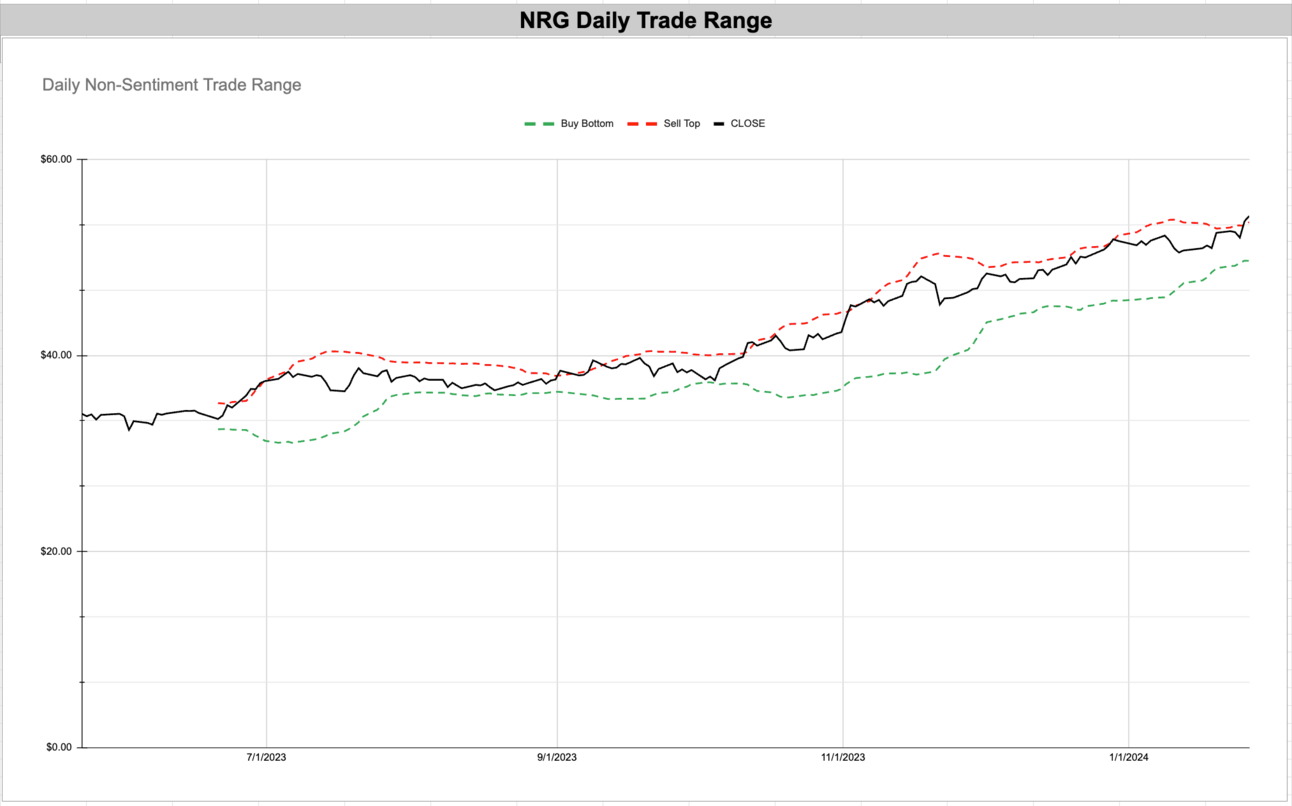

NRG - NRG Energy, Inc. - Utilities - Independent Power Producers - 🇺🇸

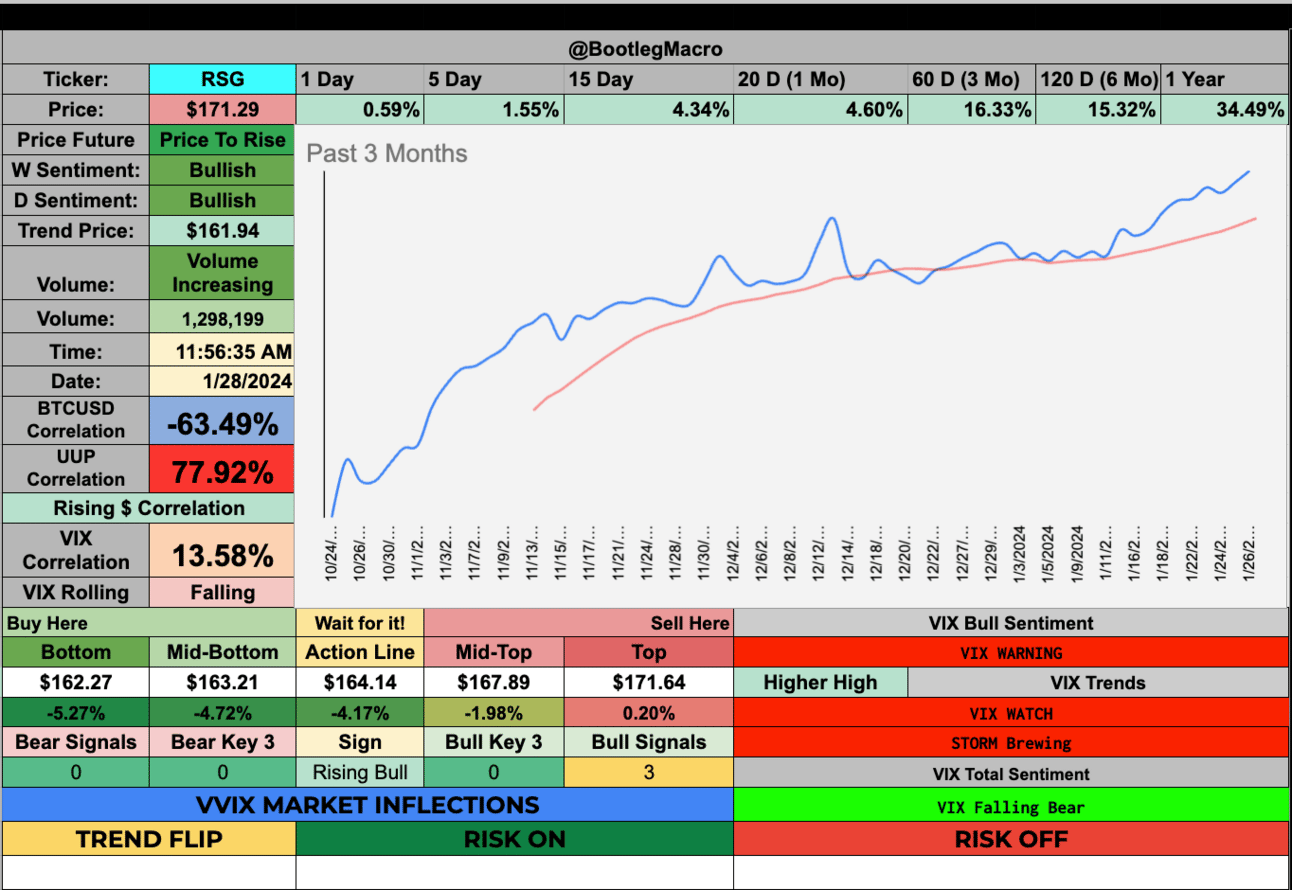

RSG - Republic Services, Inc. - Industrials - Waste Management - 🇺🇸

ROST - Ross Stores, Inc. - Consumer Cyclical - Apparel Retail - 🇺🇸

HLT - Hilton Worldwide Holdings Inc. - Consumer Cyclical - Lodging - 🇺🇸

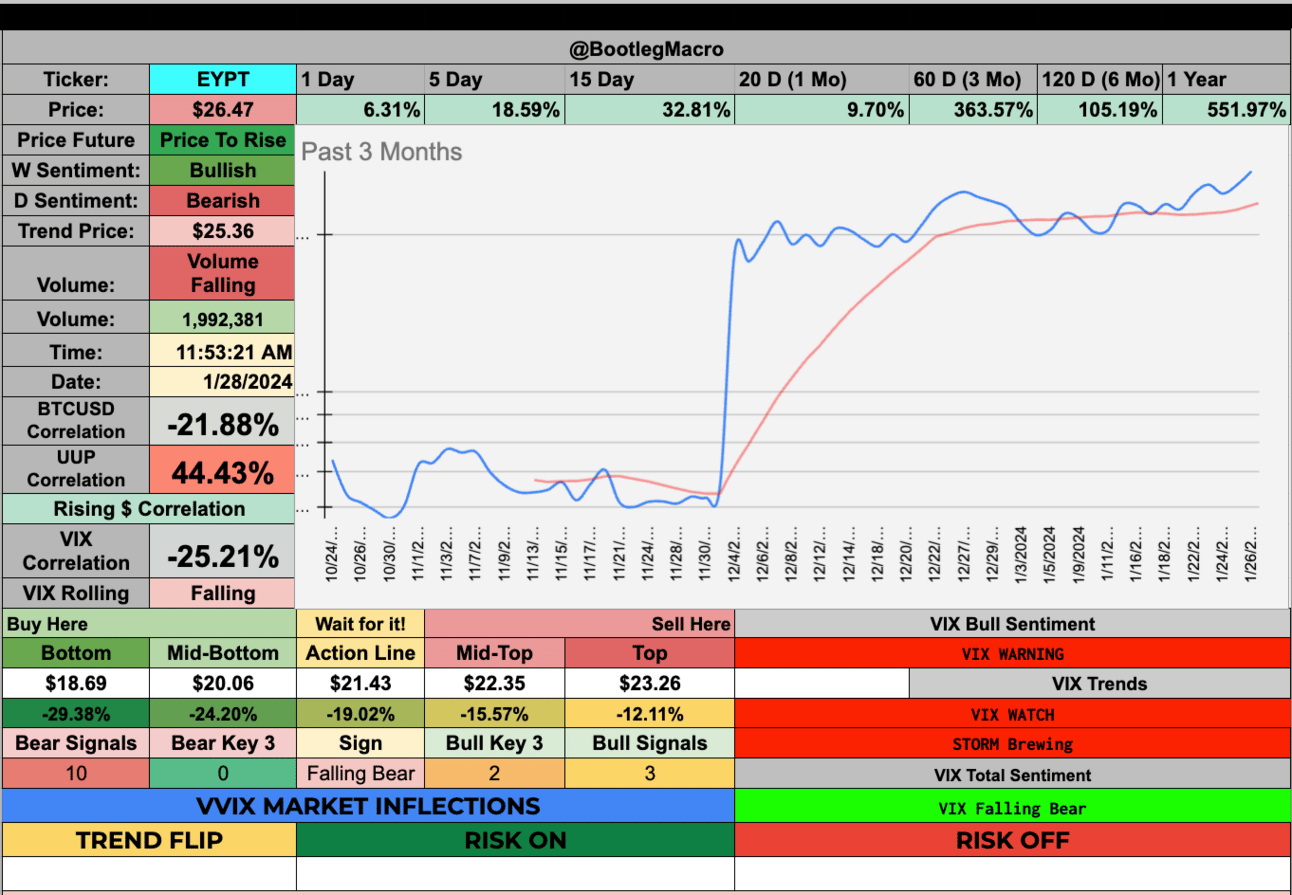

EYPT - EyePoint Pharmaceuticals, Inc. - Healthcare - Biotechnology - 🇺🇸

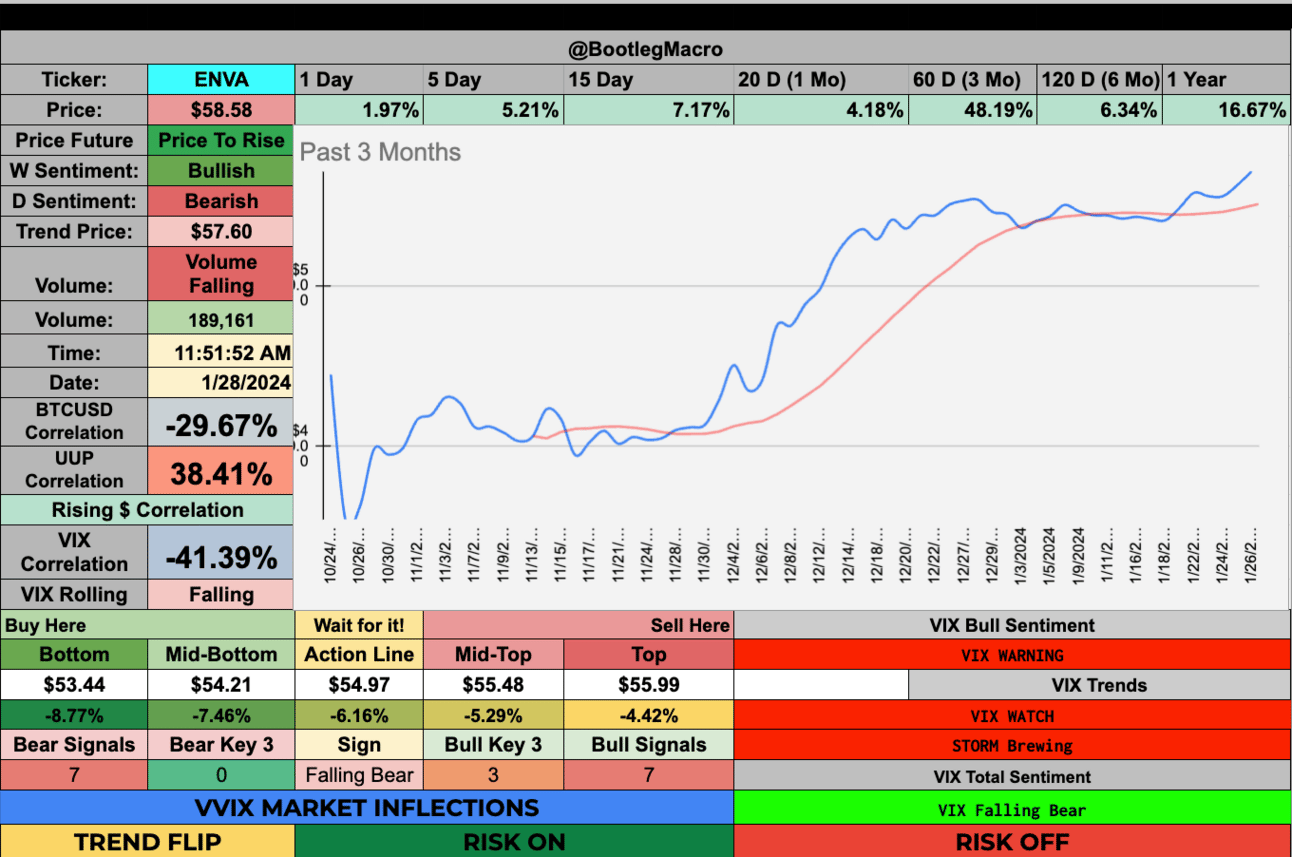

ENVA - Enova International, Inc. - Financial Services - Credit Services - 🇺🇸

AMZN - Amazon - Consumer Cyclical - Internet Retail - 🇺🇸

META - Meta Platforms Inc. - Communication Services - Internet Content & Information - 🇺🇸

AXP - American Express - Financial Services - Credit Services - 🇺🇸

KKR - KKR & Co. Inc. - Financial Services - Asset Management - 🇺🇸

NRG - NRG Energy, Inc. - Utilities - Independent Power Producers - 🇺🇸

RSG - Republic Services, Inc. - Industrials - Waste Management - 🇺🇸

ROST - Ross Stores, Inc. - Consumer Cyclical - Apparel Retail - 🇺🇸

HLT - Hilton Worldwide Holdings Inc. - Consumer Cyclical - Lodging - 🇺🇸

EYPT - EyePoint Pharmaceuticals, Inc. - Healthcare - Biotechnology - 🇺🇸

ENVA - Enova International, Inc. - Financial Services - Credit Services - 🇺🇸

Enjoying this?

& Invite a friend.

What service do we provide the reader? (Save You Time 🕰️🕰️🕰️)

The Price🏷️ of Loving ❤️Stocks📈

The biggest price we pay for a love of markets is the time 🕰️. Screen time. Sitting watching. No moving, no living, it’s silent and the same. Stop wasting time. Subscribe and get a finely designed list of company stocks to your inbox every Sunday morning ready for review.

If you spend more than 2 hours looking at charts a month, we can save you time and money. For FREE, you will get 100+ reviewed tickers sent your inbox. Get smarter about the markets without drowning in charts and wasting your life on screen time.

Take a break from the markets, let someone else send you curated, aggregated and finely designed breakouts. We see new action everyday. You don’t want to miss out on the next chance to join.

Enjoying this?

& Invite a friend.

Get Connected: Follow @BootlegMacro

If You Enjoyed This Thread

Make it simple, read The New Highs Newsletter...bit.ly/43W9K2L

We cover $SPY $QQQ $IWM and

20+ New Highs like $NVDA $TSLA $AMD $PLTR -- you get the point.Always something new. Don't miss it. Go.

— Bootleg Macro (@bootlegmacro)

11:03 PM • Jun 26, 2023

Model Builder Course:

I have a course. You build the tool you see me using in the videos. You get to build your own version of the same model you see me use in every video. I’m adding to it over time as well so you’ll get all updates I do to the course forever.

Thank you,

BootlegMacro